IB Microeconomics - conceptual

1/109

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

110 Terms

The Factors of Production

Land, Labour, Capital and Enterprise

Profit

Financial gain from selling a good or service

Opportunity Cost

Cost expressed in terms of the next best alternative

What diagram can be used to represent Opportunity Cost?

PPC or PPF

PPC/PPF

A diagram which highlights the relationship between the production of good X in relation to good Y

What is a point outside of the PPC?

Unattainable

What is a point inside the PPC?

Attainable but inefficient

What is a point on the PPC?

Attainable and Efficient

How can growth of an economy be shown?

Outward shift of the PPC curve

How can you show unemployment on the PPC?

The point is closer to coordinates (0,0)

What can the PPC illustrate?

Scarcity, Choice, Efficiency, Inefficiency, Opportunity Cost, Constant Opportunity Cost, Increasing Opportunity Cost and Growth.

Market

An institution which permits interaction between buyers and sellers ALSO be considered a mechanism that determines which goods and services will be produced in an economy and so how scarce resources will be allocated

Demand

Summarizes the behaviour of buyers in a market

Law of Demand

As prices increase, demand decreases (inverse)

Substitution Effect

If the price of X increases then all other goods automatically become relatively cheaper and so consumers will tend to substitute other goods

Income Effect

If the price of X increases then purchasing power of consumers decreases and they will be able to afford less

Factors affecting demand

PIRATES: Population size, Income, Related Goods, Advertisement, Taste, Expectation, Substitutes

Also could include (direct taxes, government action, trends and fashion, season, natural disaster, special events)

Normal Good

Increase in income leads to an increase in demand

Inferior Good

Increase income, decrease demand

Supply

The amount that producers are willing and able to supply at any given price at any given time

Law of Supply

As prices rise, supply rises

Determinants of Supply

INSECTS: Intervention by government, # of firms in the market, supply shock, expectation, cost of production, technology, supply of goods

How will a good be sold in a competitive market?

It is determined by the interaction between consumers and producers

Equilibrium Price

Where demand and supply meet

Excess Supply

Prices drop

Excess Demand

Prices Rise

Utility

Benefits or satisfaction gained from consuming goods and services - hard to measure but we assume consumers make decisions based on maximizing utility.

What does price act as?

Signalling, incentive and rationing device & helps allocate resources

What is price mechanism?

The role price plays in incentivizing producers to act in their own self interest to a change in the demand for a particular good

Consumer Surplus

The difference between how much consumers are willing and able at the most to pay for some amount of a good, and what they actually end up paying

Producer Surplus

The difference between what firms earn from selling some amount of good and the minimum they would require to be willing to offer this amount

Where is consumer surplus on a diagram?

Area below the demand curve but above the price line for the units of the good consumed

Where is producer surplus on a diagram?

The area above the supply curve and below the price line for the units of the good produced and sold

When is allocative efficiency achieved?

Allocative efficiency has been achieved when the optimal amount is produced from society's point of view. If neither too much nor too little of a good is produced and consumer than just the right amount of labour and capital are employed in its production

Allocative Efficiency

When the MB (marginal benefit) = MC (marginal cost)

Price Elasticity of Demand (PED)

The responsiveness of quantity demanded to a change in price = % change Qd / % change P

Ranges of PED

PED > 1 = elastic

0

Increase Price of Elastic Good leads to...

Quantity falls and so does Total Revenue

Increase Price of Inelastic Good leads to ...

TR will rise

Marginal Revenue (MR)

the extra revenue from selling one more unit of output

Determinants of PED

SPLAT = Substitutes, Proportion of Income, Luxury vs Necessity, Addictiveness, Time (others may include: Advertisement and Branding, How the product is defined)

Effect of PED on TR

Elastic Demand:

Price Rise - TR fall

Price Fall - TR rise

Inelastic Demand:

Price Rise - TR rise

Price Fall - TR fall

Cross Price Elasticity of Demand (XED)

The responsiveness of demand for one good (x) to a change in price of another good (y) = % change Qx / % change Py

Ranges of XED

XED>0 two goods are substitutes

XED < 0 two goods are complementary

XED = 0 two goods are unrelated

XED > 0

Substitutes : CURVE LOOKS LIKE SUPPLY CURVE

XED < 0

Complements: CURVE LOOKS LIKE DEMAND

Uses of XED

-Policy maker

-Guide their pricing policy changes

Income Elasticity of Demand (YED)

The responsiveness of demand when consumers income changes = % change Qd / % change income

Ranges of YED

YED > 0 = normal good

YED < 0 = inferior good

YED > 1 = Luxury good

0 < YED > 1 = Necessity

YED = 0 unaffected by income

YED = 1 Same change

How to illustrate YED

Simple Demand/Supply diagram

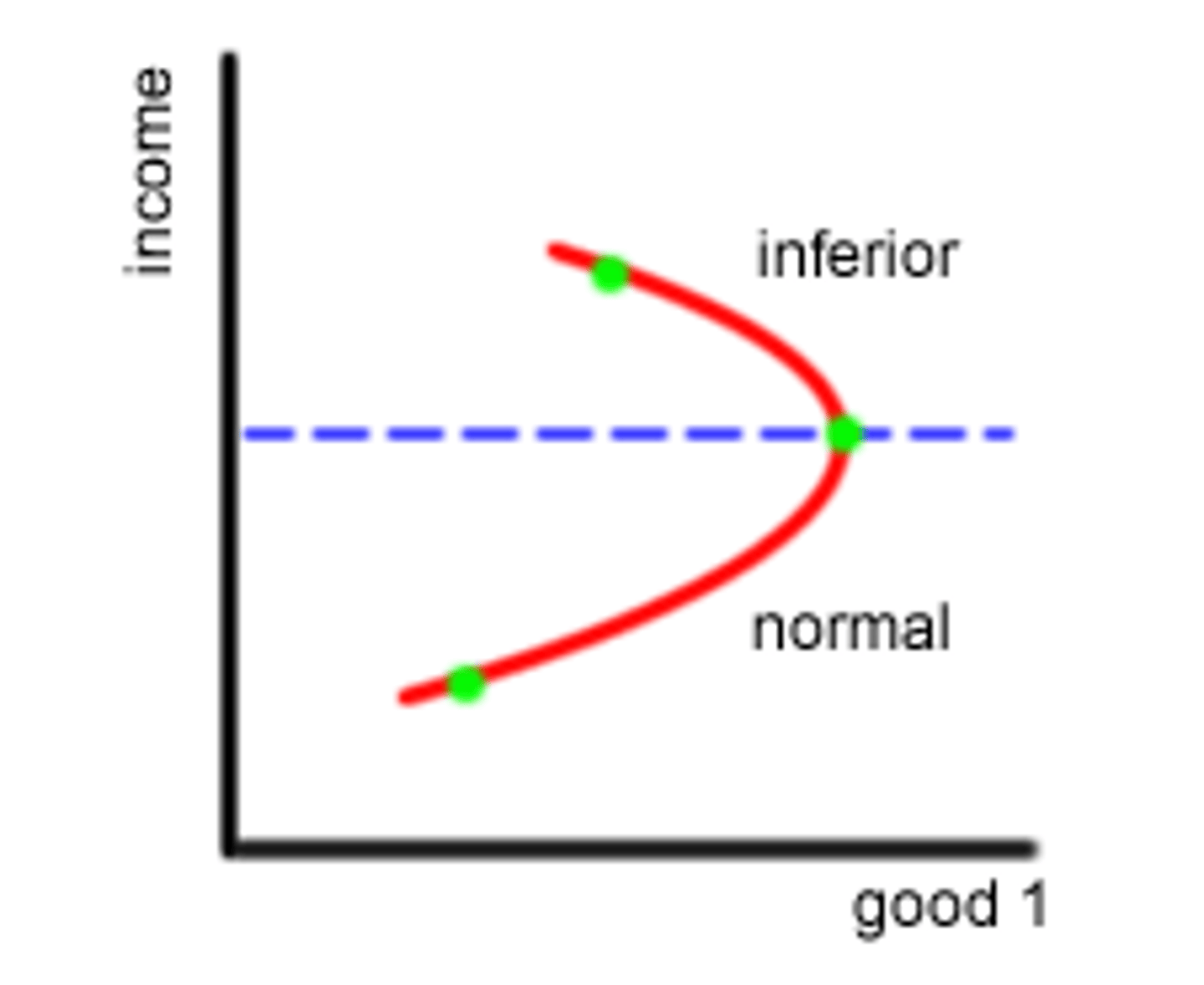

Engel Curve

Engel Curve

A graph with income on the vertical axis and quantity demanded on the horizontal axis

