4.4.3: Controlling MNCs

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

power of MNCs

powerful

contribute significantly to global wealth and job creation

help with inward investment and building foreign currency reserves for developing nations

benefits consumers

effectively use world resources

profits invested in useful R&D

criticised for being too powerful and exploiting stakeholders

operate as monopolists

exploit consumers through high prices

dominate markets

make it difficult for small firms to survive

maximimise profits

use working practices polluting the environment or consuming large quantities of non renewable resources

control flows of profit and revenue through countries with low tax rates and avoid tax payments

difficult for national governments to control MNCs

can easily relocate and take FDI, tax revenue and employment

political influence

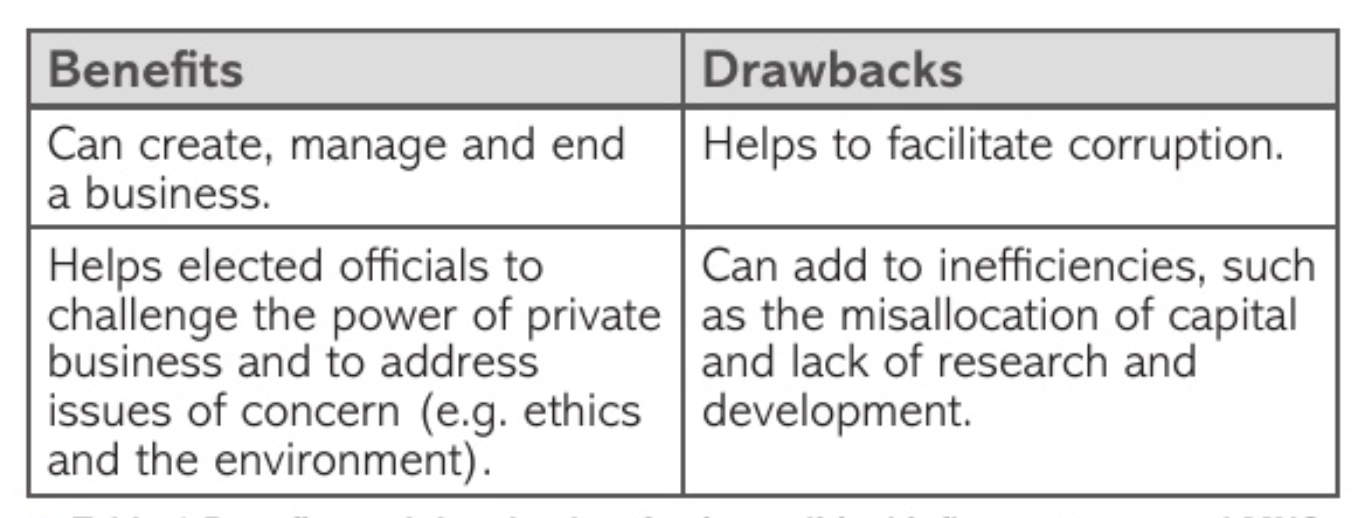

SOEs:

large MNCs owned by the state - state owned enterprises SOEs

effective method of control

political power exercised to create, manage and end a business

extensive political influence over organisations

lead to commercial and ethical issues

drawbacks of state ownership:

corruption - SOEs might be favoured by powerful politicians

state owned operations may take the capital other firms might better employ

politicians or regulators decide where funding should go

inefficient businesses may be given more money than they need and not be subject to competitive forces that reduce price and improve efficiency

shareholders and other investor rights ignored

mot true beneficiaries of the business

actual beneficiaries - politicians

ignores investment expenditure

less competitive pressure from other firms with state ownership

less incentive

non SOEs:

also important for non SOEs

national strategic priorities, boost employment or regulate financial institutions

privately owned businesses controlled using a number of political initatives:

