ACYFARP16: SFP, SCI, SCE & SCF

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

A complete set of financial statements includes all of the following, except

a. Statement of financial position

b. Statement of changes in equity

c. Statement of comprehensive income

d. Statement of changes in financial position

D

The basis for classifying assets as current or noncurrent is conversion to cash within the

a. Operating cycle or one year, whichever is shorter

b. Operating cycle or one year, whichever is longer

c. Accounting cycle or one year, whichever is shorter

d. Accounting cycle or one year, whichever is longer

B

The statement of financial position is useful for all of the following, except

a. Evaluating liquidity

b. Assessing solvency

c. Evaluating financial flexibility

d. Determining cash flow

D

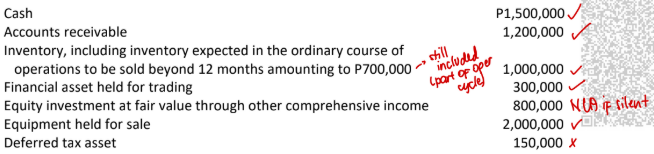

BAC Company provided the following information at year-end:

What amount should be reported as total current assets at year-end?

a. P6,000,000

b. P4,000,000

c. P6,800,000

d. P4,800,000

A

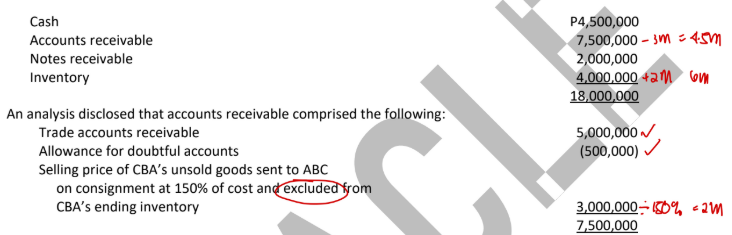

CBA Company reported the following at year-end:

What amount should be reported as total current assets at year-end?

a. P17,000,000

b. P17,500,000

c. P15,000,000

d. P16,500,000

A

XYZ Company reported the following account balances on December 31, 2025:

Accounts payable P1,900,000

Bonds payable 3,400,000

Premium on bonds payable 200,000

Deferred tax liability 400,000

Dividend payable 500,000

Income tax payable 900,000

Note payable, due January 31, 2026 600,000

On December 31, 2025, what total amount should be reported as current liabilities?

a. P7,100,000

b. P4,300,000

c. P3,900,000

d. P4,100,000

C

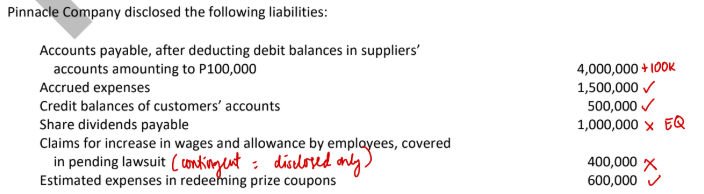

What total amount should be reported as current liabilities?

a. P6,700,000

b. P6,600,000

c. P7,100,000

d. P7,700,000

A

What is the purpose of reporting comprehensive income?

a. To replace a net income with a better measure

b. To report a measure of overall entity performance

c. To report changes in equity due to transactions with owners

d. To combine income from continuing operations with income from discontinued operations

