Macroeconomics Theme 2 <3

5.0(1)

5.0(1)

Card Sorting

1/119

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

120 Terms

1

New cards

ceteris paribus

all other things stay the same

2

New cards

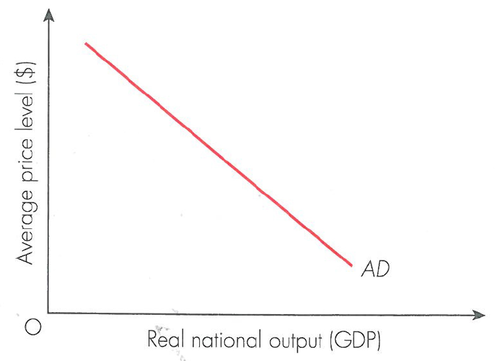

aggregate demand

the total amount of planned spending on goods and services

3

New cards

aggregate demand formula

AD = C + I + G + (X-M)

4

New cards

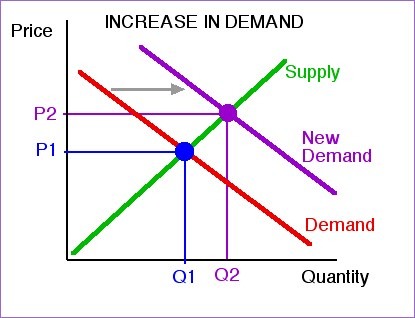

shift in AD

changes to components of AD

5

New cards

consumption

spending by households on goods and services

6

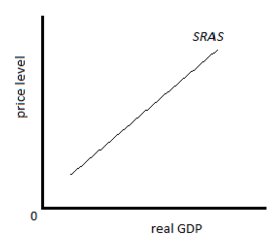

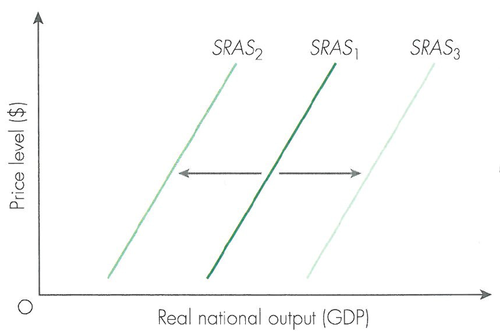

New cards

disposable income

The amount of money that households have available for spending and saving after taxes

7

New cards

marginal propensity to consume (MPC)

the proportion of additional income that is spent on goods and services

8

New cards

marginal propensity to save (MPS)

the proportion of additional income that is saved not spent

9

New cards

MPC

change in consumption/change in income

10

New cards

MPS formula

1-MPC

11

New cards

wealth

the value of assets owned

12

New cards

income

flow of money

13

New cards

collateral

an asset that a borrower pledges to a lender as a security for a loan

14

New cards

interest rates

the reward of saving and cost of borrowing

15

New cards

wealth effect

increase in house prices

higher perceived wealth

increase consumption

higher perceived wealth

increase consumption

16

New cards

investment

accumulation of capital stock

17

New cards

gross investment

total amount that the economy spends on new capital

18

New cards

net investment

gross investment - capital depreciation

19

New cards

factors that affect investment

1 rate of economic growth

2 confidence levels

3 interest rates

4 government decisions

5 access to credit

6 regulation

7 animal spirits (not rational)

2 confidence levels

3 interest rates

4 government decisions

5 access to credit

6 regulation

7 animal spirits (not rational)

20

New cards

recession

2 consecutive quarters of negative real GDP

21

New cards

budget deficit

G > T

22

New cards

budget surplus

G < T

23

New cards

austerity

decrease spending to lower the budget deficit

24

New cards

automatic stabilisers

factors that automatically work toward stabilising the economy by reducing the short term fluctuation of the business cycle(income tax and unemloyment benefits)

25

New cards

fiscal stimulus

increasing the growth of the economy through fiscal policy and government spending

