Taxes

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

Payroll Tax

tax on wages and salaries to finance Social Security and Medicare costs - About the same percentage for all levels of income

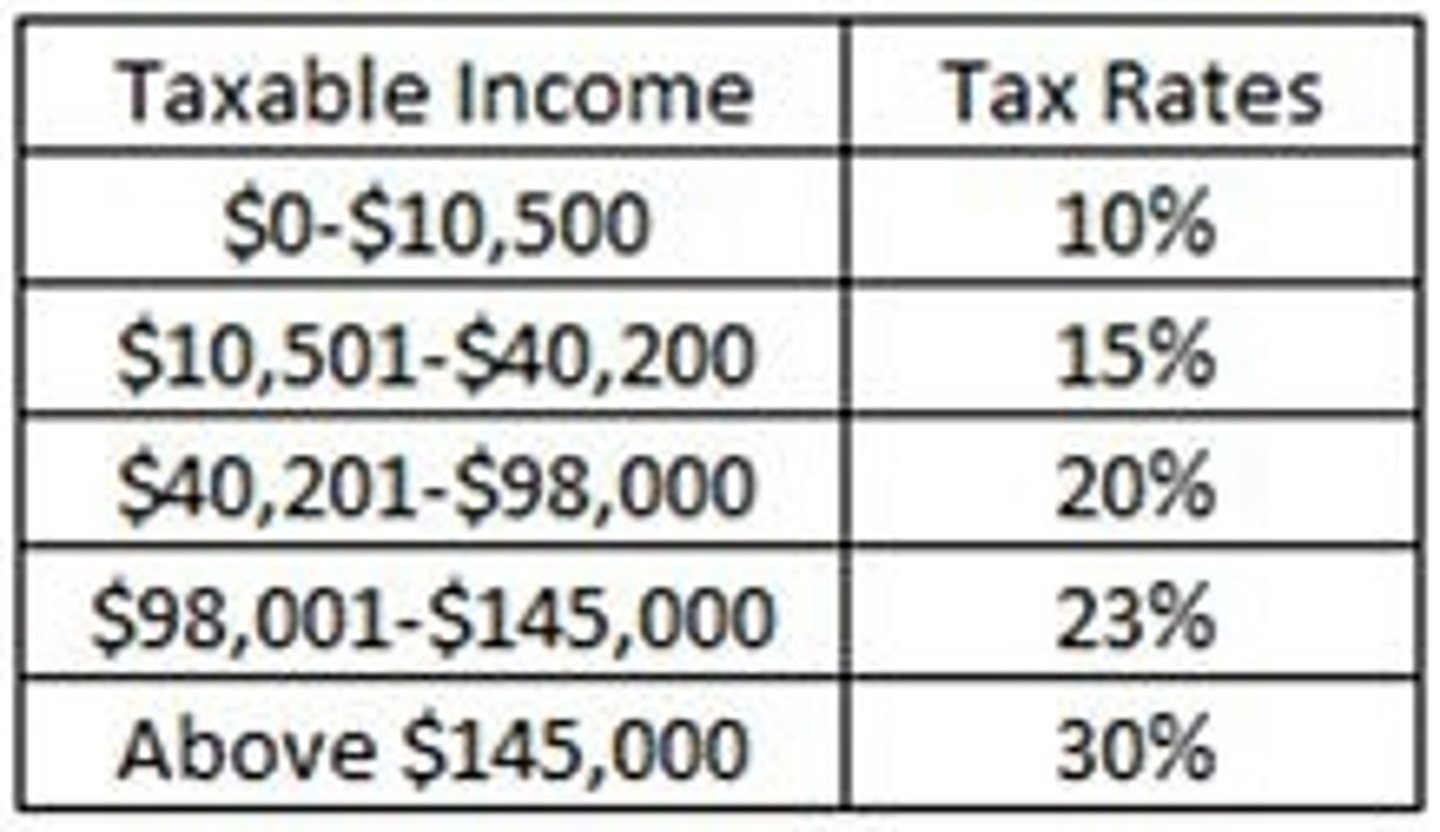

Tax Bracket

A range of income on which a given marginal tax rate is applied

Progressive Tax

A tax for which the percentage of income paid in taxes increases as income increases (IE income tax)

Income Tax

Tax paid to the state, federal, and local governments based on income earned over the past year. Typically the most expensive tax we pay

w2

Report sent from the employer to both the IRS and the employee, showing gross income, total taxes paid, and total voluntary deductions.

w4

The withholding form each new employee fills out - provides information to the employer's accounting department to determine how much to withhold from one's paycheck

1099

Form that details all "non-employee" compensation. This includes income for completing specific jobs, like freelancers or contractors who are effectively self-employed.

1098-T

A tax form produced by an institute of higher education to report payments received and still owed by an enrolled student

1095

Tax form detailing health insurance coverage.

Tax Return

an annual report one fills out and sends to the IRS summarizing total income, deductions, and the taxes withheld by employers

Tax Refund

A check returning the taxpayer's money to the taxpayer after tax returns are filed and the overpaid tax is determined.

Standard Deduction

an amount of money set by the IRS that is not taxed - currently at 12,000$ - Most people use this

Itemized deduction

People may choose this option if they have tax deductions that add up to more than $12,000

Tax Deduction

Reduces the amount of income that is "taxable" For example if someone makes 50,000$ a year and has a 5,000$ (notecard answer) they will only be taxed as if they make 45,000$

Tax Credit

An amount subtracted directly from the tax owed - Think of it like a coupon for paying taxes.

"Above the Line" Deduction

A specific type of tax deduction that can be applied alongside the STANDARD Deduction. Therefore you can have the 12,000$ of tax free money AND the specific type of deduction.