market failure, externalities, info failure, public goods, gov intervention (micro)

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

define market failure

market failure - when the free market fails to allocate resources to the optimum level

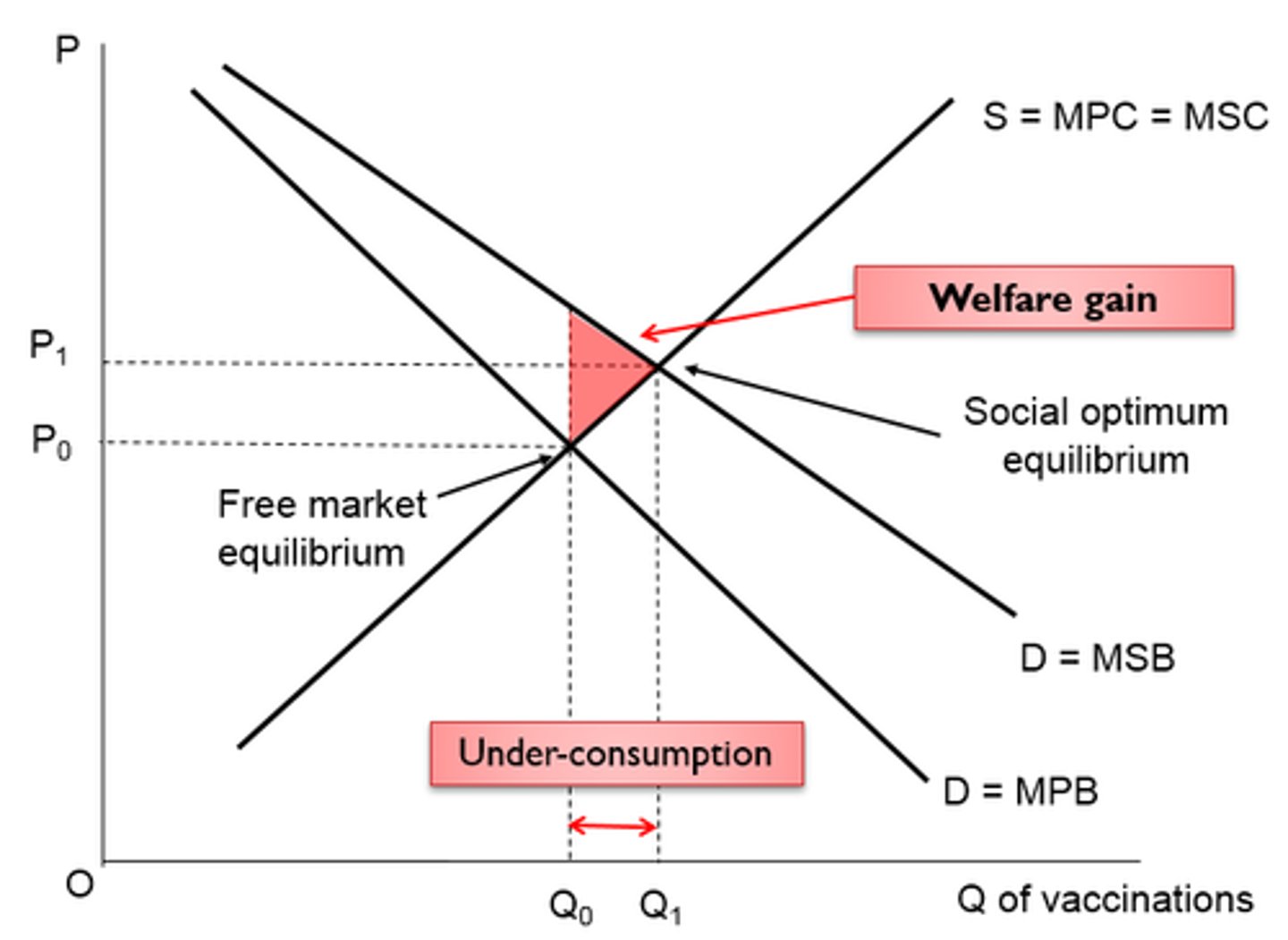

define positive externality of consumption

graph?

what does the graph therefore show about this product?

positive externality of consumption - benefit to a 3rd party that arises from consumption of a product that also has not been accounted for in the market transaction

- results in underconsumption and underproduction so misallocation and welfare loss.