B

The components of OCI include all, except

a. Unrealized gain on derivative contract designated as cash flow hedge

b. Loss from translating the financial statements of a foreign operation

c. Actuarial gain on defined benefit plan

d. Dividend paid to shareholders

D

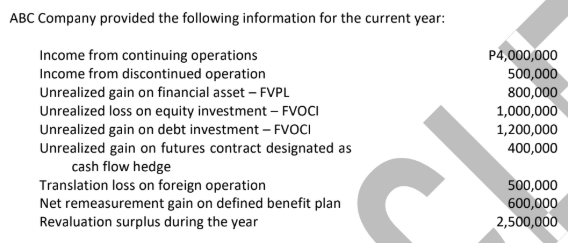

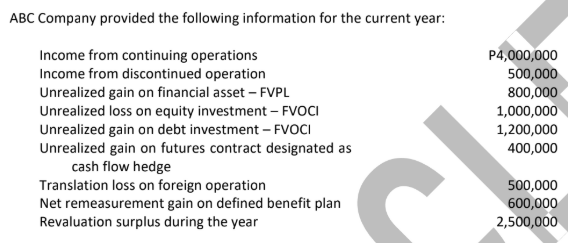

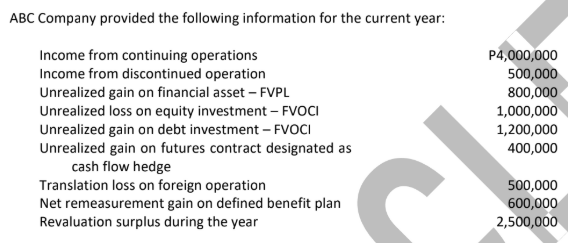

What amount should be reported as net income for the current year?

a. P4,000,000

b. P4,500,000

c. P5,300,000

d. P4,800,000

B

What net amount should be reported as OCI for the current year?

a. P4,000,000

b. P3,500,000

c. P3,200,000

d. P700,000

C

What amount should be reported as comprehensive income for the current year?

a. P5,200,000

b. P7,700,000

c. P8,500,000

d. P7,200,000

B

Which of the following financial statements shows the movements of the elements of the shareholders’ equity?

a. Statement of Financial Position

b. Statement of Comprehensive Income

c. Statement of Changes in Equity

d. Statement of Cash Flows

C

Which of the following does not appear in the Statement of Changes in Equity?

a. Net income for the period

b. Dividends paid

c. Issuance of share capital

d. Change in accounting estimate

D

Which of the following does not appear in the Statement of Retained Earnings?

a. Net income

b. Change in accounting policy

c. Ordinary share dividend

d. All of the above appear in the Statement of Retained Earnings

D

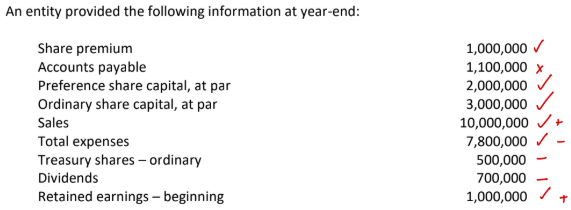

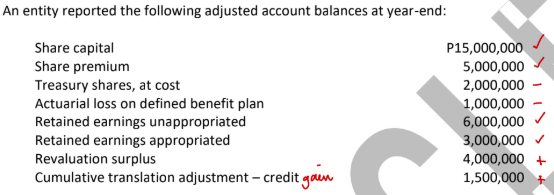

What is the shareholders’ equity at year-end?

a. P8,000,000

b. P8,500,000

c. P5,800,000

d. P8,700,000

A

What amount should be reported as shareholders’ equity at year-end?

a. P31,500,000

b. P32,500,000

c. P28,500,000

d. P25,500,000

A

In a statement of cash flows, depreciation is treated as an adjustment to net income because deprecation

a. Is a direct source of cash

b. Reduces income but does not involve cash outflow

c. Reduces net income and involves an inflow of cash

d. Is an inflow of cash for replacement of asset

B

Using indirect method for operating activities, an increase in inventory is presented as

a. Outflow of cash

b. Inflow and outflow of cash

c. Addition to net income

d. Deduction from net income

D

In a statement of cash flows, if used equipment is sold at a gain, the amount shown as a cash inflow from investing activities equals the carrying amount of the equipment

a. Plus the gain

b. Plus the gain and less the amount of tax

c. Plus both the gain and the amount of tax

d. With no addition or subtraction

A

In a statement of cash flows, which of the following should be reported as cash flow from financing activities?

a. Payment to retire mortgage note

b. Interest payment on mortgage note

c. Dividend payment

d. Payment to retire mortgage note and dividend payment

D

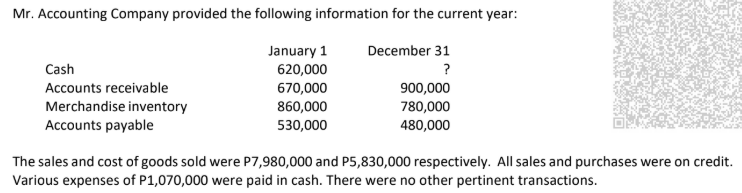

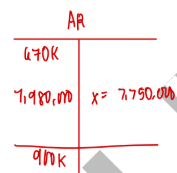

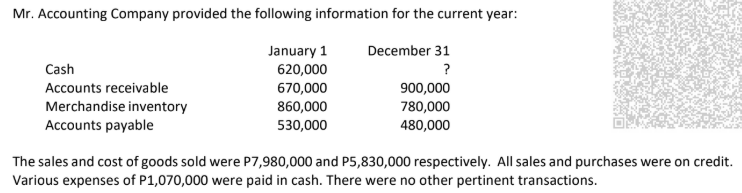

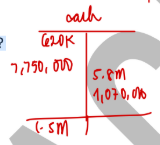

What is the amount of collections from customers?

