IMC Unit 2: Accounting

1/91

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

92 Terms

What are the objectives of accounts

SUMMARISE RESULTS of transactions to help management run

company

REPORT to interested parties THE STATE OF AFFAIRS of the

company

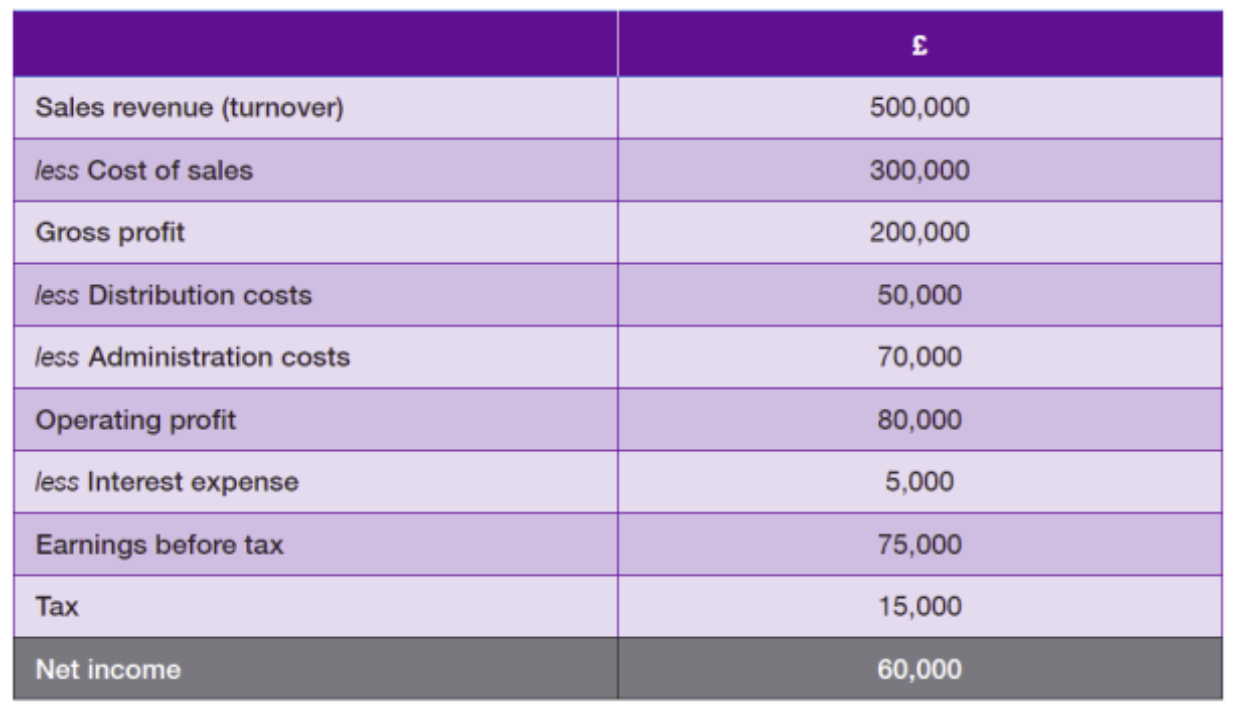

What do large companies have to provide annually

Income statement

Balance sheet

Director’s report

Auditor’s report

Cash flow statement

Statement of changes in equity

What must Listed Companies also provide

Half-yearly INTERIM reports

What are Small an Medium-Sized companies exempted from

Delivering full annual financial statements to the Registrar of Companies

File abbreviated financial statements

What is a Small company

Turnover < £6.5mn

Balance Sheet < £3.26mn

Avg No. Employees < 50

What is a Medium-Sized company

Turnover < £25.9mn

Balance Sheet < £12.9mn

Avg No. Employees < 250

What are the different ways a company can be formed

Public

Private

What are the UK accounting standards

Financial Reporting Standards (FRSs), issued by the Financial

Reporting Council (FRC)

What are the International accounting standards

International Financial Reporting Standards (IFRSs), issued by the

International Accounting Standards Board (IASB)

When are UK accounts prepared under IFRS?

Applies to CONSOLIDATED accounts of LISTED companies

What companies use UK generally accepted accounting principles (GAAP)

Companies not using IFRS

These companies comply with UK standards issued by the FRC

What makes up UK GAAP

FRS 102

Reporting Requirements of the Companies Act 2006

What is FRS 102

Took effect for accounting periods ending on or after 1st January

2015

SINGLE STANDARD covering the various different items

previously covered under separate standards

What is the Role of the Auditor

To report to shareholders on whether the accounts

• Have been properly prepared; and

• Give a ‘true and fair view

What are the different types of audit report

Unqualified (‘clean’/’clear’)

Qualified

What are the difference between Qualified and Unqualified audit reports

Unqualified

The auditor is happy with the financial statements.