Applications of YED

Help firms better plan their investments

Government may want to know in order to train displaced workers

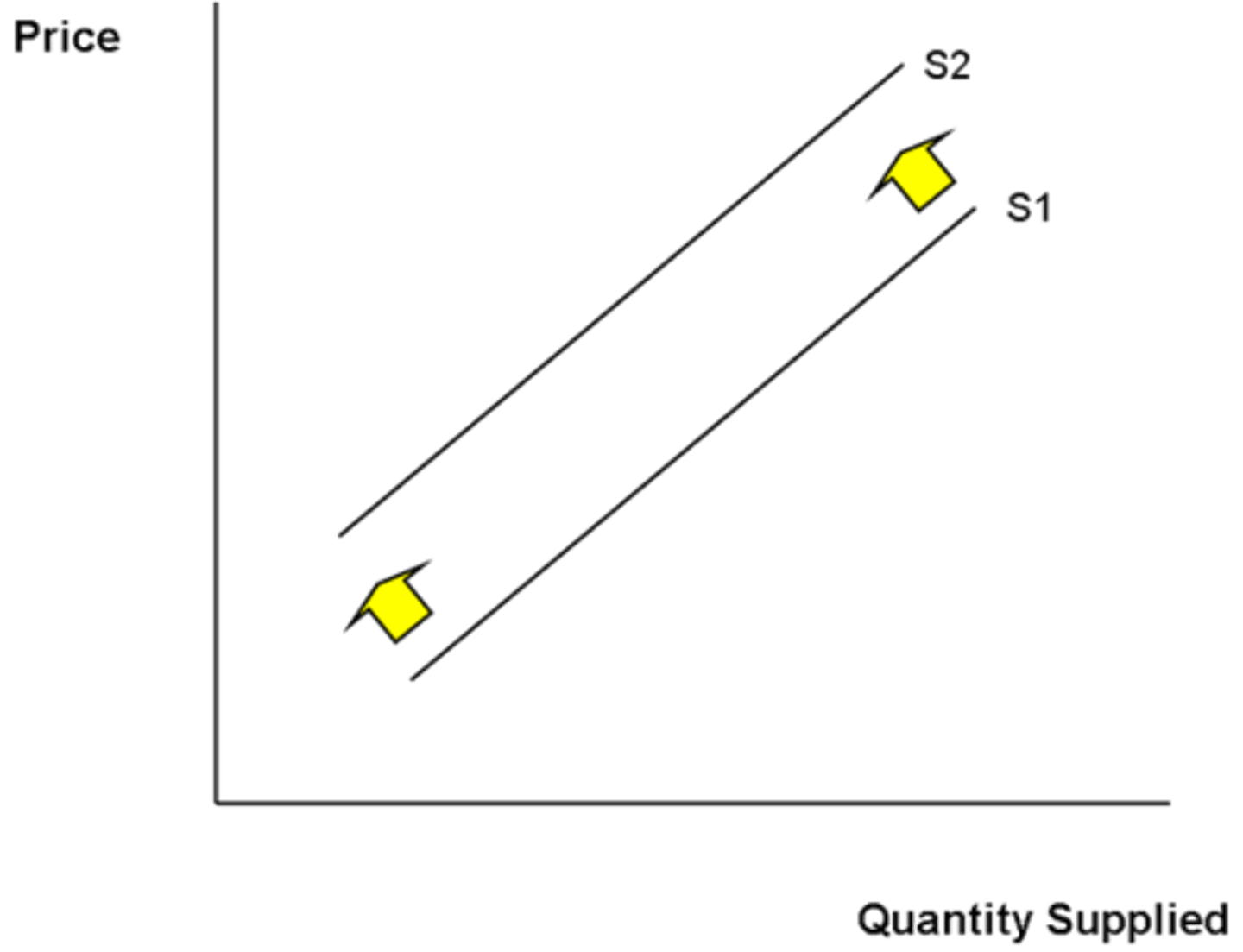

Price Elasticity of Supply (PES)

The responsiveness of quantity supplied when the price of a good changes = % change Qs / % change Price

Ranges of PES

PES > 1 = elastic

0 < PES > 1 = inelastic

PES = 1 unitary price elastic

PES = 0 perfectly inelastic

PES to infinity = perfectly elastic

Determinants of PES

Excess capacity

Whether the firm employs mostly skilled or unskilled labor

Long or short time lags

Whether it's possible to store the good

Mobility of labour

TIME

Time for PES

short term = tends to be elastic

long term = tends to be inelastic

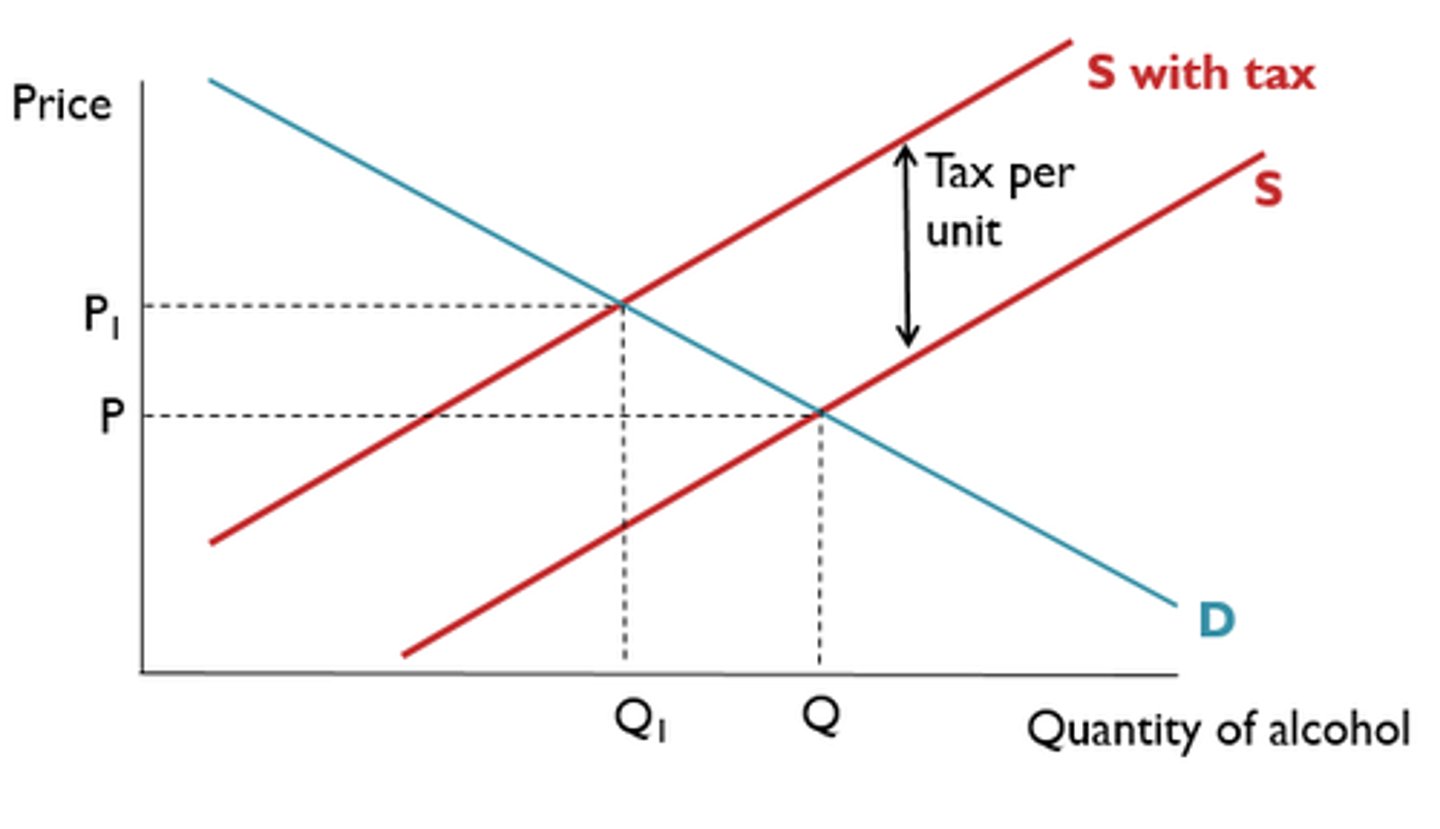

Tax

Can be categorised as direct or indirect tax

Direct Tax

Tax directly on the individual (on income)

