Econ flashcards

1/98

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

99 Terms

positive statement

easy to prove, factual

normative statement

no right answer, often political

self interest

Economics assumes humans operate in their own self interest

invisible hand

our self interested acts typically result in socially constructed transitions

opportunopprotunityty cost

the loss of potential gain from other alternatives when one alternative chosen

rational choice

mb > bc - do; mb <mc - dont; mb=mc - indifferent, do

sunk cost

a cost paid you cannot get back - this should not be a factor in decision making

resources

land, labor, capital

land = natural resources, capital - machines and productive resources

money is not a resource it is not productive in se

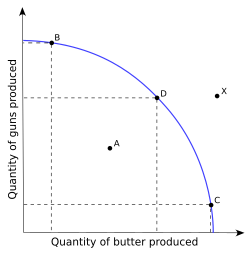

production possibilities frontier

shows all possible combinations of an output that can be produced assuming

a fixed amount of productive resources at a given quantity

efficient use of those resources

direct costs

out of pocket costs

indirect costs

opportunity costs, often a value and not monetary

law of demand

there is an inverse relationship between price and quantity demanded

If the price of milk decreases, the quantity people will buy increases

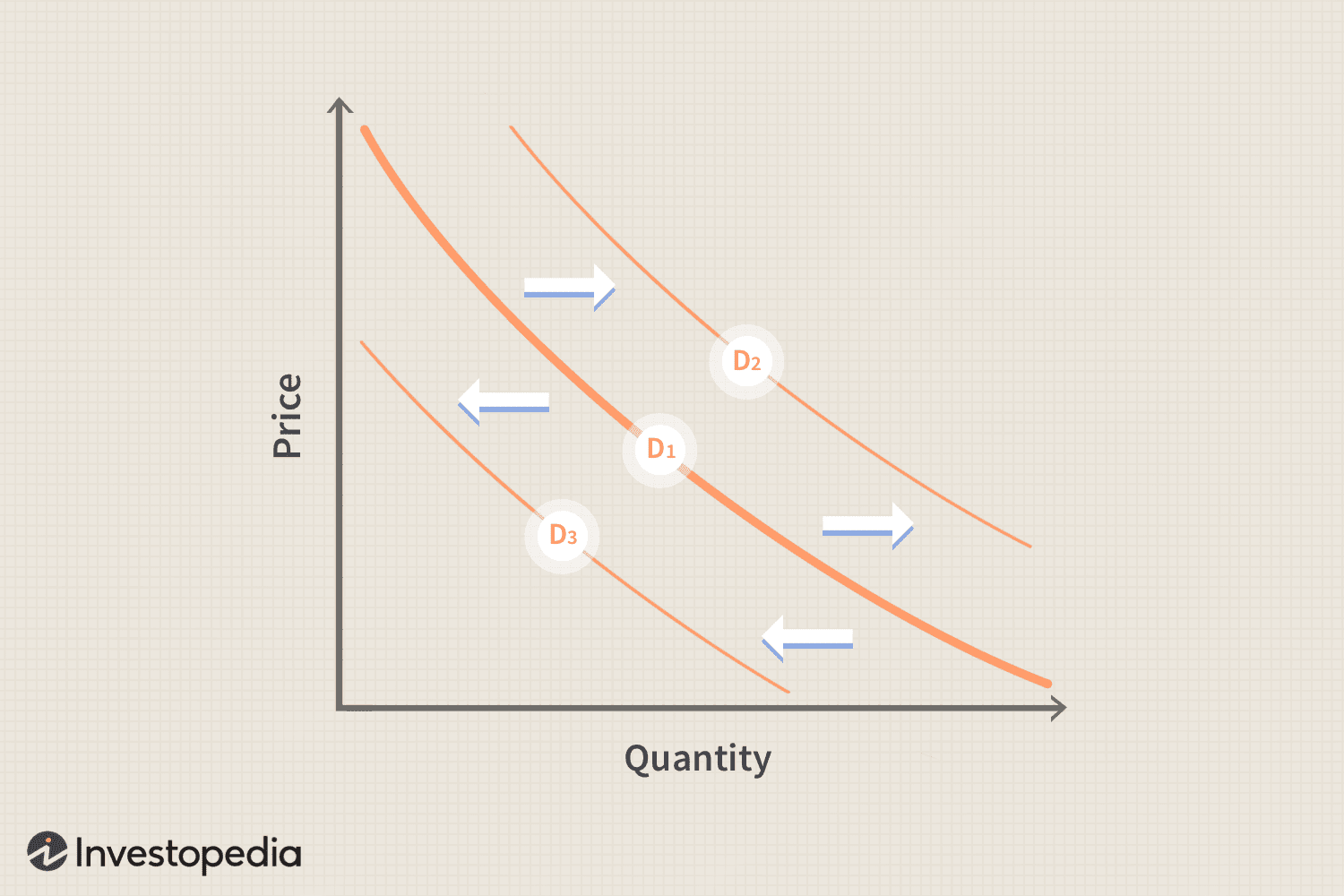

demand curve

a graph that shows the relationship between the price of a good and the quantity demanded at various prices.

Demand curve can shift to the left or right, a decrease in demand shifts to the elft while an increase in demand shifts to the right

If the graph follows the curve downard, thats a change in quantity demanded

If the graph shifts along the x axis but remains constant on the y axis, that is a change in demand

Demand stays the same but quantity demanded increases when the price decreases

substitution effect

Chances in price motivate consumers to buy relatively cheaper substitutes goods

income effect

Changes in price affect the purchasing power of consumers’ income

law of diminishing marginal utility

As you continue to consume a given product, you will eventually get less additional utility (satisfaction) from each unit you consume

5 shifters of demand

Tastes and preferences

Number of consumers

Price of related goods (substitutes and compliments)