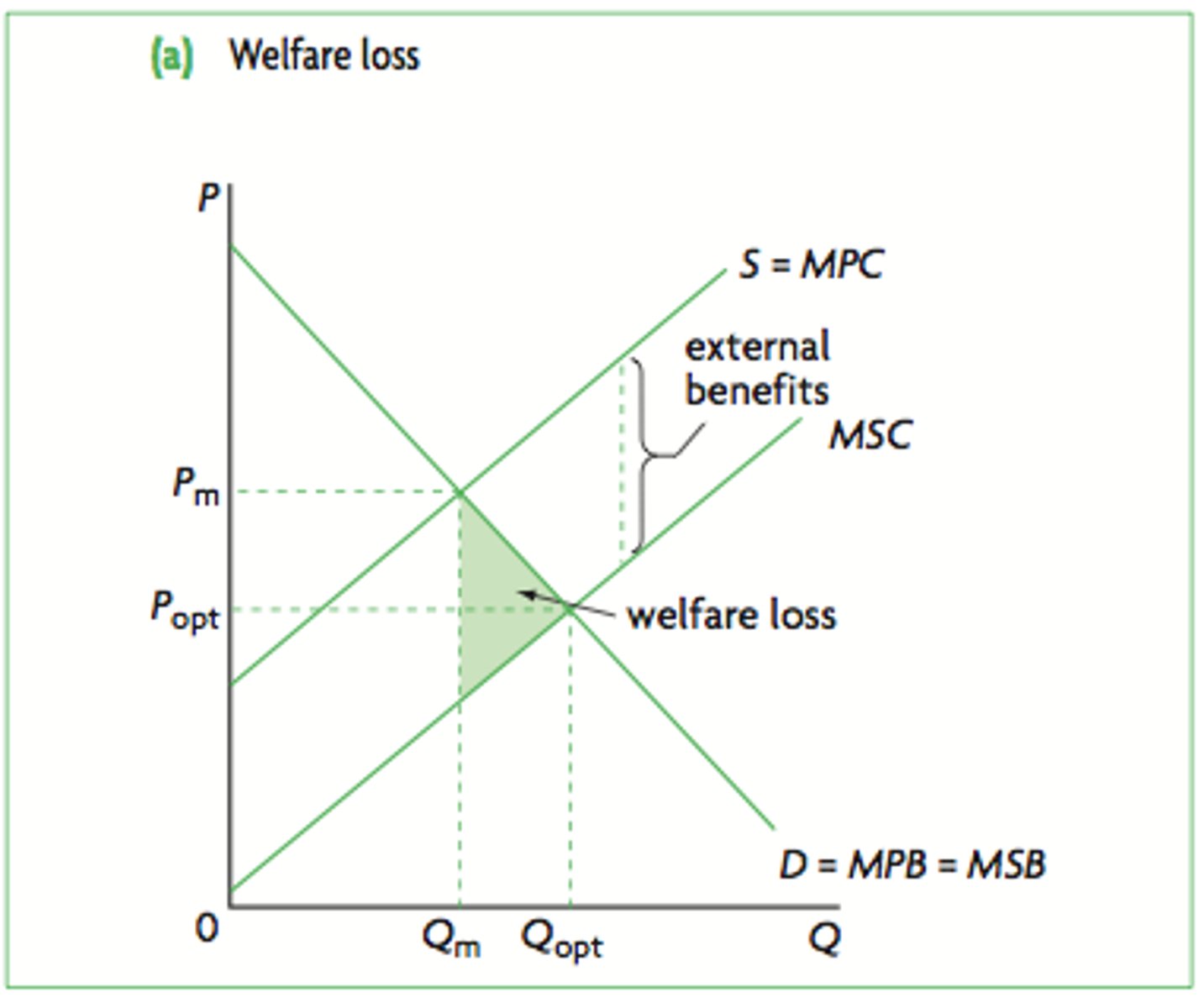

define positive externality of production

graph?

what does the graph show about this product?

positive externality of production - benefit to a 3rd party that arises from producing a product that also has not been accounted for in the market transaction

- results in an underproduction and underproduction so misallocation and welfare loss

