Monetary Policy and Aggregate Demand Curves

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

Nominal Federal Funds Rate

Interest rate banks charge each other for loans.

Real Interest Rate

Nominal interest rate adjusted for inflation.

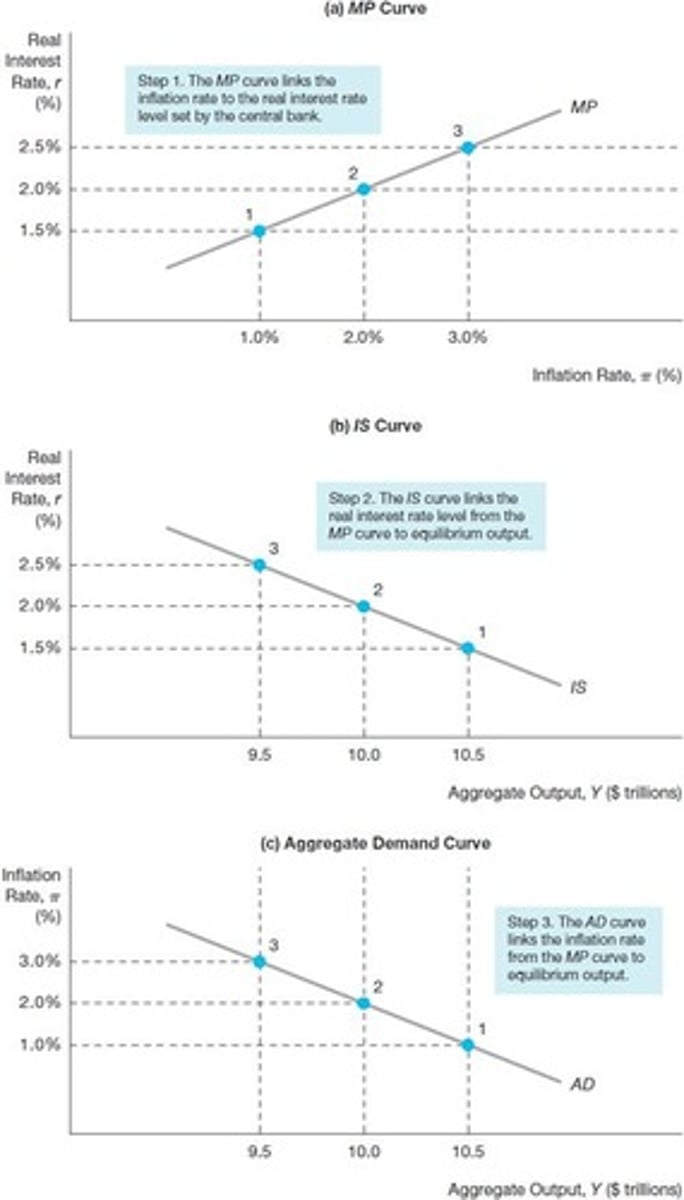

Monetary Policy Curve

Shows real interest rate response to inflation.

Aggregate Demand Curve

Relationship between inflation rate and aggregate demand.

IS Curve

Represents equilibrium in the goods market.

Taylor Principle

Nominal rates must rise more than inflation increases.

Upward Sloping MP Curve

Real interest rates increase with rising inflation.

