Flashcards law

1/67

Earn XP

Description and Tags

first carrier bcs it's green, which I think indicates the external truck?

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

118 TFEU

In the context of the establishment and functioning of the internal market, the European Parliament And the Council, acting in accordance with the ordinary legislative procedure, shall establish measures for the creation of European intellectual property rights to provide uniform protection of intellectual property rights throughout the Union and for the setting up of centralised Union-wide authorisation, coordination and supervision arrangements. (…)

DOCTRINE OF EXAUSTION

Once a product protected by intellectual property rights (IPR, e.g., a trademark, patent, or copyright) is lawfully put on the market within the EU by the rights holder or with their consent, the IP rights are considered "exhausted". This means the IPR holder can no longer oppose the resale, distribution, or use of that product within the EU. The doctrine ensures the free movement of goods within the internal market and preventslthe fragmentation of the single market by prohibiting IPR owners from using their rights to partition markets.

28-33

Tariff barriers:

34-36

• Non-tariff barriers:

110-113

Internal taxation:

Art 28

1.. The Union shall comprise a customs union which shall cover all trade in goods and which shall involve the prohibition between Member States of customs duties on imports and exports and of all charges having equivalent effect, and the adoption of a common customs tariff in their relations with third countries.

The provisions of Article 30 and of Chapter 3 of this Title shall apply to products

originating in Member States and to products coming from third countries which are in free circulation in Member States.

1.Within the EU, goods move freely without tariffs. But for goods coming into the EU from outside, all Member States apply the same tariffs.

2.Once goods from outside the EU enter one Member State and meet all customs requirements, they are treated the same as EU goods and can move freely within the EU.

Art 29

Products coming from a third country shall be considered to be in free circulation in a Member State if the import formalities have been complied with and any customs duties or charges having equivalent effect which are payable have been levied in that Member State, and if they have not benefited from a total or partial drawback of such duties or charges.

➡ Goods imported from outside the EU (e.g. from the U.S., China, etc.)

➡ The goods will be treated as if they are EU goods, and can move freely inside the EU, if the following conditions are met:

✅Conditions for “free circulation”:

Import formalities have been complied with

➤ The importer followed all legal procedures for bringing the goods into the EU (e.g., customs declarations, inspections).

Any customs duties or equivalent charges have been paid

➤ All required taxes or tariffs on the goods have been paid in the country where they first entered the EU.

No total or partial drawback has been granted

➤ The importer has not received a refund (drawback) of the customs duties paid.

⚠ This ensures the goods have genuinely contributed to the EU customs revenue and are not just passing through temporarily.

Once goods meet these conditions, they are treated the same as EU-origin goods. That means:

They can move freely between all EU Member States.

They are not subject to further customs checks or duties inside the EU.

Art 30

Customs duties on imports and exports and charges having equivalent effect shall be prohibited between Member States. This prohibition shall also apply to customs duties of a fiscal nature.

EU countries are not allowed to charge customs duties (taxes or tariffs) on goods that are imported from or exported to another EU country.

This rule also bans any other charges that act like a customs duty, even if they are called something else (like a “fee” or “contribution”).

The prohibition applies even if the purpose is to raise money (fiscal/customs duties of a fiscal nature), not just to protect domestic products.

🎯 Purpose:

To guarantee free movement of goods within the EU.

To ensure a single, unified market without hidden barriers.

To prevent discrimination or distortion of trade between Member States.

Article 34 TFEU

Quantitative restrictions on imports and all measures having equivalent effect shall be prohibited between Member States.

Quantitative restrictions on imports and all measures having equivalent effect shall be prohibited between Member States.

Member States cannot limit imports from other EU countries using:

Quotas (e.g., “only 1000 units allowed”)

Or any non-tariff measures that indirectly restrict trade, even if they don’t seem like quotas.

These are called “Measures Having Equivalent Effect” (MEEs), and the Court of Justice of the EU (CJEU) interprets this broadly.

NB (Cassis de Dijon case):

If a product is lawfully made and sold in one Member State, it should be allowed in others – known as the “mutual recognition” principle.

Article 35 TFEU

Quantitative restrictions on exports, and all measures having equivalent effect, shall be prohibited between Member States.

🇮🇹1. Commission v Italy (“Groenveld formula”) – Case C‑67/79

Italy had a law requiring exporters to display Italian origin labels on olive oil containers, but did not require the same for domestic products.

The European Commission challenged it as an export restriction under Article 35 TFEU.

⚖Legal Reasoning:

The European Court of Justice (ECJ) found:

The measure was discriminatory in practice—it targeted exports specifically, disadvantaging them relative to domestic goods.

Even though it appeared neutral, its actual effect hindered export trade more than domestic trade.

The ECJ adopted the famous “Groenveld formula”:

Article 35 prohibits both overt export restrictions (like quotas or bans) and any rules that are indistinct but operate against exports to a greater degree.

🇦🇹2. Schmidberger v Austria – Case C‑112/00

🔍What Happened:

An environmental NGO organized a demonstration on the Brenner motorway (major EU corridor from Germany to Italy), blocking traffic for about 30 hours.

A freight company (Schmidberger) sued Austria under Articles 34 & 35 TFEU.

Claim: Austria violated its duty by allowing a protest that effectively restricted exports.

⚖Legal Reasoning:

The ECJ agreed that the demonstration was a restriction on the free movement of goods:

Absent national intervention, the incident interfered with cross-border trade .

But Austria defended its decision by invoking fundamental rights:

The rights to freedom of expression and assembly are protected under the EU Charter and the ECHR.

The ECJ performed a balancing test:

Was Austria’s allowance of the demonstration pursuing a legitimate public interest? YES.

Was it proportionate—i.e., didn’t go beyond what was necessary? YES:

The event was temporary and organization minimized disruption.

Did it apply equally to all traffic, domestically and internationally? YES .

✅Outcome:

The restriction was justified based on fundamental rights, so Austria was not liable.

The case established that:

Article 35 can be overridden in exceptional cases where constitutional rights are balanced.

Such restrictions must be proportionate and necessary for a legitimate aim.

Article 36 TFEU

The provisions of Articles 34 and 35 shall not preclude prohibitions or restrictions on imports, exports or goods in

transit justified on grounds of

public morality,

public policy or

public security;

the protection of health and life of humans, animals or plants;

the protection of national treasures possessing artistic, historic or archaeological value; or

the protection of industrial and commercial property.

Such prohibitions or restrictions shall not, however, constitute a means of arbitrary discrimination or a disguised

restriction on trade between Member States.

Article 110 TFEU

No Member State shall impose, directly or indirectly, on the products of other Member States any internal taxation of any kind in excess of that imposed directly or indirectly on similar domestic products. Furthermore, no Member State shall impose on the products of other Member States any internal taxation of such a nature as to afford indirect protection to other products.

ex consumption

Article 110 of the Treaty on the Functioning of the European Union (TFEU) is not about import duties (which are dealt with under Articles 30 and 34 TFEU). Instead, it focuses on internal taxation—that is, domestic taxes applied inside a Member State, such as excise duties, VAT, or environmental taxes.

🚫 What Article 110 TFEU prohibits:

Discriminatory Taxation:

A Member State cannot tax products from other EU countries more heavily than similar domestic products.

Example: If France taxes German beer more than French beer, that’s a violation.

Protectionist Taxation:

Even if products aren’t exactly the same, a Member State can’t design its tax system to give an indirect advantage to domestic products.

Example: Italy taxes imported orange juice more heavily than domestic apple juice, subtly favoring local agriculture. This could fall under the second part of Article 110.

🔍 Key Concepts:

“Internal taxation”: These are taxes imposed after the goods have entered the market, unlike import duties which apply at the border.

“Similar products”: Products that have comparable characteristics and meet the same consumer needs (determined case-by-case, often by the Court of Justice of the EU).

“Competing products”: Even if not similar, products that compete in the market must not be treated unequally in a protectionist way.

❌ What Article 110 is NOT about:

Customs duties or border tariffs (→ covered by Article 30 TFEU).

Quantitative import restrictions or trade barriers (→ covered by Article 34 TFEU).

💡 Practical Effect:

Article 110 helps maintain fair tax treatment and a level playing field for goods moving freely across EU Member States. It’s a safeguard within the internal market, preventing governments from disguising protectionism as taxation.

Let me know if you want case examples (like Commission v. France (Wine and Beer) or Commission v. Sweden (Alcohol Tax)), or a comparison with other articles.

Article 101 TFEU (2/2)

1. The following shall be prohibited as incompatible with the internal market: all agreements between undertakings, decisions by associations of undertakings and concerted practices which may affect trade between Member States and which have as their object or effect the prevention, restriction or distortion of competition within the internal market, and in particular those which:

(a) directly or indirectly fix purchase or selling prices or any other trading conditions;

(b) limit or control production, markets, technical development, or investment;

(c) share markets or sources of supply;

(d) apply dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a competitive disadvantage;

(e) make the conclusion of contracts subject to acceptance by the other parties of supplementary obligations which, by their nature or according to commercial usage, have no connection with the subject of such contracts.

2. Any agreements or decisions prohibited pursuant to this Article shall be automatically void.

3. The provisions of paragraph 1 may, however, be declared inapplicable in the case of:

• any agreement or category of agreements between undertakings;

• any concerted practice or category of concerted practices,

which contributes to improving the production or distribution of goods or to promoting technical or economic progress,

while allowing consumers a fair share of the resulting benefit, and which does not:

a) impose on the undertakings concerned restrictions which are not indispensable to the attainment of these

objectives;

b) afford such undertakings the possibility of eliminating competition in respect of a substantial part of the products in

question. MUST BE IN PLACE ALL THESE 4 CONDITIONS AT THE SAME TIME

(3

Improved efficiency: improved performance

Consumers benefited:

Restrictions were necessary:

Competition was preserved:

Excellent — now you’re aiming for precision and granular real-life examples for each category under Article 101(1).

Let’s go step by step.

I will give you one example for each sub-element (where possible) and explain exactly why it falls under that category.

1(a) — Directly or indirectly fix purchase or selling prices or any other trading conditions

📌 Case:European Smart Card Chips Cartel (2014)

Firms involved: Infineon, Samsung, Renesas, Philips.

Facts:

The companies coordinated prices for smart card chips (used in mobile SIM cards, bank cards, passports).

They exchanged sensitive commercial information to align their pricing strategies.

Why it applies:

The companies fixed selling prices by coordinating price increases and avoiding competition, directly violating Art. 101(1)(a).

1(b) — Limit or control production, markets, technical development, or investment

1⃣Control of Production

📌 Case:Cathode Ray Tubes (CRT) Cartel (2012)

Firms involved: Philips, LG, Panasonic, Samsung SDI, etc.

Facts:

The cartel agreed on limiting output of CRTs to keep prices high.

Companies coordinated weekly to limit quantities produced.

Why it applies to “controlling production”:

By restricting output, they artificially managed supply levels, directly controlling production volumes — a textbook example of Art. 101(1)(b).

2⃣Control of Markets

📌 Case:European Beer Cartel (2007)

Firms involved: Heineken, Grolsch, Bavaria.

Facts:

Brewers secretly divided the Dutch beer market between them.

Each brewer committed to limit sales to its agreed share.

Why it applies to “controlling markets”:

By allocating customers and market shares, they prevented genuine competition in the market — this is market control under 101(1)(b).

3⃣Control of Technical Development

📌 Case:Samsung/Qualcomm (Hypothetical reference, but real elements)

While no official Article 101 decision exists directly, some investigations considered:

Patent licensing agreements that restricted each other’s development of alternative technologies.

Samsung allegedly agreed not to develop or promote certain competing mobile technologies.

Why it applies to “controlling technical development”:

If companies collude to avoid innovating certain technologies, this hinders technical progress, violating 101(1)(b).

4⃣Control of Investment

📌 Case:Visa/Mastercard Multilateral Interchange Fees (MIFs) (2014)

Firms involved: Visa, Mastercard.

Facts:

Their MIF agreements reduced banks’ incentive to invest in competing payment systems.

