Cash and Cash Equivalents

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

62 Terms

Cash

Includes money and any other negotiable instruments that is payable in money and accepted by banks for deposit and immediate credit. This is the most liquid asset.

Cash on Hand

Coins and Currencies

Checks

(X) Undelivered & Post-dated drawn by another person or entity

(X) Stale check drawn by another person or entity

Money Order

Bank Drafts

Cash in Bank

Demand Deposit

Savings Deposit

Unrestricted / Informal Compensating Balance

Bank Overdraft

Immaterial

2 or more accounts with the same bank

Cash Fund

Current Asset Acquisition

For Use in Operations

Settlement of Current Liabilities

Petty Cash Fund

A small amount of cash kept on hand to pay for small, infrequent expenses.

Check

A bill of exchange drawn on a bank payable on demand. It is a written order to the bank by the depositor to pay a specified sum of money to a designated person

Purposes of Bank Reconciliation

❖ It explains the difference between the balances reported by the company and by the bank on a given date

❖ It proves the accuracy of both the company’s and the bank’s records, and reveals any errors made by either party.

❖ It can help detect attempts at theft and manipulation of records.

❖ It establishes the adjusted ending cash balance and provide information to be used for the adjusting entries.

Deposit in Transit

Cash receipts already recorded in the cash receipts journal that reached the bank to late to be credited in the bank statement.

Outstanding Checks

Checks that have been written and recorded by the company but have not yet cleared or paid by the bank.

Credit Memorandum

The collection of receivables made by the bank on behalf of the companyresulting in an increase in the company's bank account balance. This may include amounts collected from customers or notes receivable.

Debit Memorandum

A document issued by the bank to inform the company of deductions from its account, such as service fees or returned checks.