tarrifs

quotas

regulations

local content requirement

direct/indirect ownership restrictions

support domestic industries through subsidies or tax breaks

lobbying by politicians to influence business decisions

politicians retiring to seats on the boards of plcs

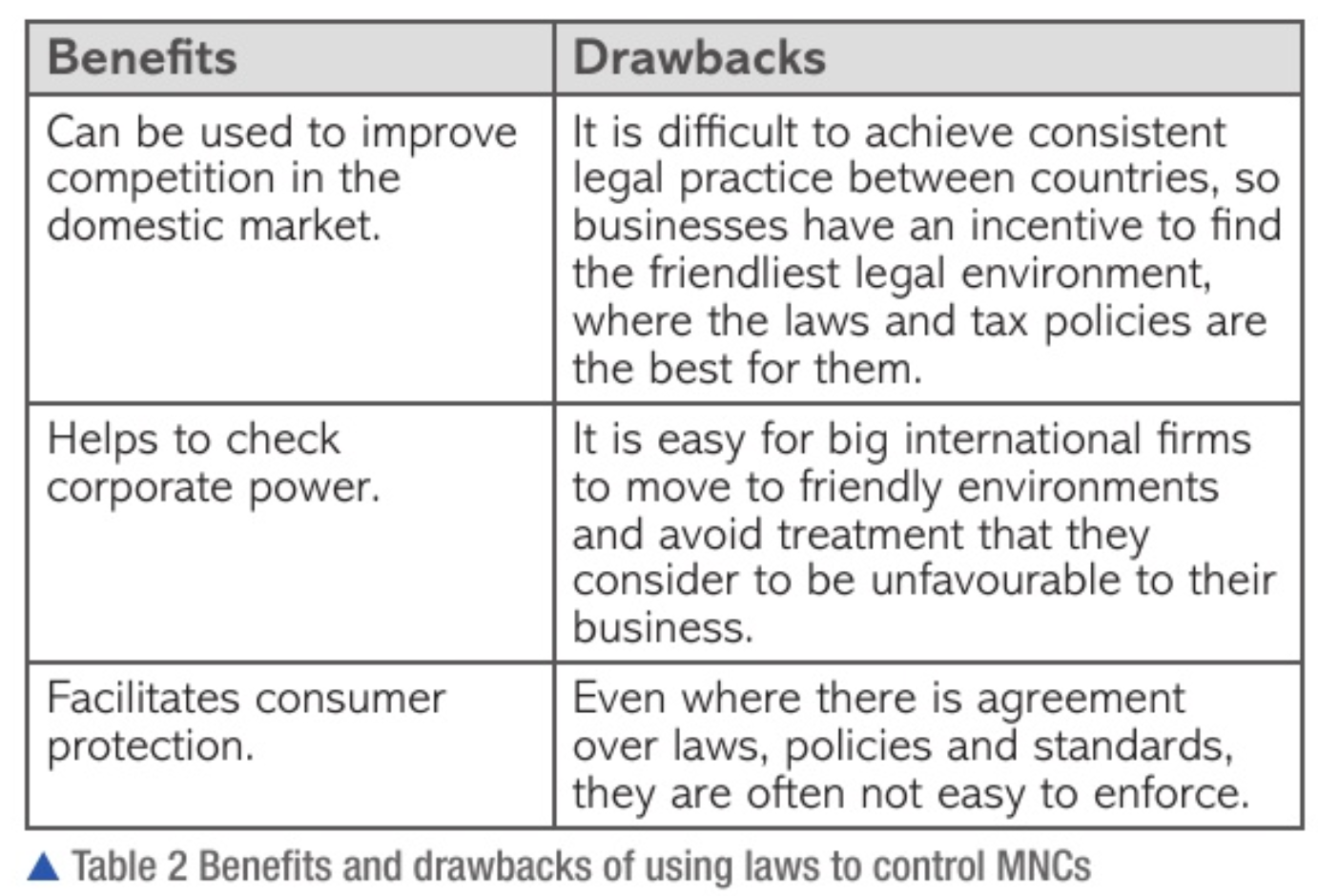

legal control

competition policy

exists to promote competition

ensures markets operate as efficiently as possible

specialised agencies set up to protect producers and consumers from unfair or anti-competitive practices

ensures firms don’t abuse market power, fix prices, or use pricing strategies to drive out competition, and don’t work together illegally

taxation policy

used to raise revenue

may help control MNC activities

low corporate tax = attracts huge FDI

may upset politicians in other countries

tax avoidance = big companies use differing systems to avoid tax

legislation

provide legal framework for business operations

system of incentives and penalties to ensure at-risk groups

too much intervention = discourages enterprise, deters foreign investment

prevents growth in income

reduces job creation

decreases tax revenue

reduces consumer choice

too little intervention = may not give attention to stakeholders best interest

legislation to penalise companies damaging environment, exploiting employees, engaging in anti-competitive practices, bullying suppliers and exploiting consumers

consumer pressure

apply pressure by avoiding products

forced to consider a wide range of social, political and historical sensitivities when marketing products in ethnically and culturally diverse regions

