ECON test 3

1/204

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

205 Terms

Money

A medium of exchange that facilitates transactions.

Money

Anything that is generally accepted in payment for goods or services or in the repayment of debts; a stock concept.

Currency in circulation

A part of the money supply (a stock concept).

Wealth

The total collection of pieces of property that serve to store value (a stock concept).

Income

Flow of earnings per unit of time (a flow concept).

Medium of exchange

Function that money serves when people exchange money for goods and services.

Barter

Trade goods for other goods.

Double coincidence of wants problem

Very high transactions costs (exchange costs).

Unit of account

Used to measure value in the economy.

Store of value

It is a store of purchasing power from the time income is received until it is spent.

Standard of deferred payment

Function that money serves when people buy something one day and pay for it later.

Legal tender

The law that states currency must be accepted in the repayment of existing debts, unless other conditions are established before the debt is created.

Commodity (full-bodied) money

Money that has intrinsic value.

Representative full-bodied money

Money that represents a claim on a commodity.

Fiat money

Currency that has no intrinsic value but is established as money by government regulation.

Checkable deposits

Deposits in a bank account that can be withdrawn on demand.

Electronic payments

Payments made through electronic means, such as online bill pay.

E-money (electronic money)

Digital currency that can be used for transactions.

Debit card

A card that allows the holder to transfer money electronically from their bank account to pay for goods and services.

Stored-value card (smart card)

A card that holds a monetary value that can be used for transactions.

E-cash

Digital cash used for online transactions.

Hyperinflation environment

A situation where the value of currency decreases rapidly, making intrinsic value items the best stores of value.

Cashless society

A society where financial transactions are conducted electronically without the use of cash.

E-money

A form of money that is stored electronically and can be used for transactions.

Bitcoin

A type of electronic money created in 2009.

Mining

The process by which bitcoin is created by decentralized users using their computing power to certify and process transactions.

Medium of exchange

An item that is widely accepted in exchange for goods and services.

Unit of account

A standard numerical unit of measurement that provides a consistent measure of value.

Store of value

An asset that maintains its value over time and can be saved and retrieved in the future.

Monetary aggregates

Measures of the money supply that are categorized based on liquidity.

Liquidity

The ease with which an asset can be converted into cash without affecting its market price.

M1

The most liquid assets, calculated as currency + traveler's checks + demand deposits + other checkable deposits.

M2

Includes M1 plus other assets that are not perfectly liquid but can be converted to perfect liquidity within a short period of time and for low transaction costs.

US currency per person

Approximately $4,000 of US currency held per person in the US.

Missing currency

Refers to the estimated $900 billion of currency (and coins) in circulation that is unaccounted for.

Household currency holding

Households hold approximately 13% of the total currency in circulation.

Business currency holding

Businesses hold approximately 5% of the total currency in circulation.

Illegal activities currency holding

Illegal activities account for approximately 3% of the total currency in circulation.

Unaccounted currency

80% of currency is unaccounted for, with some lost or damaged and most circulating in foreign countries.

M1 vs M2

Refers to the comparison of two measures of money supply which can move in different directions in the short run.

Small denomination time deposits

Deposits that are not perfectly liquid but can be converted to cash with low transaction costs.

Savings deposits

Deposits held in savings accounts that can be withdrawn but may have some restrictions.

Money market deposit accounts

Interest-bearing accounts that typically offer higher interest rates than savings accounts.

Money market mutual fund shares

Shares in a mutual fund that invests in short-term, low-risk securities.

What is the primary role of the Federal Reserve System?

To serve as a bank for banks, regulate the banking system, and conduct monetary policy.

What historical events led to the establishment of the Federal Reserve System?

Resistance to a central bank due to fears of centralized power and distrust of moneyed interests, culminating in the Panic of 1907.

What act established the Federal Reserve System and when was it enacted?

The Federal Reserve Act of 1913.

What are the three major components of the Federal Reserve System?

The Federal Reserve Banks, the Board of Governors, and the Federal Open Market Committee (FOMC).

How are the Federal Reserve Banks structured?

They are quasi-public institutions owned by private commercial banks, with directors elected by member banks and appointed by the Board of Governors.

What are the functions of the Federal Reserve Banks?

Clear checks, issue new currency, withdraw damaged currency, administer discount loans, evaluate bank mergers, and collect data on local business conditions.

What is the special status of the New York Federal Reserve Bank?

It has a permanent FOMC vote, conducts open market operations, and is the largest gold depository in the world.

How many members are on the Board of Governors of the Federal Reserve System?

Seven members.

What is the term length for a member of the Board of Governors?

14 years, nonrenewable.