a. P7,980,000

b. P8,600,000

c. P7,750,000

d. P8,210,000

C

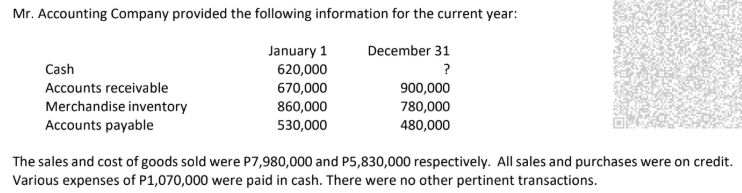

What is the payment of accounts payable?

a. P5,750,000

b. P5,880,000

c. P5,800,000

d. P5,700,000

C

What is the cash balance on December 31?

a. P1,090,000

b. P1,500,000

c. P2,570,000

d. P3,050,000

B

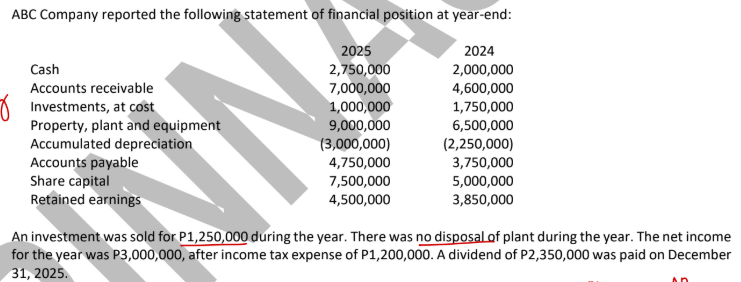

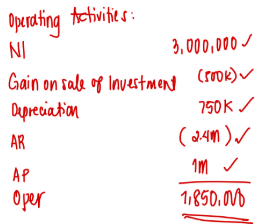

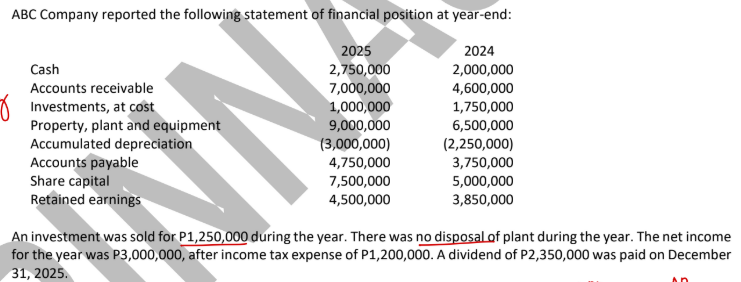

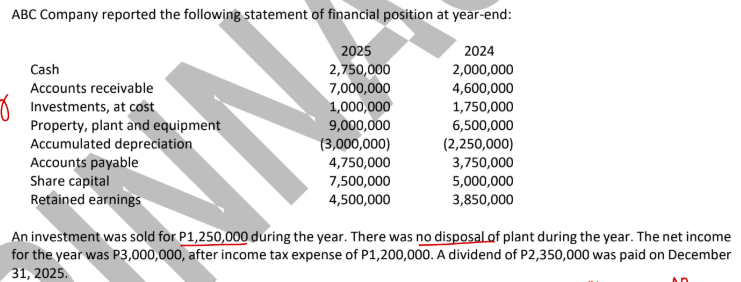

What is the net cash provided by operating activities?

a. P1,850,000

b. P2,350,000

c. P2,850,000

d. P1,100,000

A

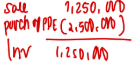

What is the net cash used in investing activities?

a. P2,500,000

b. P1,250,000

c. P1,750,000

d. P500,000

B

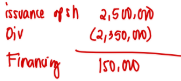

What is the net cash provided by financing activities?

a. P2,500,000

b. P2,350,000

c. P650,000

d. P150,000

D