The fees made it less attractive for new entrants to invest in the payments market.

Why it applies to “controlling investment”:

The agreements limited where and how banks invested in payment infrastructure, thereby controlling investment indirectly — falls under 101(1)(b).

1(c) — Share markets or sources of supply

📌 Case:European Car Parts Cartel (2014)

Firms involved: Yazaki, Denso, Sumitomo (automotive wire harness suppliers).

Facts:

The suppliers agreed to divide customers (automakers like Toyota, Honda, etc.)

Each supplier took responsibility for specific customers or markets.

Why it applies:

They allocated markets and customers, directly violating 101(1)(c) by sharing sources of demand and supply.

1(d) — Apply dissimilar conditions to equivalent transactions

📌 Case:British Airways Loyalty Rebates (2007)

Firms involved: British Airways.

Facts:

BA gave higher commissions to travel agents that sold more BA tickets.

Agents selling fewer BA tickets got much lower commissions.

Why it applies:

Travel agents were in equivalent positions, but received unequal treatment, disadvantaging smaller agents — 101(1)(d).

1(e) — Tie supplementary obligations to contracts

📌 Case:Microsoft Tying Case (2004)

Firms involved: Microsoft.

Facts:

Microsoft bundled Windows Media Player into the Windows OS.

PC manufacturers had to include Media Player if they wanted to install Windows.

Why it applies:

The supplementary obligation (accepting Media Player) was not directly connected to the main contract (Windows OS license).

This tying arrangement violated 101(1)(e).

🔎Summary Table (Very Precise)

Article 101(1) | Sub-Element | Case | Explanation |

|---|---|---|---|

(a) | Price fixing | Smart Card Chips Cartel (2014) | Firms coordinated prices |

(b) | Production control | CRT Cartel (2012) | Firms limited CRT production |

(b) | Market control | Dutch Beer Cartel (2007) | Firms divided beer market |

(b) | Technical development control | Samsung/Qualcomm Licensing (hypothetical) | Restricted competing technologies |

(b) | Investment control | Visa/Mastercard MIFs (2014) | Limited banks’ investment in competitors |

(c) | Market/supply sharing | Car Parts Cartel (2014) | Allocated car manufacturer customers |

(d) | Dissimilar conditions | British Airways (2007) | Discriminatory rebates to travel agents |

(e) | Tying | Microsoft (2004) | Forced bundling of Media Player |

If you’d like, I can also give you:

More recent cases (2020–2024)

Court judgments if you need citations (GC, CJEU, Commission decisions)

Examples for Article 101(3) exemptions

👉 Just say “expand” if you want any of these.

Excellent question — this is a subtle but very important distinction in the application of Article 101(1)(b) vs (c).

Let me explain it very clearly:

🔍The Key Difference: “Control markets” vs “Share markets”

Control of Markets (101(1)(b)) | Sharing of Markets (101(1)(c)) |

|---|---|

The collusion limits or regulates how much competition occurs in a market as a whole — not necessarily assigning customers. | Competitors literally divide the market or customers among themselves — “you take X, I take Y”. |

Focus on restricting entry, output, or competition in the market as a system. | Focus on allocating territories, customers, or sources of supply. |

Broader control — price ceilings, output caps, access limitations, or exclusive territories. | Narrower — direct partitioning of who supplies whom or where. |

No need to fully divide the market — may just restrict growth, entry or expansion. | Clear division of customers or territories. |

🔬Illustration with examples:

1⃣Control of Markets (101(1)(b))

Example: Dutch Beer Cartel (2007)

Brewers agreed not to compete too aggressively in supermarkets.

They coordinated pricing levels, promotion strategies, and kept market stability.

Each brewer still sold in the market, but they managed the overall competitive intensity.

👉 Why 101(1)(b)?

Because they controlled competition in the market overall, limiting aggressive competition, promotions, pricing wars, and entry of third parties — but they did not always assign specific customers.

2⃣Share Markets (101(1)(c))

Example: Car Parts Cartel (2014)

Wire harness suppliers agreed:

Yazaki supplies Toyota.

Sumitomo supplies Honda.

Denso supplies Nissan.

👉 Why 101(1)(c)?

Because they divided specific customers (automakers) — a classic customer allocation cartel.

🧪Simpler analogy:

Scenario | Provision |

|---|---|

“Let’s not compete too hard on supermarkets; everyone keeps their prices steady.” | 101(1)(b) control of markets |

“You get Tesco; I get Carrefour.” | 101(1)(c) market sharing |

⚠Why the law distinguishes them:

101(1)(b): Focuses on the way competition functions.

101(1)(c): Focuses on who gets which piece of the market.

Both are equally serious, but they attack competition in slightly different ways.

👉 If you want, I can also give you:

more ECJ case law that draws this distinction very clearly

Commission language from actual decisions to help you cite it in academic or legal work.

Shall I?

Article 102 TFEU

Any abuse by one or more undertakings of a dominant position within the common market or in a substantial part of it

shall be prohibited as incompatible with the common market insofar as it may affect trade between Member States.

Such abuse may, in particular, consist in:

• directly or indirectly imposing unfair purchase or selling prices or other unfair trading conditions;

• limiting production, markets or technical development to the prejudice of consumers;

• applying dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a

competitive disadvantage;

• making the conclusion of contracts subject to acceptance by the other parties of supplementary obligations which,

by their nature or according to commercial usage, have no connection with the subject of such contracts.

101 and 102 are NOT mutually exclusive!

🔹“Limiting production, markets or technical development to the prejudice of consumers”

Example:

A dominant tech firm deliberately slows down innovation or withholds a software update from users of rival hardware devices to keep its ecosystem closed and stifle competition, thus preventing consumers from benefiting from improved functionality or performance.

🔹“Applying dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a competitive disadvantage”

Example:

A dominant logistics provider charges different prices to two competing online retailers for the exact same delivery services, without justification. One retailer ends up paying 20% more, putting it at a cost disadvantage in the market.

🔹“Directly or indirectly imposing unfair purchase or selling prices or other unfair trading conditions”

Example:

A dominant pharmaceutical company sells a life-saving drug in one Member State at 1000 EUR per dose, despite the production cost being just 10 EUR. This pricing is far beyond what’s reasonable or justified by innovation or costs, especially when the same drug is sold in other EU countries at much lower prices.

—

🔹“Making the conclusion of contracts subject to acceptance by the other parties of supplementary obligations which, by their nature or according to commercial usage, have no connection with the subject of such contracts”

Example:

A dominant software vendor sells essential business software but requires customers to also buy unrelated cybersecurity services from them — even though the buyer already has another provider. This “tying” practice forces buyers into unnecessary purchases.

Art 118

In the context of the establishment and functioning of the internal market, the European Parliament and the Council, acting in accordance with the ordinary legislative procedure, shall establish measures for the creation of European intellectual property rights to provide uniform protection of intellectual property rights throughout the Union and for the setting up of centralised Union-wide authorisation, coordination and supervision arrangements.”

dominance

Dominance

Act independently without taking account of competitors

Exploitation of consumers (high prices)

Wearing out competition (bankruptcy through predatory pricing)

Take into account:

relevant market

market power/market share

vertical integration

accesser

relevant market

Distinguish between

Relevant Geographical Market (RGM)

e.g. dominance in a geographical market: UBC had 90% of the banana market in Ireland.

Relevant Temporal Market (RTM)

e.g. UBC: winter/summer)

Relevant Product Market (RPM)

e.g. bananas versus other fresh fruit

market share

Absolute

Less than 20%: not dominant

More than 80%: dominant

Relative: between 20 and 80%; context matters: is there a level playing field?

45%, 30%, 20%, 5%: not dominant

45%, 10%, 9%, 8%, 7%, 7%, 5%, 4%, 3%, 2%: dominant

Vertical integration

Major control over the distribution system: control of supply: dominant

E.g. UBC: green bananas: hard to ripen: absolute territorial protection-

4. Access to market

If competitors have easy access to the market: no dominance.

Article 107 TFEU

Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market.

Unless the EU Treaties say otherwise, if a national government gives any kind of financial help — in any form — to certain companies or sectors, and that help gives them an advantage that could distort competition and affect trade between EU countries, then that aid is not allowed under EU law.

Article 7

(1) In the interpretation of this Convention, regard is to be had to its international character and to the need to promote uniformity in its application and the observance of good faith in international trade.

(2) Questions concerning matters governed by this Convention which are not expressly settled in it are to be settled in conformity with the general principles on which it is based or, in the absence of such principles, in conformity with the law applicable by virtue of the rules of private international law.

To promote uniformity of interpretation of international trade the CISG is done. If there are questions then the principles of the CISG must be followed, or private international law.

• International Character: The CISG is an international treaty, so it should not be interpreted solely through the lens of any one country’s legal system.

• Promote Uniformity: The goal is consistent application across all countries that adopt it—so that similar cases are treated similarly worldwide.

• Good Faith: Emphasizes ethical conduct and honesty in international trade relationships, even though the CISG doesn’t define “good faith” precisely.

• If the CISG governs a matter, but doesn’t explicitly address it, the gap should be filled by:

1. General Principles: Use the underlying ideas of the CISG (e.g., party autonomy, good faith, reasonableness, etc.).

2. Private International Law: If no general principle can resolve the issue, refer to the law chosen by conflict-of-law rules (e.g., the national law of a particular country determined by applicable conflict rules).

Art 35

(1) The seller must deliver goods which are of the quantity, quality and description required by the contract and which are contained or packaged in the manner required by the contract.

(2) Except where the parties have agreed otherwise, the goods do not conform with the contract unless they:

(a) are fit for the purposes for which goods of the same description could ordinarily be used; I. United Nations Convention on Contracts for the International Sale of Goods 11

(b) are fit for any particular purpose expressly or impliedly made known to the seller at the time of the conclusion of the contract, except where the circumstances show that the buyer did not rely, or that it was unreasonable for him to rely, on the seller’s skill and judgement;

(c) possess the qualities of goods which the seller has held out to the buyer as a sample or model;

(d) are contained or packaged in the manner usual for such goods or, where there is no such manner, in a manner adequate to preserve and protect the goods.

(3) The seller is not liable under subparagraphs (a) to (d) of the preceding paragraph for any lack of conformity of the goods if, at the time of the conclusion of the contract, the buyer knew or could not have been unaware of such lack of conformity.

The seller must deliver the promised quantity, quality, description, and the product must be usable for the activity it said it could be used for. The packaging is supposed to be the promised one etc. The seller is not liable of any lack of conformity if the buyer knew about it or was impossible not to know

• The seller must strictly comply with the contract.

• Goods must match:

• Quantity (how many),

• Quality (how good),

• Description (type, model, specifications),

• and Packaging (how they are packed or presented),

• as agreed in the contract.

This means that, unless the contract says something different, the goods must meet certain minimum standards.

The four subparagraphs describe when goods are considered conforming:

• (a) Ordinary Use:

Goods must be fit for the usual purpose goods of that kind are used for.

➤ Example: A car should be drivable, a refrigerator should cool, etc.

• (b) Particular Purpose:

If the buyer told the seller about a special use, the goods must be fit for that —

unless the buyer clearly didn’t rely on the seller’s advice or it was unreasonable to do so.

➤ Example: If a buyer says, “I need this fabric to make fire-resistant uniforms,” the seller must supply fabric suitable for that use if they agree.

• (c) Sample or Model:

If the seller showed a sample or model, the actual goods must be like that.

➤ Example: If the seller shows a sample of red granite, the delivered granite must match it.

• (d) Packaging:

Goods must be packaged in the usual way, or, if there is no usual way, then in a suitable way to protect them.

➤ Example: Fragile items should be packaged to prevent damage during transport.

• If the buyer knew, or should have known, that the goods didn’t meet those requirements at the time of the contract, the seller is not responsible.

➤ Example: If a buyer sees that the product is scratched or defective before signing the contract, they can’t later claim non-conformity.

Article 35 sets the standards for what it means for goods to “conform” to the contract. It balances:

• The seller’s duty to deliver suitable goods,

• The buyer’s right to expect goods that match the contract,

• And the reality that buyers can’t later complain about defects they already knew about.

