Macro - Dynamic AD/AS model

1/35

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

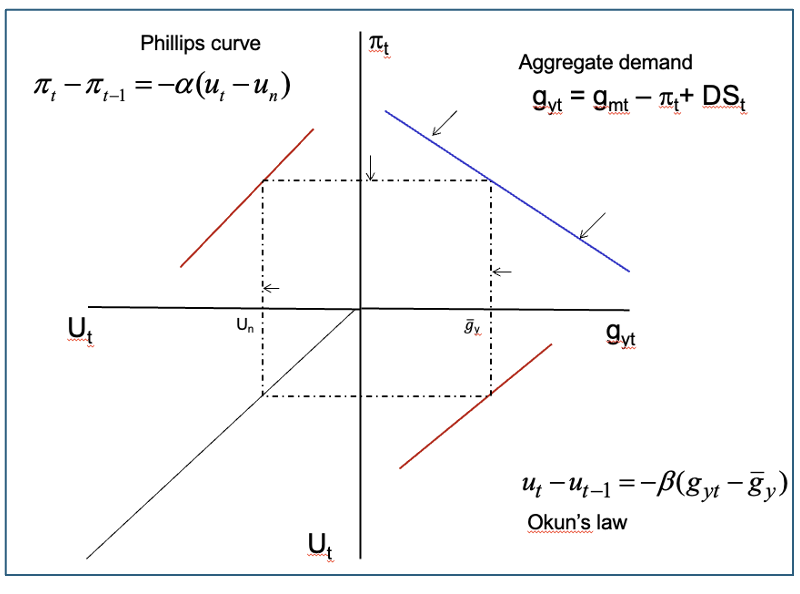

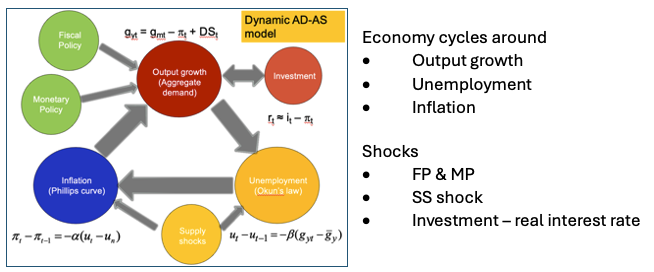

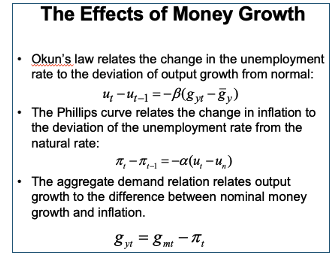

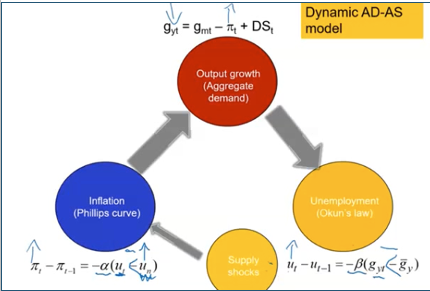

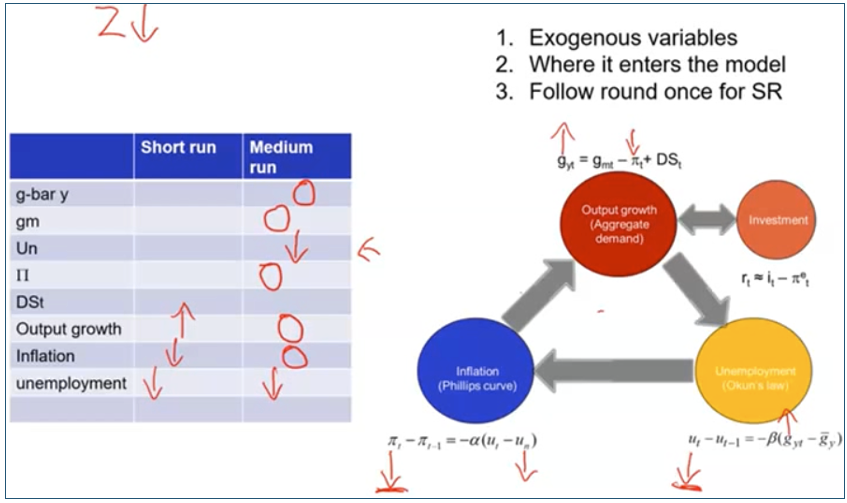

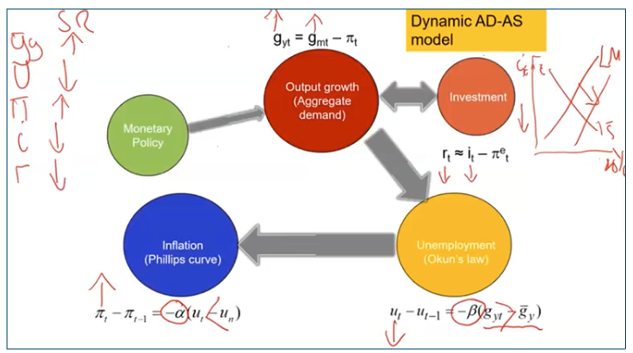