Qualified

The auditor found some issues, but they’re not serious enough to invalidate the whole report.

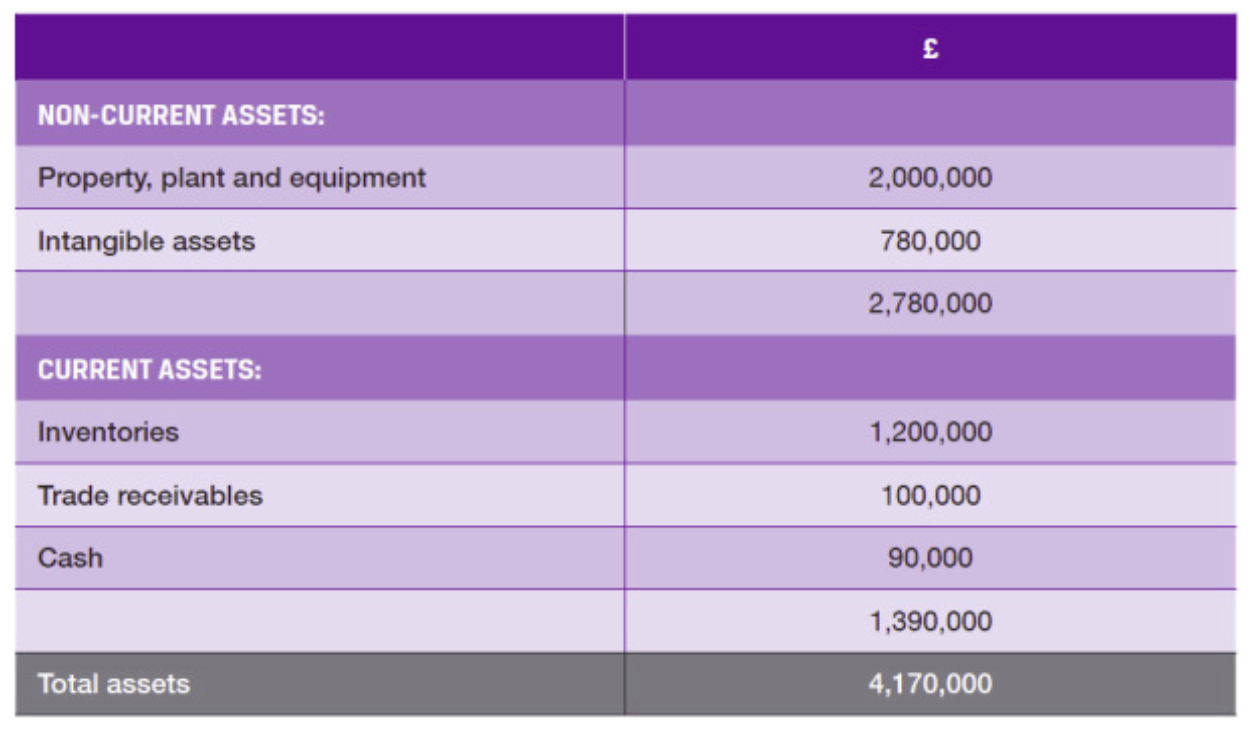

What are the different categories of assets

Non-Current assets

Current assets

What are Non-Current assets

Assets a company expects to use, sell, or convert into cash within one year

How are Non-Current assets carried in the balance sheet

at COST (or VALUATION), less ACCUMULATED

DEPRECIATION

What are Current assets

Assets that a company plans to keep for more than one year and uses to run the business over time.

What are some examples of current assets

Inventories

Receivables

Cash

What categories of inventories

Raw materials

Work in progress

Finished goods

How are current assets treated in accounting

Value at the LOWER of COST and NET REALISABLE VALUE

What is Net Realisable Value

The estimated selling price minus costs to complete and sell.

What are the 3 possible cost flow assumptions in accounting for current assets

First in first out (FIFO)

Last in first out (LIFO)

Weighted average

What does FIFO assume

Oldest items are sold first.

Ending inventory reflects newer, higher value items

What does LIFO assume

Newest items are sold first.

Ending inventory reflects older, lower value items.

What does Weighted Average assume

Averages the cost of all inventory items.

How do prices affect the cost flow assumptions

Method | Impact on Profit |

|---|---|

FIFO | Higher profit |

LIFO | Lower profit |

Weighted Avg. | Moderate profit |

How can Cash expenditure be recorded

Capital expenditure (‘capitalised’)

Revenue expenditure (‘expensed’)

What is Capital Expenditure

Creates or improves an asset

What is Revenue Expenditure

Reduces Profit

What are Intangible assets

Non-Physical assets like goodwill, development expenditure, patents, trademarks and copyrights

What is Goodwill

An intangible asset that shows up when one company buys another for more than the value of its net assets.

