VIDEO NOTES (Classes 6 &7), Chapter 6:

1/59

Earn XP

Description and Tags

Reporting and Analyzing Revenues, Receivables and Operating Income

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

60 Terms

What’s the income statement used for?

predict future performance

assess the creditworthiness of a company

evaluate the quality of management

How is Net Income classified?

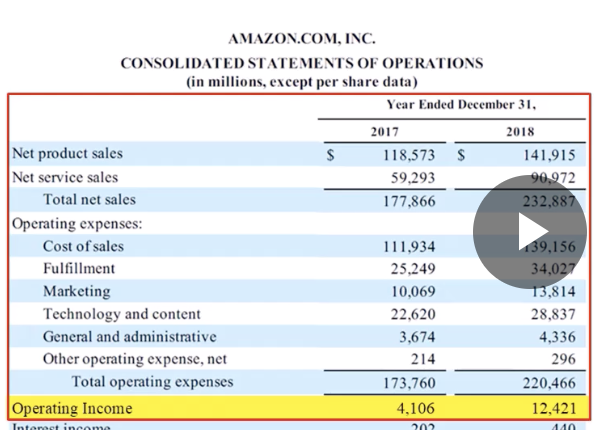

Income from continuing operations

operating income

Revenues

Less operating expenses

cost of goods sold

selling, general & administrative expenses

research & development

depreciation & amortization

non-operating income

Interest income

Interest expense

Gains or losses on investment or financing transactions

provision for taxes

Income from discontinued operations

Operating income

The primary transactions and events of a company

Non-operating income

revenue + expenses from sources not related to income

rental income

source income

What’s revenue recognition

when and how a company records its income

often manipulated by management to meet performance targets

What’s the revenue recognition standard?

you recognize revenue when you’ve actually earned it

What are the 5 steps for the revenue recognition standard?

identify contract

identify performance obligations

Determine transaction price

allocate the transaction price to the performance obligations

Recognize revenue once you’ve earned it

What’s accrued revenue

did the work, waiting to be paid

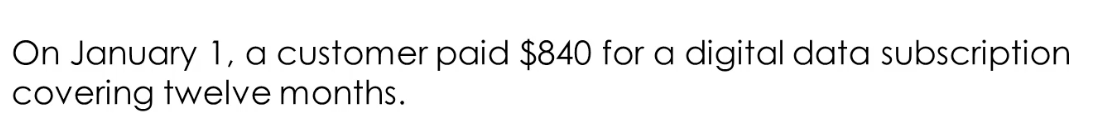

Deferred/unearned Revenue

seller receives payment before work

What’s revenue recognition when it comes to customer purchases

Customers often purchase a product before delivery

company should pay customer back

an amount paid in advance are a current liability: unearned revenue or deferred revenue

