4.1.8 - exchange rates

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

define exchange rate

the price of one currency in terms of another

international currencies are….

…products that can be bought and sold on the foreign exchange market (forex)

who chooses the exchange rate system used

the central bank

what are the three exchange rate systems

floating exchange rate

fixed exchange rate

managed exchange rate

define floating exchange rate

demand and supply determines the rate at which one currency exchanges for another

how does a floating exchange rate go up or down

excess demand for the currency = currency WORTH MORE (appreciation)

and vice versa

define a fixed exchange rate

central bank fixes the exchange rate in relation to another currency (eg. USD)

parity peg (fixing) = same (1 to 1 rate to another currency)

not always at parity (can be 1 to something else rate to another currency)

how does fixed exchange rate go up or down

central bank decides to peg and increase currency strength = revaluation

opposite = devaluation

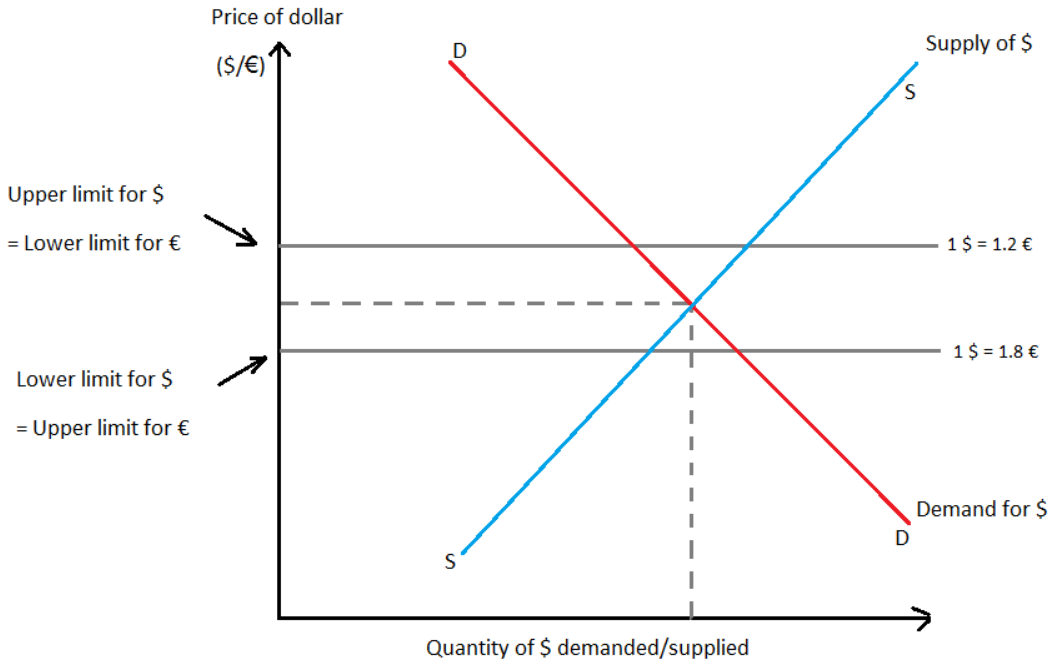

managed exchange rate definition

free market determines currency value, but central banks can also intervene to keep the value within a desired range

two types of managed exchange rate

managed/‘dirty’ float —> ER flows freely but gov intervenes

semi-fixed rates/crawling peg system —> ER allowed to float between an upper and lower limit

crawling peg system diagram

.

how do managed exchange rates go up or down

currency fluctuates above the range = central bank sells its own currency in forex markets = increased supply = decreased value

currency fluctuates below the range = central bank buys its own currency in forex markets (using foreign reserves) = reduced supply = increased value

this is called EXCHANGE EQUALISATION

can also use interest rates to intervene (hot money flows)

can also use currency controls to regulate how much people can send into/out of the country

factors influencing floating exchange rates

relative interest rates —> affects hot money flows

relative inflation rates —> ↑inflation = ↑export price = ↓demand for pound = ↓pound value

net investment —> ↑FDI = ↑pound demand = ↑pound value

the current account —> trade surplus = appreciate

speculation —> ppl buying currency to sell for profit - only if they expect it to appreciate

QE —> foreign owned gov bonds bought back = foreigners exchange their pounds = ↑supply of pounds = depreciates

consequences of competitive devaluation/depreciation

exports cheaper = higher revenues (if price elastic)

retaliation devaluation = potentially not much change

imports expensive = higher costs of production

impacts of changes in exchange rates to ME objectives, + standards of living

current account - SPICED

unemployment - depreciation = less unemployment bc more exports (and vice versa)

inflation - depreciation = AD shift right = demand pull inflation. appreciation = imports expensive = cost push inflation

economic growth - depreciation = AD shift right = ↑growth

SoL - depreciation = imports expensive = ↓SoL.

also = ↓unemployment bc ↑exports = ↑wages = ↑SoL

FDI - depreciation = ↑FDI (money invested is worth more when investing in a country with a weaker currency)