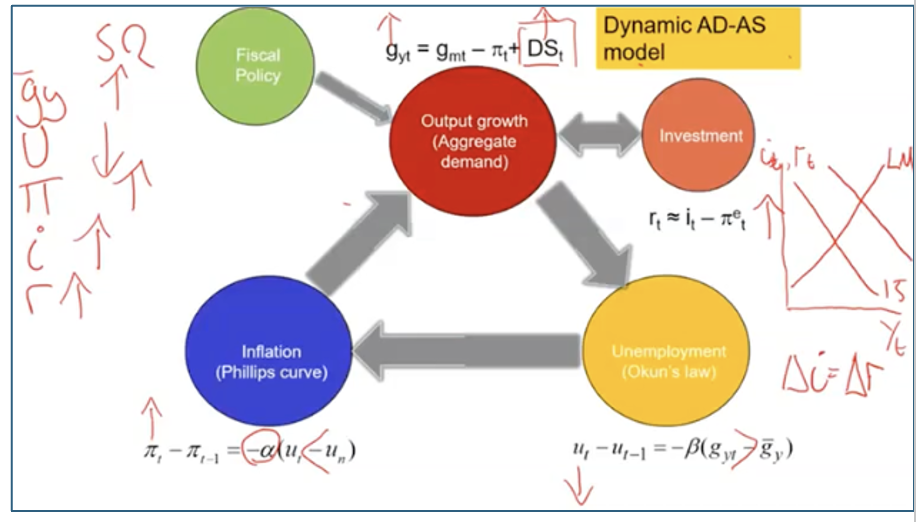

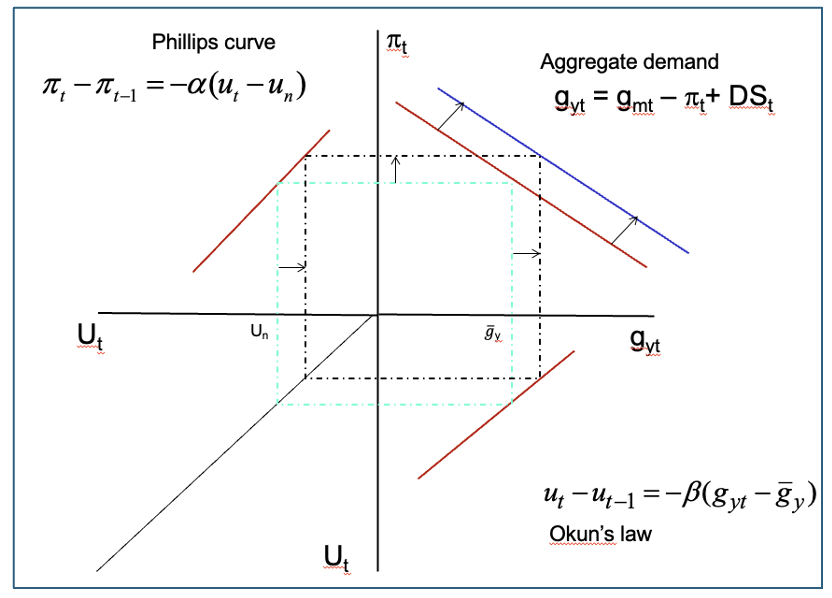

3 parts of Dynamic model

Okun’s law

Phillips curve

AD

How dynamic model works

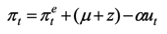

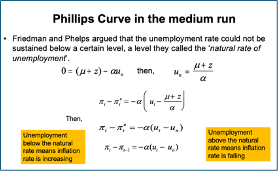

Phillips curve

the aggregate supply relation written in terms of inflation, expected inflation and the unemployment rate

