Economics - Macro

5.0(1)

Card Sorting

1/86

Earn XP

Description and Tags

Last updated 3:15 AM on 5/7/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

87 Terms

1

New cards

fiscal policy on shifting AD

Government spending increases, G ↑ and vise versa

Transfer payments ↑, disposable household income ↑, C ↑

Income tax ↑, disposable income for households ↓, C ↓

Subsidies ↑, disposable income for firms ↑, I ↑

Corporate tax ↓, disposable income for firms ↑ , I ↑

Transfer payments ↑, disposable household income ↑, C ↑

Income tax ↑, disposable income for households ↓, C ↓

Subsidies ↑, disposable income for firms ↑, I ↑

Corporate tax ↓, disposable income for firms ↑ , I ↑

2

New cards

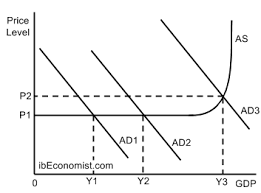

expansionary fiscal policy

Ad shifts right

boosts inflation

reduces unemployment

boosts inflation

reduces unemployment

3

New cards

contractionary fiscla policy

ad shifts left

weakens inflation

weakens inflation

4

New cards

goals of fiscal policy

low and stable inflation

reduce business cycle fluctuations

promote stable economic enviroment

equitable distribution of income → gini coefficent decreases

extneral balance

reduce business cycle fluctuations

promote stable economic enviroment

equitable distribution of income → gini coefficent decreases

extneral balance

5

New cards

strengths of fiscal policy

can target specfic sectors of economy

effectivness in deep recession

effectivness in deep recession

6

New cards

constratints of fiscal policy

political pressure

time lags

debt

time lags

debt

7

New cards

supply side policies

Shifting LRAS right to increase potential output of the economy and long term growth

8

New cards

inverentionist supply side policies

Governments intervene with direct policies to increase potential output

Increase LRAS, SRAS, AD

education/human capital

health care

new tech

infastruture

buisness support

Increase LRAS, SRAS, AD

education/human capital

health care

new tech

infastruture

buisness support

9

New cards

inverentionist supply side policies constraints

short term inflation - shifts SRAS, AD, LRAS

time lags

costly

time lags

costly

10

New cards

market based supply side policies

Getting out of the way of competitive markets, letting competition occur

\

\

11

New cards

market based supply side policies constraints

equity issues, impacts of deregulation, vested intrest, unemployment, time lags,

12

New cards

privitisation

selling of government enterprises to the private sector

13

New cards

demand side policies

involved with minimising harmful fluctuations

14

New cards

deregulation

removal of government rules and requirements to increase efficiency

15

New cards

trade liberlisation

makes international trade more free by elimination or reducing trade protection

16

New cards

labour union

association of workers w/ goal to improve working conditions and defend worker rightss

17

New cards

substitue goods

goods that replace each other e.g coke and pepsi

18

New cards

Complement goods

goods that are used/bought together e.g. pen and paper

19

New cards

normal goods

goods for which demand increases in response to increases in consumer income

20

New cards

Inferior goods

goods for which demand falls in response to increases in consumer income

21

New cards

luxury goods

luxurious items e.g. sports cars, luxury watches

22

New cards

independent goods

goods that aren't complementary

23

New cards

shortage

when quantity demanded exceeds quantity supplied; below equilibrium point

24

New cards

surplus

when quantity demanded is less than quantity supplied; above the equilibrium point

25

New cards

price mechanisim

1. sigals price is too high/low

2, incetivies to change price

3. rations exceed demands

4. allocates scarce resources

2, incetivies to change price

3. rations exceed demands

4. allocates scarce resources

26

New cards

soicety vs. consumer vs producer surplus

consumer = difference between what consumers are willing and able to pay and what they actually pay

produer = difference between what producers are willing and abl to supply and what they actually supply

soicety =consumer + producer

produer = difference between what producers are willing and abl to supply and what they actually supply

soicety =consumer + producer

27

New cards

4 key economic assumptions

scarcity - society's wants are unlimited but resources are limited

trade-off - due to scracity choices must be made and each has a trade off

everyone makes chouce to maximize their own benefit

real life situation can be explained through graphs and models

trade-off - due to scracity choices must be made and each has a trade off

everyone makes chouce to maximize their own benefit

real life situation can be explained through graphs and models

28

New cards

invisible hand

concept that through competition and self-interest the market is regulate as those who can afford buy and those who cant dont so there is perfect equilibrium

