Lecture 5 - Short Term Patterns

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

Short term patterns

Small number of bars or candlesticks forming the pattern

Basis for short term patterns is to:

Anticipate a sudden move

Take advantage of a period when prices have reached an emotional extreme

Setup

Occurs when certain known factors needed to establish the pattern have occured, and the trader is waiting for the action signal to occur

A short term reversal pattern should only be considered necessary when:

prices are at some sort of support or resistance level, or trend line

The ____ complex the pattern, the _____ frequently it is going to occur

more, less

Principal Data used in short term patterns

Open, close, high, low

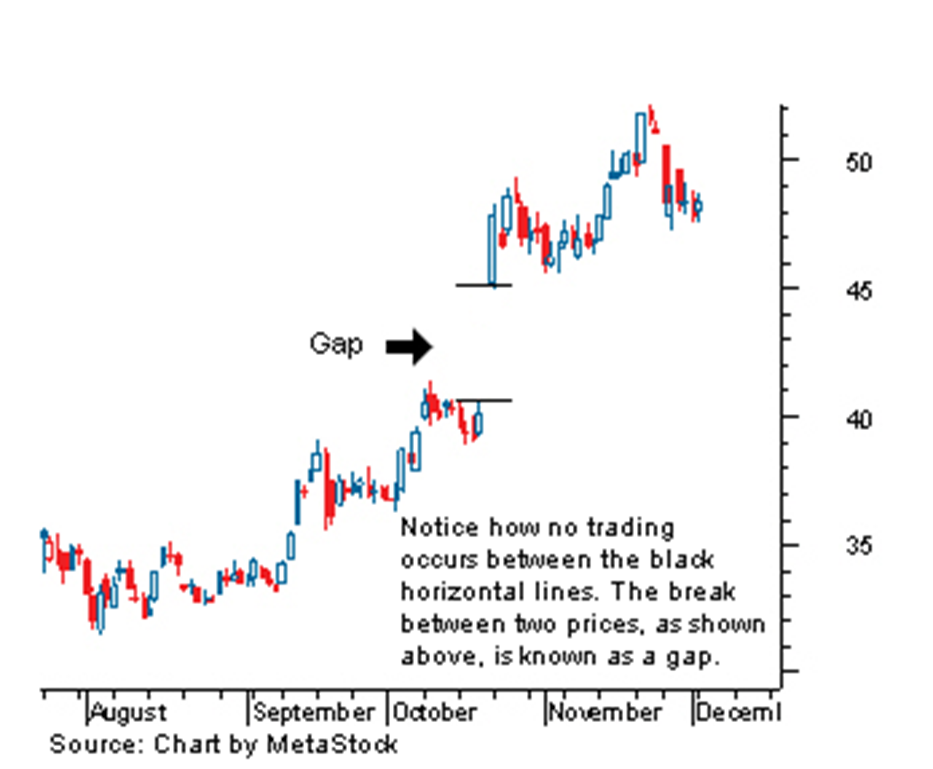

Gaps

Occur when either the low for the current bar is above the high of the previous bar or the high for the current bar is lower than the low of the previous bar

