AP Micro - Unit 2

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

40 Terms

law of demand

inverse relationship exists between price and quantity demanded

as price decreases, quantity demanded increases

demand curve

downward slope labeled D on Price v. Quantity plot

why?

Diminishing marginal utility

income effect (consumers aware of % that good is of their income)

substitution effect (consumers will find alternative if price is not ideal)

Market demand

horizontal sum of individual demands

what if demand increases/decreases?

vs

what if quantity demanded inc/dec?

demand curve shifts right/left respectively

if quant. demand. inc or dec, there is a move along the curve

determinants of demand (what causes right/left shifts)

TRIBE

Tastes/preferences (of consumers)

Price of related goods

substitutes (inc. in pepsi price drives inc. demand for coke)

complements (dec. in hot dog price drives inc. in quantity demanded for hot dog which in turn drives inc. in demand for buns)

unrelated goods (one price change does not affect the other)

Income

Normal good (superior goods, as income increases demand increases)

Inferior goods (as income increases demand decreases)(ex. Spam, Thrift clothes)

Number of Buyers (population)

Expectations (pregnancy drives demand for baby products)

law of supply

a direct relationship exists between price and quantity supplied

as price increases, quantity supplied increases (to capitalize on that higher price)

supply curve

upward trend labeled S on a price v. quantity plot

increase in supply v. quantity-supplied

in supply: shift left/right

in quant. supp.: move along the curve

Determinants of supply

ROTTEN

Resource Prices

price of resources dec. leads to increase in supply

Price of other goods

price of good 1 inc. leads to quantity supp. of good 1 to inc., and the shift in resources needed to accomplish that leads to decrease in supply of good 2

Technology

more tech = more supply

Taxes and subsidies

more taxes = less supply

subsidy = more supply

Expectations

Number of Sellers

price elasticity of demand

how much more or less will consumers buy a good as price changes

measures responsiveness to price changes

% change in quantity demanded / % change in price = Ed

where in both % change values should be absolute value

price elasticity of demand is…

inelastic from 0 to 1

necessities like insulin, changing price won’t really change quantity demanded

elastic from 1 to infinity

luxuries

unit elastic at 1

quantity change = price change, a 10% inc or dec will lead to a 10% inc or dec in the other

businesses could opt to switch to a more inelastic good to allow for price raises and more revenue

two extreme cases in price elasticity of demand

vertical line = perfect inelastic demand, consumers willing to pay anything

horizontal line = perfect elastic demand, consumers will only purchase at one specific price, will stop buying entirely if price changes

determinants of price elasticity of demand

Need v. Want

Substitutability

More subs = more elastic

Percentage of income

higher % = more elastic

Time

more time = more elastic

If an executive only has so many days to book a flight to Paris, will be willing to pay more for it (more inelastic due to less time)

total revenue

Price * Quantity = TR

TR - Total Cost = Profit

TR = consumer expenditure (synonyms)

Total Revenue Test for Elasticity

based on quant. demanded v. TR parabola (right of vertex = inelastic and left of it = elastic, vertex = unit elastic)

If price and TR move together, inelastic demand

if quantity and TR move together, elastic demand

if TR doesn’t move, unit elastic

price elasticity of supply

Es = % change in quant. supplied / % change in price

measures how much quantity supplied can change in response to a price change

determinants of price elasticity of supply

Input Substitutability

More subs (more ways and means of producing a good) = more elastic, more can be supplied after a price increase

ex, if the price of oil increases, my company only has one source of it, so I can’t just switch to a source that’s easier to extract or cheaper to produce, quantity supplied cannot increase that much

Time

Less time = inelastic

ex, less time means less strategizing, must use expensive resources available

cross-price elasticity of demand

Exy = % change in quantity demanded of X / % change in price of Y

Tests whether goods are related or not

positive = goods are substitutes (magnitude = more/less sub.)

negative = goods are complementary (magnitude = more comp. or less comp.)

zero/near-zero = unrelated

Income Elasticity of Demand

Ei = % change in quantity demanded / % change in income

positive = goods are normal (superior)

negative = goods are inferior

magnitude matters

market demand and supply graph

S and D lines intersecting on a Q v. P plot, with dashed lines towards axis where market equilibrium is (intersection)

surplus

when quantity supplied is higher than quantity demanded, when price is too high, two separate points on S and D lines that leads to two Qd values

price must be lowered

shortage

Price falls below market equilibrium, two points on Qd axis, Qs < Qd

Must raise price

Market equilibrium (what determines)

