1.2.3 Price, income and cross elasticities

5.0(1)

Card Sorting

1/22

Earn XP

Description and Tags

Last updated 2:55 PM on 5/1/24

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

1

New cards

price elasticity of demand

the responsiveness of a change in demand to a change in price

2

New cards

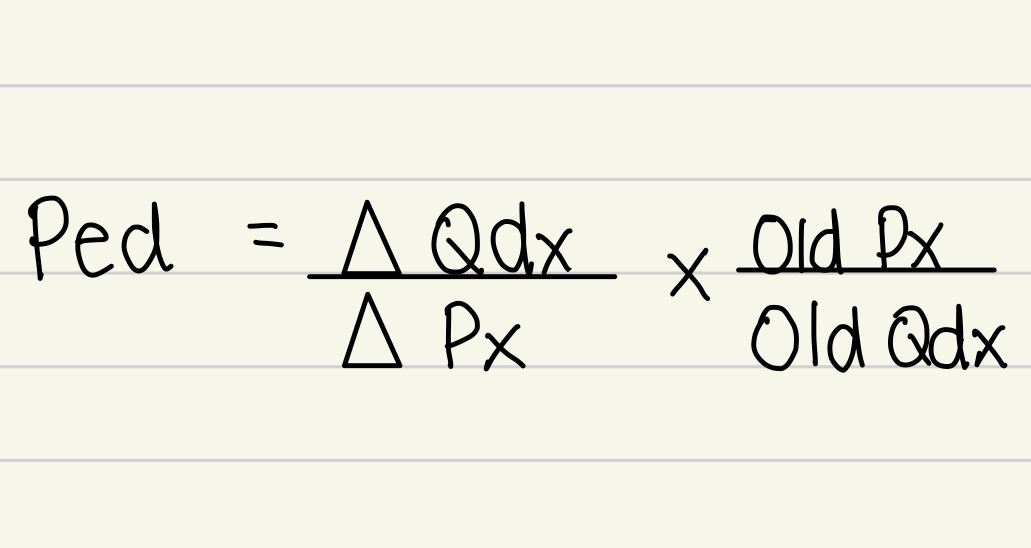

formula for PED

PED = %change in Qdx / %change in Px

3

New cards

formula for percentage change

%change = (new - original) / original x100

4

New cards

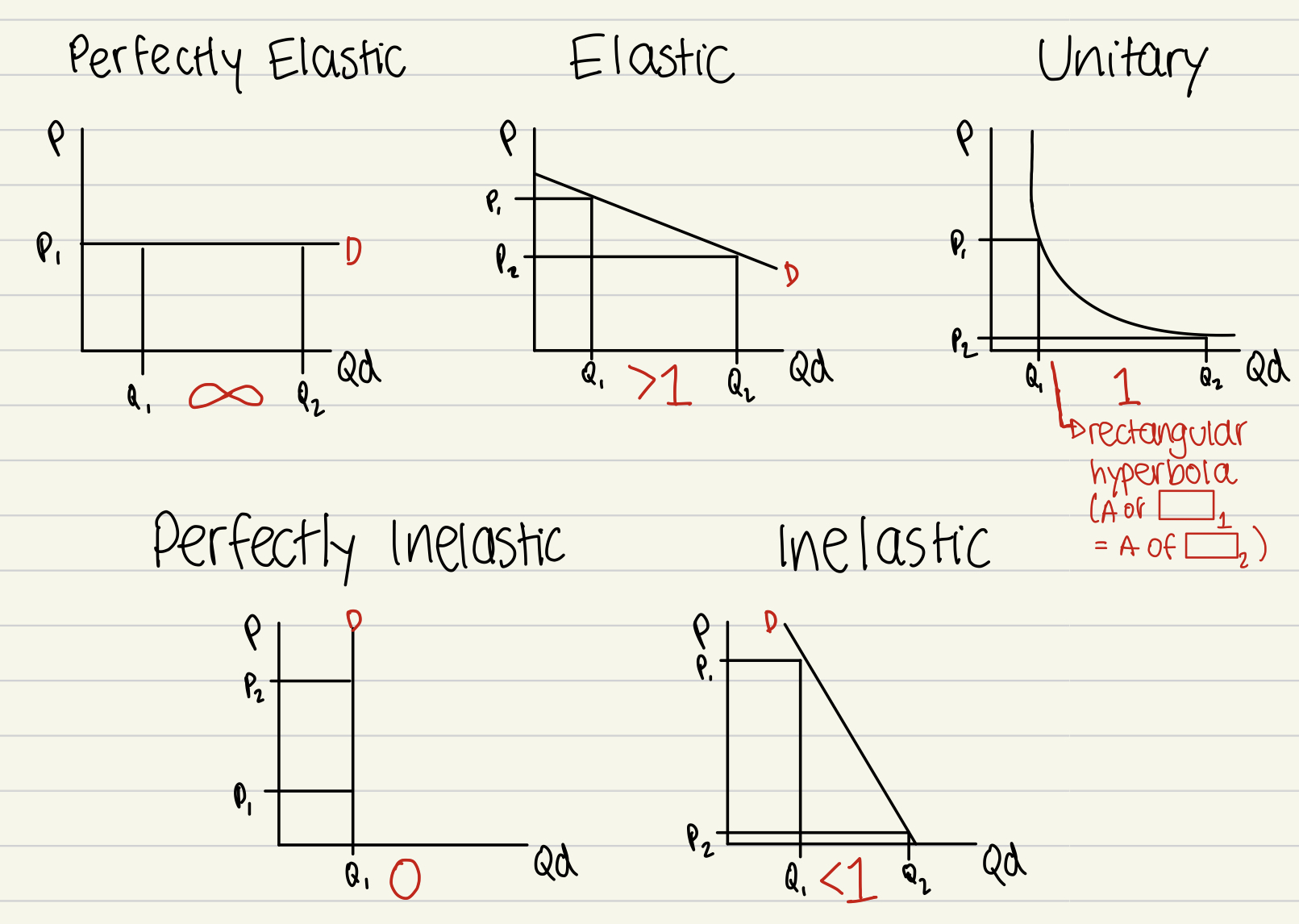

price elasticity - numerical values

- perfectly elastic: infinity

- elastic: > 1

- unitary elastic: 1

- inelastic: < 1

- perfectly inelastic: 0

- elastic: > 1

- unitary elastic: 1

- inelastic: < 1

- perfectly inelastic: 0

5

New cards

price elasticity - definitions

- perfectly elastic: extreme response in %Qdx to almost no change in %Px

- elastic: bigger change in %Qdx than change in %Px

- unitary elastic: equal change in %Qdx compared to %Px

- inelastic: smaller change in %Qdx compared to %Px

- perfectly inelastic: no response %Qdx compared to change in %Px

- elastic: bigger change in %Qdx than change in %Px