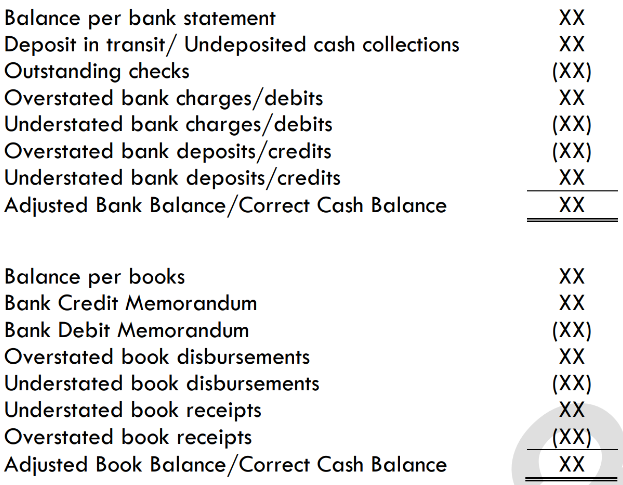

Bank Reconciliation: Adjusted Balance Method

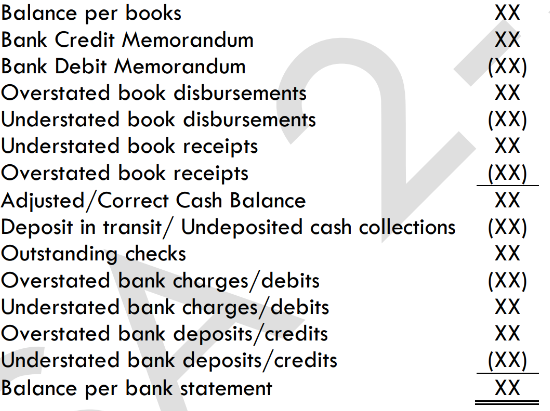

Bank Reconciliation: Book to Bank Method

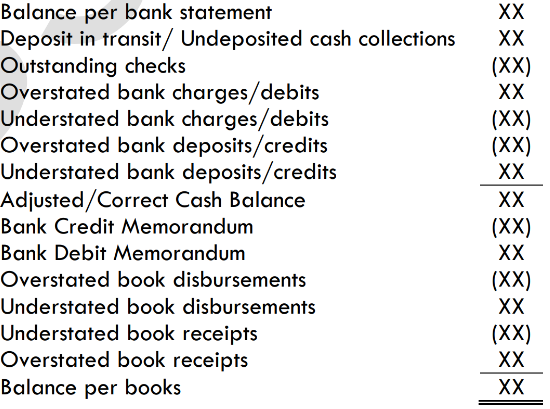

Bank Reconciliation: Bank to Book Method

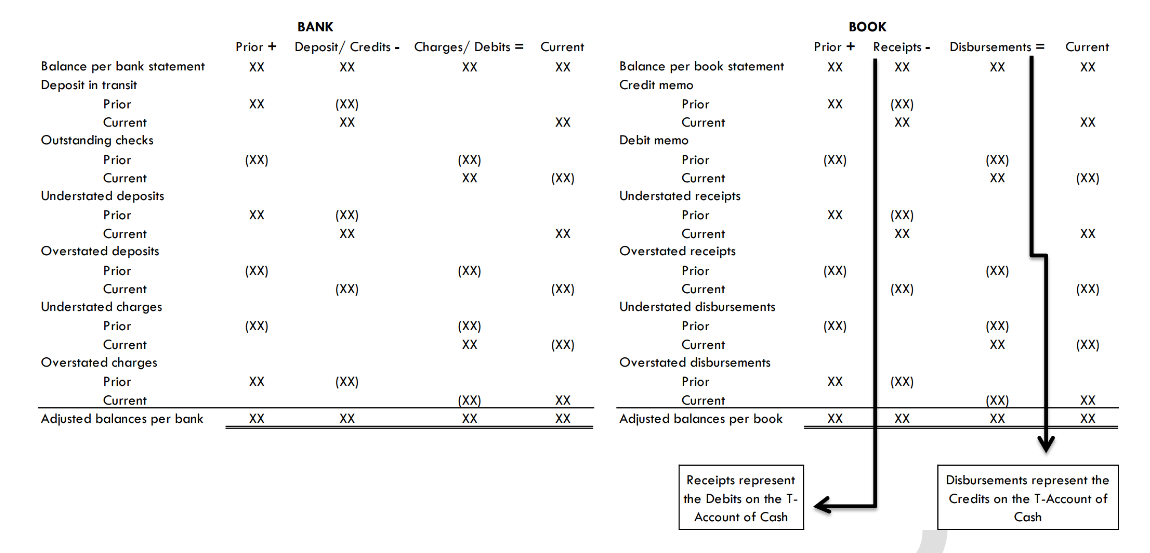

Proof of Cash

A four-column bank reconciliation is essentially a roll forward of each line item in a bank reconciliation form one accounting period to the next, incorporating separate columns for cash receipts and cash disbursements.

Proof of Cash

The most powerful tool to identify the fraudulent technique known as kiting.

Proof of Cash Pro-Forma

d. Existence

Which of the following balance-related audit objective typically is assessed as having high inherent risk for cash?

a. Cut-off

b. Detail tie-in

c. Presentation and disclosure

d. Existence

d. Even when the ending balance is immaterial.

The general cash account is considered a significant account in almost all audits:

a. Except those of not-for-profit organizations.

b. Where either the beginning or ending balance is material.

c. Where the ending balance is material.

d. Even when the ending balance is immaterial.

d. Monthly interest payment

An imprest petty cash fund would least likely be used to pay for which of the following items?

a. Minor office expenses

b. Postage stamps for mailings

c. Small contributions to a birthday event

d. Monthly interest payment

d. Cash will be overstated, and expense understated.

What is the effect of not replenishing the petty cash fund at year-end and not making the appropriate adjusting entry?

a. A detailed audit is necessary.

b. Expenses will be overstated, and cash will be understated.

c. The petty cash custodian should turn over the petty cash to the general ledger.

d. Cash will be overstated, and expense understated.

d. A bank reconciliation from the client.

The starting point for the verification of the balance in the general bank account is to obtain:

a. A cutoff bank statement directly from the bank.

b. The client’s cash account from the general ledger.

c. The client’s year-end bank statement.

d. A bank reconciliation from the client.

d. Confirm directly with bank.

Which of the following substantive audit procedures is most likely to be performed by the auditor to gather evidence in support of the balance per bank?

a. Compare to general ledger.

b. Trace items on the cutoff bank statement to bank reconciliation.

c. Trace to cash receipts journal.

d. Confirm directly with bank.

d. Inspect bank credit memo.

