Comparative economic policy

1/100

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

101 Terms

Q: What is the main purpose of economic policy in market societies?

A: To manage conflict and prevent instability and inequality through compensatory mechanisms.

Q: What did Karl Polanyi argue about self-regulating markets?

A: He said they create instability and social unrest; they commodify land, labor, and money, leading to conflicts unless compensated by the state.

Q: What are the four key institutions of the market society according to Polanyi?

A: 1) Balance of power, 2) International gold standard, 3) Self-regulating market, 4) Liberal state.

Q: What happened when Churchill returned to the gold standard in 1925?

A: It caused economic hardship and was criticized by Keynes.

Q: Define fiscal policy.

A: Government use of taxes and spending to influence the economy, promote growth, and reduce inequality.

Q: Define monetary policy.

A: Central bank control of money supply and interest rates to ensure economic stability.

Q: What was the goal of Keynesian policy after WWII in Europe?

A: Stabilize the economy through government intervention, especially with fiscal tools.

Q: Name three theories used in Third World comparative economic policy.

A: Structuralist theory, dependency theory, and modernization theory.

Q: What is the Keynesian view on state intervention?

It is necessary to stabilize aggregate demand and support the economy during downturns.

Q: What does neoliberalism emphasize?

A: Minimal state intervention, free markets, deregulation, and privatization.

Q: What’s the difference between endogenous and exogenous state models?

A: Endogenous: shaped by internal factors; Exogenous: influenced by external factors.

Q: What were key features of Thatcherism and Reaganomics?

A: Reduced state role, privatization, deregulation, tax cuts, and supply-side economics.

Q: What defines social democratic capitalism?

A: A market economy combined with strong welfare systems to reduce inequality (e.g., Nordic countries).

Q: What is liberal meritocratic capitalism?

A: Success is based on talent in open competition; promotes equal opportunity, even if outcomes are unequal.

Four institutions of Market society

1) Balance of power system 2) International gold standard 3) self regulating market 4) The liberal state

The gold standars

Currency was tied to gold. Self regulating market led to social problems

State intervention according to Say

Limited role. Primary focused on core functions and avoiding excessive interference in the market

State intervention according to Keynes

state intervention to manage aggregate demand and stabilize the economy, particularly during downturns

State intervention according to Hayek

state intervention undermines free market and individual liberties

Endogenous state

a state of an economic system that is determined by factors within the system itself rather than by external influences

Exogenous state

something that originates or is introduced from outside a system or organism

Q: What is fiscal policy, and what are its three main objectives?

A: Fiscal policy refers to government actions through revenue (taxes) and spending to influence the economy. Its goals are:

Redistribution of income (e.g., via taxes and social spending)

Reallocation of resources to satisfy collective needs (e.g., public goods)

Stabilization of the economy (e.g., counter-cyclical policies)

Q: How do we measure the size and relevance of the public sector in an economy?

By using indicators such as:

Government expenditure as a % of GDP

Tax revenue as a % of GDP

Q: Describe the three levels of state intervention in fiscal policy.

Minimum: Liberal state; basic public goods and disaster relief

Medium: Welfare state; includes regulation and redistributive pensions

Dynamic: Market socialism; asset redistribution and indicative planning

Q: What are the main purposes of taxation?

Fund public policies

Create political and social consensus

Reduce inequality

Penalize harmful behaviors

Stabilize the economy (counter-cyclical function)

Q: What is counter-cyclical fiscal policy, and how does it stabilize the economy?

In recession: Government increases spending and cuts taxes (expansive fiscal policy)→ creates a deficit to stimulate growth

In boom: Government reduces spending and raises taxes (contractive fiscal policy) → creates a surplus to cool down the economy

Q: What are automatic stabilizers in fiscal policy?

Mechanisms that adjust automatically with the economy:

Unemployment benefits increase during recessions

Progressive taxes generate more revenue as incomes rise

These reduce fluctuations without new legislation.

