[TAX-PINNACLE] PREWEEK

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

A

The power to demand proportionate contribution from persons and property to defray the necessary expenses of the government.

a. Power of taxation

b. Police power

c. Power of eminent domain

d. Power rangers

D

Which of the following is not one of the inherent limitations of the power of Taxation?

a. Public purpose

b. International comity

c. Exemption of the government

d. Uniformity

D

Which of the following is not one of the Constitutional limitations?

a. Due process of law

b. Equal protection of law

c. Free worship clause

d. Non-delegability of the taxing power

C

Which of the following is not one of the characteristics of Tax?

a. Generally payable in money

b. Proportionate in character

c. Based on the taxpayer's ability to pay

d. Exclusively levied by legislature

B

Which of the following is not one of the sources of tax laws?

a. Court decisions

b. Author's interpretations

c. BIR rulings

d. Local tax ordinances

D

C

D

Statement 1: The determination of 6% capital gains tax on sale of real property is based on net capital gains realized by the seller of real property.

Statement 2: Sale of non-domestic shares in the Philippines directly to buyer will be subject to 15% capital gains tax.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

C

Statement 1: The husband and wife shall compute their individual income tax separately based on their respective total taxable income.

Statement 2: If any income cannot be definitely attributed to or identified as income exclusively earned or realized by either of the spouses, the same shall be divided equally between the spouses for the purpose of determining their respective taxable income.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

D

The term "corporations" shall include:

I. One Person Corporation

II. Ordinary partnerships

III. Joint stock companies

IV. Joint accounts

V. Associations

VI. Insurance companies

VII. Mutual fund companies

VIII. Regional operating headquarters of multinational corporations

a. I and II only

b. I, II, III, IV and V only

c. I, II and III only

d. All of the above

A

Which of the following is taxable based on income from all sources, within and outside?

a. Domestic Corporations

b. Resident Foreign Corporations

c. Non-resident Foreign Corporations

d. All of the choices

B

A

Which of the following statements is incorrect?

a. Resident foreign corporations with net taxable income not exceeding P5 million and total assets, excluding land, not exceeding P100 million are taxed at 20%

b. Non-resident cinematographic film owner, lessor or distributor is subject to 25% corporate income tax

c. Rentals and charter fees payable to non-resident owners of vessels chartered by Philippine nationals is subject to 4.5% corporate income tax

d. Income of OBUs and foreign currency deposit units (FCDUs) of depository banks is subject to 25% corporate income tax

D

Which of the following is not an exempt corporation?

a. Cemetery company owned and operated exclusively for the benefit of its members

b. Civic league or organization not organized for profit but operated exclusively for the promotion of social welfare

c. Labor, agricultural or horticultural organization not organized principally for profit

d. Proprietary educational institutions and non-profit hospitals, on net income if gross income from unrelated trade, business, and other activities does not exceed 50% of the total gross income from all sources.

D

Which of the following statements is incorrect for taxation on dividends?

a. Dividends received by nonresident foreign corporation from a domestic corporation is subject to either 15% or 25%

b. Dividends received by a resident citizen from a resident foreign corporation is considered as an ordinary income

c. Dividends declared and paid by foreign corporations are subject to predominance test

d. Dividends received by a resident foreign corporation from a domestic corporation is considered as an ordinary income

A

Which of the following is not one of the requisites for tax exemption on foreign-sourced dividends?

a. Reinvestment should be made within the next two year from the time foreign-sourced dividends where received.

b. The DC holds directly at least 20% of the outstanding shares of the foreign corporation.

c. It has held the shareholdings for a minimum of 2 years at the time of dividend distribution.

d. Funds from such dividends actually received or remitted into the Philippines are reinvested in the business operations of the domestic corporation in the Philippines.

D

Statement 1: The distributive share of a partner in the net income of a taxable partnership is equal to each partner's distributive share of the net income declared by the partnership for a taxable year after deducting the corresponding corporate tax.