When does Goodwill arise

On the purchase of a company

= Purchase Consideration - Net Assets Acquired

What is the formula for Goodwill

Goodwill = Purchase Consideration - Net Assets Acquired

How is Goodwill accounted for (IAS 36)

Capitalise in the balance sheet

Only amortise if can’t be maintained indefinitely

Annual impairment reviews (if not amortised

What are the different methods of Depreciation

Straight line Method

Reducing Balance Method

What is the formula for annual depreciation under the straight line method

A machine has a cost of £20,000, a useful life of four years and an expected scrap value of £2,000.

What is the carrying value of the machine in the balance sheet at the end of year 3 using straight line depreciation?

Annual Depreciation = (20000-2000)/4

= 4500

Depeciation at end of year 3 = 4500×3 = 13500

Carrying value at t=3 =20000-13500

=6500

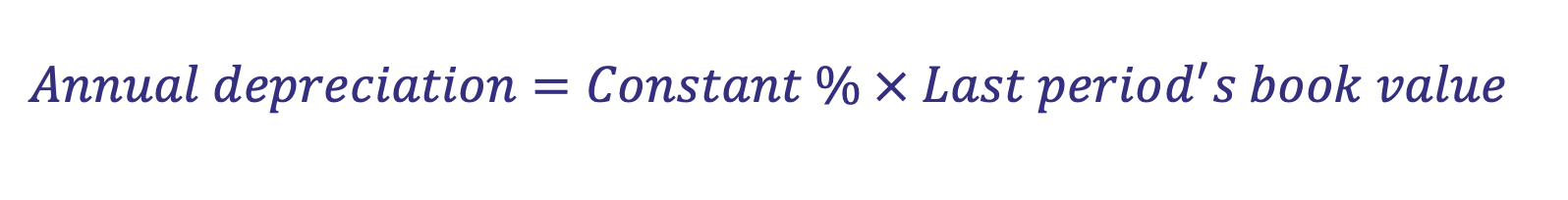

What is the formula for annual depreciation under the reducing balance method

A machine has a cost of £20,000 and a useful life of four years.

What is the carrying value of the machine in the balance sheet at the end of year 2 using 25% reducing balance depreciation?

20000 × 0.75² = 11250

What need tobe disclosed on the sale of assets

Gain or Loss on disposal

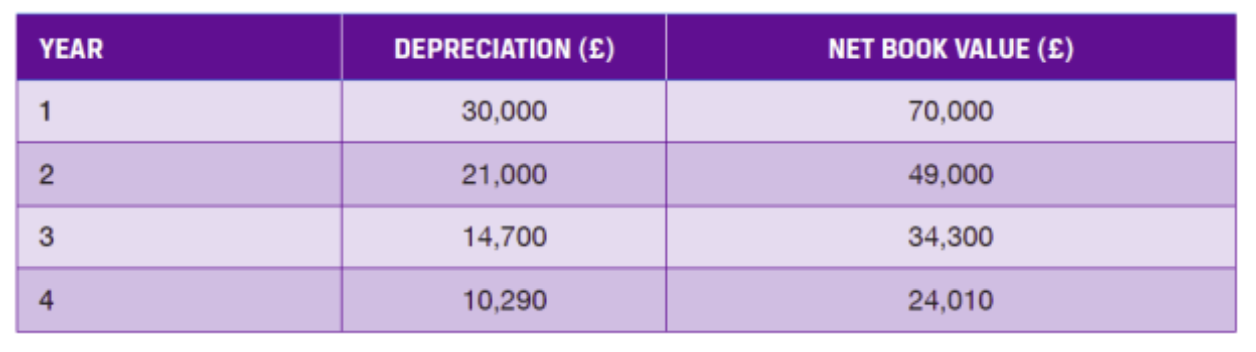

A machine has a cost of £100,000 and a useful life of eight years.

Depreciation is charged at 30% reducing balance. What will the gain

or loss on disposal be if the machine is sold for £30,000 at the end of year 4?

