4.1.7 - balance of payments

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

14 Terms

two types of trade deficit

structural - caused by permanent issues with the economy

cyclical - caused by boom and bust cycle

structural trade deficit reasons

strong currency - imports cheaper (SPICED)

high inflation - exports more expensive for foreign buyers

lack of natural factor endowment - need to import

poor quality domestically - need to import

3 types of policies to reduce deficit

supply side - improve domestic

expenditure switching - protectionism (fix structural deficit)

expenditure reducing - reduce AD (fix cyclical deficit)

they could also just do nothing

good and bad about doing nothing

floating exchange rates are a self correcting mechanism - (over time more imports = currency depreciates = SPICED fixed)

might be other factors that stop the currency from depreciating

could take a long time to self correct

good and bad about supply side

improves quality + quantity of FoPs

lowers costs of production

(exports increase due to both)

long term policies = time lag

involves government spending

good and bad about expenditure switching

(currency depreciation, tariffs, etc)

successfully changes consumer buying habits (from foreign to domestically produced goods)

protectionism = retaliation

what effect can currency depreciation have on fixing a trade deficit

the j-curve effect

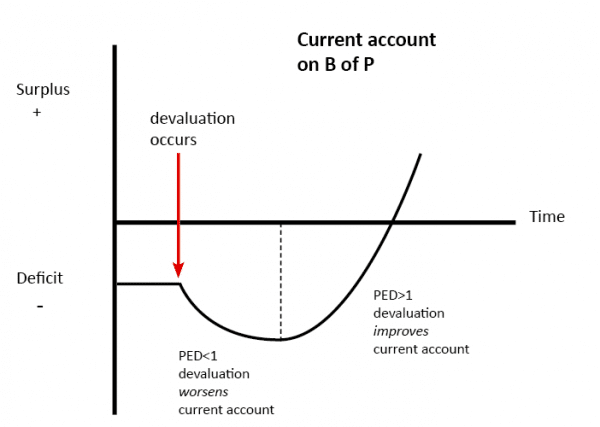

show + explain the J-Curve

SHORT-RUN:

TIME taken to substitute or terminate contracts means that:

weak currency = imports expensive = trade deficit worsens (bc it’s about value)

LONG-RUN:

deficit improves

what’s the name of the condition that summarises how the J-Curve works

the Marshall-Lerner condition:

if exports and imports PED adds to 1 or more, then a weaker currency will improve a trade deficit

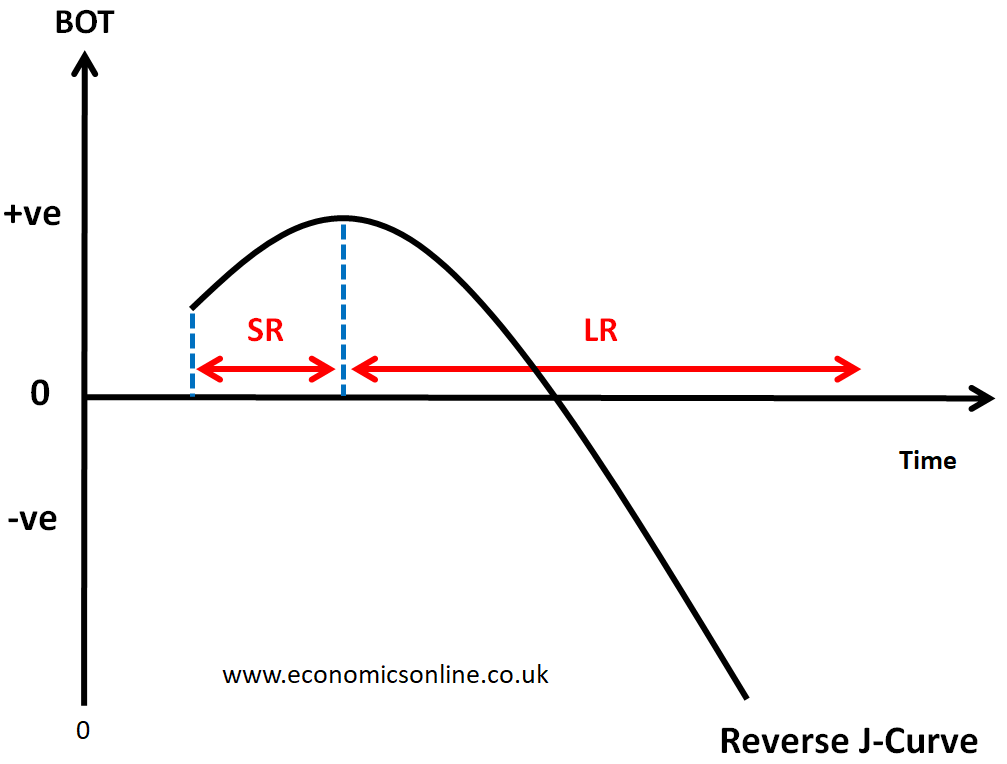

what else can the j curve do

be reverse - to fix a trade surplus

same thing applies but the other way around

good and bad about expenditure reducing

(interest rates, taxes, etc)

fall in discretionary income = demand falls for imported goods

reducing AD = GDP falls, unemployment rises

maths-wise, how does global trade work

NET ZERO - one country’s surplus is another country’s deficit

problems with persistent deficits

loans or FDI required to fund continued imports

—> a country may gradually sell its assets

—> owing money abroad = vulnerable

problems with persistent surpluses

nations resources allocated to meet foreign demand rather than domestic

—> limited availability of g+s localy

—> currency instability if exchange rate is floating