The Pyramid Scheme Running Our Economy - Flashcards

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

6 Terms

Explain the main way businesses succeed nowadays.

By being a source of wealth intended to flow back to investors and financiers (rather than serving customers and wider communities), with half of that money coming from workers’ pension savings.

Explain the big-picture explanation for the economy as a pyramid scheme.

Higher level controls lower level and extracts from lower level: In each chain of power in the economy, each level extracts as much as it can from the level beneath it, which it controls

Externalities for lower levels: Those farther down the chain bear the brunt of the negative externalities brought by the upper group, with households (workers and consumers) bearing the biggest burdens.

List the five chains of power in the U.S. economy.

Investors: individuals with a super high net worth or institutional investors, which are entities whose function depends on the growth of capital.

Includes pension funds, endowment funds, insurance companies

Asset Managers: entities that derive their power from the collected value of their assets (sources of wealth) under management.

Can be public market or private asset managers

Examples: BlackRock, Blackstone, Goldman Sachs

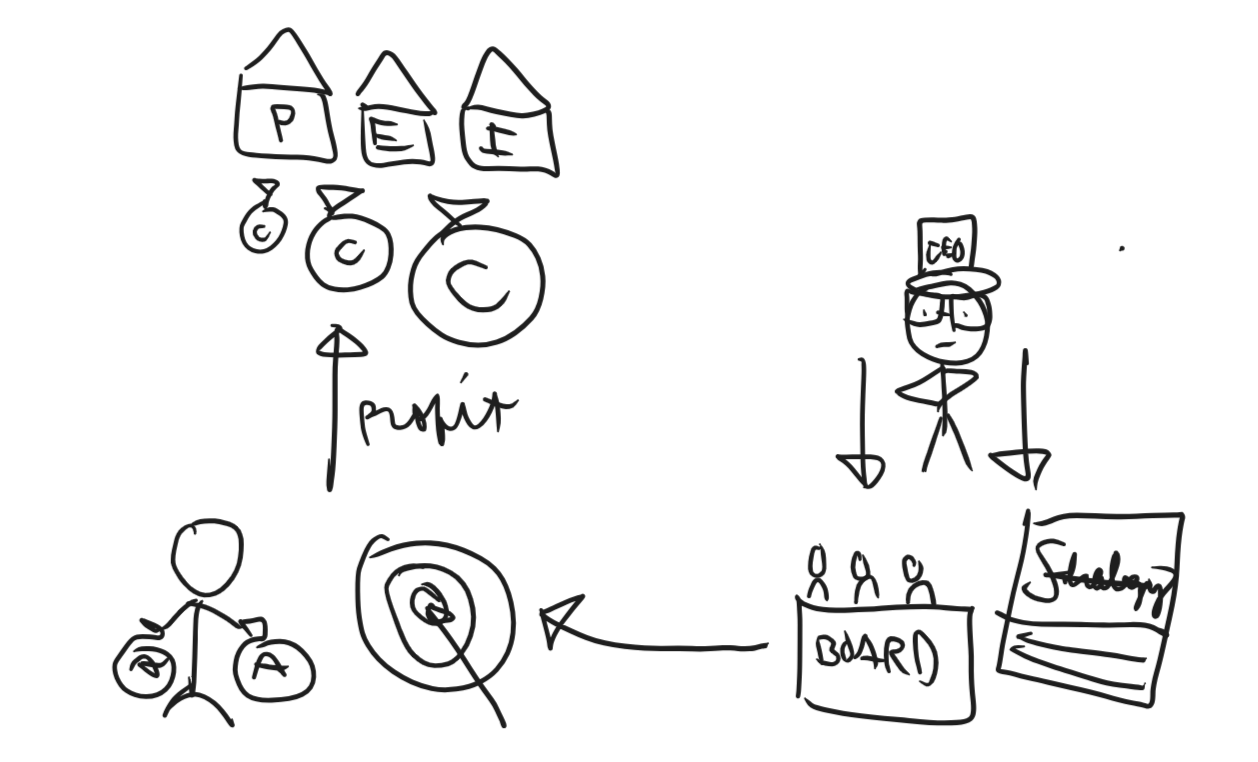

Stewards: govern the investments of the asset managers. Ensure that the Asset Managers’ financial goals are achieved

can be Boards of Directors and CEOs

Businesses: run by their CEO, with the workers under the CEO’s control.