- unitary elastic: equal change in %Qdx compared to %Px

- inelastic: smaller change in %Qdx compared to %Px

- perfectly inelastic: no response %Qdx compared to change in %Px

6

New cards

price elasticity - graphs

7

New cards

factors of price elasticity of demand

nature of commodity: necessity=inelastic, comfort=elastic, luxury=more elastic

substitutes: more substitutes=elastic, less substitutes=inelastic

number of uses(durability): single use=inelastic, multi use=elastic

habits(addictiveness): addictive=inelastic

time period: short period=inelastic, long period=elastic (more substitutes available)

urgency of needs: urgent=inelastic

level of income: higher income=inelastic

proportion of total expenditure spent: higher proportion=elastic

8

New cards

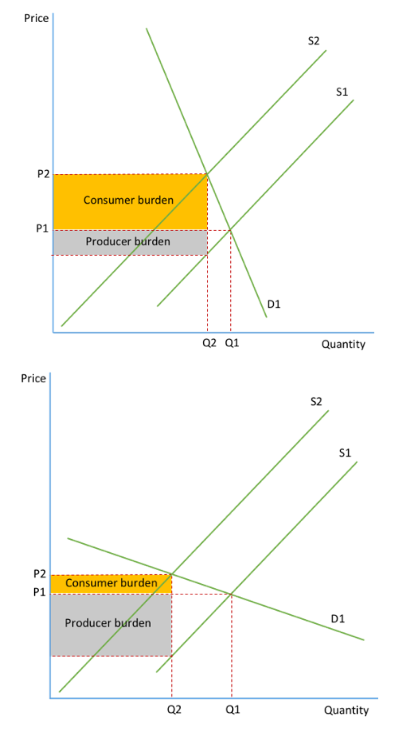

significance of PED - indirect taxes

- determines the effects of the imposition of indirect taxes and subsidies

- if PED is elastic: a tax will only lead to a small increase in price and the supplier will have to cover the majority of the cost of the tax

- if PED is inelastic: tax will mainly be passed onto the consumer, tax will be ineffective at reducing output but there will be a higher tax revenue for the gov.