26

New cards

trade balance (net exports)

the value of exports - the value of imports

27

New cards

exchange rate

the value of one currency against another

28

New cards

current account deficit

M > X

29

New cards

current account surplus

M < X

30

New cards

marginal propensity to import (MPM)

the proportional increase in imports from an increase income

31

New cards

SPICED

strong pound imports cheap exports dear

32

New cards

WPIDEC

weak pound imports dear exports cheap

33

New cards

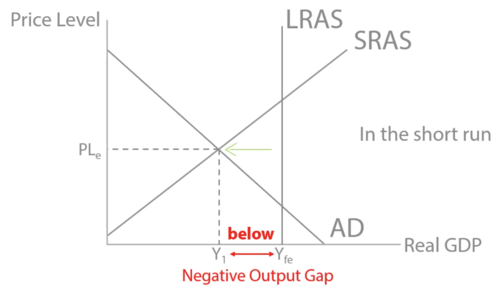

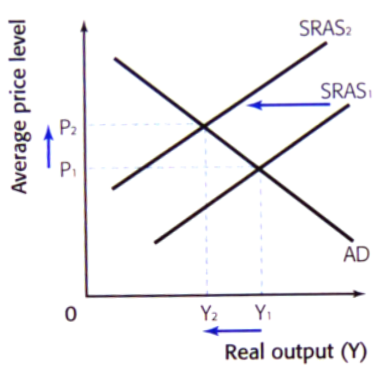

short run aggregate supply

atleast on factor of production is fixed

34

New cards

factors of production

1 land

2 labour

3 capital

4 enterprise

2 labour

3 capital

4 enterprise

35

New cards

shifts in SRAS

1 changes in cost of raw materials

2 changes in the level of international trade

3 changes in exchange rate

4 changes in tax

2 changes in the level of international trade

3 changes in exchange rate

4 changes in tax

36

New cards

long run aggregate supply

all factors of production are variable

37

New cards

shifts in LRAS

changes in productivity or quantity of factors of production

38

New cards

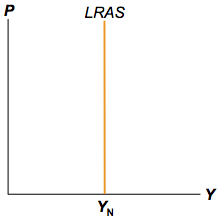

classical LRAS curve

in the LR the economy will have full capacity

39

New cards

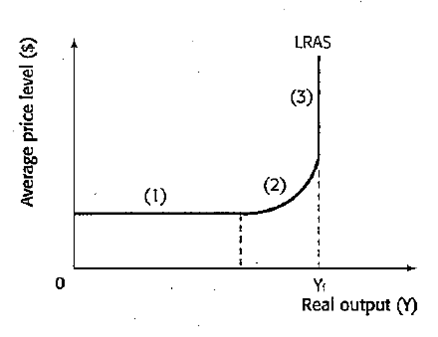

keynesian LRAS curve

in the LR there is spare capacity

40

New cards

gross domestic product (GDP)

the total value of all goods and services produced annually in an economy

41

New cards

real GDP growth

percentage increase in the total value of good and service adjusted for inflation