29

New cards

GDP

dollar value of all final goods and services produced within a country's borders in one year

C+I+G+(X-M) = GDP

C+I+G+(X-M) = GDP

30

New cards

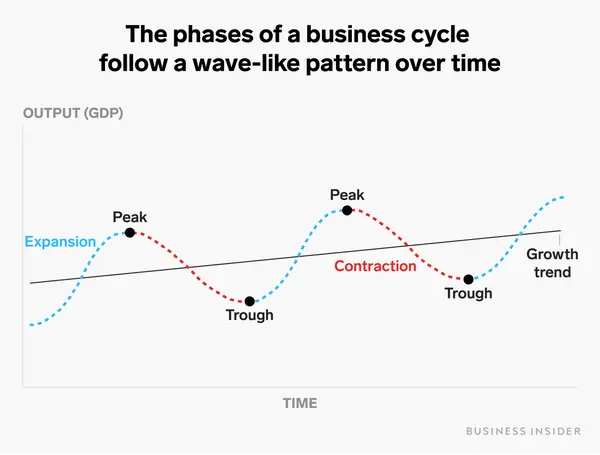

buisness cycle

represents short-term real GDP fluctuations around its long tterm trend/potential output

not predictable

strong correlation between emplyemnt and real GDP

not predictable

strong correlation between emplyemnt and real GDP

31

New cards

low unemployemnt

unemployment = when people of working age activley looking for work are without it

32

New cards

difficulties in measuring unemployment

hidden unemplyment - discourgaed workes, under employed, skilled but low skilled workers, redutant/retraining, undergournd economies

lack of specificity - riegion, gender, age, ethinicity, education level

lack of specificity - riegion, gender, age, ethinicity, education level

33

New cards

types of unemployment

structural: demand decreases for a type of labour, strcuture of economy/tech changes, invetibale

Fricitional: jon seekers entering/retutning to the labour force and looking for a job, new job seekers, people between jobs, invetiable

sesonal: demand changes based on season

cyclical: when ecoenomy is in recessionary gap from low AD causinf low demand and low production and labour demand, goes w business cycle, demand deficit unemployemtn

Fricitional: jon seekers entering/retutning to the labour force and looking for a job, new job seekers, people between jobs, invetiable

sesonal: demand changes based on season

cyclical: when ecoenomy is in recessionary gap from low AD causinf low demand and low production and labour demand, goes w business cycle, demand deficit unemployemtn

34

New cards

full employment

means natural rate of unemployment when economy is prodicying at potential or full emplyemnt lvl of output equal to structural, frictional and seasonla unemployemnt (around 4%)

35

New cards

subsidies

grants providede by governments to firms aimed at lowering production costs and increasing output

36

New cards

taxes

direct tax: paid directly to gov

indriect: spending on goods and services by consumers collected by the supplier on behalf of gov

used to raise revenue and discourage undesirable behviours

indriect: spending on goods and services by consumers collected by the supplier on behalf of gov

used to raise revenue and discourage undesirable behviours

37

New cards

price floors vs celiings

floor =gov imposed min price for sale of good or service

ceiling = gov imposed max price when below equilibrium (shortage)

ceiling = gov imposed max price when below equilibrium (shortage)

38

New cards

impact of economic growth

increased standrd of living

gretaer tax revnue if gov spends on merit goods

decreased unemployemnt

created wants

increased envriomental standrad

sime envriomental degreadtion

decreased soical inequality

gretaer tax revnue if gov spends on merit goods

decreased unemployemnt

created wants

increased envriomental standrad

sime envriomental degreadtion

decreased soical inequality

39

New cards

economic growth

increase in real/potential GDP

40

New cards

keysian model faults

wages rise faster than fall

prices raise faster than fall due to the high wages meaning that firms dont decrease price

stuck in short run faults if SRAS wont shift, recessionary gap stays

prices raise faster than fall due to the high wages meaning that firms dont decrease price