Substitute is a good you use in place of the original

A complement is a good you use along with the original good

Income

Normal goods - income and the demand for the product are directly related

inferior goods - income and the demand for the product are inversely related

Expectations

normal goods

income and the demand for the product are directly related

inferior goods

income and the demand for the product are inversely related

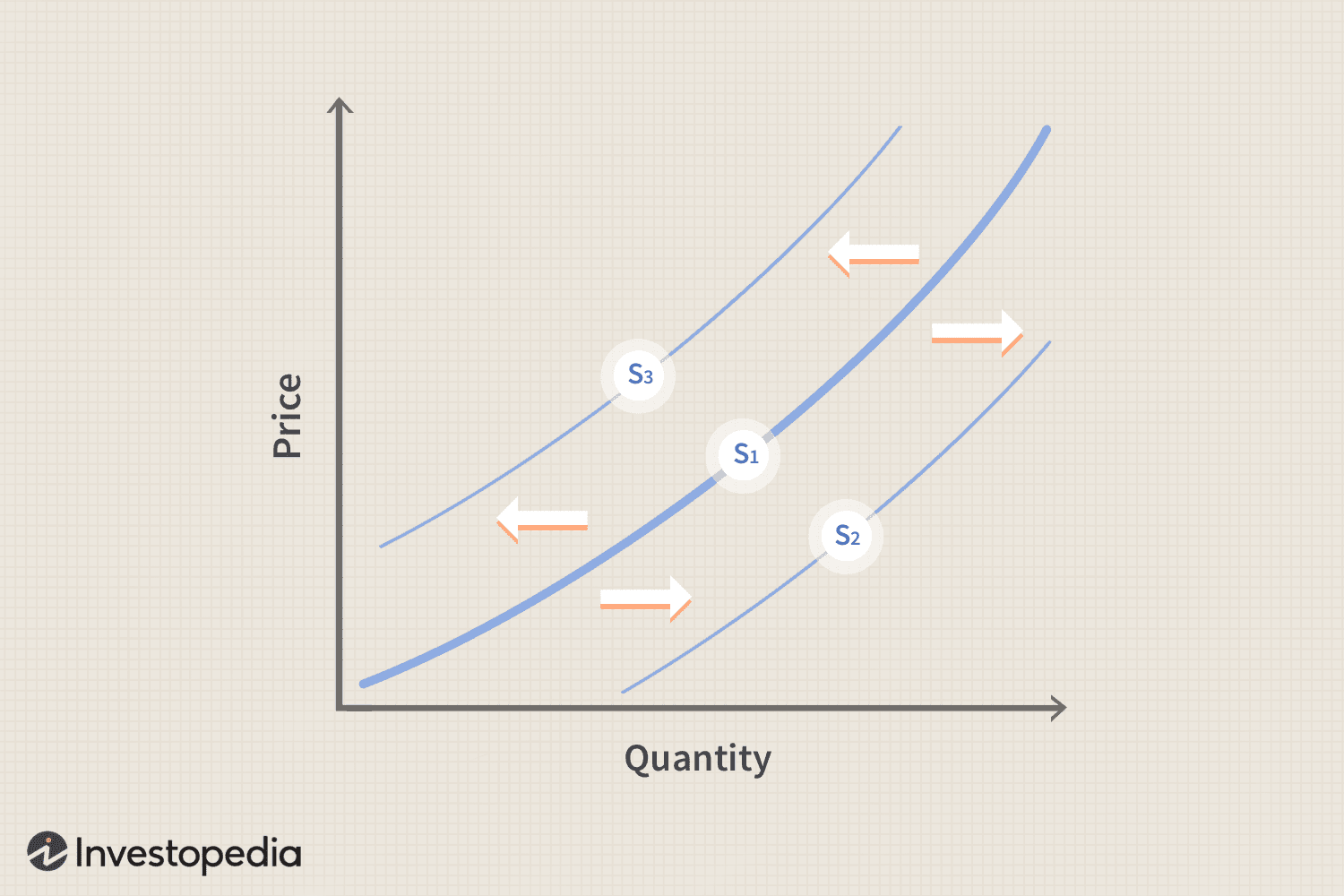

law of supply

Law of supply - there is a direct relationship between price and quantity supplied

When the price goes up for milk, the quantity produced will increase

When the price increases only the quantity supplied increases (moves along the curve) while the 5 shifters change the supply (moves curve)

5 shifters of supply

Price of resources - changes in prices of inputs (cheaper cows - more milk)

Number of producers

Technology - milking machines = increase supply

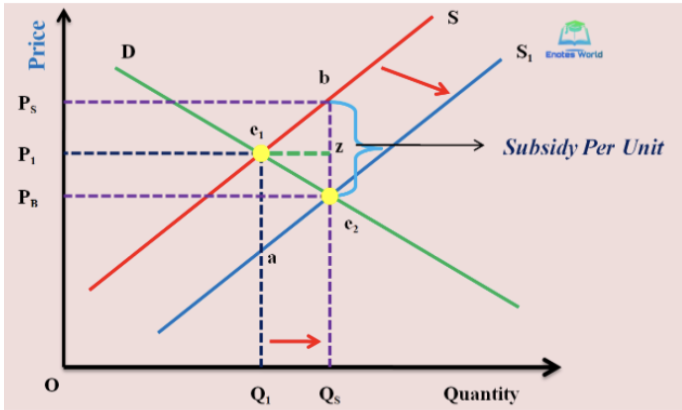

Taxes and subsidies - if gov gives subsidies, supply curve shift to right, while taxes shift to left

Expectations

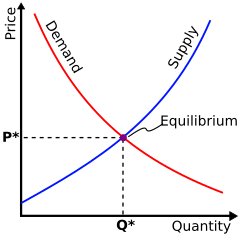

market equilibrium

Market equilibrium - where the supply and demand curves converge to determine price and quantity

disequilibrium

leads to a surplus when the quantity supplied is higher than the quantity demanded (upper region)

also leads to a shortage when the quantity demanded is higher than the quantity supplied

price ceilings

lie below the intersection of the supply and demand curve

Purpose is to prevent the price from rising above a certain level

excess demand

at a cheaper price consumers have more of an incentive to consume and producers have less of an incentive to produce, leading to an excess of demand

allocation problems

if goods are not allocated by price, allocation becomes a more first come first serve basis. Causing one to pay time in exchange for a decreased price

black markets

allows criminal organizations to gain power by controlling underground markets—making trades that are otherwise prohibited by the government

corruption

political connections are powerful, allowing politicians to acquire the goods for themselves and their friends

policing costs

the government would need to expand resources to combat lack markets, increasing opportunity costs. If government officials are benefitting from the law, they have an incentive to crack down on their black market competitors

decline in quality

producers have an incentive to cut costs, especially since they are making less of a profit. Thus, they may water down their milk or add substitutes. Declining the quality of the product they produce intentionally

targeting

price ceilings affect everyone. While intended to help the poor, the wealthy have an increased access to it and probably end up getting the goods more than the poor regardless

rigid/inflexible pricing

free market prices adjust to changing conditions, allowing prices to serve as a signal. Governments tend to be slow in reacting to changes, causing price ceilings to take a long time to change and may not adapt to evolving supply and demand conditions

lack of transparency

cost of price controls are hard to assess and measure because they are often unexpected and volatile. Making efficacy hard to determine.

