SIE Exam - Chapter 1

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

common stock

Ownership interest (equity) in an issuing corporation. The units are called shares.

authorized stock

The fixed number of common shares issued by a corporation. Par value ("price" of the share) has no bearing on the market price of stock.

issued stock

The subset of authorized stock sold to the public.

outstanding shares

The shares of issued stock.

treasury stock

Repurchased shares of issued stock (outstanding shares). Can be resold in the future or used to finance the acquisition of another company.

differences between treasury stock and shares outstanding

1) common shares have voting rights and dividends

2) treasury stock does not have these rights

settlement

When an investor buys a security, they immediately take economic ownership of it. However, they will not be recorded as the new owner until THIS time.

regular way settlement

Settlement occurs one business day after the trade date. This is called T+1 settlement.

cash dividends

Enable a company to share part of the corporation's profits with shareholders. They are declared by the board of directors and are typically paid quarterly to shareholders of record. Typically, utilities pay higher than average of these while high-tech companies may not pay it at all.

profits

earnings

stock dividends

Giving additional shares to existing stockholders. When this happens, the total number of shares outstanding increase, but the value of each share decreases. Since there is no economic value, a stock dividend is not currently taxable.

difference between stock dividends and stock split

1) stock dividends are defined as any stock distribution that involves less than 25% of outstanding shares

2) any larger proportion is called a stock split

forward stock split

Increases the number of shares outstanding and reduces price

reverse stock split

Decreases the number of shares outstanding and increases price

1) 2:1 stock split

2) 1: 10 stock split

3) 5:4 stock split

1) Twice the number of shares and half the value of each share.

2) 1/10 as many shares and 10x value for each

3) 5/4 as many share and 4/5 the value for each

Reason for forward stock split

The price per share would decrease enough to make it affordable for small shareholders.

Reason for reverse stock split

Might be made for a company whose share price has fallen below a minimum price required by an exchange such as the NYSE.

Preemptive rights

Short term securities that give the owner the option to buy a certain number of shares at a reduced price over a short period of time. It protects shareholders from their investment being diluted if the company chooses to issue more shares.

Time frame for (preemptive) rights

30 - 60 days

Optionality of preemptive right

1) Exercise right and buy new shares below current market price

2) Sell the right to another investor

3) Do nothing and let the right expire worthless

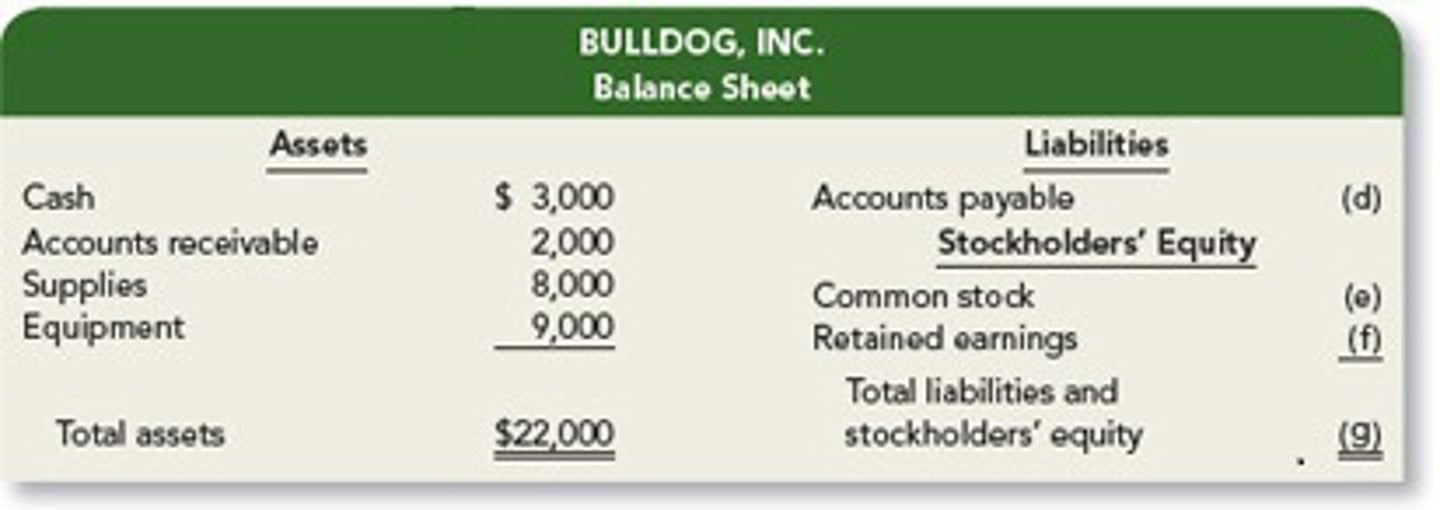

Balance Sheet

A snapshot of a company's assets and liabilities at one point in time. (Financial condition on a specific date)

Balance sheet formulas

1) Total Assets - Total Liabilities = Net Worth

2) Earnings per Common Share = (Earnings Available for Common)/(Common shares outstanding)

3) Dividend Yield = Annual Income / Market Price

4) Price/Earnings Ratio = (Market Price of Security)/(Earnings per Share)

5) Capitalization = long-term liabilities + stockholder equity

Source of a companies capital

1) Long term liabilities

2) Stockholder equity

A company raises funds by selling bonds, preferred stock, and common, and common stock -- the "capitalization" of the company.