Value at T=4 = £100,000 × 0.74 = £24010

Gain on disposal = £30,000 - £24,010 = £5,990

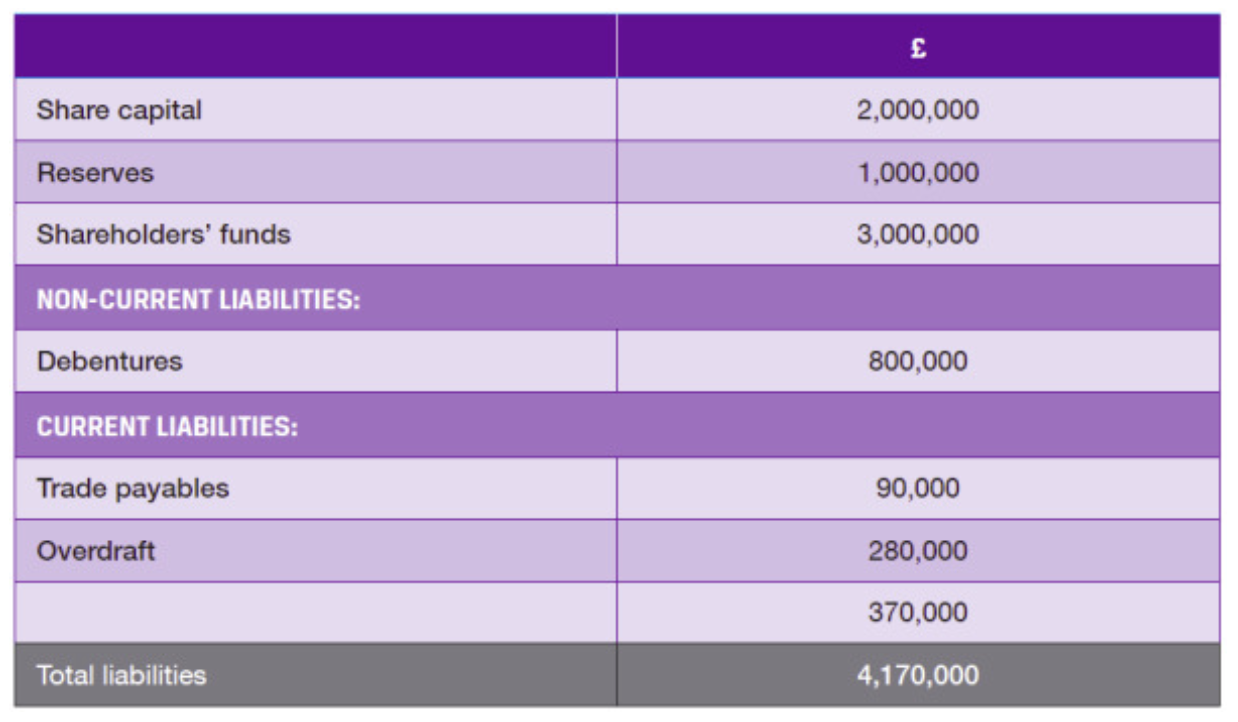

What are the different categories of liabilites

Non-Current Liabilities

Current Liabilities

What is Share Capital

The NOMINAL VALUE of issued share

What are Reserves

Parts of shareholders’ equity that arise from profits, revaluations, or premiums. They’re not part of the nominal share capital

What is Share Premium

The amount by which shares have been issued in excess of nominal

value

What are the uses of share premium

Funding’ scrip issues

Writing off start up cost

What are Scrip Issues

Issuing bonus shares to existing shareholders.

What does writing off start-up costs mean

Covering expenses related to issuing shares

What is Revaluation Reserve

Cumulative surplus on the revaluation of assets

Arises when assets (like property) are revalued upwards.

What is Profit and Loss Reserve

This is where retained earnings go

DISTRIBUTABLE profit

What are Non-Current Liabilities

Additional sources of capital over and above shareholders’ funds

Financial obligations that a company must settle after more than one year.

What are some examples of Non-Current Liabilities

Debentures (secured debt capital)

Unsecured debt capital

Loans from financial institutions

What is the advantage of Non-Current assets over equity

Interest is tax-deductible: It’s paid from pre-tax profits, reducing taxable income.

What are the risks Non-Current assets over equity

Interest and capital have to be repaid when du

What are Current Liabilities

Financial obligations—debts or payments that must be settled within one year

What are Contingent Liabilities

POTENTIAL liabilities that did not exist at the balance sheet date

What are some examples of Contingent Liabilites

Potential liabilities from court action

Good sold under warranty/guarantee

How are Contingent Liabilities treated in accounting (IAS 37)

Not sufficiently predictable to warrant a provision, so DISCLOSE

EXISTENCE in the note to accounts

When do accounting issues for pensions arise

DEFINED BENEFIT pension scheme

How are Pension Costs treated in accounting (IAS 19)

Cost of employee benefits should be recognised in the period in

which they are EARNED (not paid)

How should Pension surplus or deficit should be recognised in the balance sheet

Fair Value of Plan Assets - Fair Value of Defined Benefit Obligation

What are Post-Balance Sheet Events

Events occurring between the balance sheet date and the date the

accounts are approved

What is an Adjusting Event (Post-Balance Sheet Events (IAS 10))

Subsequent evidence of a condition THAT EXISTED at the balance

sheet date, e.g. obsolete stock

ADJUST accounts

What is an Non-Adjusting Event (Post-Balance Sheet Events (IAS 10))

Event occurring AFTER the balance sheet date (but before the

accounts are approved), e.g. major acquisition/disposal

DISCLOSE in accounts

What are the objectives of accounting treatment for Financial Instruments (IFRS 9 (instruments), IAS 32 (presentation) & IFRS 7 (disclosures))

Clarify the classification of liabilities vs. equity

Prescribe strict conditions for the offset of assets and liabilities

Require disclosure about financial instruments

What is Equity

No contractual obligation to pay cash or another financial asset.

