AP Microeconomics Vocabulary

1/185

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

186 Terms

Scarcity

a limited and desired product

Rationing

creation of a system to allocate resources

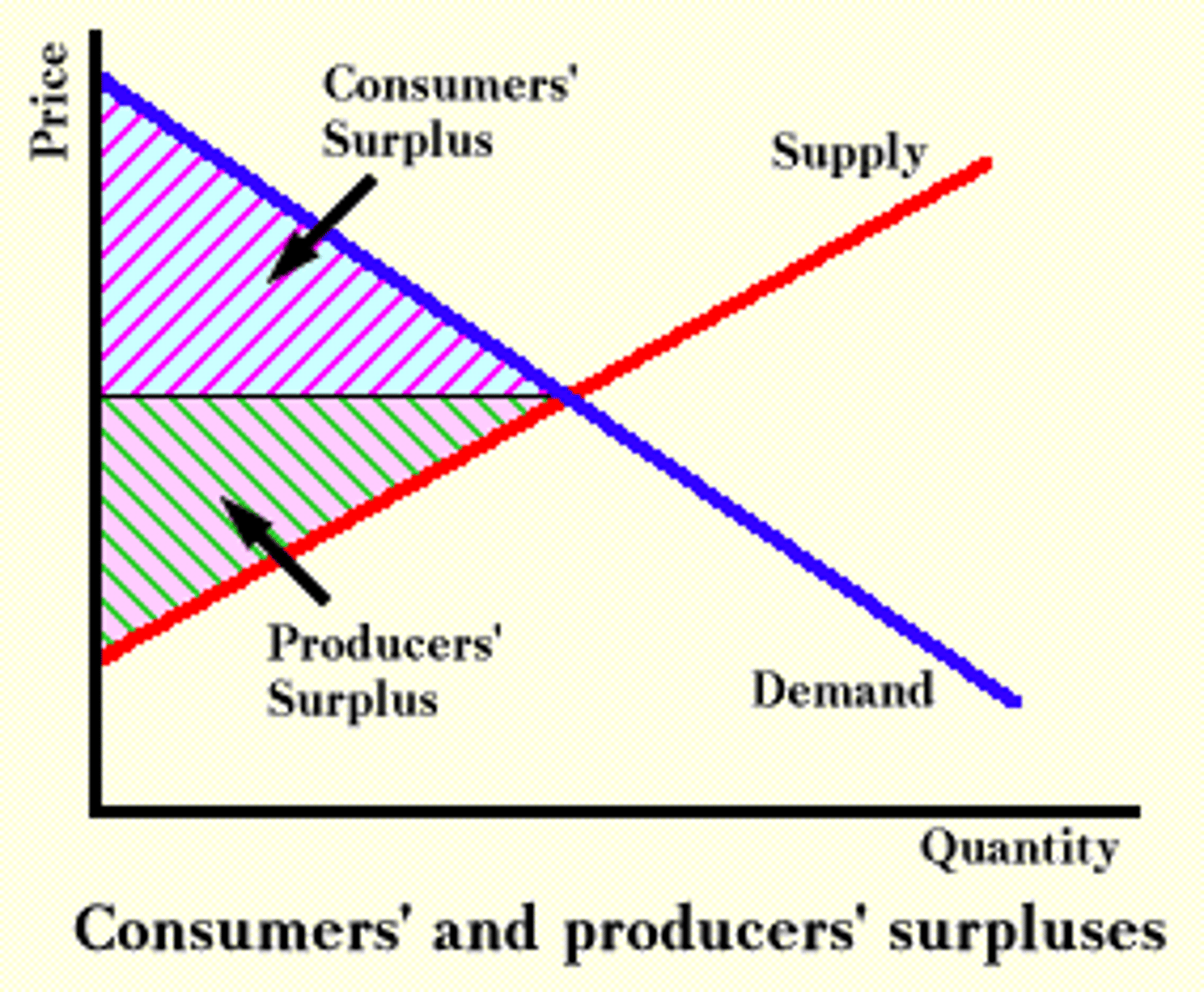

Consumer surplus

the difference between how much you are willing to pay and what you actually pay

The Basic Economic Problem

what to produce, how to produce it, who to produce for

Free goods

things that we desire but that are not limited

Economic goods

things that we desire but that are limited

positive economics

focuses on facts and cause-and-effect relationships, "what is"

normative economics

used for economic policy and incorporates judgment, "what ought to be"

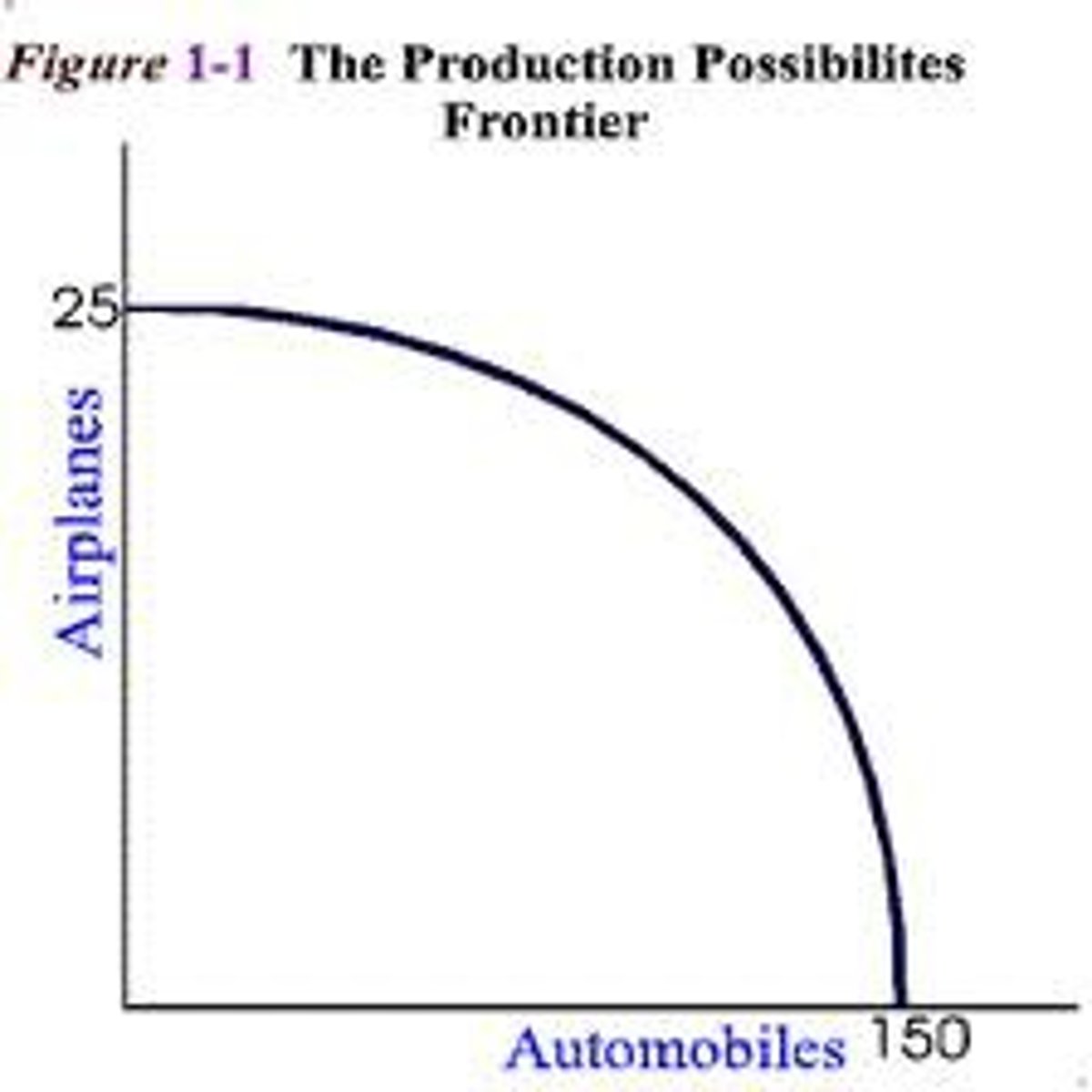

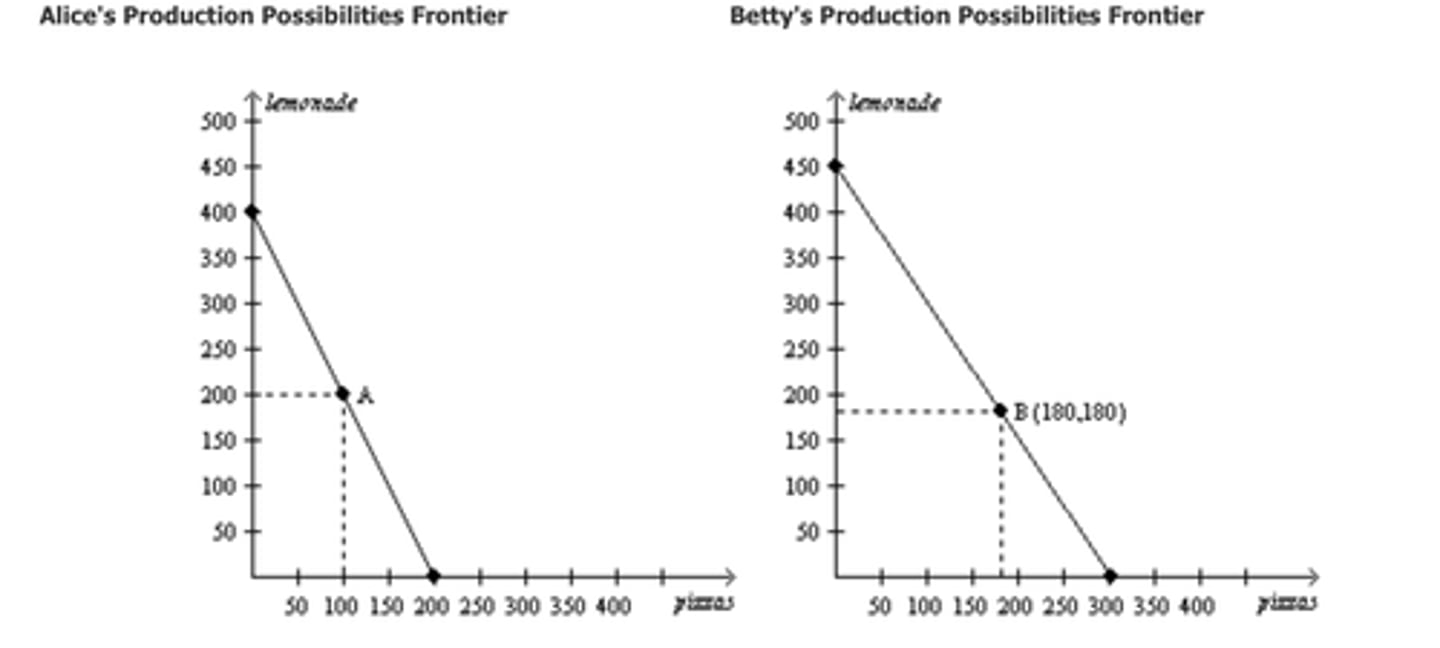

Production Possibilities Curve/Production Possibilities Frontier

illustrates the opportunity cost an economy makes when deciding what to produce and how to allocate resources

