Chapter 12 - Labour Productivity

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

long run economic growth

sustained increase in economy’s productive capacity due to increase in LRAS

importance of long run economic growth

relates to productivity growth which maintains economic growth and economic welfare and prosperity

productivity growth contributes to

higher wages

lower prices

higher profits

increased tax revenue

strong EG

higher wages

as productivity rise, labour cost to produce 1 unit of output fall

profit increase, firm can up wage

lower prices

productivity rise, labour cost fall, business can reduce price

IC improve, equitible income distribution(creates more jobs in diff sectors)

higher profit

productivity rise, unit COP fall

price fall, IC up, X revenue rise

increased tax revenue

biz profit increase, gov receive more tax revenue

gov spend on public service, SOL improve

strong EG

as productivity rise, economic capacity improve, thus GDPfe shift right

more room for economic expansion

driving forces for long run EG

labour productivity

capital deepening

technological progress

labour productivity

measure of g/s produced for every hour worked

as labour productivity improve, efficient workforce lead to economic growth

capital deepening

increase in physical assets

help improve production and efficiency, improve EG

technological progress

technological innovations lead to efficient production, EG improve

labour productivity

output per labour hour worked

output/labour input

China’s C19 policy affected global supply chains, thus although labour hours increase, output still stagnant, hence fall in labour productivity

multifactor productivity

output per unit of combined inputs

GDP/labour hours+capital input

factors affecting labour productivity growth

human capital

capital deepening

technological progress

human capital

increase in education and specialisation in workforce

include labour market turnover, labour market hoarding, demographic development, education and training

labour market turnover

increase in job mobility boosts labour productivity if it results in better job matching and labour reallocation to more productive firms

labour productivity depends on productivity of sectors

BUT short term, productivity may fall as worker have to relearn

labour market hoarding

firms hold onto more workers than needed

labour underutilization, labour productivity fall

demographic development

aging population may lead to fall in labour supply

firms must adopt labour saving techniques

education and training

educated workers more efficient

capital deepening

increase in proportion of capital stock to num of labour hours worked

may increase labour productivity and output

technological progress

level of innovation and advances in tech that allow businesses to produce more output with the same level of input

impact of changes in labour productivity on UE

structural UE

real wage UE

residual UE

structural UE

UE due to skill mismmatch

shifting of resources lead to structural UE

real wage UE

UE due to high wage, thus employers dont want hire

if gov implement labour market reform, lead to enteprise level bargaining, thus decentralize wage and real wage UE fall

residual UE

UE due to being unfit to work

gov implement infrastructure reform, EG: healthcare infrastructure, employees recover and start work faster, residual UE fall

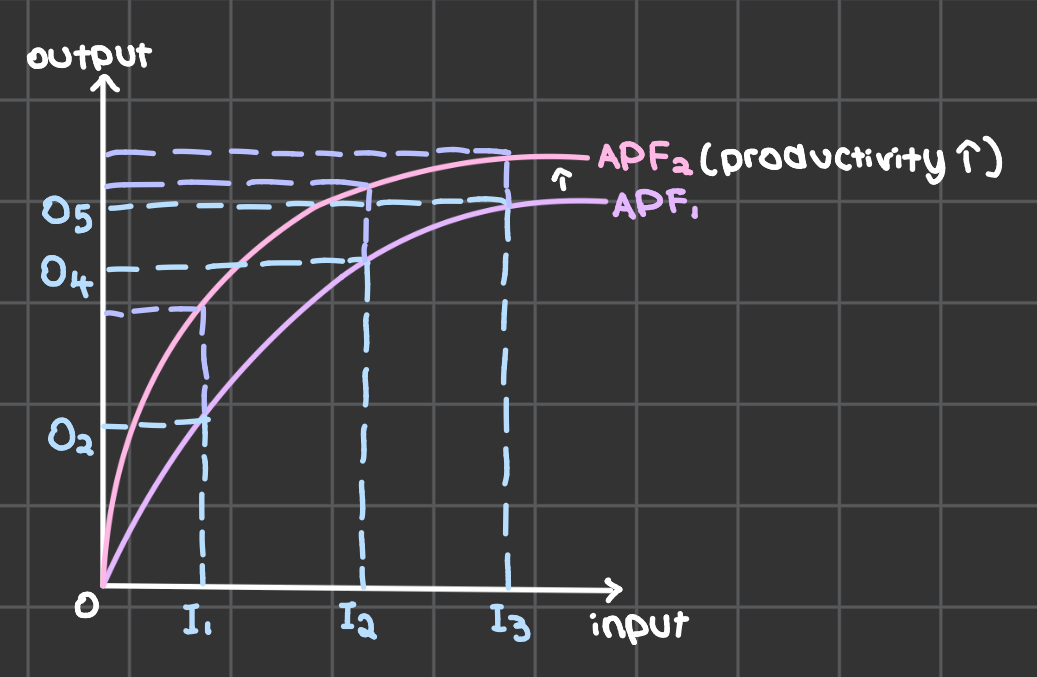

aggregate production function

reflects law of diminshing return: with each increase in input, output increase by smaller amount

gov objective

improve efficiency of market by improving competition and removing unecassary regulations

gov policies that influence labour productivity

(Please Take Donuts For Lunch To Never Ignore Teacher)

public reform

taxation reform

deregulation

financial reform

labour market reform

tariff reform

national competition policy reform

infrastructure reform

trade reform

public reform

privatisation - sale of publically owned assets to private investor, improve efficiency by forcing firms to be answerable to shareholders

corporatisation - forcing gov business enteprise to face same market as other businesses, must aim to make profit since they dont receive any gov benefits

taxation reform

reduces extent to which tax system distorts allocation of resources

EG: introduction of GST(10% tax on ALL g/s) to replace WST, replace 3 tier wholesale system

RESULT: business cost fall, encourage investment

deregulation

remove bureautic barriers to enter market

make industry more efficient

financial reform

open banking sector to new competition

many banks in industry, more money to borrow/lend

no need raise IR

labour market reform

improve functioning of labour market as a policy solution to reduce structural UE

EG: workplace relations act 1996, paved way for enteprise level bargaining, decentralize wages

RESULT: flexible wages, fairness, cooperation, improved workplace participation, less strikes

tariff reform

reduces effective rate of protection

EG: tariff on passenger motor vehicles reduced to 5% in 2010

RESULT: efficient industry, e.o.s

national competition policy reform

most extensive microeconomic reform package in recent Aus history

EG: establishment of Aus Comp and Consumer Commission - competition watchdog to ensure businesses dont engage in anti-competitive conduct, allow private firm to compete with GBEs

RESULT: price determined by market forces

infrastructure reform

provide building blocks for business to further invest in productivity measures

EG: transport infrastructure - reduce commute and delivery times, more time for worker to do productive taks

trade reform

obtain reductions in internal support and subsidies to foreign competitors to gain access to foreign markets and eliminate export subsidies

EG: WTO create fair trading environment, maximise FTA oppurtunities