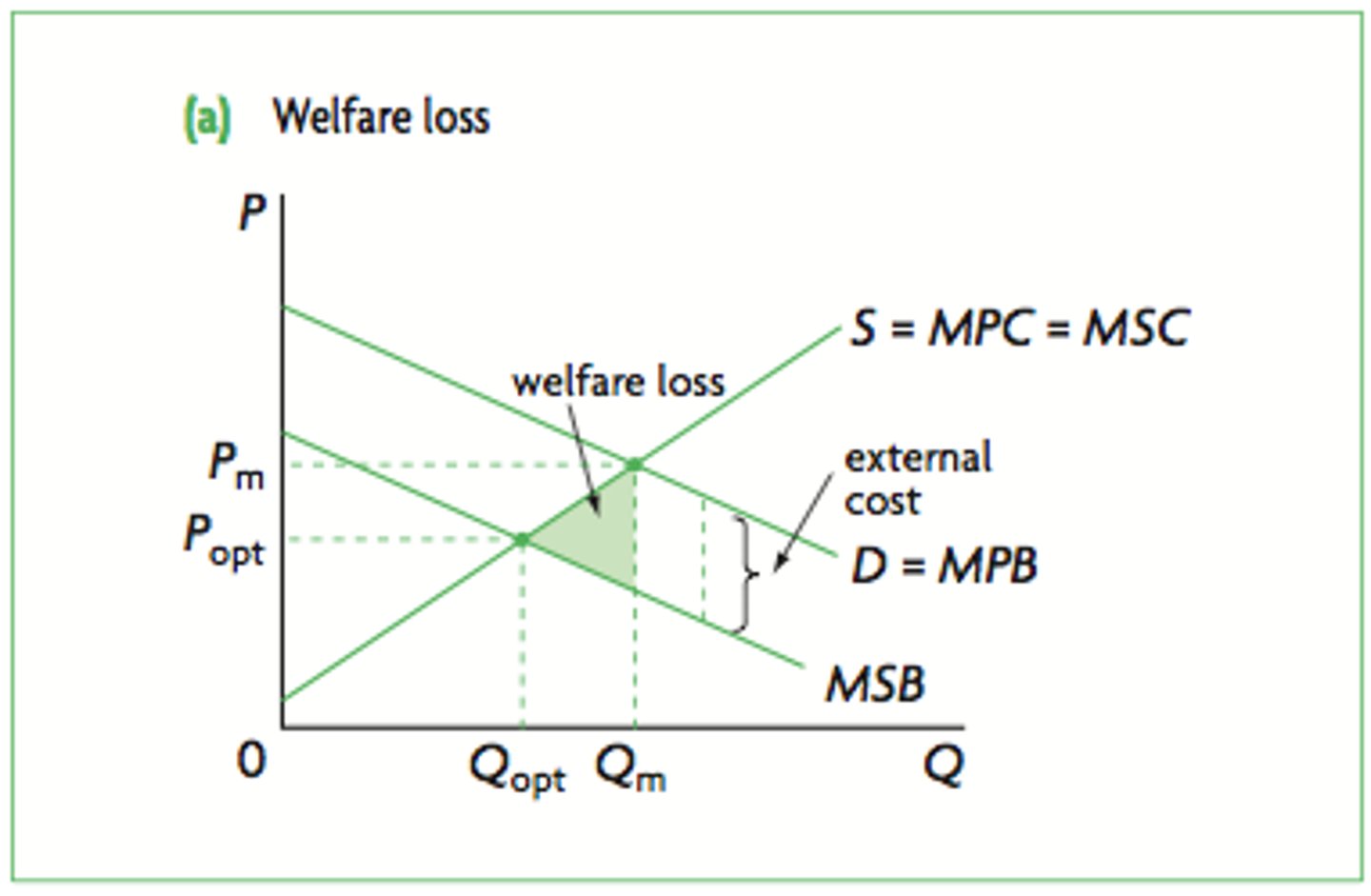

define negative externaility of consumption

graph?

what does the graph show about this product?

negative externality of conusmption - cost to a 3rd party that arises from the consumption of a product, that has not been accounted for in the market transaction

- results in overconsumption and overproduction so misallocation and welfare loss