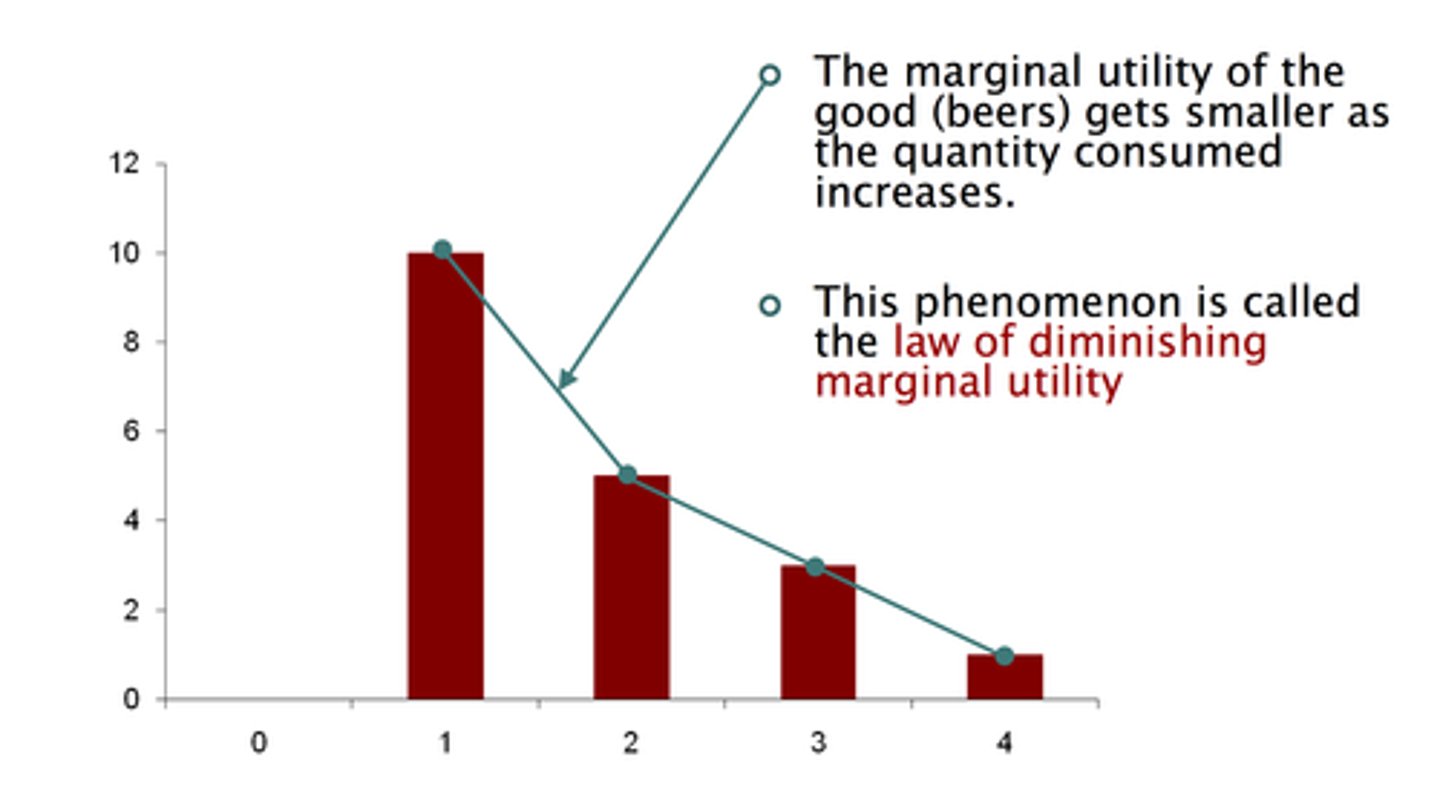

Utility

how much use a person gets from the consumption of something

Ceteris Paribus

"all things are the same/remaining equal"

Homo economicus

all people act in rational self-interest

Command Economy

the government answers all economic questions

Capitalism (Market Economy)

based on principles of supply and demand

Mixed Economy

a combination of command economy and market economy where the government answers some questions and the market answers others

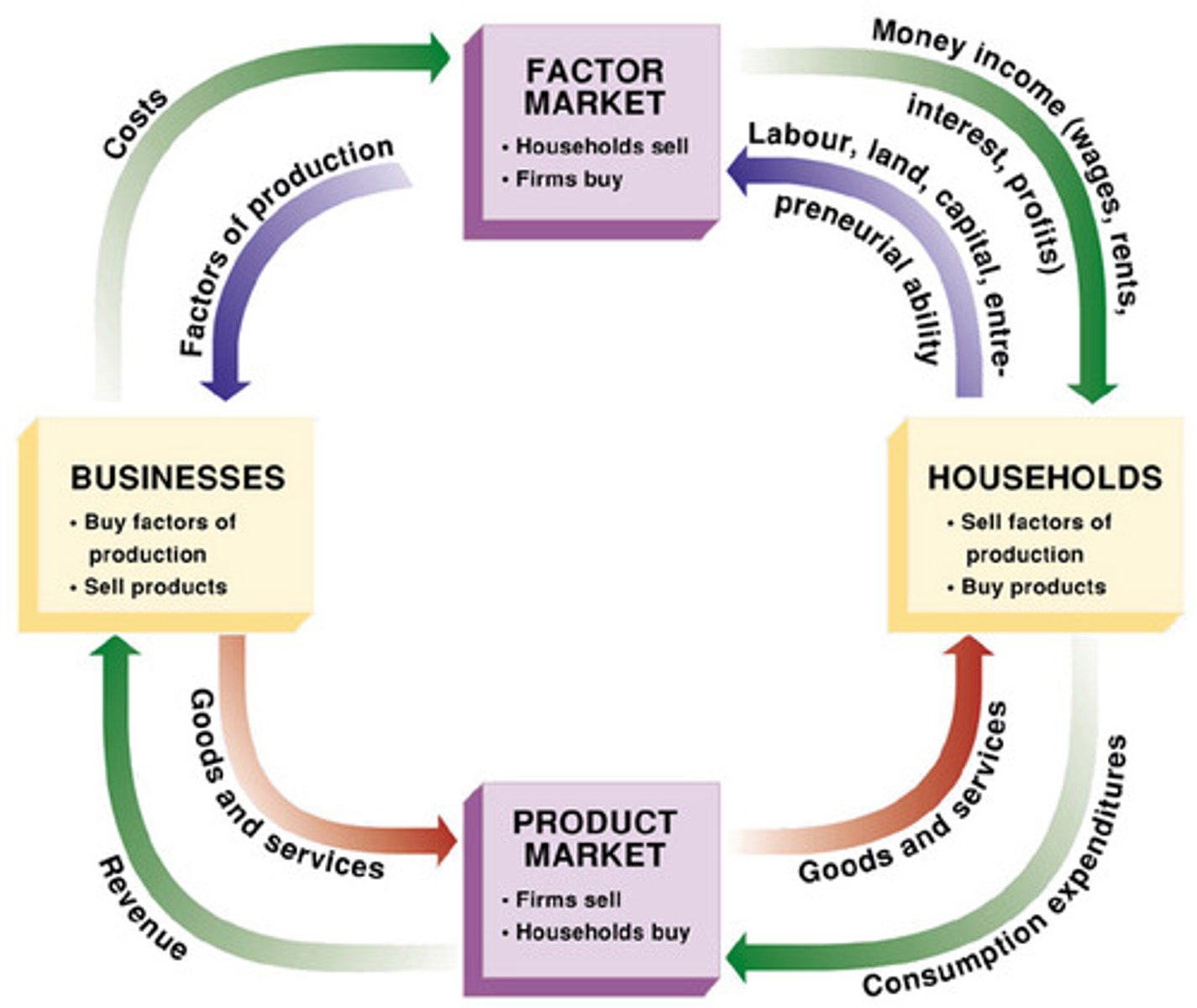

the circular flow model

a theoretical model for a market economy detailing interactions between households, product markets, firms and resource markets

market

a place where goods and services are exchanged for liquid assets or other goods and services

competitive market

large number of firms, homogeneous goods or services, barriers to entry are few

oligopoly

a few interdependent, large firms dictate prices through collusion, whereby they set prices for their own behavior through working together, producing either a standardized or differentiated product in a market with a barrier to entry

monopoly

one firm has almost total control over a market, being the sole producer of a good with no close substitutes in a market with entry barriers

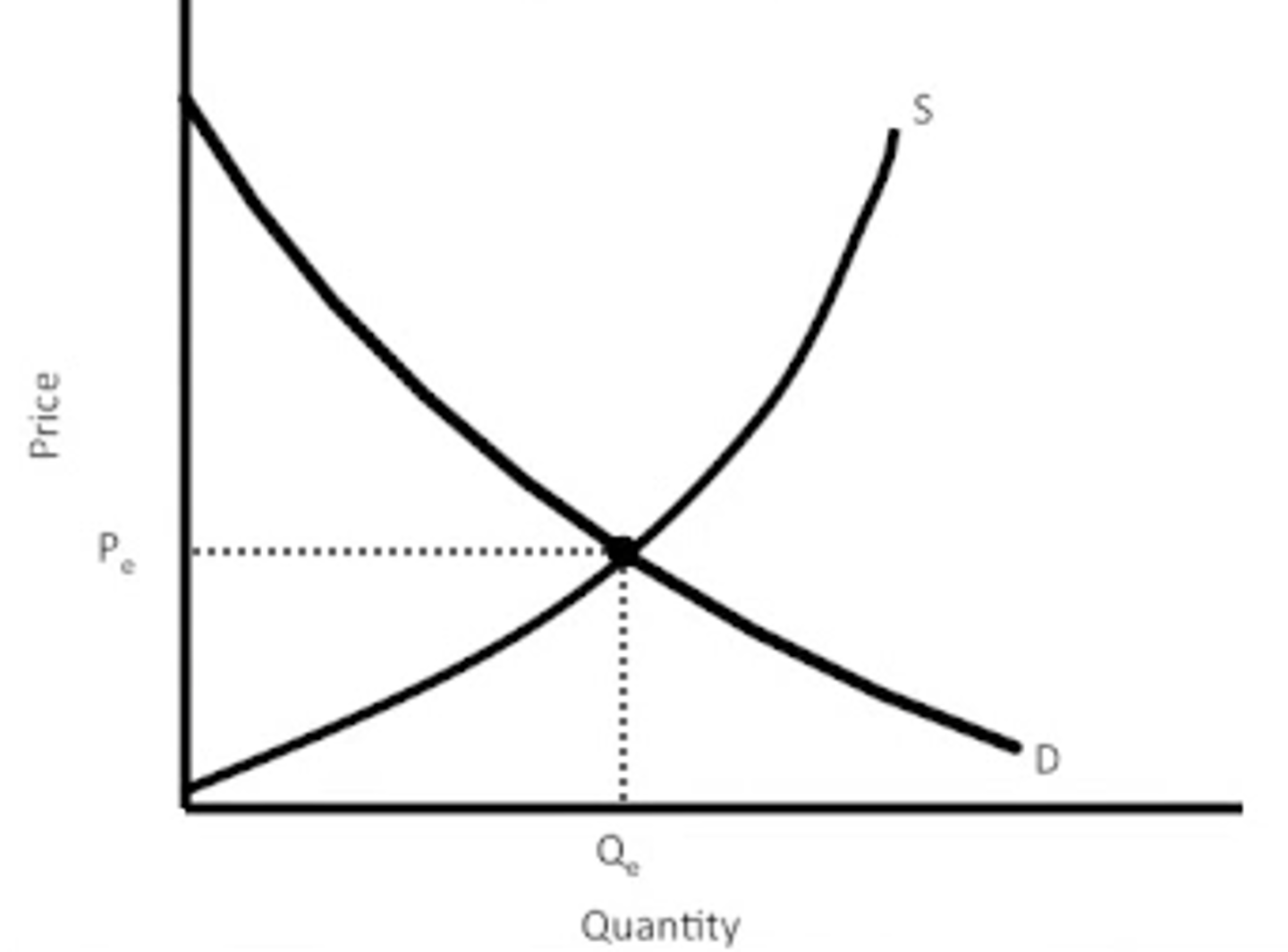

demand

the quantity of a particular good that consumers are willing and able to buy at a range of prices at a particular period in time