prices send signals

if the price on something rises it is because there is a higher demand relative to supply

Decreasing the price would just make the supply problem worse

Price controls kill the messenger

Bidding up price vs bidding up time

During the 70s the widespread price ceiling led to an economic freeze because everything was out and a literal freeze

Farmers drowned a bunch of baby chicks

Higher prices give consumers incentive to conserve and thus free some up for others

rent control

price ceiling on rents designed to provide affordable housing for the poor

Economists are not against the goals of rent control but the unpredicted consequences it tends to come with

If landlords cannot afford to pay the taxes of their property due to rent control, they also cannot pay for repairs or maintenance - buildings collapsing in mumbai

economical rent support

giving money to a target population, such as a housing voucher to ensure its spent on housing and increases demand directly

advantages of housing vouchers

Providing income to consumers - a demand subsidy - will shift the demand curve to the right

Housing vouchers are provided through tax returns

Incentive to build more rental housing units - by stimulating demand it encourages supply

Avoids black markets, policing costs, tenant-landlord litigation, and quality problems

Transparency

Sharing the burden

Price message is still heard

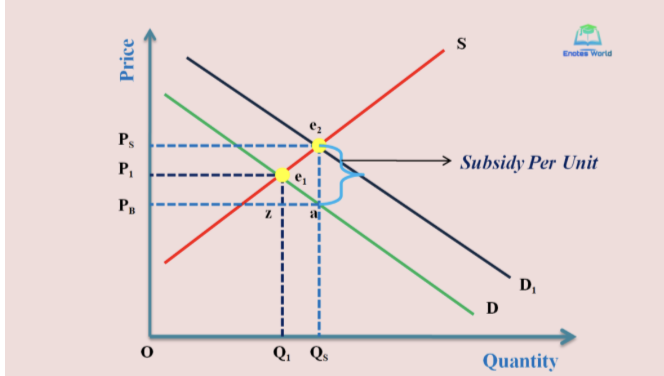

production subsidies

To subsidize the construction of affordable housing

“Low income housing tax credit”

Increases supply by lowering production cost for producers

Creates a wedge between price consumers pay and the price producers get

zoning restrictions

governmental restrictions of what can be built on the land

housing problems in the US

Mortgage rates are decreasing, but homes built are not increasing—In fact, theyre at an all time low

Exclusionary zoning makes it even more difficult to build homes

The laws dont explicitly mention race, but they continue to influence segregation

price floors

attempt to keep prices above the equilibrium price

Intended to help producers by keeping prices high

Minimum wages and agricultural farm support programs

The cost of the policy are spread out among millions of consumers while the benefits are concentrated on a small group of people

excess due to price floors

Throw it away

Save it up (just to throw it away when it goes bad)

Government cheese

Use it for the military or school lunches

Let the price fall while maintaining the target price (taxes go towards the difference

Sell it abroad

Give it away as food aid to developing countries

Tanks the agricultural sector of those countries

pure capitalism

private ownership of resources - private property of land labor and capital

prices free to adjuist

resources free to flow

firms produce to make a profit

decentralized decision making

command socialism

state ownership of resources

prices controlled by state planners

resource allocation by state planners

firms produce to meet a quota

centralized decision making

government owns all resources and production

under communism

the government disappears and there is economic cooperation as well. The principle of distribution becomes “from each according to his/her ability, to each according to his/her need”

two fundamental problems for command socialism

Incentives - a lack of incentives leads to a lack of production

Lack of knowledge - without a system of working prices the relative values of resources are unknowable

Politicians do not bet their own money when campaigning and making policy, they bet taxpayer money