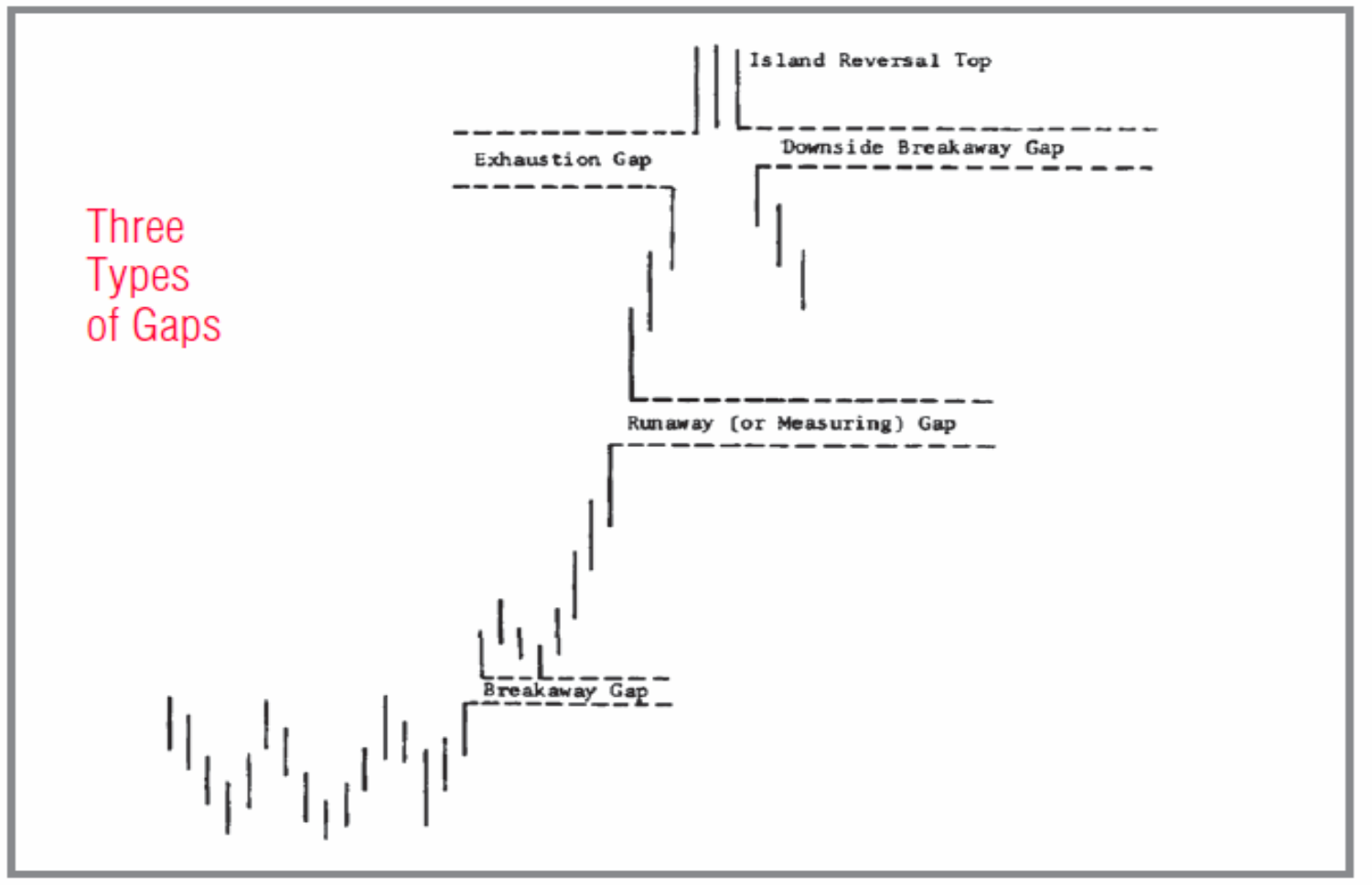

4 Types of Gaps

Opening Gap

Breakaway Gap

Runaway Gap

Exhaustion Gap

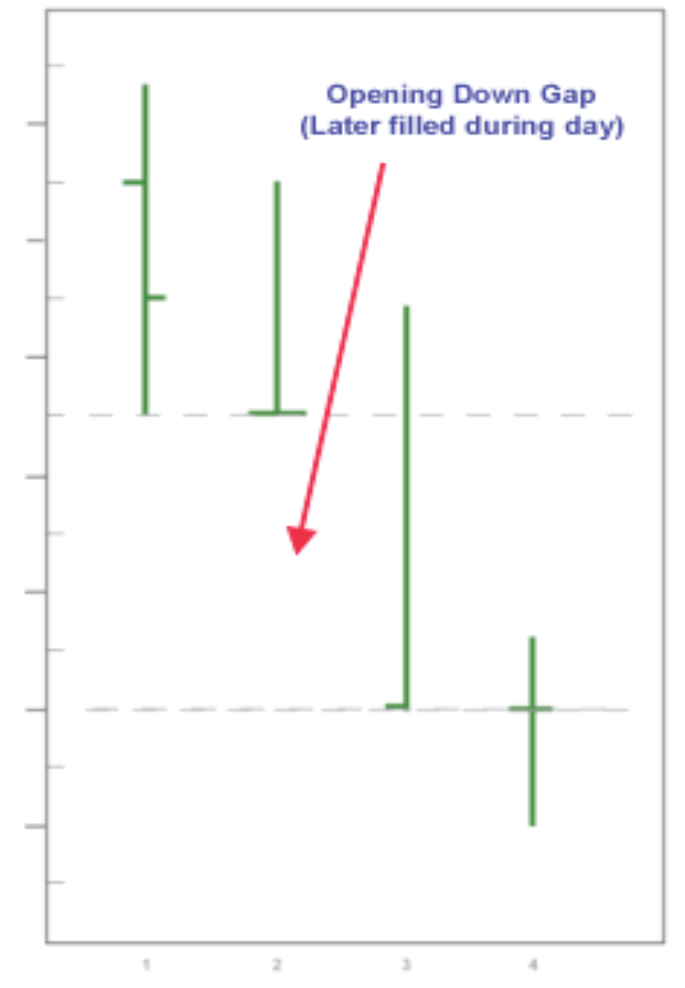

Opening Gaps

Occur when the opening price for the day is outside the range of the previous day

Opening gap rule

If the gap is not filled within the first 30 minutes of trading, chances are that the trend will continue if the direction of the gap

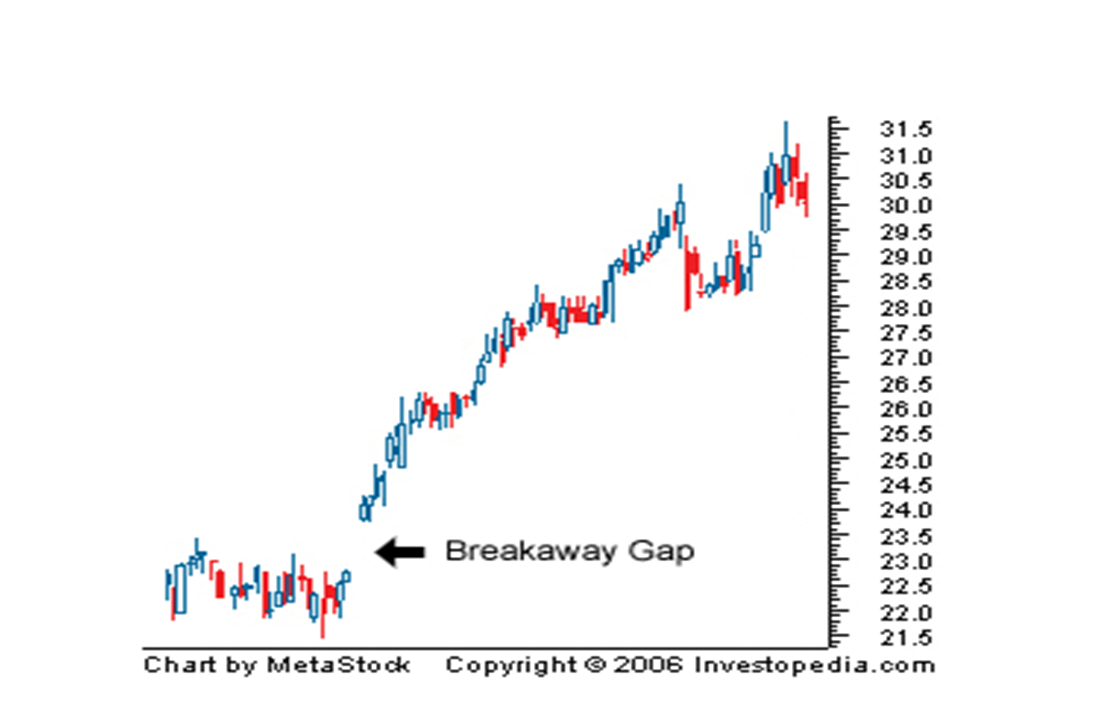

Breakaway Gap

Occurs at the beginning of a trend, most profitable gaps

Upward gaps are usually accompanied by heavy volume

Start of a new trend

Opening Gap graph

Breakaway Gap graph

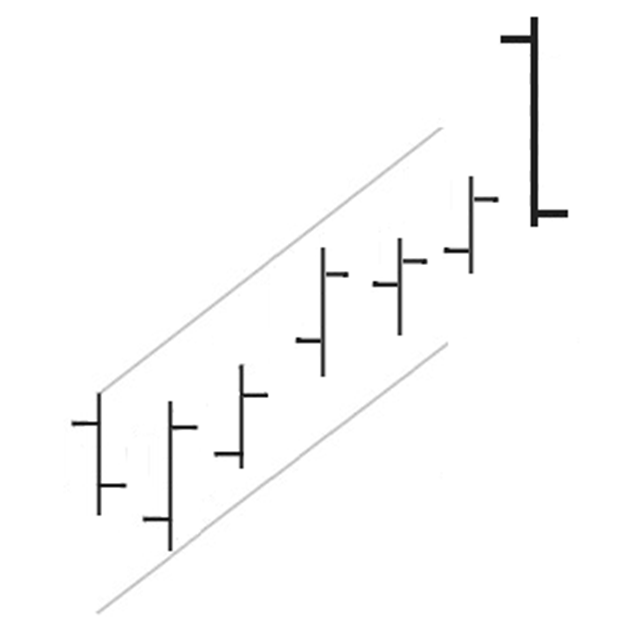

Runaway Gaps

Occurs along the trend - also called measuring gaps as they occur in the middle of a price fun

