Supply Chain Test #2

1/134

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

135 Terms

Procurement

process of selecting suppliers, negotiating contracts, establishing payment terms, and purchasing goods and services vital to an organization

Purchasing

The transactional function within procurement involving obtaining goods or services in exchange for money from a third party

Purchase Requisition

internal document notifying purchasing personnel of necessary items to order, quantity, and timeframe

does not constitute a contractual relationship with external party

Purchase Order (PO)

official offer from a buyer to a seller to acquire goods or services, controlling the purchasing process from external suppliers

Request for Information (RFI)

A standard process to collect information about supplier capabilities

Request for Proposal (RFP)

A detailed document to determine a supplier's capability and interest in producing a product or service

Request for Quote (RFQ)

document to solicit bids from interested and qualified suppliers for goods or services

Purchasing objectives

to ensure an uninterrupted flow of materials and services at lowest total cost

to improve the quality of the finished goods

to optimize customer satisfaction

Purchasing process steps

Identify need; issue Purchase Requisition

Obtain authorization

Identify and evaluate potential suppliers

Select supplier

Skip if you did this in Step 3

If not, initiate competitive bidding process

Purchase order is created and delivered to supplier

Supplier confirms purchase order

Order fulfillment

Receipt of goods

Invoice and reconciliation

3-way match - invoice, purchase order, and goods receipt must match

Payment

Close out the purchase order

Analysis

Measure efficiency and accuracy of procurement process

e-Procurement

web-enabled automation of non-strategic and transactional activities, such as:

RFI, RFP, RFQ

Execution and analysis

Reverse auction capabilities

increases visibility

e-Procurement process

Electronic purchase requisition and/or purchase order

Invoice

Payment

advantages of e-Procurement

Time savings - reduction in time between need recognition and the release and receipt of an order

Cost savings - lower overhead costs in the purchasing area

Accuracy - a reduction in errors; virtual elimination of manual paperwork

Real time - improved communication both within the company and with suppliers

Management - purchasing personnel spend less time on processing of purchase orders and invoices, and more time on strategic value-added purchasing activities

Mobility - access virtually anywhere

Trackability - real-time status tracking

Total Cost of Ownership (TCO)

the sum of all the costs associated with every activity

Purchase price of an item is very important, but it is only one part of this

= Quality + Service + Delivery + Price

Components of Total Cost of Ownership

Pre-transaction costs - activities carried out prior to the actual buy and sell transaction

Transaction costs - activities carried out as part of the actual buy and sell transaction

Post-transaction costs - activities carried out following the actual buy and sell transaction

Make vs. buy decision

The strategic decision of producing internally or buying from an external supplier based on business strategy, risks, and economic factors

Make vs. buy decision key pillars

Business strategy

Risks

Economic factors

Qualitative reasons for making

Protect proprietary technology - not wanting your intellectual property to be public

No competent supplier - in the market and you may not want to spend the time or effort to develop one

Control of lead-time - feeling you have more control over the lead time to produce the product

Use existing idle capacity - make use of excess capacity

Better quality control - feeling you have more control of the quality of the material/product than a supplier

Quantitative reasons for making

Overall lower cost

Control of transportation and warehousing costs - avoid transportation costs and potentially keep warehousing costs low

Qualitative reasons for buying/outsourcing

If it is a non-strategic item

Insufficient capacity

Temporary capacity constraints - concept of “extended workbench” (i.e., short-term supplementing internal capacity with external capacity during time of constraint or overloaded work centers)

Lack of expertise - or necessary technology

Quality - suppliers may have better technology, process, & skilled labor

Multi Sourcing Strategy - using an external supplier + an internal source

Brand Strategy - take advantage of a supplier’s brand image, reputation, popularity, etc.