- if PED is elastic: a tax will only lead to a small increase in price and the supplier will have to cover the majority of the cost of the tax

- if PED is inelastic: tax will mainly be passed onto the consumer, tax will be ineffective at reducing output but there will be a higher tax revenue for the gov.

9

New cards

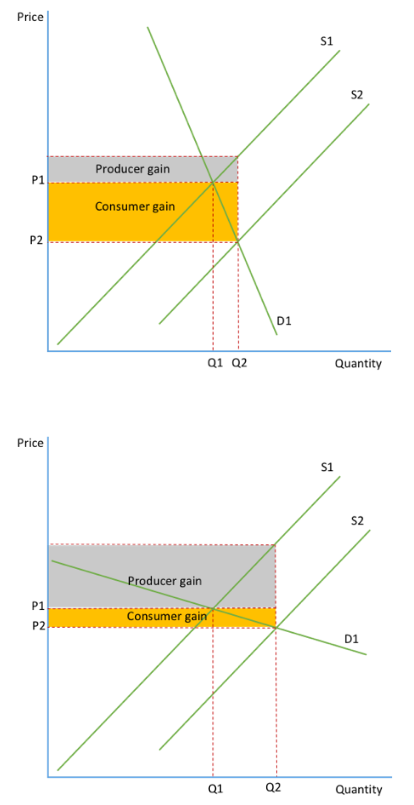

significance of PED - subsidies

SHIFT FROM S2 TO S1: subsidy

- if PED is elastic: consumer sees small fall in price, producer gains lots more revenue, large change in output following a subsidy

- if PED is inelastic: bigger fall in price but ineffective at increasing output - cheaper for gov to impose as output increases by less so the gov have to pay subsidies on less goods

- if PED is elastic: consumer sees small fall in price, producer gains lots more revenue, large change in output following a subsidy

- if PED is inelastic: bigger fall in price but ineffective at increasing output - cheaper for gov to impose as output increases by less so the gov have to pay subsidies on less goods

10

New cards

expenditure

money paid by consumer

11

New cards

revenue

money earned by worker

12

New cards

price inelastic vs revenue

total revenue PROPORTIONAL to change in price

- increase in price = increase in revenue

- decrease in price = decrease in revenue

- increase in price = increase in revenue

- decrease in price = decrease in revenue

13

New cards

unitary price elastic vs revenue

NO CHANGE in revenue even if price changes

- increase in price = no change in revenue

- decrease in price = no change in revenue

- increase in price = no change in revenue

- decrease in price = no change in revenue

14

New cards

elastic price vs revenue

total revenue INVERSE to change in price (proportional to Qdx)

- increase in price = decrease in total revenue

- decrease in price = increase in total revenue

- increase in price = decrease in total revenue

- decrease in price = increase in total revenue

15

New cards

income elasticity of demand - definition

responsiveness of a change in demand to a change in income

16

New cards

income elasticity of demand - formula

YED = %change in Qdx / %change in income

17

New cards

income elasticity of demand - numerical values

- inferior good: YED

18

New cards

income elasticity of demand - relationships and graphs

INCREASE IN INCOME:

- inferior: negative relationship, leftward shift

- normal:

=necessity: inelastic goods, positive relationship, small rightward shift

=luxury: elastic goods, positive relationship, big rightward shift

- inferior: negative relationship, leftward shift

- normal:

=necessity: inelastic goods, positive relationship, small rightward shift

=luxury: elastic goods, positive relationship, big rightward shift

19

New cards

uses of YED

-investment planning: boom in economy=invest in luxuries, recession in economy, invest in inferiors

-production planning: if income increases: increase capacity of luxuries=increase in sales, if income decreases: increase capacity of inferior goods=increase in sales

-product switching: some firms switch products, in a recessions=switch to inferior goods

-production planning: if income increases: increase capacity of luxuries=increase in sales, if income decreases: increase capacity of inferior goods=increase in sales

-product switching: some firms switch products, in a recessions=switch to inferior goods