Help record amounts recieved in advance

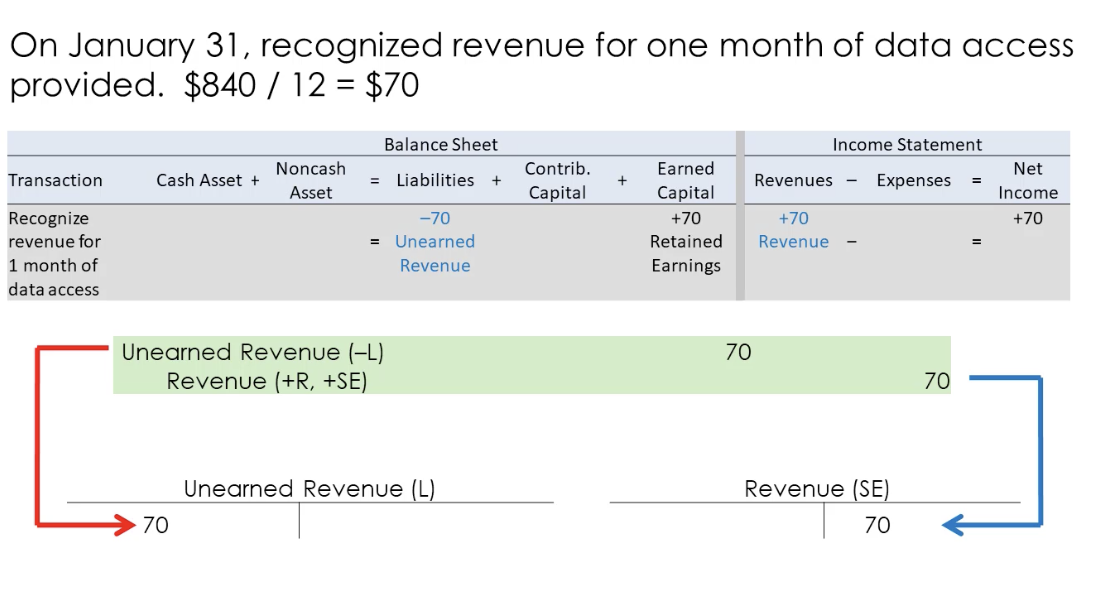

Recognize revenue for amounts previously received in advance

When G&S r delivered to the customer, the performance obligation is fulfilled

Liability is debited, revenue is credited

shown on the income statement

What are bundled sales?

2 or more goods r sold under the same price, but considered two different performance obligations

important to allocate performance obligations in proportion to their selling price

What are the complications that arise with long-term contracts?

Does this one transaction require multiple performance obligations

What’s the price

is it fufilled in a point in time or overtimeIs

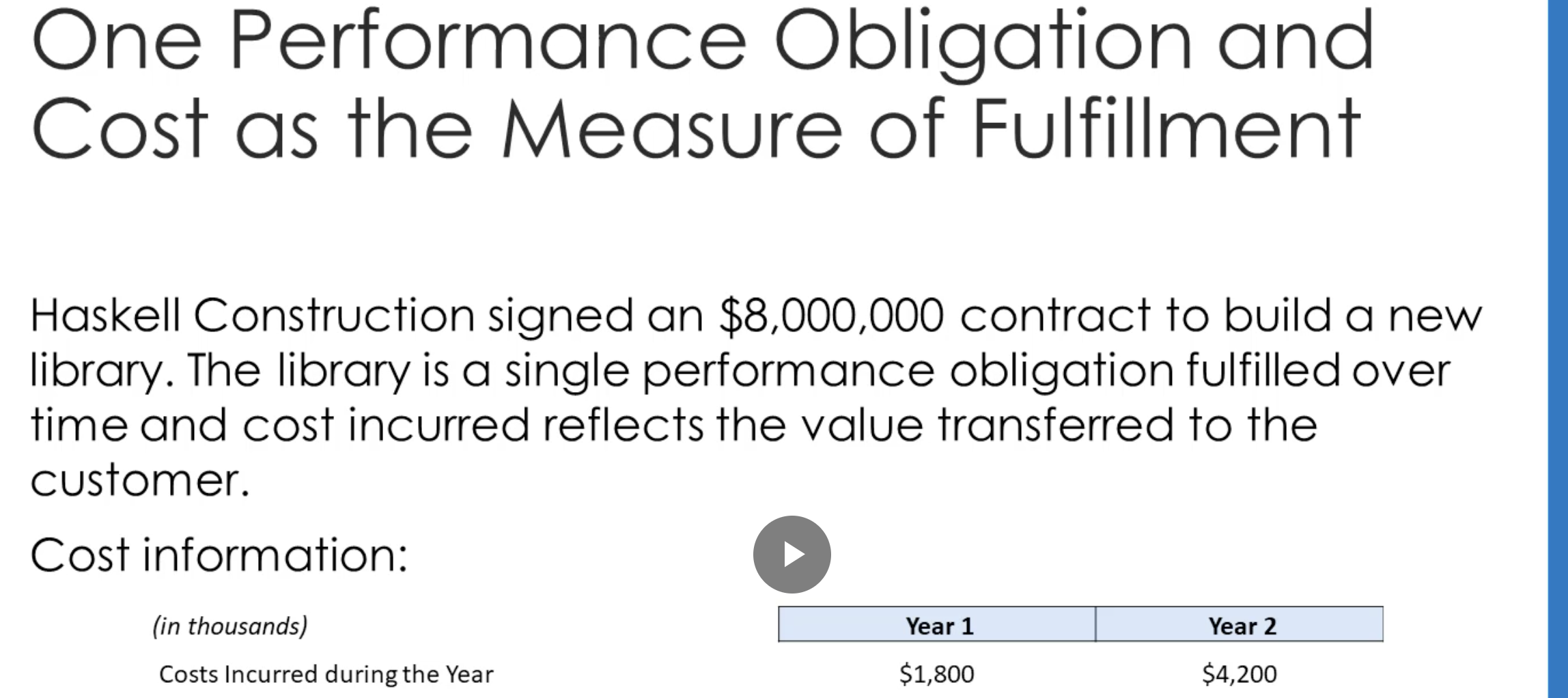

What is the performance obligation and cost as the measurement of fufillment?