Art 38

The buyer must examine the goods, or cause them to be examined, within as short a period as is practicable in the circumstances.

If the contract involves carriage of the goods, examination may be deferred until after the goods have arrived at their destination.

3. If the goods are redirected in transit or redispatched by the buyer without a reasonable opportunity for examination by him and at the time of the conclusion of the contract the seller knew or ought to have known of the possibility of such redirection or redispatch, examination may be deferred until after the goods have arrived at the new destination.

The buyer must examine the goods within a reasonable amount of time. If the contract involves the carriage of the goods, then the examination is done once the products arrive at destination.

If the buyer redirects the product then it can examine it once it arrives at the new destination if the seller could have known about them being re-directed and if the buyer couldn’t inspect beforehand

• The buyer must inspect the goods as soon as reasonably possible after receiving them.

• This is to check whether the goods:

• Match the contract (quality, quantity, packaging, etc.),

• Have any visible or obvious defects.

• What counts as a “practicable” period depends on the circumstances — like the nature of the goods (e.g., perishables vs. machinery) or the conditions of delivery.

• When the goods are shipped (by truck, ship, train, etc.), the buyer doesn’t have to examine them during transport.

• The examination may be done after delivery at the agreed destination.

• This reflects practical reality — you can’t usually open containers and inspect goods mid-transit.

• If the buyer reships the goods to a third party (e.g., a customer or warehouse) without examining them, they don’t lose their rights as long as:

• They didn’t have a reasonable opportunity to examine the goods beforehand, and

• The seller knew or should have known this kind of redirection might happen.

• In that case, the buyer can wait to inspect the goods at the final destination.

Art 39

(1) The buyer loses the right to rely on a lack of conformity of the goods if he does not give notice to the seller specifying the nature of the lack of conformity within a reasonable time after he has discovered it or ought to have discovered it.

(2) In any event, the buyer loses the right to rely on a lack of conformity of the goods if he does not give the seller notice thereof at the latest withina period of two years from the date on which the goods were actually handedover to the buyer, unless this time limit is inconsistent with a contractual period of guarantee.

If the buyer doesn’t mention the lack of conformity of the goods within a reasonable time then he loses the right to rely on the lack of conformity

• The buyer must:

1. Inspect the goods (as per Article 38),

2. Inform the seller of the problem quickly,

3. Clearly describe what’s wrong (not just say “the goods are bad”).

• The “reasonable time” depends on the circumstances (e.g., the type of goods, transport conditions, how easily the defect can be noticed).

• If the buyer waits too long after discovering the defect (or when they should have discovered it), they lose the right to complain.

• This is a strict deadline: Even if the buyer has a good excuse, if two years pass from delivery and they haven’t notified the seller, they lose the right to claim.

• Exception: If the contract includes a longer guarantee period, that agreed period applies instead.

There is a hard limit of 2 years from the date of delivery to notify the seller — after that, the buyer cannot claim for non-conforming goods, unless there’s a longer contractual warranty.

Nachfrist notice:

Articles 47 and 63

✅ Article 47 CISG (Buyer’s Nachfrist Right)

Allows the buyer to fix an additional period of time for the seller to perform their obligations.

Example: If a seller delays delivery, the buyer can give the seller a reasonable Nachfrist (grace period) to complete delivery.

✅ Article 63 CISG (Seller’s Nachfrist Right)

Allows the seller to fix an additional period of time for the buyer to perform their obligations.

Example: If a buyer delays payment or refuses to take delivery, the seller can set a final deadline (Nachfrist) before resorting to remedies.

🔧 Function of Nachfrist in CISG

Nachfrist gives the breaching party one last chance to fulfill their obligations before remedies like termination of the contract (Article 49 for the buyer and Article 64 for the seller) can be triggered.

Article 25

A breach of contract committed by one of the parties is fundamental if it results in such detriment to the other party as substantially to deprive him of what he is entitled to expect under the contract, unless the party in breach did not foresee and a reasonable person of the same kind in the same circumstances would not have foreseen such a result.

Breach of the contract becomes fundamental (u cannot make improvements…)if it results in the other party not receiving what expected d to deprive him did not receive what expected, unless unforeseeable future (ex i order from ukraine and then the war happens, so they could’t foresee it)

A breach is fundamental if:

1. It causes substantial detriment to the other party, and

2. That detriment substantially deprives the other party of what they were entitled to expect under the contract, unless:

3. The breaching party could not foresee, and a reasonable person in the same circumstances would not have foreseen, such a result.

Substantial detriment | The breach causes serious harm to the other party. |

Deprivation of expected benefit | The aggrieved party doesn’t get what they reasonably expected. |

Foreseeability test | If the loss wasn’t foreseeable, the breach may not be fundamental. |

🔹 1. “Substantial detriment”

• This is not just a small or technical breach.

• The breach must seriously affect the core value of the contract for the other party.

🔸 Example: The seller delivers machinery that does not work at all, or food that is spoiled upon delivery.

🔹 2. “Substantially deprive him of what he is entitled to expect”

• The breach must undermine the very purpose of the contract for the injured party.

• It’s not enough if the goods are slightly late, or have minor defects that can be fixed.

🔸 Example: If a buyer orders Christmas decorations and they arrive after the holiday, the timing makes them useless — this could be fundamental.

🔹 3. Exception: Lack of foreseeability

• The breach is not fundamental if the party who committed it:

• Did not foresee, and

• A reasonable person in the same situation also wouldn’t have foreseen the harm caused.

🔸 Example: If a seller ships goods on time, but a natural disaster delays delivery in an unforeseeable way, the delay may not count as a fundamental breach.

Article 47

(1) The buyer may fix an additional period of time of reasonable length for performance by the seller of his obligations.

(2) Unless the buyer has received notice from the seller that he will not perform within the period so fixed, the buyer may not, during that period, resort to any remedy for breach of contract. However, the buyer is not deprived thereby of any right he may have to claim damages for delay in performance.

Article 49

(1)The buyer may declare the contract avoided:

(a) if the failure by the seller to perform any of his obligations under the contract or this Convention amounts to a fundamental breach of contract; or

(b) in case of non-delivery, if the seller does not deliver the goods within the additional period of time fixed by the buyer in accordance with paragraph (1) of article 47 or declares that he will not deliver within the period so fixed.

(2) However, in cases where the seller has delivered the goods, the buyer loses the right to declare the contract avoided unless he does so:

(a) in respect of late delivery, within a reasonable time after he has become aware that delivery has been made;

(b) in respect of any breach other than late delivery, within a reasonable time:

(i) after he knew or ought to have known of the breach;

(ii) after the expiration of any additional period of time fixed by the buyer in accordance with paragraph (1) of article 47, or after the seller has declared that he will not perform his obligations within such an additional period; or

(iii) after the expiration of any additional period of time indicated by the seller in accordance with paragraph (2) of article 48, or after the buyer has declared that he will not accept performance.

1.Buyer can declare the contract avoided if

failure of seller to perform obligations in the contract

seller still doesn’t deliver goods after additional period (art 47) has passed

2.—if seller delivers the goods, the buyer loses his rights to declare the contract avoided unless:

late delivery, after a short time after delivery

—If the breach is about something other than late delivery (e.g., defective goods, wrong items):

The buyer knew or should have known about the breach.

After a deadline (extra time) the buyer gave the seller to fix the issue has passed:

After a deadline the seller himself set under Article 48(2) passes:

49(1)(a) | Buyer may avoid the contract for a fundamental breach. |

49(1)(b) | Buyer may avoid in case of non-delivery, if seller fails even after a grace period. |

49(2)(a) | If goods were delivered late, buyer must cancel within a reasonable time after receiving them. |

49(2)(b) | For other breaches, buyer must act within a reasonable time after: knowing of the breach, expiration of grace period, or rejection of seller’s proposed cure. |

Article 46

The buyer may require performance by the seller of his obligations unless the buyer has resorted to a remedy which is inconsistent with this requirement.

(2) If the goods do not conform with the contract, the buyer may require delivery of substitute goods only if the lack of conformity constitutes a fundamental breach of contract and a request for substitute goods is made either in conjunction with notice given under article 39 or within a reasonable time thereafter.

(3) If the goods do not conform with the contract, the buyer may require the seller to remedy the lack of conformity by repair, unless this is unreasonable having regard to all the circumstances. A request for repair must be made either in conjunction with notice given under article 39 or within a reasonable time thereafter.

1) General Rule – Right to Performance: The buyer can ask the seller to do what they agreed to do (e.g., deliver goods, fix problems).

•However, if the buyer already chose a different remedy that conflicts with this—like canceling the contract or getting a refund—they can’t also demand performance. You can’t demand delivery if you’ve already canceled the contract.

(2) Substitute Goods – Only for Fundamental Breach:

The buyer can ask for completely new (substitute) goods only if:

•The defect is serious (a fundamental breach, not just a small flaw).

•The buyer gives proper notice (as required by Article 39) or shortly after giving that notice.

(3) Repair – More Flexible Option:

•If the goods are defective, the buyer can ask the seller to repair them, unless doing so would be unreasonable (e.g., costs too much or takes too long).

•The buyer must ask for repair at the same time they notify the seller of the problem (under Article 39) or within a reasonable time after that.

Article 50

If the goods do not conform with the contract and whether or not the price has already been paid, the buyer may reduce the price in the same proportion as the value that the goods actually delivered had at the time of the delivery bears to the value that conforming goods would have had at that time. However, if the seller remedies any failure to perform his obligations in accordance with article 37 or article 48 or if the buyer refuses to accept performance by the seller in accordance with those articles, the buyer may not reduce the price.

Right to reduce | Buyer can reduce price if goods are non-conforming |

Proportionate basis | Price cut equals the difference in value between what was delivered and what was promised |

Price already paid? | Doesn’t matter — buyer can still claim a refund |

Exceptions | No reduction if seller cures defect under Articles 37 or 48 and buyer refuses to accept cure |

Article 74

Damages for breach of contract by one party consist of a sum equal to the loss, including loss of profit, suffered by the other party as a consequence of the breach. Such damages may not exceed the loss which the party in breach foresaw or ought to have foreseen at the time of the conclusion of the contract, in the light of the facts and matters of which he then knew or ought to have known, as a possible consequence of the breach of contract.

Damages for breach of contract by one party consist of a sum equal to the loss, including loss of profit, suffered by the other party as a consequence of the breach.

A sum equal to the loss, including:

Loss of profit, suffered by the aggrieved party.

BUT: Damages are limited to the loss that was foreseeable by the breaching party at the time of the contract.

Article 75

If the contract is avoided and if, in a reasonable manner and within a reasonable time after avoidance, the buyer has bought goods in replacement or the seller has resold the goods, the party claiming damages may recover the difference between the contract price and the price in the substitute transaction as well as any further damages recoverable under article 74.

You’re referring to Article 75 of the United Nations Convention on Contracts for the International Sale of Goods (CISG). This rule covers what happens after a contract is avoided (terminated) due to a serious breach — especially when one party has to find a replacement deal quickly.

📘Explanation of Article 75 CISG

🔹 When It Applies:

One party terminates the contract (legally avoids it) due to the other party’s fundamental breach (e.g., seller fails to deliver or delivers defective goods).

The aggrieved party makes a substitute transaction:

Buyer buys similar goods elsewhere.

Seller resells the undelivered goods.

🔹 What Damages Can Be Recovered?

The difference between the contract price and the substitute price

➕

Additional damages under Article 74 (e.g., extra shipping, storage, lost profits)

📌Key Conditions:

The replacement transaction must be made “in a reasonable manner”

It must be done “within a reasonable time” after avoidance.

🔍Example Scenario

A buyer agrees to purchase 1,000 laptops from a seller for $500,000.

The seller fails to deliver.

The buyer terminates the contract and buys the same laptops from another seller for $550,000.

Buyer can claim:

👉 $50,000 (difference in price under Article 75)

➕ Any additional losses caused by the breach (under Article 74).