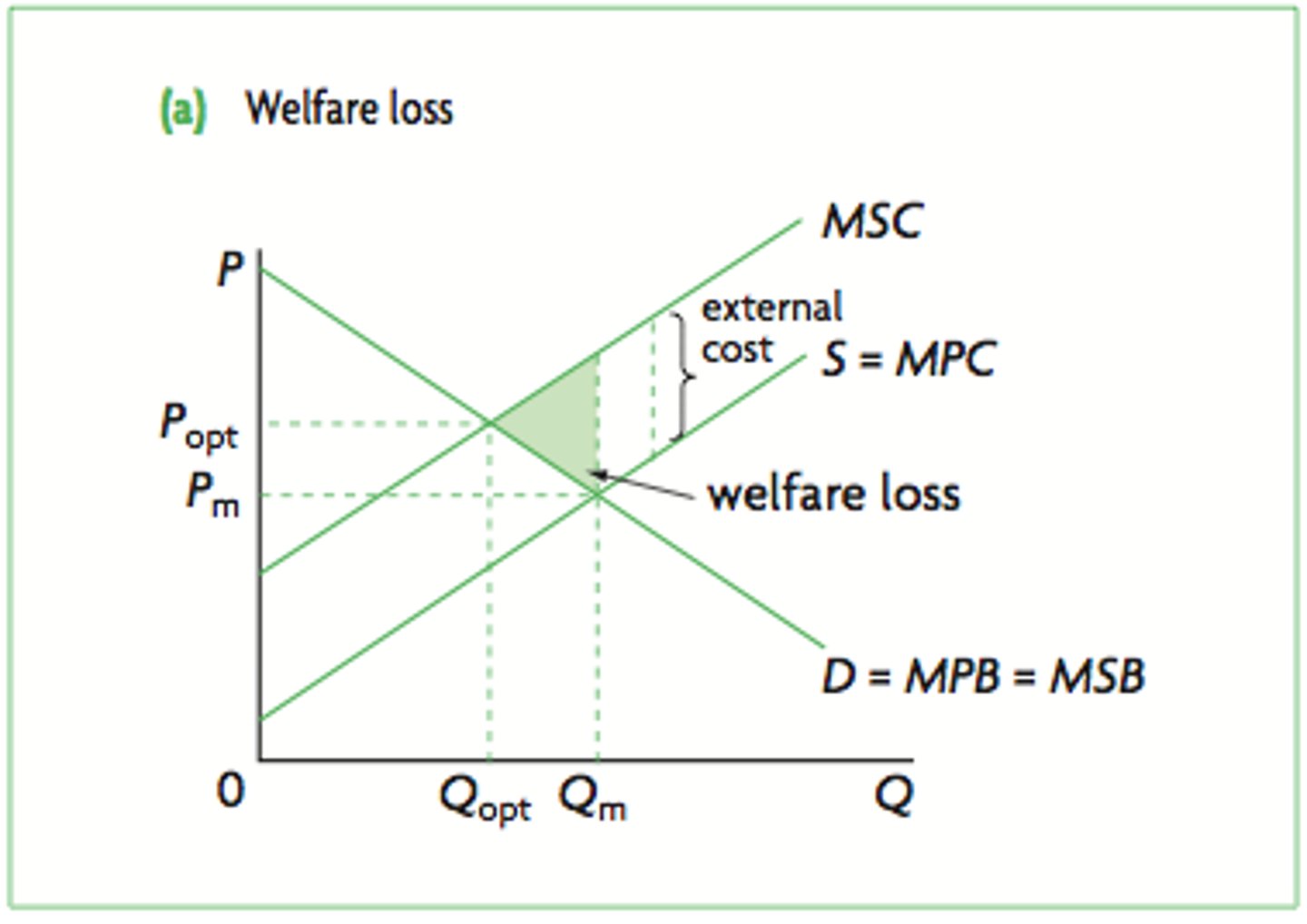

define negative externality of production graph?

what does this therefore show about this product?

negative externality of production - cost to a 3rd party that arises from the production of a product, that has not been accounted for in the market transaction

- results in overproduction and overconsumption so misallocation and welfare loss

define merit good

what could be the reason a merit good is underconsumed?

what type of externality does this cause?

do consumers behave rational or irrational?

merit goods - good that is underconsumed in a free market because a consumer does not anticipate all the benefits

- can be due to imperfect information: information failure or assymetric information

- generates a positive externality in consumption due to irrational decisions made by consumers to underconsume

define demerit good

reason it is overconsumed?

what type of externality?