Runaway Gap graph

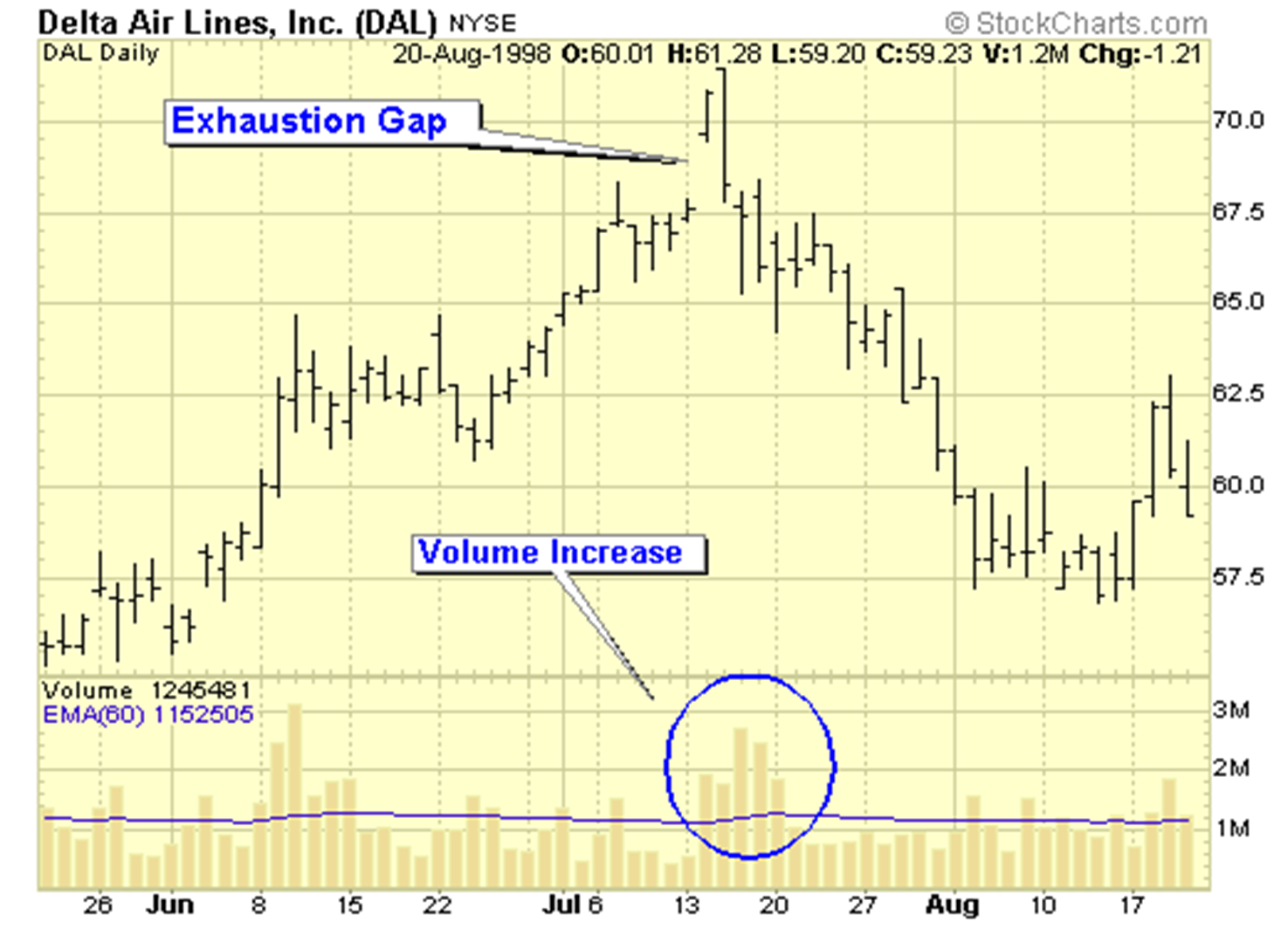

Exhaustion Gaps

Occur at the end of the moves but are not recognized at that time, because they have the same as runaway gaps

If gap is later closed, it is likely an exhaustion gap

If a gap fills after a long runaway trend, you can assume it is this gaps

Exhaustion Gap graph

Island Reversal

Can occur at either the top or bottom and only occurs after a relatively lengthy trend

Requires 2 gaps at roughly the same price: first in the direction of the trend (exhaustion gap) and the second in the reverse direction (breakaway gap)

