A LEVEL business 3.9 - strategic methods: how to pursue strategies

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

66 Terms

Retrenchment

business decides to significantly cut or scale-back its activities.

Retrenchment might occur when one or more of the following happen to a business:

Reduce output & capacity

Job losses / redundancy programmes

Product / market withdrawal

Disposal of business unit

Scaling back planned capital investment

What Are the Causes of Retrenchment?

normally arises from decisions to change strategic direction, which happens because of one or more of the following:

New leadership (usually a new CEO)

Excessively-high costs and low profitability (or unsustainable losses)

Low ROCE

Excessively high gearing (leading to cash flow problems)

Loss of market share

A failed takeover or merger

Economic downturn

Change of ownership

Implications of Retrenchment for Change Management

involves change for a business

- Small-scale, incremental retrenchment has only limited impact

- Significant retrenchment is often associated with a fundamental reappraisal of the business - and therefore with complex and costly change management

- changed organisation structure = higher stress, new teams, different deporting structures

- new leadership = uncertainty, new priorities, new sense of urgency, previous investment abandoned

- fewer people = loss of morale

Organic (Internal) Growth

Organic growth builds on the business' own capabilities and resources

Organic growth involves strategies such as:

- Developing new product ranges

- Launching existing products directly into new international markets (e.g. exporting)

- Opening new business locations - either in the domestic market or overseas

- Investing in additional production capacity or new technology to allow increased output and sales volumes

examples of businesses that have implemented successful organic growth strategies

Dominos UK, Apple and Costa Coffee.

- dominos = rise in number of stores since 2006-2015

- apple = global sales grown

- costa = costa outlets and stores grown since 2008-2015

Benefits and Drawbacks of Organic Growth

Less risk than external growth (e.g. takeovers)

Can be financed through internal funds (e.g. retained profits)

Builds on a business' strengths (e.g. brands, customers)

Allows the business to grow at a more sensible rate

Drawbacks of Organic Growth

Growth achieved may be dependent on the growth of the overall market

Hard to build market share if business is already a leader

Slow growth - shareholders may prefer more rapid growth

Franchises (if used) can be hard to manage effectively

Integration

When two businesses are brought together through a merger or takeover

types - forward, horizontal, vertical, backwards

Backward vertical integration

This involves acquiring a business operating earlier in the supply chain - e.g. a retailer buys a wholesaler, a brewer buys a hop farm

Conglomerate (vertical) integration

This involves the combination of firms that are involved in unrelated business activities

Forward vertical integration

This involves acquiring a business further up in the supply chain - e.g. a vehicle manufacturer buys a car parts distributor

Benefits of Vertical Integration

securing critical supplies,

lowering costs,

improving quality,

facilitating scheduling and planning,

facilitating investments in specialized assets

greater share profit

greater investment in customer needs

barrier to potential competitors

examples of vertical integration

november 2015 apple bus star wars motion capture company faceshift

november 2015 ikea bus romanian baltic forests to control raw materials

Horizontal Integration

Type of monopoly where a company buys out all of its competition. Ex. Rockefeller

merges or takesover those around them

Vertical Integration

the combination in one company of two or more stages of production normally operated by separate companies.

forwards - shops

backwards - suppliers

Horizontal integration

businesses in the same industry and which operate at the same stage of the production process are combined.

benefits- achieve economies of scale

buying well known brand is cheaper

wide range of products

cost synergies-savings-from the rationalisation of business

examples of horizontal integrations

december 2015- dominos buys german pizza chain for 86m

november 2015 - mariotts hotel mergers with sheraton hotels to create worlds biggest hotel chains

Takeovers

involves one business acquiring control of another business

external growth

Reasons for Undertaking Takeovers

Increase market share

Acquire new skills

Access economies of scale

Secure better distribution

Acquire intangible assets (brands, patents, trade marks)

Spread risks by diversifying

Overcome barriers to entry to target markets

Defend itself against a takeover threat

Enter new segments of an existing market

Eliminate competition

Why Might Takeovers Be Preferred to Organic Growth?

Existing products are in the later stages of their life cycles, making it hard to grow organically

The business (in particularly its management) lacks expertise or resources to develop organically

Speed of growth is a high priority

Competitors enjoy significant advantages that are hard to overcome other than acquiring them!