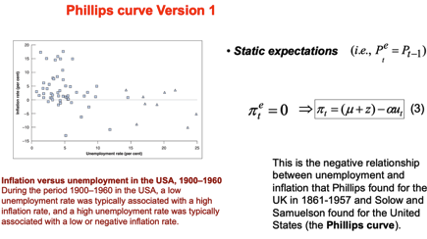

Phillips curve - Static expectations

Pet = Pt-1

When back to MR change in inflation = 0

Fits data really well until 19

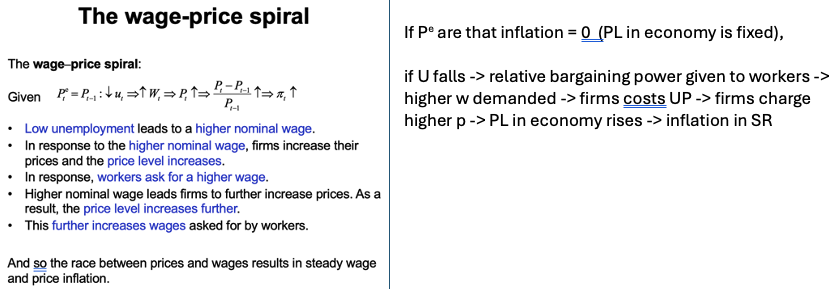

Wage price spiral

Phillips curve - Adaptive expectations

Expectation for inflation next year = inflation rate now * parameter

When Ut = Un then we’re in MR equilibrium and inflation change = 0 (inflation is the same very year)

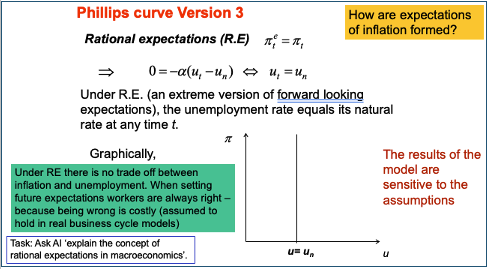

Phillips curve - Rational expectations

Rational expectations - Using all the information available + perfect understanding of how macro economy works → perfectly forecast inflation (only unexpected events can mean your prediction was wrong)

This makes the Phillips curve perfectly vertical – no trade-off between unemployment and inflation

No business cycle implied unless unexpected shocks

Pre election booms & expectations

Pre-election, political parties often artificially create a boom through expansionary FP

• With adaptive expectation (only using past data) this is unexpected and so there is a boom and inflation increases and U falls

• With rational expectations you understand there is an incentive to do this and so it is already factored into your expectations – You move up the Phillips Curve (higher inflation) but stay at un

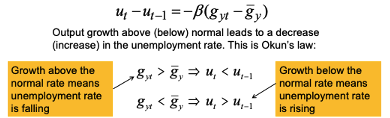

Okuns law

Relax asssumption that L is constant

If GDP growth > 3% then the change in the unemployment rate is negative → If growth is strong, U will be falling

3% GDP growth is MR equilibrium (normal growth rate)

AD

Y = M/P as we ignore FP

We assume growth of MS is positive (if growth rate of MS UP (expansionary MP) then growth rate of Y UP