8 million revenue, 6 million cost over 2 years. first year, spend 30% of costs, second year, spend 70% of costs. What’s the expense recognized and gross profit?

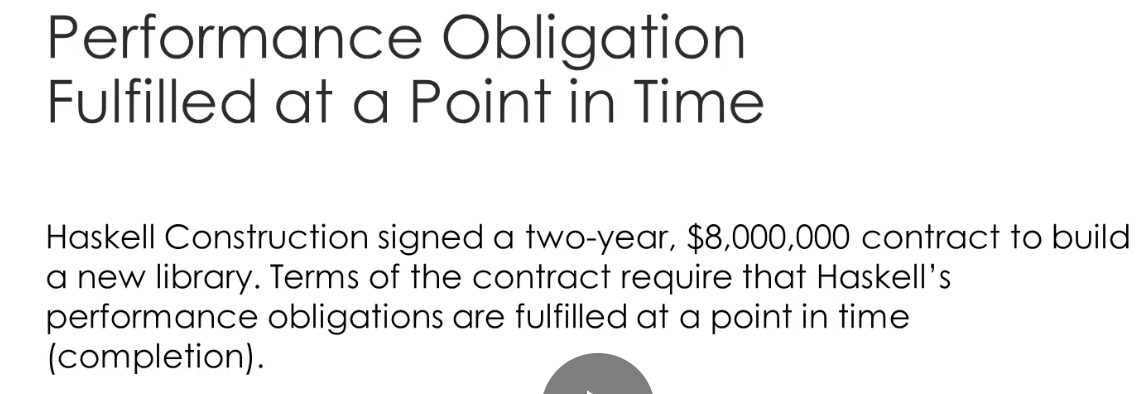

What happens when a performance obligation is fulfilled at a point in time?

Whats the difference between performance obligations fulfilled overtime and performance obligations fulfilled at a point in time?

Difference: when the revenue and gross profit are recognized

they both show a gross profit and expense of 2mil, 6mil

its just for overtime, the expenses and profits are recognized over multiple years

What are account receivables and the risks that come with them

when companies offer credit

Companies are afraid of users not paying, so GAAP requires companies to estimate and deduct expected credit losses

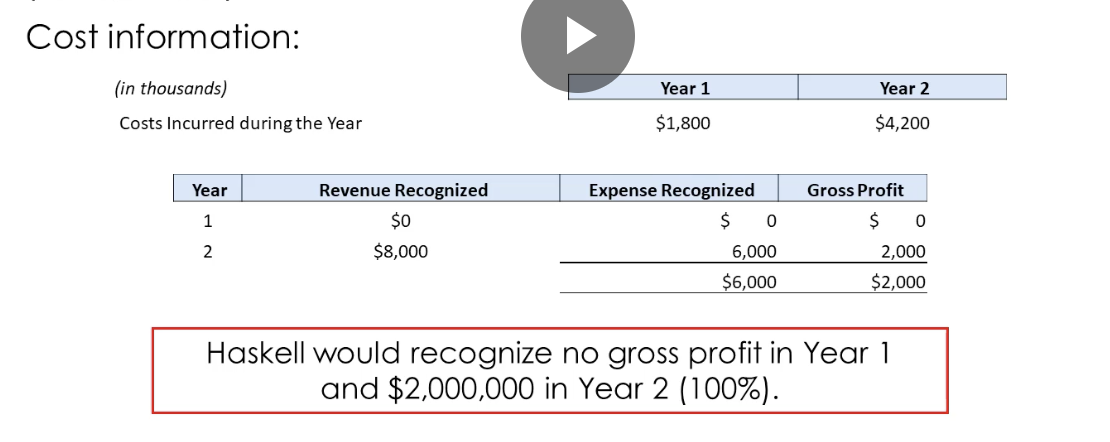

What’s Net Realizable Value?