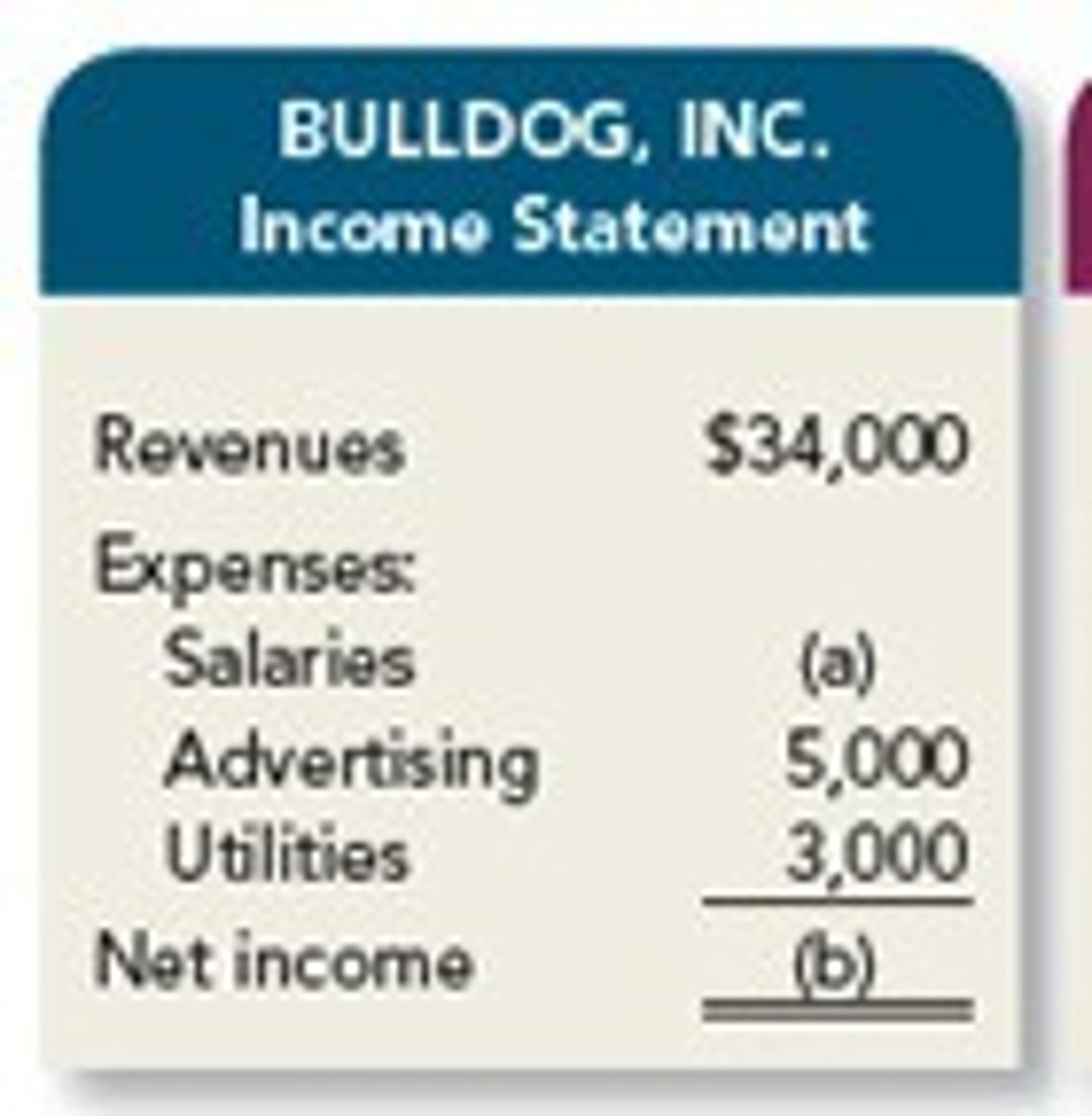

Income statement

Details all sources of revenue and expenses for the year. Final result is the "Net Income After Tax" of the company.

Cash Flow Statement

To compute earnings on a per share basis, and to see whether dividends were distributed.

