macro terms

1/196

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

197 Terms

scarcity

problem arising from human wants exceeding resources able to satisfy them; forces us to make choices among alternatives based on incentives

economics

social science that studies the choices individuals, businesses, governments,and societys make to cope with scarcity, the incentives that influence them, and the arrangements coordinate them

microeconomics

study of choices that individuals and businesses make and the way these choices interact and are influenced by governments

macroeconomics

study of total effects that choices of individuals, businesses, and government makes on the national/global economy

How do choices end up determing what/how/for whom

Goods and services how they are produced, what is produced, and who they are produced for

social interest

choices made that are best for society

self interest

choices made that are the best for the individua

rational choice

choice maximizing self-interest

consumption goods

goods and services bought my individuals to provide enjoyment and contribute to a standard of living

capital goods

goods bought by businesses to increase productivity

4 factors of production

the resources used to produce goods and services, including land, labor, capital, and entrepreneurship.

land

gifts of nature used to produce goods and services; natural resource such as minerals, water, plants, animals

labor

work and time devoted to produce goods and services; depends on human capital

entrepreneurship

human resources that organizes labor, land, and capital

capital

tools, instruments, machines, buildings, and other items produced in the past now used for making goods and services

payments to the factors of production

(rent for land, interest for capital, wages for labor, profit/loss for entrepreneurs)

marginal benefit and cost

cost; opportunity cost for a one unit increase in an activity

benefit; what is gained when you get one more unit of something

comparative advantage

the ability of a person to perform an activity or produce a good/service at a lower opportunity cost than someone else

absolute advantage

when an entity is more productive than another

opportunity cost

given up/gained; best thing given up for something else

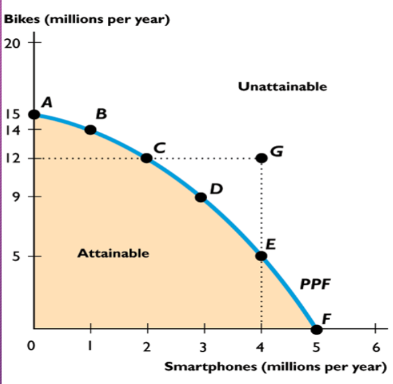

PPC and PPF

Boundary between the combinations of goods and services that can and can’t be produced due to available factors of technology

On the curve is efficient

More resources allow increase in PPF; increase is outwards shift

Slope determines oc

specialization

an economy where people combine and produce in the good where they both have a comparative advantage

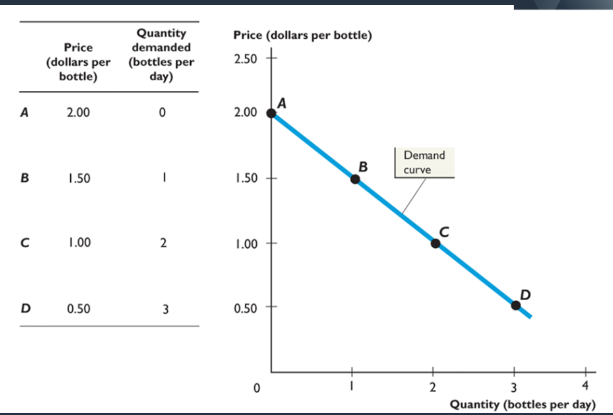

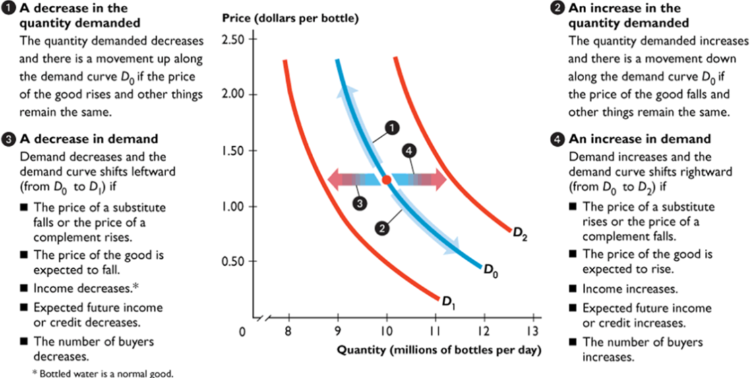

demand

relationship between quantity demanded and good price when all other influences stay the same