market demand

total demand; the sum of all the individual consumers' demands in a market

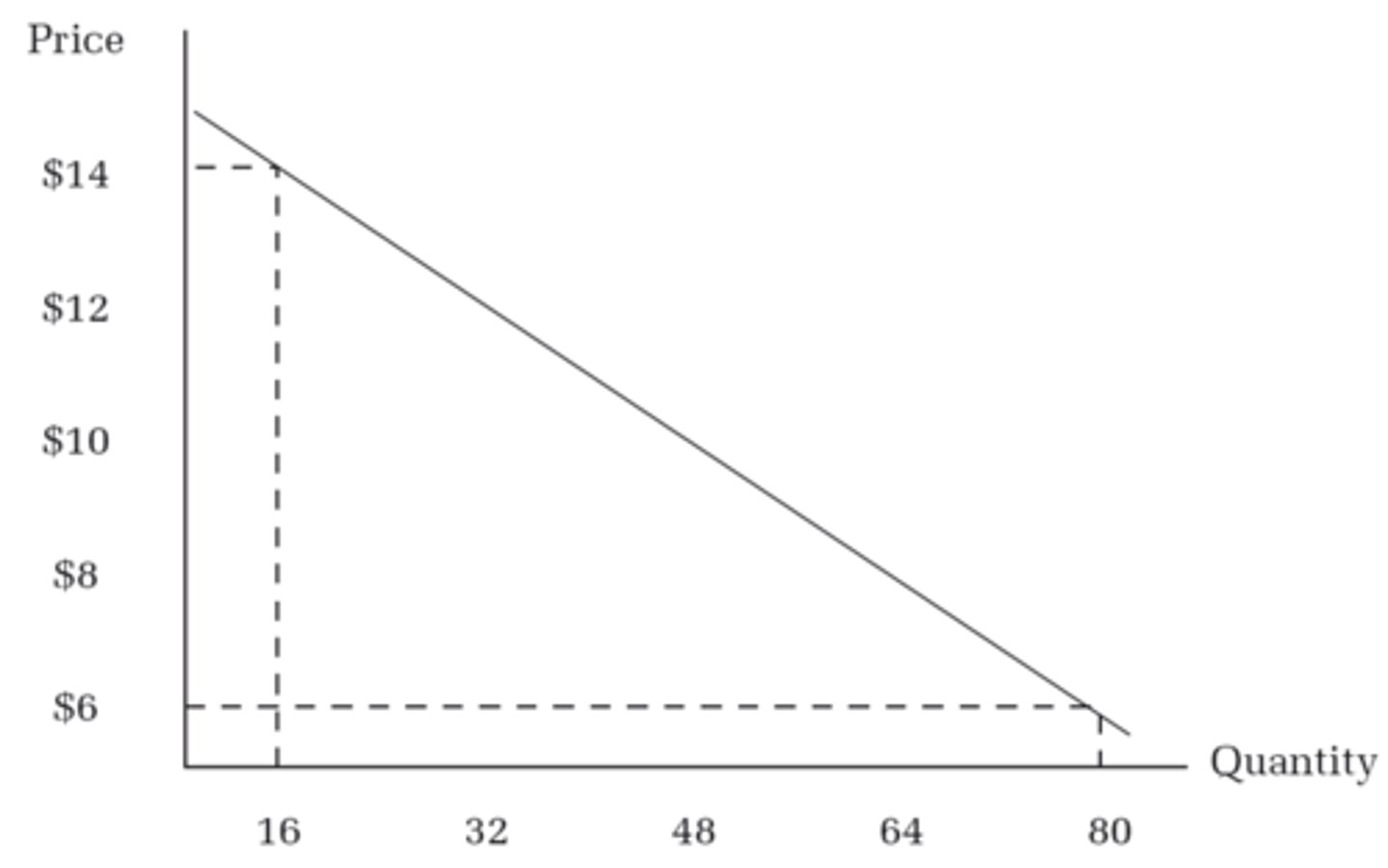

demand curve

a visual illustration of a demand schedule detailing prices and quantities

The Law of Demand

ceteris paribus, there is an inverse relationship between a good's prices and the quantity demanded by consumers

The Income Effect

as the price of a good decreases, the quantity demanded increases because consumers now have more real income to spend

The Substitution Effect

as the price of a good decreases, consumers switch from other substitute goods because its price is comparatively lower

The Law of Diminishing Marginal Utility

as we consume additional units of a good, the utility for each extra unit decreases

Non-Price Determinants of Demand (TOSISE)

Tastes, Other related goods' prices, Size of the market, Incomes, Special circumstances, Expectations

Supply

a schedule or curve showing how much of a product producers will supply at each of a range of possible prices during a specific period of time

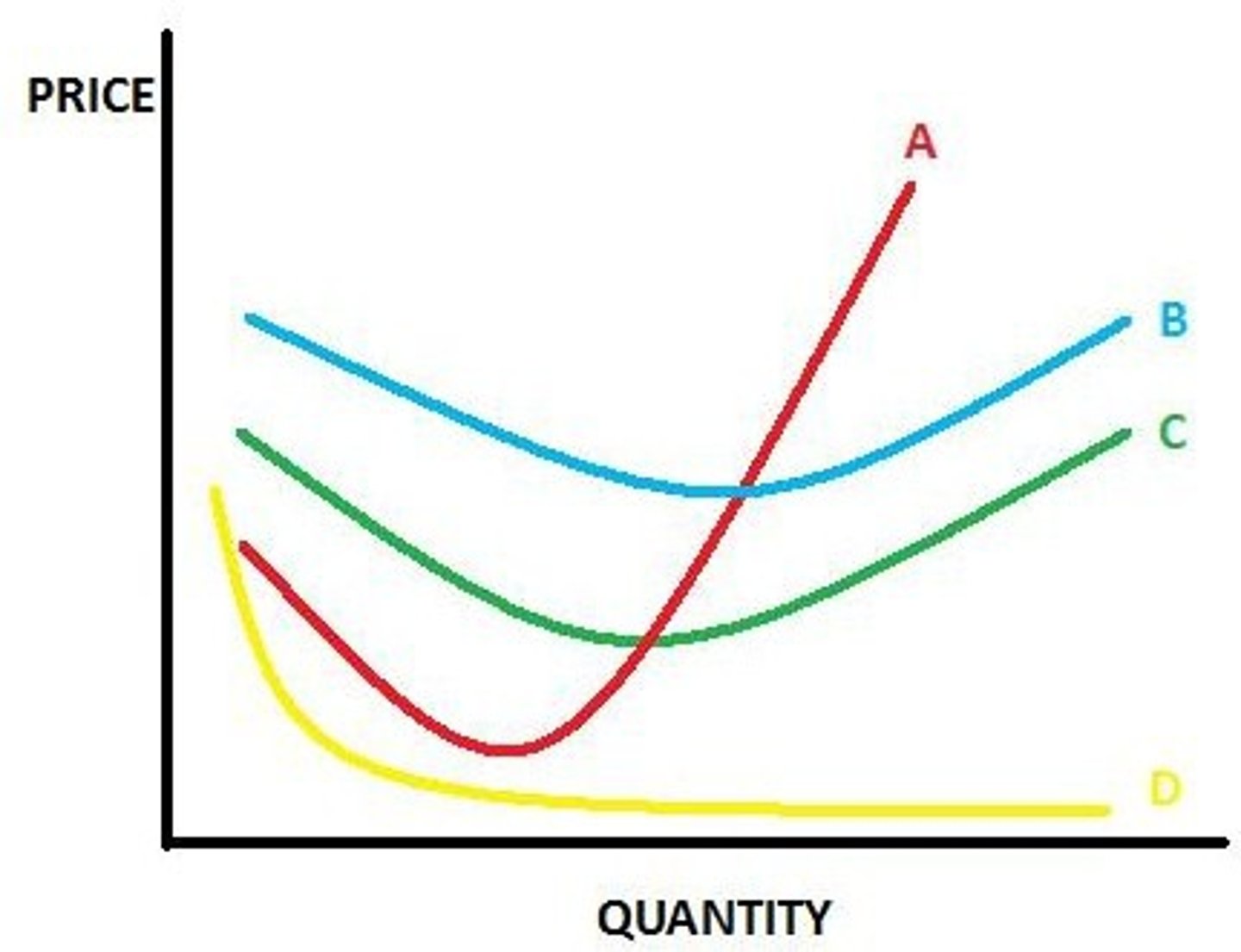

Marginal cost

cost per additional unit

The Law of Supply

ceteris paribus, there exists an direct relationship between price of a product and quantity supplied. As the price of a good increases, firms will increase their output of the good and vice versa.

Non-Price Determinants of Supply (STOREN)

Subsidies and taxes, Technology, Other related goods' prices, Resource costs, Expectations of producers, Number of firms

Market equilibrium

when the price and quantity are at a level at which supply equals demand and the market clears