42

New cards

economic growth

real GDP growth

43

New cards

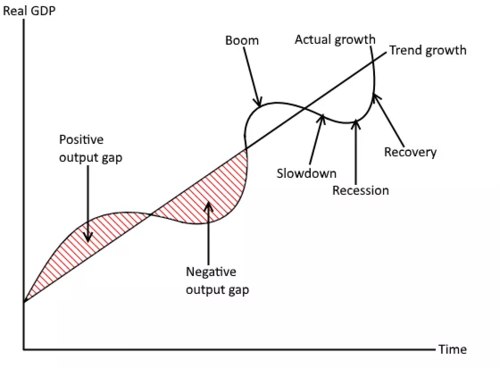

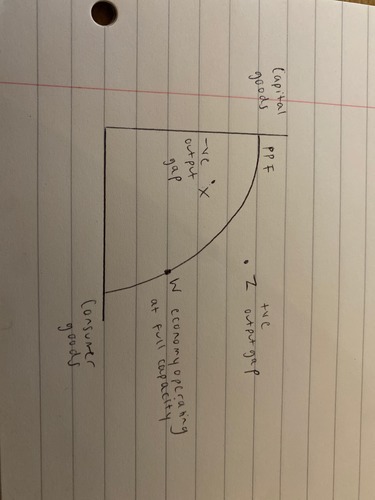

actual growth

% increase in real GDP

44

New cards

potential growth

shift in LRAS

45

New cards

sustainable growth

an increase in GDP that can be maintained without creating other problems

46

New cards

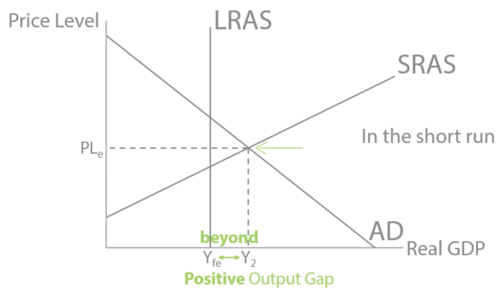

output gap

the difference between actual and potential GDP

47

New cards

factors that influence a reccession

1 fall in GDP growth

2 fall in confidence

3 fall in consumption

4 fall in global trade

5 increasing unemployment

2 fall in confidence

3 fall in consumption

4 fall in global trade

5 increasing unemployment

48

New cards

benefits of growth

1 more employment

2 more investments

3 more tax revenue

4 increase in living standards

2 more investments

3 more tax revenue

4 increase in living standards

49

New cards

cost of growth

1 inequality in wealth

2 inflation will go above 2%

3 negative externalities

4 leakages from the circular flow of income

2 inflation will go above 2%

3 negative externalities

4 leakages from the circular flow of income

50

New cards

characteristics of a boom

1 high rates of economic growth

2 near full capacity or positive output gaps

3 low unemployment

4 high inflation

5 High confidence

6 budget surplus

2 near full capacity or positive output gaps

3 low unemployment

4 high inflation

5 High confidence

6 budget surplus

51

New cards

characteristics of a recession

1 negative economic growth

2 lots of spare capacity and negative output gaps

3 high unemployment

4 low inflation

5 low confidence

6 budget deficit

2 lots of spare capacity and negative output gaps

3 high unemployment

4 low inflation

5 low confidence

6 budget deficit

52

New cards

business cycle

alternating periods of economic booms and economic recessions

53

New cards

negative output gaps

where the economy is producing less than potential output

54

New cards

positive output gap

where the economy is producing more than potential output

55

New cards

production possibility frontier (PPF)

maximum combinations of goods and services that can be produced if all resources are used efficiently

56

New cards

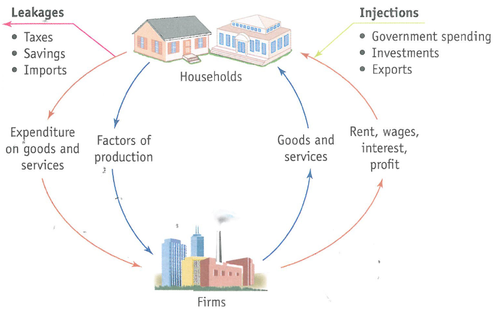

circular flow of income

a model of the economy that shows the flow of goods, services and factors of production around the economy

57

New cards

injection

investment

exports

government spending

exports

government spending

58

New cards

withdrawal

spending

imports

taxes

imports

taxes

59

New cards

multiplier effect

an increase in spending, increases national income and consumption greater than the initial amount spent

60

New cards

multiplier formula

1/(1-MPC)