stuck in short run faults if SRAS wont shift, recessionary gap stays

41

New cards

keysian model

3 sections: depression, normal, physical limit

3 equilibriums: depression, normal and physical limit equilibrium

recessionary gaps can persist: reject that economies tend to fall to full employment

increase AD doesn't push up prices

3 equilibriums: depression, normal and physical limit equilibrium

recessionary gaps can persist: reject that economies tend to fall to full employment

increase AD doesn't push up prices

42

New cards

factors of LRAS

increase in quanity of resources

increase in quality of resources

tech advancements

increase in efficency and porductivity

institauional changes (privitastion, competition polices, regulation)

increase in quality of resources

tech advancements

increase in efficency and porductivity

institauional changes (privitastion, competition polices, regulation)

43

New cards

inflationary, ressionary and full SRAS Gap

inflationary = too much demand, increase employment, increase prices, output beyong full employment, behind eq.

ressionary = not enough demand, not worth to produce at capacity, unemployment hihger than natural rate, after eq.

full = at eq.

ressionary = not enough demand, not worth to produce at capacity, unemployment hihger than natural rate, after eq.

full = at eq.

44

New cards

LRAS

Represents potential output and full-employment level of output

Independent of price level

Determined by the quantity and quality of factors of production

In long run, always produce for potentioal GDP

Always return to full emplyment as: high job seekers cause low wages causes increase SRAS and high demand for labour causes high wages and decrease SRAS

Independent of price level

Determined by the quantity and quality of factors of production

In long run, always produce for potentioal GDP

Always return to full emplyment as: high job seekers cause low wages causes increase SRAS and high demand for labour causes high wages and decrease SRAS

45

New cards

costs of unemployemtn

stress

increased debt

family breakdown

subsatnce abuse

incrase crime

homelessness

increased debt

family breakdown

subsatnce abuse

incrase crime

homelessness

46

New cards

GNI

= GDP + net income from abroad

total income of a country's FoPs regardless of location

total income of a country's FoPs regardless of location

47

New cards

real GDP and GNI

adjusted for inflation = real

not adjusted = nominal

real = nominal/deflator x 100

not adjusted = nominal

real = nominal/deflator x 100

48

New cards

desribe the buisness cycle

peak = max real GDP, low resource unemployment, low PL

expansion = growing ecnoomy, high reource emplyemny, hihg PL

contraction = shrinking economy, high resource unemployment, PL increase very slowly or decreases

trough = min real GDP, PL rises very slowly or falls

expansion = growing ecnoomy, high reource emplyemny, hihg PL

contraction = shrinking economy, high resource unemployment, PL increase very slowly or decreases

trough = min real GDP, PL rises very slowly or falls

49

New cards

AD

total demand for all goods and services produced in an economy by c, g, i and x-m at diff prices

50

New cards

AD factors

c: consumer confidence, interst rates, wealth, income tax, debt, inflation expectations

i: business confidence, interst rates, tech, corporate tax

g: policatl and econominc priorities

x-m: income of other countreis, exhcnage rates, trade policies

i: business confidence, interst rates, tech, corporate tax

g: policatl and econominc priorities

x-m: income of other countreis, exhcnage rates, trade policies

51

New cards

AS

total quanitity of goods/services produced in an economy (real GDP) over a particular time at diff prices

52

New cards

AS factors

wages

commodities price

oil prices

taxes/subsisds

import prices

shocks

commodities price

oil prices

taxes/subsisds

import prices

shocks

53

New cards

expansionary vs contractionary monetary policiy

contractionary = increase intrest rates to weaken inflation, shifts AD down, reduces peaks on buisness cycle

expansionary = decrease interst rates to boost inflation to avoid deflation, reduces unemplyemnt as more labour needed for more consumption, shift AD up, reduces troughs on buisness cycle

expansionary = decrease interst rates to boost inflation to avoid deflation, reduces unemplyemnt as more labour needed for more consumption, shift AD up, reduces troughs on buisness cycle

54

New cards

strengths vs contrasints of monetray policiy

streghts: quick implementation, incremental, flexible, easily-reversible, apolitical

constraints : not effective for supply issues, limited cscope in reducing rates, low cosumer and business confidencede but spending is required for it to work

constraints : not effective for supply issues, limited cscope in reducing rates, low cosumer and business confidencede but spending is required for it to work

