Ch. 20 EOC Problems: Fed Model

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

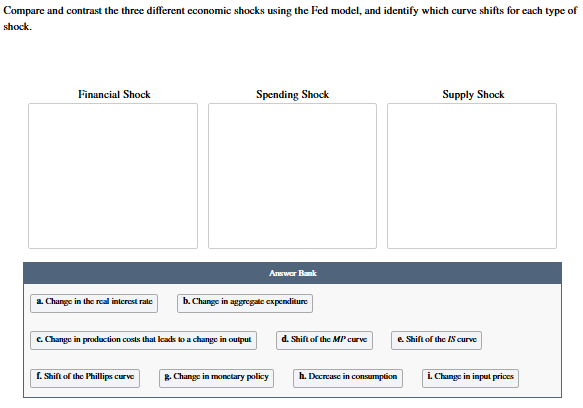

a. Change in the real interest rate, b. Change in aggregate expenditure, c. Change in production costs that leads to a change in output, d. Shift of the MP curve, e. Shift of the IS curve, f. Shift of the Phillips curve, g. Change in monetary policy, h. Decrease in consumption, i. Change in input prices

Financial Shock: a. Change in the real interest rate, d. Shift of the MP curve, g. Change in monetary policy Spending Shock: b. Change in aggregate expenditure, e. Shift of the IS curve, h. Decrease in consumption Supply Shock: c. Change in production costs that leads to a change in output, f. Shift of the Phillips curve, i. Change in input prices

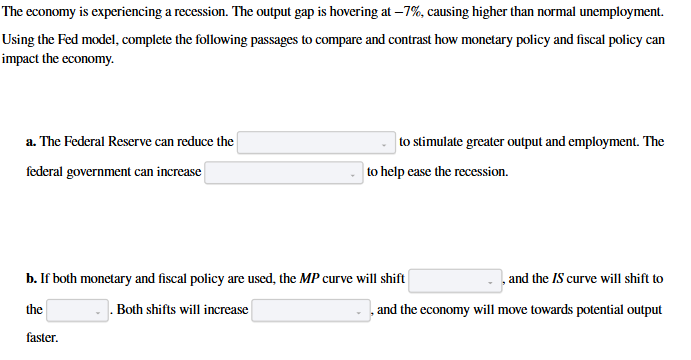

a. federal funds rate/government purchases, federal funds rate/government purchases b. upward/downward, left/right, output/unemployment

a. federal funds rate, government purchases b. downward, right, output

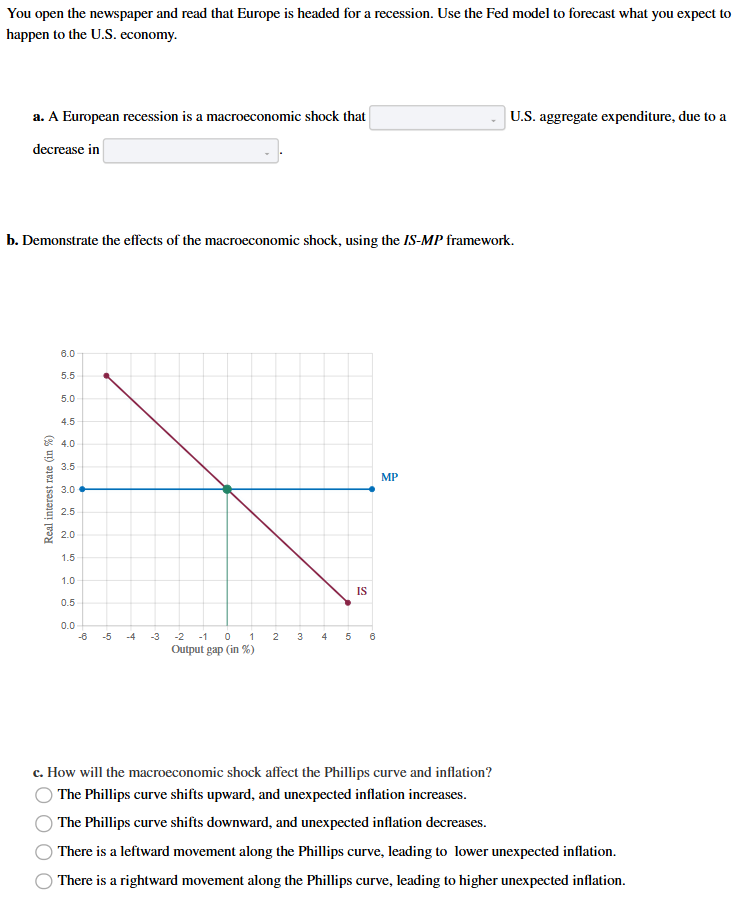

a. decreases/increases/does not change, consumption spending/government spending/investment spending/net exports

