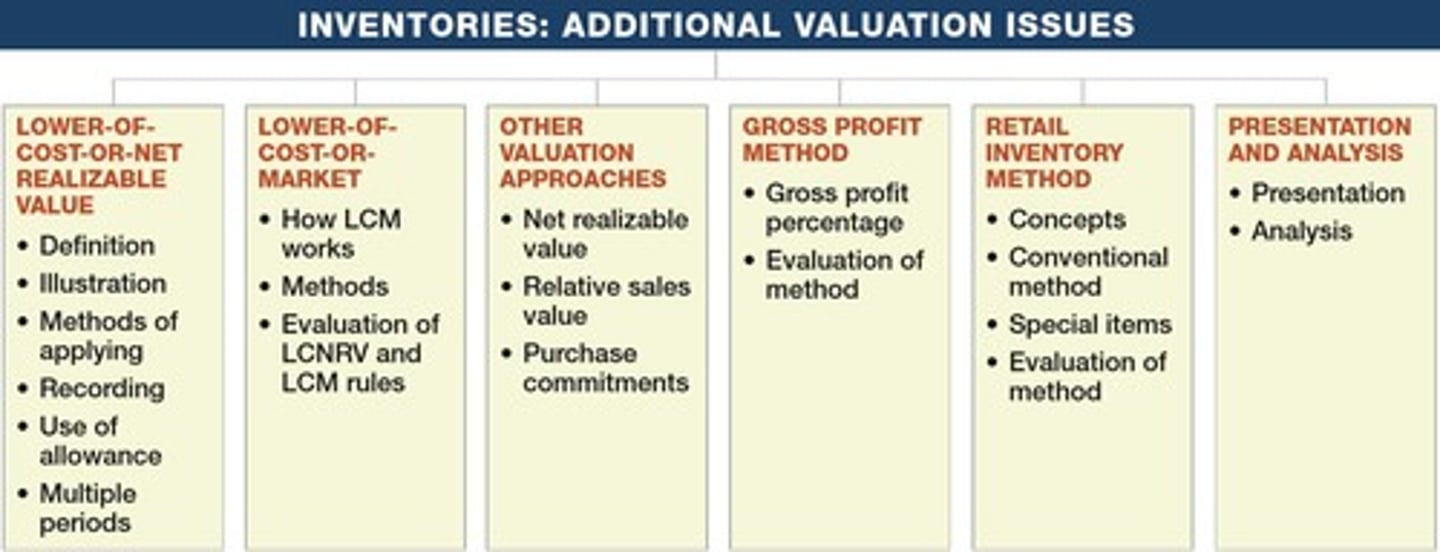

Inventory Valuation Methods: LCNRV, LCM, and Fair Market Value

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

What is the general rule for recording inventory?

Inventory is generally recorded at cost, which includes what was paid to acquire it and get it ready for use.

What must be assessed at the end of each period regarding inventory?

The utility of inventory to determine if the company will recover its investment.

What does utility refer to in the context of inventory?

Utility refers to the revenue-producing ability of the inventory.

What is the Lower of Cost or Net Realizable Value (LCNRV)?

A method to value inventory at the lower of its cost or its net realizable value.

How is Net Realizable Value (NRV) calculated?

NRV = Estimated Selling Price - Reasonably Predictable Costs of Completion, Disposal, and Transportation.

When should a loss on inventory be recognized?

When the utility has decreased below cost, not in the period of sale.

What are the two methods for recording the Lower-of-Cost-or-NRV?

COGS Method (Direct Method) and Loss Method (Indirect or Allowance Method).

What does the COGS Method entail?

Record ending inventory at LCNRV and include the loss in Cost of Goods Sold.

What does the Loss Method involve?

Record ending inventory at cost, establish an allowance for reduction to NRV, and recognize the loss as an expense.

What is the rationale behind the Ceiling and Floor limitations in inventory valuation?

Ceiling prevents overstatement of obsolete inventory; Floor prevents understatement and overstatement of losses.

What is the alternative approach for companies using LIFO or retail inventory methods?

They compare a designated market value of the inventory to cost, known as lower-of-cost-or-market (LCM).

How is Market defined in the context of LCM?

Market is defined as the Replacement Cost of the inventory.

What is the purpose of using Replacement Cost (Repco) for Market?

Repco usually reflects a decline in selling price and allows for a consistent rate of gross profit.

What are some deficiencies of the Lower-of-Cost-or-Market rule?

Inconsistent reporting of inventory values and potential distortion of income data.

What is a major disadvantage of LCNRV and LCM rules?

Mismatch in valuation and income recognition, leading to potential income manipulation.

What conditions must be met for valuation at Net Realizable Value to be permitted by GAAP?

There must be a controlled market with a quoted price applicable to all quantities.

What is the formula for net realizable value?

Selling price minus cost to complete and sell.

What conditions must be met for GAAP to permit valuation at net realizable value?

1. A controlled market with a quoted price for all quantities. 2. No significant costs of disposal. 3. The product is available for immediate delivery.

Give examples of when net realizable value valuation is used.

1. Certain agricultural and mineral products. 2. Inventory where cost figures are difficult to obtain. 3. Damaged, obsolete, or repossessed goods.

What is relative fair market value used for?

It is used when buying several items in a single lump-sum purchase, also known as a basket purchase.

What is the procedure for allocating purchase price using relative fair market value?

1. Determine FMV of each item. 2. Sum all FMVs. 3. For each item, calculate individual FMV times purchase price divided by sum of FMVs.

What are purchase commitments?

Agreements to buy inventory in advance, where the seller retains title and the buyer recognizes no asset or liability.

What should a buyer do if the contract price is greater than market price?

Recognize losses in the period when declines in market prices occur.

Why do companies estimate ending inventory?

1. To check accuracy of physical count. 2. For interim financial reports. 3. When physical count cannot be taken due to destruction.

How is inventory estimated in a perpetual system?

By looking at the inventory account balance, which reflects the dollar amount that should be on hand.

What are the two methods used to estimate inventory in a periodic system?

The gross profit method and the retail inventory method.

What are the steps in the gross profit method?

1. Determine gross profit percentage. 2. Calculate GAFS. 3. Determine net sales. 4. Estimate gross profit. 5. Estimate COGS. 6. Estimate ending inventory.

What are some disadvantages of the gross profit method?

1. Provides only an estimate. 2. Uses past percentages. 3. May not be representative. 4. Normally unacceptable for financial reporting.

What types of disclosures are required for financial reporting of inventories?

1. Basis for inventory amounts. 2. Cost determination method. 3. Composition of inventory. 4. Significant financing arrangements.

What should be reported regarding inventories pledged as collateral?

They should be reported in the current assets section rather than as an offset to the liability.

What is required regarding the application of costing methods for inventories?

Consistent application of costing methods from one period to the next.