Equilibrium price and quantity (location of it)

Indeterminate (either equil. price or equil. quantity may be)

rationing function of prices (market will move itself to equilibrium, prices ration out goods and shortages/surpluses occur when priced wrong)

changes in demand/supply (as opposed to changes in Qd and Qs)

welfare economics

study of economic wellbeing

market equil. will maximize the welfare of buyers and sellers

consumer surplus and producer surplus

consumer surplus

price buyer is willing to pay minus market price

“upwards” triangle formed beneath demand curve by highest price willing to pay, lowest price willing to pay, and point where consumer surplus is zero

area of this triangle = surplus of all consumers

producer surplus

market price minus price producer is willing to sell at\

“downward” triangle formed above supply curve by highest price willing to sell, lowest price, and where producer surplus is zero

area is surplus of all producers

Market efficiency

consumer surplus + producer surplus = total surplus

free markets maximize efficiency (total surplus) at equilibrium

drawing single / double shifts

always start with P v. Q plot, labeled S and D lines, and market equilibrium with dashed lines to axes (P1 and Q1)

single shifts: draw the new line, label the old one 1 and new one 2, draw new equilibrium with P2 and Q2

double shifts: move each line equal distance, new equilibrium is one formed by D2 and S2 curves, one value (P or Q) should be indeterminate, since we can’t know which shift had a greater effect on that value (label this one X1,2)

taxation, general effects

When a tax is levied on a good…

Price paid by buyer increases

Price received by producer decreases

Both end up with less money

Must fit within S and D curve, drives a wedge between price buyers pay and that sellers receive

quantity sold decreases (occurs left of equilibrium)

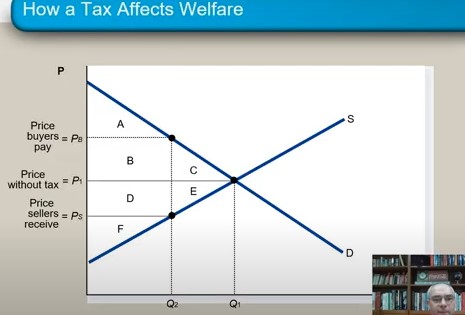

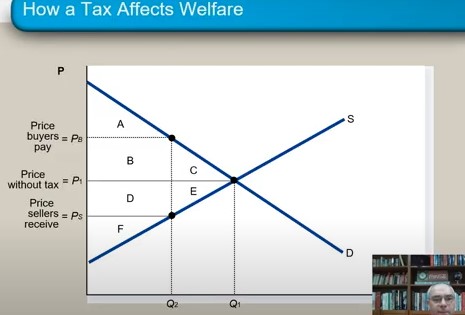

tax distortion on a graph

A = consumer surplus

F = producer surplus

B + D = tax revenue (size of tax (vertical) * quantity of good sold (horizontal))

C + E = Deadweight loss (DWL, fall in total surplus) (c for consumer and e for producer)

ABC = consumer surplus without tax

what determines size of DWL?

elasticity of supply and demand

more elastic (flatter line) = more loss

tax incidence

How is tax split between buyers and sellers?

The steeper (more inelastic) curve pays more

notice larger DWL triangle for the steeper curve when the tax distortion is applied to the graph

price controls

enacted when policymakers believe market price is unfair to buyers or sellers

price ceiling: legal maximum, benefits consumers

price floor: legal minimum, benefits producers

two types: binding (effects equilibrium), non-binding (no effect)

effects of non-binding ceiling/floor

equilibrium already above the floor / below the ceiling, all is well

effects of binding floor / ceiling

ceiling: equi. price is above the ceiling, price must be lowered, but this creates a shortage, Qs < Qd, and non-price-rationing (long lines, discrimination, not everyone gets the good now)

floor: equil. price below the floor, must increase, but this creates a surplus, Qs > Qd, and non-price rationing (companies bribing others to sell their product)

price control effect on total surplus

binding price floor

consumer surplus = A

producer surplus = BDF (floors help prod.)

DWL = CE

binding price ceiling

Producer surplus = F

consumer surplus = ABD (ceilings help consum.)