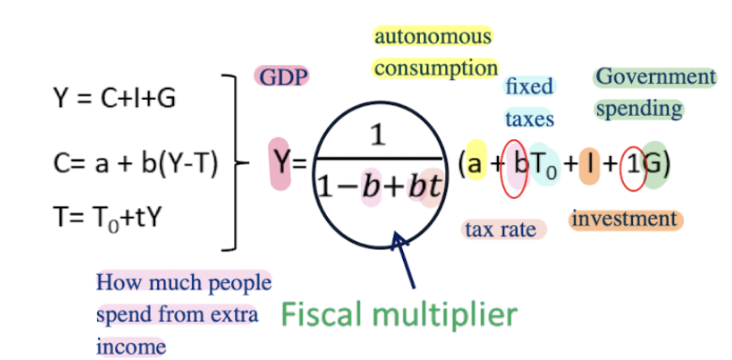

Q: What is the fiscal multiplier and why does it matter?

The fiscal multiplier measures how much GDP changes in response to government spending or tax changes.

Spending increases (G↑) → larger multiplier effect than tax cuts

Important because not all fiscal actions have the same impact

Q: What is the difference between structural and cyclical budget balances?

Cyclical balance: Changes automatically with the economy

Structural balance: Reflects deliberate fiscal policy (discretionary changes)

A structural deficit means the government is actively spending more than it takes in, beyond economic cycles

Q: Define fiscal impulse (FI).

FI = A way to measure active policy and to measure wheater the government is becoming more or less expansionary = Structural balance (this year) − Structural balance (last year)

If FI > 0 → expansionary policy

If FI < 0 → contractionary policy

Q: According to monetarists, how can a government finance a deficit, and what are the consequences?

Taxes (T) – unpopular; harms incentives

Money printing (M) – causes inflation

Borrowing (B) – raises interest rates, crowds out private investment. Still the way to go

→ Monetarists argue deficits harm long-term growth

Q: What is the monetarist view on fiscal policy's effectiveness?

Fiscal policy has short-term effects on real variables

In the long run, it only affects nominal variables (e.g., inflation)

Monetary policy should be independent and focused solely on price stability

Q: Why are fiscal and monetary policy considered interconnected in reality?

Deficits must be financed (via taxes, debt, or money)

This affects money supply, interest rates, inflation

Central banks may need to respond to fiscal actions (e.g., raise rates due to borrowing)

Q: What is crowding out in fiscal policy?

When government borrowing raises interest rates, it reduces private sector investment → “crowds out” private spending.

Q: Why is financing the deficit a political issue, not just an economic one?

Because the method of financing (taxes, debt, or printing) determines:

Who holds power over public policy

Who bears the cost (citizens, banks, foreign creditors)

How democratic and sovereign the process is

Q: What is the difference between a fiscal budget deficit and a fiscal budget surplus?

Deficit (G > T): Government spends more than it collects → typically expansionary

Surplus (G < T): Government collects more than it spends → typically contractionary

Q: What is the “balanced budget multiplier”?

It shows that equal increases in government spending and taxes still raise aggregate demand.

→ Because government spending has a larger impact than the equivalent tax increase.

Q: What is the structural deficit in fiscal policy?

The part of the deficit that is due to deliberate policy choices (e.g., new spending), not just economic cycles.

→ Measured as the vertical gap between actual deficit and the cyclical (automatic) deficit.

Q: Why do not all fiscal budgets have the same macroeconomic effect?

Because the composition matters:

€1 on unemployment benefits → high multiplier

€1 on corporate tax cuts → low multiplier

→ Two same-sized deficits can be expansionary, neutral, or contractionary depending on the items.

Q: What is the Primary Balance (PB) and why is it useful?

PB = Fiscal balance excluding interest payments on debt

It shows the current government's policy impact, not costs from past borrowing

Q: What are automatic stabilizers and how do they affect the budget?

Built-in responses to economic conditions (e.g., taxes rise with income, benefits rise during recessions)

They create cyclical deficits/surpluses without policy changes

Q: What is the monetarist equation for government deficit financing?