demerit good - good that is overconsumed in a free market because a consumer does not anticipate the lack of benefits

- due to imperfect info: info failure or assymetric info

- generates a negative externality in consumption

Define public goods

public goods are non-excludable, non-rivalrous, non-rejectable and zero marginal cost

define non-excludable for public goods

when potential consumers cannot be prevented from consuming a good without paying for it

define non-rivalrous for public goods

when consumption of a good does not prevent consumption by another person as the quantity of good doesnt diminish upon consumption

Define non-rejectability

when consumption cannot be prevented by a consumer

What is a quasi-public good?

share some characteristics of private goods and some of public goods

What is one way that public goods can cause market failure?

public goods can lead to market failure

one way is overconsumption by people who were not involved in the market transaction

known as free-rider problem

What is the free rider problem in relation to public goods in the private sector?

Will the price mechanism work? Why?

What happens if all consumers behave like free riders?

How does this cause market failure?

As a result, gov must?

Once a public good is provided, it's impossible to stop someone from benefiting from it even if they haven't paid towards it

- The price mechanism cannot work if there are free riders, as consumers won't choose to pay for a public good they can get for free because other consumers have paid for it

- If everyone waits for others to pay for the public good, then it won't be provided

- This results in the good being underprovided or not provided at all, resulting in a missing market and therefore market failure, as there is a misallocation of resources, causing a net welfare loss

- As a result, gov must intervene by providing the public good and funding it through taxation

main 4 ways of market failure

externalities

information failure

merit and demerit goods

public goods

define direct and indirect tax?

which is aimed to affect supply and which for demand?

direct taxes are levied onto businesses or individuals that must be paid straight to the government - aimed to affect demand curve

indrect taxes are taxes that are LEVIED on good and services thus passing onto consumers in the form of higher prices - aimed to affect supply curve

how can indirect tax correct market failures?

what is an indirect benefit of an indirect tax to correct market failure

Indirect taxes can be used to affect the supply curve to correct market failures: indirect tax internalises the externality as they shift the supply curve left towards the social optimum, thus correcting market failure

- The indirect benefit is that it produces tax revenue

what are disadvantages of using an indirect tax to correct market failure

- difficult to place monetary value on the cost of negative externalities

- If PED is inelastic, then demand is not reduced by a large amount

- increased cost of production reduces international competitiveness, which may drive a firm to relocate, removing tax revenues and employment

what is a subsidy?

how can it correct market failure?

Subsidy is an amount paid to a business to produce goods and services with positive externalities

- Subsidy shifts the supply curve right, closer to the social optimum level, thus internalising the negative externality

What are the advantages (preferences + growth) and disadvantages (value + gov spending + loss of incentive + elasticity) of a subsidy to internalise negative externalities

Making a merit good cheaper and affordable may change preferences, increasing demand more than intended

- Subsidy can support the domestic industry to grow so can exploit economies of scale and become internationally competitive

- it can be difficult to place a monetary value on the benefit of positive externalities

- any subsidy has an opportunity cost

- Subsidies can make producers inefficient and reliant on subsidies, as firms have less incentive to reduce costs

- The effectiveness of subsidies depends on the elasticity of demand as subsidies wont significantly increase demand for inelastic goods