📚Real Case: Tribunal of International Commercial Arbitration at the Russian Federation Chamber of Commerce (CISG Case No. 406/1998)

📄 Facts:

A Russian buyer avoided the contract after the seller failed to deliver goods.

The buyer purchased replacement goods at a higher price within a reasonable time.

⚖ Outcome:

The tribunal applied Article 75 and awarded the difference in price, because:

The buyer acted promptly and reasonably.

The new transaction was comparable in terms of quantity and quality.

✅ Result: Damages based on the price difference were allowed under Article 75.

✅ Summary Table

Element | Explanation |

|---|---|

Contract avoided | Due to fundamental breach |

Substitute transaction made | Buyer re-buys goods or seller resells |

Price difference recoverable | Between original and new contract |

Further damages possible | Under Article 74 (e.g., costs, lost profit) |

Must be timely and reasonable | Otherwise Article 75 won’t apply |

Would you like a diagram comparing Article 74 (general damages) and Article 75 (substitute sale damages)?

Article 76

1.If the contract is avoided and there is a current price for the goods, the party claiming damages may, if he has not made a purchase or resale under article 75, recover the difference between the price fixed by the contract and the current price at the time of avoidance as well as any further damages recoverable under article 74. If, however, the party claiming damages has avoided the contract after taking over the goods, the current price at the time of such taking over shall be applied instead of the current price at the time of avoidance.

(2) For the purposes of the preceding paragraph, the current price is the price prevailing at the place where delivery of the goods should have been made or, if there is no current price at that place, the price at such other place as serves as a reasonable substitute, making due allowance for differences in the cost of transporting the goods.

“If the contract is avoided and there is a current price for the goods…”>> Damages Based on Price Difference (If No Replacement Transaction Was Made):

You can claim damages based on:

• The difference between the contract price and the current market price at the time the contract was avoided.

• Plus any additional losses covered under Article 74 (like lost profits or extra costs caused by the breach).

BUT:

• If you already took over the goods (received them) and then avoided the contract, you use the market price at the time you received the goods, not the price at the time of avoidance (?You calculate the damages by comparing the contract price with the market price at a specific point in time, in this case when the goods are received)

🔁 This applies only if:

• You did not make a replacement purchase (or resale) under Article 75, which deals with damages based on actual transactions.

“The current price is the price at the place of delivery…”>>How to Determine the “Current Price”:

• The current price is the market price at the place where the goods were supposed to be delivered.

• If there’s no market price at that place, use a reasonable substitute location, but:

• Make adjustments for differences in transport costs between the two places.

Article 77

A party who relies on a breach of contract must take such measures as are reasonable in the circumstances to mitigate the loss, including loss of profit, resulting from the breach. If he fails to take such measures, the party in breach may claim a reduction in the damages in the amount by which the loss should have been mitigated.

If you suffer a loss because the other party breached the contract, you can claim damages — but:

You must take reasonable steps to reduce or avoid further loss, including lost profits.

If you don’t, the party who broke the contract can reduce the amount they owe you in damages by the amount you could have avoided.

(If you suffer a loss because the other party breached the contract, you can claim damages — but: You must take reasonable steps to reduce or avoid further loss, including lost profits. If you don’t, the party who broke the contract can reduce the amount they owe you in damages by the amount you could have avoided.)

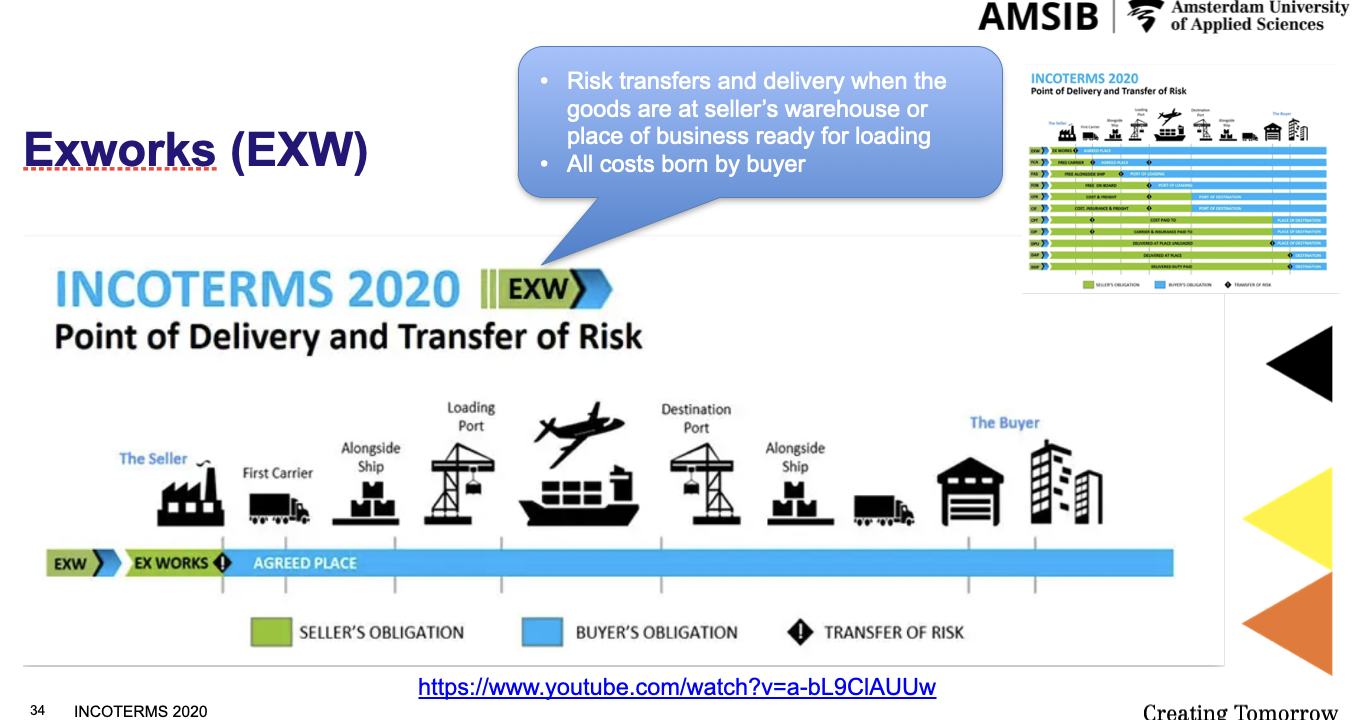

INCOTERMS 2020

Adopted by the ICC in Paris, have to be specifically agreed upon in the contract. Deal with

(i) Transportation costs

(ii) Passing of risk for damage/loss of the goods

(iii) Place of delivery of the goods

Part of the contract for sale of goods; contract of carriage: a contract for the transportation of the goods by air, road or water.

EXW (Exworks)

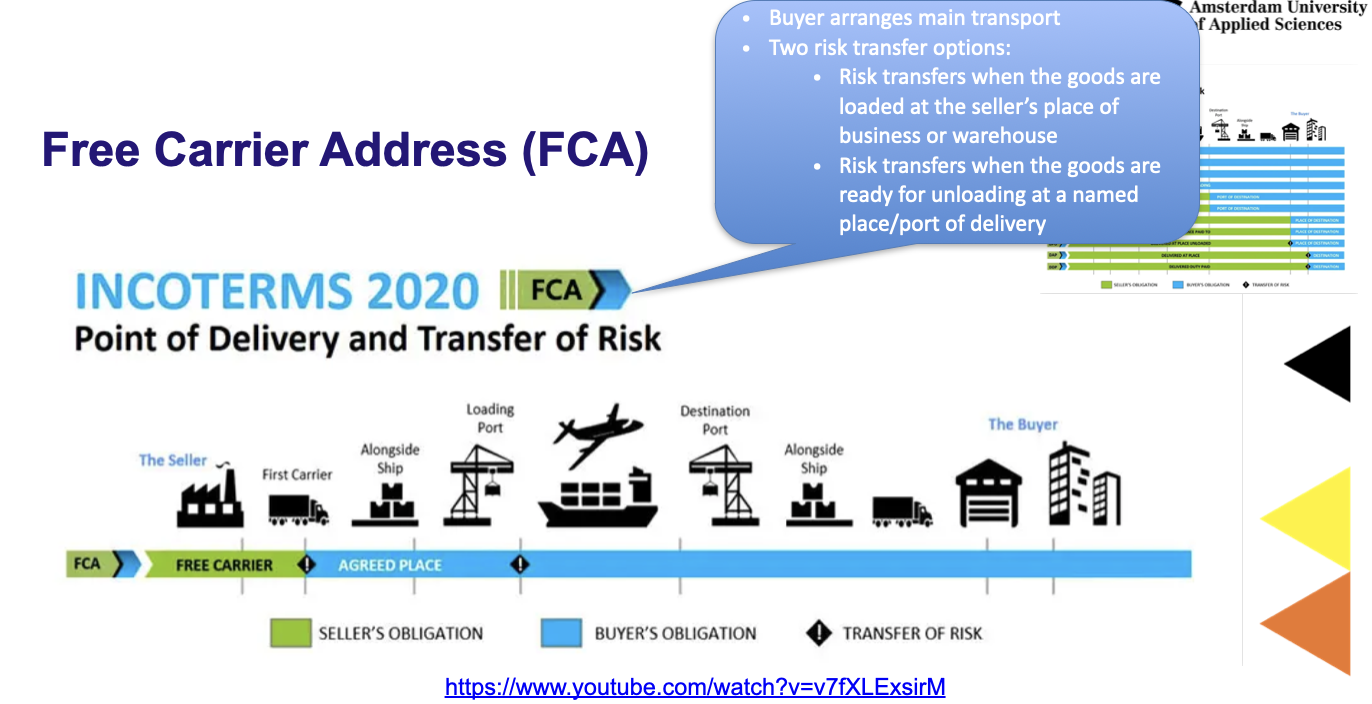

FCA (Free Carrier Address)

Responsibility:

Seller (Germany):

Packs goods, clears them for export.

Delivers goods to a carrier nominated by the buyer at the seller's facility.

Buyer (Canada):

Arranges and pays for main carriage, insurance, and import clearance.

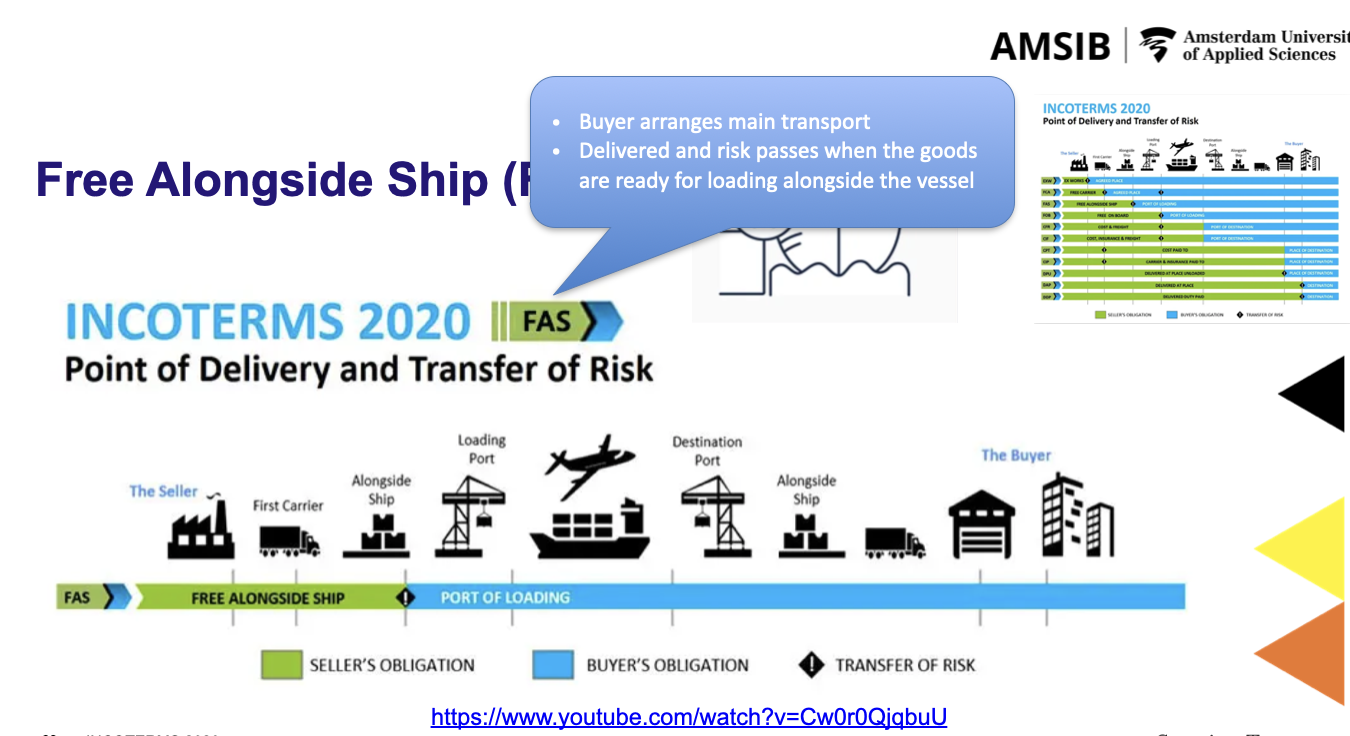

FAS (Free Alongside Ship)