55

New cards

affects of monetary policy

c: increase intrest rates cause decrease c as dispsoable income decreases, cost of borrowing money increases and increased return on savings incentives it, and vise versa

i: increase intrest rate decrease i as cost of borrwoing money increases and vise versa

i: increase intrest rate decrease i as cost of borrwoing money increases and vise versa

56

New cards

monetray policiy

chnaging of money supply and intrest rates by central banks to influence AD

57

New cards

intrest rates

cost of borrrowin/reward for saving money

58

New cards

central bank

exsists for every currency, regulator of banks, banker to gov

59

New cards

goals of monetray policy

low and stable inflatio (2-3%)

low unemployment

decrease buisness cycle fluctuations

promote stable economice enviroment

external balance

low unemployment

decrease buisness cycle fluctuations

promote stable economice enviroment

external balance

60

New cards

limitation of CPI

no typical household

consuemrs often buy at sale CPI doesnt

chages in consumption patterns

international comparisons are difficult

consuemrs often buy at sale CPI doesnt

chages in consumption patterns

international comparisons are difficult

61

New cards

inflation

sustained increase in PL

62

New cards

deflation

sustained decrease in PL

63

New cards

disinflation

PL rises at decreasing rate

64

New cards

inflation rate

= current yr CPI - previous yr CPI/current yr CPI x 100

65

New cards

CPI

consumer price index, compares a basket of goods from yr to yt to relfect consumption habits of an avergae household

each good weighted on a frequency of purchaswe

each good weighted on a frequency of purchaswe

66

New cards

progressive tax

as income increases, tax rate incrases

67

New cards

regressive tac

as income increases, tax rate decreases

68

New cards

proportional tax

as income increasesm tax rate is constant

69

New cards

downwards deflation cycle

AD decreases so PL decreases so incentive to consume decreases as they wait for PL to fall more so I decrease and Production decreases so unemplyemnt increase and c decreases and production decreases and so on

70

New cards

downwards deflation cycle w bankruptcies

bankrupticies so real value debt increases so its harder to pay off so AD decrease as your not earning as much as you lower price and real value of money increases

71

New cards

equality vs equity

equality = being fair or just

equity = being equal

economic inequality = unequal ditsribution of wealth or income (more wealth unequality)

equity = being equal

economic inequality = unequal ditsribution of wealth or income (more wealth unequality)