G−T=M+B

G = spending, T = taxes,

M = money creation, B = borrowing

→ Governments must finance deficits through some mix of money or debt

Q: Why did central banks become independent in the 1990s, and what changed?

To prevent direct money financing of deficits (e.g., inflationary printing)

Deficits must now be financed by borrowing (G – T = B)

Q: What is crowding out, and how does it differ between neoclassical and Keynesian views?

Neoclassical: Debt raises interest rates → reduces private investment

Keynesian: Debt can stimulate demand (via wealth effect) if resources are underused

Q: What is the IS-LM framework's relevance to fiscal policy?

IS curve: Investment-Savings → affected by fiscal demand (e.g., G↑ shifts IS right)

LM curve: Liquidity-Money → affected by money supply or interest rates

→ Fiscal policy moves IS; monetary policy moves LM

Q: According to monetarists, what happens when deficits are financed by printing money?

Short-term: boosts demand and output

Long-term: causes inflation, erodes money value, with no real gains

Q: What are the long-term effects of deficit financing by debt, according to monetarists?

Interest rates rise

Private investment falls

Output does not increase → just a shift in who spends (government vs private sector)

Q: What is the “golden rule” in public finance?

A: Governments should only borrow to invest, not to fund current spending.

Q: Why are EMU rules (Eurozone) based on limiting deficits?

To ensure price stability

Avoid excessive borrowing by member states

Keep monetary union functioning smoothly

Q: How did post-2008 policies challenge monetarist views on deficits?

Massive public spending (e.g., Biden’s Inflation Reduction Act) was used to fight recession and inflation

Modern Monetary Theory (MMT) argued for active fiscal use even with deficits

Why is the way a deficit is financed not politically neutral?

Because it gives different groups power over policy:

Taxes (T) → Power stays with voters

Money creation (M) → Power to central banks

Debt (B) → Power to lenders/creditors, possibly foreign investors

Q: What is the Quantity Theory of Money and its basic equation?

The Quantity Theory of Money states:

MV = PQ

M = Money supply

V = Velocity of money

P = Price level

Q = Output

→ Classical economists assume V and Q are constant, so M↑ leads directly to P↑ (inflation).

Q: How does Keynes criticize the classical Quantity Theory of Money?

Keynes says V and Q are not constant:

V depends on how quickly people spend money

Q (output) can increase when there is unemployment or idle resources

→ So increasing M does not necessarily cause inflation; it may increase output and jobs.

Q: According to Keynesians, when does inflation occur due to monetary expansion?

Only after the economy reaches full employment.

→ Before that, more money increases demand, output, and jobs — not prices.

Q: What is the liquidity effect in Keynesian monetary policy?

Increasing money supply lowers interest rates → boosts investment → increases output and employment.

Q: What are the main points of Milton Friedman's "old monetarism"?

Money does not affect real variables in the long run

Monetary policy should not serve fiscal policy

The central bank’s only role: price stability

Avoid money supply shocks → ensure predictability and discipline

Q: What happens if central banks support fiscal deficits by printing money, according to monetarists?

→ It causes inflation, reduces confidence, and harms economic stability.

Q: What is the monetarist view on monetary vs real variables?

Monetary variables: inflation, money supply, exchange rate

Real variables: employment, GDP, investment

→ Monetarists: monetary policy should only target monetary variables

Q: What is the Post-Keynesian view of the money supply?

Endogenous:

The money supply is determined by credit demand

Banks create money when they issue loans

→ Central banks don’t control M directly.

Q: According to Post-Keynesians, how are interest rates set?

Central banks announce and set interest rates directly — not via market supply-demand mechanics.

Q: What’s the Post-Keynesian critique of the neoclassical view on foreign reserves and money supply?

They reject the idea that foreign inflows automatically expand money supply.

→ Only if credit demand increases, does money grow. Reserves alone don't cause it.

Q: What is Modern Monetary Theory (MMT)?

