10.0 How the Macroeconomy Works (All in 1)

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

32 Terms

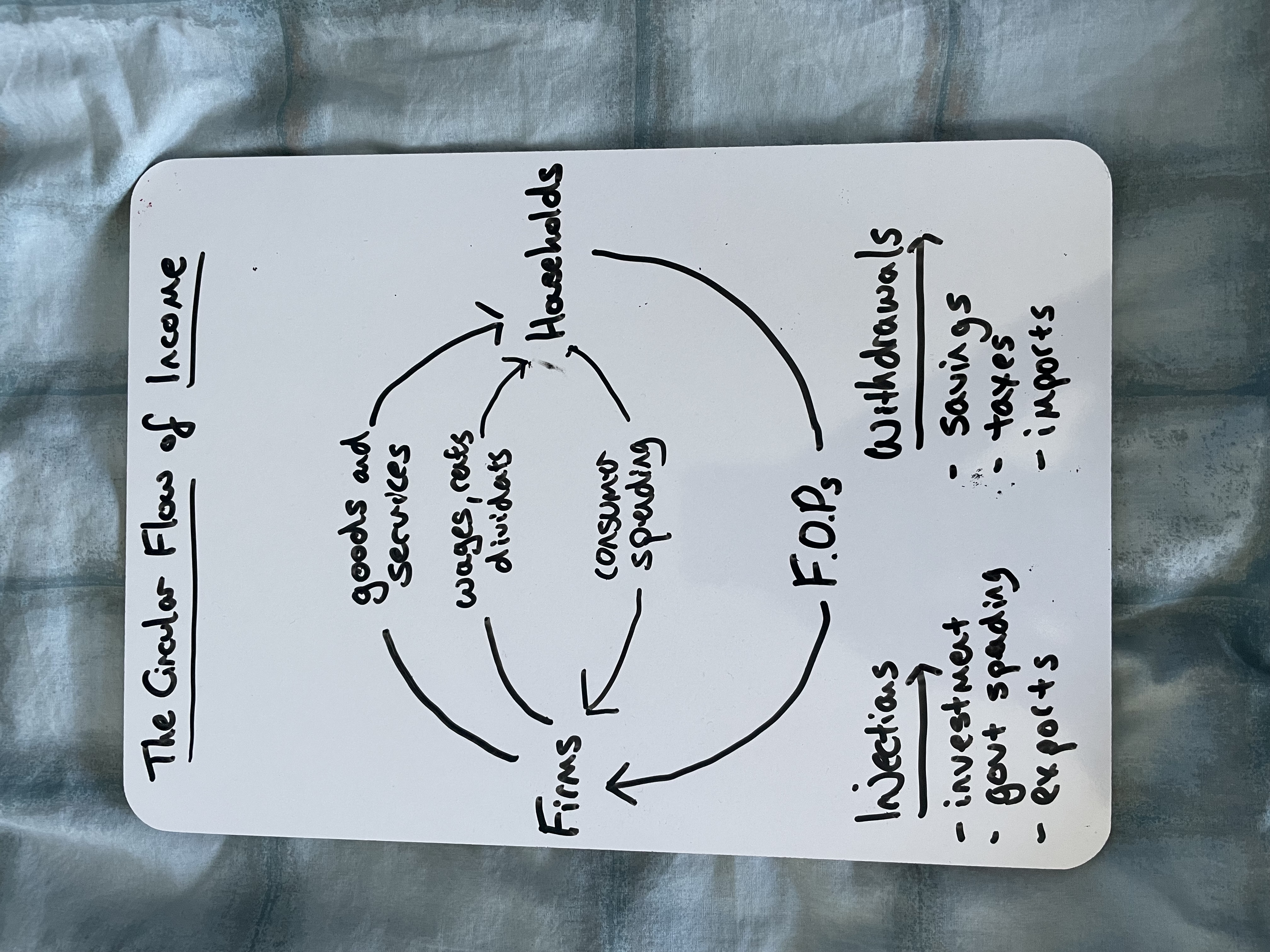

What do households supply to firms in the circular flow of income

Households supply factors of production such as labour and capital

What do firms provide to households in exchange for factors of production

Wages, dividends, and goods and services

What are injections in the circular flow of income

Injections are additions to the economy, including government spending, investment, and exports

What are withdrawals in the circular flow of income

Withdrawals are leakages from the economy, such as taxes, savings, and imports

Draw the Circular Flow of Income

What is the accelerator effect

The idea that changes in national income can cause proportionally larger changes in investment by firms

Why do firms invest more when the economy grows quickly

Firms expect higher future demand and invest in capital goods to expand productivity capacity when national income rises rapidly

What happens to investment when economic growth slows, even if GDP is still rising?

Firms may reduce investment due to expectations of lower future demand

What is the key differences between the accelerator and the mulitplier

The accelerator deals with how investment changes based on growth

The multiplier explains how initial spending leads to an increase in national income

What are the components of AD

C + I + G + (X - M)

C (consumer spending) is the largest, making up just over 60% of GDP

What factors influence consumer spending in an economy

Interest Rates

Consumer Confidence

Disposable Income

MPC and MPS

What is the marginal propensity to consume

MPC is the proportion of additional income that a consumer spends on goods and services

What influences investment by firms

Economic growth

Business confidence

Interest rates

Govt Regulation

What is the accelerator effect in investment

It suggests that investment levels are linked to the rate of change in GDP

What influences government spending in the economy

Trade cycle (recession increases, boom decreases)

Fiscal Policy

What affects the (X - M) or net exports components of AD

Real income

Exchange rates

State of World Economy

Protectionism

Competitiveness

What are the main factors that influence the level of economic activity

Employment

Confidence

Events (e.g. natural disasters, Christmas)