What are the responsibilities of the Board of Governors?

Set reserve requirements, set the discount rate, advise Congress and the president, inform the media, and vote on monetary policy.

What is the Federal Open Market Committee (FOMC)?

The policy-making body of the Federal Reserve that meets every six weeks to discuss monetary policy.

Who has voting rights in the FOMC?

Only the governors and five district presidents, with the president of the New York Fed always voting.

What is the role of the chairman of the Board of Governors?

Advise the president on economic policy, testify in Congress, and represent the Federal Reserve to the media.

What is the relationship between the FOMC and open market operations?

The FOMC sends directives to the New York Fed trading desk to carry out open market operations.

What is the significance of the Federal Reserve as a lender of last resort?

It provides backup for banks to prevent nationwide bank panics.

What is the primary concern that led to the first US experiments with a central bank being terminated?

Fear of centralized power and distrust of moneyed interests.

What is the role of the FOMC in relation to reserve requirements and the discount rate?

While primarily responsible for open market operations, the FOMC effectively controls reserve requirements and the discount rate.

How often does the FOMC meet?

Every six weeks.

What is the significance of the FOMC's 'general directive'?

It guides the New York Federal Reserve trading desk in executing open market operations.

What is the composition of the directors in the Federal Reserve Banks?

Three A directors are professional bankers, three B directors are from industry, labor, agriculture, or consumer sectors, and three C directors are appointed by the Board and cannot be bank officers.

What is the primary concern of the Federal Reserve regarding monetary policy?

To manage inflation, employment levels, and economic growth.

What are the four main policy tools used by the Federal Reserve to achieve its objectives?

Required reserve ratios, last resort loans (discount loans), open market operations, and interest on reserves.

What is the required reserve ratio (rd)?

The percentage of demand deposit liabilities that banks must hold back against those deposits.

How does increasing the required reserve ratio (rd) affect the money supply?

It reduces the money supply and is contractionary for the economy.

What effect does decreasing the required reserve ratio (rd) have on the money supply?

It increases the money supply and is expansionary for the economy.

What was the reserve requirement set by the Federal Reserve in March 2020?

0%.

What is the purpose of discount loans in the Federal Reserve system?

To provide a lender of last resort function and originally reason for the creation of the Fed.

What is the discount window?

A facility through which banks can borrow money from the Federal Reserve, typically at a premium over borrowing from other banks.

What is Interest on Reserves (IOR)?

The rate at which the Federal Reserve banks pay interest on reserve balances.

What is the effect of increasing Interest on Reserves (IOR)?

It is contractionary for the economy.

What is the effect of decreasing Interest on Reserves (IOR)?

It is expansionary for the economy.

What are open market operations (OMO)?

The purchase and sale of US government securities by the Federal Reserve.

What is the role of the FOMC in open market operations?

To increase or decrease the money supply through the purchase or sale of securities.

What does a defensive open market operation involve?

Sales or purchases to offset market changes and maintain a certain target rate.

What does an offensive (dynamic) open market operation involve?

Sales or purchases to move to a new target rate, requiring a policy change by the FOMC.

What is the Fed funds rate?

The interest rate at which depository institutions trade federal funds with each other overnight.

Is the Fed funds rate set by the Federal Reserve?

No, it is a market interest rate.

What is the Fed funds target rate?

The rate at which the Federal Reserve wants banks to charge each other for overnight loans.

What is one characteristic of the Fed funds rate?

It is one of the lowest (if not the lowest) short run interest rates.

What are the main players in the money supply process?

Central bank (Federal Reserve System), banks (depository institutions), the public, depositors, and borrowers.

What is the Federal Reserve System's simple balance sheet composed of?

Assets (government securities, currency in circulation, discount loans, reserves) and liabilities (monetary liabilities including currency in circulation and reserves).

How is the money supply defined mathematically?

The money supply is a function of the monetary base times the money multiplier: M = m x MB.

What does the monetary base (MB) consist of?

Currency in circulation (C) plus total reserves (R) in the banking system.

How does the Fed control the monetary base?

By controlling the amount of reserves in the system through open market operations and discount window loans.

What happens when the Fed buys treasury securities on the open market?

It increases the monetary base.

What happens when the Fed sells treasury securities on the open market?

It decreases the monetary base.

What is the effect of making a discount loan to a bank on the monetary base?

The monetary base increases by the amount of the loan.