The Risks of Takeovers

highest risk method of growth.

they consistently show that a large percentage of takeovers destroy value for the shareholders of the acquiring firm

most fail

common drawbacks of takeovers include:

High cost involved - with the takeover price often proving too high

Problems of valuation (see the price too high, above)

Upset customers and suppliers, usually as a result of the disruption involved

Problems of integration (change management), including resistance from employees

Incompatibility of management styles, structures and culture

Questionable motives

Why Takeovers Fail

Price paid for takeover was too high (over-estimate of synergies)

Lack of decisive change management in the early stages

The takeover was mishandled

Cultural incompatibility between the two businesses

Poor communication, particularly with management, employees and other stakeholders of the acquired business

Loss of key personnel & customers post acquisition

Competitors take the opportunity to gain market share whilst the takeover target is being integrated

Synergy

concept associated with external growth. Synergy happens when the value of two businesses brought together is higher than the sum of the value of the two

1+1 = more than 2

two main kinds of synergy:

Cost synergy: where cost savings are achieved as a result of external growth

Revenue synergy: where additional revenues are achieved as a result of external growth

Cost Synergies

When two businesses are combined there is often significant scope for achieving cost savings. These might include:

Eliminating duplicated functions & services (e.g. combining the two accounting departments)

Getting better deals from suppliers - which might be possible if combining two businesses gives them improved bargaining power

Higher productivity & efficiency from shared assets: can capacity utilisation of the combined businesses be improved, perhaps by closing down spare capacity?

Example of successful cost synergies:

Back in 2004, investors and analysts were doubtful that Santander would be able to achieve its plan of stripping £300 million of costs from Abbey National which it bought for £9.6bn. Santander delivered the £300 million of cost synergies a year ahead of schedule.

Revenue Synergies

Potential revenue synergies include:

Marketing and selling complementary products

Cross-selling into a new customer base

Sharing distribution channels

Access to new markets (e.g. through existing expertise of the takeover target)

Reduced competition

The Crucial Role of Synergy in Takeovers and Mergers

The primary objective of any takeover is to create value for shareholders that exceeds the cost of the acquisition

Synergies represent the extra value that can be created from the takeover

how synergy works - look at the example

For example, consider a business valued at £10 million by the market (e.g. from the market capitalisation on the stock market).

A buyer comes along and, after negotiation and due diligence, agrees to pay £13 million to complete the takeover. The buyer has paid a bid premium of 30% (or £3 million) to complete the takeover.

The shareholders of the target business are happy. But the shareholders of the buyer business will need to be convinced that the price was worth paying. They have had to pay £3 million over the apparent value of the business to achieve the takeover.

How can the bid premium be justified? Only if the takeover achieves synergies worth at least £3 million in value terms (e.g. the NPV of future synergies).

Mergers

two previously separate firms which is achieved by forming a completely new business

Some Examples of Mergers

2010: British Airways and Iberia merge to form IAG

2015: Paddy Power and Betfair merge to form Paddy Power Betfair

2015: H.J. Heinz Company & Kraft Foods Group merge to form The Kraft Heinz Company

Joint Ventures

separate business entity created by two or more parties, involving shared ownership

different from takeovers and mergers in that the risks and returns of the business formed as the joint venture are shared by the parties involved. Usually this is a 50:50 share

EXAMPLE uber and volvo 350 million dollars voint together to create driverless cars/taxis

The parties involved in a joint venture are usually looking to benefit from complementary strengths and resources brought to the venture

Potential Benefits of Using Joint Ventures as a Method of Growth

JV partners benefit from each other's expertise and resources (e.g. market knowledge, customer base, distribution channels, R&D expertise)

Each JV partner might have the option to acquire in the future the JV business based on agreed terms if it proves successful

Reduces the risk of a growth strategy - particularly if it involves entering a new market or diversification

Potential Drawbacks of Using Joint Ventures as a Method of Growth

Risk of a clash of organisational cultures - particularly in terms of management style

The objectives of each JV partner may change, leading to a conflict of objectives with the other