socialism

market economies with a high preference for income equality

social democracy

seeks to modify capitalism

democratic socialists

seek to replace capitalism with a decentralized socialist ownership structure

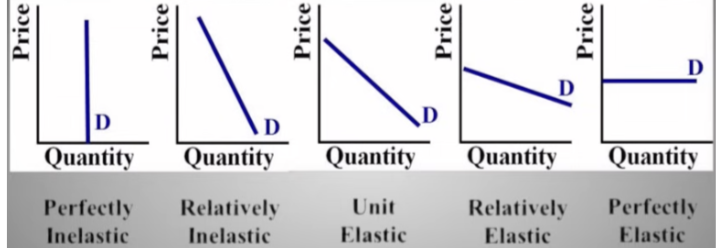

elasticity of demand

measures how sensitive quantity demanded is to a change in price

inelastic demand

the quantity is insensitive to the change in price

Products that are inelastic have very few substitutes

Price goes up, total revenue goes up

Price goes down, total revenue goes down

When change is = 1 , unit elastic demand

elasticity coefficient less than 1

elastic demand

quantity is sensitive to a change in price

Many substitutes

Elasticity coefficient greater than 1

Price goes up, total revenue goes down

Price goes down, total revenue goes up

perfectly inelastic

quantity demanded does not change for price, it remains constant

midpoint formula

ped = (q2-q1/(q1+q2)/2)/(p2-p1/(p1+p2)/2)

price elasticity of supply determinants

When we are more horizontal (flatter the supply curve) - relative elasticity

For inelastic

Short run

Not a lot of available resources

For elastic

Long run

Arent resource constrained

price elasticity of supply

Calculates how responsive quantity supplied is to a change in price

% change in quantity supplied/ % change in price

Supply elasticity will be greater the easier it is for producers to acquire the resources needed to produce the good in question

Goods needing specialized input will tend to be more inelastic than goods that do not need a specialized input

income elasticity of demand

How responsive demand is to a change in income

Positive for normal goods

Negative for inferior goods

Luxury good > 1 > necessity

All luxury goods are normal goods, but not are normal goods are luxury goods

cross price elasticity of demand

How responsive demand for good x is to a change in the price of good y

Positive for substitutes

Negative for complements

the labor market

For the labor market - the supply is the amount of labor available (workers) while the demand is coming from employers

When new labor comes into the country, it has no necessary effect on wages in general (although it can be focused on other low skilled labor). But these individuals are also driving up demand for food, clothes, and other things, so it evens out

in favor of minimum wage

minimum wage has not been risen since 2009

A “starvaton wage”

Treating workers decently is worth the price

Increase in minimum wage does not reduce the number of jobs

A higher minimum wage can actually lower costs for small business

The choice leads to higher productivity, better service, etc

A majority of workers who received a wage increase improved their performance

Employee turnover decreased by 34%

For every10% increase in the minimum wage, prices increased by less than half of the percent (and this is a temporary increase!)

Raising the minimum wage would decrease the taxes spent on public assistance

Will reduce racial and gender paid disparities

Low minimum wage is harming people in their prime working years

Good for workers, good for businesses, good for the economy

against minimum wage

May reduce employment - depends on the price elasticity of demand for labor

If higher wages are good for a business then they would do that on their own - a government mandate is not required

earned income tax credit

the program where the government provides extra income for work

Based on annual income earned and size of family

income subsidies over minimum wage

Incentivising - creates the incentive to hire workers instead of firing them. The subsidy is paid by taxpayers not by employers - thus encouraging a greater hiring of labor

Targeting - goes to low income families. Provides those with more dependents a larger subsidies. Minimum wage does not adjust for how many dependent there are

Transparency - the whole program is transparent and we can see that the programs work and then argue about the size

Sharing the burden - its covered by all taxpayers instead of just employers

marginal benefit

the additional benefit arising from a unit increase in a particular activity

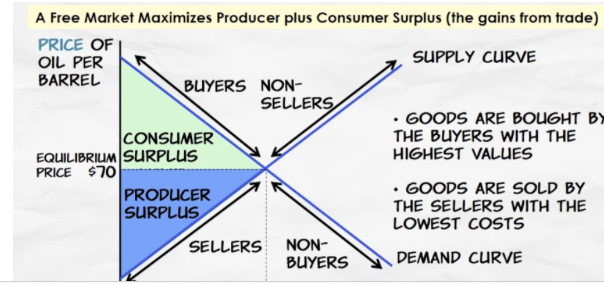

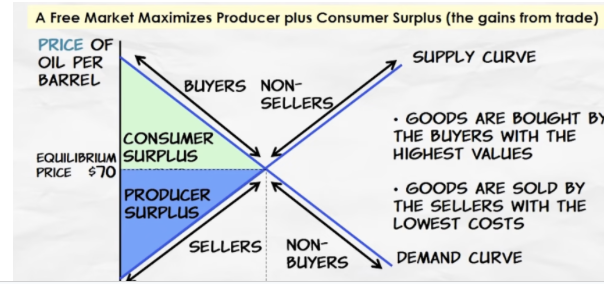

consumer surplus

consumers gain from exchange - the difference between the maximum price a consumer is willing to pay for a quantity vs the price they actually have to pay