A framework arguing that a government with monetary sovereignty (its own currency) can:

Run deficits without needing to “fund” them by taxes or borrowing

Use money creation to achieve full employment

Control inflation through taxation, not austerity

Q: What is monetary sovereignty in MMT?

A country has it if it:

Issues its own currency

Borrows in its own currency

Lets its currency float (not fixed to another)

→ Examples: USA, UK, Japan (but not Eurozone countries

Q: What are MMT’s three theoretical foundations?

Chartalist theory: Money is created by the state to organize the economy

Functional finance: Policy should target employment/inflation, not budget balance

Sectoral balances: One sector’s deficit is another’s surplus

Q: How does MMT view taxes?

Do not fund spending

Used to:

Create demand for the currency

Prevent overheating (control inflation)

Redistribute wealth

Q: What are MMT’s main policy implications?

Spend first, tax later

Deficits are good if they support jobs and demand

Debt is not a problem, but inflation is

Public debt = record of money already spent

Q: What are the risks or critiques of MMT?

Unclear which countries truly have sovereignty

Focuses too much on taxes to control inflation

Underestimates external constraints (e.g., currency pressure, capital flight)

May lead to speculative bubbles or inflation if mismanaged

Q: According to MMT, when is inflation a risk?

Only when spending exceeds real productive capacity (i.e., full employment).

→ Deficits are fine until inflation appears

Q: How are fiscal and monetary policy interdependent in practice?

Even though textbooks treat them separately, in reality:

Fiscal deficits require financing (via taxes, borrowing, or money)

These choices influence monetary policy outcomes (e.g., interest rates, inflation)

→ Example: large government borrowing may force central banks to raise rates (crowding out).

Q: What is the crowding out effect and how does it happen?

When government borrows heavily:

Demand for loanable funds increases

Interest rates rise

Private investment falls

→ Monetary policy may tighten, limiting the effectiveness of fiscal stimulus

Q: What are the monetarist concerns about financing fiscal deficits through money creation?

Inflation risk

Loss of central bank independence

Erosion of trust in monetary policy

→ Monetary policy should not be used to accommodate fiscal expansion.

Q: How does government financing method affect democratic control?

Taxes: Citizen-controlled, more democratic

Money creation: Central bank controlled, less transparent

Borrowing (debt): Puts power in the hands of creditors (banks, investors, possibly foreign powers)

→ Financing methods shape who holds influence over national policy

Q: What is the political economy perspective on fiscal and monetary interaction?

Budget decisions are not just technical but deeply political:

They determine who pays, who benefits, and who controls economic levers

→ Austerity, taxation, borrowing all reflect ideological and power-based choices

Q: What are the risks of relying heavily on debt to finance deficits?

Loss of sovereignty if borrowing from foreign investors

Creditors may demand austerity measures

Future generations may bear the burden through higher taxes or reduced services

Q: What was the policy logic behind the European Monetary Union (EMU) rules?

Avoid inflation and unsustainable debt

Require countries to keep balanced budgets or small deficits

→ Based on monetarist and neoclassical principles

Q: How did the 2008 crisis and COVID-19 shift thinking on monetary-fiscal coordination?

Countries used massive deficits and stimulus

Challenged monetarist rules

Showed that strict budget limits can be harmful in deep recessions

→ Boosted support for approaches like MMT and Keynesian revival

Q: According to MMT, what should guide fiscal policy: deficit size or economic outcomes?

Economic outcomes

Focus on employment, inflation, and real capacity

Not on balancing budgets or meeting deficit limits

→ Deficits are tools, not targets

Q: What is the MMT view on the role of public debt?

Public debt is just a record of past spending; it is not inherently dangerous

Government doesn’t need to borrow to spend

Concern should be on resource use and inflation, not debt levels

Q: What are the democratic implications of different deficit financing methods?