quantity demanded

the amount of any good/service people will buy at a certain price

Only affected by price: Lower the price the more demand

Indicated by an arrow along the curve

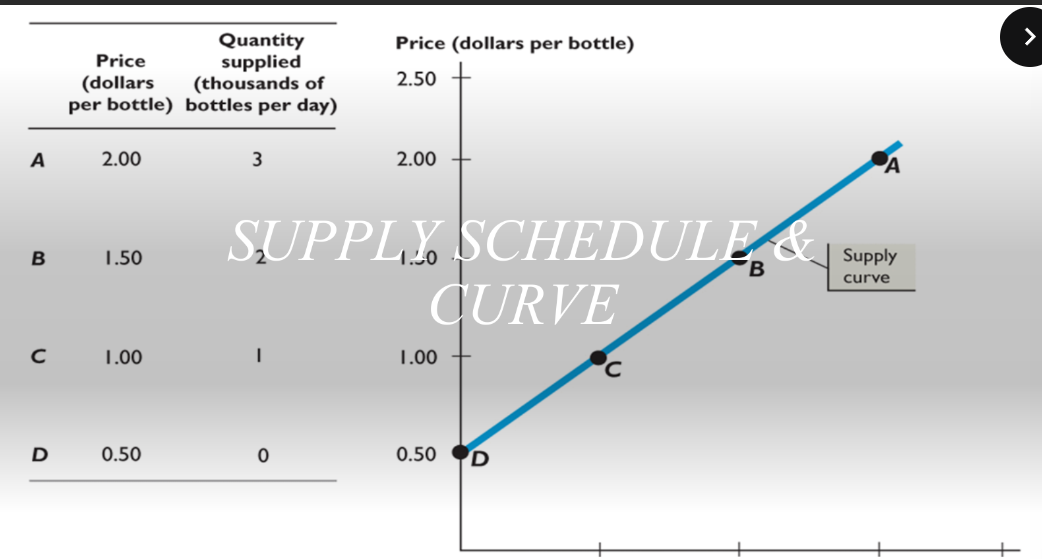

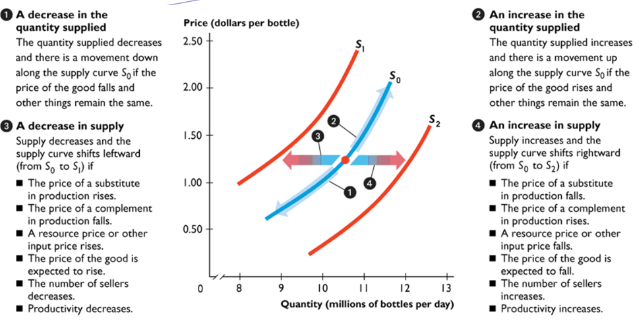

supply

relationship between quantity supplied and price

law of supply/quantity supplied

amount of a good or service people are willing and able to sell at a price; rises when price rises, decreases when price falls

demand shifters: TRIBE

Taste: New information/ new goods may increase demand

Related Goods:

Substitutes: Move in same direction: Demand increases when sub price rises, and vice versa

Complements: Move in opposite direction: Demand increases when price decreases, and vice versa

Income: Rise in income means more demand

#Buyers: More buyers, more demand

Expected Future Income: When income is expected to decrease, demand decreases; vise versa

supply shifters: ROTTEN

Related Goods:

Substitutes: Move in opposite direction; supply decrease when substitute price rises

Complement: Move together: Supply increases if price of complement rises

Other Inputs: Price of a resource/input used to produce a good; more it costs, less supply