Taxes + Interest rates

How does employment affect economic activity

It influences production and consumption

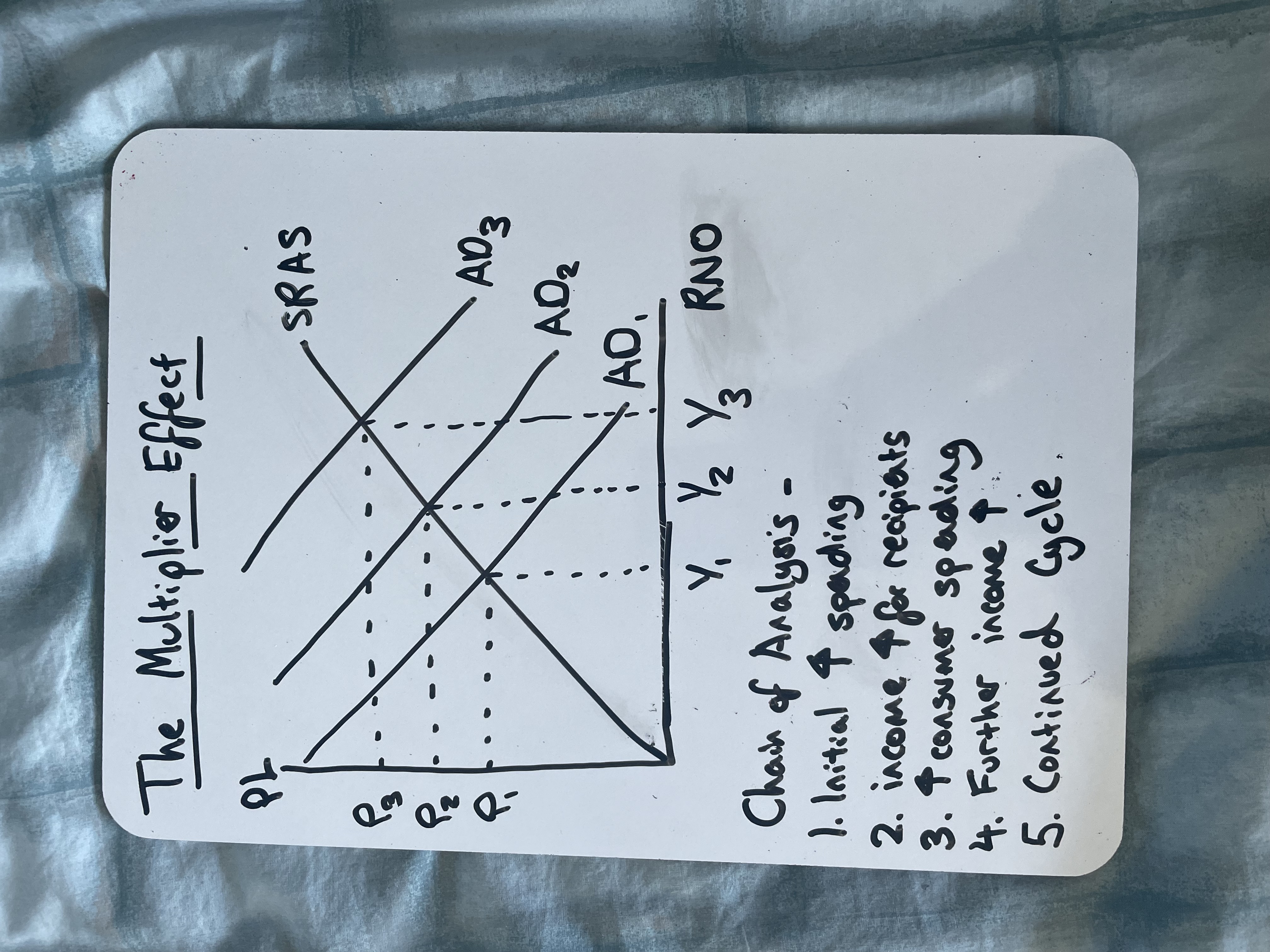

What is the multiplier effect

It is the process where an initial increase in aggregate demand leads to a greater final increase in national income

Why does the multiplier effect occurs

Because one person’s spending is another person’s income, creating a chain reaction

Draw the Multiplier Effect

How is the multiplier calculated using the marginal propensity to consume

Multiplier = 1 / (1 - MPC)

How does spare capacity in an economy affect the multiplier

If spare capacity is high (elastic SRAS), the multiplier effect is larger because more output can be produced without causing inflation

What is reverse multiplier effect

A withdrawal of income from the circular flow can lead to a larger decrease in national income, reducing growth

What factors cause the SRAS curve to shift

Changes in the conditions of supply, such as:

Employment costs

Input costs

Exchange rates

Regulations

Capital Investment

How do rising employment costs (e.g. wages, taxes) affect SRAS curve

They increase production costs and shift the SRAS curve inwards

What impact does a stronger currency have on SRAS

It lowers the price of imports, reducing input costs and shifting SRAS outwards

How can govt regulation affect SRAS

Excessive regulation can reduce business efficiency, causing SRAS curve to shift inwards

What is the long-run assumption about the LRAS curve in classical economics

LRAS curve is vertical, meaning output is fixed at full employment and not affected by price level

What can shift LRAS to the right

Increase in the quanitity or quality of factors of production

In the Keynesian AS curve, what does the horizontal section represent

It shows spare capacity - output can increase without increasing the price level

According to Keynesian theory, what happens when resources are fully employed and AD increases

Output causes inflation, moving the price level up from P2 to P3