Debt: Can give influence to non-democratic actors (e.g., foreign banks)

Money creation: Raises concerns over central bank power and lack of transparency

Taxation: Most democratic but politically difficult

→ Who finances the deficit affects who rules the economy

Q: What is economic growth and how is it measured?

A: Economic growth is the increase in the monetary value of all final goods and services produced over time. Measured primarily by GDP = C + I + G + NX.

Q: What are different GDP measures and why are they used?

Nominal GDP: Measured at current prices

Real GDP: Adjusted for inflation (shows real output growth)

GNP: GDP + net income from abroad

PPP GDP: Adjusted for cost of living between countries

Per capita: GDP divided by population (shows average income)

Q: What is the difference between GDP and NDP?

NDP (Net Domestic Product) = GDP – Depreciation

→ Reflects more sustainable income by accounting for capital wear and tear

Q: What is the Solow-Swan model (exogenous growth)?

Growth depends on:

Capital (K)

Labor (L)

“A” = residual factor (tech, institutions)

→ A is exogenous and explains long-run growth through productivity

Q: What are endogenous growth models?

They explain growth from within the system through:

Education, innovation

Public investment

Trade & institutions

→ Policy decisions can drive long-run growth, not just external tech change

Q: What is Thirlwall’s Law or the Balance of Payments Constrained Growth Model?

A demand-side theory:

Export growth limits how fast an economy can grow

If exports can’t finance needed imports → growth is constrained

→ Explains why some developing countries grow slowly

Q: What is full employment?

Everyone willing to work at current wages can find a job.

Underemployment and involuntary unemployment are minimized.

Q: What are the 4 types of unemployment?

Frictional – moving between jobs

Seasonal – tied to specific seasons

Cyclical – caused by recessions

Structural – mismatch of skills and job demand

Q: What is the neoclassical view of labor markets?

Wages adjust to clear the market

Unemployment is voluntary or due to regulations

Labor supply = utility tradeoff between income and leisure

Labor demand depends on productivity and wage level

Q: What is the Keynesian view of labor markets?

Wages are sticky due to contracts, laws, norms

Unemployment is involuntary

Labor demand depends on expected profits

Labor supply shaped by social/institutional factors, not just wages

Q: What policies can promote full employment?

Demand-side: fiscal/monetary stimulus

Training & active labor market programs

Job creation subsidies

Reducing working hours

Immigration and structural policies

Q: What is the difference between equity and equality?

Equity: Fairness → rewards based on effort/ability

Equality: Reducing gaps between social groups and ensuring opportunity

Q: How do different schools view inequality?

Neoclassical: Inequality is natural, drives innovation (trickle-down)

Keynesian: Hurts demand and stability, calls for redistribution

Marxist: Inherent to capitalism, due to class exploitation

Q: What are the effects of inequality?

Political: Weakens democracy, fosters extremism

Social: Marginalization, unrest, xenophobia

Economic: Reduces demand, slows growth

Q: What are the two types of distribution policies?

Pre-distribution: Before the market (education, labor rights, UBI)

Redistribution: After the market (taxes, transfers, pensions)

Q: What is price stability and why is it important?

Keeping inflation low and stable ensures predictability, protects purchasing power, and avoids boom-bust cycles.

Q: Define inflation, disinflation, and deflation.

Inflation: Sustained rise in price level

Disinflation: Slower inflation (e.g., from 6% to 4%)

Deflation: Price level falls → can cause stagnation

Q: What are CPI and PPI?

CPI (Consumer Price Index): Measures household price changes

PPI (Producer Price Index): Measures price changes for producers (early signal of inflation)

Q: What causes demand-pull inflation?

When aggregate demand exceeds the economy’s capacity → prices rise

Can result from: M↑, G↑, T↓, or rising investment/exports

Q: What is the monetarist vs Keynesian view of inflation?

Monetarist: Always a monetary phenomenon (MV = PQ)

Keynesian: Inflation happens only when demand exceeds full employment

Q: What is cost-push or supply-side inflation?

Price rises caused by supply shocks (e.g., oil prices, wage hikes, currency depreciation)