The area beneath the demand curve and above the price on a graph

½(base x height)

producer surplus

producers gain from exchange. The difference between the market price and the minimum price at which producers would be willing to sell a given quantity

The sum of the producer surplus of each seller is total producer surplus

Measured by the area above the supply curve and below the price

free market equilibrium

Equilibrium price is the only stable price

For any quantity below the equilibrium quantity there are unexploited gains from trade

The equilibrium quantity = all gains from trade exploited

For any quantity above the equilibrium quantity there is waste

A free market maximises the gains from trade (consumer and producer surplus)

Goods are bought by the buyers that value them the most

Goods are sold by the sellers with the lowest cost

The supply of goods is bought by the buyers with the highest willingness to pay

The supply of goods are sold by the seller with the lowest costs

Between buyers and sellers there are no unexploited gains from trade or any wasteful trades

excise tax

tax on producers of a specific good

The consumers and producers both pay a portion of the tax

calculating tax

Vertical distance between price and new price tells us the per unit amount of tax

Consumer and producer surplus decreases

total tax revenue

tax x quantity demanded

tax paid by consumers

change in consumer price x quantity demanded

tax paid by producers

total tax revenue - total amount paid by producers

total expenditures

new price x quantity demanded

total revenue to firms

total expenditures - total tax revenue = producer takeaway

taxes and elasticity

For inelastic goods, consumers will end up bearing more of the tax burden because as the price rises consumers do not shift away from the product

If supply and demand have identical elasticities then the burden is shared equally

Excise taxes on goods with relatively inelastic demand results in less distortion and more tax revenue for the government

eitc and minimum wage

Price controls tend to work against arket forces and tend to come with more unintended consequences than market friendly interventions (taxes and subsidies)

EITC is a production subsidy in which workers supply labor

Market friendly policies tend to lead to greater transparency, better targeting, less corruption, lower policing costs, fewer lawsuits, and a shared burden

means tested

assistance is targeted to a certain group - typically low income households

assistance prograsm: housing vouchers, food stamps, medicaid, temporary assistance for needy families, unemployment benefits, pell grants etc

entitlements

if you qualify then the government will give it to you

Incentive to not work so you qualify for a government subsidy?

A lower BRR (benefit reduction rate) increases work incentives but will increase the cost of the program

The extra income earned reduces benefits from each program

Families are in some sense trapped in poverty

Universal basic income

Government progvides everyone a basic monthly income

market failures

occur when the free unregulated market produces a result that is not optimal

Comes in positive externalities, negative externalities, common property goods, public goods, information failures, and insufficient competition

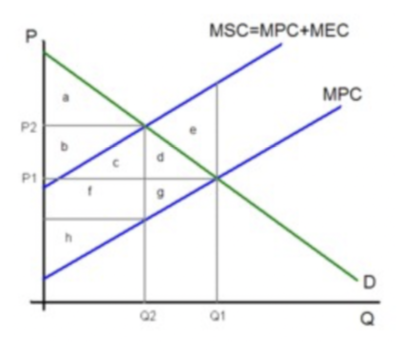

negative externalities

when actions by one party force others to suffer a consequence

You do not need to have the sale of a good to have an externality

marginal private cost

the internal costs considered in supply curves such as labor, power, machines, etc.

Free market outcome

marginal external costs

externalities that fall on other parties rather than the company

Imposes costs on anyone not involved in the decision making

Marginal social costs

the combination of marginal private cost and external costs, all costs are considered

The total cost to all members of society

marginal social benefit

area e is the degree to which the free market results in a less than optimal outcome

Government solutions to negative externalities

Internalize the externalize costs

postive ecternalties

choices that result in the benefits of others

Social benefits exceed private benefits

Gov solution - internalize the external effect

Gov needs to make the decision more beneficial to the private decision maker

As you decrease costs, the marginal benefit of decreasing it more decreases

We dont equally accrue benefits and we dont all equally play the cost of pollution reduction

correcting for externalities

Voluntary action - moral suasion - educat and encourage people to “do the right thing”

Command and control - government sets a law or regulation

Tax negative externalities/subsidize positive externalities

Marketable (like pollution) permits for dealing with some negative externalities

Permits that give you the right to pollute

non-exclusive competition

once a good is provided it is difficult or impossible to restrict access to it based on whether someone has paid for it or not