GAAP requires companies to estimate and deduct expected credit losses

What’s a contra-asset?

the amount a company expects that its customers will not pay

How can contra-asset accounts be estimated?

through an aging analysis

receivables owed by customers

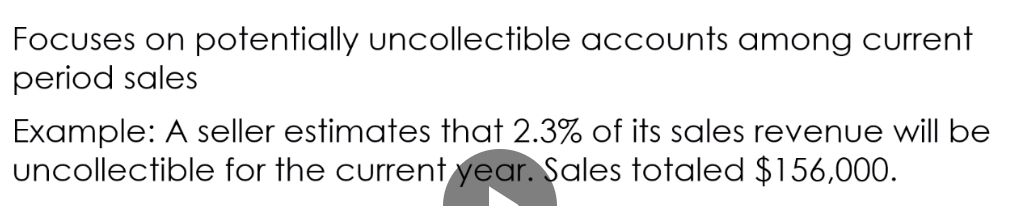

percentage of sales

uncollectible accounts among current-period sales

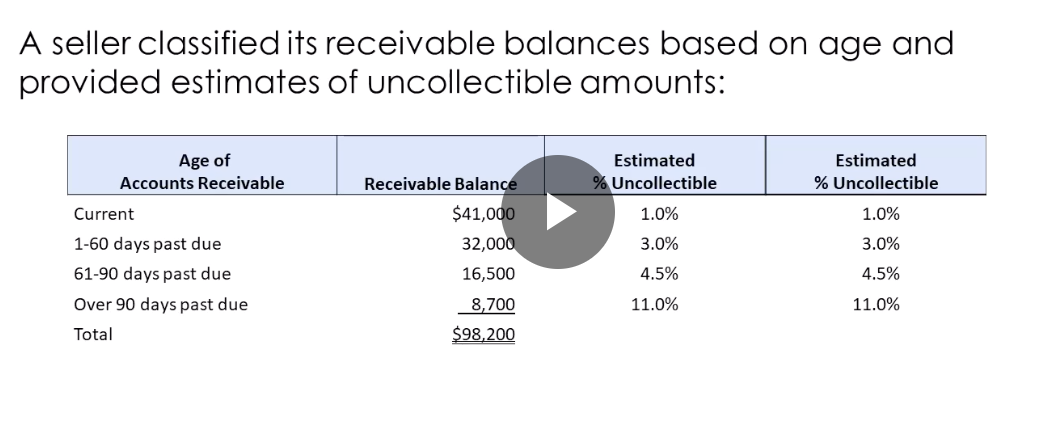

Aging of Accounts Receivable Example

Longer the account has been standing, less likely to be paid back

Percentage of Sales example

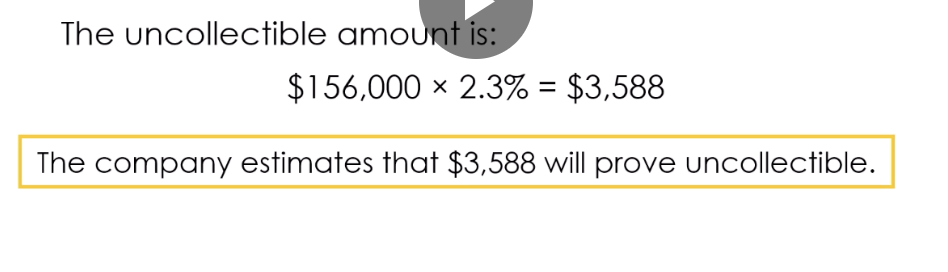

Record sales on account

Sales for the year totaled 560,000

Recording estimated bad debt expense

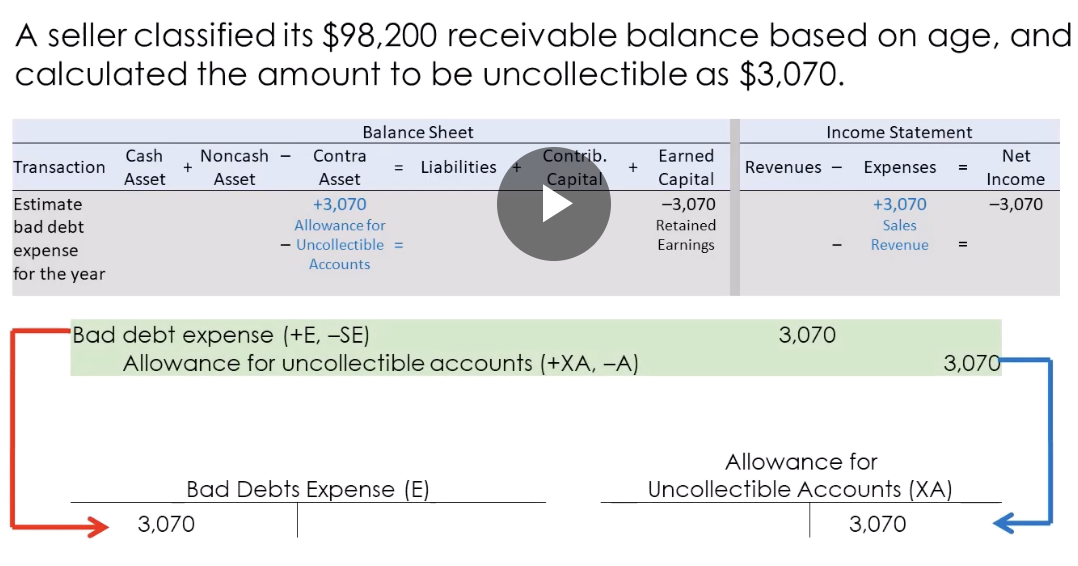

A seller classified its $98,200 receivable balance based on age, and calculated the amount to be uncollectible as $3,070

Recording Write-Offs of Uncollectible Accounts

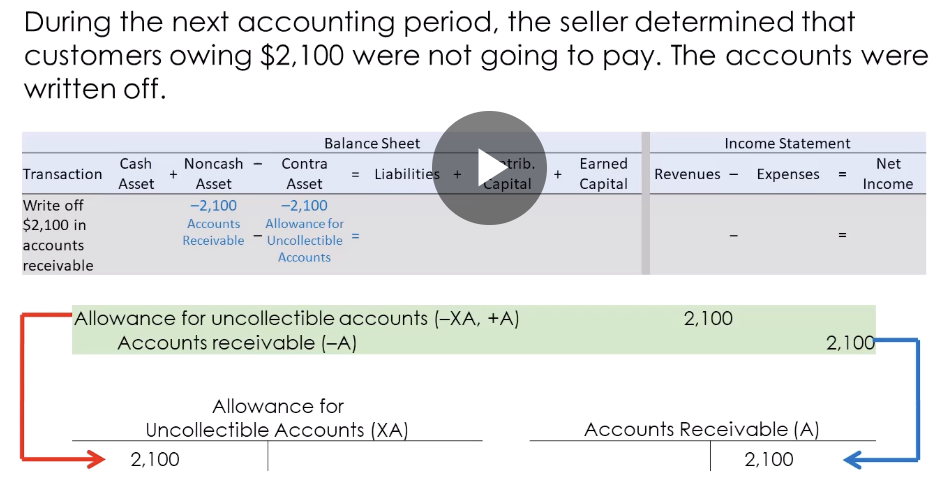

During the next accounting period, the seller determined that customers owing $2,100 were not going to pay. The accounts were written off

write offs dont affect net income

Why are there no changes that occur to the net realizable value of receivables?

the write-off causes assets to increase and decrease by the same amount

What are two ways account receivables can raise operating revenue

Pledging

uses receivables as make up for the loan

Factoring

receivables are sold to a bank or finance company

How do account receivables appear to improve the appearene of the financial statements

companies shift income to make it appear better whenever they want

2019: overestimate the amount of bad debt, make it appear as if they have lower profits

accounted all the debt in 2019

it makes 2020’s profit looks higher than they actually are

How do you compare allowance accounts? aka uncollectible

comparing gross receivables in percentages reflect differences

What’s, NOPAT, Net Operating Profit After Taxes

Net income that can evaluate a company’s overall performance

What’s NOPAT’s formula?