Volume inside the gap is low normally

Island Reversal graph

Summary of Classic Gaps

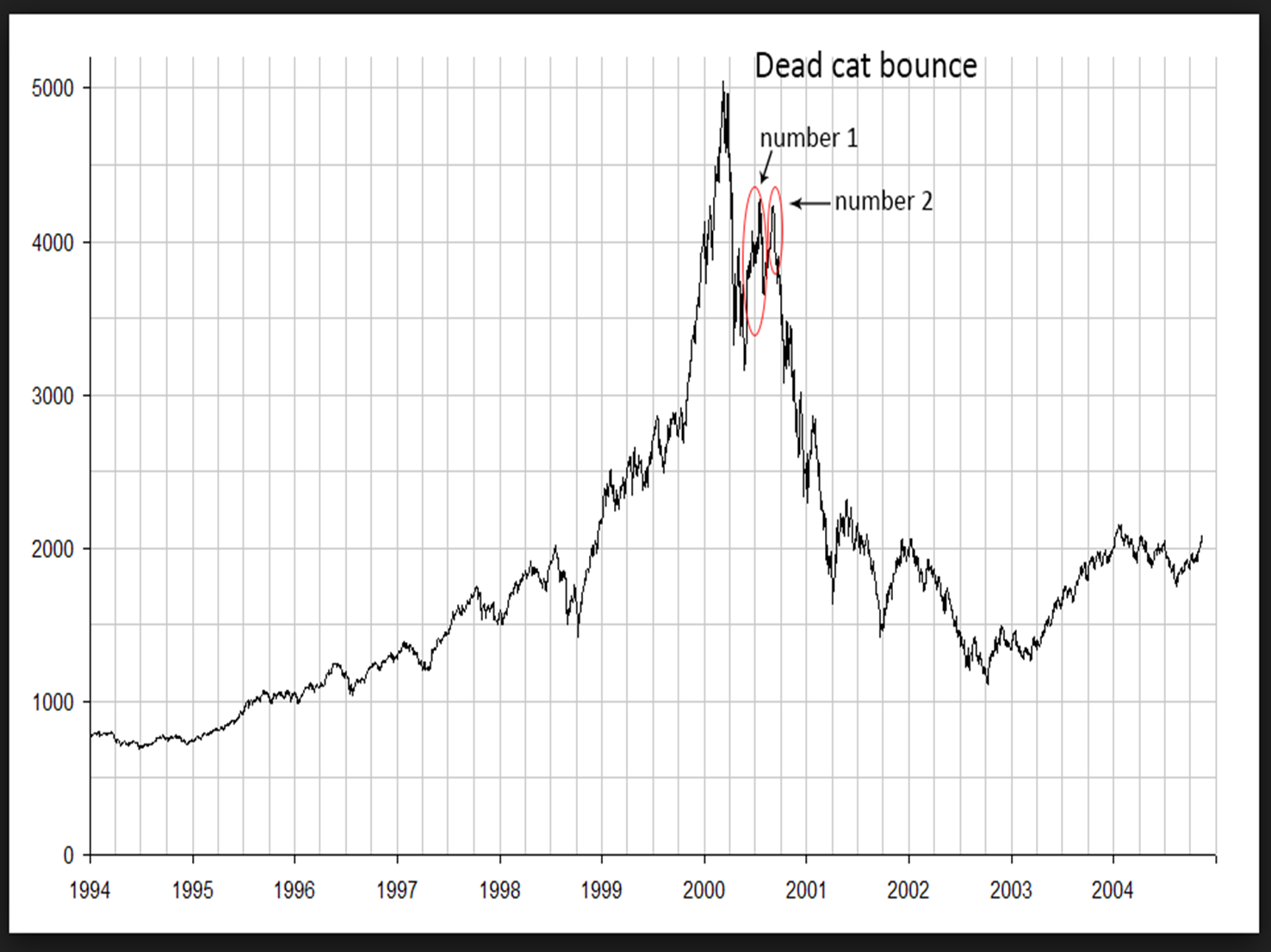

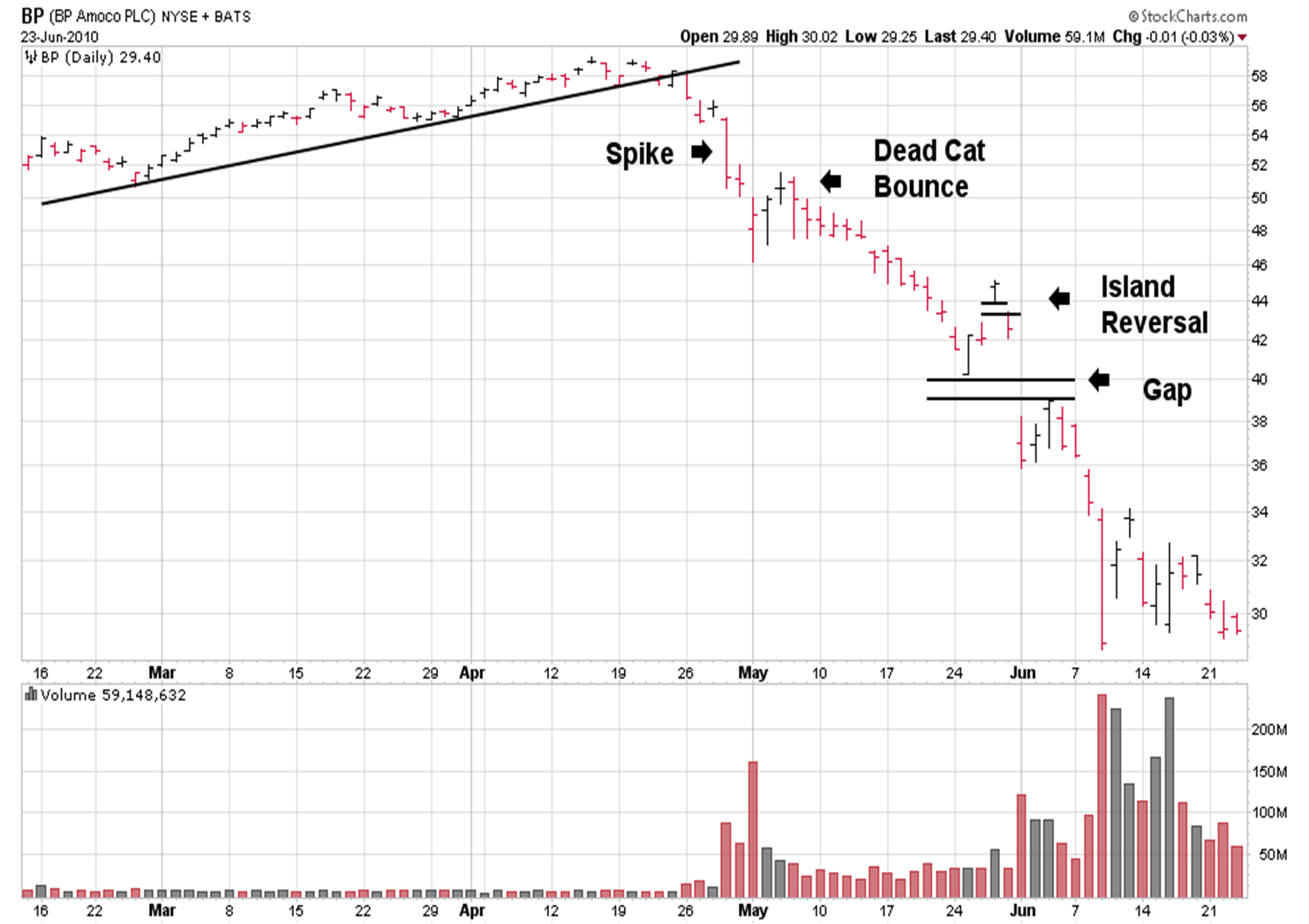

Dead Cat Bounce

Term for a failed rally after a sharp decline

Short rally lasting from several days to up to 2 weeks, following an event decline (game changing event, loss of patent, filing for bankruptcy protection, etc…)

Event that declines that precede the dead cat bounce is 20%

Should not go back to its peak

Dead Cat bounce graph

Spikes

Similar to gaps except that the empty space associated with a gap is a solid line

One long bar, crazy motion (wide range/large long range bar)

Also occur on dissemination of news

Normally takes place at the end of a gap

Graph that has Spike, Dead Cat Bounce, Island Reversal and Gap

One Bar Reversal Pattern

When a trading bar high is greater than the previous bar high and the close is down from the previous bar close

Occurs at bottoms

One Bar Reversal Pattern graph

Key Reversal Day

One day chart pattern where prices sharply reverse during a trend

The wider the price ranges on the day and the heavier the volume, the greater the odds that a reversal is taking place