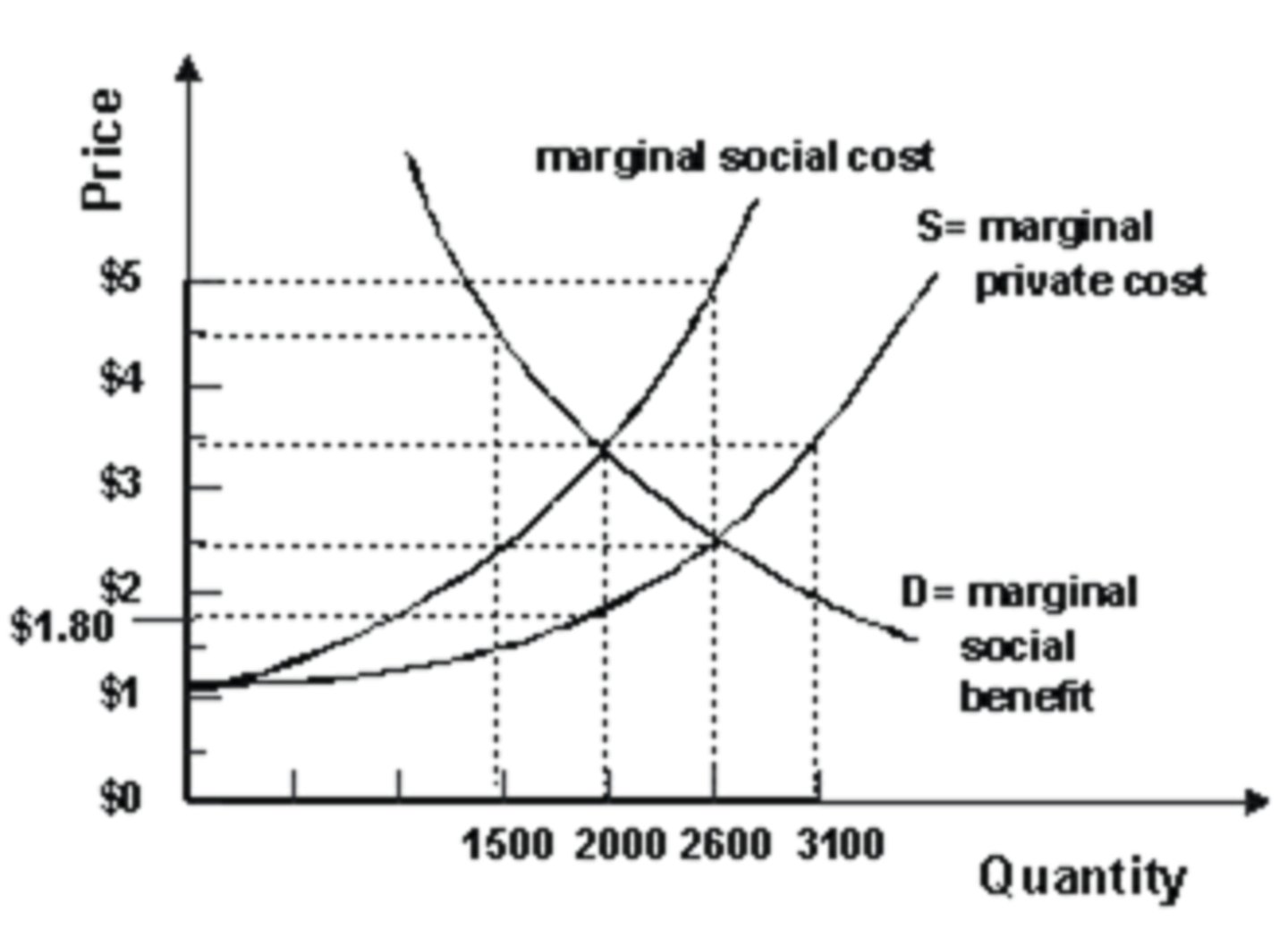

Demand = Marginal Social Benefit (MSB)

the demand for any good represents the benefits that society derives from the consumption of that good

Supply = Marginal Social Cost (MSC)

the supply of a good represents the cost to society of producing that good. The more is produced, the more it costs to produce additional units.