Quantitative reasons for buying/outsourcing

Cost advantage - suppliers may provide the benefit of economies of scale, esp. for non-vital components

Inventory considerations - opting to have the supplier hold inventory of the item or the materials required to produce the item

Benefits of outsourcing

Concentrate on core capabilities

Reduce staffing levels

Accelerate reengineering efforts

Reduce internal management problems

Improve manufacturing flexibility

In-sourcing

reverting to in-house production when external quality, delivery, and services do not meet expectations

Co-sourcing

internal staff and an external provider share a process or function

using exclusive dedicated staff as an external provider

Backward vertical integration

a company acquires one or more of their suppliers

Forward vertical integration

a company acquires one or more of their customers

Profit-leverage effect

Decrease in purchasing expenditures directly increases profits before taxes

Return on Assets (ROA) effect

a high [this] indicates managerial expertise in generating profits with lower spending

= Profit / Assets

Centralized purchasing

purchasing department located at the firm’s corporate office makes the purchasing decisions for all departments

advantages

Concentrated volume

Leveraging purchase volume

Avoiding duplication

Specialization

Lower transportation costs

No competition within units

Common supply base

Decentralized purchasing

individual, local purchasing departments make their own purchasing decisions

advantages

Knowledge of local requirements

Local sourcing

Less bureaucracy

Hybrid approach (centralized/decentralized purchasing)

centralized purchasing for products and services used throughout the corporation

decentralized purchasing for products and services used only locally at each facility

Specialized Knowledge

Essential for international purchasing

Tariffs - duties, taxes, or customs imposed by the host country on imported/exported goods

Non-tariff barriers - quotas, licensing agreements, embargoes (i.e., official ban on trade with a particular country), laws and regulations imposed on imports and exports

Countertrade - international trade by exchange of goods rather than by currency

Bid

a proposal or quotation submitted in response to a solicitation from a contracting authority

Competitive Bidding

competing suppliers bid for the right to supply specified materials or services

no negotiations—contract goes to cheapest responsible bidder

Purchasing function

enhances value

performance is preferably monitored periodically against standards, goals, and/or benchmarks

Strategic Sourcing

comprehensive approach for locating and sourcing key suppliers, so that an organization can leverage its consolidated purchasing power to find the best possible values in the marketplace

emphasis on product life-cycle

how it works

Identifying suppliers

Cultivating relationships

Continuously improving skills

Understanding and embracing the possibilities

Objectives of strategic sourcing

Improve the value‐to‐price relationship

i.e. achieve cost reductions while maintaining or improving quality/service

Understand the category buying and management process to identify improvement opportunities

Examine supplier relationships across the entire organization. Share best practices across the organization

Develop and implement multi‐year contracts with standardized terms and conditions across the organization

Leverage the entire organization’s spend

Sourcing Strategies

Insourcing - producing goods or services internally

Outsourcing - traditionally involves purchasing an item or service externally, which had previously been produced internally

Recently: term has become synonymous with the concept of buying an item from an external supplier regardless of whether the item had previously been produced internally

Single-source - a sourcing strategy where there are multiple potential suppliers available for a product or service, but the company decides to purchase from only one supplier

RISKY

Multi-source - purchasing a good or service from more than one supplier

creates competition between suppliers to achieve higher quality and lower price

Reasons for single supplier

To establish a good relationship

Less quality variability

Lower cost

Transportation economies

Proprietary product or process

Volume too small to split

Reasons for multiple suppliers

Need more capacity

Spread risk of supply disruption

Create competition

More sources of information

Dealing with special kinds of business

Functional products

MRO items and other commonly low profit margin items with relatively stable demands and high levels of competition

Ex.: office supplies, food staples

Potential strategy: reliable, low cost multi-sourced suppliers

Innovative products

have short product life cycles, volatile demand, high profit margins, and relatively less competition

Ex.: technology products such as iPhone

Potential strategy: innovative, high-tech, cutting edge, market leading single-sourced supplier. Long-term partnership

Strategic sourcing process

Identify the targeted spend area

Create the sourcing team

Develop a team strategy and communication plan

Gather market information

Develop a supplier portfolio

Develop a future state

Select suppliers and negotiate

Implement Supplier Relationship Management (SRM)

Spend analysis

Categorizing and analyzing expenditure data to decrease costs, improve efficiency, and monitor compliance

key areas

Total historic expenditures and volumes

Future demand projections or budgets

Expenditures categorized by commodity and sub-commodity

Expenditures by division, department, or user

Expenditures by supplier

Spend analysis process

Define the scope

Ex.: expenditures over a specified period

Identify all data sources

Gather and consolidate all data into one database

Cleanse the data (i.e., correcting errors) and standardize it for easy review

Categorize the data

Ex.: commodity and sub-commodities

Analyzing the data for:

Best deals per supplier

To ensure that all purchases are from preferred suppliers

To reduce the number of suppliers per category

Repeat the process on a regular basis

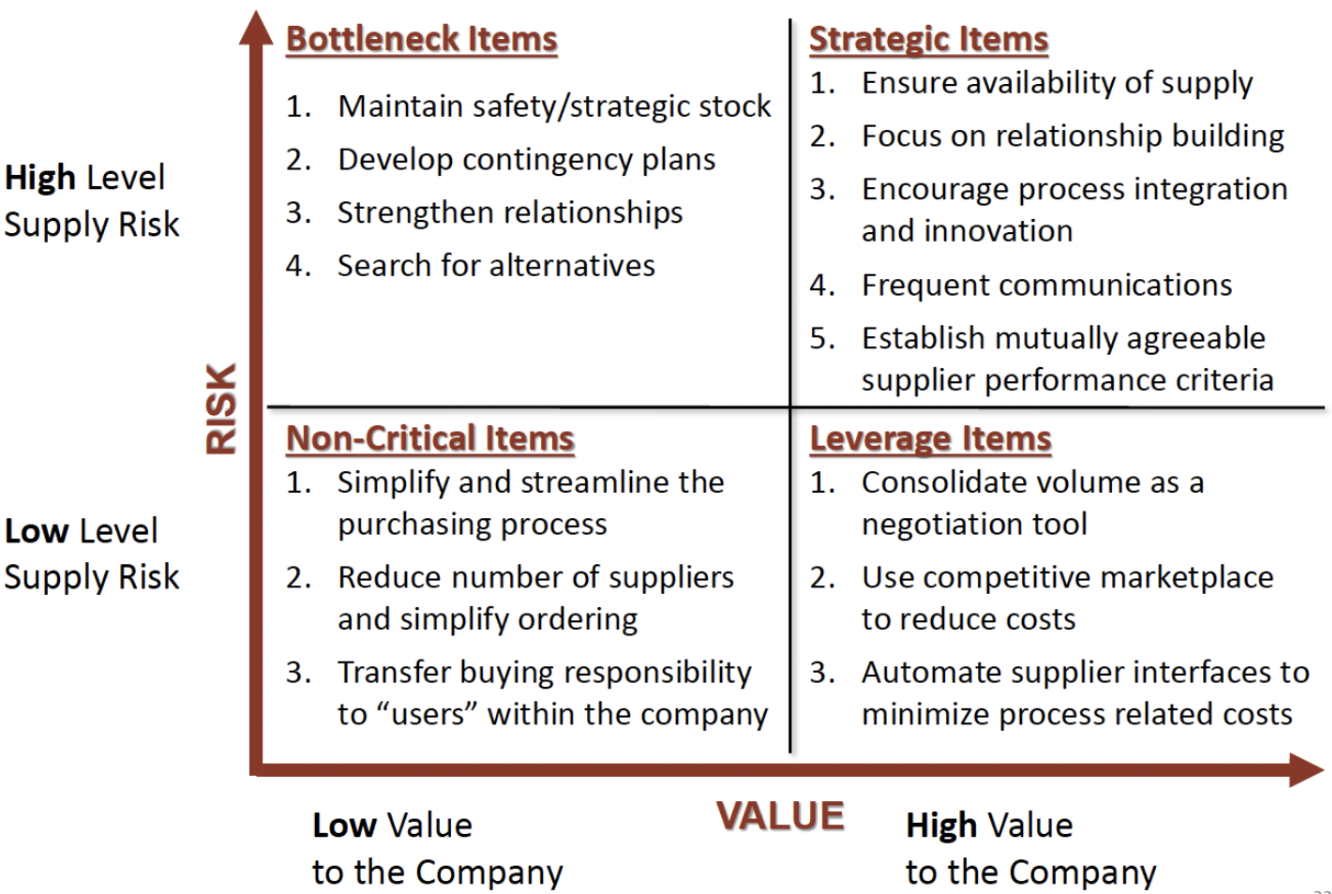

Sourcing strategies by category

non-critical, bottleneck, leverage, and strategic items

Non-critical items

involve a low percentage of the firm’s total spend and involve very little supply risk