How is financial liability different from equity

There is a contractual obligation to deliver cash or another asset.

How is the decision made on whether something is a liability or an equity

Based on the substance of the contract, not just its legal label

E.g. a preference share with a mandatory redemption and fixed

rate dividend will be recognised as a LIABILITY

How do hedges have to be disclosed

Fair value hedges

Cash flow hedges

Are disclosed separately

How are financial assets categorised for disclosed

• Held for trading through the profit and loss account

• Held to maturity investments: quoted long-term debt investments

• Loans and receivables: unquoted financial assets

• Available-for-sale financial assets: financial assets not included

above

Which financial asset categories are held at fair value in the balance sheet

Held for trading through the profit and loss account

Available-for-sale financial assets: financial assets not included

above

How are financial liabilities categorised for disclosed

Fair value through profit and loss: trading liabilities

Measured at amortised cost: default category for liabilities

Which financial liabilities categories are held at fair value in the balance sheet

Fair value through profit and loss: trading liabilities

How is the income statement formatted

What is involved in the statement of changes in Equity

Changes to:

• Share capital

• Share premium

• Revaluation reserve

• Profit and loss reserve (including dividend distributions

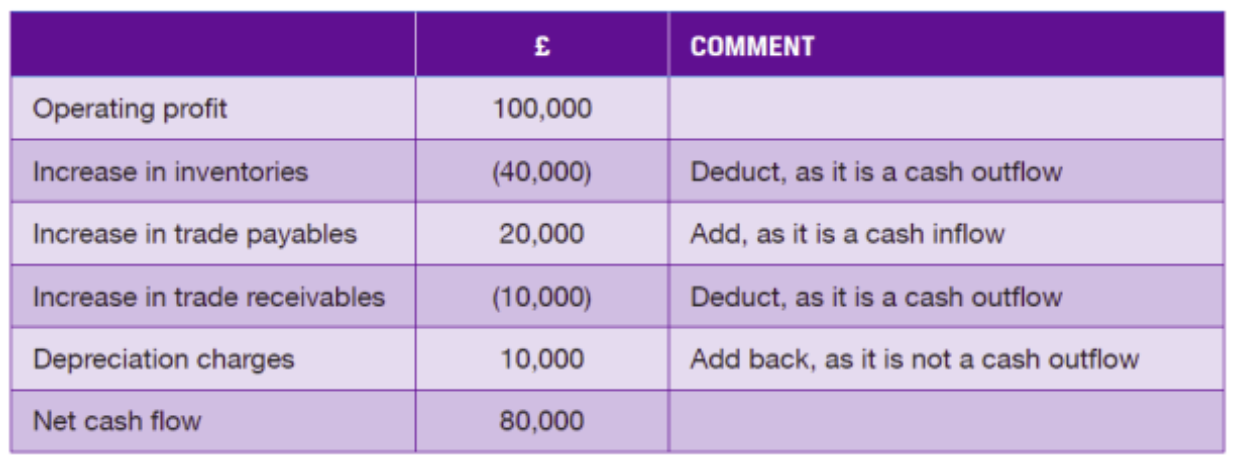

How are cash flows classified in the cash flow statement

Operating activities

Investing activities

Financing activities

Example of net cash flow from operating activities

A company has an operating loss of £6m in the income statement for the period. During the period depreciation was £6m, work-in-progress decreased by £2m and both accounts receivable and accounts payable increased by £1m each.

What is net cash flow from operating activities for the period?