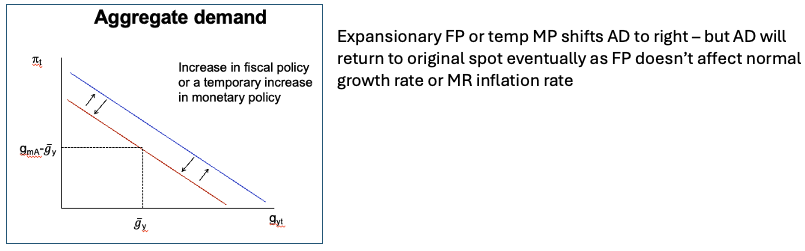

AD & MP or FP

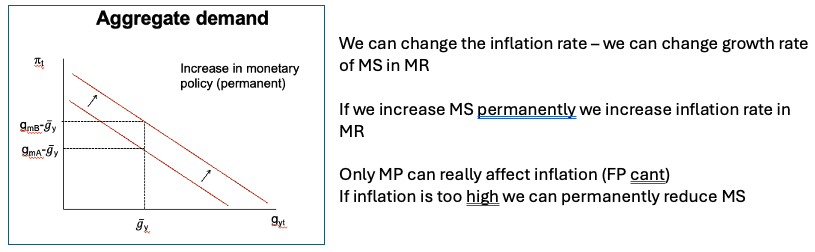

AD and permanent MP

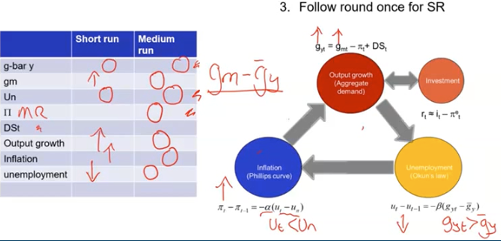

Dynamic model summary

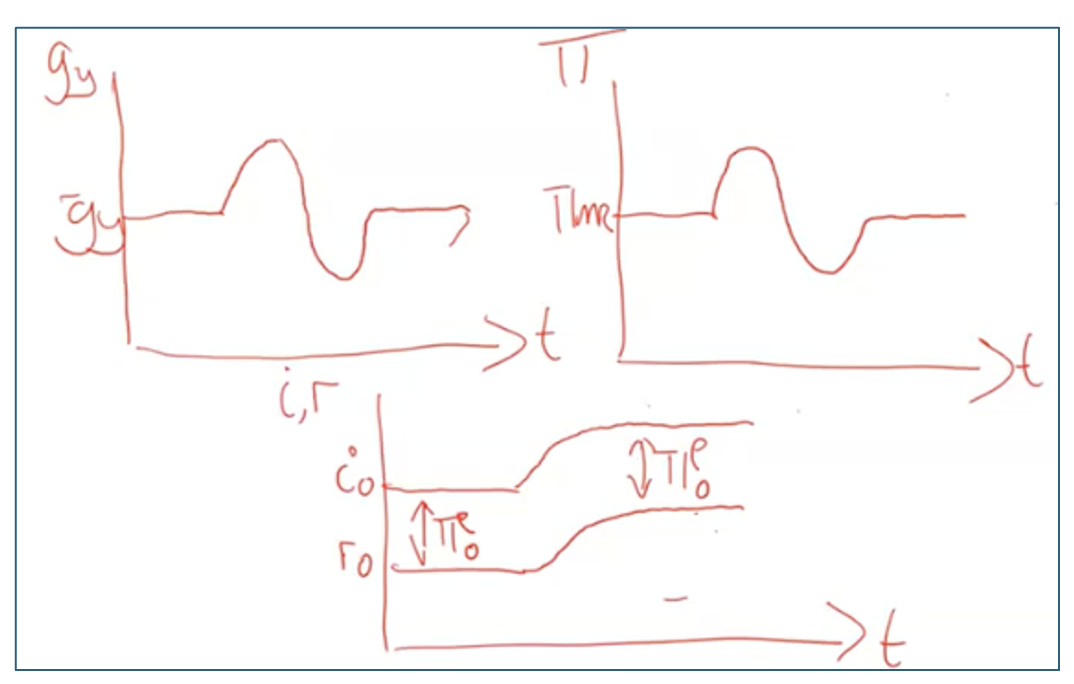

SR expansionary MP overview

Positice change in growth rate of MS

Causes SR boom

SR expansionary MP explained

Expansionary MP shifts MS out → Move along MR as i falls

MS shifting → LM to shift out

Move along IS as lower i leads to higher I & C → Y rises

GDP growth rate > natural growth rate

Y rises → L rises as firms offer higher W (L has bargaining power) → Firms cost rise so P rises

Okun’s law shows that u < un → inflation is above natural

Inflation expectations start to adjust and so economy cycles round again until MR equilibrium

What happens in MR

• Output must grow at its normal rate of growth

• Unemployment must return to the natural rate, un

• Expected Inflation must equal actual inflation, pit = piet Delta pi = 0

• Therefore the increase in money supply growth is exactly equal to the increase in inflation

Permanent Expansionary MP

If an economy has a problem with inflation it can change it by changes in the growth rate of MS – only permanent fix

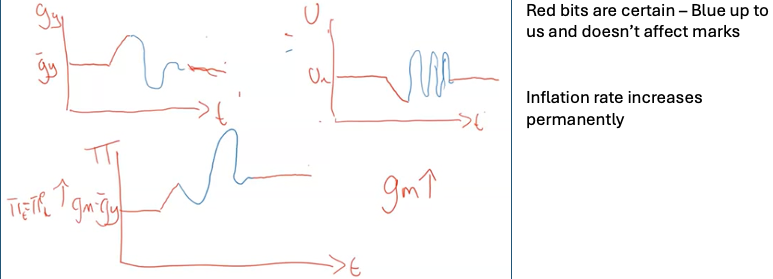

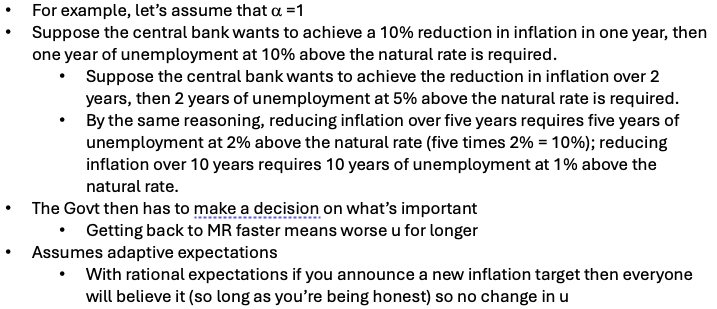

Problems with reducing inflation

reducing inflation will induce a recession for a time

SS shock - Negative shock to x or z

SR: U rises + Pi rises + Y falls Enters via PC

MR: U permanent rise + Y → Yn + Pi = Pin

Problem with policy response to negative SS shock

In SR: High inflation + low growth

However they cant fix both problems at once – policy is either inflationary and U decreasing or U increasing but deflationary