Ex.: standard screws in a computer factory

Bottleneck items

unique procurement problems. Supply risk is high and availability is low. Small number of alternative suppliers

Leverage items

commodity items where many alternatives of supply exist, and supply risk is low. Spend is high and there are potential procurement savings

Strategic items

involve a high level of expenditure and are vital to the firm’s success

Sourcing categories examples

Supply base rationalization (/reduction/optimization)

reducing the supply base as much as possible without significantly increasing risk

results in:

Reduced purchase prices

Fewer supplier management problems

Greater levels of quality and delivery reliability

Closer and more frequent interaction between buyer and supplier

AI in supplier selection

can increase effectiveness of supplier relationship management

eliminates human error

can quickly and thoroughly analyze supplier-related data (e.g., on-time, in-full delivery performance, evaluations, and credit scoring) and provide information for future decisions

can improve customer service

Preferred suppliers

Best meet your company’s overall purchasing requirements

Achieve a specific and exceptional level of performance over time as measured by agreed-upon criteria, providing higher value than competitor

they provide

Product and process technology and expertise

Product development and value analysis

Information on latest trends in materials, processes, or designs

Capacity for meeting unexpected demand

Cost efficiency due to economies of scale

Strategic alliance

A sourcing agreement between a buyer and a supplier to pursue agreed-upon objectives while remaining independent organizations, sharing information and resources for mutual benefit

benefits

Potential to increase profits for both parties

Potential to create a competitive advantage or block a competitor from gaining market share

Mitigate risks and ensure a continuity of supply

Position the partners for future strategic opportunities

Strategic alliance development

an extension of supplier development which refers to increasing a key or strategic supplier’s capabilities

Results in:

better market penetration

access to new technologies and knowledge

higher return on investment

Distributive negotiations

leads to self-interested, one-sided outcome

counterproductive - parties work against each other; lose-lose

competitive - compete for value and barely share info; win-lose

Collaborative negotiations

Both sides work together to create a win-win result, requiring open discussions and alignment on motivation, contribution, and financial benefit

cooperative - parties work tg and trust each other

collaborative - same goals and parties work tg to create new opportunities and solve problems

Reverse auction

pre-qualified suppliers bid against one another to secure the buyer’s business, driving the price to be paid for the item downward

Vendor Managed Inventory (VMI)

Suppliers directly manage buyer inventories to reduce carrying costs and avoid stockouts, determining delivery schedules and order quantities

From buyer-firm’s perspective:

Supplier tracks inventories

Supplier determines delivery schedules and order quantities

Buyer can take ownership at the stocking location

Buyer may also be able to avoid taking ownership until the material is actually being used

From supplier’s perspective:

Avoids ill-advised customer orders

Supplier decides inventory set up and shipments

Opportunity for supplier to educate customers about other products

Co-managed Inventory (CMI)

a specific quantity of an item is stored at buyer’s location, and supplier replaces it with approval from buyer when stock is depleted

supplier only recommends orders and requires approval

Supplier co-location

Supplier representative embedded in the buyer's purchasing group to forecast demand, monitor inventory, and place orders, benefiting both parties

employee is paid by supplier but works for buyer

Business Ethics

Corporate social responsibility (CSR) - the practice of business ethics

2 main ethical approaches

Utilitarianism - an ethical act is one that creates the greatest good for the greatest number of people and should be the guiding principle of conduct

Rights and duties - some actions are just right in and of themselves, regardless of the consequences

Supplier Relationship Management (SRM)

Strategically planning and managing interactions with third-party suppliers to maximize value

defining needs and wants and establishing company links to obtain them

part of Strategic Sourcing rollout

best supplier candidate traits

Providing high volumes of a product/service

Providing lesser quantities of a crucial product/service

Serve many business units of a company or organization

Applied where intensive engineering, manufacturing and/or logistic interaction is essential

Strategic Partnerships

Mutual commitment over an extended time to work to benefit both parties, sharing relevant information and the risks and rewards of the relationship

10 Keys to developing successful strategic partnerships

Building trust

Having a shared vision and objectives

Developing personal relationships

Establishing mutual benefits and needs

Gaining commitment from top management

Managing change

Information sharing and lines of communication

Understanding and influencing capabilities

Continuous improvement

Measuring performance

Common Continuous Improvement process

Plan - identify each specific improvement that is needed, what change is necessary to make the improvement, and then plan for that change