Operating loss: –£6m

Add back depreciation: +£6m

Work-in-progress decrease: +£2m

Receivables increase: –£1m

Payables increase: +£1m

--------------------------------------------------

Net cash flow: +£2m

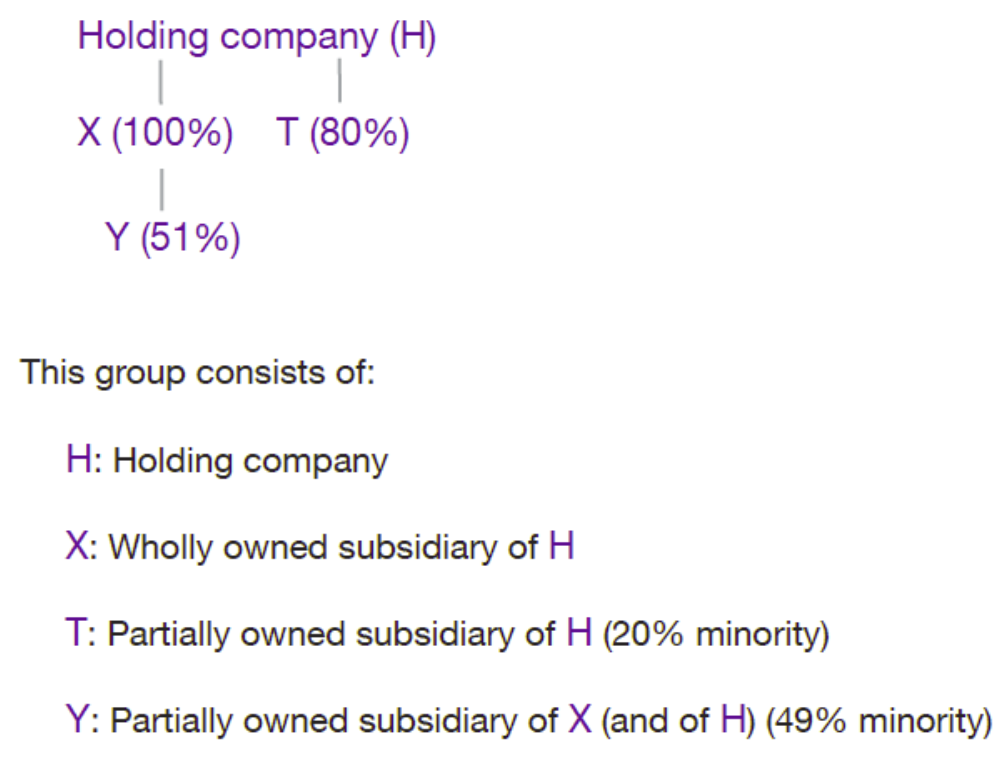

What is a Parent company/holding company (IAS 27)

Holds the majority of the voting rights (greater than 50%) in

another company (a ‘subsidiary’); and/or

Exercises dominant influence

What is the formula for Return on capital employed (ROCE)

What is the formula for Return on equity (ROE)

