World of Money - End of Term Test

1/74

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

75 Terms

Investment

An asset purchased to build wealth and save money with intention of producing capital gain. e.g. bonds, shares, property, cash and fixed interest

Capital gain

Occurs when the sale price for an asset is greater than the initial cost.

ASX

The Australian Security Exchange provides services to issuers of capital, including the security holding statements and other shareholder and sub-register services. Some sectors it includes are consumer discretionary and staples.

Marketplace

The facilitated exchange of goods (shares, etc.) between buyer and seller

Shares

Singular unit of a company that can be bought giving a small percent of ownership in the company

Bond

Investor lends money to company for regular interest payments

Fixed Interest

Set rate of interest for an amount of time with the principle repaid

Shareholder

A person or company that has bought a share in a companies stock

Capital Gains Tax

Profit or gain from an asset giving you income that can be taxed yearly

Dividend

An investors share of company’s profit that happens biannually.

Interest

a percent added to an amount of money you owe that builds

Risk

The level of uncertainty associated with a particular investment

Returns

The amount of money received from an investment each year. Income or capital growth expressed as a percentage

Risk vs Reward

The greater the risk taken, the greater the reward

Equities

The value of an investment subtracting the amount of money owing on the investment

International Stocks

Stocks in companies that are listed on exchanges outside of the country you're in. e.g vanguard

Australian Stock Example

Myer, Coles, Woolworths

Stock/Securities

Share or ownership in a company

Money

Has value, means of payment, unit of measure

Commodity

Raw materials used to manufacture consumer products

Property/Realestate

Can be lucrative but can have many risks including bad locations, negative cash flows, high vacancies, and problematic tenants

Risk asset order

Cash, Bonds, Property, Australian Equities, International Equities

Diversifying

Buying different investments to reduce the volatility.

Cryptocurrency

A digital currency that’s a medium of exchange through a computer network. It’s not reliant on any central authority, such as a government or bank, to uphold or maintain it.

Floating Stock

Number of available stocks a company has to trade in an open market

Impacts on a Stocks value

Pandemics, Economy, GDP, Customer Spending

Inflation/Inflation Impact the Economy

The rise of goods and services over a period of time due to the RBA. Prices rise and consumer spending slows; less money being moved around the economy

Index

A group of securities or other financial instruments that measures the performance of a specific market, asset class, market sector, or investment strategy.

ROI [return on investment]

Measures the profitability of a monetary investment

Bull and Bear Markets

A bull market occurs when securities are on the rise, while a bear market occurs when securities fall for a sustained period of time.

Visualisation

The act or process of interpreting in visual terms or of putting into visible form

S.M.A.R.T

Specific, Measurable, Attainable, Relevant, Time-bound.

Skills for Success

Adaptability, Time management, Teamwork, Ethics, Critical thinking and Goal Setting

Forms of Money

Coins/Banknotes, Deposits/Digital and electronic

Role of Money

Money makes trade possible and trade makes society prosperous

RBA

Reserve Bank of Australia; produces money and increases or decreases inflation.

Economy

The system for deciding how scarce resources are used so that goods and services can be produced and consumed

Producers

Corporations/Groups/People that creates goods/services for people to buy.

Consumers

People who buy goods/services to satisfy their needs and wants

Goods

A tangible item you’re buying

Service

A experience or act another person or group completes for a consumer in return for money

Income

Money earned from working and the returns on investments

Sources of Income

Penalty Rate, Overtime, Wages, Salary, Rent, Royalties, Commission, Dividend, Flexitime, Interest

Penalty Rate

A rate of pay that is applied based on when the work is performed rather than how many hours are worked. A penalty rate often applies to weekend work.

Overtime

The amount of time worked in excess of the

standard working hours.

Wages

Income received for work done based on the hours worked each week.

Salary

Income received each year for a job, usually irrespective of the number of hours worked.

Rent

Income received for the use of a property.

Royalties

Income from the sale of a piece of work, such as a song, a book or an invention.

Commission

Income from acting as an agent, or go- between, between buyers and sellers.

Flexitime

A system that provides salaried workers with flexible working hours.

Net Wage

Wage after taxes

Gross Wage

Wage before taxes

Profit

The excess of revenue over expenses of running a business.