Do - implement the change on a small scale to see if the change improves the process before moving forward with a full implementation

Check - use data to analyze the results to see if the change made a positive impact

Act - if the change was successful, implement the change on a larger scale and continuously assess results

If the change did not work, then the root cause was most likely not identified, or the change was not the correct solution, and you may need to begin the cycle over again

Benefits of strategic partnerships with suppliers for buyers

Increased operating efficiencies

Preferred access to the supplier’s best people

Influence over supplier investments and technology

Preferred access to supplier ideas

Increased innovation from and with suppliers

Sustainable competitive advantage

Benefits of strategic partnerships with suppliers for suppliers

Increased operating efficiencies

Lower cost of sales

Increased margins

Incremental revenue

Greater visibility into buyer’s purchasing plans

Increased scope of business

Opportunities to develop, pilot, and showcase innovative solutions

Longer term buyer commitments; greater predictability of future business

Sustainable competitive advantage

Supplier Evaluation

Process to identify most reliable suppliers based on facts, not perception

frequent feedback can help avoid surprises

Supplier performance evaluation

It is important to actively monitor a supplier’s performance and provide visibility and feedback on supplier performance

relevant metrics

Price and cost performance

Product quality

Delivery performance

Contractual compliance

Participation in product development initiatives

Cooperativeness in third-party production management

Support of ethics and sustainable practices

Key supplier selection

typically conducted by a cross-functional team using evaluation forms or scorecards

Weighting techniques often used

robust Supplier Evaluation process to select key suppliers with whom to develop a collaborative relationship → purchase cost becomes relatively less important

Weighted-criteria evaluation system

Select the key dimensions of performance mutually acceptable to both buyer and supplier

Monitor and collect performance data

Assign weights to each of the dimensions

Evaluate performance measures between 0 and 100

Multiply dimension rating by weight and sum of overall score

Classify suppliers based on their overall score

e.g., certified, preferred, acceptable, conditional, developmental, unacceptable, etc.

Audit and perform ongoing certification review

Benefits of supplier certification programs

Reducing the amount of time and labor required for the buyer to conduct incoming inspections of products and materials from certified suppliers, creates cost savings

Building long-term relationships

Recognizing excellence

Decreasing the supplier base

Supplier certification

verification that select suppliers operate, maintain, improve, and document effect procedures that relate to the buyer’s requirements

Internal certification program example criteria

Supplier has no incoming product rejections for a specified time period

Supplier has no incoming late deliveries for a specified time period

Supplier has no significant negative quality related incidents for a specified time period

Supplier is ISO 9000 certified or has successfully passed a recent on-site quality system evaluation

Supplier consistently meets a mutually agreed-upon set of clearly specified quality performance measures

Supplier has a fully documented process and quality system with cost controls and continuous improvement capabilities

Supplier’s processes are determined to be stable and in control

ISO 9000

A series of management and quality standards focusing on design, development, production, installation, and service

global market

Supplier development

Assistance given to suppliers to improve quality and delivery performance

should achieve:

Lower supply chain total cost

Increased profitability for all supply chain participants

Increased product quality

Near-perfect on-time-delivery at each point in the supply chain

Supplier recognition programs

recognize high-performing suppliers and motivate them to meet customer expectations

Companies should recognize and celebrate the achievements of their best suppliers

Award winners exemplify true partnerships, continuous improvement, organizational commitment, and excellence

Award-winners serve as role models for other suppliers

Benefits

Motivate suppliers

Improve supplier loyalty

Encourage suppliers to adapt to the company’s culture

Helps create entry barriers for competitors

Encourages supplier participation in product innovation

Supplier Relationship Management System

Provides a comprehensive and objective view of supplier performance and helps in sourcing decisions

5 key characteristics

Automation handles routine transactions

Integration spans multiple departments, processes, and software applications

Visibility of information and clear and concise process flows

Collaboration through information sharing

Optimization of processes and decision making

Operations management

Managing the process to convert resources into goods and services in alignment with the company’s business strategy as efficiently and effectively as possible

Manufacturing

to process components into a finished product, especially by means of mass production

Includes the machines used, personnel involved, inventory handling, warehousing, etc.

