Financial accounting chapter 2

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

What’s the accounting equation?

Assets= liabilities + equity

What is equity made up of? 2

Owners capital + retained earnings

What is retained earnings?

Profit - dividends

What is profit made up of?

Revenues - expenses

Where in the financial accounting equation does owned go?

Assets

Where in the financial accounting equation does Owed to third parties go?

Liabilities

Where in the financial accounting equation does Owed to owners go?

Equity

Where in the financial accounting equation does Settled in future go?

Liabilities

Where in the financial accounting equation does Past events go?

Liabilities

Where in the financial accounting equation does Used, consumed, incurred go?

Expense

Where in the financial accounting equation does Future benefit go?

Assets

Where in the financial accounting equation does Investment by owners go?

Owners capital

Where in the financial accounting equation does Earned go?

Revenue

Where in the financial accounting equation does Past event go?

Assets

Where in the financial accounting equation does Help generate revenue go?

Expenses

Where in the financial accounting equation does Provided a service go?

Revenue

Where in the financial accounting equation does Distributions to owners go?

Dividends

Where in the financial accounting equation does Profit retained go?

Retained earnings

What are the 4 financial statements required by GAAP?

Balance sheet, income statement, cash flow, owners equity

What does the balance sheet give?

Assets, equities and Liabilities. Shows company’s financial position, shows general categories of accounts

What can you see from income statement?

Income/revenues and expenses of a company over a period of time (usually a calendar year).

What does the statement of cash flow provide? What are the three categories?

Beginning and ending of cash in business. (Inflows and outflows of cash). These are shown in three categories investing activities, financing activities, operating activities.

What does the statement of ownership equity show?

Beginning and ending equity accounts.

What is BS?

Also referred to as ”picture” because it depicts a financial position at one point in time (closing date of accounting period). Ex cash in BS shows how much cash a company had at the end of the accounting period.

What is IS?

Also, referred to as ”movie” because it relates to a period of time (accounting year) . Ex sales in IS represents the aggregate amount if the companies sales made over the entire accounting period.

What do we find in the BS?

Assets- what is owned by the company (cash, cars, machinery, buildings)

Sources of finance - if financing comes from the owners of the company its called equity, if it comes from third parties (bankers, trade creditors etc.) we call it liabilities. Liabilities have to be repayed in the future.

Why do assets have to equal to equity + liabilities?

Because everything the company ownes needs to be financed

What are priority claims of creditors

Liabilities

What are residual claims of owners?

Owners equity

What two things does equity consist of? Explain

1) actual contributions (in cash or in kind) made by owners (in return for shares) this is so called contributed capital.

2) profits (or losses) kept within the firm and its decided to keep the profits within the firm. The owners basically make an additional investment to the firm. This is called ”earned capital”

What formats do BS have?

Horizontal (2 columns with the assets in one and equity + liabilities in the other), vertical (1 columns with everything underneath each other)

What is the difference between current and non current?

Current: to be used or settled within accounting period (current assets: cash, inventories, current liabilities: short term bank loan)

Non-current: to be used or settled more then on accounting period (non-current assets: buildings, machines, non-current liabilities: kong therm bank loan

Why are inventory current assets

Because you want to sell them asap

Why are trade receivables a current asset?