DWL = CE

international trade (two types of attitudes)

closed economy (autarchy) (no trade at all)

open economy (trades freely)

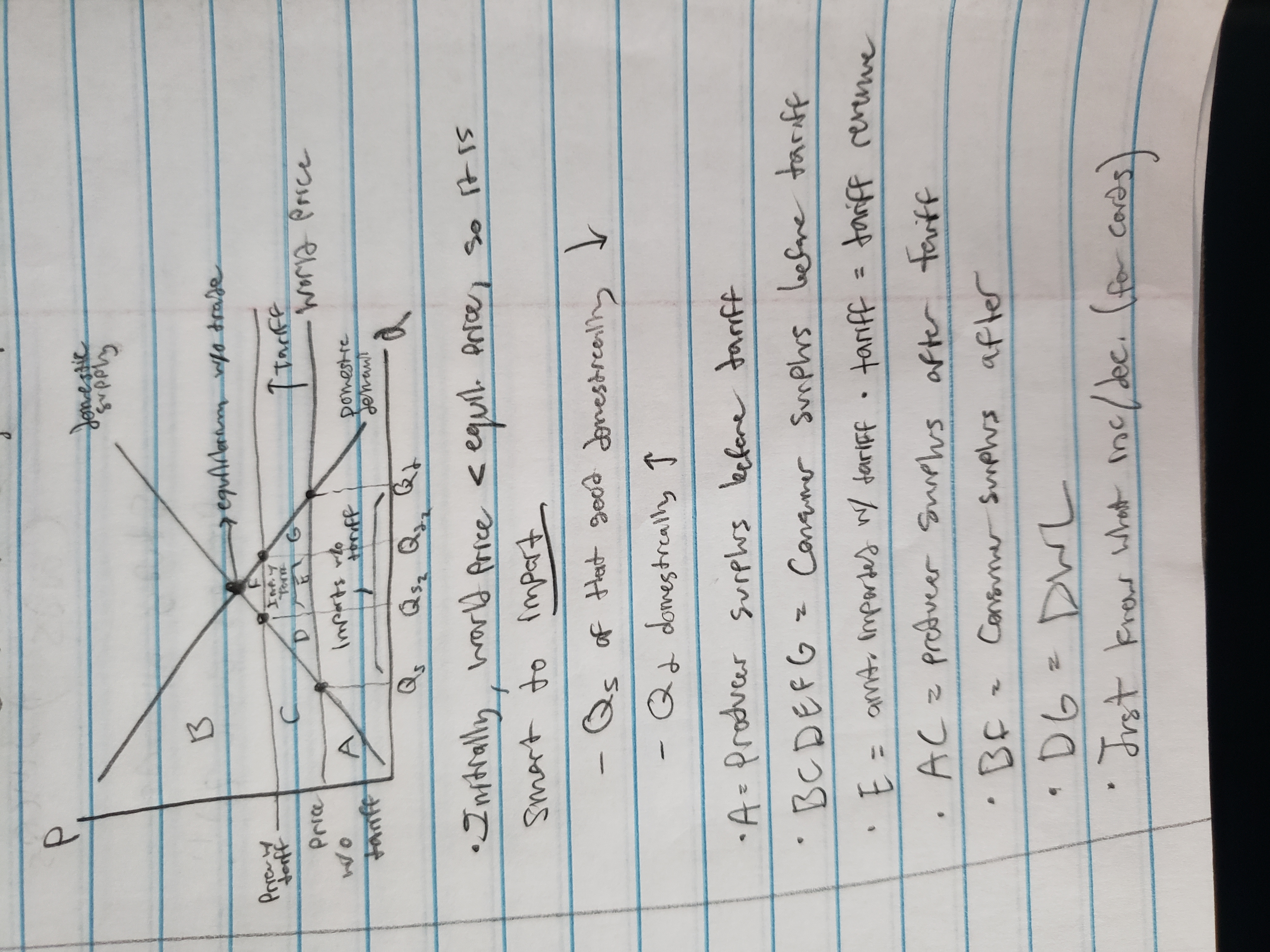

tariffs and effects

tax on foreign goods that are sold domestically

raises price of imported goods by amount of tariff

decreases domestic consumer surplus

increases domestic producer surplus

government gets tariff revenue

creates DWL, total surplus falls

tariff on a graph

two other trade mechanisms

import quota

limit on quantity of imports

export subsidy

lowers domestic cost of production

both tariffs and quotas….

Raise domestic price

Reduce imports

Reduce domestic consum. surplus

Increase domestic prod. surplus

Reduce total surplus (create DWL)