Net Income - [(Non-operating revenues - Non-operating expenses) x (1 - statutory tax rate)]

![<p>Net Income - [(Non-operating revenues - Non-operating expenses) x (1 - statutory tax rate)]</p>](https://knowt-user-attachments.s3.amazonaws.com/6cab045b-bff9-4bf5-8259-cfa14ef6533c.png)

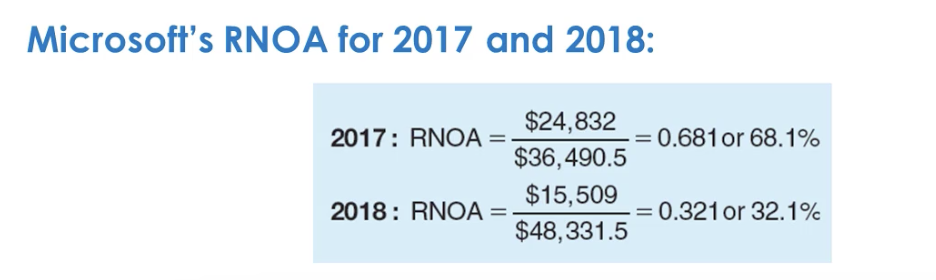

What’s RNOA, Return Net Operating Assets?

how well the company is performing relative to its core objective

What’s RNOA’s formula?

Net operating profit after taxes (NOPAT) / Average net operating assets

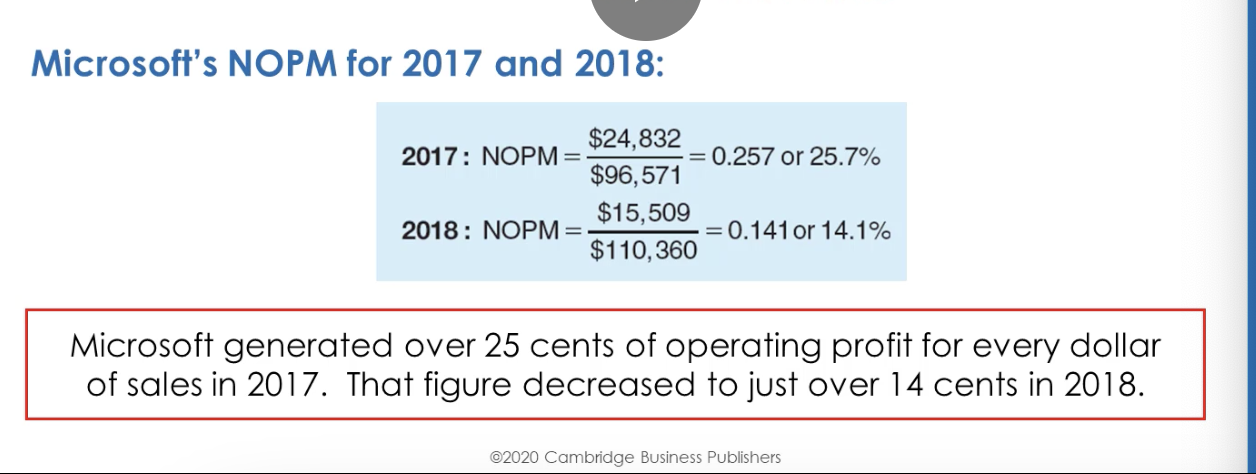

What’s NOPM, Net Operating Profit Margin?

overall operating profitability of a company relative to its sales revenue

What’s NOPM formula?

NOPM = NOPAT / Sales Revenue

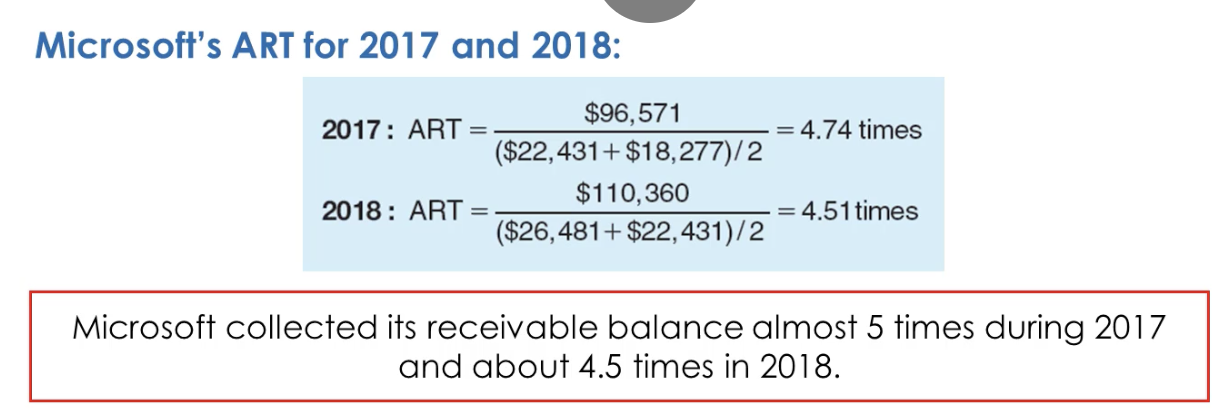

What’s ART, Assets Receivable Turnover?

