Auditing Final MC

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

Which of the following account balance assertions for the Inventory asset can be tested with the year-end physical inventory observation?

a. Existence

b. Completeness

c. Accuracy, Valuation and Allocation

d. All the above

d. All the above

Your audit client has encountered challenging economic conditions, which resulted in a significant amount of unsold inventory that is at risk of becoming obsolete. Which of the following is not a proper response in your planned financial statement audit?

a. Increase RMM to a moderate or high level

b. Increase planned substantive testing of the Inventory asset, valuation assertion.

c. Increase planned audit risk to a moderate or high level

d. Increase sample size for the year-end Inventory physical observation.

c. Increase planned audit risk to a moderate or high level

Your audit client uses the LIFO inventory method and has experienced significant inflation in the current year. You plan to compare the inventory turnover ratio (CGS expense/Inventory asset) with a competitor that uses FIFO. What is the likely LIFO method effect compared to FIFO?

a. CGS expense higher, Inventory asset lower

b. CGS expense lower, Inventory asset lower

c. CGS expense lower, Inventory asset higher

d. CGS expense higher, Inventory asset higher.

a. CGS expense higher, Inventory asset lower

You are testing the Equipment asset account, classification assertion, and decide to analyze the audit client’s operating profit margin (operating profit/sales revenue) as a substantive analytical procedure. Which of the following trends compared to the prior year will increase the risk that operating expenses have been misclassified as Equipment acquisitions?

a. Operating profit margin decreased from -3% last year to -7% this year.

b. Operating profit margin decreased from 12% last year to 8% this year.

c. Operating profit margin increased from 8% last year to 12% this year.

d. None of the above. There is no predictable relationship between operating profit and sales revenue

c. Operating profit margin increased from 8% last year to 12% this year.

You are performing substantive tests of details of the Equipment asset account, existence assertion. What is the best population to select a sample to begin your substantive testing?

a. Receiving documents completed when the Equipment arrived.

b. Recorded Equipment assets on the books.

c. Depreciation expense accruals recorded at year-end.

d. Purchase invoices from the equipment vendor.

b. Recorded Equipment assets on the books.

You are designing a substantive test of details of Equipment purchase transactions, classification assertion. You are concerned that your audit client has misclassified a variety of operating expense transactions as Equipment asset purchases. What is the proper population to select a sample to begin your substantive test?

a. Recorded operating expense transactions.

b. Cash disbursements to the equipment suppliers.

c. Recorded Equipment purchase transactions.

d. Recorded Accounts Payable at year-end.

c. Recorded Equipment purchase transactions.

An auditor compares the current-year revenues and expenses with those of the prior year and investigates all changes exceeding 5 percent. This procedure would most likely cause the auditor to learn that

a. A current-year increase in property tax rates has not been recognized in the client’s accrual for property tax expense.

b. Fourth-quarter payroll taxes in the current year were not paid.*

c. The current-year provision for uncollectible accounts expense is inadequate because of worsening economic conditions.

d. The client changed its capitalization policy for small tools in the current year.**

* Note it says they were not “paid”. You should assume that the taxes were accrued as an expense, but that the accrued amount was not paid.

** This change could either be:

(1) Prior year tools were capitalized (recorded as an asset), this year they were expensed.

(2) Prior year tools were expensed when purchased, this year they were capitalized.

d. The client changed its capitalization policy for small tools in the current year.**

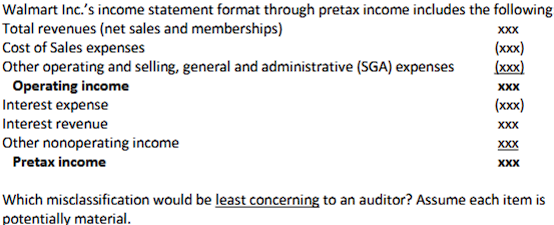

a. Other operating expenses recorded as SGA expenses

b. Interest revenue recorded as sales revenue.

c. Interest expense recorded as Cost of Sales expense.

d. Interest expense recorded as SGA expense.

a. Other operating expenses recorded as SGA expenses

In Session 23 we discussed the article about Bank of America’s period-end transactions used to manipulate its balance sheet. Which of the following ratio trends most likely will increase the auditor’s risk assessment that similar transactions are present?

a. Operating profit margin (operating income/sales revenue) has increased.

b. Operating profit margin has decreased.

c. Debt/equity has increased.

d. Debt/equity has decreased.

d. Debt/equity has decreased.

Which of the following would the auditor least likely perform when auditing the bank reconciliation?

a. Confirm the bank’s balance shown on the bank reconciliation directly with the bank.

b. Prepare the bank reconciliation and verify the outstanding checks to the following month’s cutoff bank statement.

c. Inspect documentation to test for proper separation of duties between the preparer of the bank reconciliation and the control over the Cash asset.

d. Verify the deposits in transit to supporting documentation of the cash receipts.

b. Prepare the bank reconciliation and verify the outstanding checks to the following month’s cutoff bank statement.