Indirect Tax

Tax on goods and services

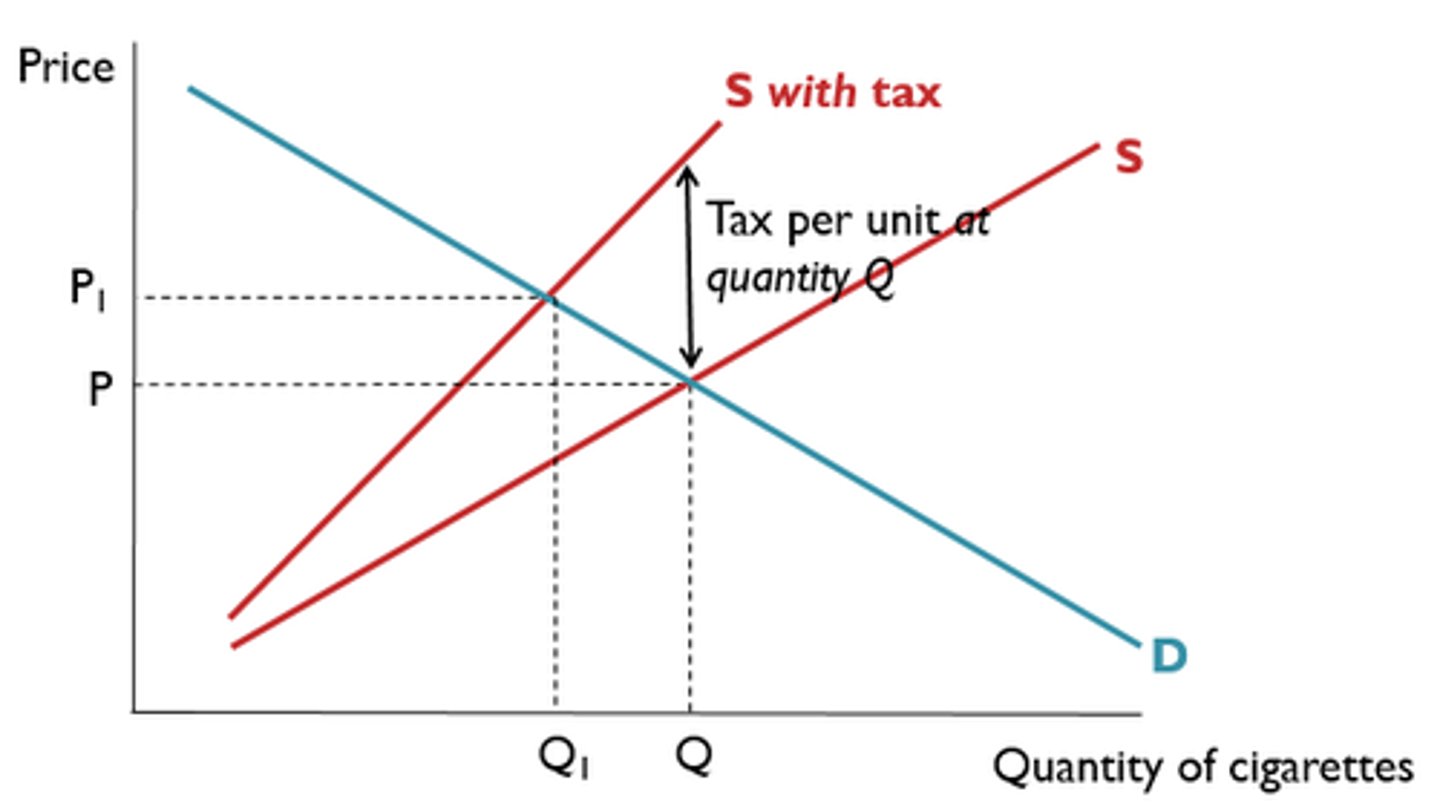

Specific Tax or Unit Tax

Fixed amount per unit of the good produced or consumed

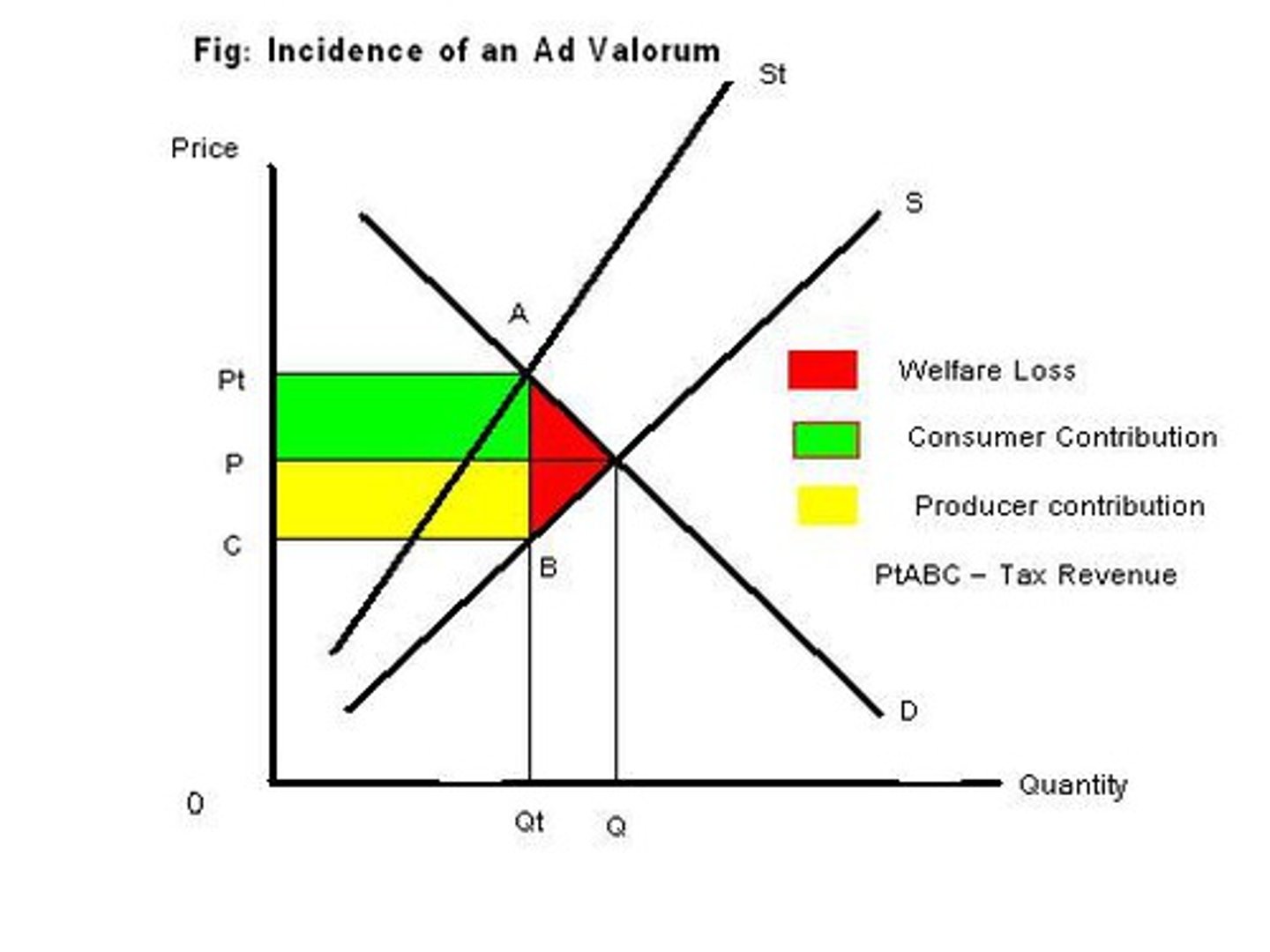

Ad Valorem Tax

Percentage tax of the price and so of consumer expenditure

Why do governments impose taxes?