FOB (Free On Board)

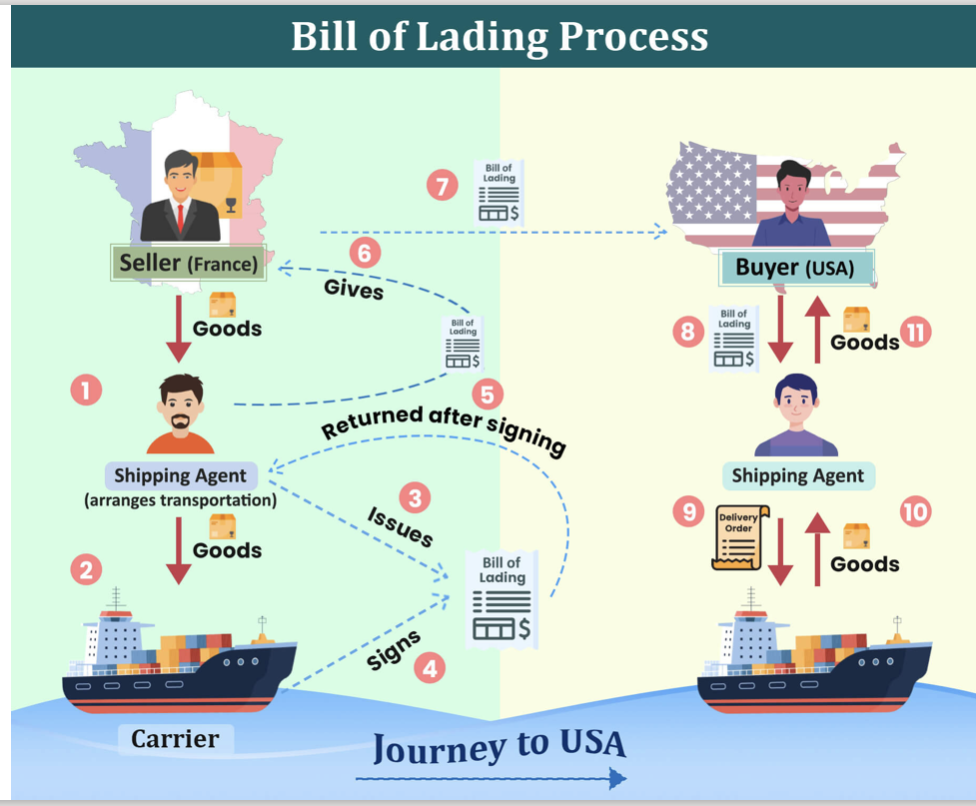

Bill of Lading

A bill of lading (B/L) is a legal document used in international trade and shipping that serves multiple important functions. It is issued by a carrier (e.g., shipping company) to the shipper (seller/exporter) and relates to the transportation of goods.

A bill of lading is a document that:

Acknowledges receipt of goods by the carrier.

Is a contract of carriage between the shipper and the carrier.

Acts as a document of title to the goods — meaning the holder of the bill can claim ownership and take delivery.

1. Receipt of goods | Confirms that the carrier received the described goods from the shipper in good condition. |

2. Evidence of contract of carriage | It outlines the terms and conditions under which the goods will be transported. |

3. Document of title | The person holding the original bill of lading can claim the goods at the destination. This makes it negotiable in some cases (like a cheque). |

A bill of lading is a key document in shipping that proves goods were loaded, outlines shipping terms, and can transfer ownership. It acts as a receipt, a contract, and a title document — all in one.

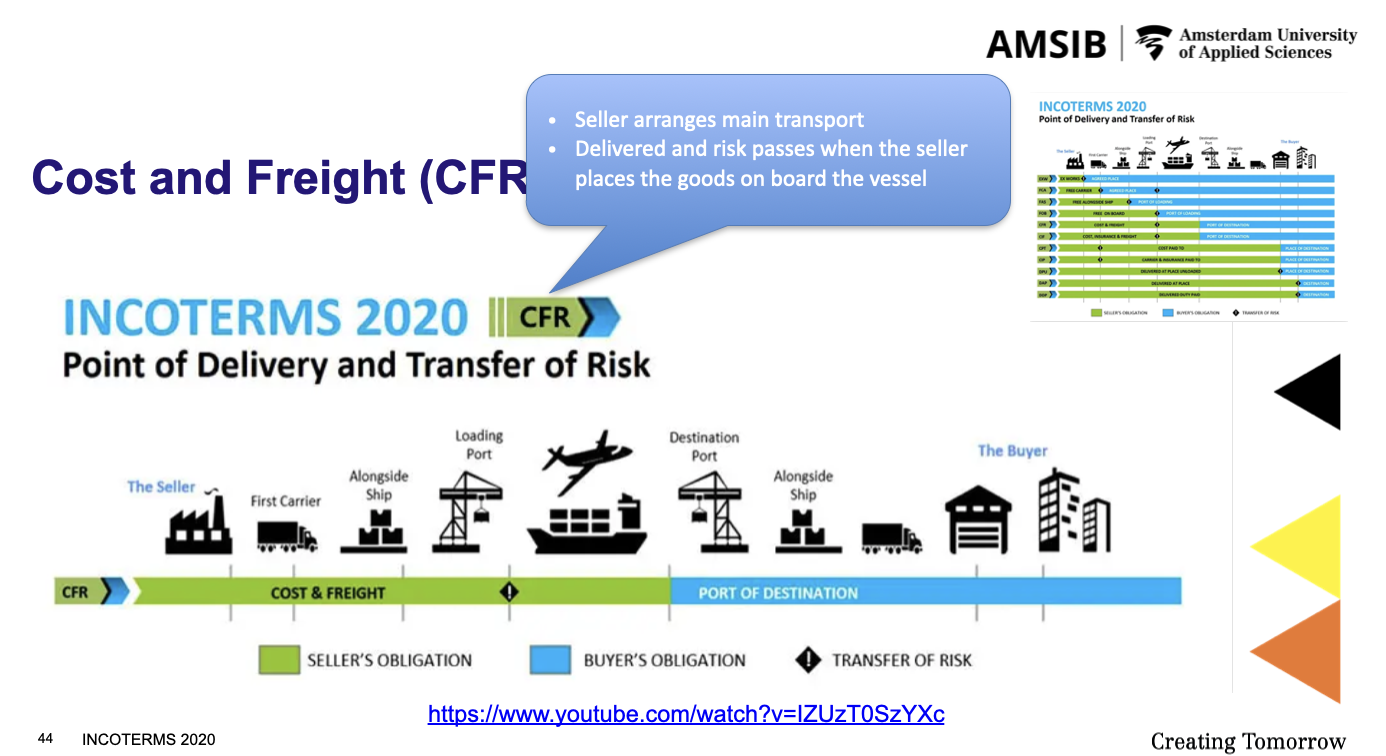

CFR (Cost and freight)

The key difference between FOB (Free On Board) and CFR (Cost and Freight) lies in who pays for shipping and where the risk transfers from the seller to the buyer.

🔹FOB (Free On Board)

Risk transfers: When the goods are loaded onto the ship at the port of departure.

Cost responsibility:

Seller pays: Costs up to and including loading the goods on the vessel.

Buyer pays: Ocean freight, insurance, unloading, and further transport.

✅ Buyer takes responsibility early.

🛳 Used mostly for containerized goods.

🔹CFR (Cost and Freight)

(Also called CNF - Cost and Freight)

Risk transfers: Also when the goods are loaded onto the ship (same as FOB).

Cost responsibility:

Seller pays: All costs up to the destination port, including ocean freight.

Buyer pays: Insurance, unloading at destination, and transport from port onward.

✅ Seller covers more cost, but risk still passes at origin.

📦 Used more for bulk cargo.

🧾 Summary Table:

Term | Seller Pays | Buyer Pays | Risk Transfers |

|---|---|---|---|

FOB | Up to loading at port | Freight, insurance, destination | At origin port (when loaded) |

CFR | Up to port of arrival (freight included) | Insurance, unloading, inland transport | At origin port (when loaded) |

Let me know if you want the comparison for FOB vs CIF (CIF includes insurance).

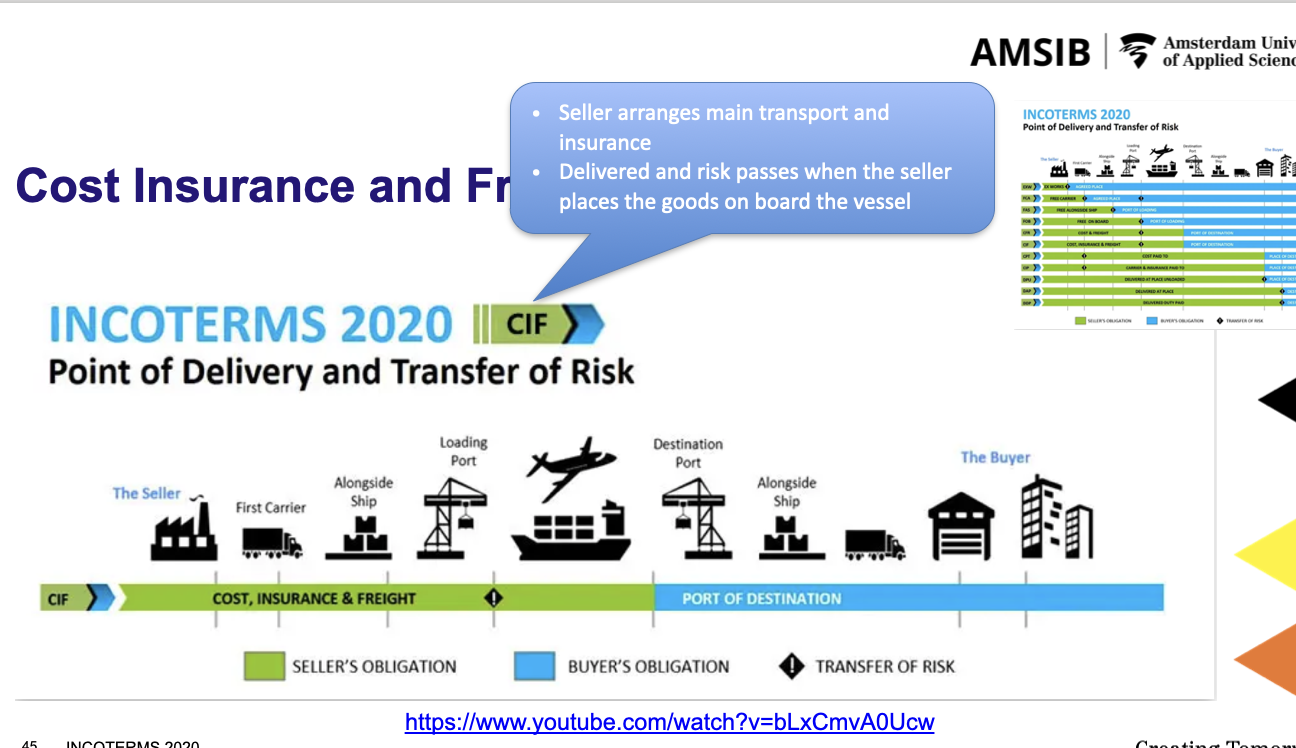

Cost Insurance and Freight (CIF)

Risk transfers from seller to buyer when the goods are loaded on board the vessel at the port of shipment (Hamburg).