use of review systems allows customers to write freely about their experiences

companies want to avoid bad reviews

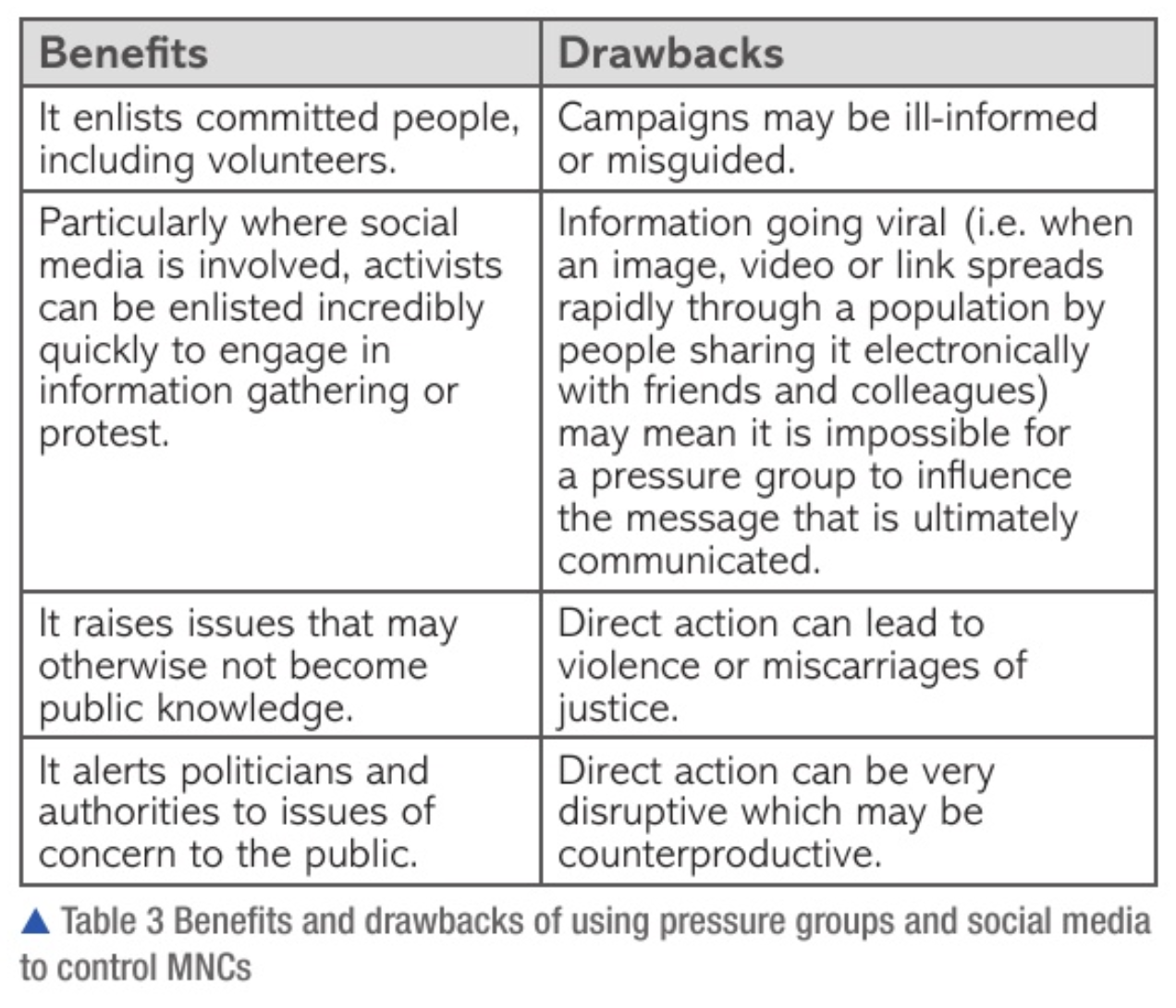

pressure groups

company behaviour may violate what many people consider acceptable but not break any laws

publicise bad behaviour and threaten to damage the image of form

voluntary organisations

methods to control MNCs:

boycotting - withdrawing from commercial or social relations

media criticism - criticised in the media, protest movements

direct action - demonstrations, protests, strikes or sabotage to achieve a political or social goal

lobbying - taking issues directly to government in an effort to influence change

social media

interaction between electronic and mobile devices, applications and people, that allows users to create content

controls MNC behaviour by:

making information collection easier

increasing social awareness

ensuring greater transparency

bringing together people to create social authority to challenge large companies

self-regulation

group of firms in the same industry agree to follow a set of rules and guidelines to ensure proper conduct

guidelines specific to industry

designed to ensure companies maintain common standards

address issues such as health and safety, ethical behaviour, responsibility to employees and consumers and environmental practices

code of practice

these companies also practice self-policing

signed up businesses monitor their own activities

set performance targets

advantages of self-regulation:

avoids rigorous, expensive government regulation and compliance costs

needs of stakeholders better served

improved image and reputation

easier for business to encourage its employees to adopt ethical behaviour and principles

benefits taxpayers

disadvantage: conflict of interest - difficult to comply if financial performance is threatened