ACYFARP1: Cash and cash equivalents

1/11

Earn XP

Description and Tags

Cash and cash equivalents, Petty cash fund and Bank reconciliation

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

Which of the following should not be considered “Cash” for financial reporting purposes?

a. Petty cash fund and undeposited collections

b. Money orders and customer checks

c. Coin and currencies

d. Postdated checks and IOUs

d. Postdated checks and IOUs

Which of the following is not considered part of “Cash and cash equivalents”?

a. Money market placement

b. Commercial paper

c. Treasury bill

d. Bank overdraft

d. Bank overdraft

The “Petty Cash Fund” account is debited

a. Only when the fund is established

b. When the fund is established and when it is replenished

c. When the fund is established and when the size of the fund is increased

d. When the fund is established and when the fund is decreased

c. When the fund is established and when the size of the fund is increased

Pinnacle Company provided the following information at year-end comprising the cash account (see image)

What total amount should be reported as cash at year-end?

a. P8,050,000

b. P7,050,000

c. P6,550,000

d. P6,450,000

c. P6,550,000

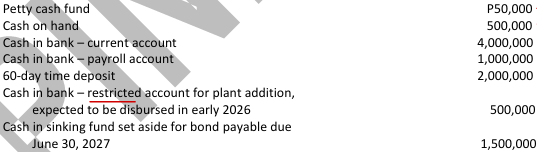

Mr. Accounting Company had the following account balances on December 31, 2025:

The petty cash fund included unreplenished December 2025 petty cash expense vouchers of P5,000 and employee IOU of P5,000. The cash on hand included a P100,000 check payable to the entity dated January 31, 2026.

What total amount should be reported as cash and cash equivalents on December 31, 2025?

a. P6,940,000

b. P8,940,000

c. P7,940,000

d. P7,440,000

d. P7,440,000

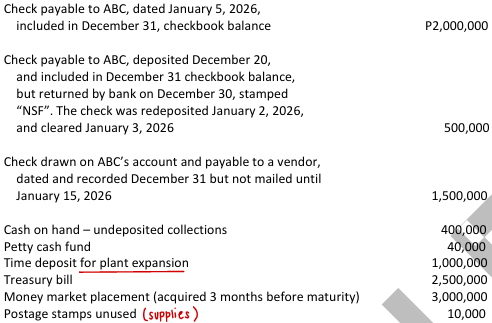

ABC Company had a checkbook balance on December 31, 2025 of P8,000,000 and held the following item in the safe:

What total amount should be reported as “Cash” on December 31, 2025?

a. P7,400,000

b. P7,440,000

c. P8,440,000

d. P7,450,000

b. P7,440,000

ABC Company had a checkbook balance on December 31, 2025 of P8,000,000 and held the following item in the safe:

What total amount should be reported as “Cash equivalents” on December 31, 2025?

a. P6,500,000

b. P3,000,000

c. P5,500,000

d. P2,500,000

c. P5,500,000

A bank reconciliation is prepared monthly in order for the entity to

a. Arrive at the correct cash balance

b. Correct book errors

c. Correct bank errors

d. Detect any cash fraud

a. Arrive at the correct cash balance

Bank reconciliations are normally prepared on a monthly basis to identify adjustments needed in the depositor’s records and to identify bank errors. Adjustments on the part of the depositor should be recorded for

a. Bank errors, outstanding checks and deposits in transit

b. All items except bank errors, outstanding checks and deposits in transit

c. Book errors, bank errors, deposits in transit and outstanding checks

d. Outstanding checks and deposits in transit

b. All items except bank errors, outstanding checks and deposits in transit

A bank statement provides information about all of the following, except

a. Bank charges for the period

b. Errors made by the company

c. Check cleared during the period

d. NSF checks

b. Errors made by the company

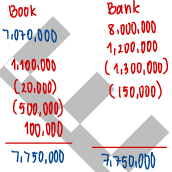

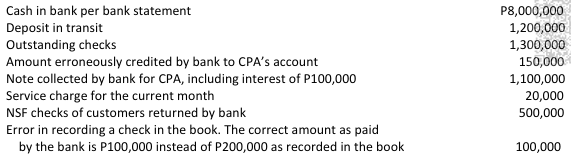

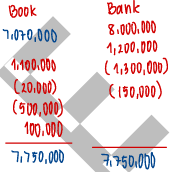

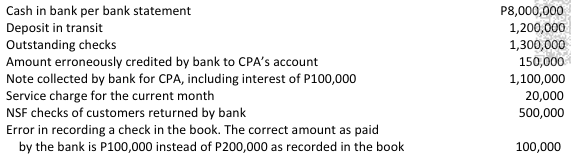

CPA Company provided the following information at month-end:

What is the adjusted cash in bank at month-end?

a. P7,750,000

b. P7,900,000

c. P8,050,000

d. P7,550,000

a. P7,750,000

CPA Company provided the following information at month-end:

What is the unadjusted cash in bank per ledger at month-end?

a. P7,070,000

b. P7,220,000

c. P7,270,000

d. P7,750,000

a. P7,070,000