Which of the following substantive audit procedures is least likely to be performed by the auditor to gather evidence in support of the deposits in transit?

a. Inspect supporting documents for reconciling item not appearing on cutoff bank statement.

b. Trace items on the bank reconciliation to cutoff bank statement.

c. Trace to cash receipts journal.

d. Inspect bank credit memo.

d. Confirm directly with bank.

Which of the following substantive audit procedures is least likely to be performed by the auditor to gather evidence in support of the outstanding checks?

a. Ascertain reason for unusual delay.

b. Trace items on the bank reconciliation to cutoff bank statement.

c. Trace to cash disbursements journal.

d. Confirm directly with bank.

d. A cutoff bank statement.

A partial-period bank statement and the related canceled checks, duplicate deposit slips, and other documents included in bank statements, mailed by the bank directly to the CPA firm's office, is called:

a. A four-column proof of cash.

b. A short-period bank statement.

c. A year-end bank statement.

d. A cutoff bank statement.

d. Verify reconciling items on the client’s bank reconciliation.

An auditor who is engaged to examine the financial statements of a business enterprise will request cutoff bank statement primarily in order to:

a. Detect kiting.

b. Detect lapping.

c. Verify the cash balance reported on the bank confirmation inquiry form.

d. Verify reconciling items on the client’s bank reconciliation.

d. Corroborate information regarding deposit and loan balances.

The primary purpose of sending a standard confirmation request to financial institutions with which the client has done business during the year is to:

a. Detect kiting activities that may otherwise not be discovered.

b. Provide the data necessary to prepare a proof of cash. c

. Request information about contingent liabilities and secured transactions.

d. Corroborate information regarding deposit and loan balances.

d. The confirmation form also seeks information about indebtedness to the bank.

The auditor should ordinarily mail confirmation requests to all banks with which the client has conducted any business during the year, regardless of the year-end balance, since:

a. The mailing of confirmation forms to all such banks is required by GAAS.

b. This procedure relieves the auditor of any responsibility with respect to non-detection of forged checks.

c. This procedure will detect kiting activities which otherwise not be detected.

d. The confirmation form also seeks information about indebtedness to the bank.

d. Material control weaknesses in cash receipts and cash disbursements.

Auditors are likely to prepare a proof of cash when the client has:

a. Material control weaknesses in accounts payable and inventory.

b. Material control weaknesses in accounts receivable and revenue.

c. Material control weaknesses in payroll.

d. Material control weaknesses in cash receipts and cash disbursements.

d. A substantive test of transactions and test of details of balances.

A proof of cash represents:

a. A substantive test of transactions.

b. A test of controls and substantive test of transactions.

c. A test of details of balances.

d. A substantive test of transactions and test of details of balances.

c. Internal substantiating evidence are adequate.

We use the positive confirmation template in the following situations except for:

a. Individual account balances are relatively large.

b. There is reason to believe that there may be a substantial number of accounts in dispute or with inaccuracies or irregularities.

c. Internal substantiating evidence are adequate.

d. Internal control system is weak.

d. Presentation and disclosure

Review of credit balances and unusual items for accounts receivable is being performed to test what assertion?

a. Existence

b. Rights and obligations

c. Completeness

d. Presentation and disclosure

b. Other reliable external evidence to support the balances is likely to be available.

Auditors may choose not to confirm accounts payable because:

a. The balances due will have changed between the year-end and the date of confirmation.

b. Other reliable external evidence to support the balances is likely to be available.

c. Confirmation obtains evidence identical to that obtained by cutoff tests.

d. A reading of the corporate minutes reveals that confirmation is unnecessary.

c. Reviewing interbank transfers near the reporting date

Which audit procedure is performed specifically to detect and correct kiting?

a. Bank confirmations

b. Testing cash valuation

c. Reviewing interbank transfers near the reporting date

d. Journal entry testing

b. Validates samples of both bank and book reconciling items based on the testing thresholds as documented in the audit plan.

In reviewing client’s bank reconciliation schedules, the auditor ordinarily

a. Validates all bank and book reconciling items.

b. Validates samples of both bank and book reconciling items based on the testing thresholds as documented in the audit plan.

c. Validates all book reconciling items. After all, only book reconciling items such as collections made by the bank in behalf of the depositor, interest income, and bank charges require adjusting entries in the books.

d. Validates samples of book reconciling items based on the testing thresholds as documented in the audit plan. After all, only book reconciling items such as collections made by the bank in behalf of the depositor, interest income, and bank charges require adjusting entries in the books.