What is operational gearing

The sensitivity of operating profit to changes in sales revenue

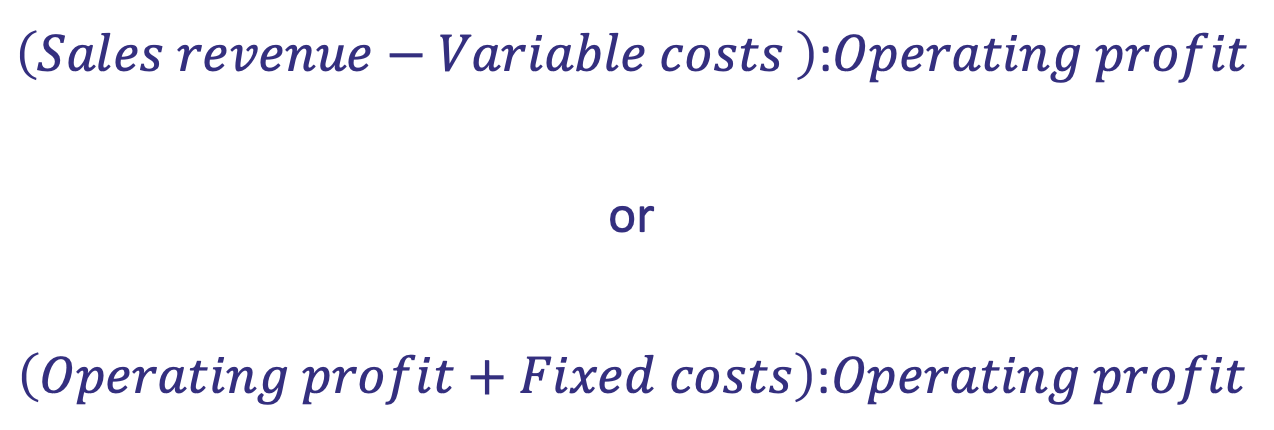

What are the two potential formulas for operational gearing

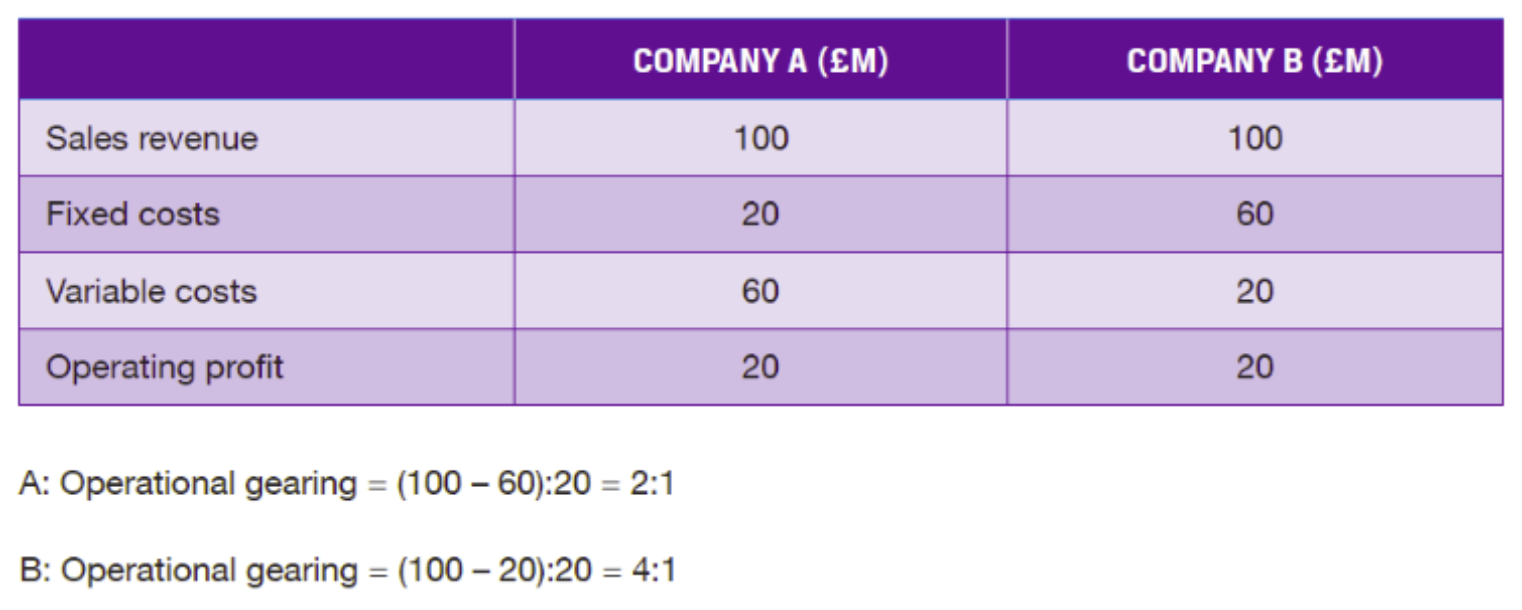

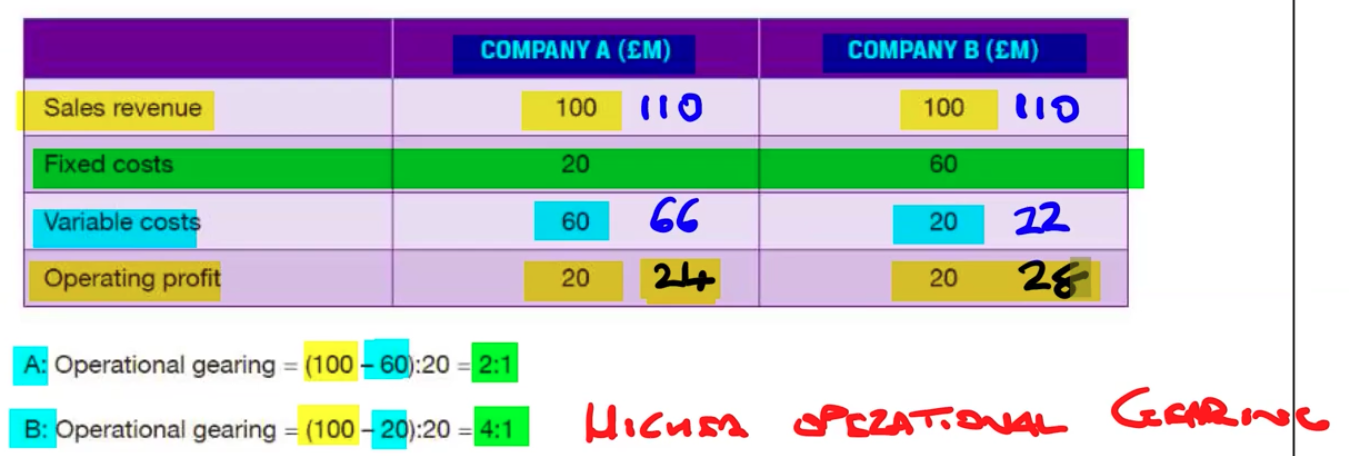

Example of operational gearing

What is the impact on operating profit of a 10% increase in revenue for Company A and Company B?