Taxes: Taxes lower supply, subsidies increase supply

Technology: Better technology means more supply

Expectations: An expected higher price means more supply

Number of Sellers: More sellers = More supply

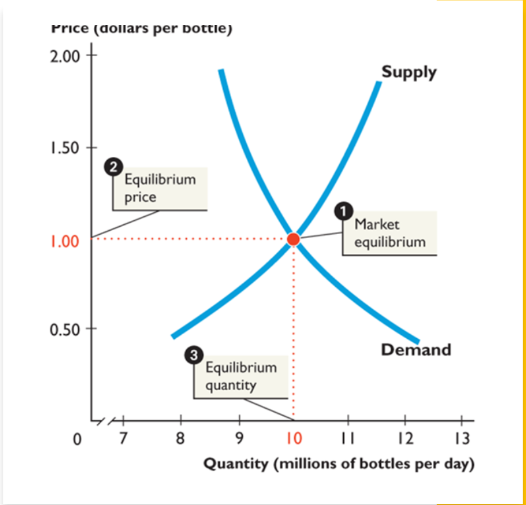

market equilibrium

When quantity demanded = quantity supplied

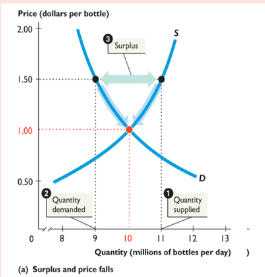

surplus

quantity supplied > quantity demanded; requires the price to fall to equilibrium

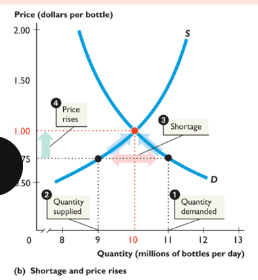

shortage

when quantity demanded > quantity supplied; requires price to rise to equilbrium

circular flow

GDP

the market value of all final goods and services produced within a country in a given time period; calculated quarterly with market prices

final good

good produced for its final user and not as a component of another good

intermediate good

good produced by a firm that is bought by another and used as a part of a final good/service

GDP formula(expenditure approach)

Y = C + I + G + NX(X-M)

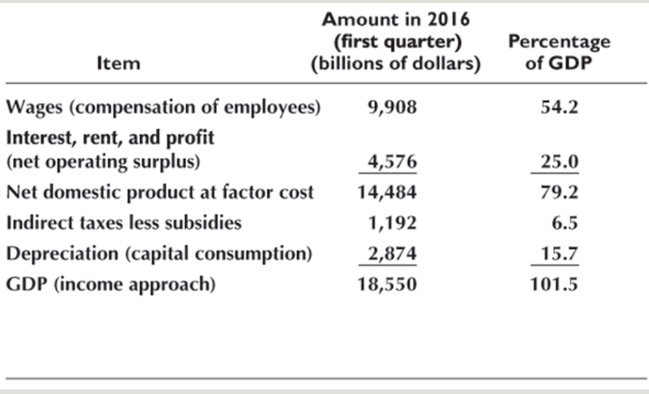

Income approach

Wages + interest, rent, profit + NDP at factor cost +indirect taxes- subsidies + depericiation

gnp

market value of all final goods and services produced anywhere in the world in a given time period by factors of production supplied by residents; doesn’t matter where its produced

real vs nominal

real; expressed in base year nominal; expressed in same year

gdp deflator

(Nominal/Real GDP)*100; average of all the current prices of all the goods and services included in GDP