Seller is obligated to provide insurance only to minimum cover, unless otherwise agreed.

Responsibility:

Seller (China):

Arranges and pays for carriage to Santos and marine insurance.

Risk transfers to the buyer once goods are loaded on the vessel in China.

Buyer (Brazil):

Bears the risk during sea transit (despite not arranging the transport).

Handles import clearance and delivery from the port.

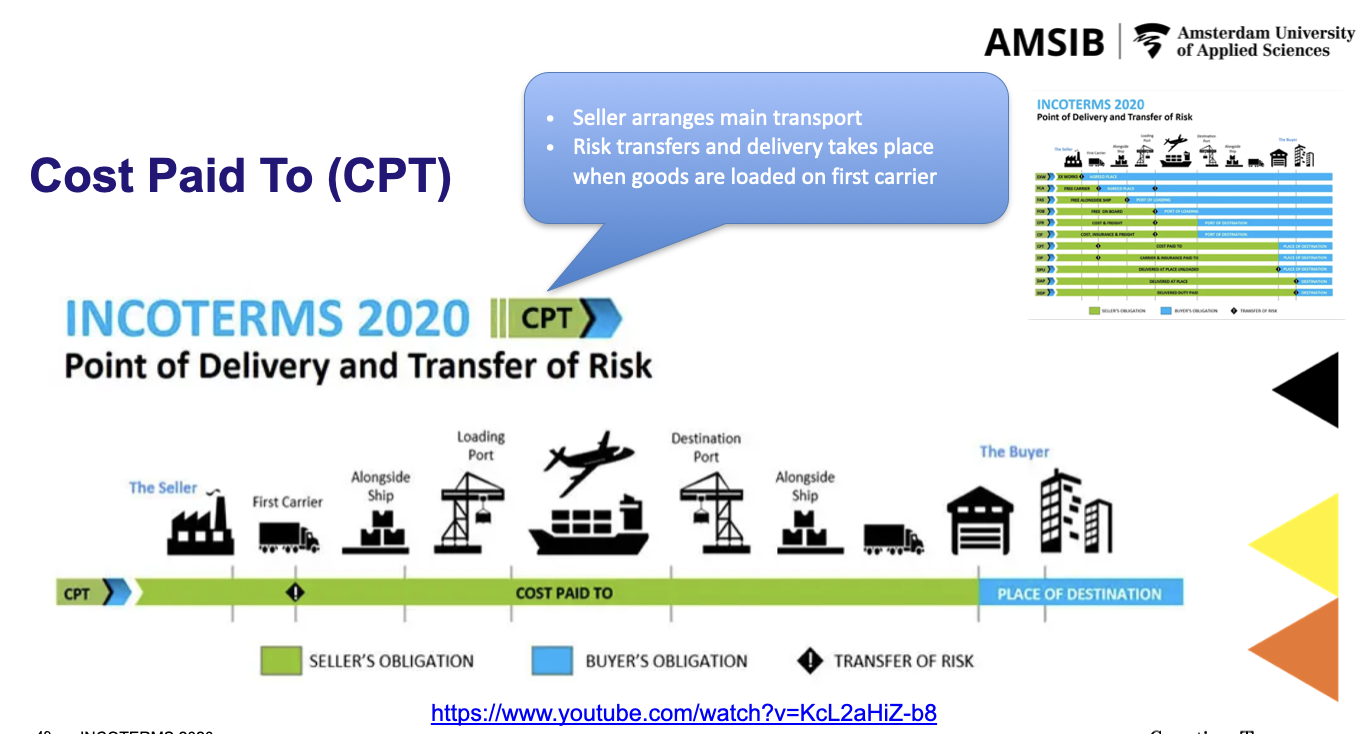

Carriage Paid To (CPT)

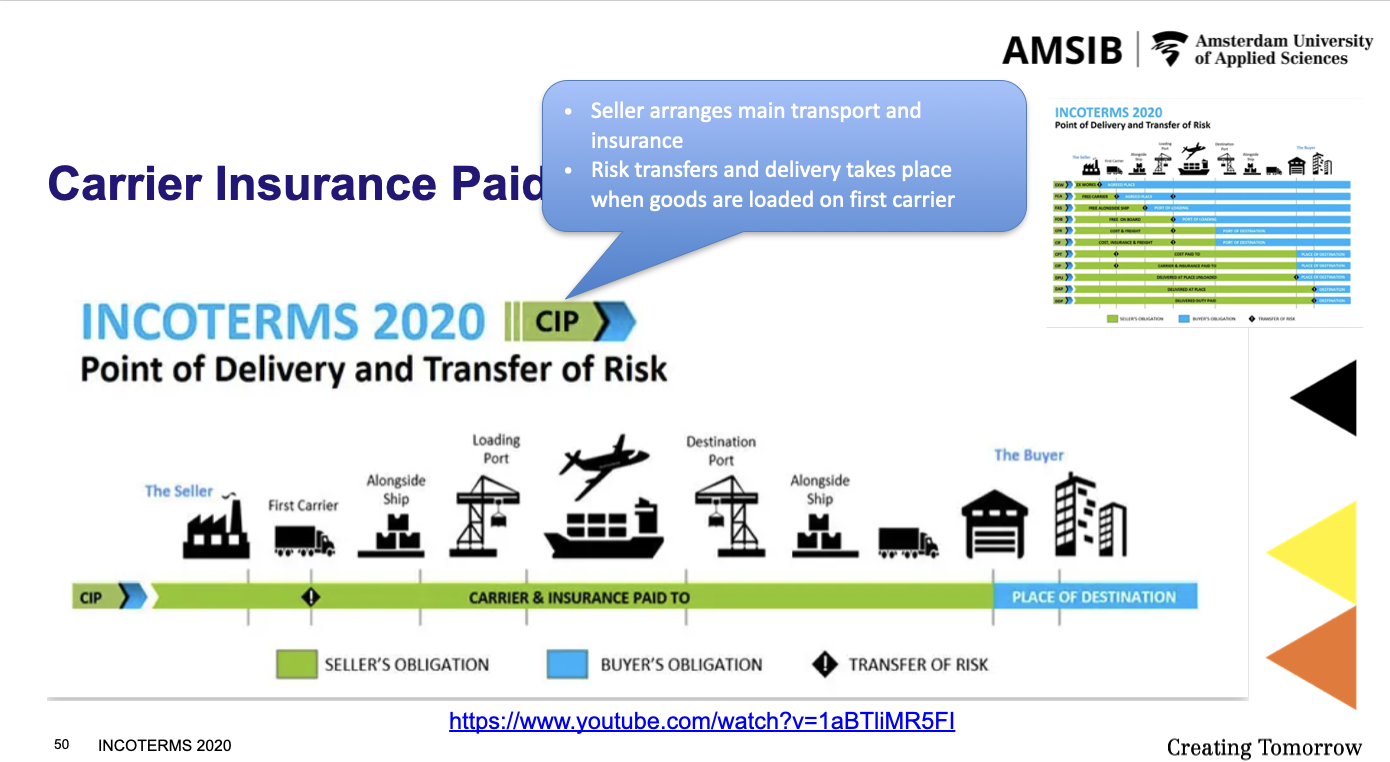

Carrier Insurance Paid to (CIP)

