Inflation and Normal vs. Real Values

1/29

Earn XP

Description and Tags

Week 8

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

What is inflation?

A sustained increase in the price level of an economy

How much higher are prices on average compared to the previous year?

3% higher than the previous year.

What are price levels?

The average level of prices in an economy.

What is deflation?

A sustained decrease in the price level of an economy.

What does the UK set as its inflation target?

2% as the inflation target for the UK economy.

How does inflation happen?

Both the demand side and the supply side of the economy can cause inflation.

What is demand-pull inflation?

It is caused by an increase in the demand-side activities of the economy.

When do prices of goods and services go up?

When the demand-side activities (consumer demand, government purchases, strong export) are stimulated more than the supply-side.

What is cost-push inflation?

It is caused by an increase in the cost of production (higher input prices).

What are consequences of inflation?

An increase in the cost of living, as things become more expensive.

A decrease in purchasing power of the people in the economy (a decrease in real interest rate)

What happens to savers when there is a decrease in purchasing power of interest earnings?

Savers lose (a decrease in real value savings)

What are the consequences for lender and borrows when inflation happens?

Lender lose and borrowers gain as inflation reduces the burden of debts for borrowers because the cash they pay back is worth less than it was when borrowed.

What is a regressive effect?

If prices of food, water, and electricity rise rapidly.

What are the consequences for menu costs when inflation happens?

Costs of having to change the price tags and menu lists (reduced by better technologies).

How does inflation cause uncertainty?

Volatile and high inflation makes decisions difficult for businesses (not sure about the costs of businesses and prices of the products) as well as for households (how much to spend/save), therefore affecting business and consumer confidence.

What are the purposes of the inflation target of 2%?

To provide a sense of certainty so that people can plan for the future.

If the inflation rate is too low, people may cut back spending in anticipation of lower prices to come, resulting in a decrease in economic activities.

How do we measure the change in our purchasing power?

By constructing price indicies.

What is the price index?

It expresses the cost of a ‘basket’ (set) of goods and services relative to its cost in some ‘base’ period.

The ‘basket’ differs, depending on the index.

Because we are comparing the cost of a set of goods and services across time, the extent of inflation measured depends on what are in the ‘basket’.

How do you calculate the Consumer Price Index (CPI)?

It is calculated using a ‘basket’ of goods and services consumed by a typical urban household.

e.g., the office of national statistics collects private information on about 700 items to calculate the CPI.

How do you calculate the GDP deflator?

It is calculated using a market basket of every item in the GDP. It is a broad measure of economy-wide inflation and is used to convert nominal GDP to real GDP.

How do you calculate the Producer Price Index (PPI)?

It is calculated using prices of goods and services received by domestic producers for their outputs.

What are the issues with Consumer Price Index (CPI)?

The value depends on whats in the basket; it does not capture the changes in the consumption behaviour when relative prices change (substitution bias), and new products may not go into the basket promptly (new product bias).

A price increase could mean an increase in the quality of the product, rather than just a price increase (quality bias).

We may change where to buy things (e.g., online) but the basket may include items sold at stores (new outlet bias).

What are the issues with GDP deflator?

Focus only on goods and services produced domestically.

What are the benefits with GDP deflator?

These indicies tend to come fairly close in measuring inflation, and using these indicies, we can measure inflation and deflation.

When we use monetary values for economic analyses what to we need to do?

We need to make a distinction between nominal values and real values.

Where are nominal values represented?

In current monetary values

Where are real values represented?

in ‘constant’ monetary values, using the prices of a chosen base year to adjust for inflation.

What is an example of nominal and real values?

GDP can be expressed in nominal or real values. In many cases we are interested in real GDP (e.g., production over time)

How do we use a price index to ‘deflate’ (‘adjust for inflation’), to convert the nominal

value into the real value?

Real value = (nominal value/ price index) x 100

Example: The inflation rate between 2017 and 2018 was 2%. This means, generally, £500

you had in 2017 and £510 you had in 2018 have the same purchasing power.

We can ‘convert’ the nominal value of £510 (in 2018 pounds) into its real (‘inflation-adjusted’)

value, in 2017 pounds, by:

(£510/102) x 100 = £500

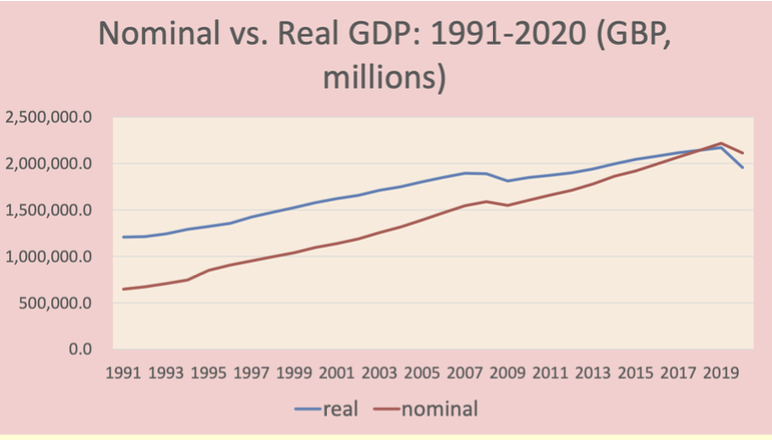

What does the chart look like showing nominal vs real GDP?