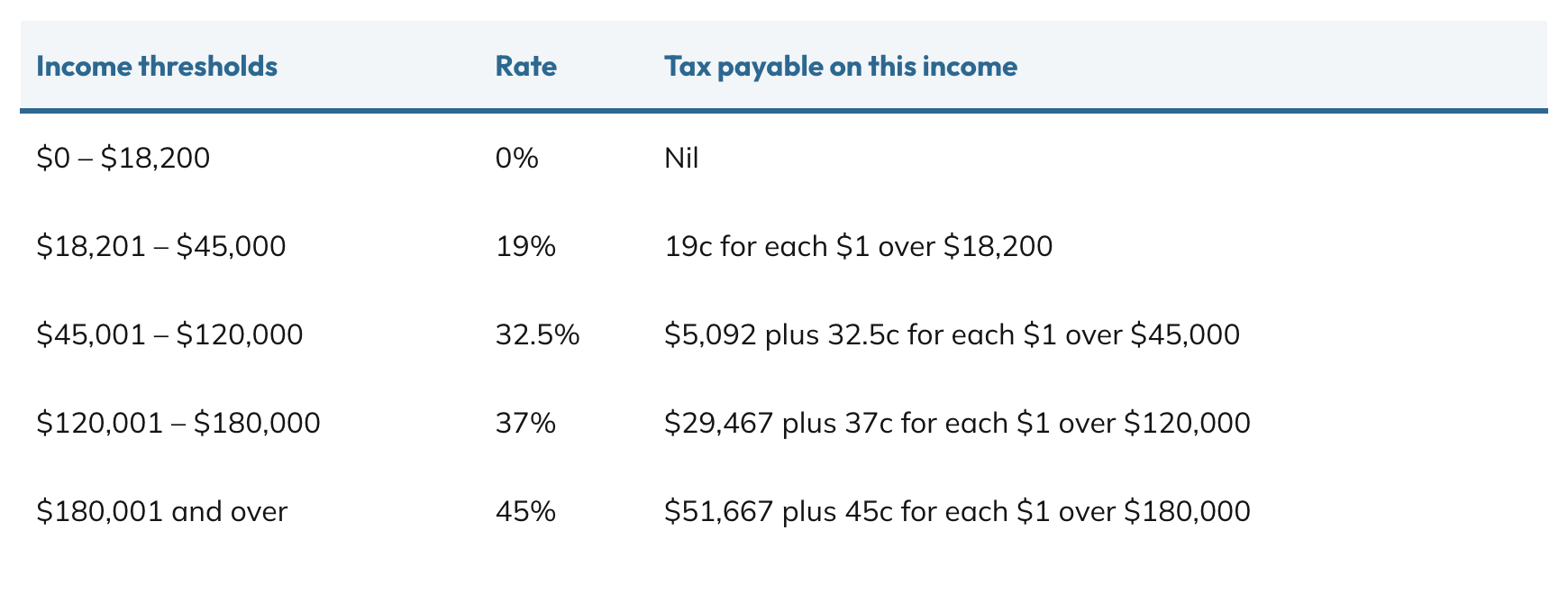

Australia’s Tax System

Australia has a progressive system where the higher the pay bracket the higher the tax you have to pay.

Tax

A mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

5 Taxes in Australia

Individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes.

Levels of Tax

GST

Goods and Services Tax

Income tax

A government levy on the earnings of individuals and businesses.

TFN

Tax file number; individuals use this to pay taxes

Budget

They help people control or see how much they are going to spend on things.

Fixed cost

Price doesn’t change

Variable cost

Price may change

Big 4 Banks

NAB, CBA, Westpac, ANZ

ATM

Automated Teller Machine

Cash

No surcharge for using but many places are stopping using it.

Credit

Surcharge when used but more places offer it.

Surplus

Overflow of money

Deficit

Not enough money

Mortgage

Loan that funds the purchase of a property

Sole Trader

Individual: unlimited liability, taxable income, earns all profit, easy to set up

Partnerships

2+ people: unlimited liability, taxable income, easy to set up, shared workload

Private Company

Separate entity with Pty or Ltd: expensive, shared profits, limited liability, company tax return

Not for Profit

Not working for a profit or gain: no clear guidelines, not closely monitored, inexpensive, may be exempt from tax