1.3.1 + 1.3.2 - types of market failure + externalities

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Market failure

Occurs when the allocation of resources in a free market results in an inefficient or socially undesirable outcome

→ indicates that the market, left to its own devices, fails to achieve an optimal allocation of g+s

What does market failure often lead to?

Underproduction, overproduction, misallocation of resources

How many types of market failure are there?

3

Externalities

Unintended side effects of economic activities that affect third parties who are not part of the transaction

can be positive (benefits)/negative (costs)

How do externalities cause market failure?

They disrupt the efficient functioning of markets

This is because the prices + quantities determined by supply + demand in the market do not account for these external costs or benefits resulting in either overproduction or underproduction of goods

Positive externalities of consumption

Unintended benefits experienced by third parties as a result of economic consumption activities, leading to increased overall welfare.

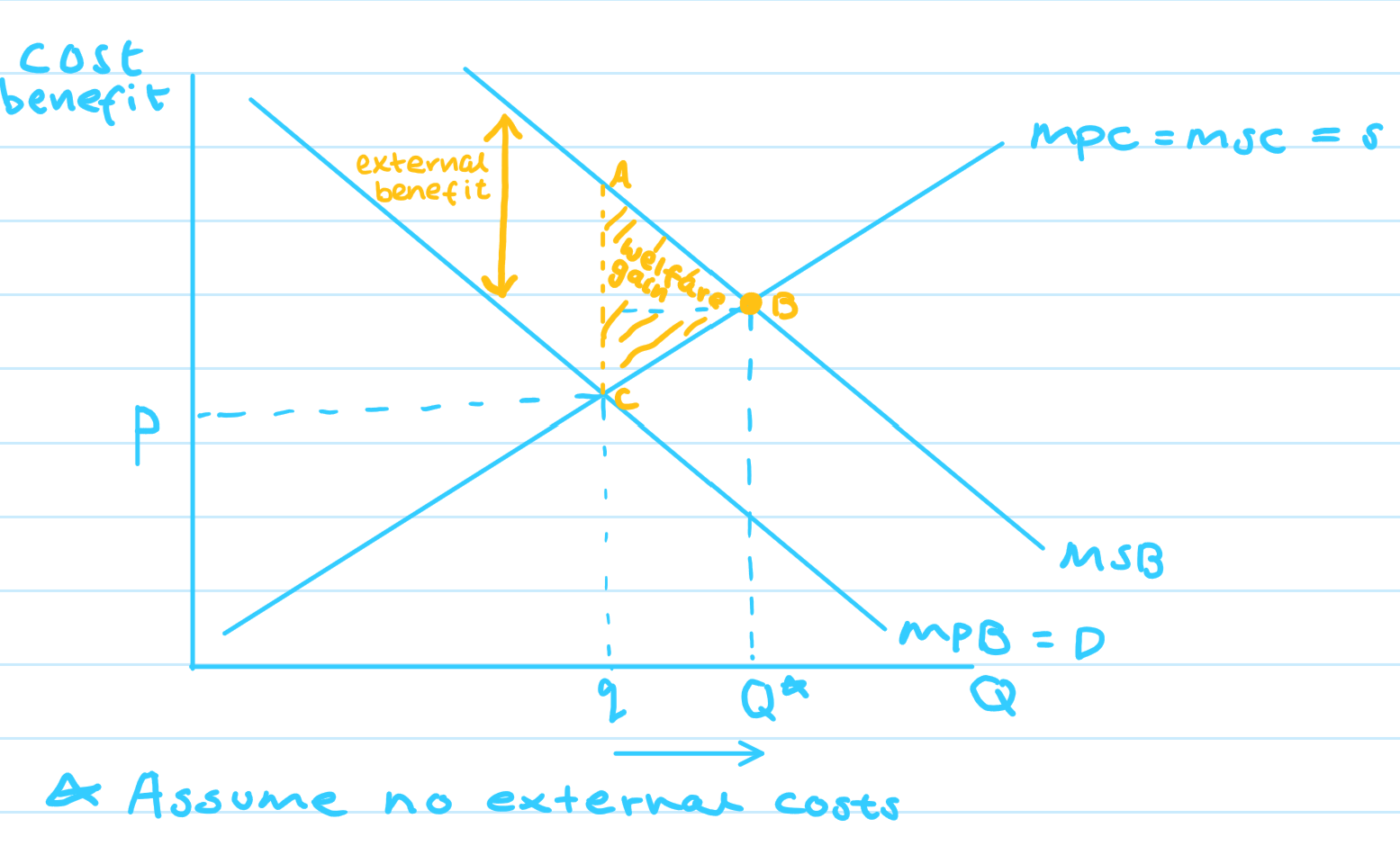

What does the positive externalities of consumption diagram look like?

There is underconsumption + underproduction of what we want in society → leads to misallocation of resources

By not producing these extra benefits → society is losing out on potential extra social benefit

Social benefit > private benefit

Negative externalities of production

Occurs when the production of goods or services imposes costs on third parties not involved in the transaction, leading to overproduction and inefficient resource allocation.

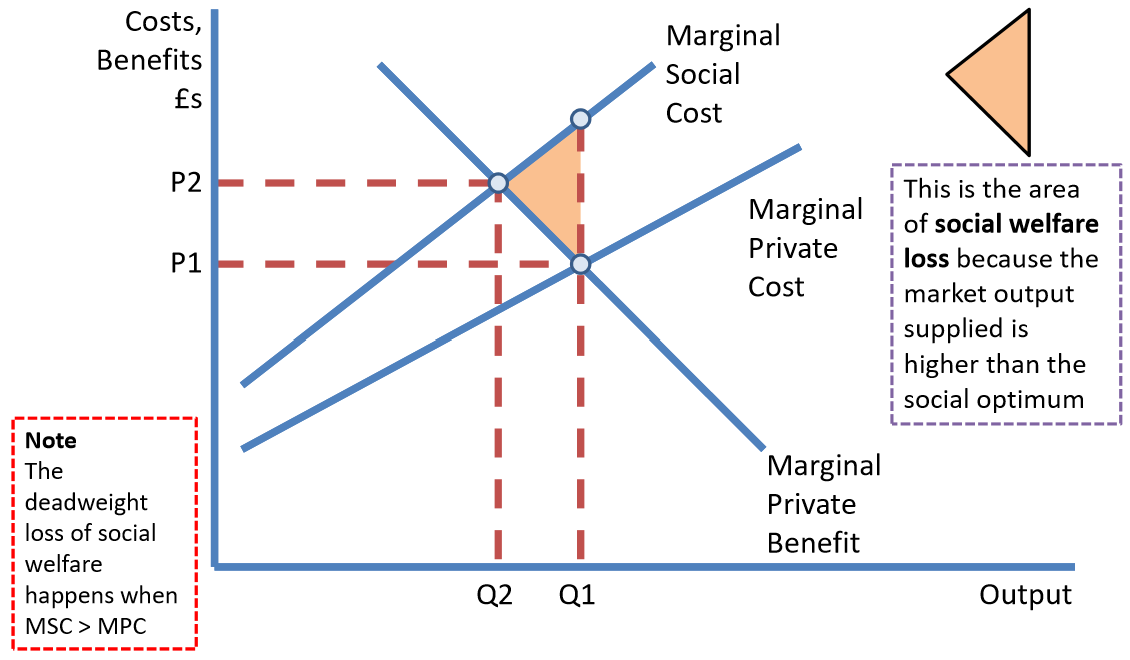

What does the negative externalities of production diagram look like?