The investment in receivables required to generate one dollar of sales

What’s ART formula?

Sales Revenue / Average Accounts Receivable

What does a higher receivable turnover imply?

amounts receivables are being collected more quickly

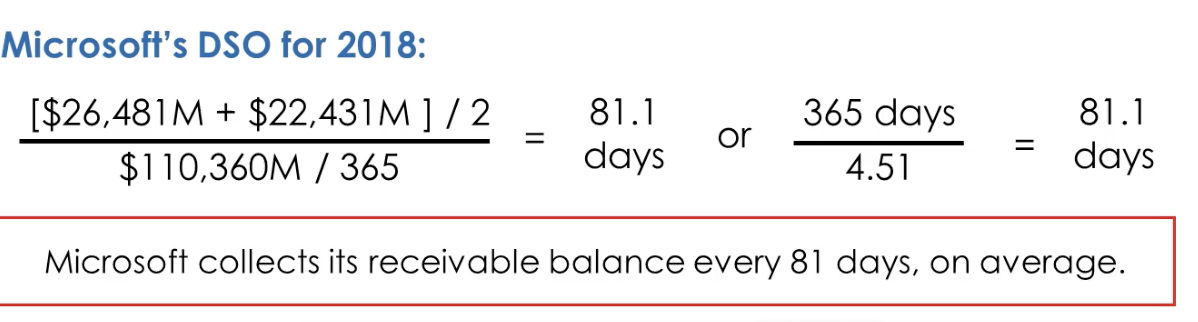

What’s Average Collection Period?

Says how long, on average, a company takes to collect its outstanding receivables (aka DSO Days Sales outstanding)

What’s the formula for Average Collection Period?

Average Collection period = Average Accounts Receivable / Average Daily Sales (sales /365 days) = ART

What are the possible reasons for turnover rates to decline/look worse

deterioration

sellers have extended its credit terms

sellers take a longer time paying customers

What’s Asset turnover?

it indicates efficiency and productivity

What’s earning management?

management hides true economic performance of a company

What are 2 motives for earnings management?

Mislead investors and creditors

influence legal contracts, loan agreements

What are some tactics for Earning Management?

Transaction timing

Overly optimistic or pessimistic

estimating in accrual accounting

revenue recognition with certain timing

depreciation expense estimates

bad debt expense

What’s Channel Stuffing?

another earning management tactic

when a company uses its market power over customers to make them purchase more goods then necessary

it can be recorded as revenue

Strategic timing

its another earning management tactic

management can control what time certain things are reported, to change financial statements. To smooth income

Income smoothing

Big bath

Whats income smoothing

mgmt tries to make income look steady and consistent overtime

Whats Big Bath?

Occurs when MGMT makes one year look bad, and the subsequent ones look better

What’s Mischaracterizing transactions?

a company pretends a deal was fairly made, when in reality, they are both secretly connected or when a buyer is apart of the company

What’s Quality of Earnings

how honest a company reports income, it shows the real underlying business performance

Why do we seperate recurring and non-reccuring things on the income statement?

To evaluate and compare performance

Compare normal business results year to year

One-time events shouldn’t confuse

separating helps make a good judgment of the company

to estimate future company values

Predict how much money the company will make with recurring income

forecast based on steady, repeatable earnings

What’s restructuring charges?

expenses and losses due to reorganization of company’s operations

What’s discontinued operations?

income from the business’ discontinued parts

What’s Discontinued operations?

when a company sells off or shuts down a seperate part of its business

it must be a seperately identifiable part of the business

How is Discontinued operations reported?

separately from continuing operations on the income statement

“Income from discontinued operations, net of income taxes”

What’s restructing costs?

expenses a company has when it reorganizes itself, but without selling an entire business unit

the company keeps the business, just changes how it operates

How are restructuring costs reported?

reported as part of the company’s normal, ongoing business results

What are the two components of restructuring costs?

employee severance costs

estimated cost of firing employee

Asset Write-downs

write down of longterm asset, such as building, as a result of closing or relocating business