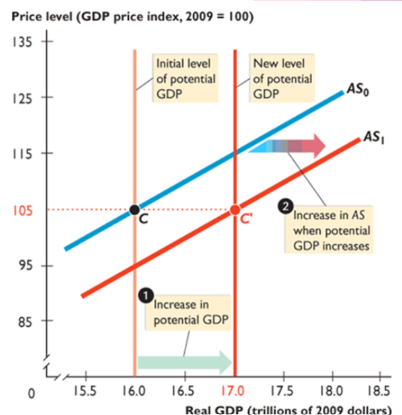

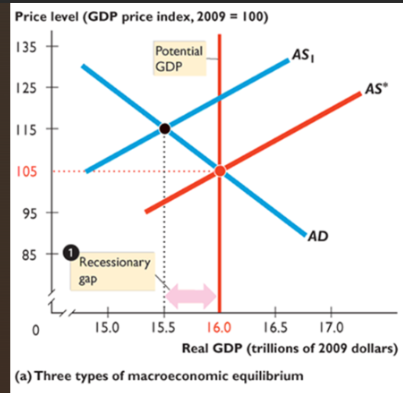

potential Gdp

real GDP when economy is at full employment

CPI

measure of the average of the prices paid by urban consumers for a fixed market basket of consumer goods and services

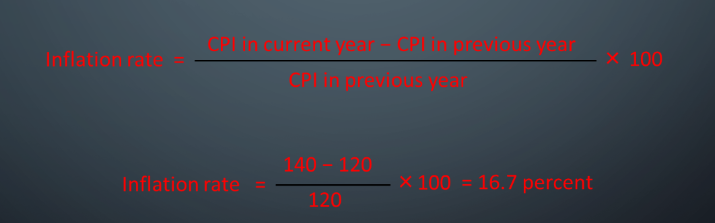

Inflation Rate

Change in price level from one year to the next

Nominal and Real Interest Rate

Real IR = Nominal -Inflation rate

labor force

number of people employed + unemployed

unemployed

have not worked while being available to work; made efforts to find employment in past 4 weeks or were waiting to be recalled to a job they were laid off from

working age population

the total number of people 16 and over who are not in jail, hospital, or some other form of insitution

Unemployment rate

percentage of people in labor force who are unemployed

Employment-pop ratio

percentage of the working-age population who are employed

Labor force particpation rate

the percentage of the working-age population who are members of the labor force

Frictional unemployment

unemployment coming from normal labor turnover; people entering and leaving jobs

Structural Unemployment

unemployment coming from technological changes

Cyclical Unemployment

unemployment due to the business cycle

Natural Unemployment

unemployment that arises from frictional and structural change without cyclical unemployment; rate hovers around 4.5 to 5.5

Full-employment

employment where almost everyone finds a job; no cyclical employment

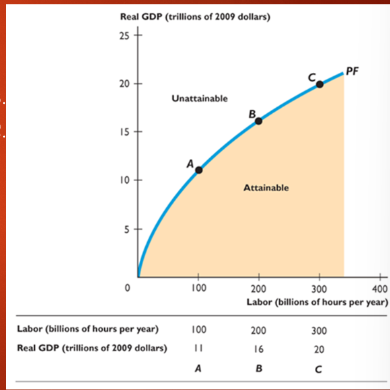

production function

relationship showing the maximum quantity of real GDP that can be produced as quantity of labor and real GDP changes; demonstrates dimishing returns