Statement 2: The income of a general commercial (ordinary) partnership is also subject to MCIT or Regular Corporate Income Tax whichever is applicable.

a. Statement 1 & 2 are false

b. Statement 1 is true but statement 2 is false

c. Statement 1 is false but statement 2 is true

d. Statement 1 and 2 are true

D

It arises when two or more heirs or beneficiaries inherited an undivided property from a decedent, or when a donor makes a gift of an undivided property in favor of two or more donees

a. Partnership

b. Joint account

c. Trust

d. Co-ownership

A

Statement 1: The share of a co-venture individual in the net income of a tax-exempt joint venture or consortium is subject to normal income tax.

Statement 2: The share of a co-venturer corporation in the net income of a tax-exempt JV is subject to 10% dividend tax.

a. Only statement 1 is correct

b. Both statements are correct

c. Only statement 2 is correct

d. Both statements are incorrect

A

A mass of all property, rights and obligations, which are not extinguished by death, of a person existing at the time of his death, and includes those which have accrued since the opening if succession.

a. Estate

b. Co-ownership

c. Trust

d. Partnership

C

A right of property, real or personal, held by one person for the benefit of another.

a. Estate

b. Co-ownership

c. Trust

d. Partnership

B

Which of the following statement/s is/are correct?

I. When an estate, under administration, has income-producing properties, the annual income of the

estate becomes part of the taxable gross estate.

II. The items of gross income of the estate are the same items as the items of gross income of individual taxpayers.

III. Where the estate is not under judicial administration, the income of the estate shall be taxable to the heirs and beneficiaries.

a. I and II only

b. II and III only

c. III only

d. I, II and III

D

Which of the following statements is not correct?

a. An irrevocable trust is subject to income tax.

b. An irrevocable trust is taxed in the same manner as an individual taxpayer.

c. Tax on irrevocable trust is based on the income of the trust after deducting the income distributed

to the beneficiaries

d. None of the above

A

It means all wealth which flows into the taxpayer other than mere return of capital and includes gains derived from the sale or other disposition of capital assets.

a. Income

b. Capital

c. Asset

d. Fund

D

The gross income, as per section 32(A), shall include:

I. Compensation income from services

II. Gross income derived from the conduct of trade or business or the exercise of a profession

III. Gains derived from dealings in property

IV. Interest

V. Rents

VI. Royalties

VII. Dividends

VIII. Annuities

IX. Prizes and winnings

X. Pensions

XI. Partner's distributive share from net income of a GPP

a. I, II, III V, X and XI only

b. I, II, III, IV and V only

c. I, II, III, IV, V, VIII only

d. All of the above

B

Income, for tax purposes:

I. Means all income from whatever source (legal or illegal), unless specifically excluded under the Tax Code.

II. Means all wealth which flows into the taxpayer other than return of capital.

III. Is recognized in the year it is actually received in cash or cash equivalent.

IV. Refer to the amount of money coming to a person or corporation within a specified time, whether as payment of services, interest, or profits from investment.

a. I, II and III only

b. I, II, III and IV

c. I and IV only

d. None of the above

D

The exclusion from gross income, as per section 32(B), shall include but not limited to:

I. Life insurance

II. Amount received by insured as return of premium

III. Gifts, bequests, and devises

IV. Compensation for injuries or sickness

V. Income exempt under treaty

VI. Retirement benefits, pensions, gratuities, etc.

a. I, II, III, IV and V only

b. I, II, III, V, VI and VII only

c. I, II, III, IV, V and VI only

d. All of the above

A

Statement 1: Tips or gratuities paid directly to an employee by a customer of the employer that are not accounted for by the employee to the employer are considered as taxable income subject to basic tax.