Positive SS shock to ̅gy

E.g. AI making everyone more productive

Positive SS shock - fall in z

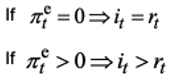

Nominal i

Interest rates expressed in terms of currency

Real i

Interest rates expressed in terms of a basket of goods

Real i in dynamic model

In MR, r determined by balance of S & I. We assume it varies only if changes to FP

r & i behave similarly in SR but different in MR

In ISLM + static , we assumed in MR pi = 0 → pie = 0 → i = real i

Which interest rate is directly affected by MP

nominal i

Which interest rate affects spending and Y

real i

its the i affected by costs → impacts I as raises OC + reduces present value of I

What do the effects of MP and FP on Y growth depend on

SR - how movements in the nominal interest rate translate into movements in the real interest rate.

MR - If real i changes in MR then composition of GDP changes. If not then composition doesn’t change even if nominal i changes in MR

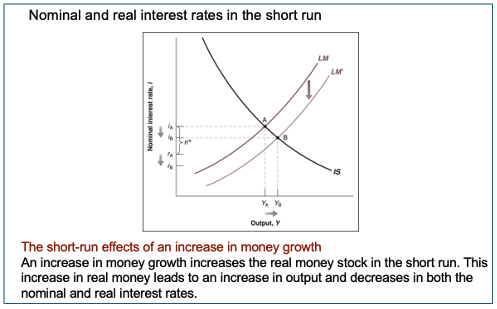

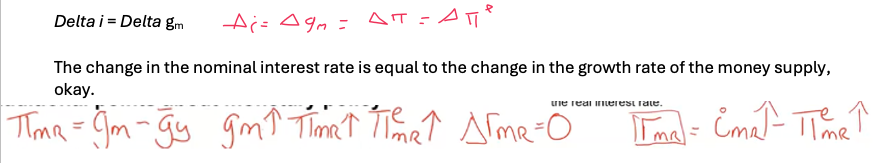

How does permanent chnages in Ms affect i

If MS increase → SR - lower i MR - higher i

→ SR - lower r MR - original r

How MP affects i in SR (IS-LM)

Expansionary MP shifts LM out → More cash in Money market →

Return on alternative financial asset falls (nominal i falls) → translates to an equal change in real i → I rises so move along IS

Fisher Hypothesis

In MR, a change in the growth rate of the money supply will lead to a one-for-one increase in the nominal interest rate and inflation

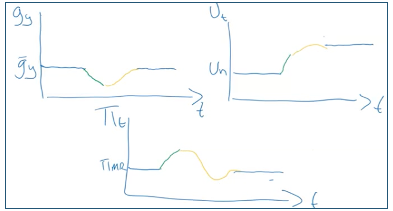

How Expansionary MP affects economy + i in SR (Dynamic AD/AS)

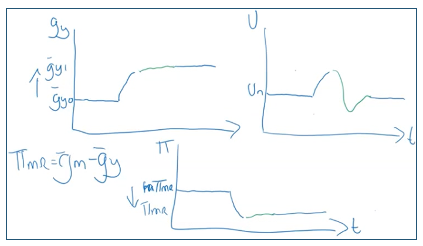

How MP affects Dynamic AD/AS in MR

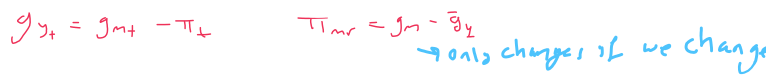

gy returns to the natural rate + u → un

pi = gm - gy → Increase in money growth = increase in inflation

(true only for permanent increase to gm)

i + Pi increases, so r unchanged in MR → composition of Y unchanged → Monetary Policy affects Pi but not Y, nor its composition (the neutrality of money)

FP in dynamic model SR

FP in dynamic model MR

Y & U → Yn & Un

PiMR = gm - gy

Nominal (and therefore) Real i increase

I fallen compared to G → Y composition changed

FP and crowding out

Crowding out always happens with FP – real i change causing the crowding out