Finance 1 IBEB

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

What is the disposition effect?

Refers to our tendency to prematurely sell assets that have made financial gains, while holding on to assets that are losing money.

Does an efficient market require every shareholder to make efficient choices?

No, as long as there is enough competition/arbitrage investors, the efficient market still holds even with some irrational agents present.

Does having an efficient market mean that all stocks match their expected returns exactly?

No, there is still uncertainty and volatility. Some stocks will do better than expected, others worse, precisely because new information (good or bad) arrives randomly.

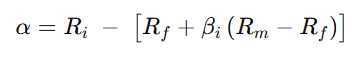

What is the equation to calculate alpha?

What is Alpha?

It is a measure of how much a security portfolio outperforms or underperforms its expected returns based on systematic risk.

What is a self-financing portfolio?

It is a portfolio that purchases a certain portfolio of assets and shorts other positions to finance it.

How do you calculate the enterprise value?

Market Value of Equity + Debt - Cash

How do you calculte the rate of return of a levered firm?

rL = rU+(rU−rD)*(E/D)

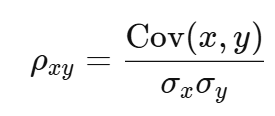

What is the equation for the correlation coefficient?

What is the Modigliani-Miller Theory 1?

The value of an asset remains the same, regardless of how the operating cash flows generated by the asset are divided between different classes of investors.

What is the Modigliani-Miller Theory 2?

With an increase in debt, the WACC does not increase in a world with no taxes, transaction costs or bakcruptcy costs. The cost of equity does increase though to compensate for higher financial risk.

What is distress cost?

Higher levels of debt increase the likelihood of financial distress and bankruptcy. Even if bankruptcy is avoided, the mere possibility can incur significant costs.

Why do agency costs matter in capital restructuring?

Agency costs arise from conflicts of interest between managers and shareholders. Managers may pursue strategies that benefit themselves (such as empire-building) rather than maximizing shareholder wealth.

What is the FCF equation?

EBIT(1-T) + Depreciation - Change in Net Working Capital (Change in Current Assets - Current liabilities) - CAPEX

What can be done to prevent the free-rider problem of management of a company?

A leveraged buyout can be used, it is effective in capturing the value you believe you can create once you take over the company. A minority stake can also potentially be used and then acquiring the rest of the shares needed to get to 50%.

What is weak, semi-strong and strong form efficiencies?

Weak: All historical information of pricing etc. is incorporated in pricing. Semi-strong: All publicly available information is incorporated into pricing. Strong: All information is incorporated into pricing of stocks.

What is Static tradeoff theory?

Interest on debt is tax-deductible, so there is an increase in after-tax cash flow to investors with more debt. However, debt also increases the chance of financial distress. The value of a levered firm is equal to the value of an unlevered firm of the same risk class plus the tax shield.

Whats is merger-arbitrage?

A strategy where someone simultaneously purchases and sells the respective stock of two merging companies to create "riskless" profits. Because there is the uncertainty of the deal being completed, the stock price of the target company typically sells at a price below the acquisition price.

Do borrowing costs decrease or increase due to a merger?

Generally, borrowing costs decrease due to how cash flows might differ from the two firms, and combining the cash flows will lead to more stable cash flows.

Why are unprofitable divisions often maintained for too long in large conglomerates?

Due to internal capital allocation, leading to some divisions essentially being subsidized by the profitable divisions.

What is merger-arbitrage-spread?

The difference between the stock price of the target firm and the implied offer price.

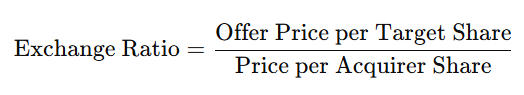

What is the exchange ratio?

What is the cash ratio?

The synergies to be realized divided by the shares outstanding of the target.

What is the difference between general and limited partners?

General partners are the ones that work with managing the portfolio, limited partners are those that provide the capital.

What is a best-efforts IPO?

Underwriters aim to sell shares without committing to buying unsold shares.

Lower risk for underwriters as they aren't obligated to purchase unsold shares, but success depends on effective marketing.

What is a firm commitment IPO?

Underwriters commit to buying the entire offering at a fixed price, regardless of market demand.

Higher risk for underwriters as they must purchase shares even if market demand is low, selling them later at a lower price.

What is an auction IPO?

Offering price determined through a bidding process.

Generally lower underwriter risk as the market sets the price through competitive bids. Underwriters facilitate the process but do not necessarily commit to purchasing shares at a fixed price.

How to find volatility of a stock?

Find the variance of the returns and square it to find the standard deviation.

Why is the share price of an IPO generally higher at the end of the IPO day?

Due to the Winner’s curse. Investors generally cannot fulfill their orders as the demand is too high at the IPO price, when an investor gets all the shares they request, the IPO is more likely to perform badly.

What can a board do to prevent a hostile takeover?

The board can try to find a "White knight” firm, a friendlier firm that can take over the firm at a better price.

What are the two ways to calculate Enterprise Value?

Discounted cash flows

Market value of equity + market value of debt - cash

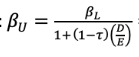

What is the formula to go from a Levered Beta to an Unlevered Beta?

What is arbitrage pricing theory?

A model that is based on the fact that asset’s return can be predicted by using linear return and compensate for macroeconomic factors.