Revenue Collection

Decrease Consumption of Good

Switch expenditure away from imports towards domestically produced goods

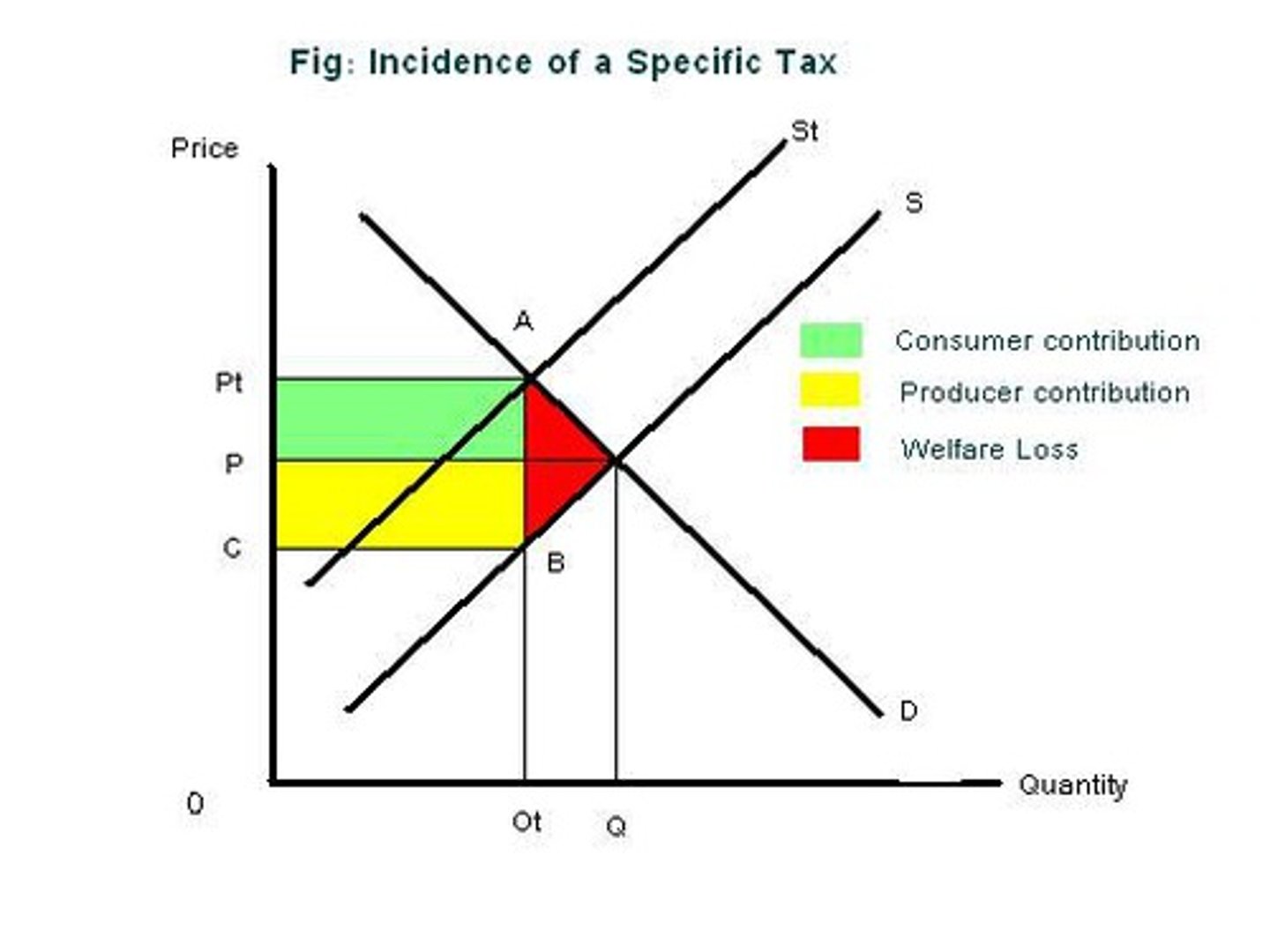

Consequences of a specific indirect tax:

Market Prices Rise

Producer average revenue is less

Government collects tax revenue

Resources are misallocated and a welfare loss

Consumers generally consume less = depends on PED

Social Welfare decreases

Tax Incidence

Refers to who pays what proportion of a tax =

% tax incidence on consumers (PES) / % of tax incidence on producers (PED)