Statement 2: The tips described in statement 1 shall not be subject to withholding tax for the reason that tips are not accounted for by the employee to the employer.

a. Both statements are correct

b. Both statements are incorrect

c. Only the first statement is correct

d. Only the second statement is correct

D

Which of the following is not excluded from gross income?

a. Retirement benefits received under RA 7641

b. Benefits received from or enjoyed under the Social Security System in accordance with the provisions of RA 8282

c. Benefits received from the GSIS under RA 8291

d. Retirement pay by reason of resignation

B

The deduction from gross income, as per section 34 of the tax code, shall include:

I. Necessary and ordinary expenses

II. Interest

III. Taxes

IV. Losses

V. Bad debts

VI. Depreciation

VII. Depletion

VIII. Charitable contribution

IX. Research and development

X. Contributions to pension trust

XI. Premium payments on health and/or hospitalization insurance

XII. Proceeds on life insurance

a. I, II, IV, VI, IX, and X

b. I, II, III, IV, V, VI, VII, VIII, IX, X, and XI

c. I, II, IV, V, VI, VII, IX, and X

d. All of the above

A

Statement 1: A taxpayer can deduct an item or amount from the gross income only if there is a law authorizing such a deduction.

Statement 2: For income tax purposes, a taxpayer is free to deduct from the gross income the full amount or a lesser amount of the deduction allowed or not claim any deduction at all.

a. True, True

b. True, False

c. False, False

d. False, True

A

Which of the following is a nondeductible expense?

a. Interest incurred between a fiduciary of a trust and a beneficiary of such trust

b. Actual bad debt write-off

c. Depreciation using sum-of-the-years' digits method

d. Net operating loss carry-over

C

Statement 1: A "fringe benefit" is any goods, service or other benefits furnished or granted by an employer in cash or in kind, in addition to basic salaries to individual employee.

Statement 2: The term "compensation" means all remuneration for services performed by an employee

for his employer under an employer-employee relationship, unless specifically excluded by the Code.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

A

Which of the following statement/s is/are correct?

I. Fringe benefit is a form of pay which may be in the form of property, services, cash or cash equivalent to supplement a stated pay for the performance of services under an employee-employer relationship.

II. Fringe benefits subject to fringe benefit tax cover only those fringe benefits given or furnished to a managerial or supervisory employee.

III. FBT is a final tax imposed on the employee withheld by the employer, computed based on the monetary value of the fringe benefit.

IV. FBT is an income tax. Accordingly, the one liable under the law to pay the fringe benefit tax is the employee.

V. Fringe benefits subject to FBT shall be included in the income tax return of the employee.

a. I and II

b. All of the above

c. I, II and IV only

d. None of the above

C

Which of the following is incorrect in determining the monetary value of the fringe benefit?

a. For housing privilege, if the employer leases residential property, for the use of the employee, the monetary value is computed as rental paid multiplied by 50%

b. For housing privilege, if the employer owns residential property for the use of the employee, the monetary value is computed as higher of FMV or zonal value multiplied by 5% and 50%

c. For housing privilege, if the employer purchases a residential property and transfers the ownership in the name of the employee, the monetary value is computed as higher of acquisition cost or zonal value multiplied by 5% and 50%

d. For housing privilege, if the employer purchases a residential property and transfers ownership to the employee on a lesser amount, the monetary value is computed as higher of FMV or zonal value less payment by employee

D

Which of the following is subject to fringe benefits tax?

a. Benefits given for the convenience or advantage of the employer

b. De minimis benefits within the limits

c. Benefits given to rank and file employees

d. Educational assistance to the employee or his dependents

D

Which of the following is considered a capital asset?

a. Stock in trade of the taxpayer, or other property of a kind which would properly be included in the inventory of the taxpayer

b. Property held by the taxpayer primarily for sale to customers in the ordinary course of trade or business

c. Real property used in trade or business of the taxpayer

d. None of the above

B

Which of the following statement/s is/are correct?

I. Capital assets include real property not used in trade or business of taxpayer.

II. The holding period does not apply to corporations; hence, capital gains and losses are capitalized at 50%.

III. In computing the gain or loss from sale or other disposition of property acquired as gift or donation,

the basis of cost shall be the same as it would be in the hands of the donor.