Because you want to receive your money asap

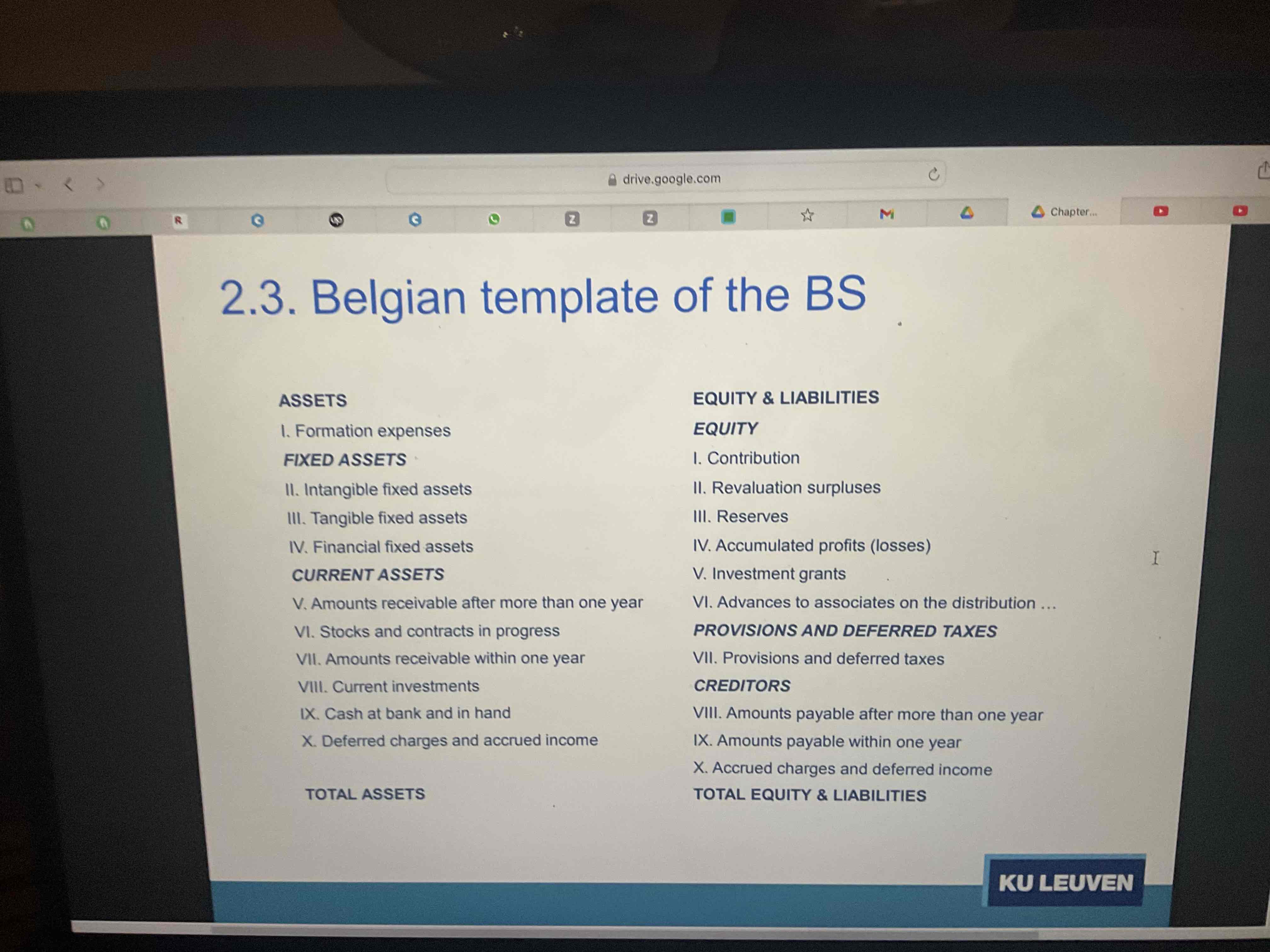

What order does the Belgian BS work in? 9

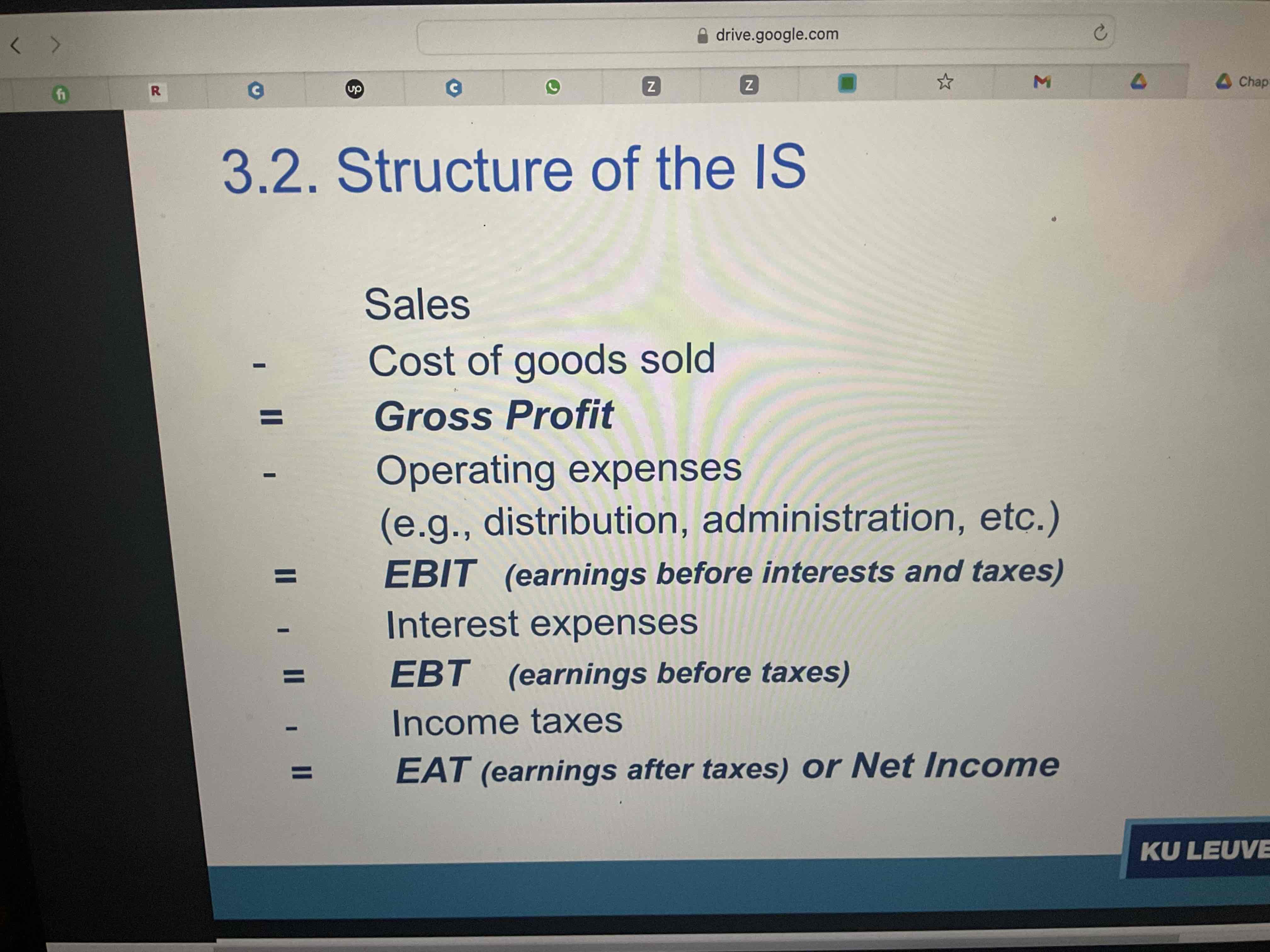

What’s the structure of the IS?

What does gross profit mean?

Revenue - Cost of items sold

What does EBIT stand for?

Earnings before interest and taxes

What does EBT stand for?

Earnings before taxes

What does EAT stand for?

Earnings after taxes or net income

What is cost of sales?

Expense that represents the cost of the items sold

What is meant by interconnectivity?

Each financial statement is connected to one or more other statements. For an example CF provides detail regarding the evolution of cash in BS.