Cash funds that are intended for settlement of long-term obligations in the future qualify to be reported as part of the current assets.

Which of the following statements relating to cash is INCORRECT?

The presentation of the cash item must parallel the intention of the management for which cash is held.

Cash funds that are intended for settlement of long-term obligations in the future qualify to be reported as part of the current assets.

Cash deposits with banks that have been restricted because of an unforeseen circumstance are excluded from cash.

Working funds segregated for current use in the ordinary conduct of business, such as petty cash fund and change fund, qualify as cash under current assets.

Not-sufficient fund checks

Which of the following would NOT be classified as cash?

Cashier's checks

Not-sufficient fund checks

Personal checks

Traveler's checks

errors made by the company

Bank statements provide information about all of the following, EXCEPT

bank charges for the period

checks cleared during the period

errors made by the company

not-sufficient funds check

cash reserved for acquisition of property, plant and equipment within 3 months from the reporting date

Cash and cash equivalents on the statement of financial position EXCLUDE

cash reserved for acquisition of property, plant and equipment within 3 months from the reporting date

checks drawn before the reporting date but held for later delivery to creditors

unrestricted 30-day time deposits

US dollars deposited in foreign currency depository account

if legally restricted and held against short-term credit should not be included in the cash balance but is reported among current assets

Deposits held as compensating balances

if legally restricted and held against long-term credit may be included among current assets

if legally restricted and held against short term credit may be included as cash

if legally restricted and held against short-term credit should not be included in the cash balance but is reported among current assets

usually do not earn interest

preparing regular bank reconciliation

A good internal control system provides for

allowing one person to receive cash and to record cash receipts

delaying the deposit of cash collections because no one knows for sure the account to be credited

making payments from the day's collections

preparing regular bank reconciliation

I, II and III

Which of the following are characteristics of an effective control of cash disbursements?

I. Requiring all checks to be pre-numbered

II. Requiring all checks to be signed by one person and countersigned by another

III. Requiring approved supporting documents for each check issued

IV. Requiring disbursements to be done in cash from daily receipts prior to making bank deposits to minimize handling of cash

I, II and III

I, III and IV

I and II

II, III and IV

a reconciliation of the cash receipts and payments during the current period together with the beginning and ending balances of cash

A proof of cash is

a proof of a company's liquid position

a proof of the existence of a cash deposit in a bank

a reconciliation of the cash receipts and payments during the current period together with the beginning and ending balances of cash

a reconciliation of the cash receipts and payments during the previous period, together with the beginning and ending balances of cash

unrestricted and available for use in current operations.

For an item to be reported as cash and cash equivalents, it must be

unrestricted and available for use in current operations.

available only for the purchase of property, plant and equipment

set aside for the liquidation of long-term debt.

deposited in bank and restricted by the court exclusively for payment of back wages of employees who won in a court case against the employer company.

debited when the petty cash fund proves out short

A cash short and over account is

a contra account to cash

debited when the petty cash fund proves out over

debited when the petty cash fund proves out short

not generally accepted

pay small and immediate miscellaneous expenses

A petty cash system is designed to

encash checks of selected employees.

handle cash sales.

account for all cash receipts and payments of minimal amounts.

pay small and immediate miscellaneous expenses

to avoid the overstatement of cash and the understatement of expenses.

A petty cash fund is reimbursed just prior to the end of the reporting period and an adjusting entry is made

to avoid the overstatement of cash and the understatement of expenses.

to avoid the understatement of cash and the overstatement of expenses.

to conceal shortages in cash.

to avoid the misstatement of sales

Inventories

Which of the following is NOT a financial asset?

Cash and cash equivalents

Investment in equity shares of other entities

Trade receivables, loans and other receivables

Inventories

may include a debit to miscellaneous expense for bank service charges.

The journal entries for a bank reconciliation

are taken from the balance per bank section only.

may include a credit to accounts receivable for an NSF check

may include a debit to accounts payable for an NSF check.

may include a debit to miscellaneous expense for bank service charges.

A past-due promissory note in favor of ABC Company by its president

As of December 31, 2020, ABC Company had various checks and papers in its safe. Which item should NOT be included in its cash account in its statement of financial position?