20

New cards

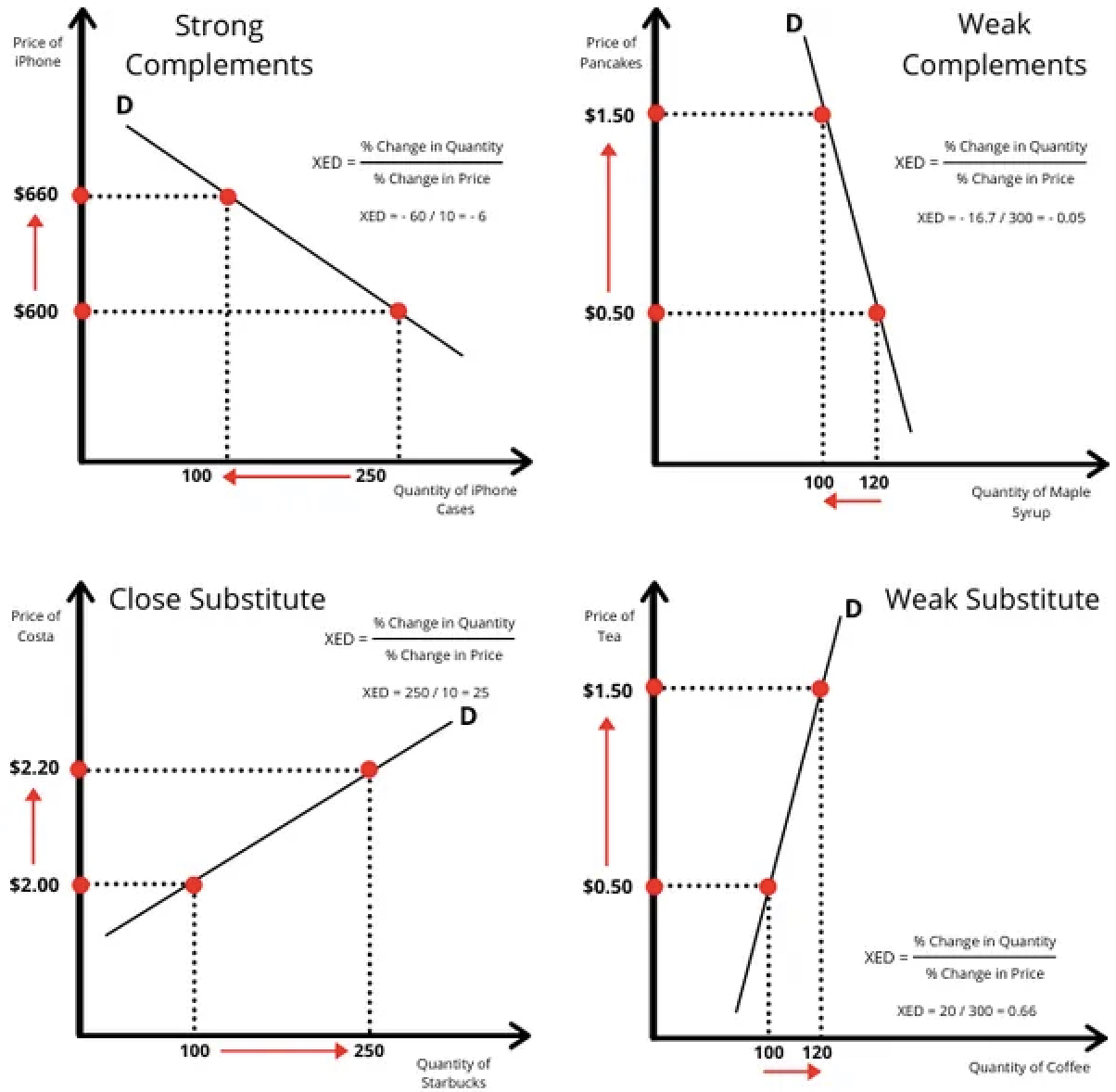

cross elasticity of demand - definition

the responsiveness of quantity demanded of one good when the price of a related good changes

21

New cards

cross elasticity of demand - formula

XED = %change in demand of good X / %change in price of good Y

22

New cards

cross elasticity of demand - numerical values and graphs

- complementary goods (negative relationship):

STRONG= XED>1, flatter curve, elastic

WEAK= XED

STRONG= XED>1, flatter curve, elastic

WEAK= XED

23

New cards

uses of cross elasticity of demand

- allows firms to see competition = less likely to be affected by price changes by other firms if they are selling complementary/substitute goods

- if there are no close substitutes, firm can increase prices

- loss leaders: firms can use knowledge of complementary products to increase overall revenue (e.g. sell one product cheaply to profit from a more expensive product)

- if there are no close substitutes, firm can increase prices

- loss leaders: firms can use knowledge of complementary products to increase overall revenue (e.g. sell one product cheaply to profit from a more expensive product)