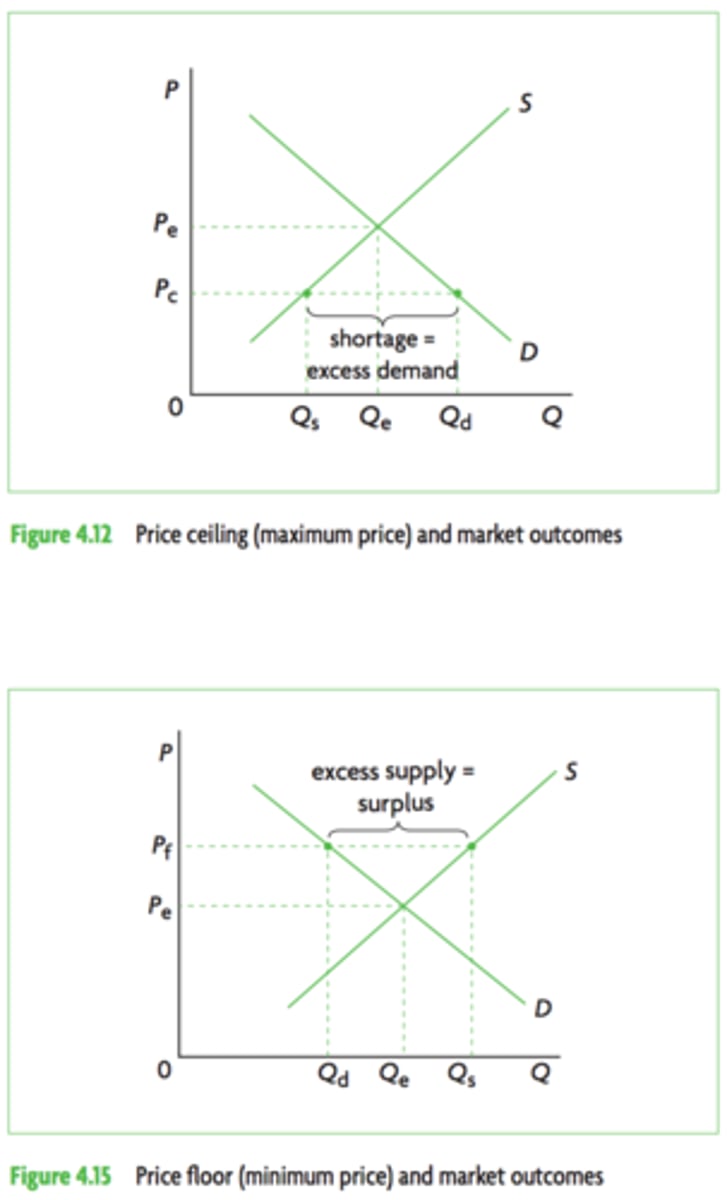

how can minimum and maximum price correct market failure?

how can you show this on a graph?

The maximum price can be set to increase the consumption of a merit good or make a necessity more affordable, as the maximum price causes an extension in demand, and therefore, excess demand

The minimum price can decrease the consumption of a demerit good, reduce demand and increase supply, causing excess supply