Key Reversal Bar

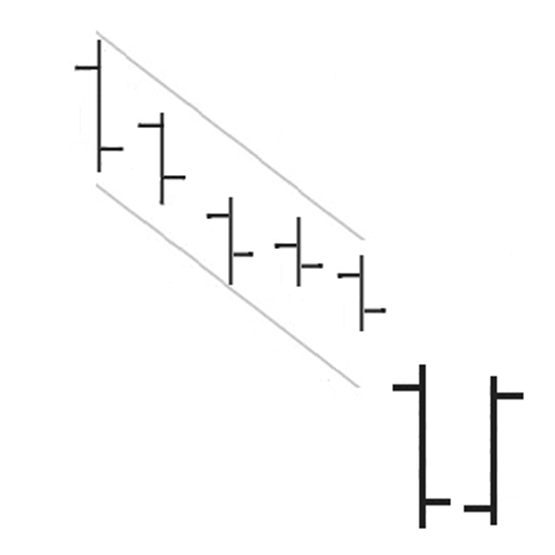

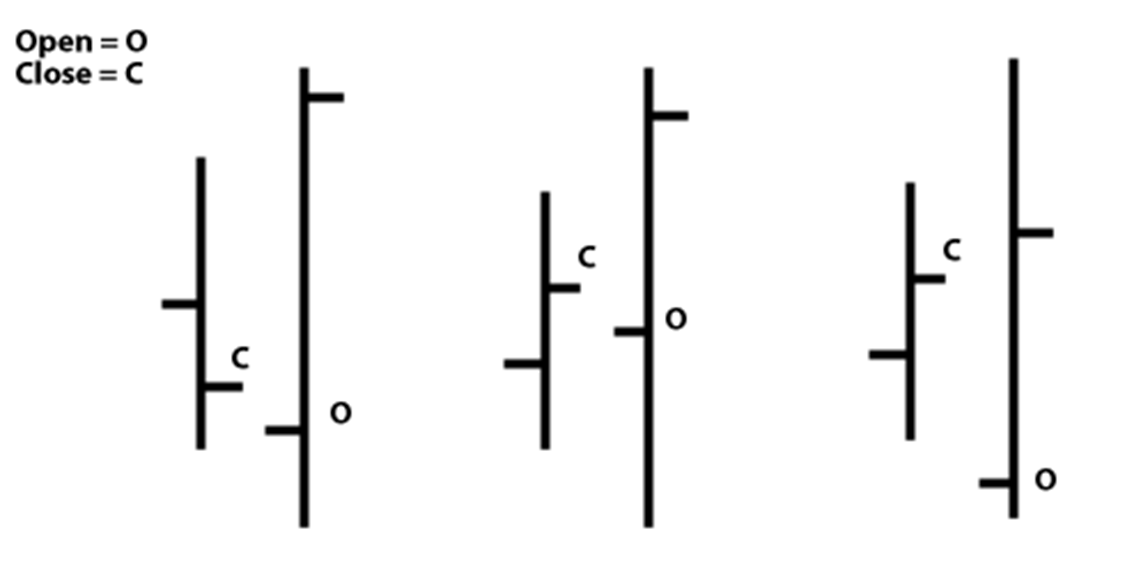

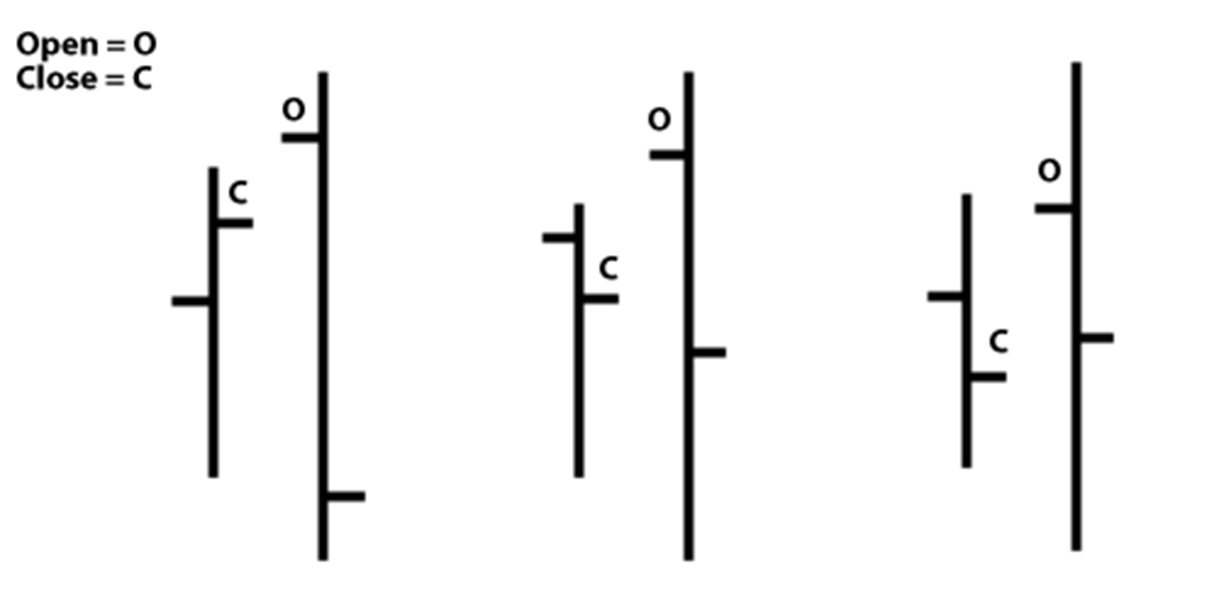

Two Bar Reversal Pattern

Classic signal of trend exhaustion

First bar should exhibit a dramatic continuation of the inbound trend, closing close to the bar’s extreme end

Second bar completely negates the first bar, with the open price on the second bar bring close to the close of the first bar and the close of the second bar being close to the open of the first bar

Two Bar Reversal Pattern Graph

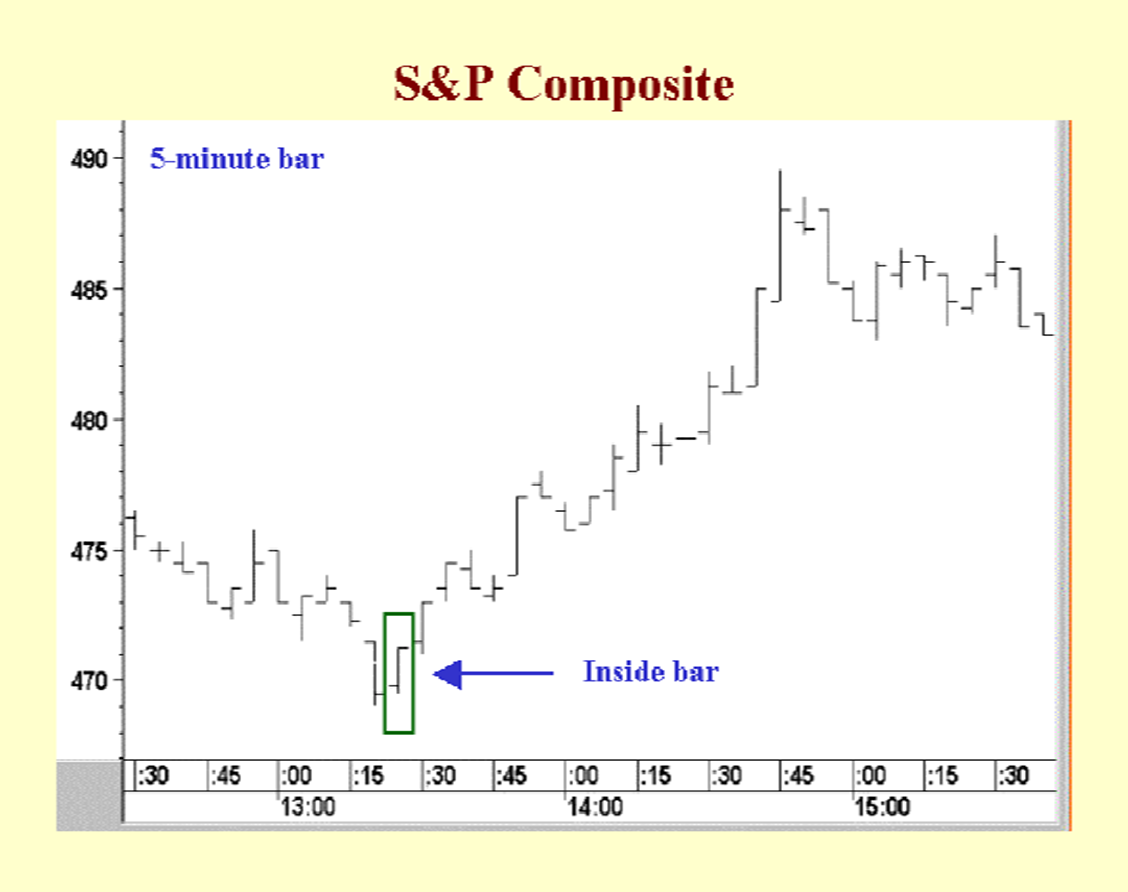

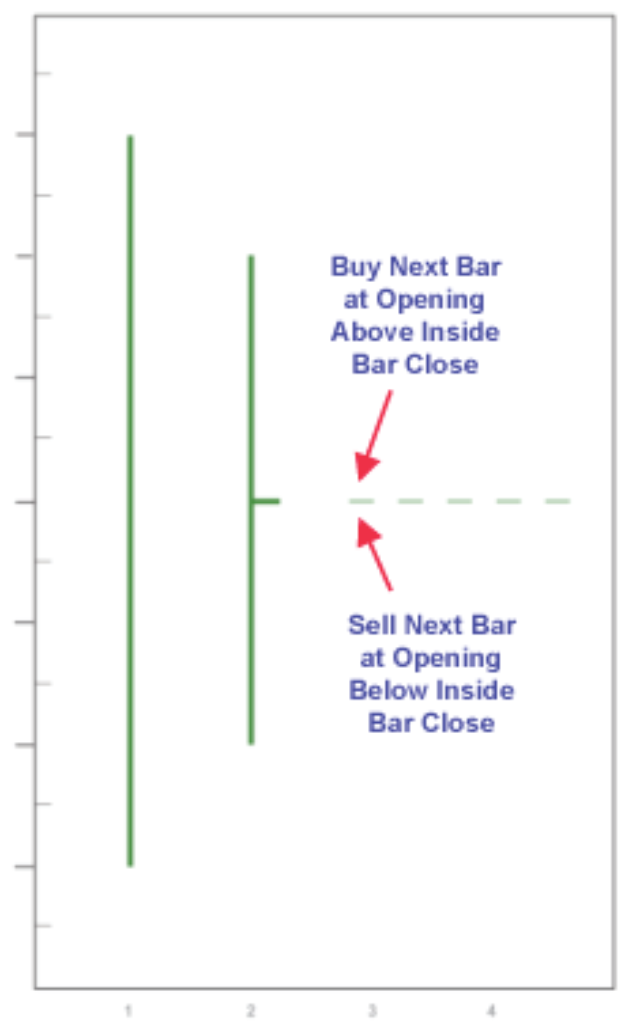

Inside Bar

Bar with a range that is smaller than and within the previous bar’s range

Reflects a momemtum in the trend - a pause, a period of directionless equilibrium, waiting for something to happen that will signal the next trend direction

Context of the pattern’s location of more important than the pattern configuation