Structure of Cash Flow Statement

1) Beginning of year Retained Earnings

2) Add: Net income for the year

3) Deduct: Preferred Dividend, Common Dividend

4) End of year Retained Earnings

limited liability

Common shareholders losses are limited to the money they invest.

Basic rights of shareholders

1) Right to inspect books and records -- corporations must provided shareholders with annual reports that include the company financial statements

2) Right to transfer ownership -- shares are liquid

3) Preemptive right

4) Right to corporate distributions -- dividends

5) Right to corporate assets upon dissolution -- in the event of liquidation, shareholders have residual claim to the company's assets. This means they will be paid after all claims have been satisfied.

6) Right to vote

Voting rights

Shareholders vote for the board of directors, which will oversee the management of the issuers. They also vote on issues that are important to the company (such as acquisitions).

Items that require shareholder vote

1) Declare a stock split

2) Declare a reverse stock split

3) Issue convertible bonds or preferred stock

4) Issue stock options to officers on a preferential basis

Items that DO NOT require shareholder vote

1) Declare cash dividend

2) Declare stock dividend

3) Declare preemptive rights distribution

Statutory voting

Votes are cast evenly. Also the most common type of voting.

Example: I have 100 share and there are 3 seats open on board of directors. Then, I would have 300 votes. I can cast exactly 100 votes for any one candidate, and can vote for however many candidates I want.

Cumulative voting

Shareholder may divide votes in whatever manner they choose.

Example: I have 100 share and there are 3 seats open on board of directors. Then, I would have 300 votes. I can cast exactly 300 votes for any one candidate, or do 100 for each, or whatever.

Proxy voting

The way most votes are actually cast. Shareholders not attending the meeting receive ballots from the company -- these ballots are called proxies.

Preferred stock

A senior equity security with priority over common stock issued by the company.

difference between preferred stock and common stock

1) Owners of preferred stock receive dividends before common stock dividend is paid.

2) If the company liquidates, preferred shareholders are paid before.

3) Preferred stock does not have the right to vote and does not have preemptive rights.

differences between preferred stock and bonds

1) Bonds mature on a set date while preferred stock has an indefinite life

2) Bondholders have priority of claim to interest payments and corporate assets upon liquidation ahead of preferred stockholders

3) Bondholders have a legal right to interest payments; preferred dividends are only paid if declared by the board of directors

How do market price, risk, voting rights, and income production differ between common and preferred stock?

Market price: Preferred fluctuates with interest rates and issuer creditworthiness while common fluctuates with company PnL.

Risk: Common riskier than preferred

Voting rights: Preferred has none

Income production: Preferred dividends are paid as 5% of par

Cumulative Preferred

(Type of Preferred Stock) If the issuer does not pay, the missed payments accumulate and must be paid before the issuer can resume making any other dividend payments. All accumulated preferred dividends must be paid before a dividend can be paid to common shareholders.

Callable Preferred

(Type of Preferred Stock) The issuer has the right to redeem the shares after a set date. When the stock is called, shareholders will receive par amount. Issuers may call in shares when interest rates are highest and issue new preferred shares at a lower rate. These typically pay higher dividends than the non-type of these.

Convertible Preferred

(Type of preferred stock) Shareholders can exchange their preferred shares for common stock based on predetermined price. If market price of common stock rises, then price of this also rises.

Participating Preferred

(Type of preferred stock) Receive additional dividends on top of the fixed dividend rate -- this additional dividend is decided by the board of directors.

Current Yield of Preferred Stock

Annual Income from Security / Market Value of Pref Stock

Relationship between preferred stock prices and interest rate

There is an inverse relationship between interest rate movements and preferred stock prices.

warrant

A long-term option to buy stock at a fixed price. This price is usually quite a bit above the market price of the stock when the warrant is issued.

differences between warrants and preferred rights

1) warrants are above market price and rights are below

2) warrants are long term (5-10 years) and rights are short term

3) both can be traded

perpetual warrants

warrants with no expiration date

ADR (american depository receipts)

A way to trade foreign securities in the US. Foreign companies can list their shares on US exchanges, but this process is time consuming and costly. An alternative is to offer a receipt that represents shares of a foreign company.

How ADRs are created

A bank will buy foreign stock and place it in a trust in the country of origin. The bank then issues ADRs, which are backed by the securities held in trust. Then, the ADRs are registered with the SEC, sold in the US, and priced in US dollars.

ADR Receipt Holder Rights

Receipt holder does not have voting or preemptive rights. The bank votes the shares that it owns, and it will sell off any preemptive rights and send the money to the receipt holder.

Exchange rate risk

The risk of currency exchange fluctuation. If foreign currency weakens against the US dollar, the ADR will be worth less in US dollars.