Company A Operating Profit: 24

Company B Operating Profit: 28

The company with higher operational gearing, Company B’s operational profit increased by more

If revenues are increasing do you want a company with higher or lower operational gearing

If markets and revenue are rising, generally you want a company with higher operational gearing.

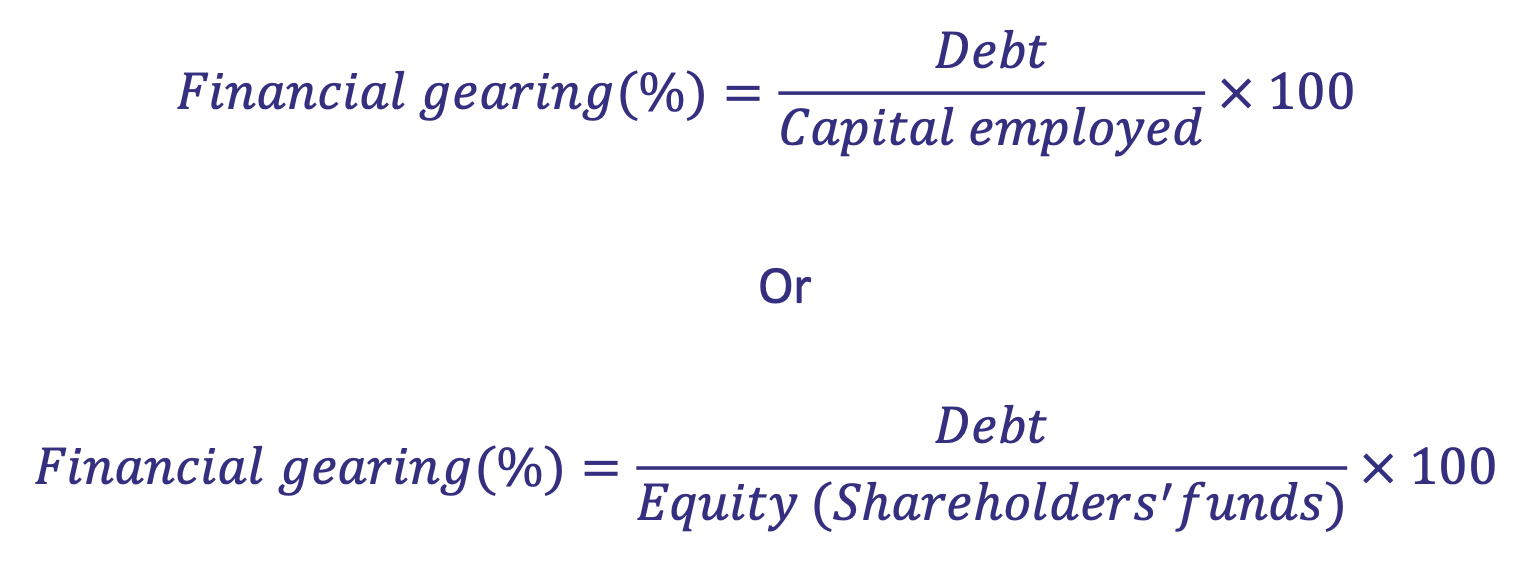

What are the two potential formulas for financial gearing

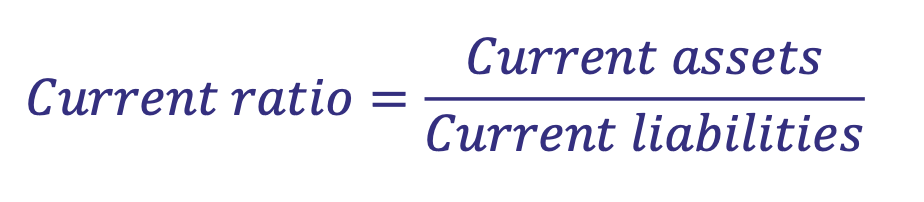

What is the formula for Current Ratio

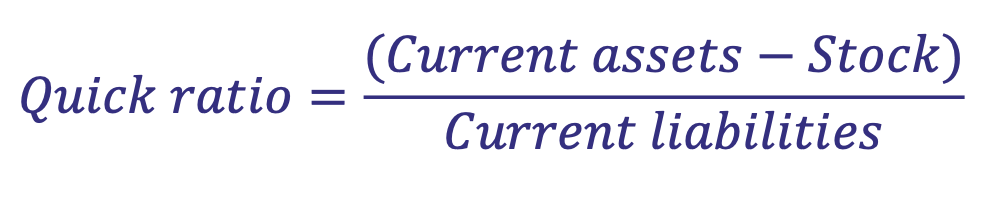

What is the formula for Quick Ratio