In practice, there turns out to be an imbalance in levels of expertise, investment or assets brought into the venture by the different partners

Strategies for Expanding into International Markets - Selling into international markets is increasingly attractive for UK businesses. For example because of:

Stronger economic growth in emerging economies such as China, India, Brazil and Russia (BRICs) and Malaysia, Indonesia, Nigeria & Turkey (MINT)

Market saturation and maturity (slow or declining sales) in domestic markets

Easier to reach international customers using e-commerce

Greater government support for businesses wishing to expand overseas

The main methods of investing in international markets are:

Exporting direct to international customers - The UK business takes orders from international customers and ships them to the customer destination

Selling via overseas agents or distributors - A distribution or agency contract is made with one or more intermediaries

Distributors & agents may buy stock to service local demand

The customer is owned by the distributor or agent

Opening an operation overseas - Involves physically setting up one or more business locations in the target markets

Initially may just be a sales office - potentially leading onto production facilities (depends on product)

Joint venture or buying a business overseas - The business acquires or invests in an existing business that operates in the target market

business looking at international expansion needs to consider some specific risk factors:

Cultural differences: a business needs to understand local cultural influences in order to sell its products effectively. For example, a product may be viewed as a basic commodity at home, but not in the target overseas market. The sales and marketing approach will need to reflect this.

Language issues: although the common business language worldwide is now English, there could still be language issues. Can the business market its product effectively in the local language? Will it have access to professional translators and marketing agencies?

Legislation: legislation varies widely in overseas markets and will affect how to sell into them. A business must make sure it adheres to local laws. It will also need to consider how to find and select partners in overseas countries, as well as how to investigate the freight and communications options available

Exporting direct to international customers - adv

Uses existing systems - e.g. e-commerce

Online promotion makes this cost-effective

Can choose which orders to accept

Direct customer relationship established

Entire profit margin remains with the business

Can choose basis of payment - e.g. terms, currency, delivery options etc

Exporting direct to international customers - disadv

Potentially bureaucratic

No direct physical contact with customer

Risk of non-payment

Customer service processes may need to be extended (e.g. after-sales care in foreign languages)

Selling via overseas agents or distributors - adv

Agent of distributor should have specialist market knowledge and existing customers

Fewer transactions to handle

Can be cost effective - commission or distributor margin is a variable cost, not fixed

Selling via overseas agents or distributors - disadv

Loss of profit margin

Unlikely to be an exclusive arrangement - question mark over agent and distributor commitment & effort

Harder to manage quality of customer service

Agent / distributor keeps the customer relationship

Opening an operation overseas - adv

Local contact with customers & suppliers

Quickly gain detailed insights into market needs

Direct control over quality and customer service

Avoids tariff barriers

Opening an operation overseas - disadv

Significant cost & investment of management time

Need to understand and comply with local legal and tax issues

Higher risk

Joint venture or buying a business overseas - adv

Popular way of entering emerging markets

Reduced risk - shared with joint venture partner

Buying into existing expertise and market presence

Joint venture or buying a business overseas - disadv

Joint ventures often go wrong - difficult to exit too

Risk of buying the wrong business or paying too much for the business

Competitor response may be strong

Innovation can come in many forms:

Improving or replacing business processes to increase efficiency and productivity, or to enable the business to extend the range or quality of existing products and/or services

Developing entirely new and improved products and services - often to meet rapidly changing customer or consumer demands or needs

Adding value to existing products, services or markets to differentiate the business from its competitors and increase the perceived value to the customers and markets

Intrapreneurship

involves people within a business creating or discovering new business opportunities

examples of products that were the result of intrapreneurial activity are:

Gmail (Google) = Employees at Google are allowed time for personal projects. Some of Google's best projects come out of their 20 percent time policy. One of these was Gmail, launched on 1 April 2004

PlayStation (Sony) = Ken Kutaragi, a relatively junior Sony Employee, spent hours tinkering with his daughters Nintendo to make it more powerful and user friendly. What came from his work turned into one of the world's most recognisable brands - the Sony PlayStation

Potential business benefits of intrapreneurship

In addition to identifying and executing new business opportunities, intrapreneurs can help drive innovation within businesses

What can a business do to encourage intrapreneurship?

