Economics 2: Consumer Theory

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

Reflexivity Assumption

It is assumed that each bundle is at least as good as itself

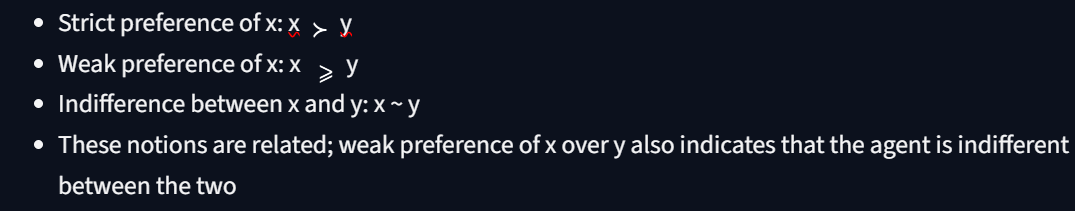

Preference Symbols

Ad valorem tax and subsidy

Ad valorem means 'to add value'

An ad valorem tax means a tax is paid on a good based on its price; a subsidy implies the inverse

Budget Constraint

The budget line is given by p1x1 + p2x2 = m, which just exhausts a persons income

It has a slope of −p1/p2, a vertical intercept of m/p2, and a horizontal intercept of m/p1.

The Numeraire is when one of the variables is fixed as constant; this doesn't change the constraint (check by rearranging)

Increasing income shifts the budget line outward. Increasing the price of good 1 makes the budget line steeper. Increasing the price of good 2 makes the budget line flatter.

Pareto Efficiency

An allocation is Pareto Efficient if there is no way of making one better off without making another worse off

Equilibrium Principle

Generally, prices are determined when supply for a good meets the demand for a good

Optimisation Principle

People choose the best patterns of consumption available to them

Endogenous and Exogenous Meaning

Most simply, endogenous variables are explained and contained in a particular model whereas exogenous variables are not

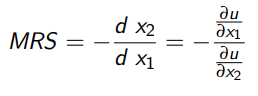

Marginal Rate of Substitution

The rate at which an agent will swap one good for another

The slope of an indifference curve

Monotonic Transformation

Utility functions are ordinal, meaning they only show an order of preference, but don't assign an actual value to preferences

If preferences are represented by numbers - coffee = 4 and tea = 5 - by adding 5 to the values the order of preference is preserved

Perfect Substitutes

An agent is completely indifferent between two goods; they seek to maximise utility regardless of which good they have

u(x,y) = x + y

Perfect Complements

When two goods are only enjoyed when consumed together; there is no point having more of one good without the other

u(x,y) = min(x,y)

Convexity Assumption

Averages are better than extremes

This works when we take a weighted average of two bundles of goods and represent it on an indifference curve; this new curve will be equal to or strictly preferred to the singular curves

Transitivity Assumption

A logical assumption which mitigates against preference cycles

There is no situation in which A > B, B > C, and C > A

Monotonicity Assumption

Assumes that more of a good is better

This simply means that in models we will only study allocations of goods before satiation occurs

Completeness Assumption

Agents are able to exhibit preferences, avoiding situations in which they can't choose between different bundles

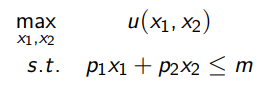

Marshallian Demand

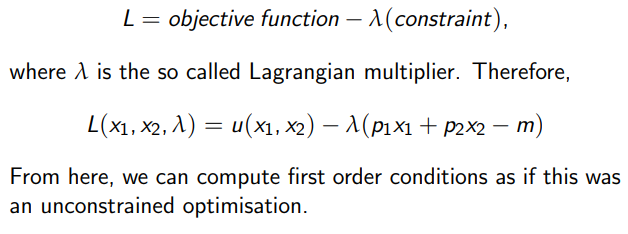

The solution to the constrained optimisation problem in the image

This solution gives the optimum quantity given fixed income and prices x(p,m)

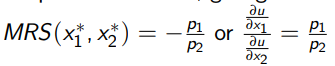

The Equimarginal Principle

Most utility curves are smooth and convex (Cobb-Douglas Equations)

At the optimum, the indifference curve and budget constraint will be tangent at the optimum, giving the equimarginal condition

Find the marginal utility by differentiating a utility function with respect to one of the arguments, then set the ratio of the marginal utilities equal to the ratio of the prices