Lean Manufacturing

Philosophy of waste reduction and value enhancement in the supply chain flow

Six Sigma

Data-driven methodology for identifying and removing causes of defects and minimizing variability in manufacturing and business processes

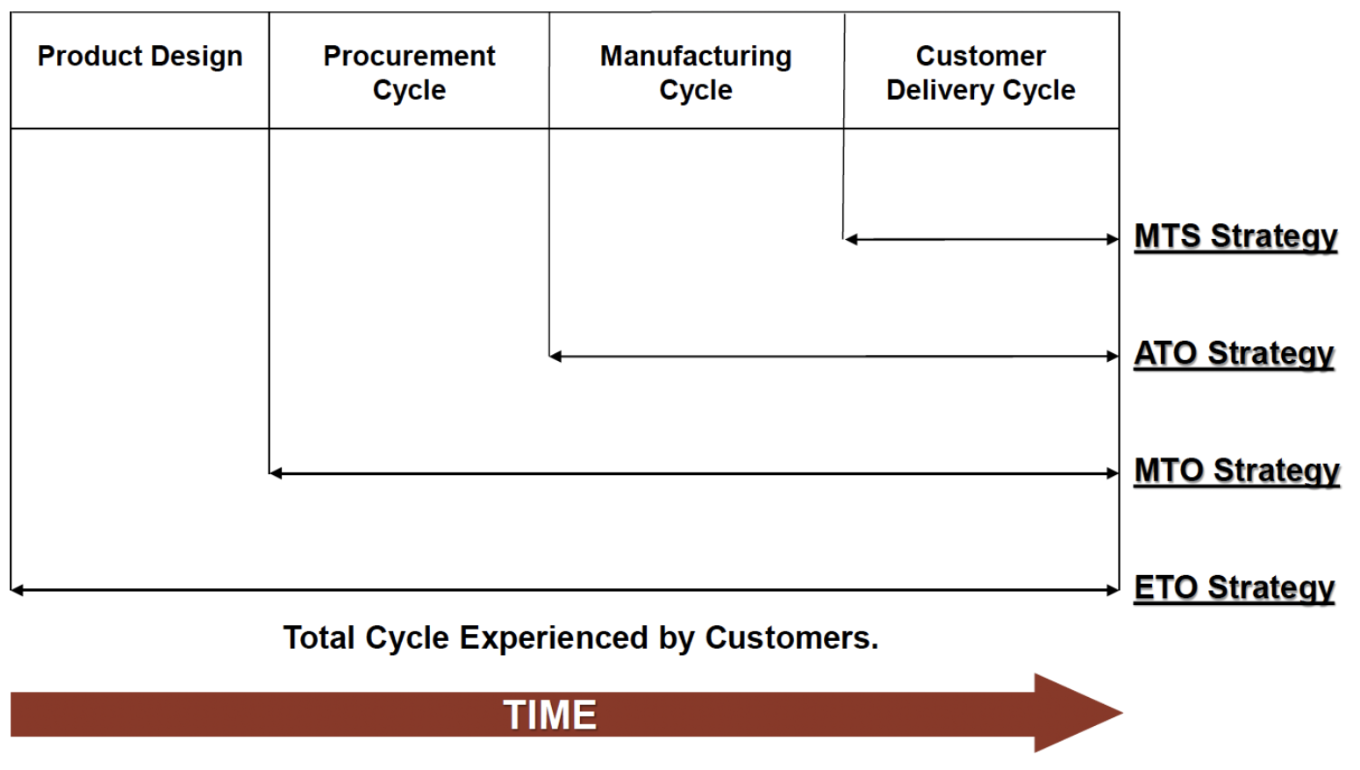

Make-to-stock

to manufacture products for stock based on demand forecasts

used for most daily necessities such as food and textiles

challenge: avoid having excess inventory

Make-to-order

manufacturing starts only after a customer’s order is received

used for highly configured products

Ex.: aircraft

Assemble-to-order

products ordered by customers are produced quickly and are customizable to a certain extent

requires that the basic parts for the product are already manufactured but not yet assembled