72

New cards

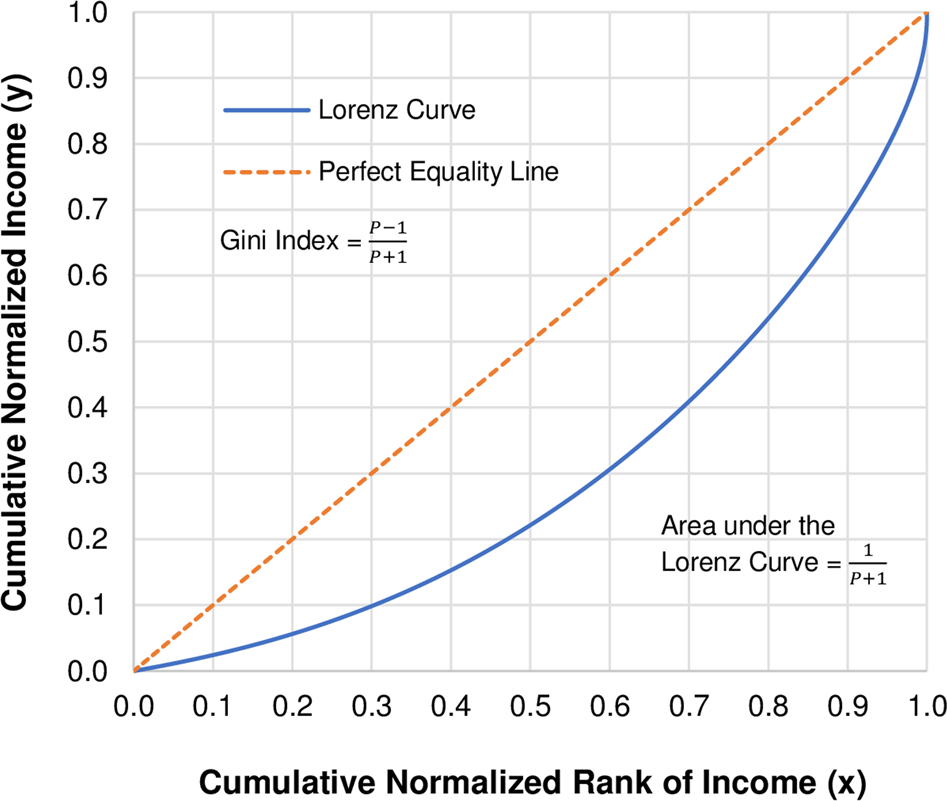

lorenz curve

visually represents income iequality, larger lorenz curve = larger inequality

73

New cards

gini coefficenent

numeroical representation of lorenz curve between 0-1

0 = prefect equality

hihger no = hihger inequality

gini coeff. = area between perfect line and lorenz curve/entire areas under perfect line

0 = prefect equality

hihger no = hihger inequality

gini coeff. = area between perfect line and lorenz curve/entire areas under perfect line

74

New cards

causes of inequality

inequality o opportunity

diff human capitak

diff resource ownership

discrimination

government tax and benfits policies

unequal status/power

tech changes

globalistaoin

market based supply side policies

diff human capitak

diff resource ownership

discrimination

government tax and benfits policies

unequal status/power

tech changes

globalistaoin

market based supply side policies

75

New cards

poverty

absoulte = ppl live below lvl of income neceassry to meeet basic needs (10% og global population0

relative = ppl earn income insufficent ot maintain a socially acceptable living standard, measured as % of ppl loving below 50% of median income

relative = ppl earn income insufficent ot maintain a socially acceptable living standard, measured as % of ppl loving below 50% of median income

76

New cards

mesuring povert and diffculties

single indictaor = interntaionl poverty line, minimum income standradas

composite = multidemensional poverty line

difficulties:

differnet meanings

measuremtne problems

over/underestimation

composite = multidemensional poverty line

difficulties:

differnet meanings

measuremtne problems

over/underestimation

77

New cards

costs of high inflation

uncertainty - harder to plan for furture so less i

redistributive effect: loss for ppl on fixed income/welfare, loss for cash hlder as real cash value decreases, savers lose if inflation rate exceeds intrest rate

damage to export competitveness: decreases exports, increase imports

decrease to AD and economic growth

inefficentcen resource allocation - high prices so high wages so firms alter resource allocation

redistributive effect: loss for ppl on fixed income/welfare, loss for cash hlder as real cash value decreases, savers lose if inflation rate exceeds intrest rate

damage to export competitveness: decreases exports, increase imports

decrease to AD and economic growth

inefficentcen resource allocation - high prices so high wages so firms alter resource allocation

78

New cards

effects of inflatoin

pushes SRAS to left (cost push inflation)

puses AD to right (demand pull inflation), makes things scarce as it too high

puses AD to right (demand pull inflation), makes things scarce as it too high

79

New cards

effects of deflation

moves SRAS to right, increase real GDP

moves AD to left, decrease GDP and employment

moves AD to left, decrease GDP and employment

80

New cards

unemployment rate formula

unemployment rate = no unemployed/full labour force (e + eu) x 100

81

New cards

economic growth formula

economic growth = real GDP in current - real GDP in previous/real GDP in previous x 100

82

New cards

economic growth in SRAS/AD model

actual output = equilbrium

actual growth = increase in SRAS or AD

potential output = shift is LRAS/SRAS

actual growth = increase in SRAS or AD

potential output = shift is LRAS/SRAS

83

New cards

economic growth in PPC model

in PPC real is inside curve and potential is shift of the curve

84

New cards

real inflation formula

real intrest rate = nominal intrest rate - inflation rate

85

New cards

fiscal policy

manipulations by government of its own expenditures and taxes to influence the level of AD

86

New cards

governmetn revenue streams

taxes (direct and indeirct), govenrment owned enterprises, selling government assets/privitisation

87

New cards

government expinditures

current expenditure (consumption payments), capital expinditure (investment payments), transfer payments

transfer does not go towards GDP

transfer does not go towards GDP