Inside Bar Graph

Inside Bar Indicators

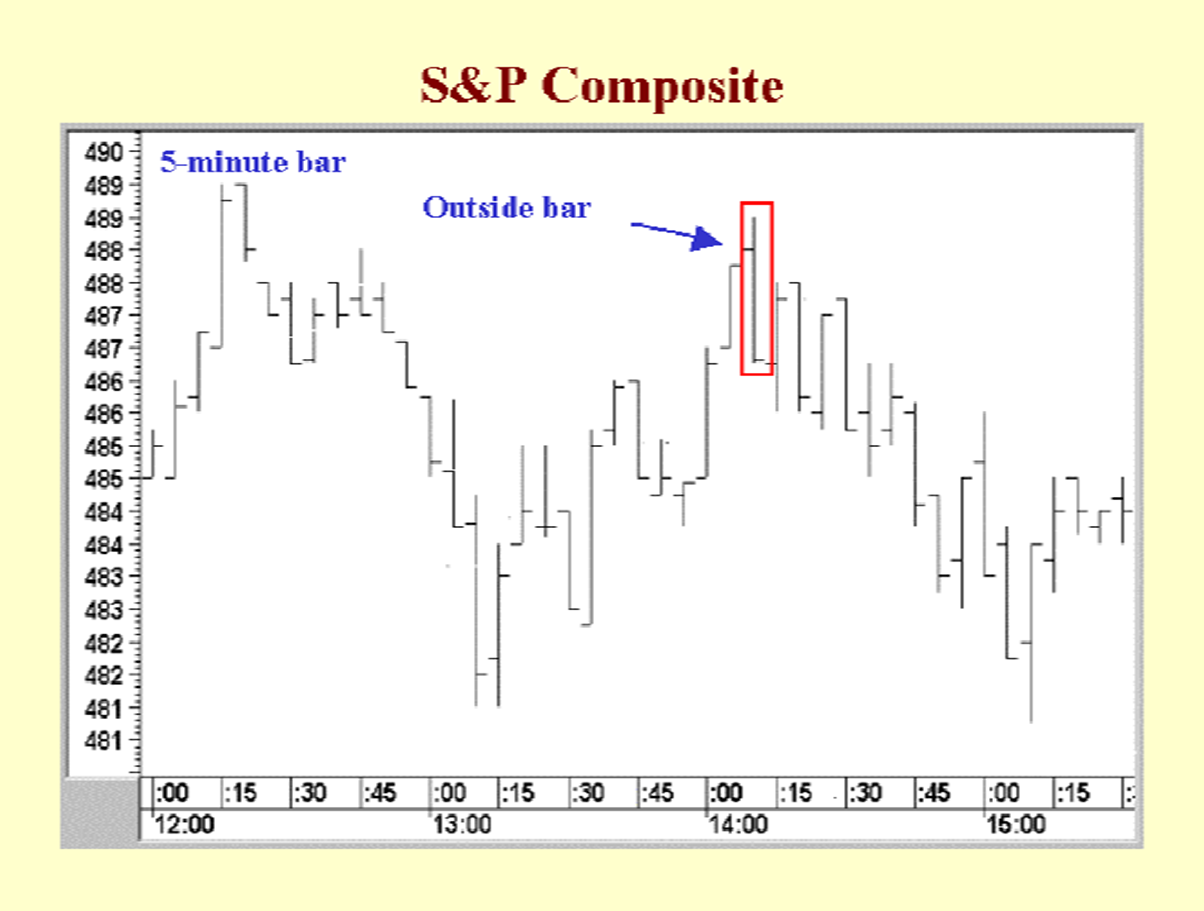

Outside Bar

Occurs when the high is higher than the high of the previous bar and the low is lower than the low of the previous bar