hybrid strategy = make-to-stock + make-to-order

Engineer-to-order

product is designed, engineered, and built to the customer’s specifications after receipt of the order

every product is unique

poor quality is expensive

Manufacturing strategy vs. performance cycle

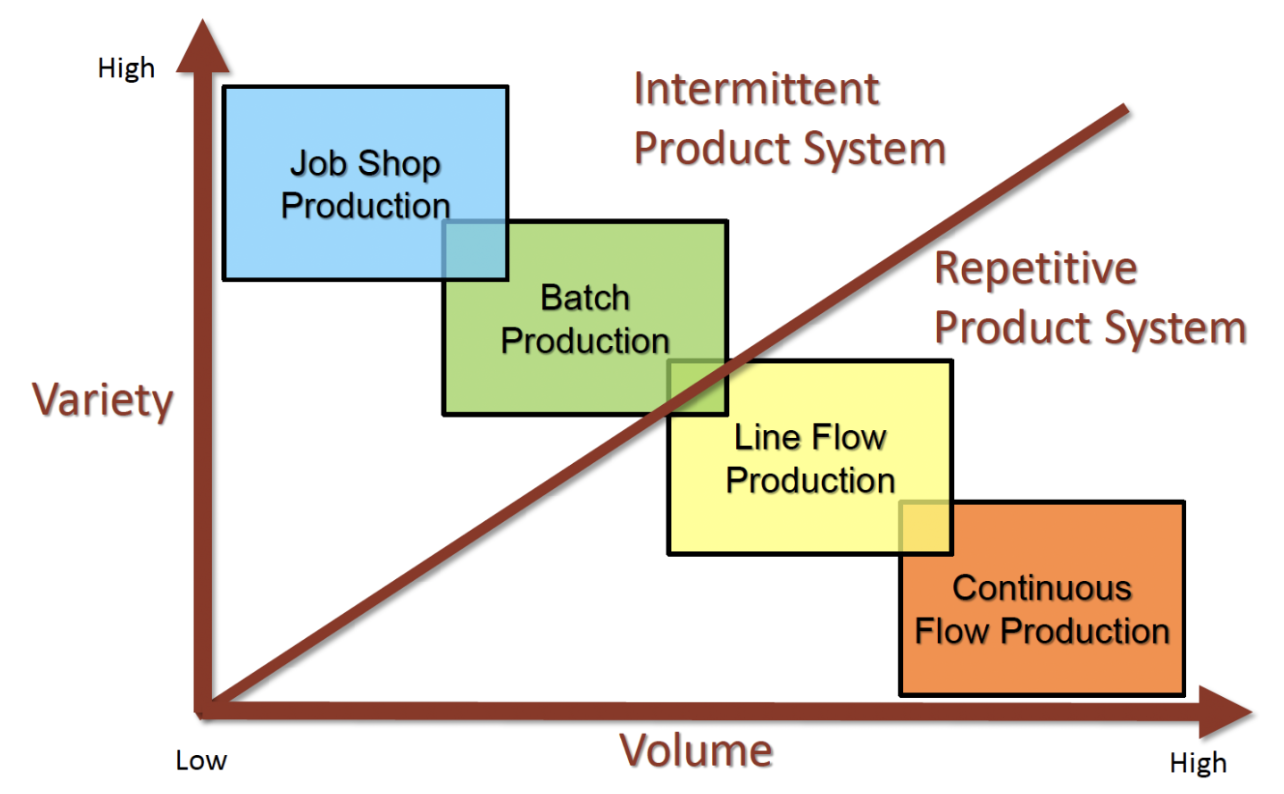

Intermittent manufacturing process

used to produce a large variety of products with different processing requirements in lower volumes

Repetitive manufacturing process

used to produce one or a few standardized products in high volumes

Types of manufacturing processes

Job shop production (aka project production)

Creates a custom product for each customer, generally one at a time

intermittent

ETO, MTO

long lead time

Batch production

Manufacturing of a small fixed quantity of an item in a single production run

Each individual item in the batch goes through one stage of production process before the whole batch moves on to the next stage

Aims to achieve better use of equipment

Produces good quality products more economically than manufacturing them individually

intermittent

MTO, ATO

long lead time

Line flow production (aka mass production)