IV. The gain or loss recognized from sale or exchange of capital assets by an individual taxpayer, other than real properties and shares of stocks, which are held for more than 12 months shall be 50% of the net capital gain.

a. I, II and IV

b. I, III and IV

c. I, II and III

d. All of the above

B

Which of the following is not one of the requisites for exemption from CGT on sale of principal residence?

a. The taxpayer is a citizen of the Philippines or resident alien

b. Notice to make such utilization was given to the BIR within 60 days from the date of sale

c. The proceeds of the sale was invested in acquiring a new principal residence

d. The reacquisition of the new residence must be within 18 months from date of sale

C

Which of the following cases may the taxable income be computed not on the basis of the calendar year?

I. Taxpayer has no accounting period

II. Taxpayer does not keep books of accounts

III. Taxpayer is an individual taxpayer

IV. Taxpayer is a corporation

V. Taxpayer is a general partnership

a. IV only

b. III, IV and V only

c. IV and V only

d. None of the above

B

The total amount or price of the sale including the cash or property received and including all notes of the buyer or mortgages assumed by him.

a. Initial payment

b. Contract price

c. Selling price

d. Fair market price

B

Which of the following donations inter vivos may not require that it be made in writing?

a. Donation of personal property, the value of which exceeds P5,000

b. Donation of personal property, the value of which is P5,000

c. Donation of real property, the value of which is less than P5,000

d. Donation of real property, the value of which exceeds P5,000

A

Statement 1: Donor's tax shall be levied, assessed, collected and paid upon the transfer of property by any person, resident or non-resident, as a gift.

Statement 2: The donor's tax shall apply whether the transfer is in trust or otherwise, whether the gift is direct or indirect, and whether the property is real or personal, tangible or intangible.

a. True, True

b. True, False

c. False, False

d. False, True

C

When an indebtedness is cancelled without any service rendered by the debtor in favor of the creditor, the forgiveness of debt will result to:

a. Taxable income

b. Distribution of dividend

c. Taxable indirect donation

d. Taxable estate

A

Estate tax accrues from:

a. The moment of death of the decedent

b. The moment the notice of death is filed

c. The moment the estate tax return is filed

d. The moment the properties are delivered to the heirs

B

The personal properties of a non-resident, not citizen of the Philippines, would not be included in the gross estate if:

a. The intangible personal property in the Philippines

b. The intangible personal property is in the Philippines and the reciprocity clause of the estate tax law applies

c. The tangible personal property is in the Philippines

d. The personal property is shares of stock of a domestic corporation 90% of whose business is in the Philippines.

B

Which of the following is an exclusion from gross estate?

a. Transfer in contemplation of death

b. Transfer under special power of appointment

c. Transfer for insufficient consideration

d. Claim against insolvent person

D

Which of the following is a not considered an ordinary deduction from gross estate?

a. Unpaid mortgage or indebtedness

b. Indebtedness or claims against the estate

c. Transfer for public use

d. Standard deduction

C

Statement 1: Conjugal partnership of gains, absolute community of property and complete separation are

all valid regimes that may govern property relations between spouses.

Statement 2: Under the regime of absolute community of property, the husband and the wife place in a common fund the proceeds, products, fruits and income from their separate property and those acquired by either or both spouses through their effort or by chance.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

C

Which of the following statements is incorrect?

a. Property acquired during marriage through gratuitous title is exclusive under conjugal partnership of gains

b. Property acquired gratuitously before marriage is community under absolute community of property

c. Fruits or income from exclusive property earned during marriage are exclusive under conjugal partnership of gains

d. Property acquired during marriage in exchange of exclusive property is exclusive under absolute community of property

C

Statement 1: For VAT purposes, a taxable person is any person liable to pay the VAT, whether registered or registrable in accordance with the Tax Code.