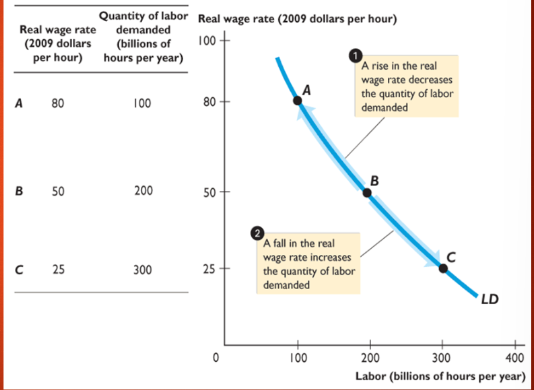

labor demand

quantity of labor demanded compared to real wage rate

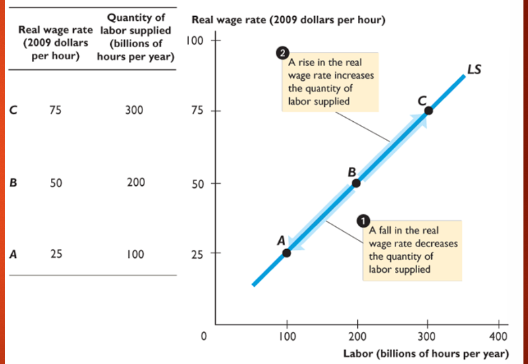

labor supply

quantity of labor supplied compared to real wage rate

classical approach

market economy gives best macroeconomic performance; aggregate fluctuations are a natural consequence of expanding economy; government intervention only hinders ability of market to allocate resources; disputed during Great Depression with high unemployment and stagnant production

keynesian approach

market economy is unstable and needs active government interventon for full employment and sustained economic growth; promoted by John Meynard Keynes;believes too little consumption and investment caused Great Depression; wanted to cure unemployment in the short term but also increased it in long term

monetarist approach

classical approach but takes into account economic fluctuations leading to the business cycle; believe that monetary contractions cause recessions

NRU

rate of unemployment at full employment

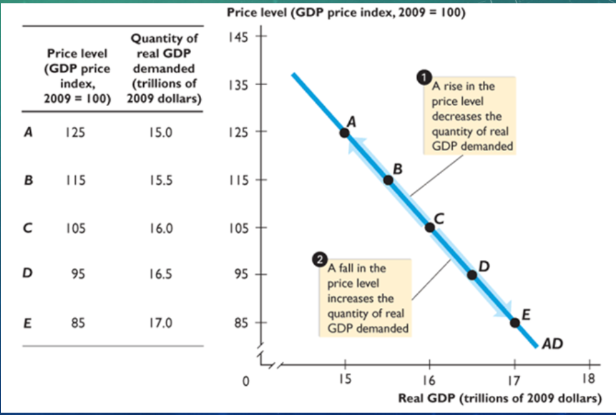

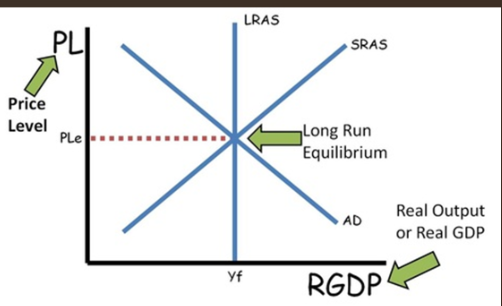

Aggregate demand

total of demand; relationship between quantity of real GDP demanded and the price level

When price level rises, quantity of real GDP demanded decreases; and vice versa

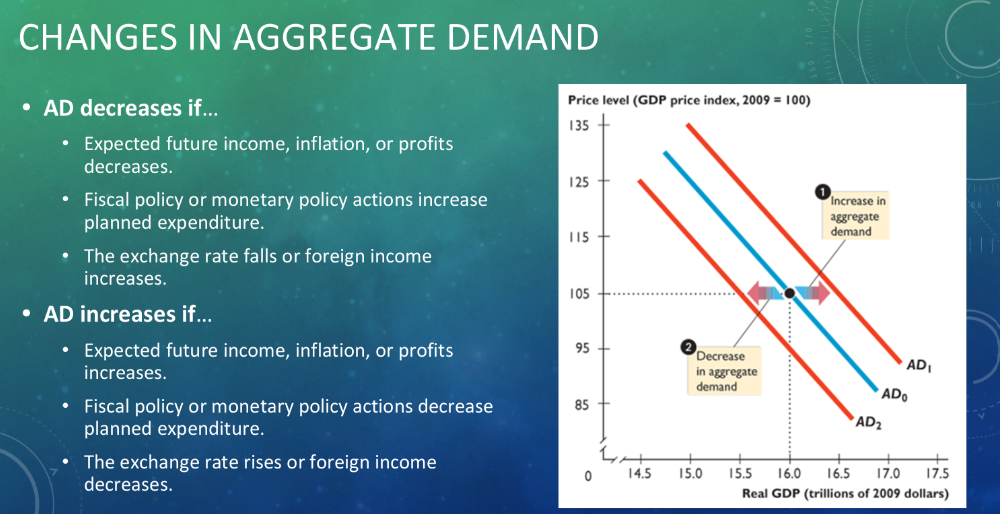

Expectations: Increase in expected future income, inflation, or profit increases AD