Interpreting Tax Incidence

PES > PED = tax incidence is bigger on consumers

PES = PED tax incidence is split

PES < PED = tax incidence on producers is bigger

PES = producers are burdened by the tax only

PED = 0 consumers are burdened by the full amount of tax

Tax Incidence Diagram

Who the tax most largely affects

Ad Valorem Tax Diagram

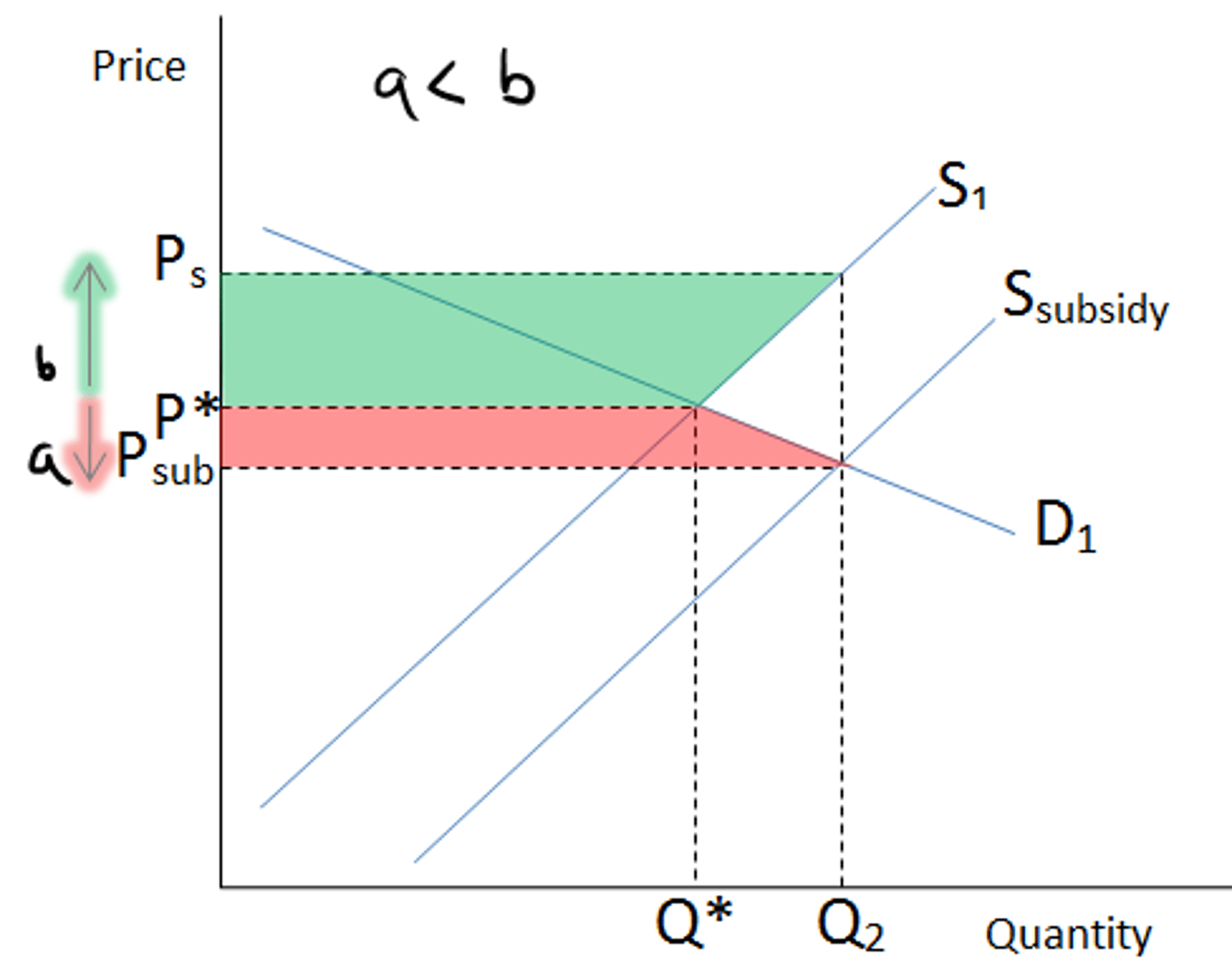

Subsidy

Per unit payment by the government aimed at lowering their costs and the market price increasing production

Effects of the Subsidy

Consumers pay lower market price

Quantity supplied increases

Average revenue collected by producers increases

Total revenue collected by producers increases

Government expenditure increases

Social welfare decreases

Consumer expenditure = depends on PED

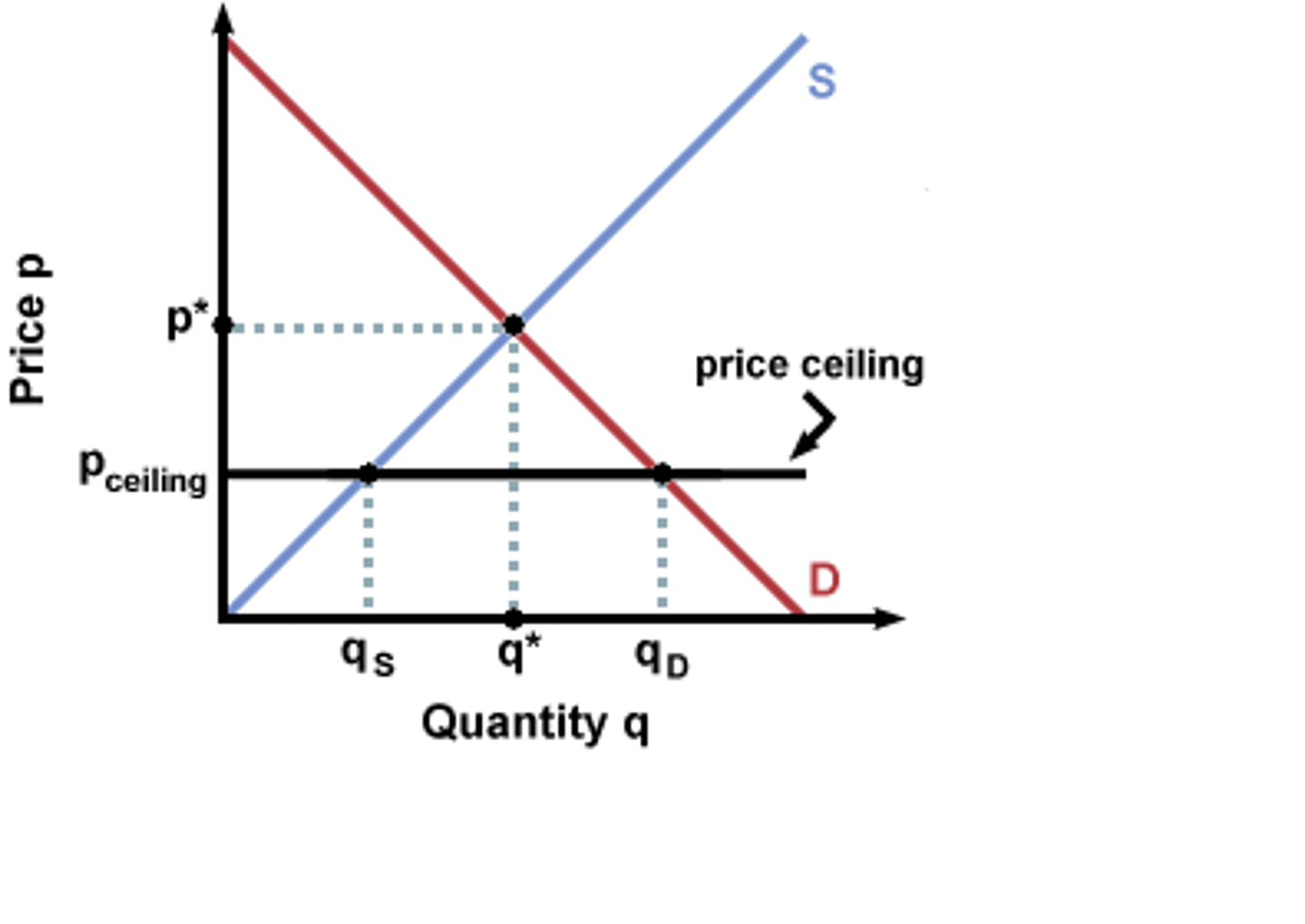

Price Controls

Refer to cases where for some reason the government considers the market determined equilibrium price unsatisfactory and as a result intervenes and sets the price either below or above it

Price Ceiling

Maximum price set below the equilibrium

Aim of a Price Ceiling

To protect the buyers of the product

Problems with Price Ceiling

The new price cannot preform it's rationing functions and thus individuals may be willing and able to pay the price but it is not certain they they will end up with the good since there is shortage: "first come first serve"

-Black markets (parallel markets)

Rationing Methods:

Ballots

Coupons

Etc.

Cons of Price Ceiling

Takes away rationing capabilities of Price

Parallel Markets (for people willing to pay higher)

Lower quality of good

Shortage

How to fix shortage of price ceiling

Subsidy

Promotion of substitute goods

Stakeholders in Price Ceiling

Producers - worse off (lower revenue)

Consumers - better off (lower price BUT shortage)