Statement 2: The status of a "VAT-registered person" as a VAT-registered person shall continue until the cancellation of such registration.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

B

This refers to any person who is required to registered under the provisions of the Tax Code but failed to

register.

a. VAT-registered person

b. VAT-registrable person

c. VAT-exempt person

d. None of the choices

D

Which of the following shall be subject to VAT?

a. Sale of agricultural food product in their original state

b. Sale of services subject to other percentage tax

c. Lease of residential units with monthly rent not exceeding P15,000

d. None of the above

D

Which of the following is not exempt from VAT?

a. Transport of passengers by international carriers

b. Services rendered pursuant to employee-employer relationship

c. Sale or importation of agricultural and marine food product in their original state

d. Distribution or transfer of inventory to creditors in payment of debt

D

Statement 1: The input VAT on purchase of capital goods valued at P1,000,000 shall be spread over 60 months if the life of property is equivalent to 5 years or more.

Statement 2: The input VAT on purchase of capital goods valued at P1,000,000 shall be spread over the life of property if the life of the property is less than 5 years.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

D

Which of the following is incorrect?

a. Presumptive input VAT is 4% based on the purchases of primary agricultural products which are used as inputs to the production of processor of sardines, mackerel and milk and manufacturers of refined sugar, cooking oil and packed noodles-based instant meal

b. Transitional input VAT rate is 2% and applies to taxpayers which became liable to VAT for the first time

c. Standard input VAT of 7% applies to sales to government

d. Excess input VAT over output VAT on domestic sales can be used as carry-over to offset output tax, apply for refund or tax credit certificate.

A

Statement 1: Transactions that are subject to other percentage taxes are no longer subject to the value-

added tax but may be subject to excise tax.

Statement 2: All VAT-exempt taxpayers shall be subject to other percentage taxes.

Statement 3: A taxpayer who is subject to percentage tax on his gross sales will also be subject to income tax on his net income.

a. One of the statements is incorrect

b. One of the statements is correct

c. None of the statements are correct

d. All of the statements are correct

D

One of the following is subject to percentage tax under Section 116 of the Tax Code:

a. Establishment whose annual gross sales exceed P3,000,000 and who are VAT-registered

b. Businesses whose annual gross sales exceed P3,000,000 and who are not VAT-registered

c. VAT-registered establishment whose annual gross sales do not exceed P3,000,000

d. Establishment whose annual gross sales do not exceed P3,000,000 and who are not VAT registered

A

Statement 1: A non-VAT registered transportation contractor whose engaged in the transport of passengers, goods, and cargoes shall be liable to percentage tax under section 116 on gross sales from transport of goods and cargoes and 3% common carrier's tax on gross sales from transport of passengers.

Statement 2: There are franchise holders whose gross sales are subject to 12% VAT even if not VAT registered.

Statement 3: The operators of bowling alleys are subject to amusement tax.

a. One of the statements is incorrect

b. One of the statements is correct

c. None of the above statements are correct

d. All of the statements are correct

D

Which of the following statements is incorrect?

a. Franchise grantees on water and gas utilities are subject to 2% franchise tax

b. Proprietor, lessor or operator of place for professional basketball games is subject to 15% amusement tax

c. International air and shipping carriers doing business in the Philippines are subject to 3% common carriers' tax

d. The owner of the winning horse is taxable based on his net winnings

C

Which of the following is incorrect?

a. If an article is domestically produced, the excise tax is paid before the goods are removed at the point of production

b. If an article is imported, the excise tax is paid before the removal of the goods from the customs

c. Excise tax cannot be imposed together with VAT or percentage tax

d. Excise tax is an indirect tax which can be passed on to the buyer

A

DST is necessary in:

a. Sale of real property

b. Inheritance of real property

c. Estate tax payment

d. Donation of real property exempt from the donor's tax

B

Where does the local tax authority emanate from?

a. Legislature

b. Sanggunian

c. Executive

d. Supreme Court

D

Which of the following is not a fundamental principle of local taxation?

a. It shall be uniform in each local sub-unit

b. It shall evolve a progressive system of taxation

c. The revenues collected under the Local Government Code shall inure solely to the benefit of and subject to disposition by the LGU levying the tax or other imposition (autonomy)

d. Collection of local taxes can be delegated to any private person

D

Which of the following is not one of the fundamental principles of real property tax?