Outside Bar Graph

Bullish Outside Bars

Bearish Outside Bars

1 Bar Candlestick Formations

Doji

Dragonfly Doji

Gravestone Doji

Spinning top

Hammer

Hanging Man

Shooting Star

Inverted Hammer

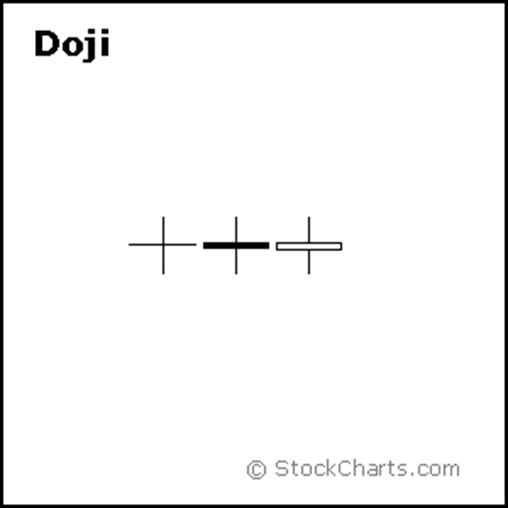

Doji

Pattern formed when open and close are identical, or nearly identical

Suggests market is in equilibrium and affefted by indecision

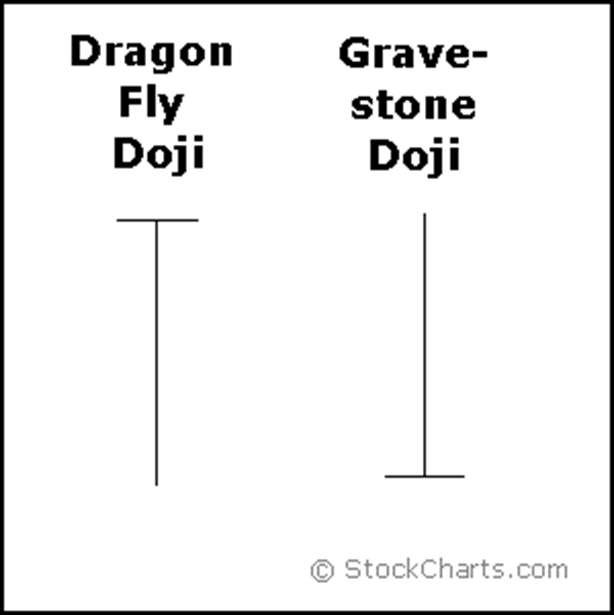

Dragonfly Doji

Doji where by the open and close are at the top of the period’s range

BULLISH CANDLE

Gravestone Doji

Doji where by the open and close are at the bottom of the period’s range

BEARISH CANDLE

Normal Doji Graph

Dragonfly and Gravestone Doji

Spinning Top

Candle with a long upper shadow, a long lower shadow and small real body

Represents indecision

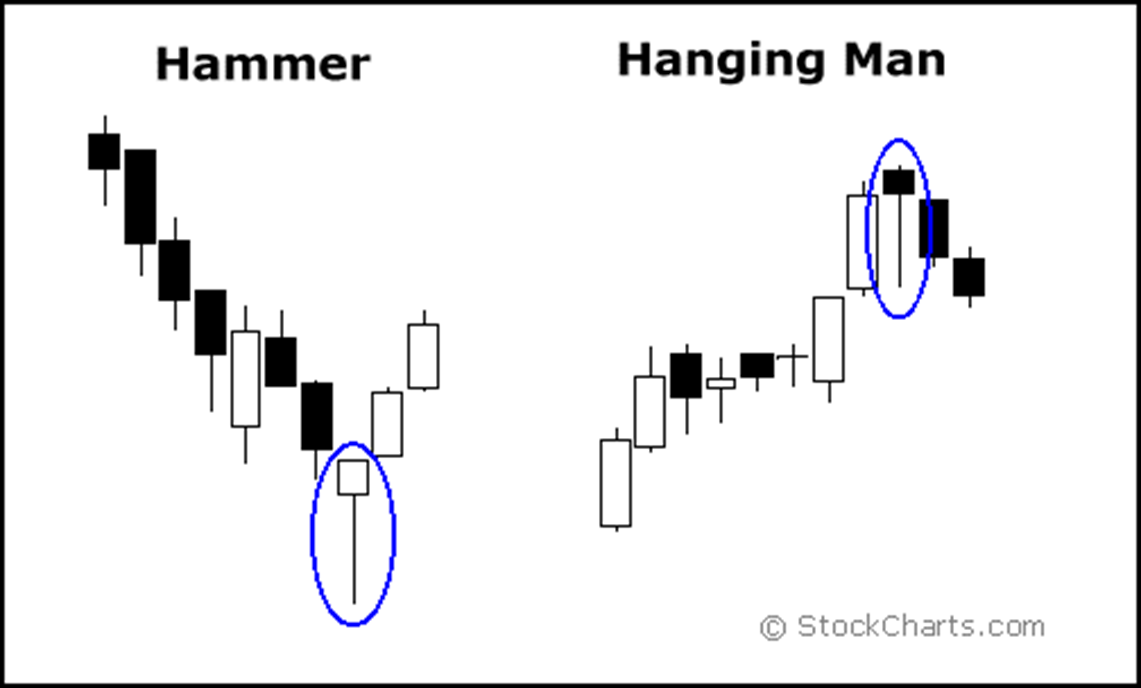

Both the Hammer and Hanging man are candlesticks in which:

The real body is located at the upper end of the trading range with the open and closes in the top 1/3 of the bar’s trading range

Hammer

Bullish reversal pattern that comes after a downtrend

Lower shadow must be at least 2 times longer than the real body

Hanging Man

Bearish reversal pattern that must come after an extended rally

Hammer and Hanging Man graph (refer to body)

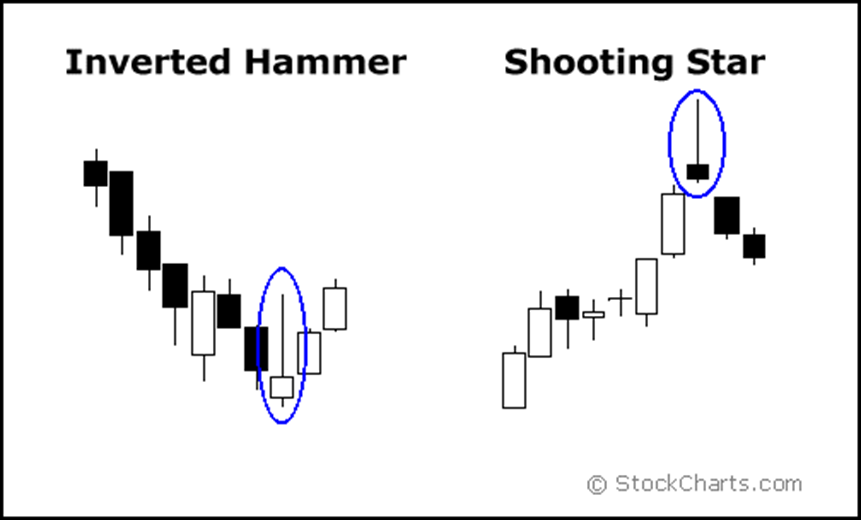

Shooting Star (upside down hanging man)

Bearish Reversal pattern that comes after a rally

Inverted Hammer

Bullish reversal pattern that comes after a decline

Inverted Hammer and Shooting Star Graph

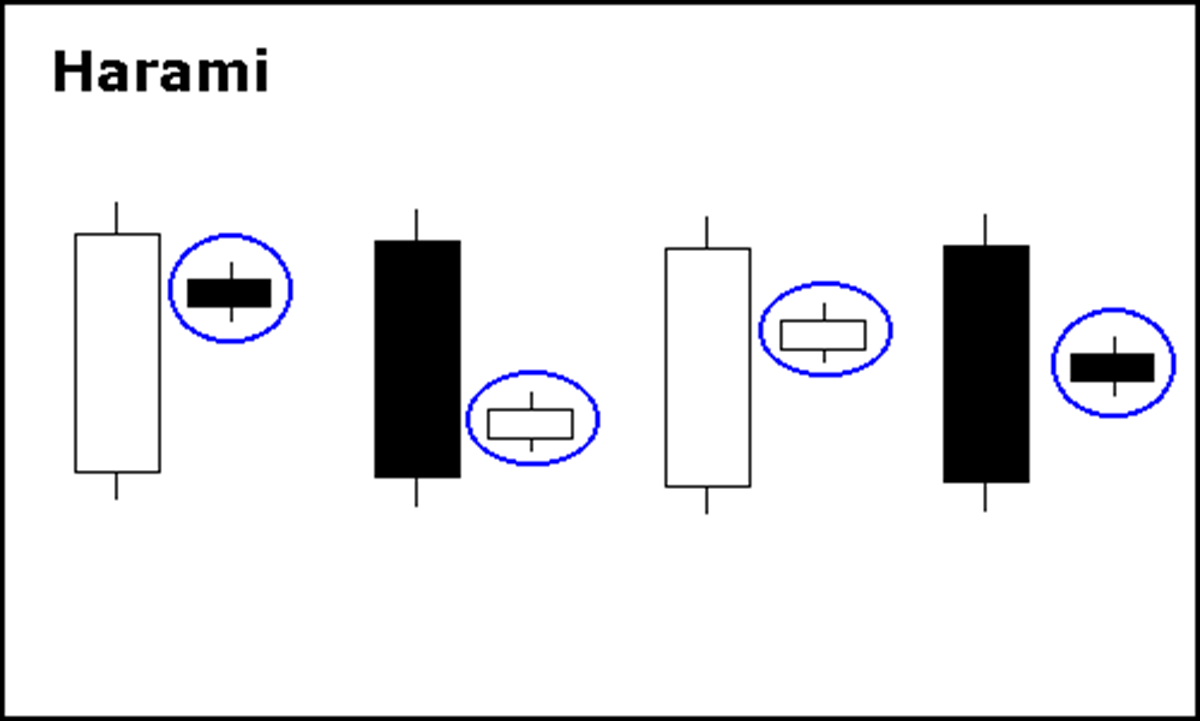

Harami

2 day pattern consisting of a large body of either color, followed by a small body of either color that is completely within the boundaries of the large body

Reversal patterns that represent price action indicesion that goes from high volatility to one of lower volatility

Harami Graph

Harami Cross

Even stronger reversal signal as the second candle is replaced by a Doji

This implies a greater indicesion, and an even stronger signal of an impending end to prevailing trend