Government - decrease tax revenue BUT increased popularity

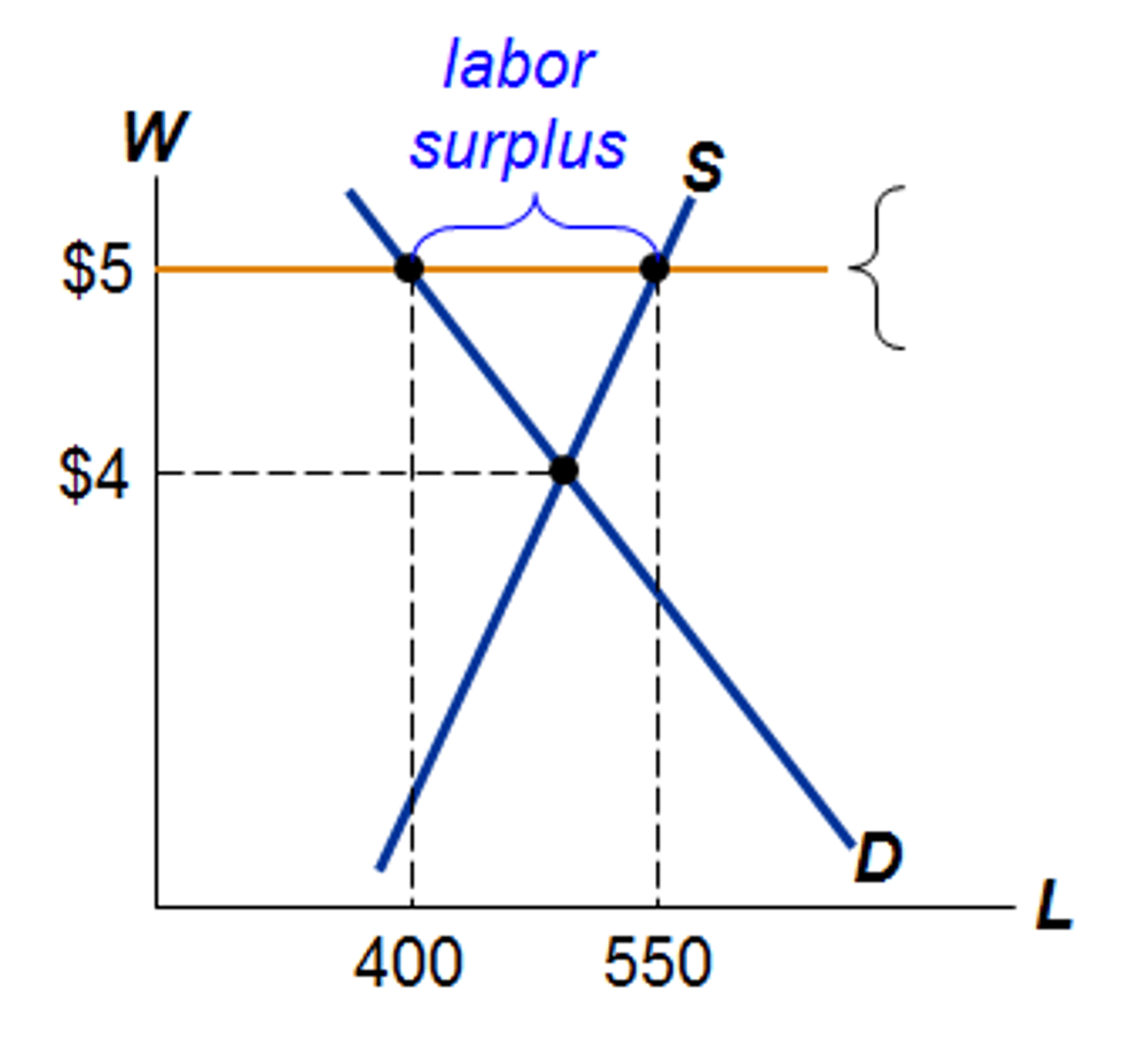

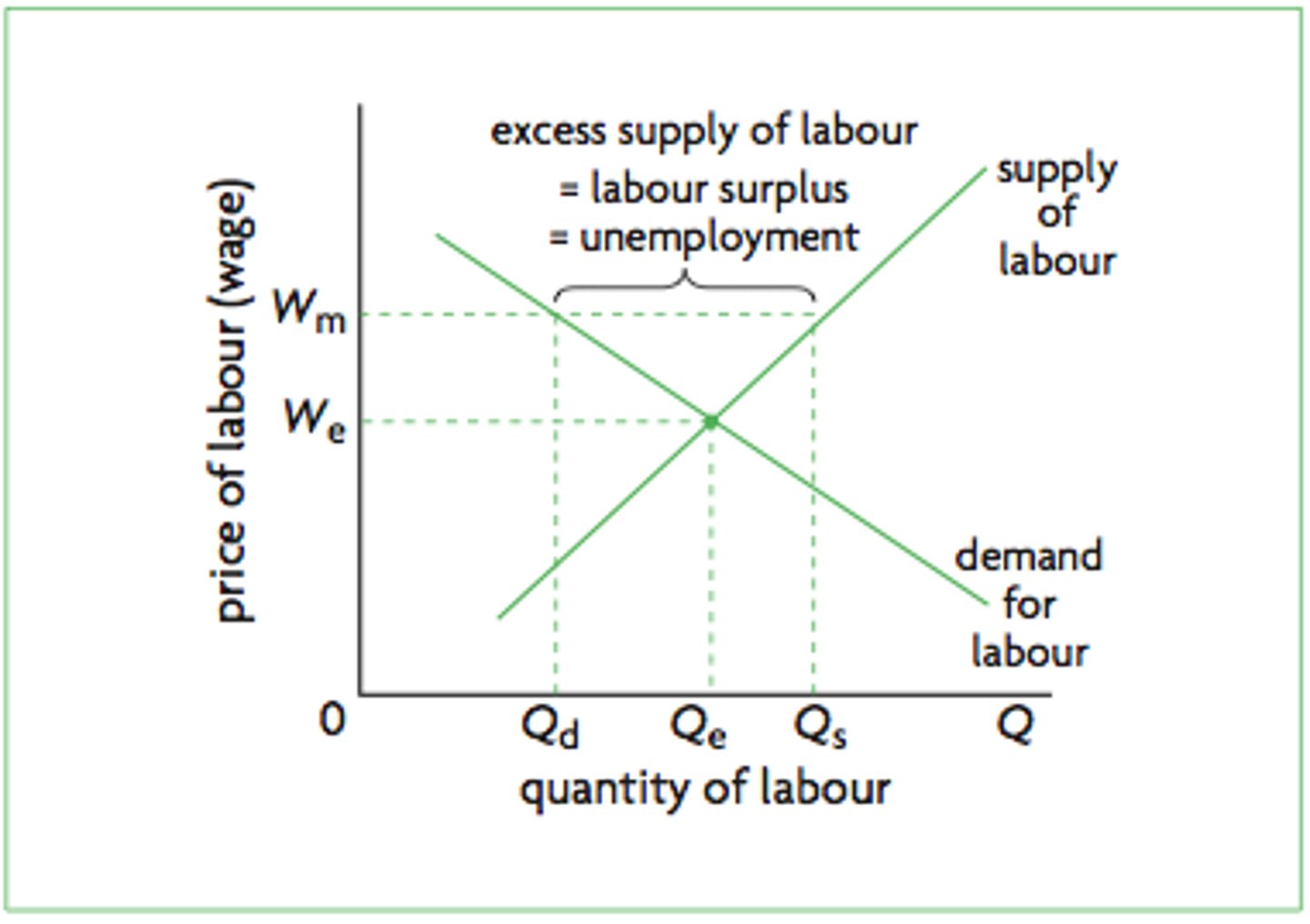

Price Floor

Minimum price set above the market-determined equilibrium

Price Floor in the Labour Market

Minimum Wage

Price Ceiling vs Price Floor

Price Ceiling:

Aim - protect consumers

Results - shortage, price cannot preform rationing role, possibility parallel market, worse quality good

Consumers - depends

Producers - worse off (lower price)

Welfare - inefficient Welfare Loss

Examples - food price controls, rent control

Price Floor:

Aim- protect producers (farmers)

Results - surplus, government forced to buy surplus and destroy it, burden on tax payers

Consumers - worse off (higher price)

Producer - better off

Welfare - Welfare loss

Example - farmers, minimum wage

Market Failure

Encompasses: externalities, public goods, monopoly power, asymmetric information

Externalities as Market Failure:

If an economic activity imposes costs on, or creates benefits for third parties for which they do not get compensated for, or do not pay for - imposes costs on third parties

Public Goods as Market Failure:

Leads to the collapse of the market as profit-oriented firms will not have the incentive to producer and offer these goods

Monopolies as Market Failure:

Less than the socially optimal amount of the good will be produced = no incentive

Asymmetric Information as Market Failure:

Buyers and sellers share different sets of information then this may also lead to a market failure