a. Real property shall be appraised at its current and fair market value

b. Real property shall be classified for assessment purposes on the basis of actual use

c. Real property shall be assessed on the basis of uniform classification within each LGU

d. None of the above

D

Which of the following is incorrect regarding situs of local business tax?

a. When there is a sales outlet or branch, the situs is the LGU where the outlet is situated

b. When there is no sales outlet or branch, the situs is the LGU where principal office is situated

c. When the manufacturer's office is the same as factory outlet or plant, the situs is the LGU where the manufacturer's principal office is situated

d. When the manufacturer's office is different from factory outlet or plant, the situs is 70% by the LGU where the principal office is located and 30% by the LGU where the project office or plant is located

D

Which of the following is not one of the benefits of senior citizens?

a. 20% discount and exemption from Value Added Tax on certain goods and services for their own use

b. A minimum of 5% discount on water and utility bills up to 100 kilowatt hours of electricity and 30 cubic meters of water, registered under their name

c. Mandatory PhilHealth coverage

d. Groceries worth up to P1,300 per week and 10% off the retail prices of at least four kinds of basic necessities and prime commodities:

D

Which of the following is not one of the benefits of PWDs?

a. 20% discount and Value Added Tax (VAT) exemption when buying certain products and services nationwide

b. 5% discount on basic necessities and prime commodities

c. Express lanes for PWDs

d. A minimum of 5% discount on water and utility bills up to 100 kilowatt hours of electricity and 30 cubic meters of water, registered under their name

C

It is defined as any business enterprise engaged in production, processing, or manufacturing products,

including agro-processing, as well as trading and services, with total assets of not more than P3 million. Such assets shall include those arising from loans but not the land on which the plant and equipment are located.

a. Economic zones

b. RHQs/ROHQs of Multinational Corporations

c. Barangay Micro Business Enterprise (BMBEs)

d. PEZA registered entities

D

Which of the following is not one of the benefits of BMBEs?

a. Exemption from the coverage of the Minimum Wage Law

b. Income tax exemption from income arising from the operations of the enterprise

c. Priority to a special credit window set up specifically for the financing of BMBEs

d. Exemption from payment of any and all local government imposts, fees, licenses, or taxes.

B

In general, in order to avail of relief from double taxation on income earned within the Philippines in the form of decreased tax rates thereon or exemption therefrom, what must be submitted by a non-resident alien to the International Tax Affairs Division (ITAD) of the BIR?

a. Tax treaty law of the host country

b. Tax treaty relief application (TTRA)

c. None of the above

d. Memorandum of agreement between the taxpayer and host country

C

It is the Philippines government agency tasked to promote investments, extend assistance, register, grant incentives to and facilitate the business operations of investors in export-oriented manufacturing and service facilities.

a. Board of Investments

b. Bureau of Customs

c. Philippine Economic Zone Authority

d. National Economic Development Authority

D

Which of the following is not one of the incentives of PEZA-registered companies?

a. Income Tax Holiday (ITH) - 100% exemption from corporate income tax

b. Tax and duty free importation of raw materials, capital equipment, machineries, and spare parts.

c. Exemption from wharfage dues and export tax, impost or fees.

d. Exemption from VAT on local purchases of goods and services, subject to compliance with BIR and PEZA requirements.

B

The Philippine Board of Investment (BOI) is an agency under the

a. National Economic Development Authority

b. Department of Trade and Industry

c. Office of the President

d. Bureau of Domestic Trade

D

Which of the following is not one of the incentives of BOI-registered companies?

a. Income tax holiday

b. Duty exemption on imported capital equipment, spare parts, and accessories

c. Additional deduction for labor expense (ADLE)

d. 5% gross income tax upon expiration of the income tax holiday

B

Generally, the following individuals are required to file an income tax return. Who is the exception?

a. Every Filipino citizen residing in the Philippines.

b. Every Filipino citizen residing outside the Philippines, on his income from sources outside the Philippines.

c. Every alien residing in the Philippines on income derived from sources within the Philippines.

d. Every non-resident alien engaged in trade or business in the Philippines.