Harami Cross Graph

2 Bar Candlestick formations

Engulfing Patterns

Bullish Engulfing

Bearish Engulfing

Dark Cloud Cover

Piercing Pattern

Star Patterns

Morning Star

Evening Star

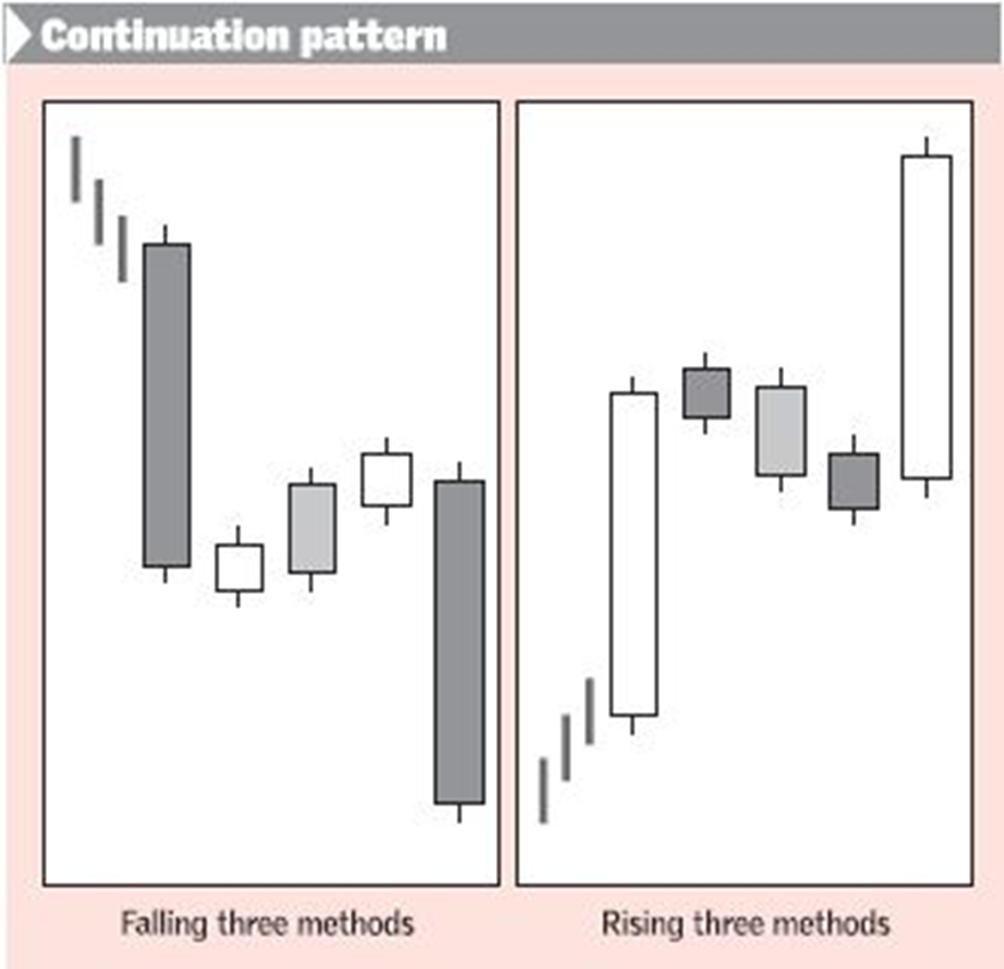

Continuation Patterns

Rising Three Method

Falling Three Method

Bullish Engulfing

2 candle reversal pattern that comes at the end of a clearly defined downtrend

Body is made up of a large white candle that completely engulfs the real body of a smaller black candle found at the bottom of a downtrend

Bullish Engulfing Graph

Bearish Engulfing

Occurs at the end of a clearly defined uptrend, and is made up of a large black candle that completely engulfs a previous smaller white candle

Dark Cloud Cover

2 candle bearish reversal pattern

Large white candle followed by a large dark candle

Second dark candle should open above the previous day’s close and it should close at least halfway into the real body of a previous white candle

Dark Cloud Cover Graph

Piercing Pattern

Opposite of Dark Cloud

2 day bullish reversal pattern that occurs at the bottom of a clearly defined downtrend and is made up of alarge candlestick followed by a large white candlestick

White candlestick must open below the previous candlestick’s close and close at least halfway into the dakr candlestick’s real body

Piercing Pattern graph

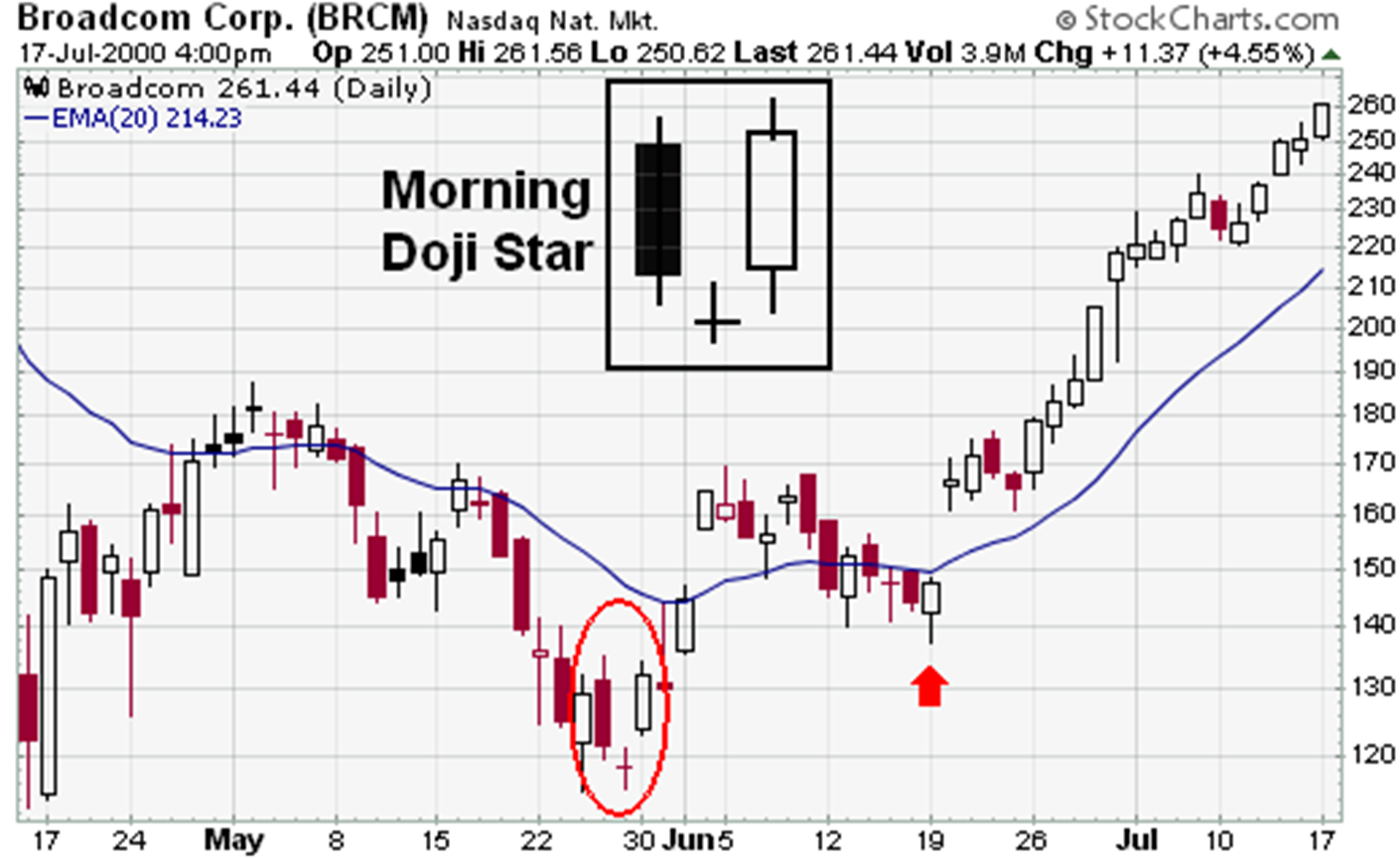

Morning Star

3 candle bullish reversal pattern that occurs at the end of a downtrend (market bottom)

Long black candlestick, small star candlestick, then white candlestick that gaps below the close of rpevious candlestick

Morning Star graph

Evening Star pattern

3 candle bearish reversal pattern that occurs at the end of an uptrend

Evening Star graph

Rising Three Method

Bullish continuation pattern which:

Long white body is followed by 3 small body days, each contained within the range of the high and low of the first day

Falling Three Method

Bearish continuation pattern in which

A long black body is followed by three small body days, each contained within the range of the high and low of the first day

Continuation Patterns