MUx1/MUx2 = x2/x1, x2/x1 = p1/p2

The Lagrange Method

Revealed Preference

In a situation where there are two goods available and one chooses A over B, we can say that A is revealed preferred to B

Weak Axiom of Revealed Preference

If a person chooses x over y at some prices p when both are affordable, we can never reverse the choice at any other price in which both are affordable

Thus, something consists with the weak axiom of revealed preference if someone has a strict preference of one good over another

Strong Axiom of Revealed Preference

Adds a condition to the weak axiom which ensures that transitivity is respected

If A is revealed preferred to B, and B is revealed preferred to C, then C can not be revealed preferred to A (this event would be lots of curves crossing each other)

Optimal choices for concave preferences

Concave preferences imply a person doesn’t want to buy two goods together (like olives and ice cream; if they have ice cream they DON'T want more olives)

Thus the solution for nonconvex preferences is always a boundary point

Shortcut for optimal choices in Cobb-Douglas

To be used instead of conducting the Lagrangian, where the Cobb-Douglas is given by u(x1,x2) = x1cx2d

It is often useful to choose Cobb-Douglas functions where the exponents sum to 1 because this means that the exponents can be interpreted as a fraction of income

Normal good

A type of good where an increase in income will increase demand (eg cars, steaks)

dx1*/dm > 0

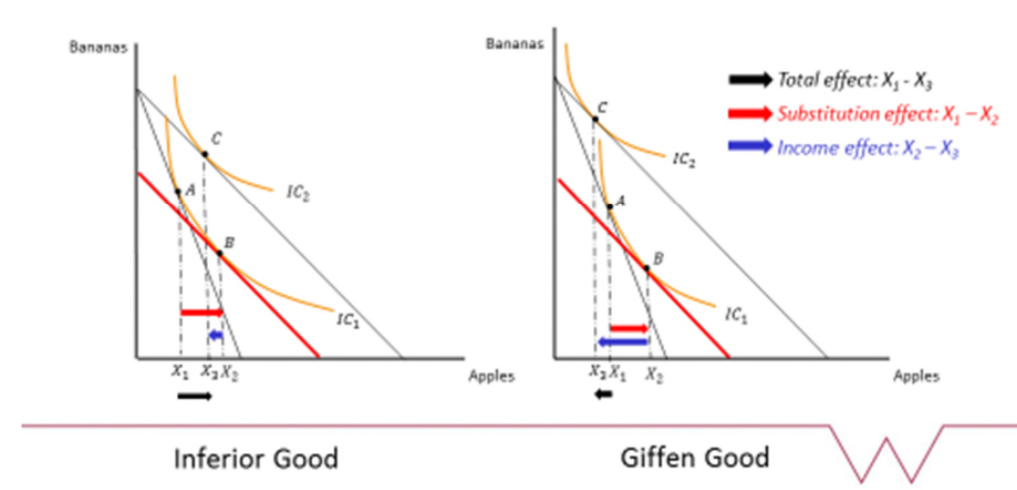

Inferior good

As income increase, demand for the good decreases (eg fast food)

dx1*/dm < 0

Ordinary good

Demand decreases when price increases (eg clothes)

dx1*/dp1 < 0

Giffen good

Demand increases when the price increases (watches, cars)