A past-due promissory note in favor of ABC Company by its president

ABC Company's December 28, 2020, P50,000 check payable to NSR Company, an ABC Company's supplier

XYZ Company's check dated December 5, 2020, P15,000 check payable to ABC Company

US$15,000 cash

II, III and IV

Which of the following are basic characteristics of a system of cash control?

I. Combined responsibility for handling and recording cash

II. Daily deposit of all cash received

III. Internal audit at irregular intervals

IV. Use of a voucher system

I, II and III

II, III and IV

I, III and IV

II and III

I, V and VI

Bank reconciliations are normally prepared on a monthly basis to identify adjustments needed in the depositor's records and to identify bank errors. Adjustments should be recorded for the following:

I. Book errors

II. Outstanding checks

III.Deposits in transit

IV. Bank errors

V. Debit memos

VI. Credit memos

II, III and IV

I, V and VI

I, II and III

II, III and IV

time-lapse differences

Seldom does the balance of the cash in bank account in the depositor's books agree with the balance appearing in the bank statement at a particular date because of

a tax avoidance

bank secrecy requirements

negligence by the bookkeeper

time-lapse differences

II, V and VI

The following are reconciling items in an enterprise's bank reconciliation statement.

I. Deposit in transit

II. Company check for P32,500 recorded in the books for P23,500

III. Check of another company erroneously charged by bank in the company's account

IV. Deposit of another company erroneously credited by bank to the company's account

V. Bank service charges

VI. No sufficient fund check charged back by the bank

VII. Company deposit for P32,500 recorded in the books for P23,500

Which of the foregoing adjustments would be shown as deduction from the cash balance per books in order to arrive at the correct cash balance?

II, IV, V, VI and VII

II, V, VI and VII

II, V and VI

V, VI and VII

Post dated checks payable to the company

Which of the following items would normally be EXCLUDED from the amount to be reported as cash on a company's statement of financial position?

Petty cash fund

Post-dated checks issued by the company

Post dated checks payable to the company

Undelivered checks written and signed by the company

Prove the correctness of the cash balance in the client's year-end balance sheet.

A proof of cash is used by a CPA to

Comply with Philippine Auditing Practice Statements.

Determine if there were any unauthorized disbursements or unrecorded deposits during the reconciliation period.

Prove that the client's bank did not make an error during the period under examination.

Prove the correctness of the cash balance in the client's year-end balance sheet.

Customer’s postdated checks

Which of the following would not be classified as cash?

Personal checks

Customer’s postdated checks

Cashiers' checks

Travelers' checks

It establishes the adjusted ending cash balance and provide information to be used for the closing entries.

Which of the following is not a purpose of bank reconciliation?

It establishes the adjusted ending cash balance and provide information to be used for the closing entries.

It proves the accuracy of both the company’s and the bank’s records, and reveals any errors made by either party.

It can help detect attempts at theft and manipulation of records.

It explains the difference between the balances reported by the company and by the bank on a given date

The Petty Cash account is debited when the fund is replenished.

Which of the following is not true?

The imprest petty cash system in effect adheres to the rule of disbursement by check.

Entries are made to the Petty Cash account only to increase or decrease the size of the fund or to adjust the balance if not replenished at year-end.

The Petty Cash account is debited when the fund is replenished.

All of these answer choices are not true

The reimbursement of the petty cash fund should be credited to the cash account.

When a petty cash fund is used, which of the following is true?

The petty cashier's summary of petty cash payments serves as a journal entry that is posted to the appropriate general ledger account.

The balance of the petty cash fund should be reported in the statement of financial position as a long-term investment.

The reimbursement of the petty cash fund should be credited to the cash account.

Entries that include a credit to the cash account should be recorded at the time the payments from the petty cash fund are made

I, II, IV, V, VII

Which of the following are considered cash for financial reporting purposes?

I. Petty cash funds and change funds

II. Money orders, travelers' checks, and personal checks

III. Postdated checks and IOUs

IV. Coins, currencies and funds for current operations

V. Savings account for employees’ travel

VI. Savings account for acquisition of equipment

VII. Savings account for acquisition of inventories

I, II, III, IV, VII

I, II, III, IV, V, VII

I, II, IV, V, VI, VII

I, II, IV, V, VII