Increase in foreign income increases AD

Monetary policy; Tax cut or interest rate cut increases it

Aggregate demand shifters

Same as Real GDP; C+I+G+NX

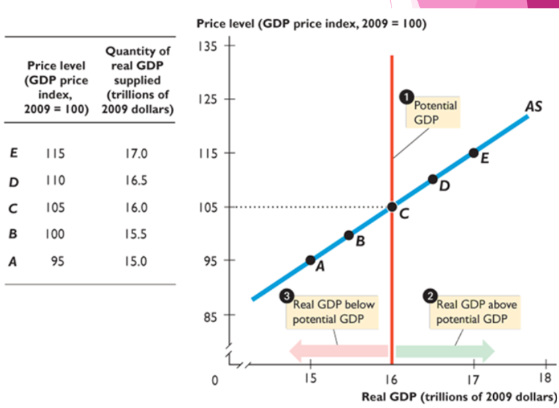

Aggregate supply

relationship between total amount of final goods and services that firms plan to produce(quantity supplied) and price level

Demands on 4 factors of production

Potential is LRAS

AS shifters

Key Resources: More expensive, less supply(remember wages)

Productivity; more productivity with new technology and capital

Quality of Labor: More is more supply

Change in EXPECTED price level: affects wages

Gov’t action: Taxes and subsidies

Anything that changes potential GDP shifts AS

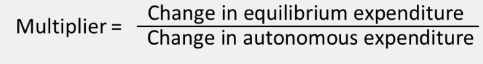

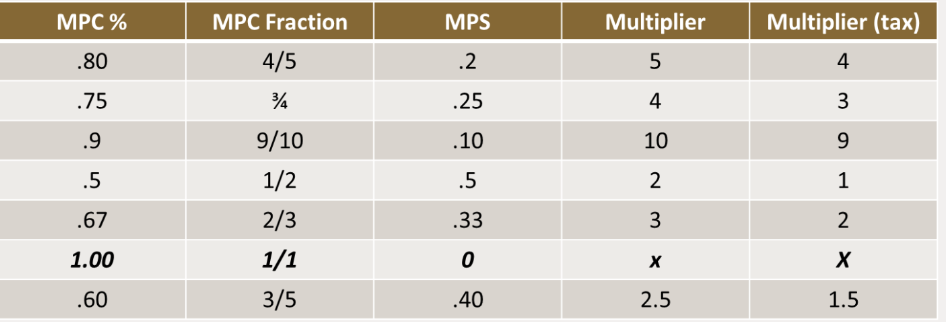

Multipliers

magnifies expenditure changes; equilibrium expenditure/autonomous expenditure; always greater than 1

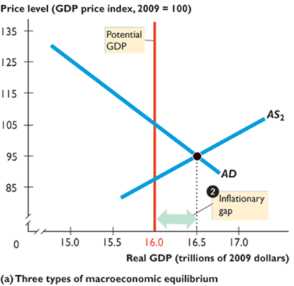

AS-AD graph

explains fluctuations in GDP and price level

when firms can’t meet demand they increase production and raise prices; when they can’t sell what they produce they cut production and lower prices

Equilibrium = full employment

recessionary gap

exists when potential GDP > real GDP; price level falls

inflationary gap

exists when real GDP > potential GDP; price level rises

Human capital

knowledge and skills people obtain from education, training, and work-experience

Aggregate expenditure

Same components as real GDP

MPC

Marginal propensity to consume; Consumption expenditure/disposable income; larger this is, larger the multiplier; 1/1-mpc = multiplier