61

New cards

MPW formula

MPW = MPS + MPT + MPM

62

New cards

MPC formula

1 - MPW

63

New cards

Change in GDP formula

change in GDP = change in injections x multiplier

64

New cards

measuring GDP

total output = total income = total expenditure

65

New cards

problems with GDP

1 underground markets

2 income distribution

3 size of public sector

4 quality of data

2 income distribution

3 size of public sector

4 quality of data

66

New cards

gross national income (GNI)

GNI = GDP + net income from abroad

67

New cards

nominal GDP

GDP measured in current prices not adjusted for inflation

68

New cards

real GDP formula

(nominal GDP/price index) x 100

69

New cards

GDP per capita formula

real GDP/population

70

New cards

purchasing power parity (PPP)

the amount of money needed in one country to purchase the same goods and services in another country

71

New cards

base year

benchmark year which other years are compared against

72

New cards

price level

average value of goods and services as an index value

73

New cards

inflation

sustained increase in the general price level

74

New cards

deflation

a sustained decrease in the general price level

75

New cards

disinflation

a fall in the inflation rates

76

New cards

consumer price index (CPI)

weighted average of basket of good

77

New cards

basket of goods

weighted by percentage expenditure compared to income

78

New cards

percentage change

change/original x 100

79

New cards

problems with CPI

1 might not be relevant to everyone

2 not measured accurately

3 ignores substitution effect

4 ignores changes to quality of goods

2 not measured accurately

3 ignores substitution effect

4 ignores changes to quality of goods

80

New cards

retail price index (RPI)

a measure of inflation

81

New cards

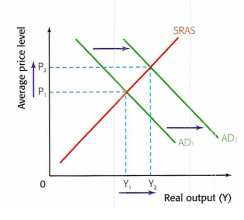

demand pull inflation

increase in AD

82

New cards

cost push inflation

decrease in SRAS

83

New cards

wage price spiral

expected inflation

wage bargaining

increase in cost

increase in inflation

wage bargaining

increase in cost

increase in inflation

84

New cards

effects of high inflation

borrowers - real value of debt decreases

savers - value of your saving decreasing

savers - value of your saving decreasing

85

New cards

cost of inflation

1 higher cost of living

2 wage price spiral

3 decrease the value of savings

4 increase in unemployment

5 value of exports decreases

6 bad for people with fixed incomes

2 wage price spiral

3 decrease the value of savings

4 increase in unemployment

5 value of exports decreases

6 bad for people with fixed incomes

86

New cards

benefits of deflation

1 increase in value of savings

2 technology improvements and decrease in costs of production

3 increase in current account

2 technology improvements and decrease in costs of production

3 increase in current account

87

New cards

cost of deflation

1 value of our debt increases

2 downward wage price spiral

3 unemployment

4 investments are shifted abroad

2 downward wage price spiral

3 unemployment

4 investments are shifted abroad

88

New cards

causes of deflation

increase in LRAS

decrease in AD

decrease in AD

89

New cards

measures of unemployment

claimant count

ILO measure

ILO measure

90

New cards

claimant count

The number of people claiming jobseekers allowance

91

New cards

international labour organisation (ILO)

a survey asked to people aged 16-65 if they have been out of work for the past 4 weeks and if they are ready to work within the next 2 weeks

92

New cards

unemployment formula

unemployed/(unemployed + employed) x 100

93

New cards

types of unemployment

1 frictional

2 structural

3 cyclical

4 seasonal

2 structural

3 cyclical

4 seasonal

94

New cards

frictional unemployment

when people are between jobs

95

New cards

structural unemployment

mismatch of skilled workers and skills demanded

96

New cards

cyclical unemployment

when demand for labour is low in a recession

97

New cards

seasonal unemployment

demand for labour is relatively low in certain times of the year

98

New cards

underemployment

workers are overqualified for their jobs or work fewer hours than they would prefer

99

New cards

occupational mobility of labour

The ability to change occupations

100

New cards

geographical mobility of labour

The ability to move from one location to another for work