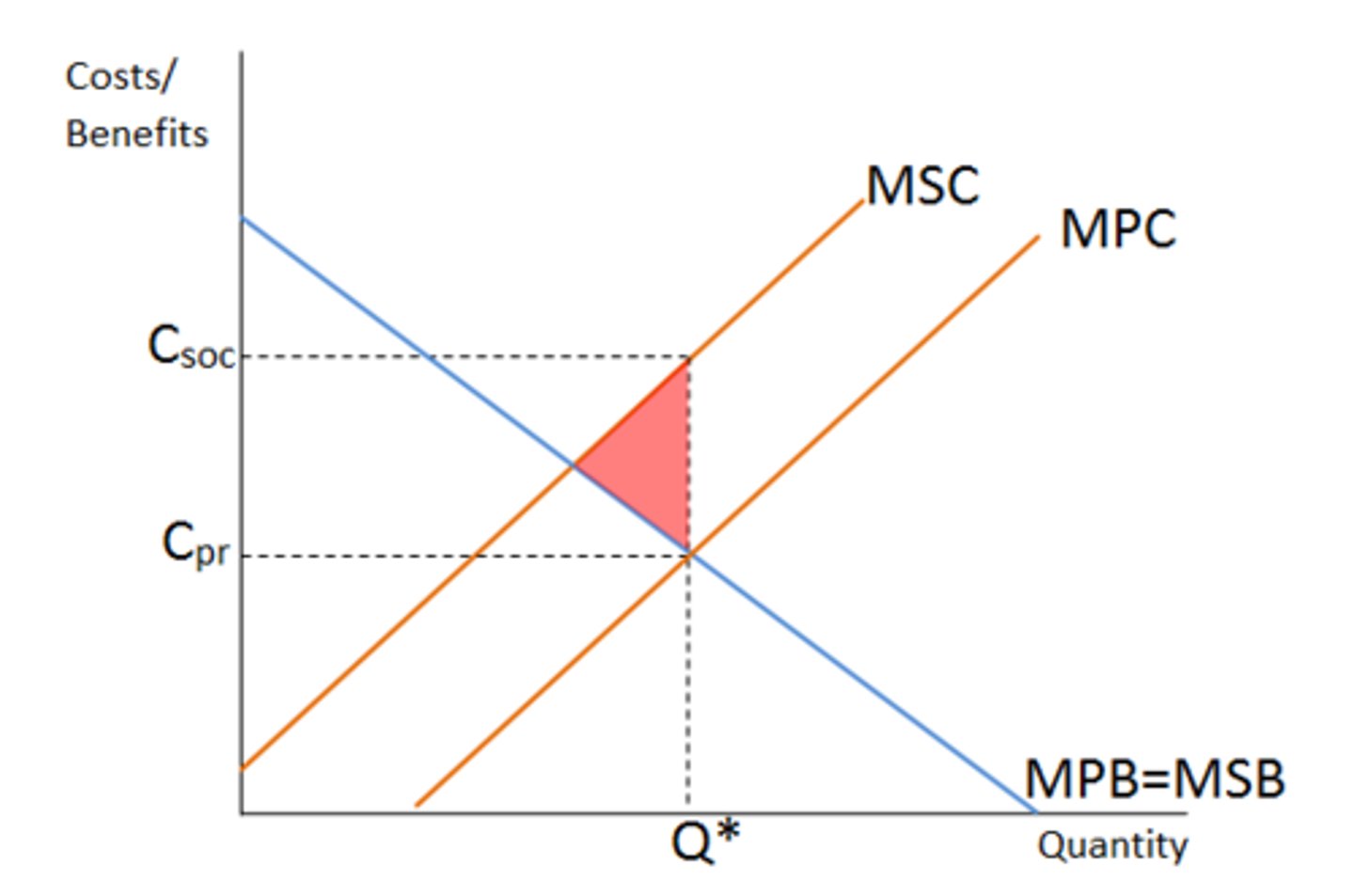

NEGATIVE CONSUMPTION EXTERNALITY

Negative Externality

Impose costs on third parties

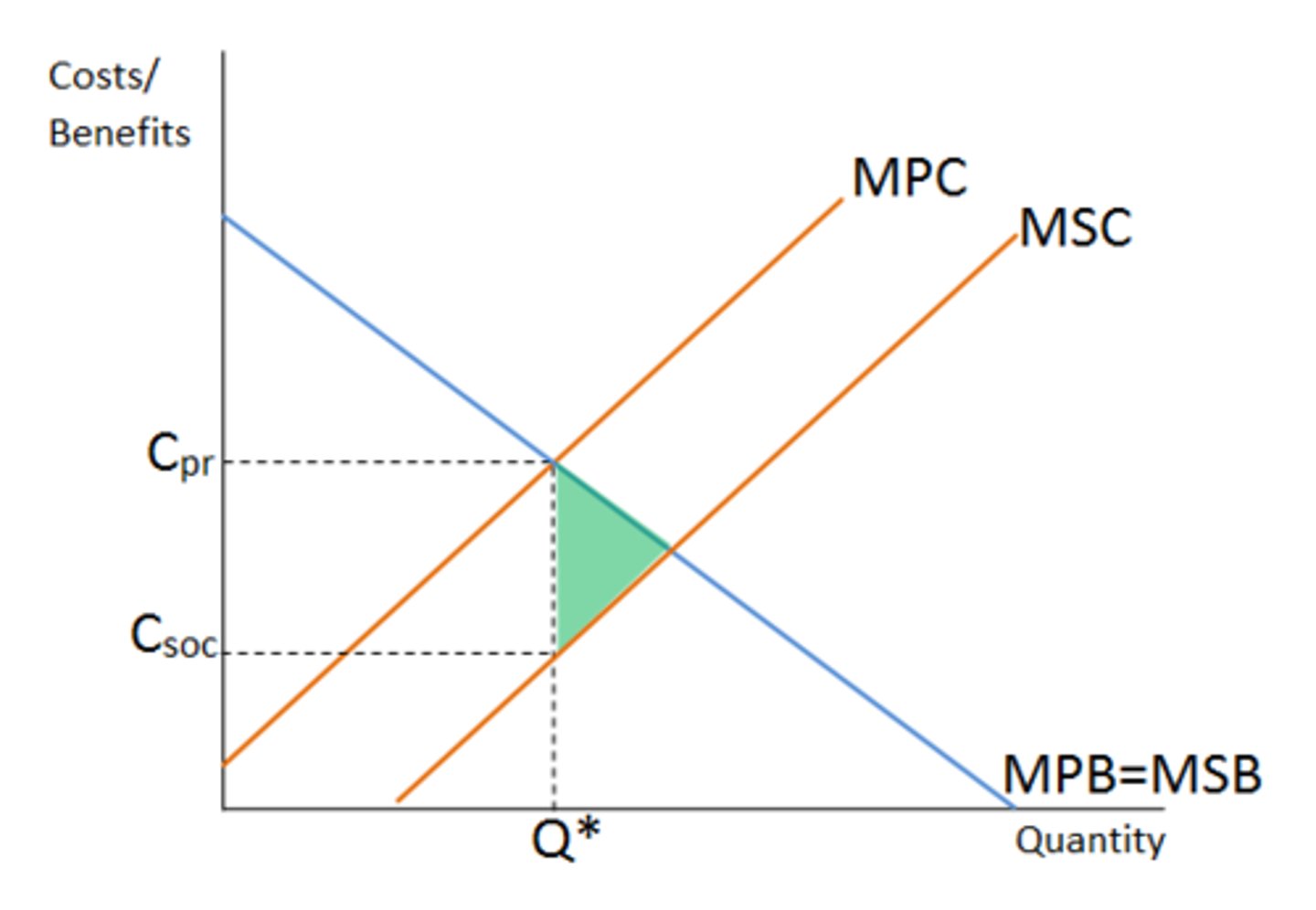

Positive Externality

Provide benefits for third parties

Marginal Cost

MPC (Private): costs of producing an extra unit of output

MSC (Social): Costs of producing an extra unit of output that are borne by society

Marginal Benefit

MPB (Private): Benefits individuals enjoy from the consumption of an extra unit of good