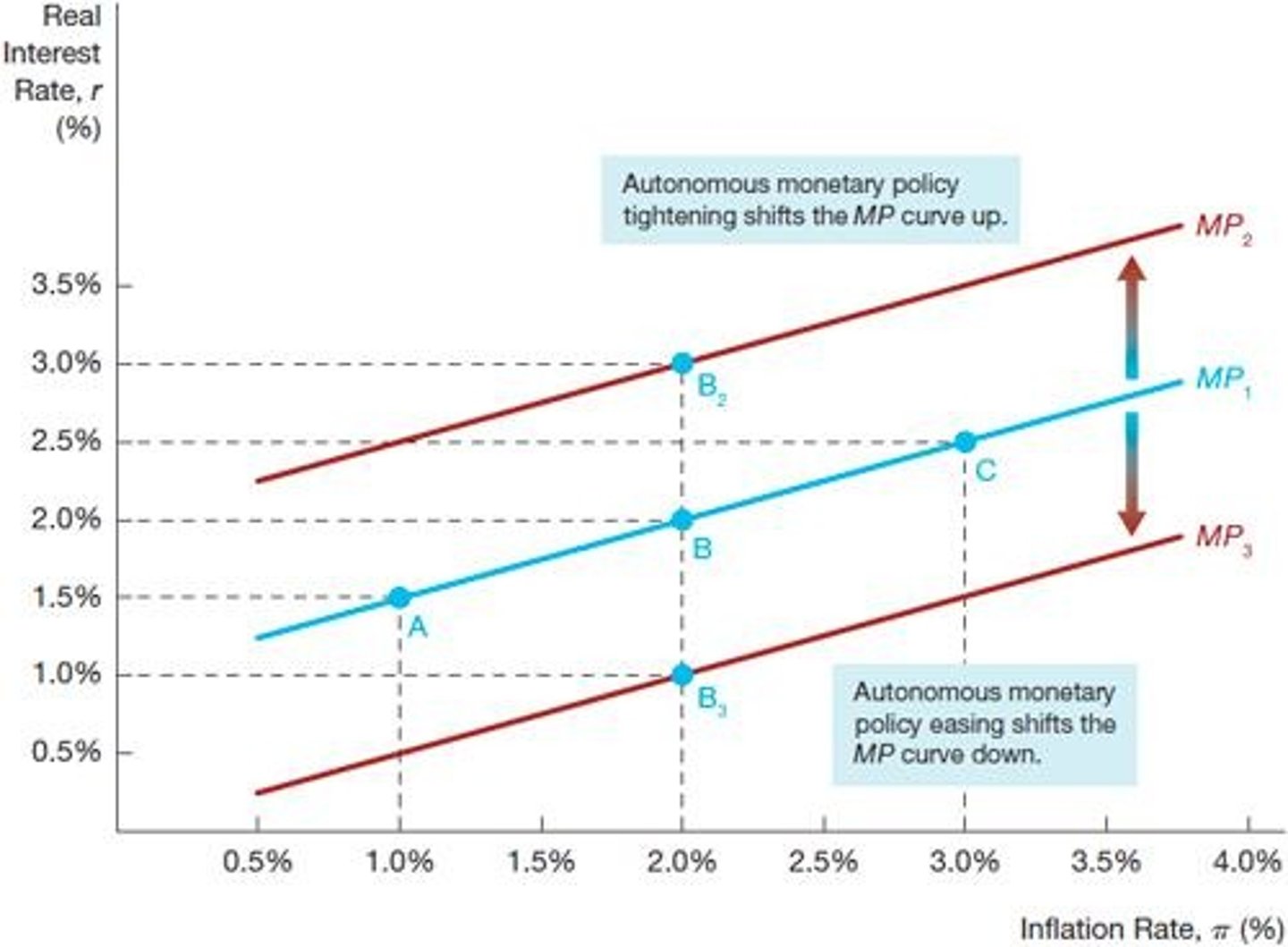

Shifts in MP Curve

Changes in monetary policy affecting interest rates.

Autonomous Tightening

Increases real interest rates to reduce inflation.

Autonomous Easing

Decreases real interest rates to stimulate economy.

Downward Sloping AD Curve

As inflation rises, aggregate output falls.

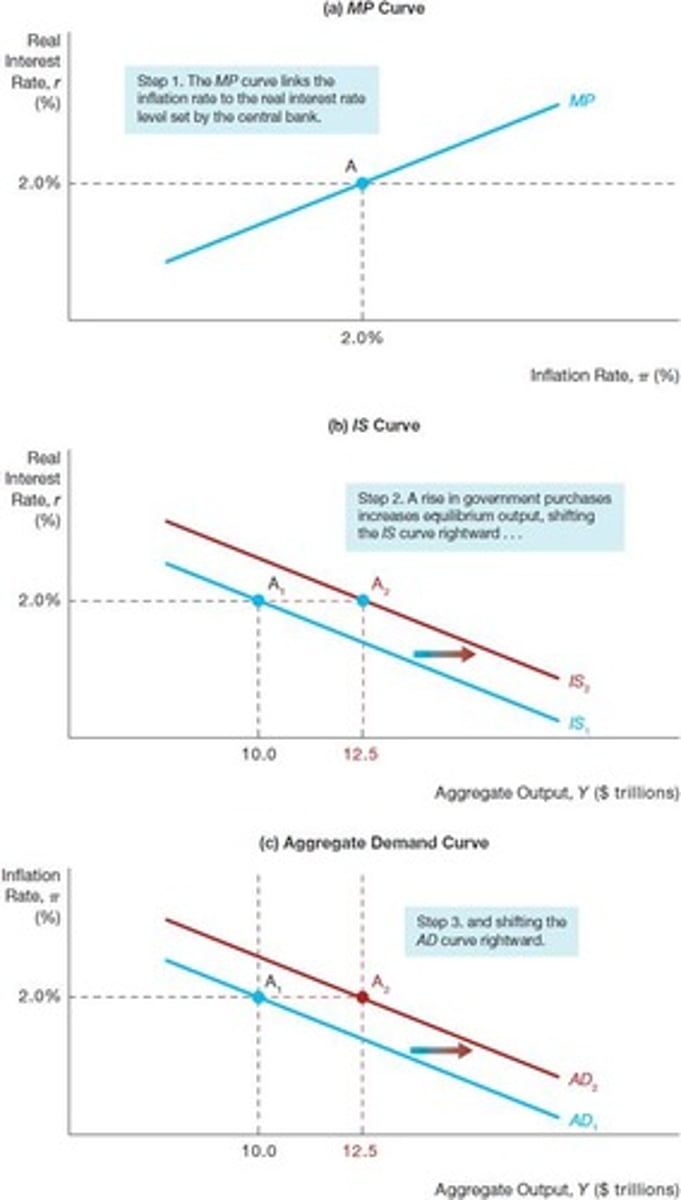

Factors Shifting AD Curve

Changes in consumption, investment, government spending, taxes.

Equilibrium Aggregate Output

Level of output where goods market clears.

Inflation Rate

Percentage increase in price level over time.

Short-run Fluctuations

Temporary changes in output and inflation levels.

Monetary Policy Actions

Decisions by central banks affecting money supply.

Federal Reserve

U.S. central bank responsible for monetary policy.

Automatic Changes

Adjustments in rates based on Taylor principle.

Autonomous Changes

Deliberate policy shifts affecting the MP curve.

Consumption Expenditure

Total spending by households on goods and services.

Investment Spending

Business expenditures on capital goods.

Net Exports

Exports minus imports influencing aggregate demand.