There is overproduction + overconsumption → leads to welfare loss/misallocation of resources

Firms are ignoring the full social cost because of self-interest. They are only concerned about private cost. As a result, market allocates resources at Q1 x P1 - which is the private optimum, instead of Q2 x P2 - which is the social optimum

At P1 - price is too low, encourages more consumption

Give an example of a negative externality + the impact

Air pollution from factories imposes health costs on nearby residents, even if they do not use the factory’s products

Give an example of a positive externality + the impact

Vaccination not only benefits the vaccinated individual but also reduces spread of diseases in community, benefitting others (herd immunity)

Under-provision of public goods

Non-excludable + non-rivalrous → no one can be excluded from their benefits, + consumption by one doesn’t reduce availability to others

Why is there a tendency for public goods to be underprovided by the private market?

Because individuals cannot be excluded from using public goods, they often do not pay for them, leading to insufficient incentive for private firms to produce these goods

Give some examples of public goods

National defence, public parks, clean air, street lighting

e.g. national defence: people within a country benefit from national security regardless of their contributions

Information gaps (asymmetric information)

Info gaps arise when one party in a transaction has more or better information than the other party

→ can lead to adverse selection + moral hazard problems

Example of info gap - adverse selection

In the used car market, sellers may have more information about the car's condition than buyers. Buyers may be cautious because they fear purchasing a lemon.

Example of info gap - moral hazard

Insurance markets can suffer from moral hazard. When individuals have insurance coverage, they may take on riskier behaviours because they are protected from the full consequences of their actions.

Private costs

The costs incurred by producers/consumers directly involved in a transaction or economic activity

These costs do not account for externalities affecting third parties

Private costs example

In the production of a car, private costs include the cost of labour, raw materials and manufacturing equipment as well as wages paid to workers and rental costs for factory space.

External costs (negative externalities)

Costs imposed on third parties who are not part of the transaction or activity. These costs are not considered by the parties directly involved + are often detrimental to society

This includes pollution, noise, or resource depletion that negatively affects others.

External costs example

Air pollution caused by a factory’s emissions imposes external costs on nearby residents, leading to health problems + environmental damage

Social costs

The total costs of an economic activity, including both private costs + external costs

Reflect the overall impact of an activity on society, accounting for both direct + indirect costs

SC = PC + EC

Social costs example

If a factory’s production generates pollution, social costs include not only the factory’s production costs but also the costs of healthcare for affected residents + environmental clean-up

Private benefits

The benefits received by producers or consumers directly involved in a transaction or economic activity

These benefits are enjoyed by the parties directly engaged in the production or consumption of a good/service + do not account for externalities

Private benefits example

Private benefits of education include improved job prospects + higher earning potential for individuals who receive education

External benefits (positive externalities)

The benefits received by third parties who are not part of the transaction or activity

These benefits are often beneficial to society but are not considered by the parties directly involved

External benefits example

Vaccination not only benefits the vaccinated individual by preventing disease but also benefits the community by reducing the spread of illness, leading to herd immunity

Social benefits

The total benefits of an economic activity, including both private benefits + external benefits

Reflect the overall positive impact of an activity on society, accounting for both direct + indirect benefits

SB = PB + EB

Social benefits example

If a company invests in employee training, social benefits include not only increased productivity + job satisfaction for employees (private benefits) but also higher workforce skills that benefit the broader economy (external benefits).

Impact on economic agents of negative externalities

Producers may not fully account for external costs, leading to overproduction of goods with negative externalities

Consumers may not fully consider external costs, leading to overconsumption

Overall, negative externalities can result in market inefficiencies + reduced social welfare

Impact on economic agents of positive externalities

Producers may not capture all external benefits, leading to underproduction of goods with positive externalities

Consumers may not fully appreciate external benefits, leading to underconsumption

Overall, positive externalities can result in underallocation of resources to beneficial activities

Government intervention

In the form of regulations, taxes, or subsidies aims to correct market failures + promote efficiency by addressing externalities + ensuring resources are allocated appropriately

Impact on economic agents of gov intervention

Taxes on negative externalities (e.g. carbon taxes) internalise external costs, reducing overproduction

Subsidies on positive externalities (e.g. education subsidies) encourage greater provision of beneficial g+s

Regulations can also be used to limit external costs (e.g. emissions standards) or promote external benefits (e.g. safety regulations)