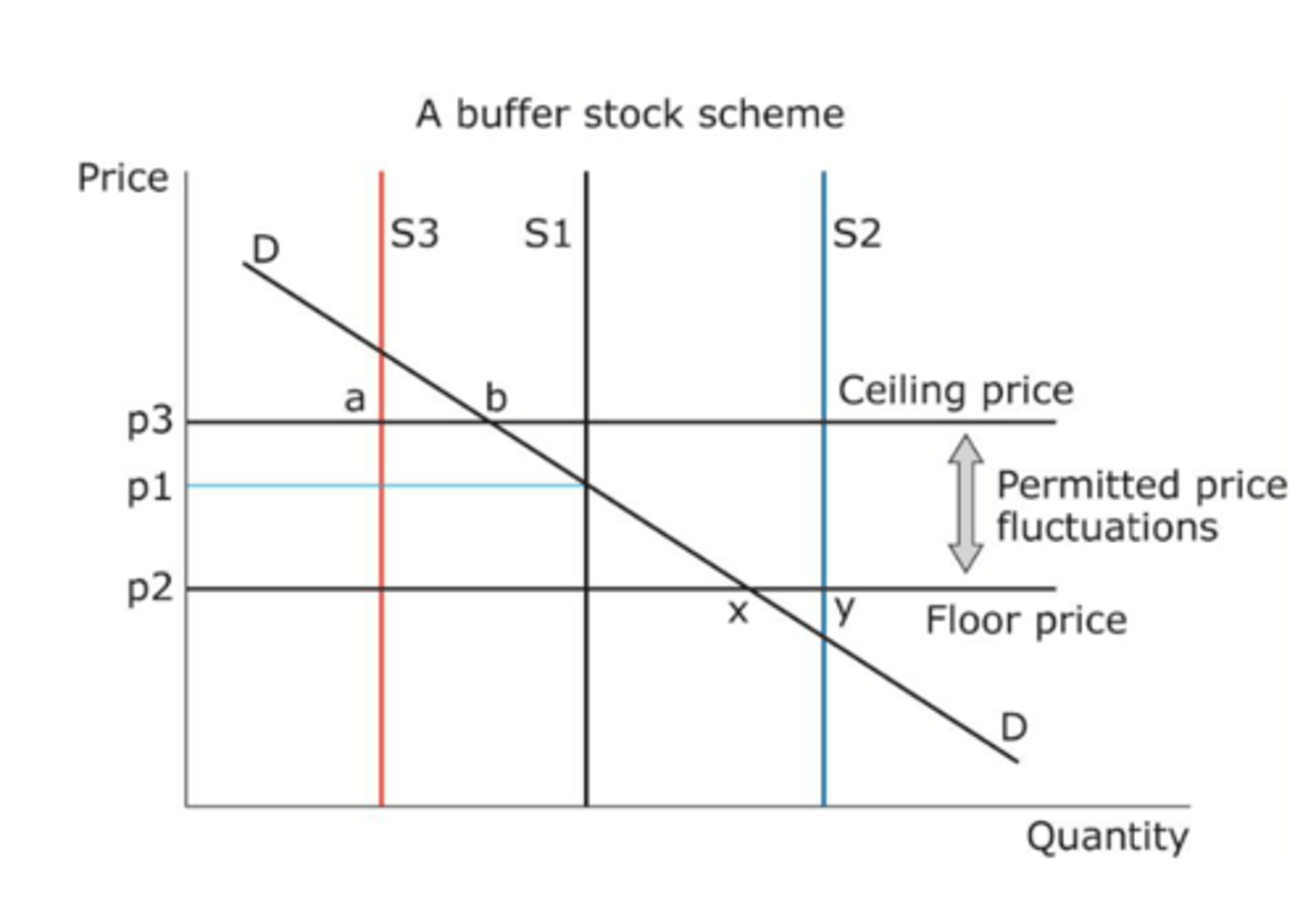

what is a buffer stock system

what market typically used in?

why is there min and max price?

how does it work?

draw the graph

buffer stock schemes - a system where the government intervenes in a commodity market to stabilise the process by buying up surplus stock when there is excess supply and releasing stock when there is a shortage to maintain price stability

- In a commodity market, a maximum price is in place to protect consumer welfare, and a minimum price is set to protect producers to ensure they are guaranteed a minimum price for commodities so primary sectors are not exploited

- In times of good weather, good harvest, the supply is high, so price is very low, if below min price, gov will buy up the excess stock at the minimum price to bring back the supply to the accepted region of price fluctuations

- In times of low supply due to bad weather, for example, the government will sell their stock of the good at the maximum price to increase supply and bring the supply back to the accepted price fluctuations

what are the advantages of buffer stock schemes(volatility, protection )

what are the disadvantages of buffer stock schemes (min price, type of commodity, moral hazard)

- reduces price volatility so consumers and producers can plan ahead encouraging investment and spending

- protects primary sector

- if min price is set too high, the scheme will spend excessively to maintain the min price

- Some commodities are perishable so buying up excess supply and not using will cause loss

- moral hazard; if producers know gov will always buy surplus, they may produce inefficiently large amounts, wasting resources and causing market distortions

what is privitisation

what are the different types?

Privatisation is the transfer of ownership of a firm/industry from the public sector to the private sector

- Privatisation encompasses:

- The complete sale of a public firm to the private sector

- contracting out services where the government pay private firms to carry out specific services like cleaning and catering at schools and hospitals

- public-private partnerships (PPPs) - where a private firm works with the gov to provide services

how can privatisation reduce market failure

what is privitisation?

Why is it needed?

- Privatisation is the transfer of ownership of a firm/industry from the public sector to the private sector

- Public-owned firms are owned by the gov and act in the best interest of consumers so prices tend to be low and output high, as they do not have to make profits

- but publicly owned firms tend to be inefficient because they lack competition and experience, and the inefficiency can lead to market failure

- Through privatisation, competition can be increased, increasing efficiency as firms have shareholders, so they'll need to maximise profits

- So they will reduce market failure by ensuring adequate provision of goods

what are the advantages and disadvantages of privitisation

- increased competition increases efficiency and reduces x-inefficiency

- Improves allocative efficiency as private firms react to the price mechanism

- A privatised public monopoly is likely to become a private monopoly, and monopoly power can lead to another market failure, so regulation may be necessary

- Regulation costs money, so the opportunity cost for the government

define regulation

regulation - rules that are specific to an industry or market and that govern the production or consumption of a product within that industry.

what is information provision?

how can it correct market failure?