Look out for - and encourage - entrepreneurial activity

Give employees ownership of projects

Make risk-taking and failure acceptable

Train employees in innovation

Give employees time outside the confines of their job description

Encourage networking & collaboration

Reward entrepreneurial thinking and activity

Some reasons why large businesses are not entrepreneurial

Complacency / arrogance

Bureaucracy (stifling initiative)

Reward systems do not provide an incentive to innovate

Short-termism (discouraging long-term thinking or risk-taking)

reason for operating overseas - Cost reduction

ncreasingly skilled labour is available at lower cost, which encourages businesses looking to reduce their cost base without compromising customer service.

To put the advantage of low-wage economies into perspective, the hourly cost of labour in India and China is around 5% of the cost of equivalent labour hours in economies like the UK and Germany. A business that has a labour-intensive production process is bound to be attracted by the potential cost savings

A decision to operate overseas raises several more issues for a business:

Exchange rates - Operating in another country almost certainly exposes a business to the effects of fluctuating exchange rates.

Trade barriers - locating a business to avoid trade barriers is certainly important for businesses looking to compete effectively. Common types of trade barrier include quotas, tariffs on imported goods and government subsidies for domestic industries.

The European Union is an example of a free trade area

Political stability - Most developed economies enjoy relative political stability - i.e. there are no sudden or dramatic changes in the political landscape which impact on businesses.

Offshoring

relocation of business activities from the home country to a different international location.

Offshoring has traditionally been associated with the relocation of manufacturing activities from a domestic economy overseas

The Difference between Offshoring and Outsourcing

Offshoring is about WHERE the work is done.

Outsourcing is about WHO does the work.

offshoring involves changing the international location of WHERE work is done for or by a business.

Outsourcing involves changing WHO does work for a business - away from the business itself to an external supplier.

Key Reasons for Offshoring

To access lower manufacturing costs (particularly in emerging markets which enjoy the advantage of lower labour costs)

To access potentially better skilled & higher quality supply

To makes use of existing capacity overseas

To take advantage of free trade areas and avoid protectionism

To make it easier to supply target international markets (where it is important to be located in, or near to, those markets)

Potential Drawbacks to Offshoring

Longer lead times for supply & risks of poorer quality

Implications for CSR (harder to control aspects of operating long distances away from the home country)

Additional management costs (time, travel)

Impact of exchange rates (potentially significant)

Communication: language & time zones

Reshoring

involves a business returning production or operations to the host country that had previously been moved to a different international location.

Reasons for Reshoring

Greater certainty around delivery times (including shorter delivery times)

Minimising risk of supply chain disruptions

Reducing the complexity of the supply chain

Making it easier to collaborate with home-based suppliers

Getting greater certainty about the quality of inputs and components

Recognising that the cost advantage of producing or sourcing overseas is not as significant as it used to be (particularly in China where unit labour costs have risen significantly in recent years).