allocative efficiency

is achieved when MSB=MSC

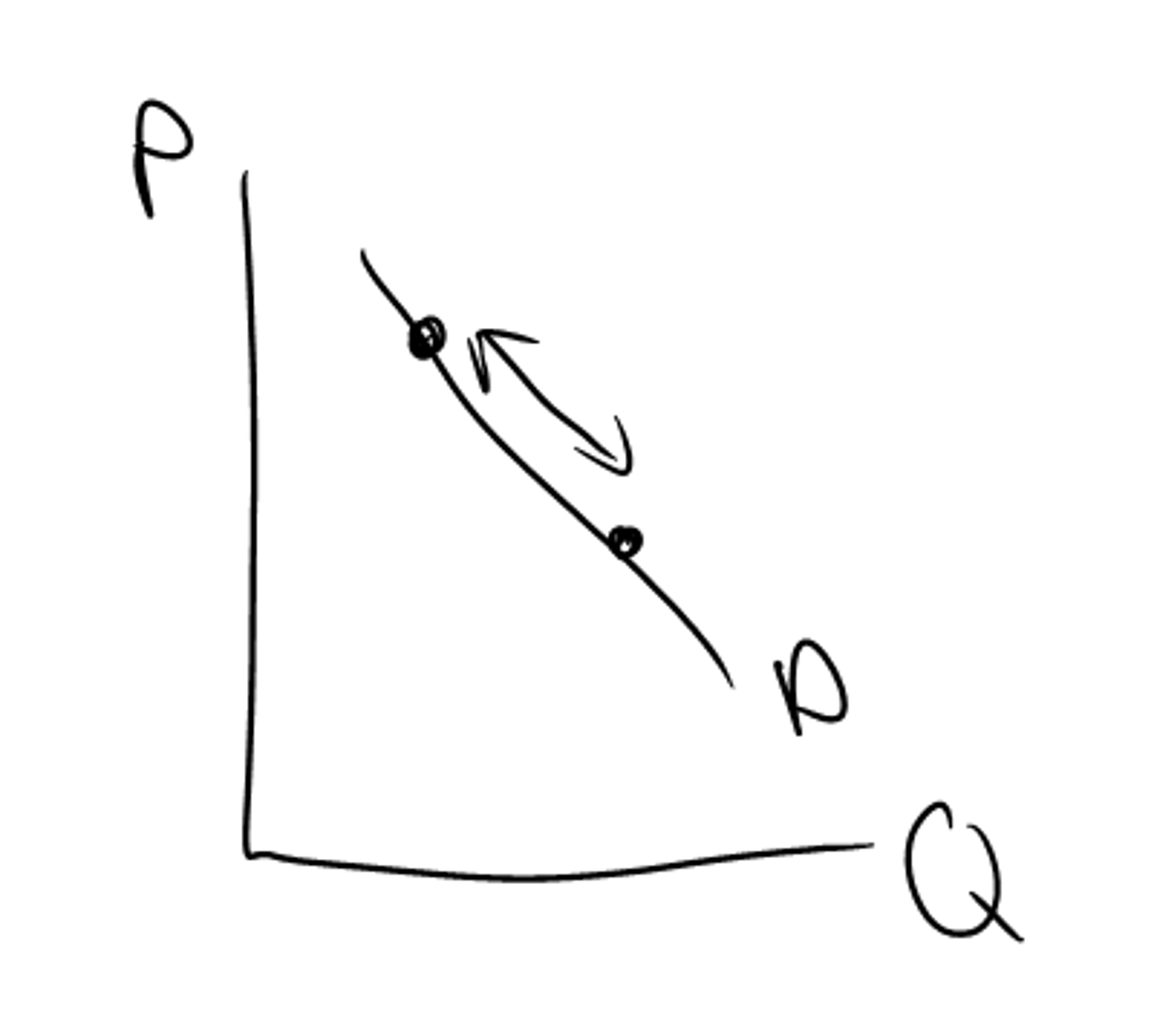

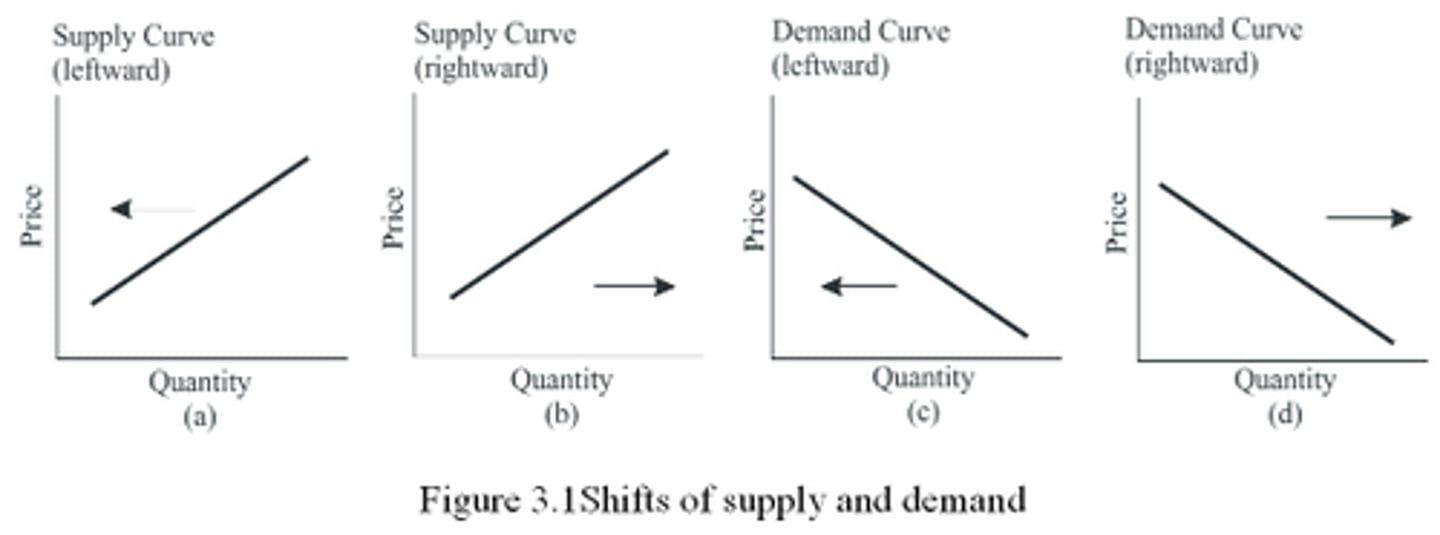

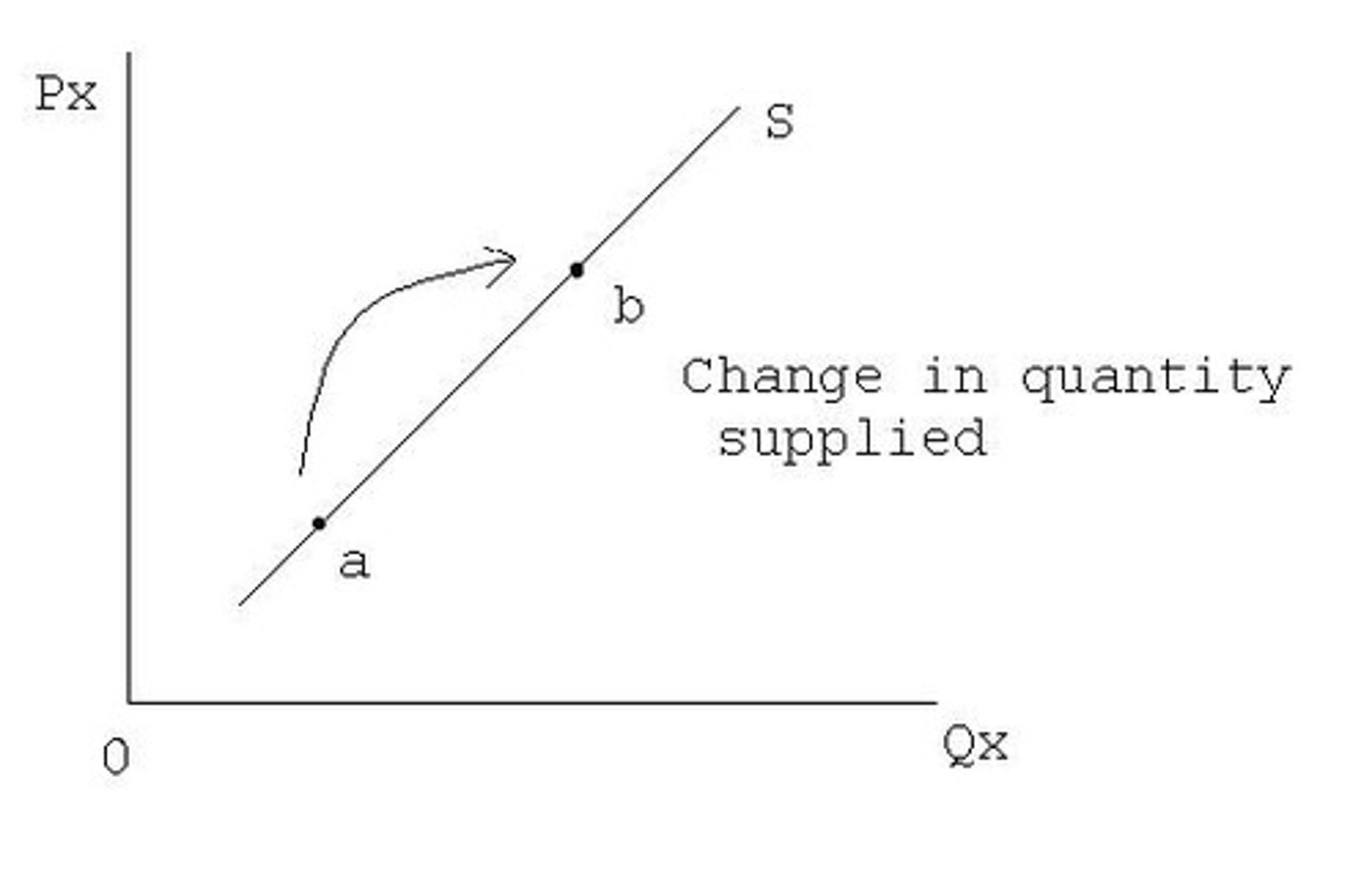

Quantity demanded

price change

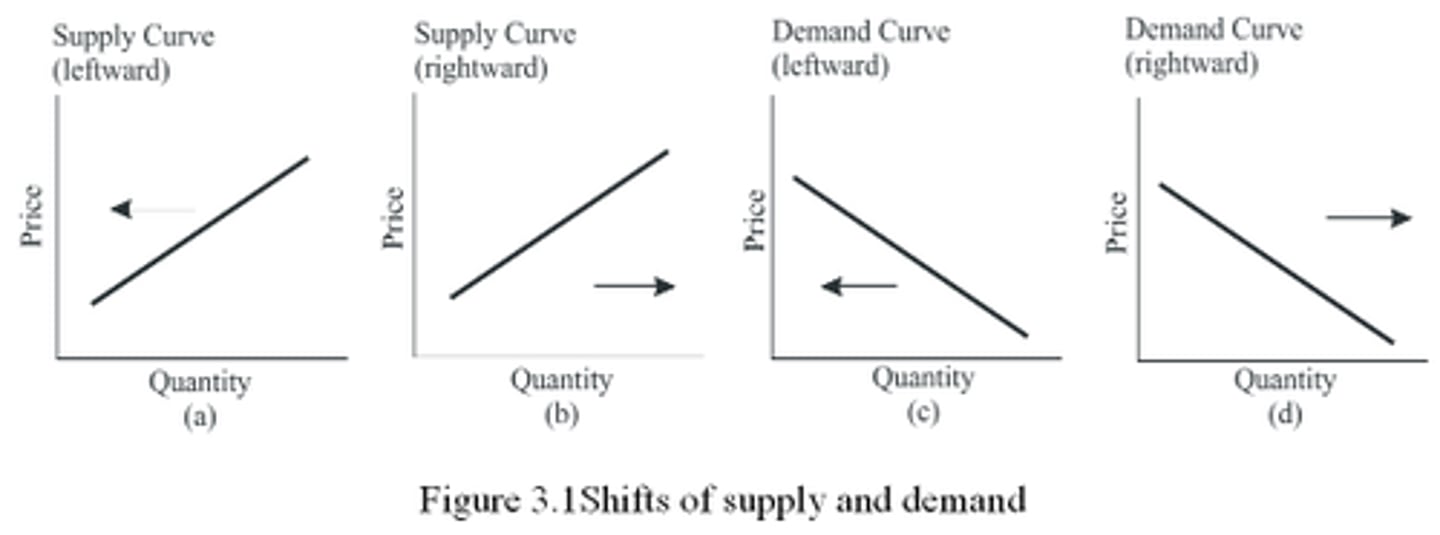

Demand change

demand curve shift

Quantity supplied

price change

Supply change

curve shift

Producer Surplus

the difference between what you are willing to produce for and what the production cost was

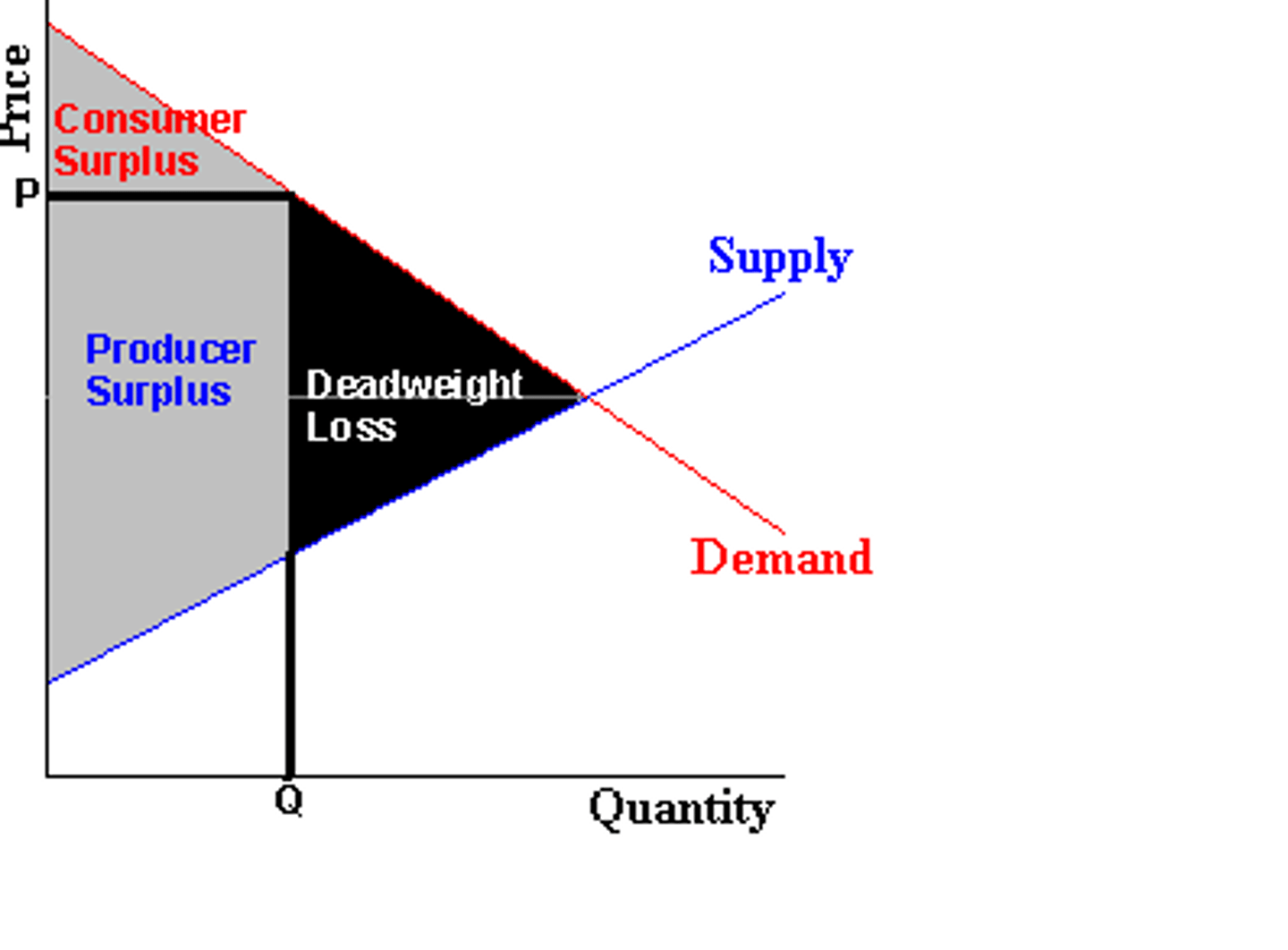

Deadweight loss

when producer surplus does not equal consumer surplus there is a waste

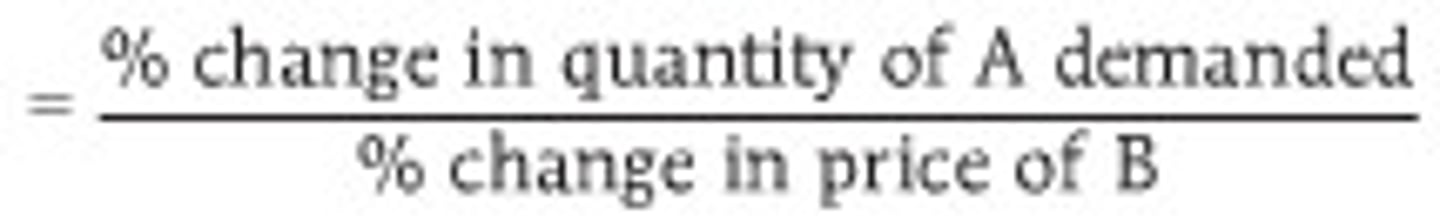

Price Elasticity of Demand (PED)

measures the responsiveness of consumers of a particular good to a change in price

total revenue formula

price received x quantity

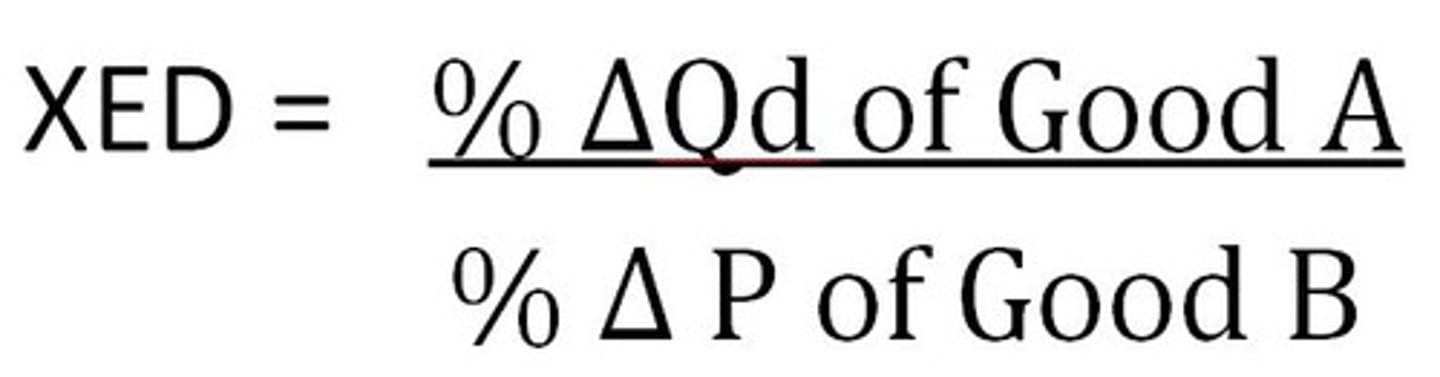

Cross Price Elasticity of Demand (XED)

measures the responsiveness of consumers of one good to a change in the price of a related good (either a substitute or a complement)