The CEO oversees the achievement of the strategies that the board sets in order to:

Tackle the financial targets prescribed by the Asset Manager, in order to:

Achieve maximum profits for their Investors.

Households (Workers and Consumers)

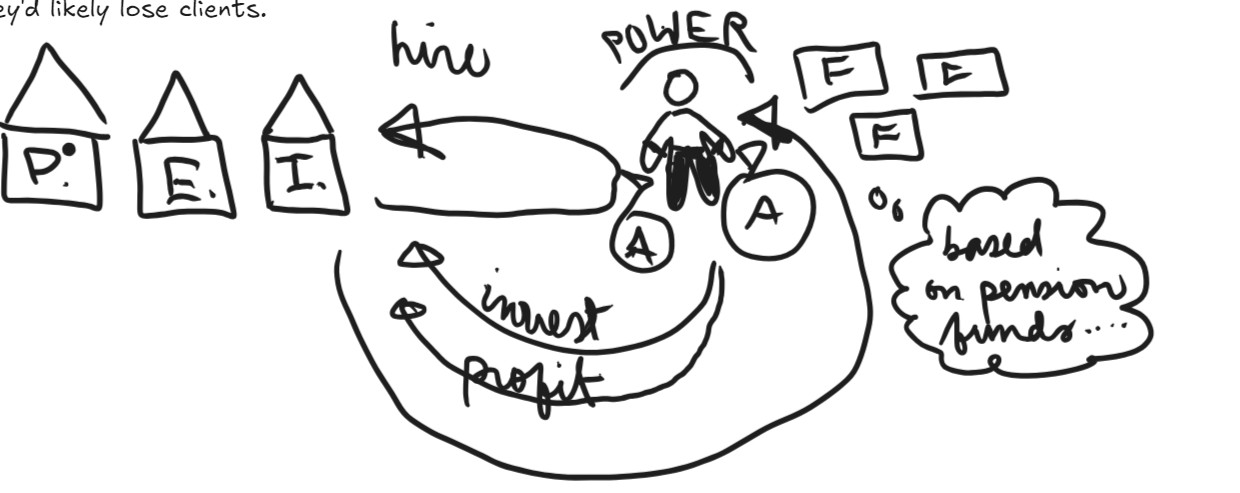

What is the relationship between investors and asset managers?

They hire asset managers to invest their money and make profits, while investors pay them high fees.

The way asset managers make decisions about how money is invested depends on the value of pension funds.

What are the main ways that profit can be maximized by businesses? Which three strategies have led to an increase in worse-ification?

Sell more of the same stuff

Sell the same stuff for more money

Reduce the cost of the same stuff sold

Reduce overhead costs of the overall business

Make new stuff to sell

Sell off business’ assets for a one-time windfall (a sudden, unexpected piece of good fortune)

What are some of the ways economic extraction (like environmental extraction) happens?