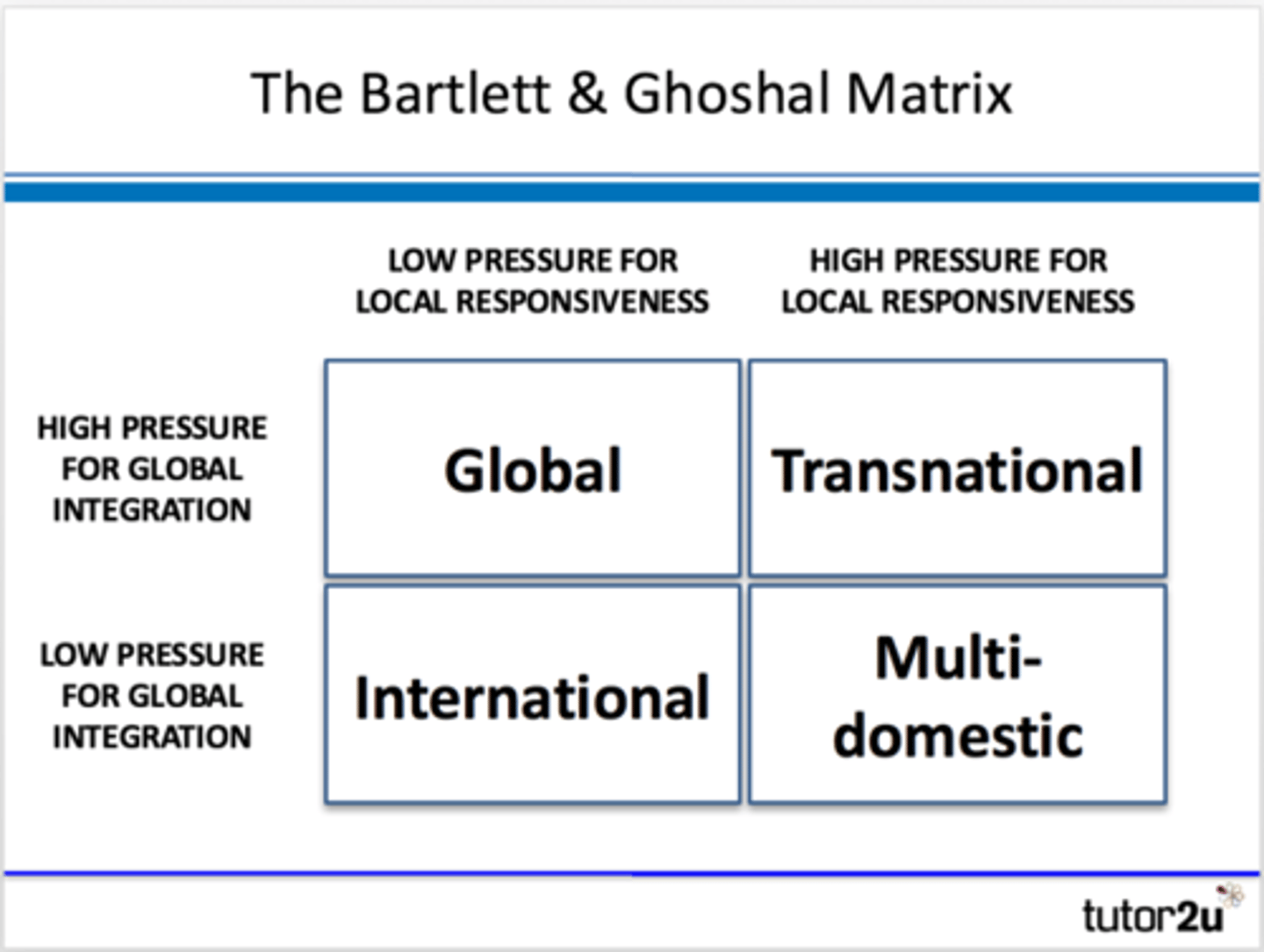

Bartlett & Ghoshal Model of International Strategy

strategic options for businesses wanting to manage their international operations based on two pressures: local responsiveness & global integration.

Force for local responsiveness = Do customers in each country expect the product to be adapted to meet local requirements

Force for global integration = How important is standardisation of the product in order to operate efficiently (e.g. economies of scale)

barlett and ghosal - global strategy

pressure for local responsivness = low

pressure for global integration = high

key features = highly centralised

focus on efficiency

little sharing of expertise

standardised products

examples = cat and pfizer

global - standardised product sold around the world

barlett and ghosal - transnational strategy

pressure for local rsponisvness = high

pressure for global integration = high

key features = complex to achieve

aim to maximise local responsivness but also gain benefits from global integration

wide sharing of expertise

examples = unilever and starbucks

transnational - highly responsive to local markets but business shares expertise and knowledge

barlett and ghosal - international strategy

pressure for local response = low

pressure for global integration = low

key features = aims to achieve efficiency by focusing on domestic activities

international operations are managed centrally

relitavley little adaption of product to local needs

examples = mcdonalds

ups

international strategy - products produced for domestic markets some alterations to fit into the international markets

barlett and ghosal - multi domestic strategy

pressure for local responsivness = high

pressure for global intergration = low

key features = aims to maximise benefits of meeting local markets through extensive customisation

decision making decentralised

local businesses treated as seperate businesses

strategies for each country

examples = nestle and mtv

multi domestic - products and services tailored for local markets