MSB (Social): Benefits that society enjoys from each extra unit consumed

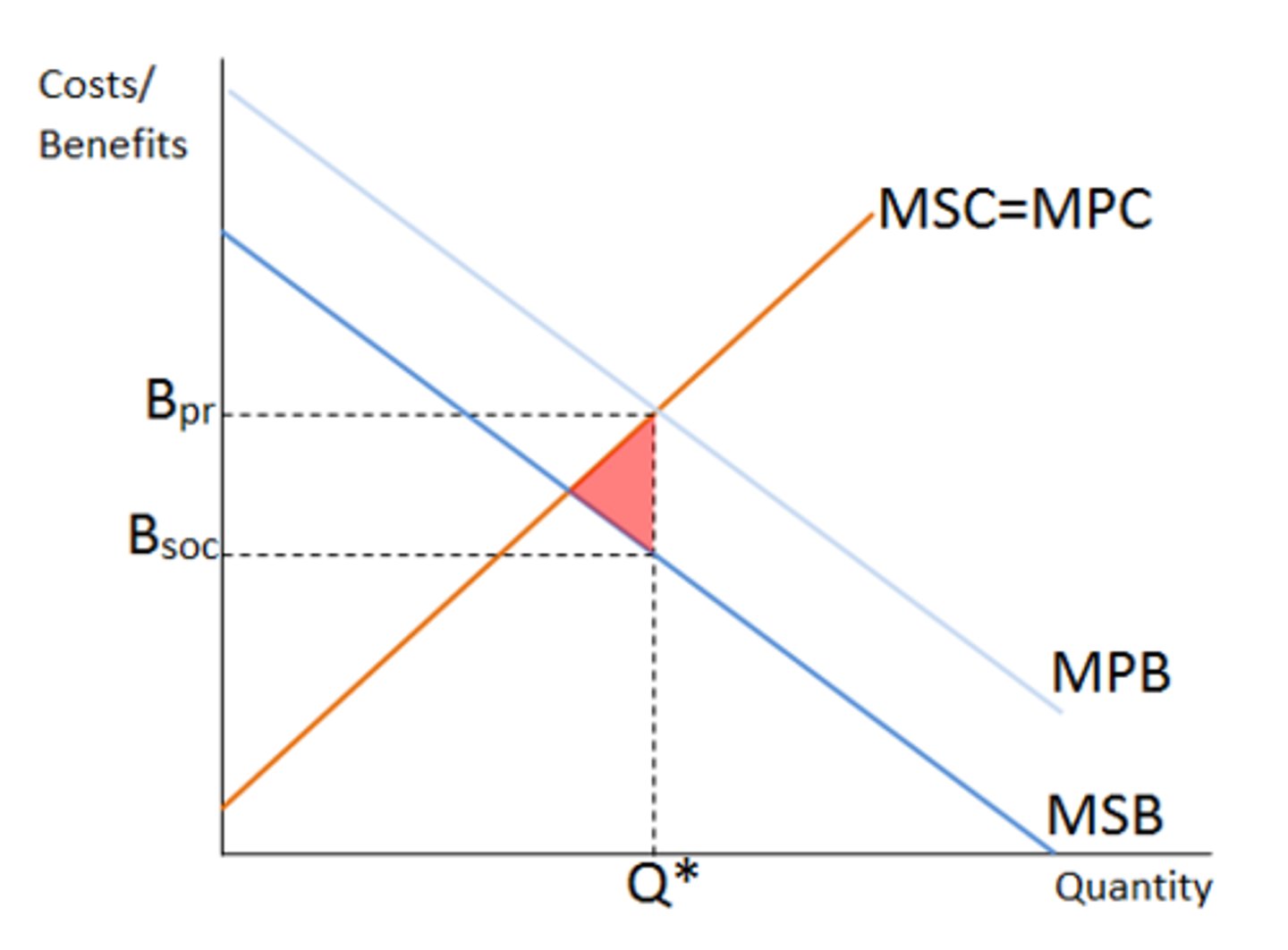

Negative Production Externality

Overproduction of the good

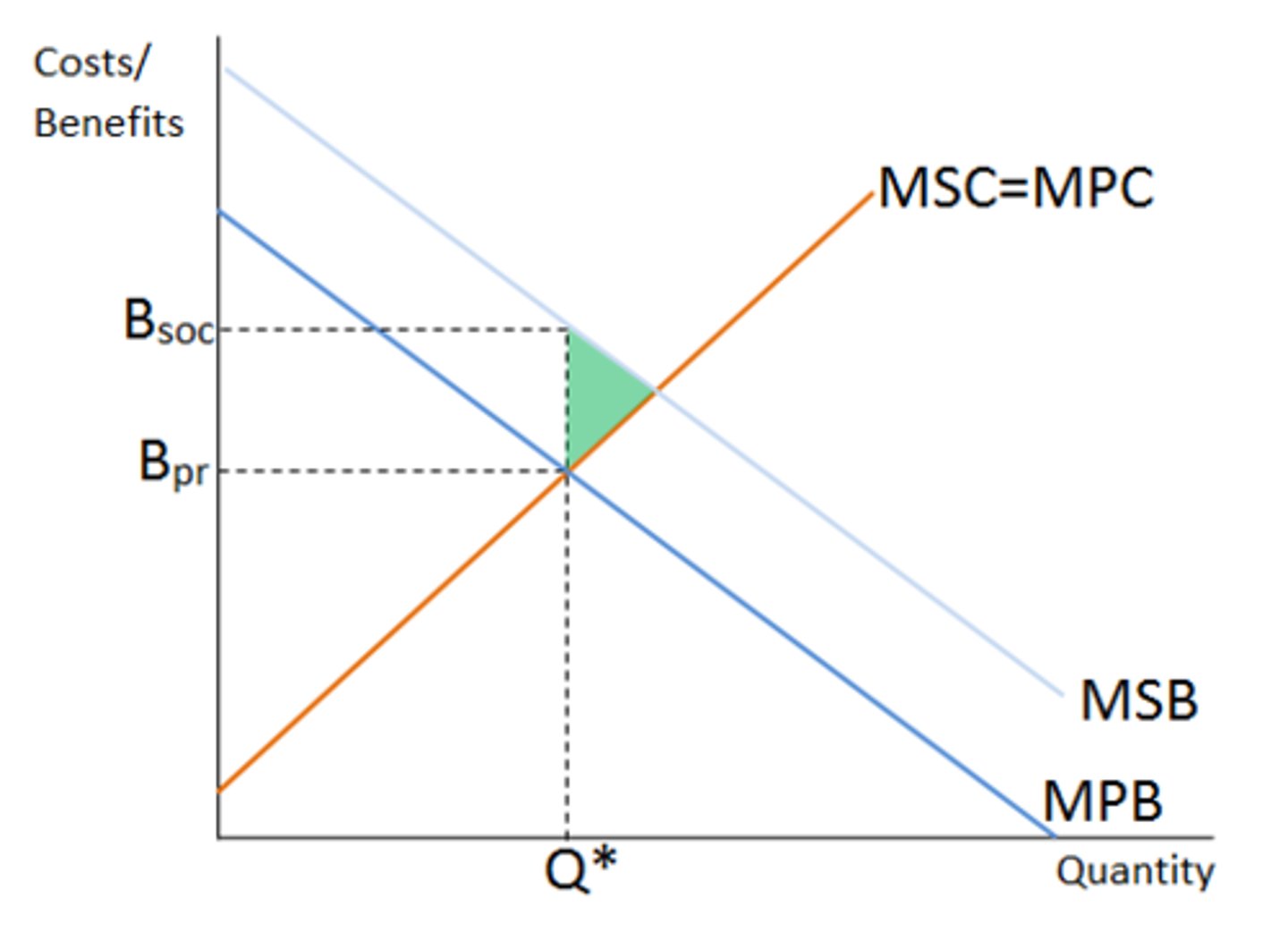

Positive Production Externality

Underproduction of the good

Negative Consumption Externality

Positive Consumption Externality

Welfare Loss

Point towards your new P1 or Q1

Merit Good

A good which creates very significant externalities OR goods that the government would like for the public to consume regardless of their income

Examples: Education and health care

Demerit Good

Consumption of the good creates very significant negative externalities

Examples: Alcohol and Tobacco

Solutions to Negative Production Externalities

Indirect Taxation, Assigning and enforcing property rights over assets, Tradable pollution permits (cap and trade schemes), Advertising, Persuasion, Education

Solution to Positive Production Externality

Subsidy, Intellectual Property Rights, Mergers, Direct Regulation

Solution to Positive Consumption Externality (Merit Goods)

Subsidy, Legislation and Direct Provision, Advertisement and moral provision

Solutions to Negative Consumption Externality (Demerit Good)

Indirect Tax, Direct Regulation, Advertisement and moral persuasion

Public Good

Non-Rivalrous, Non-Excludable

Examples: light house, traffic lights, roads