Often referred to as luxury goods; they are partly valued because of their price

dx1*/dp1 > 0

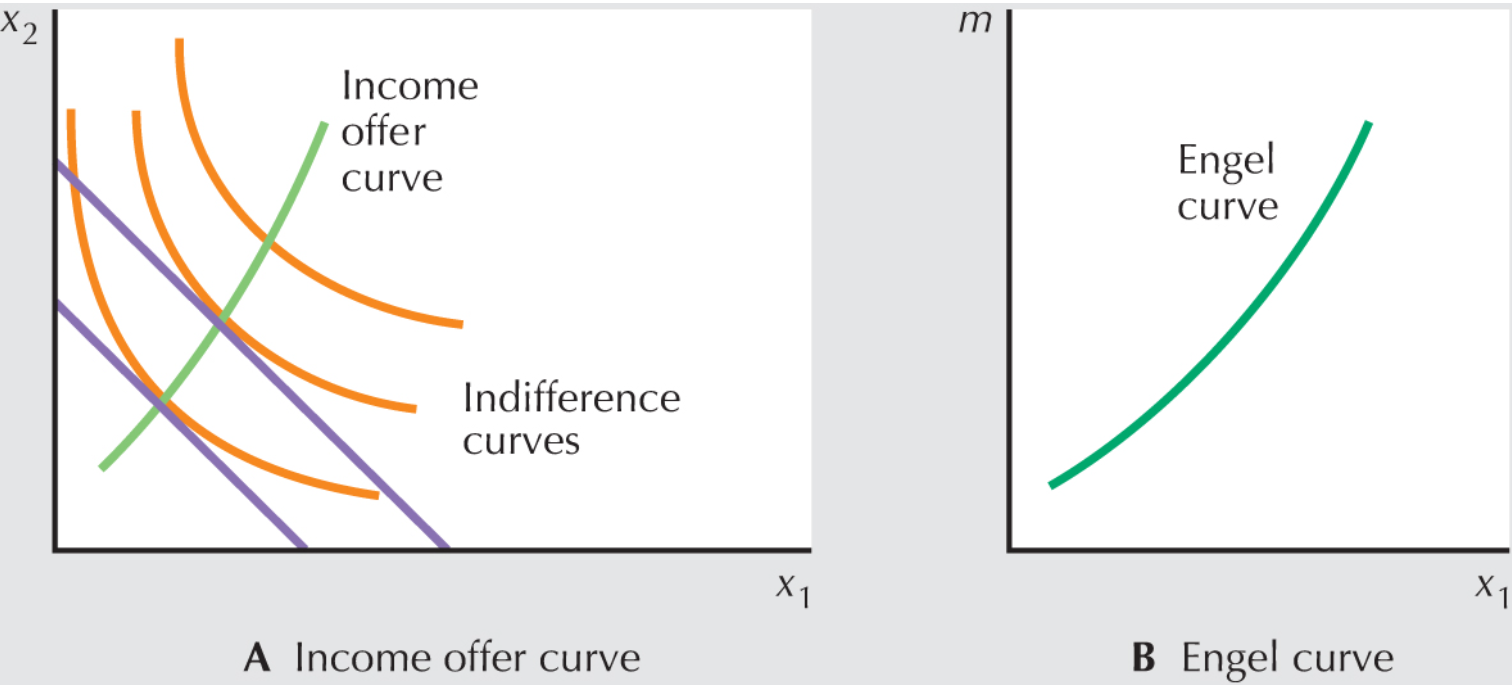

Engel Curve and Income Offer Curves

The shape of the income-offer curve is referred to as the income-expansion path; when income increases and the goods are normal, the slope will be positive

The income offer curve illustrates the bundles of goods demanded at different income levels

The Engel curve is one which shows the path of demand for a good given fixed prices

Demand Curve

Derived by plotting all of the price-demand combinations on a graph (price over demand)

Shows how one person reacts to changes in price and income

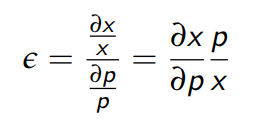

Price Elasticity of Demand

The slope of a demand function, understood as the ratio of relative changes

When the PED > 1, demand is called elastic, meaning that the demand curve is flatter (x changes a lot with price)

Constructing market demand

Summing horizontally is equivalent to fixing the price and summing the demand of different consumers

This allows one to find aggregate market demand at a particular price

Kinks can occur when one is summating market demand and a price goes above one of the consumers WTP

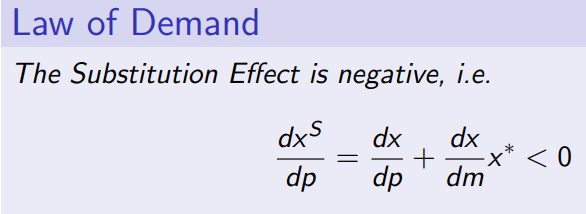

Slutsky Decomposition

Deals with the effects a price change has on demand

The first effect is the substitution effect; a person switches consumption to the other good

The second effect (income effect) involves a loss of purchasing power

This separating of these two effects is called the Slutsky decomposition

Compensated Demand

Is constructed to eliminate any purchasing power effect

If original prices are p1 and p2, with income m, then when prices change to p1’ and p2, the new income must be m’ to allow for purchasing the same quantities at different prices

Substitution effect

When a person shifts consumption from one good to another after a price change

The difference between the bundle x* and x’ (where x* is the original quantity demanded, and x’ is the quantity demanded after the price change)