C

The following are not required to file ITRs, except:

a. Individual whose sole income has been subjected to final withholding tax.

b. Individual whose compensation income does not exceed the statutory minimum wage.

c. Individual whose gross income from business does not exceed his allowable deductions.

d. Individual with respect to pure compensation income derived from one employer in the Philippines.

A

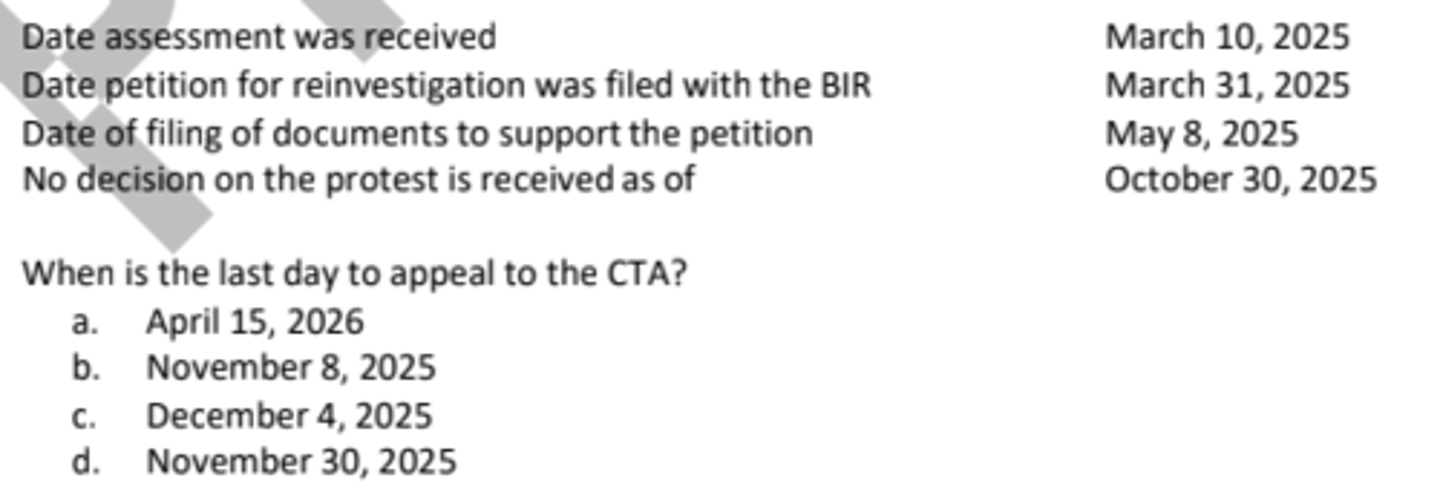

An assessment shall become final if not protested administratively or if such protest is not filed with the BIR from receipt of the assessment within

a. 30 days

b. 60 days

c. 90 days

d. 180 days

B

Using the preceding number, relevant supporting documents must also be presented to the BIR, from filing

the protest on the assessment (request for investigation) within

a. 30 days

b. 60 days

c. 90 days

d. 180 days

C

D

D

Statement 1: All criminal violations may be compromised, except those already filed in court and those involving fraud.

Statement 2: For filing a false and fraudulent return, a 50% surcharge is imposed.

Statement 3: A compromise for a tax liability on the ground of financial incapacity to pay shall still involve a payment of tax from the taxpayer at a minimum compromise rate of 10% of the basic assessed tax.

Statement 4: Abatement or cancellation may be availed by the taxpayer on grounds of unjust and excessive assessment of tax.

a. Only one (1) of the above statements is true

b. Two (2) of the above statements are true

c. Three (3) of the above statements are true

d. All of the above statements are true

D

How much is the maximum annual additional community tax for individuals?

a. 20,000

b. 10,000

c. 15,000

d. 5,000

B

The maximum annual additional community tax for corporations is:

a. 20,000

b. 10,000

c. 15,000

d. 5,000