MPS

1/MPS = multiplier; equal to 1-MPC; marginal propensity to save

Tax multiplier

MPC multiplier- 1

financial capital

funds firms use to buy and operate physical capital

gross investment

the total amount spent on new capital goods

net investment

the change in the quantity of capital; gross investment - depreciation

depreciation

wealth

value of all things a person owns; not earn

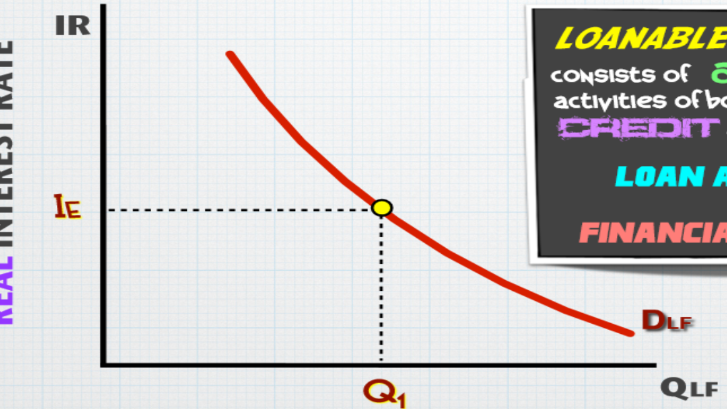

loan markets

market for loans to buy big ticket items and inventories; earn high interest rates

bond markets

bond; promise to pay amount of money on a specified date; used by gov’t and firms to raise money

stock markets

stock are certificates of ownerships and claim to the profits a firm makes; traded in these markets