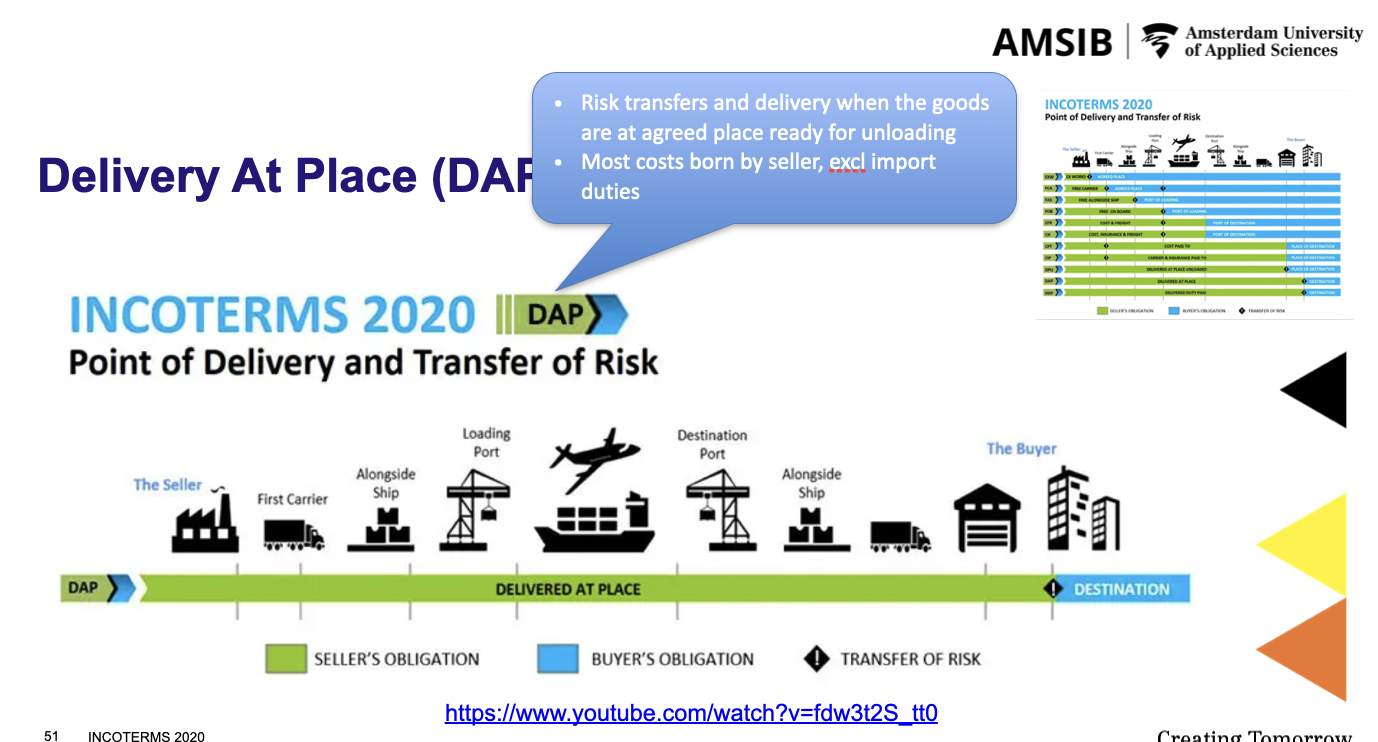

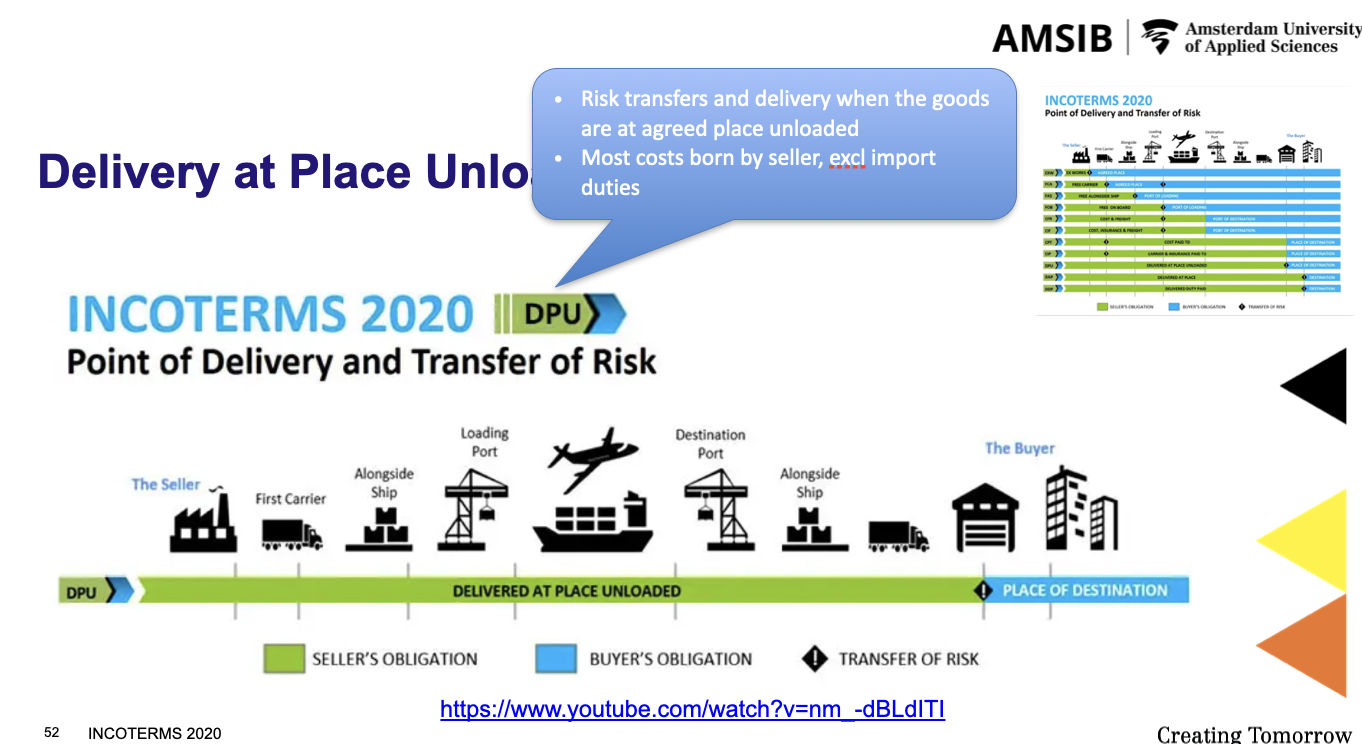

Delivery At Place (DAP)

Delivery At Place (DAP)

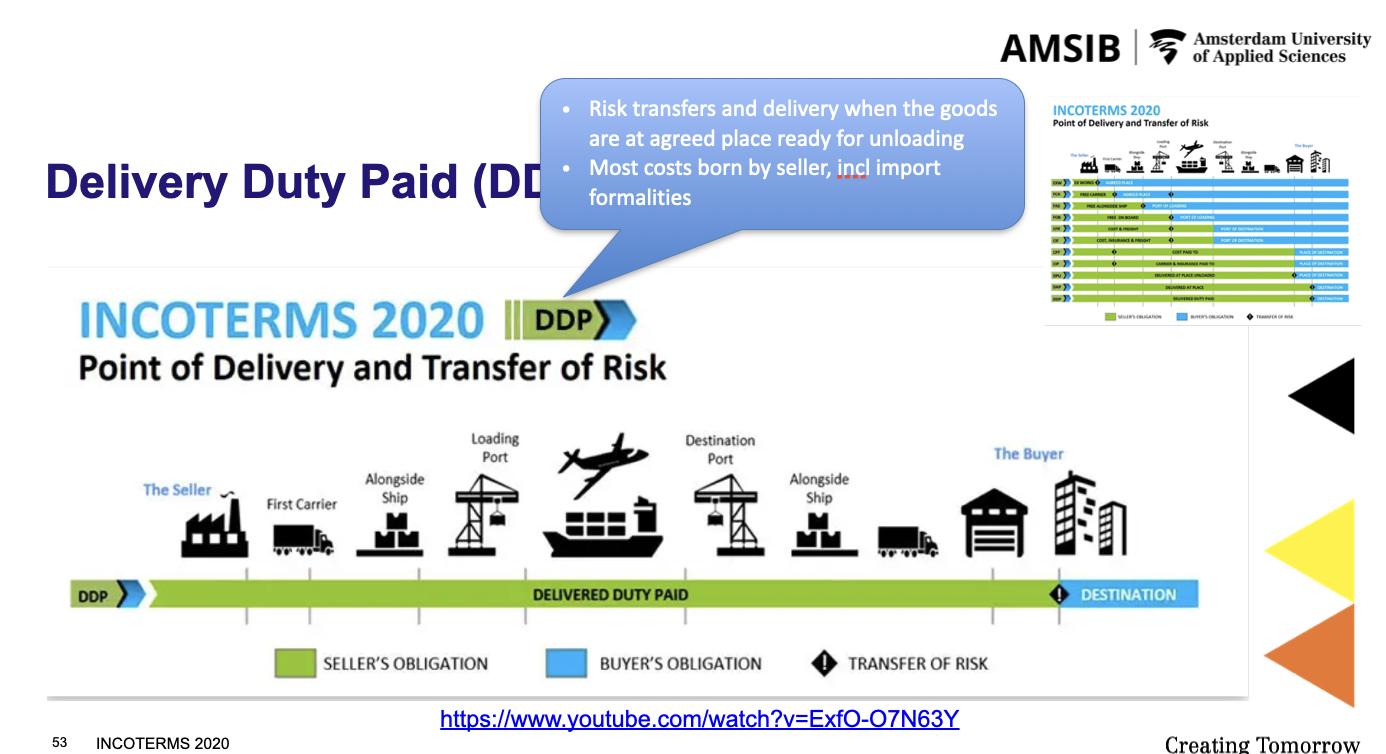

Delivery Duty Paid (DDP)

The seller bears all costs and risks until goods are delivered to the agreed destination.

The seller is responsible for import customs clearance, including duties, taxes, and any necessary licenses or permits.

Responsibility:

Seller (USA):

Handles everything: export clearance, main carriage, import duties, and delivery to the buyer’s location in France.

Buyer (France):

Only receives the goods at the agreed destination.

In the exam

• Free movement of workers:

• Free movement of workers:

Article 45 - 48

• Freedom of establishment:

Article 49 - 55

• Freedom to provide services:

Article 56 – 62

Article 45 TFEU

1. Free movement for workers shall be secured within the Union.

2. Such freedom of movement shall entail the abolition of any discrimination based on nationality between workers of

the Member States as regards employment, remuneration and other conditions of work and employment.

3. It shall entail the right, subject to limitations justified on grounds of public policy, public security or public health:

a)to accept offers of employment actually made; to move freely within the territory of Member States for this

purpose;

b)to stay in a Member State for the purpose of employment in accordance with the provisions

c) governing the employment of nationals of that State laid down by law, regulation or administrative action;

d)to remain in the territory of a Member State after having been employed in that State, subject to conditions

which shall be embodied in regulations to be drawn up by the Commission.

4. The provisions of this Article shall not apply to employment in the public service.

Article 45 of the Treaty on the Functioning of the European Union (TFEU) sets out the rules and rights regarding the free movement of workers within the EU. Here’s a clear explanation of each part:

🔹1. Free movement for workers shall be secured within the Union.

This means that EU citizens have the right to work in any EU country, and the EU must protect and ensure this freedom.

🔹2. Abolition of discrimination based on nationality

No discrimination between workers from different EU countries.

This includes:

Employment opportunities

Pay/salary

Working conditions

💡 Example: A Spanish worker in Germany must be treated the same as a German worker regarding pay and job rights.

🔹3. Rights that come with this freedom

Workers from one EU country have the right to:

a)Accept job offers and move for work

Move across borders to take a job.

b)Live in another EU country for work

Reside in a country for the purpose of working.

c)Work under the same rules as nationals

Follow the same employment laws and rules as citizens of that country.

d)Stay after employment ends

Remain in the host country even after finishing work (under certain conditions defined by EU regulations).

🔹4. Exception: Public service

This Article does not apply to jobs in the “public service” (e.g., police, military, certain government positions).

Member States can reserve these roles for their own nationals.

🧾 In Summary:

Article 45 TFEU gives EU citizens the right to work anywhere in the EU without discrimination.

It ensures mobility, equal treatment, and residence rights tied to employment.

Some exceptions apply, especially for public service jobs.

!

• Article 45 TFEU restricts its application to workers who are nationals of the Member

State

• definition of term ‘worker’ has been held to be a matter for Union law and therefore

not the national legislature of the MS!

• definition of ‘worker’ includes a person who is currently unemployed, but capable of

taking another job.

Exceptions to the

free movement of workers

Here are some key EU Court of Justice (ECJ) cases that interpret the “public service” exception under Article 45(4) TFEU. These cases clarify which jobs may be restricted to nationals and which cannot:

🔹1. Commission v Belgium (Case 149/79)

🗓 Date: 1980

📌 Issue: Belgium reserved many public sector jobs for Belgian nationals — including postal workers, railway workers, etc.

💡 Ruling:

The ECJ said most of these jobs did NOT qualify as “public service” under Article 45(4), because they did not involve the exercise of public authority or safeguarding national interests.

✅ Only roles with sovereign powers (e.g., police, military, judges) may be restricted.

❌ General admin, technical, or manual jobs in public bodies must be open to EU citizens.

🔹2. Commission v Luxembourg (Case C-473/93)

🗓 Date: 1996

📌 Issue: Luxembourg limited access to public-sector roles in hospitals and education.

💡 Ruling:

Jobs like nurses and teachers (except those teaching national values/authority) do not qualify as “public service”unless they exercise official authority or protect state interests.

🔹3. Sotgiu v Deutsche Bundespost (Case 152/73)

🗓 Date: 1974

📌 Issue: A non-German (Italian) worker was being treated differently in terms of pay at the German Post Office.

💡 Ruling:

Even if the employer is a public body, it must apply equal treatment under EU law unless the job is in the core public service (involving sovereign powers).

🔹4. Commission v France (Case C-405/01)

🗓 Date: 2004

📌 Issue: France restricted access to certain administrative roles to French nationals.

💡 Ruling:

The ECJ found that only specific roles that directly involve public authority can be reserved for nationals. Broad or general restrictions were not allowed.

✅ Key Principles from These Cases:

The “public service” exception is narrow and interpreted strictly.

It only applies to roles involving:

The exercise of public authority (e.g., law enforcement, judiciary, diplomacy).

Protection of national interests (e.g., internal or external security).

Administrative, technical, and support jobs in the public sector must generally be open to all EU nationals.

Would you like a quick summary in chart form or more detail on a specific case?• public service

• official authority

• public policy

• public security

• public health

Public service and official authority exceptions govern the work;

Public policy, public health and public security govern specific characteristics of particular persons, including

conduct of that EU citizen

Vertical and horizontal

direct effect

Direct effect means that a provision of EU law can be relied on by individuals directly in national courts without

needing national implementation — but only if it's sufficiently clear, precise, and unconditional.

Vertical direct effect: an individual invokes an EU law against the state or a public body.

Horizontal direct effect: the employer-employee relationship is also governed by non-discrimination on nationality

principle.

• In other words: discrimination prohibition based on nationality does not only apply to actions of public

authorities, but also to rules of any other nature aimed at regulating in a collective manner gainful employment

and the provision of services.

• Netherlands: CAO provisions that discriminate on nationality are illegal, null and void

• ECJ: MS are allowed to reserve for nationals those posts which would require a

specific bond of allegiance and mutuality of rights and duties between state and

employee. Which posts?

• must involve participation in the exercise of powers conferred by public law

• must entail duties designed to safeguard the general interests of the state.

• examples: armed forces, judiciary, police, tax authorities.

NB: meaning of public service is to be determined by the ECJ, not the MS.