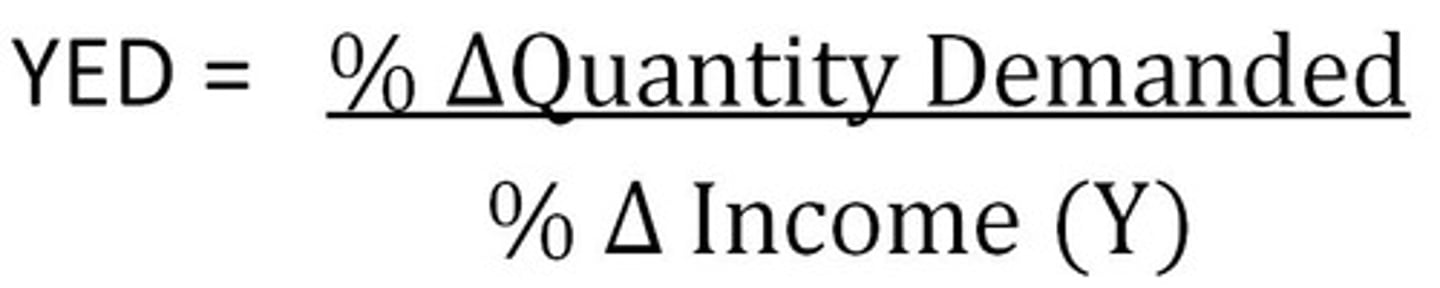

Income Elasticity of Demand (YED)

measures the responsiveness of consumers of a particular good to a change in their income

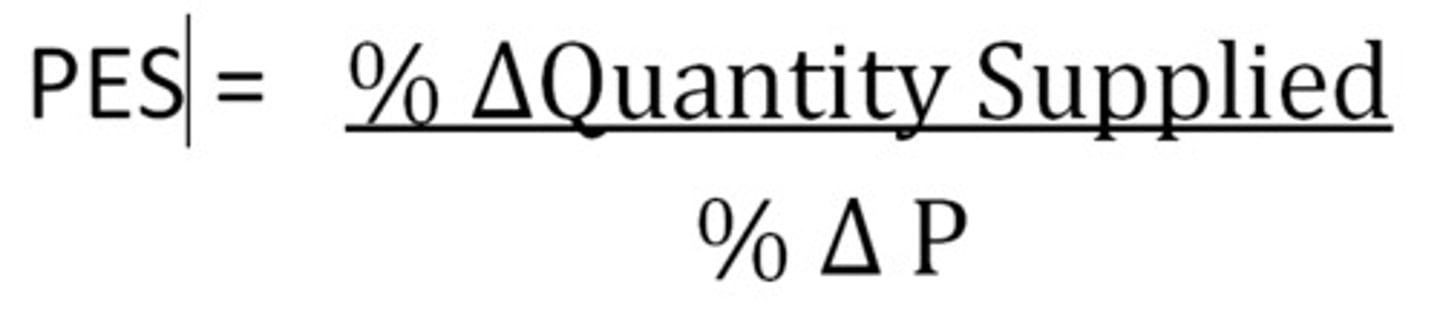

Price Elasticity of Supply (PES)

measures the responsiveness of producers of a particular good to a change in the price of that good

PED formula

percentage change in quantity demanded / percentage change in price

((Q2-Q1)/(Q1))/((P2-P1)/P1))

slope

consistent along the demand and supply curve

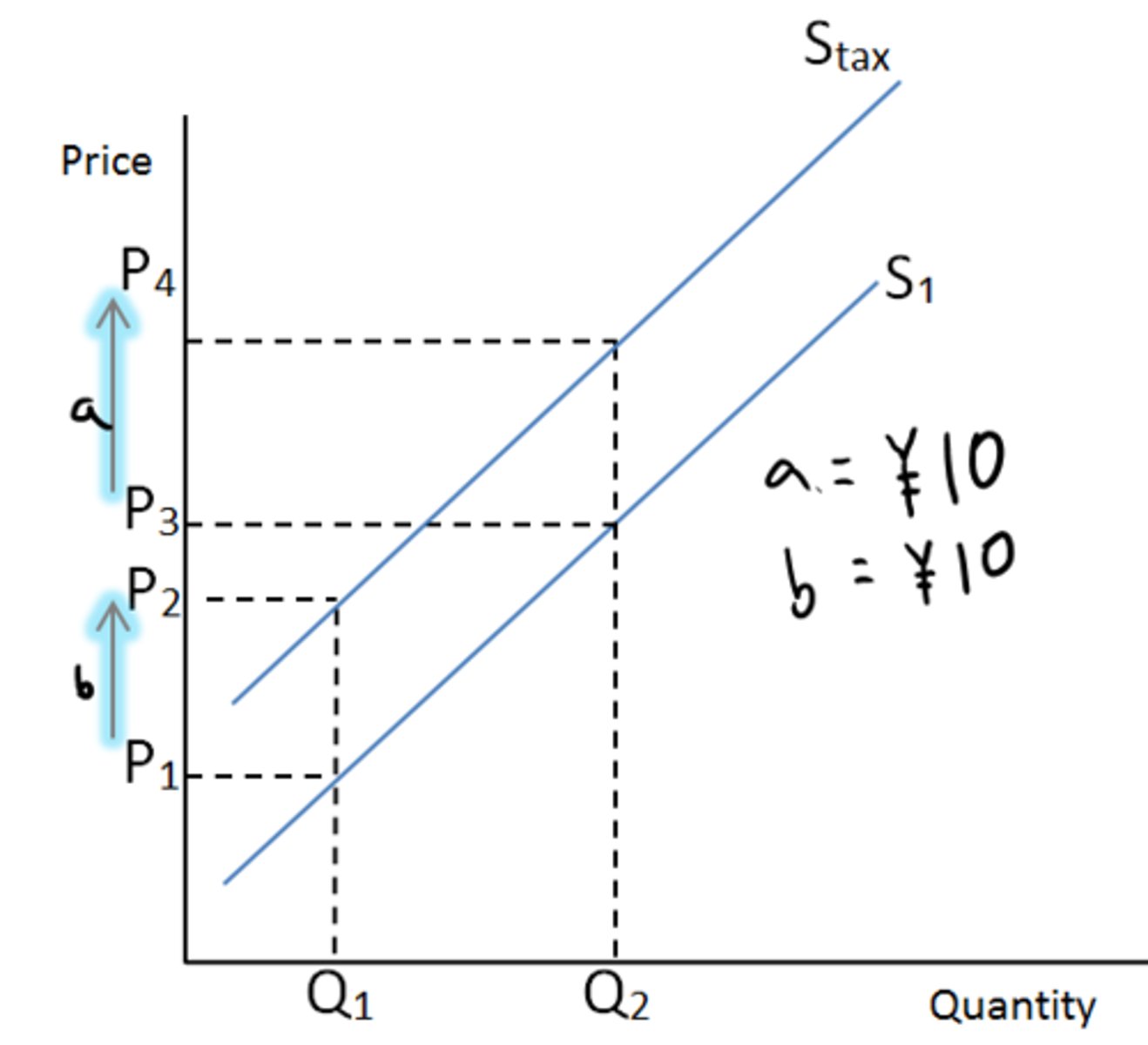

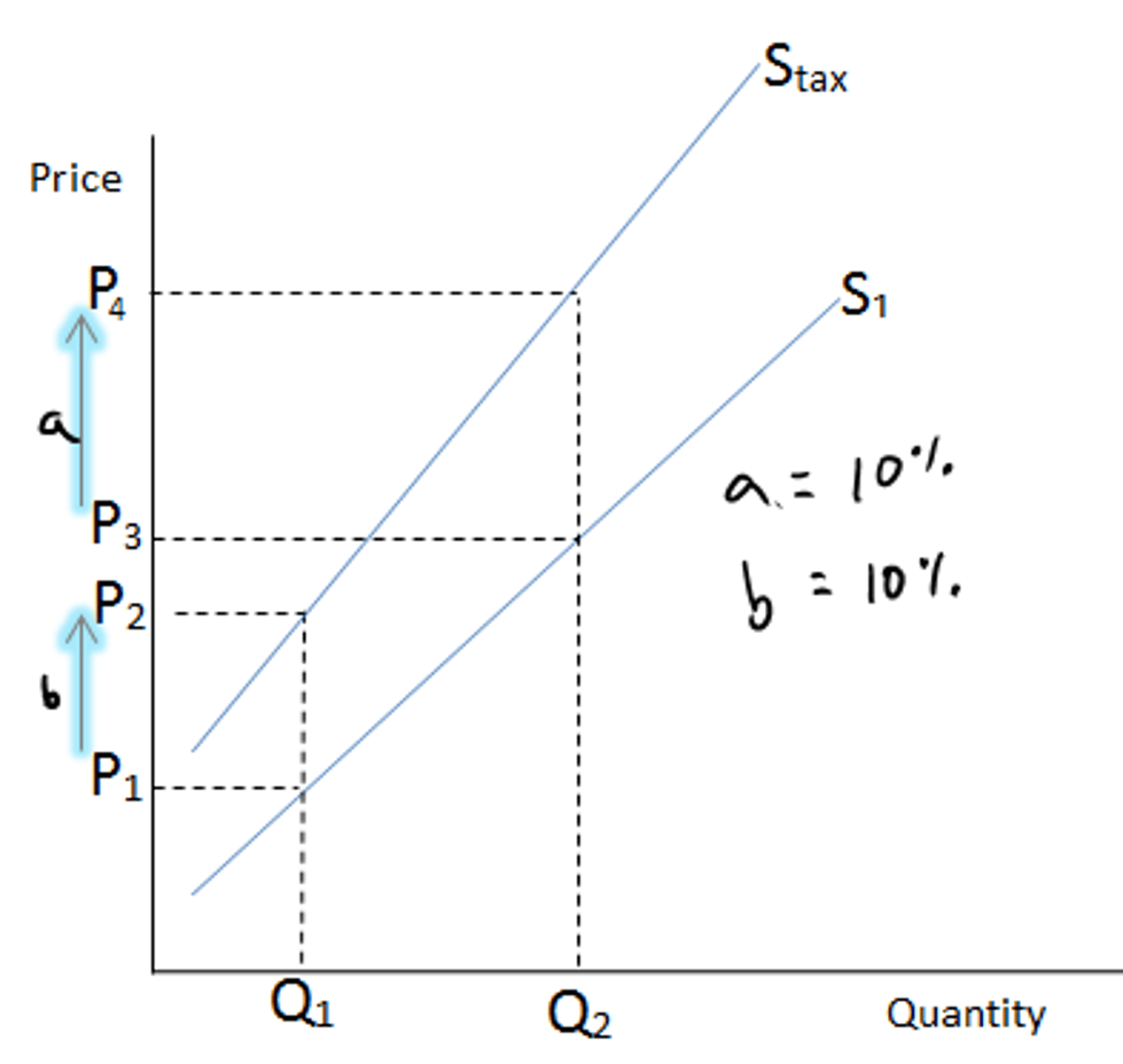

tax burden

proportion of tax spending that is paid by producers or consumers; changes based on elasticity

excise tax

tax on specific goods imposed to earn revenue, discourage consumption, redistribute income, and correct externalities