what are some examples of?

what type of goods will this mainly effect and how?

evaluate the effectiveness

Information provision - gov can provide information on the full costs and benefits of goods and services to help consumers make rational choices and prevent market failure from asymmetric information

- examples: health warnings, advertising for healthy eating, school performance league tables

- gov will try to increase demand for merit goods and decrease demand for demerit goods

- effectiveness of gov info provision is questioned as there is still a massive market for cigarettes and alcohol, and there is a growing obesity problem

what is the aim of regulation

how does it do this

reduce market failure

- reduce the use of demerit goods and services by banning or limiting sale of such products

- Reducing the power of monopolies by using regulatory bodies to set price caps

- providing protection for consumers and producers from problems arising from asymmetric information

What is deregulation?

The policy of reducing or eliminating regulatory restraints in an industry or market to increase competitiveness by removing barriers to entry

Advantages (resource allocation and contestability + monopoly power) and disadvantages of deregulation

- improves resource allocation as markets become more contestable, so the threat of new competitors means prices fall closer to allocative efficiency (P=MC)

- can be used to prevent a public monopoly from becoming a private monopoly

- Improves efficiency by reducing red tape

- difficult to deregulate natural monopolies

- deregulation means there is less safety and protection for consumers

what is competiton policy

when is it usually used?

The competition policy is legislation and regulation that aims to make the market more competitive

- gov usually intervenes in concentrated markets where monopoly power is causing market failure, maybe due to setting prices above the equilibrium price, causing misallocation of resources and therefore a deadweight welfare loss

what is the CMA

What sort of things do they monitor and regulate

The competition and markets authority that independently regulates markets to promote competition to prevent market failure, they carry out competition policy

- they monitor mergers and takeovers to prevent mergers that would give a firm too high a market share and make it a monopoly

- They prevent collusive behaviour, often from oligopolies and prevent cartels, which can involve price fixing or limiting production

- They ensure a public monopoly does not become a private monopoly after privatisation

what are the advantages of tradeable pollution permits, what are disadvantages

- internalise the externality

- Reduce pollution as they encourage firms to become more efficient and pollute less

- Firms with low emissions can sell permits, allowing them to invest and expand

- gov can use revenue from fines to invest in other schemes

- The optimal pollution level can be difficult to set: too high, firms won't reduce emissions, too low, firms may relocate

- costs to regulate

what are tradeable pollution permits

how does it correct market failure

how does it work

tradeable pollution permits - a system that forces producers to include the costs of pollution in their production decisions by putting a limit on how much firms can pollute, thus internalising negative externalities

- Firms may trade their permits with other firms

- These permits use the market mechanism

- Each year, the number of allowances is reduced, giving firms incentives to lower their emissions

Define government failure

government failure - when gov intervention does not reduce market failure and may even increase it, or introduce new failure, leading to misallocation of resources and therefore, a net welfare loss and government failure

what are the causes of government failure?

explain why it fails

causes of market failure:

- being able to estimate the extent of market failure accurately so intervention isnt more or less than neccessary

- cost of the intervention

- information gaps

- unintended consequences

- moral hazard: unintentionally encourages riskier behaviour

how can min and max prcies lead to government failure

Max price: The max price is set below the equilibrium to make the goods more affordable, which leads to excess demand, which can create queues, black markets, reduced quality of goods, and disincentive to invest, thus, all causing misallocation of resources

min price: At a price above the equilibrium, there will be excess supply, which can lead to wastage due to overproduction, and the government buying the excess supply comes at a cost that is wasted

how can susidies cause gov failure

Subsidies to the wrong industries with low levels of competition may

how can inadequate information lead to government failure

imperfect information means its difficult to assess the extent of market failure, making it difficult to put a value on the government intervention thats needed to correct the failure

how can administrative costs cause government failure

- policies and regulations, subsidies, information provision, can all use a large amount of resources, which can result in high costs

- high costs can outweigh the benefits which causes net welfare loss thus government failure

how can regulaiton cause market failure

- Excess regulation, called red tape, can interfere with the market forces of supply and demand, which can prevent efficiency

- Excessive red tape, reducing efficiency, may cause time lags in markets, distorting the price mechanism as supply will be unable to respond to the needs of consumers quickly, distorting equilibrium and allocative efficiency causing a net welfare loss thus gov failure