Freedom of establishment

and to provide services (1/2)

Here is the actual legal text from the Treaty on the Functioning of the European Union (TFEU) regarding:

🔹Freedom of Establishment

Articles 49–55 TFEU

📜 Article 49 TFEU(Freedom of Establishment):

Restrictions on the freedom of establishment of nationals of a Member State in the territory of another Member State shall be prohibited.

Such prohibition shall also apply to restrictions on the setting up of agencies, branches or subsidiaries by nationals of any Member State established in the territory of any Member State.

Freedom of establishment shall include the right to take up and pursue activities as self-employed persons and to set up and manage undertakings, in particular companies or firms, under the conditions laid down for its own nationals by the law of the country where such establishment is effected.

🔹Freedom to Provide Services

Articles 56–62 TFEU

📜 Article 56 TFEU(Freedom to Provide Services):

Within the framework of the provisions set out below, restrictions on freedom to provide services within the Union shall be prohibited in respect of nationals of Member States who are established in a Member State other than that of the person for whom the services are intended.

The European Parliament and the Council, acting in accordance with the ordinary legislative procedure, may extend the provisions of the Chapter to nationals of a third country who provide services and who are established within the Union.

• Article 49 – 55 TFEU: freedom of establishment -> require the removal of restrictions

on the right of individuals and companies to maintain a permanent or settled place of

business in a Member State

Definition of establishment: ‘the actual pursuit of an economic activity through a

fixed establishment in another Member State for an indefinite period’

.

• Article 56 – 62 TFEU: freedom of services -> require the removal of restrictions on the

provision of services between Member State, whenever a cross-border element is

present

• NB: while the Treaty provisions governing the free movement of services are residual,

in that they apply only in so far as the provisions concerning capital, persons, or goods

do not apply, it is often difficult, in contexts such as broadcasting or

telecommunications, to separate the issues concerning goods from those concerning

services.

• MS may invoke public-interest justifications to restrict these freedoms.

• Article 57 TFEU: services shall in particular include: a) activities of an industrial

character; b) activities of a commercial character; c) activities of craftsmen; d)

activities of the professions.

Article 56 TFEU

Within the framework of the provisions set out below, restrictions on freedom to provide

services within the Union shall be prohibited in respect of nationals of Member States

who are established in a Member State other than that of the person for whom the

services are intended.

The European Parliament and the Council, acting in accordance with the ordinary

legislative procedure, may extend the provisions of the Chapter to nationals of a third

country who provide services and who are established within the Union.

Article 57 TFEU

Services shall be considered to be ‘services’ within the meaning of the Treaties where they are normally provided for

remuneration, in so far as they are not governed by the provisions relating to freedom of movement for goods, capital

and persons.

‘Services’ shall in particular include:

(a) activities of an industrial character;

(b) activities of a commercial character;

(c) activities of craftsmen;

(d) activities of the professions.

Without prejudice to the provisions of the Chapter relating to the right of establishment, the person providing a service

may, in order to do so, temporarily pursue his activity in the Member State where the service is provided, under the

same conditions as are imposed by that State on its own nationals.

Regulation 1251/70: the right

to remain in the territory

The right to remain in the territory of a MS after having been employed there. Who has the right to remain?

• a worker who has reached the statutory age for entitlement to old-age pension, has worked in the host State for at

least the last 12 months and has resided there continuously for more than 3 years;

• a worker who has resided continuously in the host state for more than 2 years and has ceased work because of

permanent incapacity. No residence requirement is imposed where that incapacity results from an industrial

accident or occupational disease entitling the worker to a state pension;

• a frontier worker, under certain circumstances;

• members of a worker’s family, if the worker is entitled to remain. Family members have the right to remain

permanently, even after the worker’s death. Under certain circumstances, they are entitled to remain even if the

worker dies before having acquired himself or herself an entitlement to remain.

International transport

Sea: Hague Rules 1924/ Hague Visby Rules 1968/Hamburg Rules1978 /Rotterdam Rules not yet operational

Air: Warsaw 1929/Montreal Conventions 1999

Road: CMR 1956

maximum liability limit in the CMR

1. Risk Allocation & Predictability

Carriers take on risk every time they transport goods. Limiting liability:

Makes risk quantifiable and insurable

Helps carriers calculate costs and set fair prices

Protects carriers from unlimited financial ruin for high-value cargo

Example: A truck transporting €10 million in diamonds shouldn't make the carrier liable for the full value if those goods were undeclared or improperly insured.

✅ 2. Encouraging Proper Insurance

Shippers (cargo owners) are expected to:

Declare high-value goods

Take out cargo insurance themselves if necessary

Not rely solely on the carrier’s liability as "free insurance"

This encourages a shared responsibility model.

✅ 3. Preventing Abuse and Fraud

Limiting liability deters:

Fraudulent or exaggerated claims

Opportunistic lawsuits where actual loss was minor but claimed value is massive

✅ 4. Standardization Across Borders

International transport treaties (like CMR, Hague-Visby Rules, Montreal Convention, etc.):

Set uniform rules for compensation

Make cross-border logistics and dispute resolution more predictable

Prevent "forum shopping" for countries with no liability caps

✅ 5. Fairness in Pricing

If carriers were liable for full, unlimited cargo value, they would:

Charge significantly more

Possibly refuse to carry high-risk or high-value items

The current system lets them charge reasonably, while cargo owners choose to insure additionally if needed.

Air Transport

Central document in international transport: Consignment Note/Air Waybill

Receipt for proper reception of goods transported

Evidence for a contract of transportation

Sea Transport

International Sea transport document: Bill of Lading:

Evidence for existence of contract of transportation

Receipt for goods

Document of Title

Hague-Visby Rules

The Hague-Visby Rules are an international set of rules that govern the carriage of goods by sea, particularly the responsibilities and liabilities of carriers (typically shipping companies) and the rights of cargo owners.

They are used in many countries as the legal basis for maritime shipping contracts, especially under bills of lading.

KEY PROVISIONS:

Carrier’s Responsibilities:

Must exercise due diligence to:

Make the ship seaworthy.

Properly man, equip, and supply the ship.

Ensure the ship is fit for carrying the goods.

Carrier’s Liabilities:

Responsible for loss or damage to cargo due to failure in their duties (e.g. unseaworthiness, improper care).

Not liable for loss or damage due to excepted perils, like:

Acts of God

Perils of the sea

War

Negligence in navigation or management of the ship

Limitation of Liability:

Liability is limited to 666.67 SDRs per package or 2 SDRs per kilogram, whichever is higher (as amended by the Visby Protocol).

An SDR (Special Drawing Right) is an international reserve asset created by the IMF. Its value is based on a basket of major currencies; its value fluctuates daily.

Time Limit:

A claim must be made within one year from the date of delivery or the date the goods should have been delivered.

Road Transport: CMR

CMR Convention (Convention on the Contract for the International Carriage of Goods by Road)

Purpose: To standardize conditions for contracts in international transport of goods by road between member countries.

Key Features of the CMR Convention:

Applicability:

Applies to contracts for the international transport of goods by road when at least one of the countries is a signatory.

Covers carriers, senders, and consignees.

CMR Document:

A CMR consignment note is used as a proof of the transport contract.

Contains details like sender, consignee, carrier, goods description, and route.

Carrier Liability:

Carriers are liable for loss, damage, or delay unless caused by:

Fault of the sender

Inherent nature of goods (A natural characteristic or tendency of the goods themselves that causes damage, loss, or deterioration, without any external cause.)

Circumstances beyond control (force majeure)

Compensation:

Compensation is generally limited based on the weight of goods unless higher value is declared and paid for.

Jurisdiction: Legal disputes are handled by courts in the country where:

The defendant is based

The contract was made

The goods were taken over or delivered

Article 17 CMR

The carrier shall be liable for the total or partial loss of the goods and for damage thereto occurring between the time when he takes over the goods and the time of delivery, as well as for any delay in delivery.

The carrier shall, however, be relieved of liability if the loss, damage or delay was caused by the wrongful act or neglect of the claimant, by the instructions of the claimant given otherwise than as the result of a wrongful act or neglect on the part of the carrier, by inherent vice of the goods or through circumstances which the carrier could not avoid and the consequences of which he was unable to prevent.

The carrier shall not be relieved of liability by reason of the defective condition of the vehicle used by him in order to perform the carriage, or by reason of the wrongful act or neglect of the person from whom he may have hired the vehicle or of the agents or servants of the latter.

Subject to article 18, paragraphs 2 to 5, the carrier shall be relieved of liability when the loss or damage arises from the special risks inherent in one or more of the following circumstances:

a) Use of open unsheeted vehicles, when their use has been expressly agreed and specified in the consignment note;

b) The lack of, or defective condition of packing in the case of goods which, by their nature, are liable to wastage or to be damaged when not packed or when not properly packed;

c) Handling, loading, stowage, or unloading of the goods by the sender, the consignee, or persons acting on behalf of the sender or the consignee;

d) The nature of certain kinds of goods which particularly exposes them to total or partial loss or to damage, especially through breakage, rust, decay, desiccation, leakage, normal wastage, or the action of moth or vermin;

e) Insufficiency or inadequacy of marks or numbers on the packages;

f) The carriage of livestock.

Where under this article the carrier is not under any liability in respect of some of the factors causing the loss, damage, or delay, he shall only be liable to the extent that those factors for which he is liable under this article have contributed to the loss, damage, or delay.

Article 17.1 discusses the carrier's liability for the goods from the time they take over the goods until delivery, including the loss, damage, or delay in delivery.

Article 17.2 delineate the circumstances under which the carrier is not liable, such as wrongdoings by the claimant, instructions of the claimant not attributable to the carrier, inherent vice of the goods, or circumstances the carrier could not avoid and whose consequences he could not prevent.

Article 17.3 stipulates that a carrier cannot be exonerated from liability due to the defective condition of the vehicle used for the transport of goods, nor can the carrier be relieved of liability due to the wrongful acts or neglect of the person from whom the vehicle was hired, or their agents or employees.

Article 17.4 details specific exceptions to the carrier's liability, focusing on certain goods' nature or faults in packaging.

This provision outlines specific circumstances where a carrier can be relieved of liability for loss, damage, or delay of goods during transport. It limits the carrier’s responsibility when the loss is due to special risks related to the inherent nature of the goods or agreed conditions of carriage.

🔹General Rule (Subject to Article 18, paragraphs 2–5):

The carrier is not liable if the loss or damage is caused by special risks linked to specific, predefined situations (listed below).

But — as the final paragraph states — if the damage has multiple causes, the carrier is only partially liable, based on their share of responsibility.

🔹List of Special Risk Exemptions Explained:

a)Use of open unsheeted vehicles

✅ No liability if the vehicle was exposed (not covered) and the use of such a vehicle was expressly agreed and written in the consignment note.

💡 Example: rain damage to machinery on an open truck is not the carrier’s fault if the shipper agreed to it.

b)Lack or poor condition of packing

✅ No liability for goods that needed proper packing to avoid damage but weren’t packed correctly.

💡 Example: fragile glassware shattered because it was placed loosely in boxes.

c)Handling, loading, or unloading by sender or consignee

✅ No liability if the shipper or receiver (or their agents) did the loading/unloading and caused the damage.

💡 Example: sender loads heavy crates poorly, and they topple over.

d)Nature of the goods

✅ No liability for damage due to the inherent properties of certain goods — such as:

Breakage (glass)

Rust (metal)

Decay (food)

Desiccation (drying out)

Leakage (liquids)

Wastage (evaporation)

Moth/vermin damage (textiles, grain)

💡 Example: iron parts rust during normal shipment even though properly stowed.

e)Inadequate marks or numbers

✅ No liability if packages lack proper identification, making correct handling difficult.

💡 Example: crates without “fragile” labels are stacked wrongly.

f)Carriage of livestock

✅ No liability for loss or injury related to the natural unpredictability of animals.

💡 Example: some animals become ill or die during transit despite good care.

Shared Responsibility Clause (last paragraph):

If the damage results from both exempted causes and carrier’s own fault, the carrier is liable only for the part of the loss they caused.