-results in a vertical shift in the supply curve by the amount of the tax

spending/sales tax

tax on all goods

Specific Tax

fixed amount, regardless of price of the product

Ad Valorem Tax

fixed percentage of the good's cost

Subsidies

government financial assistance, often to firms, which influences prices as it signals change leading to a reallocation of resources

Total Tax Revenue Formula

- (Pc x Qt) - (Pp x Qt)

- (Pc - Pp) x Qt

-2 x Qt

-tax x Qt

Calculating consumer surplus after subsidy

((P-intc. Demand - Price S.) x Qsub) / 2

Calculating producer surplus after subsidy

((Price S. - P-intc. Supply) x Qsub) / 2

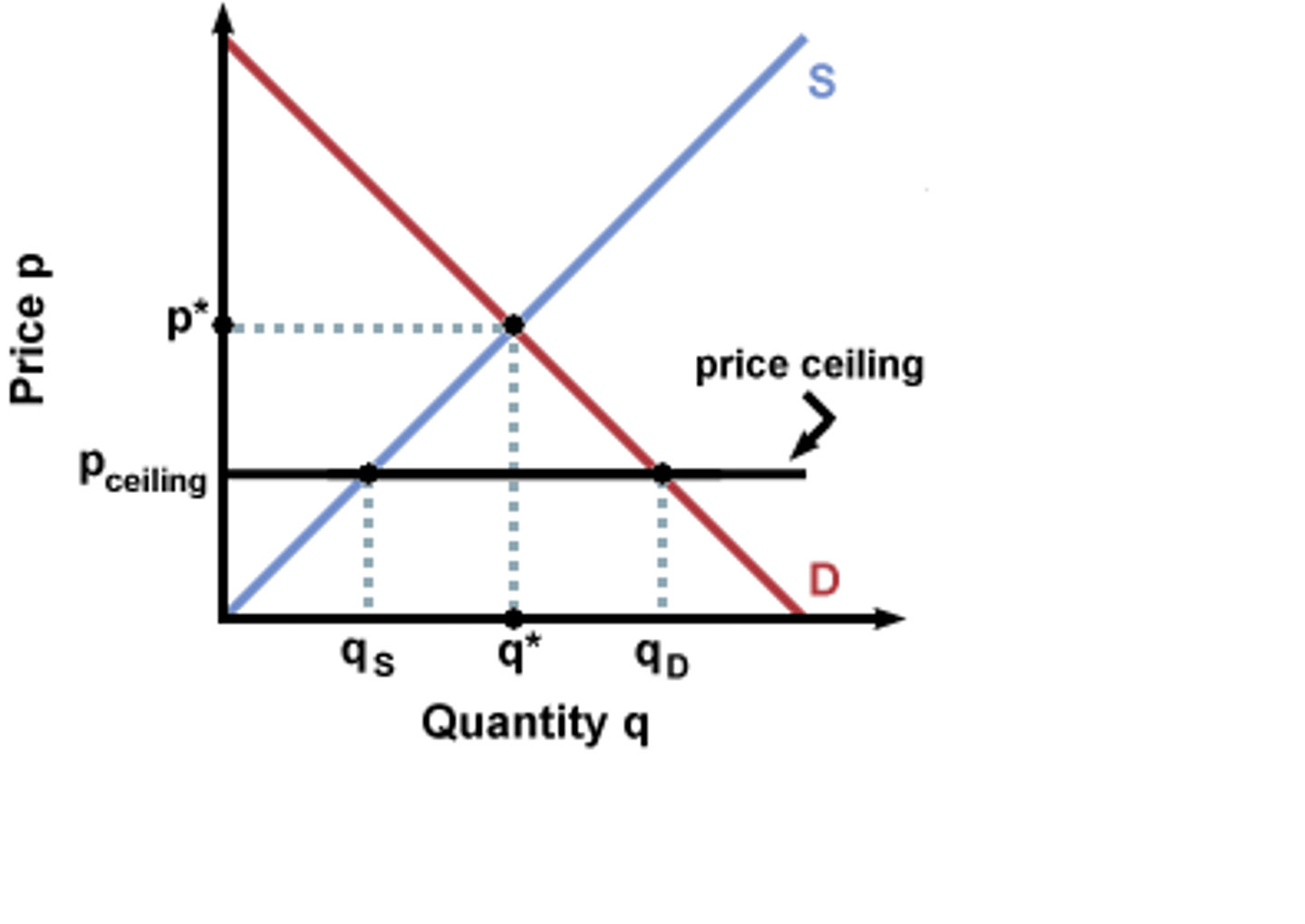

Price ceiling

a maximum price below market price

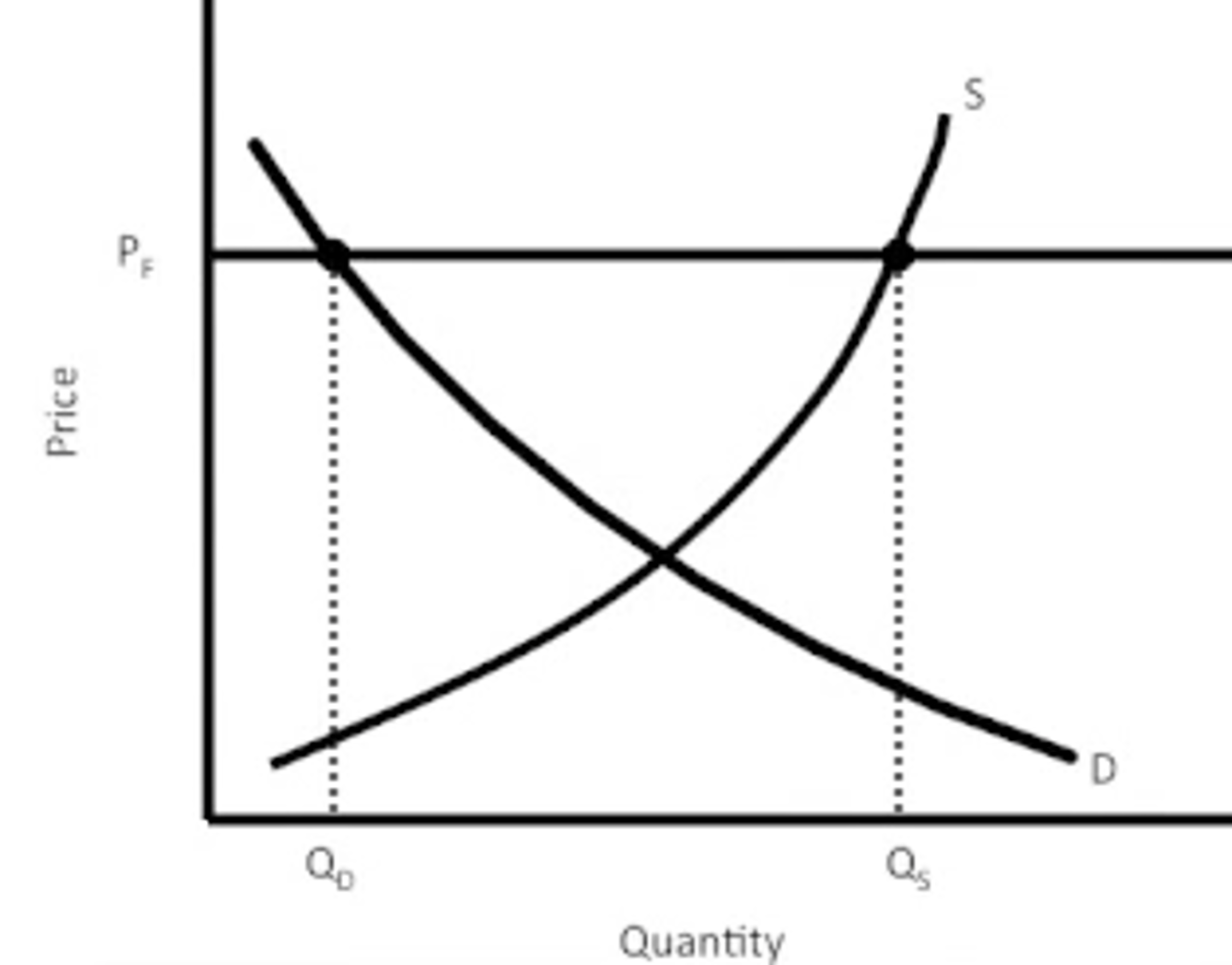

Price floor

a minimum price above market price

Benefits of a free market

-allocative efficiency

-consumer and producer surplus are maximized

-MC=MB

Pareto optimality

no one can be better off without making someone else worse off

Market failure

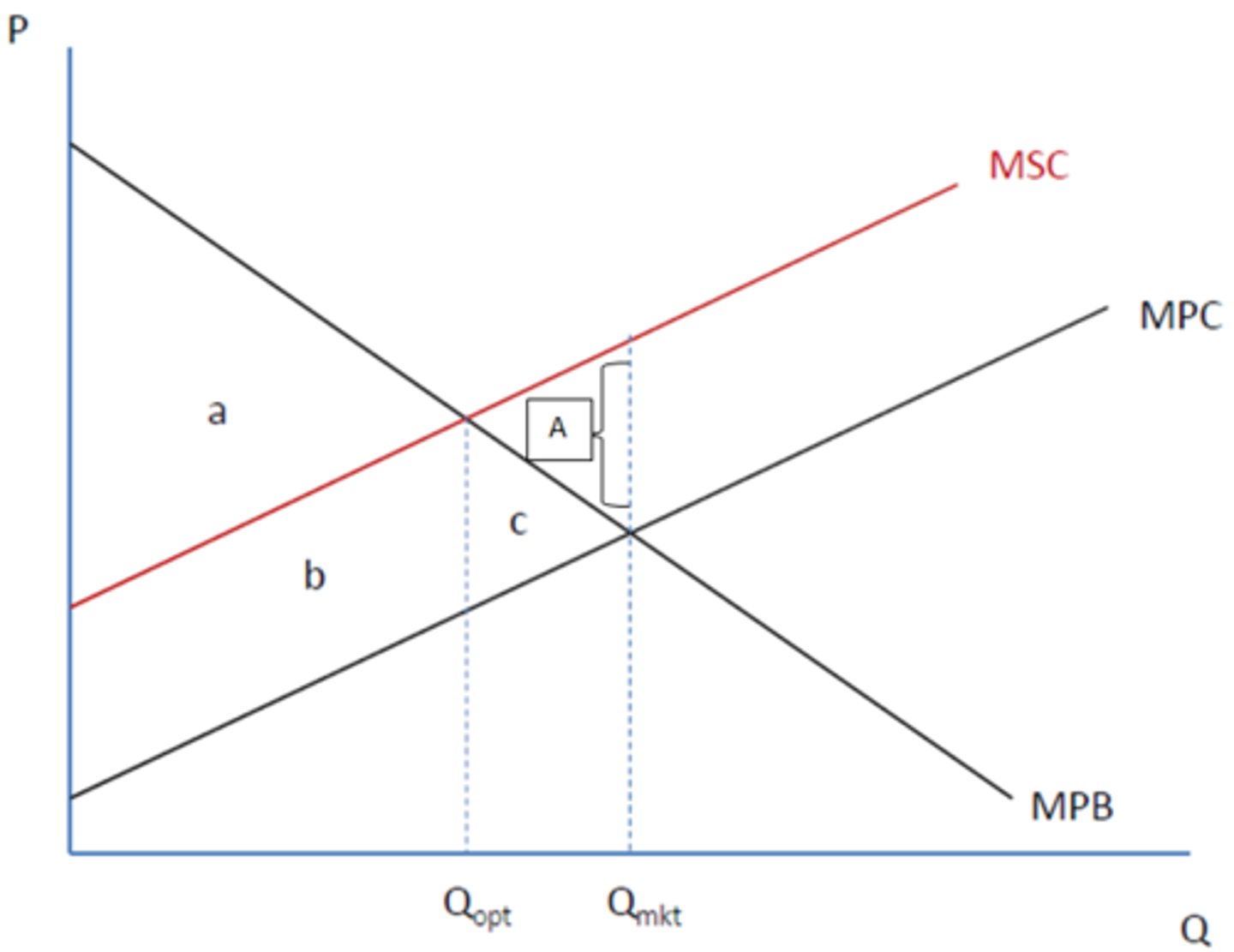

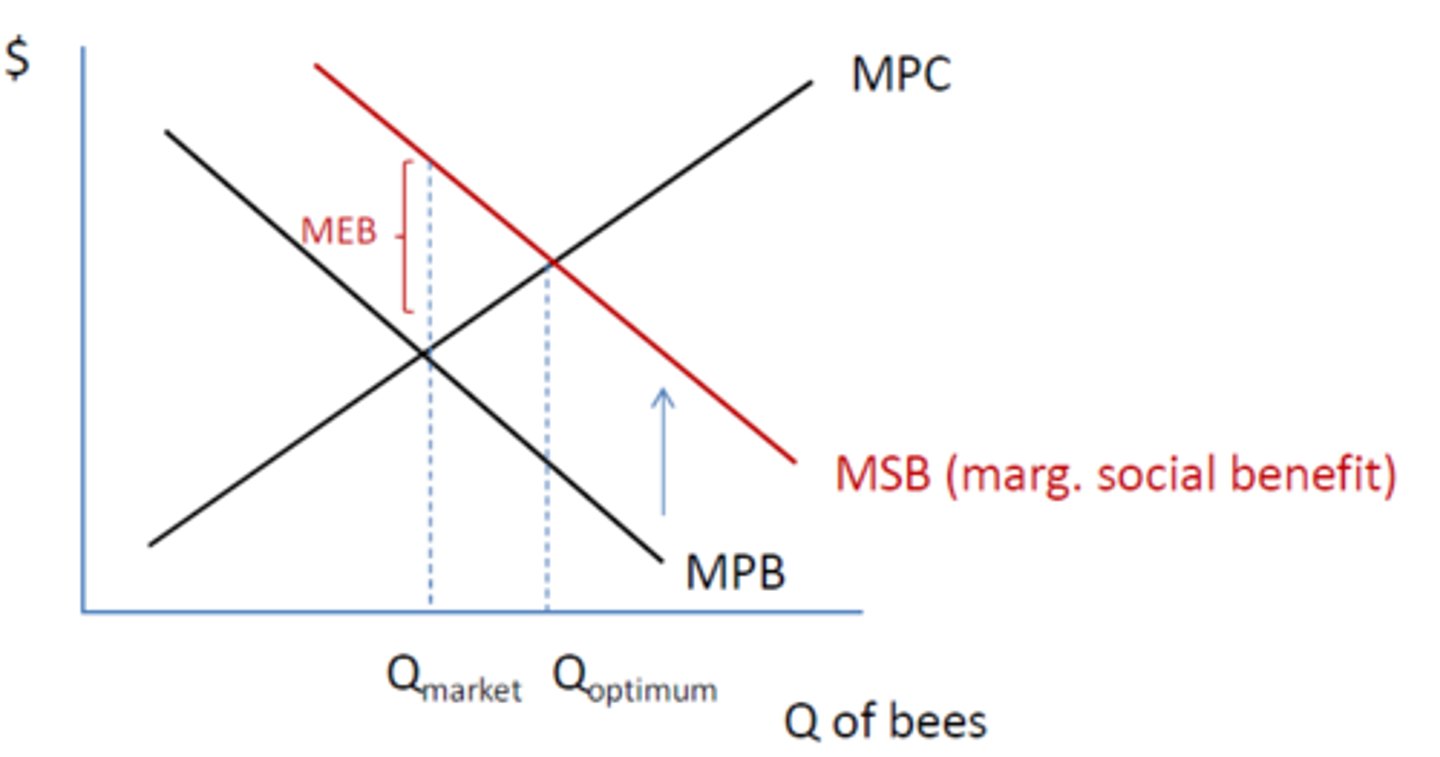

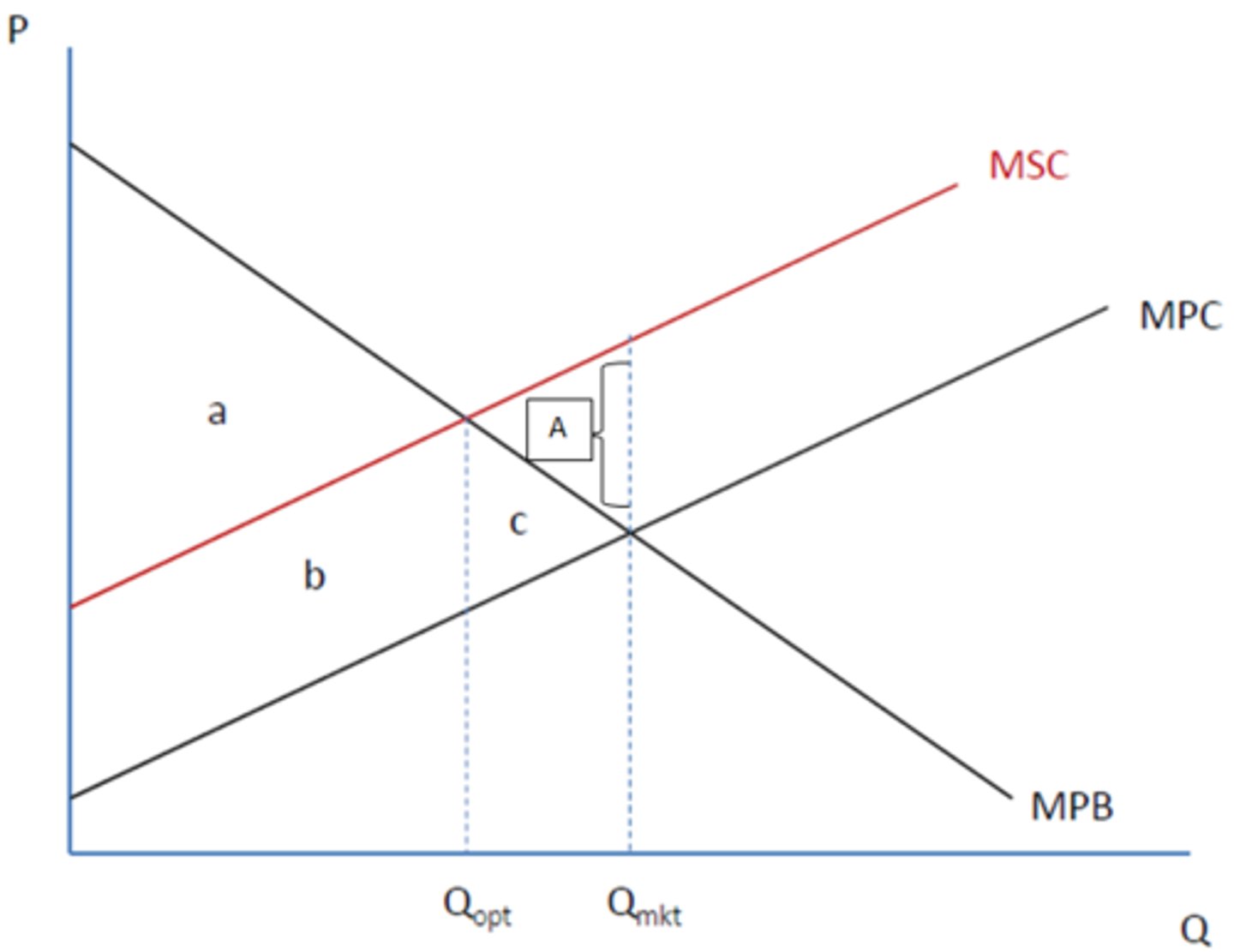

a failure to allocate resources efficiently

Marginal Social Benefit

benefit to SOCIETY of the consumption of a good

Marginal Social Cost

cost to SOCIETY of the production of a good

Marginal Private Benefit

benefits received by CONSUMERS for consumption of a good

Marginal Private Costs

costs for PRODUCERS for production of a good

Externalities

when a market outcome affects parties other than the buyers and sellers in the market

Positive externality

when the impact on the bystander is beneficial

Negative externality

when the impact on the bystander is adverse

Alternative correction for negative production externalities

-regulations and legislations; laws

-bans

Pigovian taxes

enacted to correct the effects of NEGATIVE externalities

Demerit goods

a good that is overvalued by society, typically restricted by government policies. Its consumption is often regarded as socially undesirable. If left to market forces, it will be over-consumed.

Lump-Sum Tax

a tax that is the same amount for every person

Regressive Tax

a tax for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayers

Alternative correction for negative consumption externalities

-bans

-limit behaviors

-advertising and persuasion

Alternative correction for positive consumption externalities

