ap macro terms to know (in progress)

1/75

Earn XP

Description and Tags

answer with term

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

76 Terms

4 factors of production

land, labor, capital, entrepreneurship

Land

one of the four factors of production, any natural resources on the land

Labor

one of the four factors of production, the effort of people

Capital

One of the four factors of products, has two types — human and physical

Human Capital

knowledge/skills gained from education and training

Physical Capital

machines, factories, tools, bridges, office buildings, etc.

Entrepreneurship

One of the four factors of production, the organizing of resources for production

Trade-off

all of the alternatives you are giving up when making a decision

Opportunity cost

the next best thing (most desirable alternative)

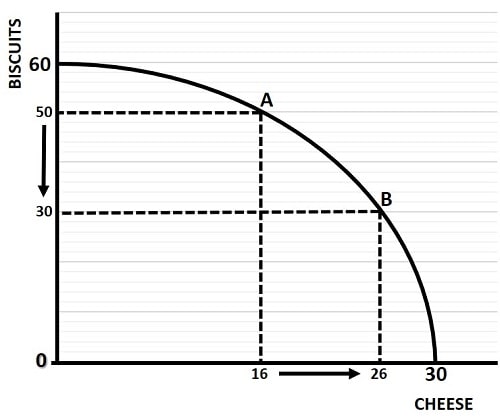

Production Possibilities Curve (PPC)

also called the production possibilities frontier (PPF); a model that shows ways that an economy can use its scarce resources

Absolute Advantage

one producer can produce more of a good than another producer given the same resources

Comparative Advantage

one producer can produce at a lower opportunity cost than another producer

Law of Demand

The higher the price for a good or service, all else equal, people will demand a lesser quantity

Factors that shift the demand curve

Tastes/preferences, change in income, change in the number of consumers, change in expectations, change in price of related goods or services

Normal good

Tise in income leads to an increase in demand

Inferior good

Rise in income leads to a decrease in demand

Law of Supply

There is a positive (direct) relationship between price and quantity supplied

Factors that shift the supply curve

Price or availability of inputs, number of sellers, technology, government action, expectations of future profit

Price ceiling

maximum price that sellers are allowed to charge; governments might be motivated to set this for basic necessities like gas, rent, or food. If this is below equilibrium price, there will be a shortage.

Price floor

minimum price that sellers must charge; governments may be motivated to set this to keep a good from going out of business. If this is above the equilibrium price, then there will be a surplus.

government spending

Government injects money into the circular flow in the from of _____.

taxes

Government causes a leak in the circular flow because of ____.

Government transfer payments

things like unemployment insurance, welfare, grants, subsidies, etc.

Gross Domestic Product (GDP)

the total value of all final goods and services produced within a country’s borders during a given time period (usually one year).

Not counted in GDP

Intermediate goods, used goods, bartering/trading, goods produced in another country, financial transactions, household production, non-market transactions, work without pay

GDP = C + I + G + NX

Equation for GSP in which C stands for consumer goods, I stands for investment spending, G stands for government spending, and NX stands for net exports

investment spending

spending by businesses

net exports

exports - imports

Expenditures approach

one method to calculating GDP in which the final value of each good/service in the economy are added up — most common + easiest to calculate

income approach

one method to calculating GDP by adding up all the income from the factors of production

value-added approach

a method to calculating GDP in which all contributions on the way to final production are added together

GDP per capita

average GDP per person; limited as a measure of overall well-being/productivity because negative things can contribute positively to GDP, good things aren’t counted in GDP at all (volunteering, etc), working within the home, trading …

unemployed

people, 16 and older, who do not have a job but are willing/able to work

Labor force

unemployed + employed

Who doesn’t count as a part of the labor force?

kids, retired persons, disabled persons who are unable to work, students, stay-at-home parents, institutionalized (prison or mental) persons, discouraged workers

labor force participation rate

(labor force size / population 16 or older) *100

Frictional unemployment

new workers entering the work force, people leaving jobs voluntarily to look for a new job, relatively normal in an economy

cyclical unemployment

unemployment due to business cycle (recession, depression, etc.)

structural unemployment

workers lack skills for the current job market, more people seeking jobs than positions available

natural unemployment

frictional + structural

actual unemployment

natural + cyclical

aggregate price level

number that attempts to measure general overall prices in an economy

market basket

hypothetical set of consumer purchases of goods/services

price index

measure of overall price level compared to some base year

consumer price index (CPI)

measure of cost for a market basket of typical urban American family; to calculate, cost of market basket in a given year divided by the cost of market basket in base year * 100.

inflation rate

[(price index in year 2 - price index in year 1)/price index in year 1] × 100

100

The CPI in the base year will always be ___.

inflation

general rise in prices; it takes more money to buy the same stuff than it used to — your dollars lose value over time when prices rise.

disinflation

rise in prices, but at a slower rate than previously

deflation

fall in prices

Borrowers; lenders

In general, ____ are helped by unexpected inflation and ____ are hurt by unexpected inflation.

Menu Costs

costs that are incurred as a result of inflation, such as restaurants having to reprint menus due to changing prices, stores having to change price tags when prices change, or changing signs/advertising due to price changes.

Shoe-Leather Costs

increased costs of transactions due to rising prices (ex. having to make additional trips to the bank).

Unit-of-Account Costs

costs that arise from the way inflation makes money a less reliable unit of measurement

Nominal interest rate

real interest rate + anticipated inflation

Nominal GDP

measured in current year prices

Real GDP

measured in constant, unchanging dollars; adjusted for inflation.

GDP Deflator

nominal gdp/real gdp *100

6 month

A recession is a ____ period of decline in Real GDP.

Aggregate Demand (AD)

all of the goods and services (real GDP) that buyers are willing and able to purchase at different price levels.

along

A change in the price level causes a movement ____ the AD curve.

Marginal Propensity to Consume (MPC)

change in consumption/change in disposable income

Marginal Propensity to Save (MPS)

change in savings/change in disposable income

1

MPS + MPC = _

Spending Multiplier

1/MPS

Aggregate Supply (AS)

Amounts of goods/services (real GDP) that firms will produce in an economy at different price levels

Short-run aggregate supply

wages and resource prices are “sticky” and will not change as price levels change.

long-run aggregate supply

wages and resource prices are “flexible” and will change as price levels change.

price level

A change in the ___ causes movement along the SRAS curve.

Shifters of the AS curve

RAP: Resources, Action by the government, Productivity

Shifters of the LRAS

change in resource quantity/quality or change in technology

Full Employment

long-run equilibrium where the economy is producing at its potential output

inflationary gap

above or beyond full employment, aka positive output gap

recessionary gap

below or less than full employment, aka negative output gap

stagflation

a recessionary gap with inflation (rising prices) and lower rGDP

right; inflationary; prices and wages; right

If there is an increase in consumer spending, in the short-run AD will shift to the ___. There will be an ____ gap. In the long-run ____ will adjust and AS will shift to the ___ to get back to equilibrium.