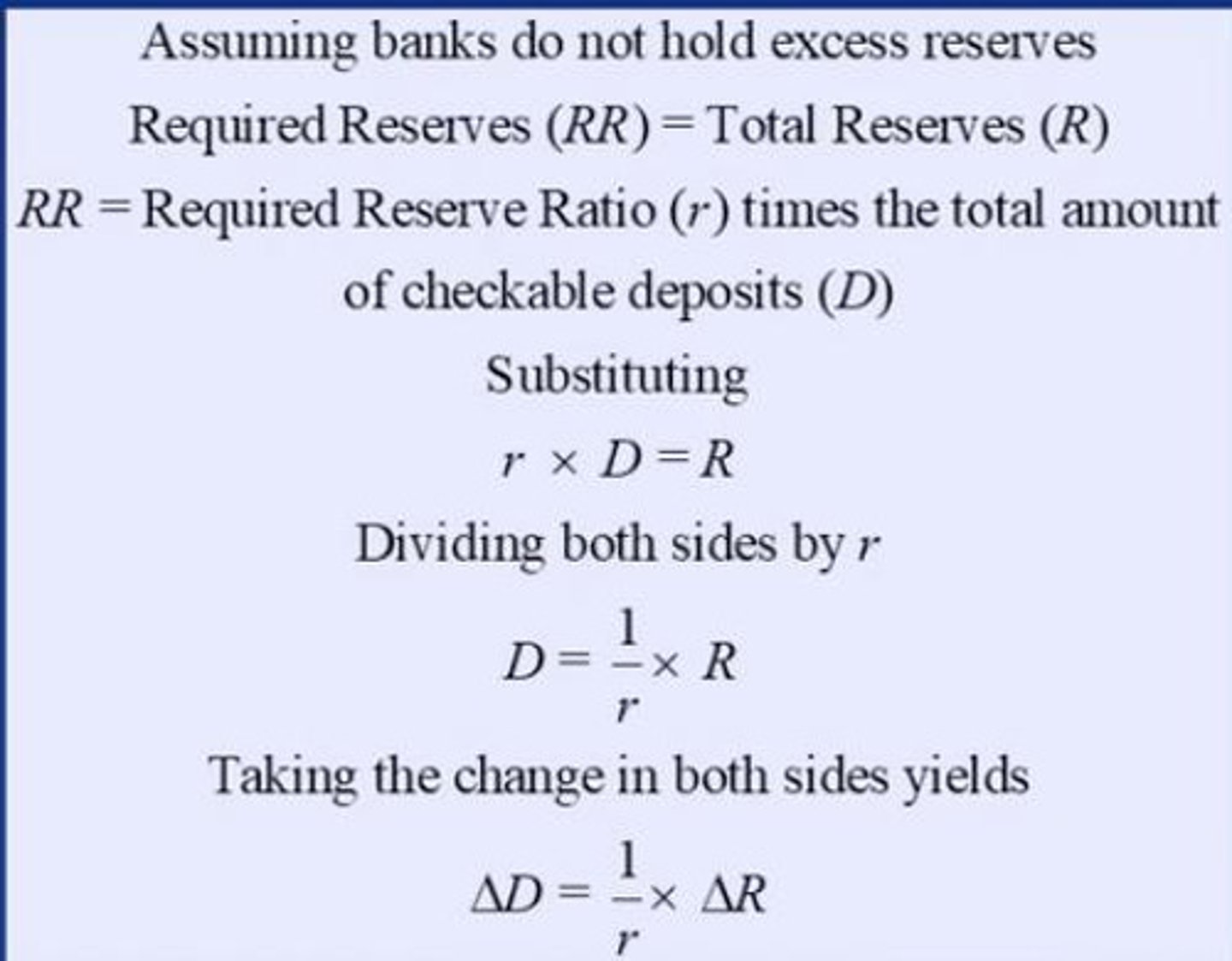

What is the simple deposit multiplier?

It is the ratio of the amount of deposits created by banks to the amount of reserves they hold, assuming a specific reserve requirement.

What is the reserve requirement in the example provided?

10 percent.

How does the money supply model define money (M1)?

Money is defined as currency plus checkable deposits.

What are the factors that determine the money multiplier?

Changes in the required reserve ratio (r), currency ratio (c), and excess reserves ratio (e).

How does the required reserve ratio (r) affect the money multiplier?

The money multiplier and the money supply are negatively related to the required reserve ratio.

What is the relationship between the currency ratio (c) and the money supply?

The money multiplier and the money supply are negatively related to the currency ratio.

How do excess reserves (e) impact the money multiplier?

The money multiplier and the money supply are negatively related to the excess reserves ratio.

What are the two avenues through which the Fed can influence the money supply?

By manipulating the monetary base and manipulating the money multiplier.

What is the primary determinant of movements in the money supply over long periods?

The non-borrowed monetary base, which is controlled by the Fed's open market operations.