-subsidies

-government provisions

-vouchers/promotions

-legal mandates

Merit good

a commodity or service that is regarded by society or government as deserving public finance as it is a necessity, i.e. education or health care

Promotion

marketing focused on 4 elements: advertising, sales promotions, personal selling, and public relations

Trade-offs

scarce resources imply that individuals, firms, or governments are constantly faced with difficult choices that involve benefits and costs

Law of Increasing Costs

the more of a good that is produced, the greater the opportunity cost of producing the next unit of that good

Absolute advantage

this exists if a producer can produce more of a good than all other producers

Comparative advantage

a producer has comparative advantage if he can produce a good at a lower opportunity cost than all other producers

Normal goods

a good for which higher income increases demand

Inferior goods

a good for which higher income decreases demand

Price elastic

the responsiveness of the consumer exceeds the initial change in price

Price inelastic

the initial change in the price exceeds the responsiveness of the consumer

Unit elasticity

the initial change in price is exactly equal to the responsiveness of the consumer

Perfectly inelastic

No matter what percentage increase or decrease in price, the quantity demanded remains the same

Perfectly elastic

Even the smallest percentage change in price causes an infinite change in quantity demanded

Determinants of elasticity

-number of good substitutes

-proportion of income

-time

Incidence of tax

the proportion of the tax paid by consumers in the form of a higher price for the taxed good is greater if demand for the good is inelastic and supply is elastic

Midpoint Method

(difference QD/ average Qd) / (difference P/ average P)

absolute advantage

the ability to produce more of a good than all other producers

absolute prices

the price of a good measured in units of currency

accounting profit

the difference between total revenue and explicit cost

ceteris paribus

all else equal; the assumption that all other variables are held constant so that we can predict how a change in one variable affects a second

average fixed cost (AFC)

total fixed cost / output

average product of labor (APL)

total product / labor employed

average tax rate

the proportion of total income paid to taxes