For standardized products with a limited number of variations

When one task is finished, the next task must start immediately → time taken on each task must be equal

repetitive

limited variety

ATO, MTS

short lead time

Continuous flow production

Raw materials run through a series of inflexible processes

Generally highly automated and workers act as monitors rather than as active participants over 24 hr day

Ex.: oil refining; laundry detergent

repetitive

limited variety

MTS

short lead time

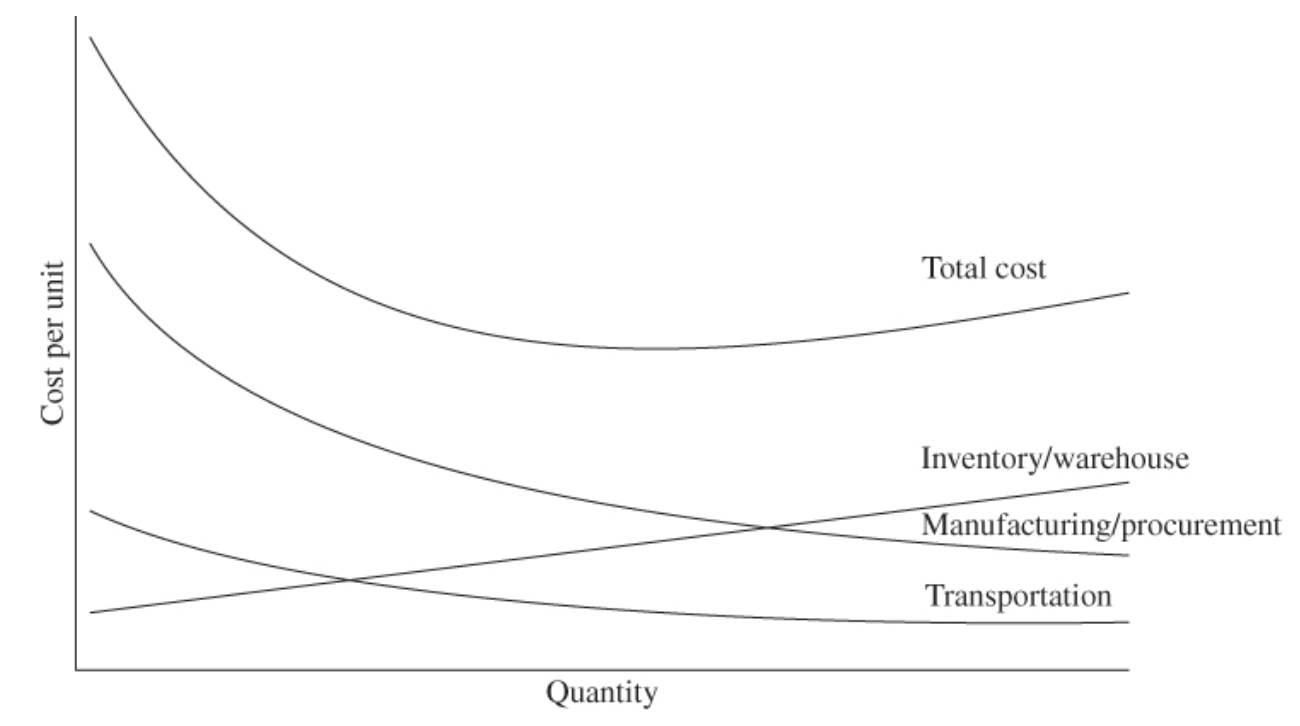

Total cost of manufacturing

Complete cost of producing and delivering products, including fixed and variable costs from manufacturing, storing, and delivery

generally expressed as cost per unit

TCM vs. strategic alternatives - as volume goes up:

Manufacturing and Procurement costs go down due to economies of scale

Inventory and Warehousing costs go up

Transportation costs go down, but level off at high volumes as the shipping container gets filled to capacity and another container must be used

LEAN Manufacturing

A management philosophy based on the Toyota Production System, aiming to eliminate waste in the customers’ eyes

use value stream mapping as primary work unit

focus on improving process performance using learn-by-doing approach

standard in many industries

Value stream map

Shows information flows from customer to supplier, driving material flow back to the customer based on requirements

Value

inherent worth of a product as judged by the customer and reflected in its selling price and market demand