financial institutions

a firm that borrows and lends financial capital

saving

the amount of income that is not paid in taxes or spent on consumption goods

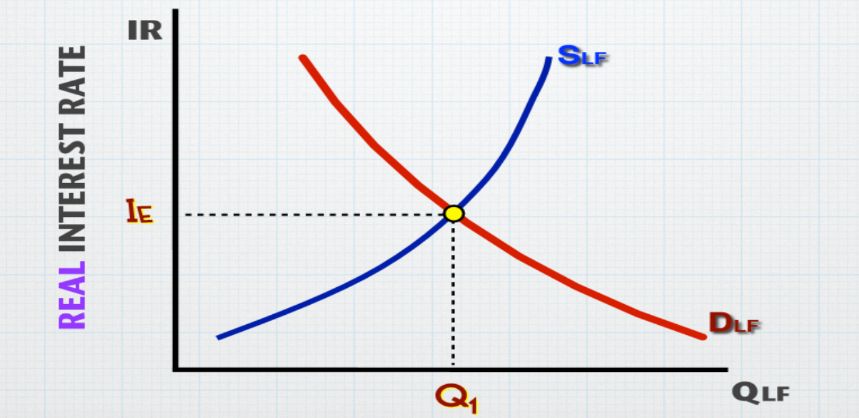

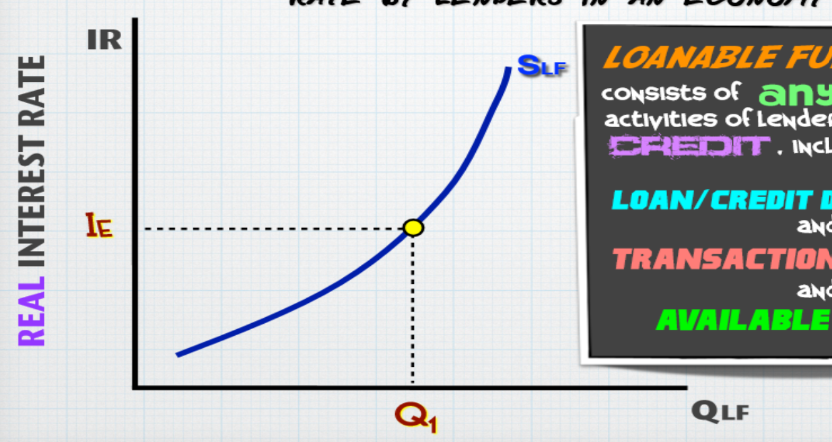

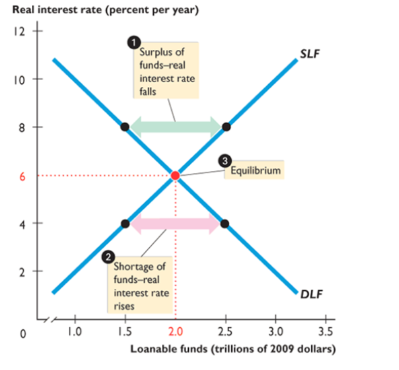

loanable funds market

aggregate of loan, bonds, and stock markets; relationship between RIR and quantity

Used for investment

demand for loanable funds

Higher IR = smaller QLF demanded

Demand is shifted by expected profit; increase and decrease together

Supply is quantity of credit provided at RIR; financed by saving

supply for loanable funds

Higher interest rate = greater QLF supplied

More disposable income decreases it; increase in wealth or expected future income increases

equilibrium for loanable funds

increase in demand = higher RIR; increase in supply = lower rir

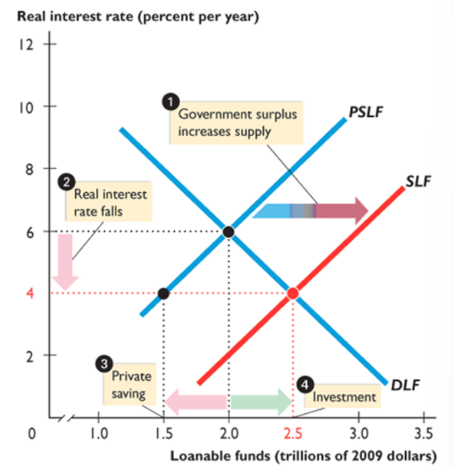

gov’t budget surplus

increases the supply of loanable funds, bringing a lower interest rate, decreasing quantity of private saving, increasing quantity of investment and loanable funds demanded; highly unlikely

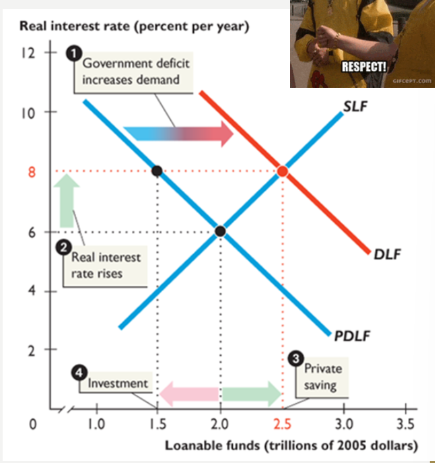

gov’t budget deficit

increases DLF, raising RIR, increasing quantity of private saving, decreasing investment and QLF

crowding-out effect

tendency for a government budget deficit to raise RIR and decrease investment

ricardo-barro effect

budget deficit doesn’t really affect RIR or investment; supply of loanable fund increases by amount = to deficit to make up for it

money

commodity or token generally accepted as a means of payment

functions of money

medium of exchange; general accepted in return for goods and services

unit of account: agreed-upon measure for stating the prices of goods and services

store of value: a commodity/token that can be held and exchanged later for goods and services

fiat money

money because the law says so

monetary base

sum of coins, Fed notes, and banks reserves at the Fed

m1

currency by individual and businesses, traveler’s checks, and checkable deposits; is money

m2

M1+ saving deposits, small time deposits, money market funds, and other deposits; is not money

reserves

currency in bank’s vaults + balance at Fed’s reserve account