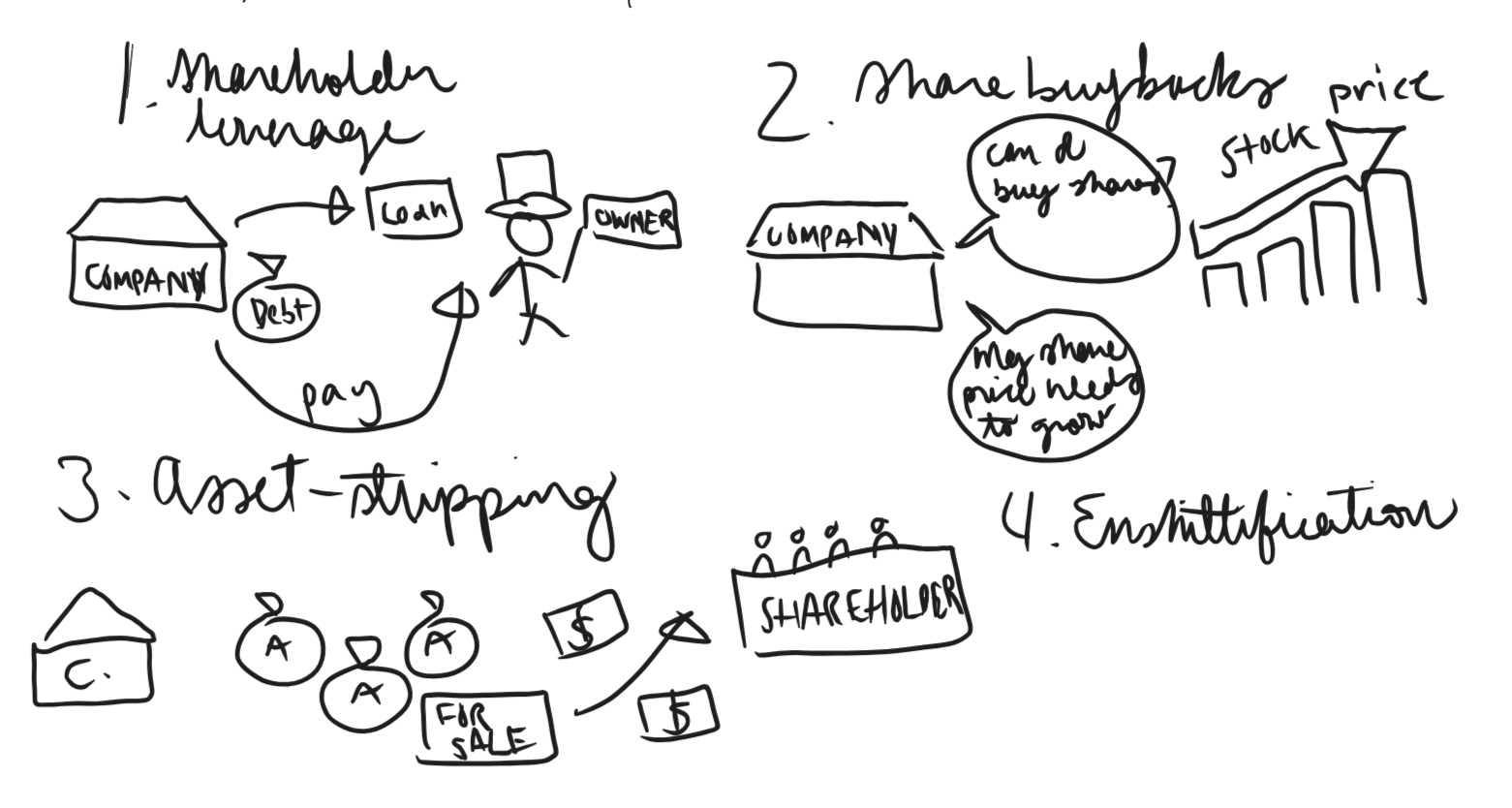

1. Shareholder leverage: companies take on debt or take out a loan to pay owners instead of investing in the business.

Share buybacks: companies use cash to raise their stock price rather than grow or improve the company

Asset-stripping: companies sell valuable assets (buildings, subsidiaries) to give cash to shareholders, leaving the company burdened with rent payments and lacking property assets to use during economic downturns

Worse-ification: companies cut quality, raise prices, and squeeze workers/customers to extract more profit out of them.