Which of the following would the auditor most likely perform when auditing the bank reconciliation for a December 31 year-end audit?

a. Confirm the audit client’s book balance shown on the bank reconciliation directly with the bank.

b. Subtract the outstanding check amounts from the audit client’s book balance.

c. Verify the audit client’s book balance shown on the bank reconciliation to the Cash balance in the audit client’s trial balance and general ledger.

d. Verify the deposits in transit amounts to the audit client’s December bank statement

c. Verify the audit client’s book balance shown on the bank reconciliation to the Cash balance in the audit client’s trial balance and general ledger.

An auditor plans to test the existence assertion for the Cash asset by sending confirmations to banks. What is the appropriate population to select a sample for the confirmations?

a. The list of banks provided by the audit client’s accounting personnel.

b. The list of banks that were sent confirmations in last year’s audit.

c. Recorded cash accounts on the audit client’s books.

d. The bank statement documents provided by the audit client’s accounting personnel.

c. Recorded cash accounts on the audit client’s books.

Which of the following statements is correct regarding period-end cash transfers from an audit client’s Bank A account to the Bank B account?

a. A transfer recorded by the audit client before year end and processed by Bank B after year end should be an outstanding check on the audit client’s Bank B reconciliation.

b. A transfer recorded by the audit client after year end and processed by Bank B after year end should be an outstanding check on the audit client’s Bank B reconciliation.

c. A transfer recorded by the audit client before year end and processed by Bank B after year end should be a deposit in transit on the audit client’s Bank B reconciliation.

d. A transfer recorded by the audit client after year end and processed by Bank B after year end should be a deposit in transit on the audit client’s Bank B reconciliation.

c. A transfer recorded by the audit client before year end and processed by Bank B after year end should be a deposit in transit on the audit client’s Bank B reconciliation.

In Session 25, we discussed Article 12 (originally discussed in Session 13) regarding a person’s use of “kiting” in their personal bank accounts. What is kiting in the context of cash transactions?

a. Misappropriating cash during a weather event with significant wind gusts when people are distracted.

b. Writing checks frequently between bank accounts to overstate someone’s total cash balance.

c. An individual with control over cash writes checks to themselves to steal cash.

d. An individual with control over cash deposits incoming cash receipts to their personal bank account.

b. Writing checks frequently between bank accounts to overstate someone’s total cash balance.

Which of the following is the least likely RMM assessment an auditor will make for the Investment asset, valuation assertion?

a. Low RMM for Level 3 fair value hierarchy.

b. High RMM for Level 3 fair value hierarchy.

c. High RMM for Level 2 fair value hierarchy.

d. Low RMM for Level 1 fair value hierarchy

a. Low RMM for Level 3 fair value hierarchy.

Which of the following items is most likely a Type 1 subsequent event that the auditor will need to evaluate for potential financial statement adjustments at the fiscal year end?

a. The audit client issued debt in the subsequent events period to finance a business acquisition.

b. Uninsured loss of the audit client’s manufacturing facilities that occurred within the subsequent events period.

c. A major business acquisition of the audit client that occurred within the subsequent events period.

d. The settlement of a lawsuit within the subsequent event timeline for an amount different than the contingent liability recognized at year end.

d. The settlement of a lawsuit within the subsequent event timeline for an amount different than the contingent liability recognized at year end.

An auditor identified a 40% increase in current year Legal Expense compared to the prior two years. What is the least likely response by the auditor?

a. Increase RMM for the year-end contingent liability.

b. Increase planned audit risk.

c. Increase substantive testing at year-end for the contingent liability account.

d. Decrease planned detection risk for the contingent liability account.

b. Increase planned audit risk.

Which of the following is not a required communication by the auditor to the audit client’s Audit Committee of the Board of Directors for the ICFR audit?

a. Significant deficiencies in ICFR

b. Control deficiencies in ICFR that are determined to not rise to the level of a significant deficiency

c. Disagreements with management regarding ICFR over critical accounting policies

d. Material weaknesses in ICFR

b. Control deficiencies in ICFR that are determined to not rise to the level of a significant deficiency

A public entity changed its inventory accounting principle from the FIFO method to the weighted average method. The client’s financial statements contain no material misstatements and the auditor concludes that this change is justified. If the change is disclosed in the notes to the financial statements, the auditor should issue a(n)

a. “Except for” qualified opinion.

b. Adverse opinion.

c. Unqualified opinion with no modification to the audit report.

d. Unqualified opinion with an explanatory paragraph

d. Unqualified opinion with an explanatory paragraph

An auditor includes a separate paragraph in the financial statement audit report to emphasize that the entity being reported upon had significant transactions with related parties. The inclusion of this separate paragraph

a. Is considered an “except for” qualification of the opinion.

b. Is appropriate and would not change the unqualified opinion.

c. Violates auditing standards if this item is already disclosed in the financial statement footnotes.

d. Will result in a disclaimer of opinion.

b. Is appropriate and would not change the unqualified opinion.

King, CPA, was engaged to audit the financial statements of a client after the fiscal year had ended. King neither observed the inventory count nor confirmed the receivables by direct communication with customers but was satisfied that both were fairly stated after applying appropriate alternative audit procedures. King’s financial statement audit report most likely contained a(n)

a. Unqualified opinion.

b. Qualified opinion.

c. Disclaimer of opinion.

d. Adverse opinion

a. Unqualified opinion.