The solution to max(x1,x2) u(x1,x2) s.t. p1’x1 + p2×2 = m’

Income effect

The loss of purchasing power caused by a price change, which is found by locating the optimal bundle at a new price and non-adjusted income

We move from x’ (adjusted demand with adjusted income) to x’’ (adjusted demand with non-adjusted income)

The income effect is the difference between x’’ and x’

The solution to max(x1,x2) u(x1,x2) s.t. p1’x1 + p2×2 = m

Graphically, this is a linear transformation of the budget constraint and indifference curve tangency

Slutsky Decomposition - Maths

Where dx/dp is the change in demand w.r.t the change in price and x*(dx/dm) is the income effect

Homothetic preferences on Engel and Income Offer curves

They will always be represented as straight lines through the origin, because any change in the quantity of bundles doesn’t change the ratio of preferences

Quasilinear indifference curves

All the indifference curves are just linear transformations of one indifference curve

We say that there is zero income effect due to an increase in income, and the Engel’s curve is a straight vertical line

The Price Offer Curve

When we change the price of one good, keeping the other fixed, the budget constraint pivots, intersecting different indifference curves at different points

These new intersections are connected through the price offer curve

Hicksian Compensated Demand

Also known as the Hicksian Subsitution Effect, this computes the optimal point by fixing utility and finding the compensated demand required to reach this utility

This implies a new solution framework; we can’t maximise the problem because we’re keeping utility fixed, so we invert it and solve in terms of expenditure minimisation instead

We minimise expenditure using the Lagrangian or Equimarginal Principle

minx1,x2 p1x1 + p2x2 , s.t. u(x1,x2) = u*, where u* is the fixed level of utility

The minimal point lies on the lowest budget line touching the indifference curve constraint

Unconstrained Optimisation

Rearrange the budget constraint to get x2 = (m-p1x1)/p2

Substitute this into the utility expression and then maximise it, solving for x1 by setting it equal to 0

Hicksian Demand Substitution Effect

We want to fix utility at its optimal level, so plug the Marshallian demands into u(x1, x2) to find the optimal utility, u*

Minimise expenditure subject to the new constraint (ie, x1x2 = u*) and compute

Solve for new optimal quantities given the price changes; take x2 from x2* to see the substitution effect

These new optimal quantities, x1* and x2* are called Hicksian Compensated Demands, subject to H(P1, P2, v), where v is the fixed level of utility

Hicksian Demand Income Effect

Simple compute the Marshallian demands of the goods at the new prices; this accounts for what expenditure will actually be like given the change in income

Hicksian Demand Total Effect

The direction of the total effect depends on what type of good it is; for a normal good, the substitution and income effect will both be positive

Compensating Variation

Fix utility before the price change and find how to adjust income to ensure the same utility after the price change

If e(p’, u(x*(p, m))) is the minimum expenditure needed to achieve the same utility at final prices, then the compensating variation, CV (p,p’,m) = |m - e(p’, u(x*(p, m)))|

Equivalent Variation

Fix utility after the price change, u(x*(p’, m))

Tries to figure out how we can adjust the income to ensure the consumer experiences the same level of utility before the price change as it does after

EV(p, p′, m) = |e(p,u(x*(p′, m))) − m|

Consumer Surplus

The net benefit we receive from consuming q units of good 1, where CS(q1) = v(q1) - p1q1

The area below the demand curve

Comparing Equivalent Variation and Compensated Variation

For a normal good, CV > EV for a price increase and vice versa for a decrease

They will only be equal for quasilinear preferences where indifference curves are parallel and there is no income effect

Computing Compensated Variation

Original budget constraint is P1*x1* + P2x2 = E1. When the price of P1 rises to P1**, the budget constraint changes with new Marshallian Demands to become P1**x1** + P2×2** = E1

We shift the second budget line out so that it becomes tangential to the original utility curve. The budget constraint becomes E2 = P1**x1*** + P2x2*** where E2 is compensated income

E2 - E1 is the compensated variation

Computing Equivalent Variation

How much money to take away from a consumer before a price change to ensure they will be just as well-off after it

Original BC is P1*x1* + P2x2* = M1

When the price P1 rises, BC pivots inwards and new BC is P1**x1** + P2x2** = M1

We must takeaway money from the consumer to ensure constant utility, so shift the original BC inwards to get the new BC P1*x1*** + P2x2*** = M2

EV = M1 - M2