a. decreases, net exports b. IS curve shifts left c. c

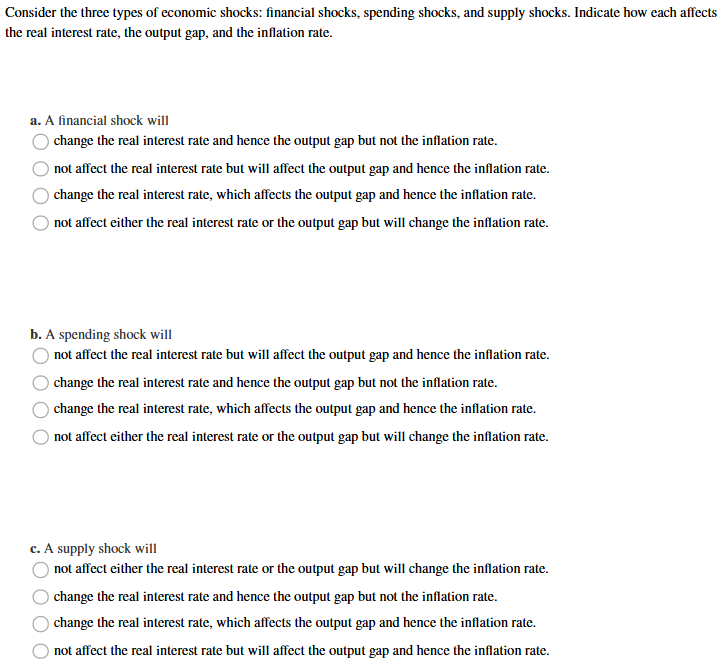

a. c. b. a c. a

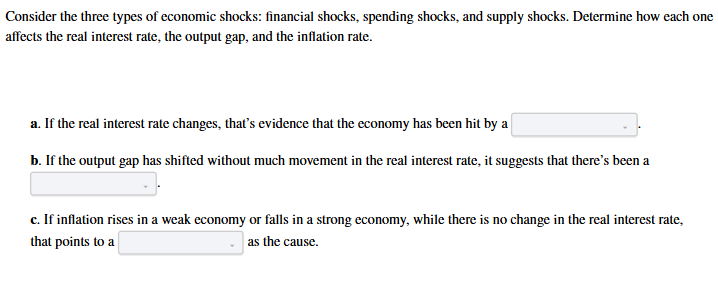

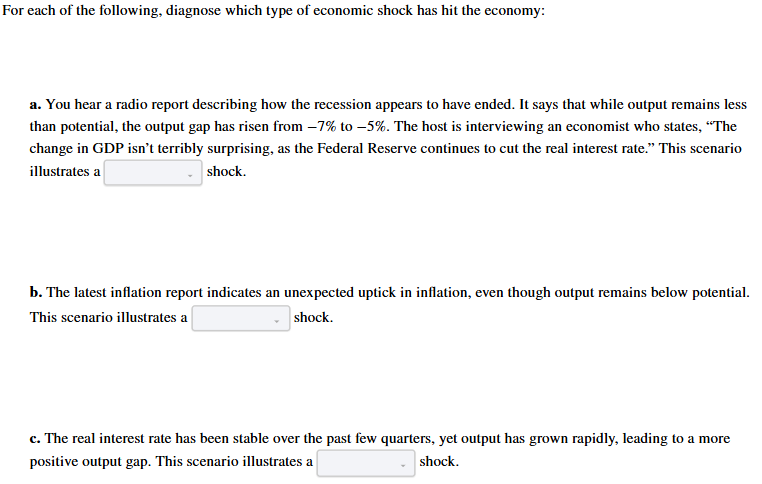

a. spending shock/supply shock/financial shock b. spending shock/supply shock/financial shock c. spending shock/supply shock/financial shock

a. financial shock b. spending shock c. supply shock

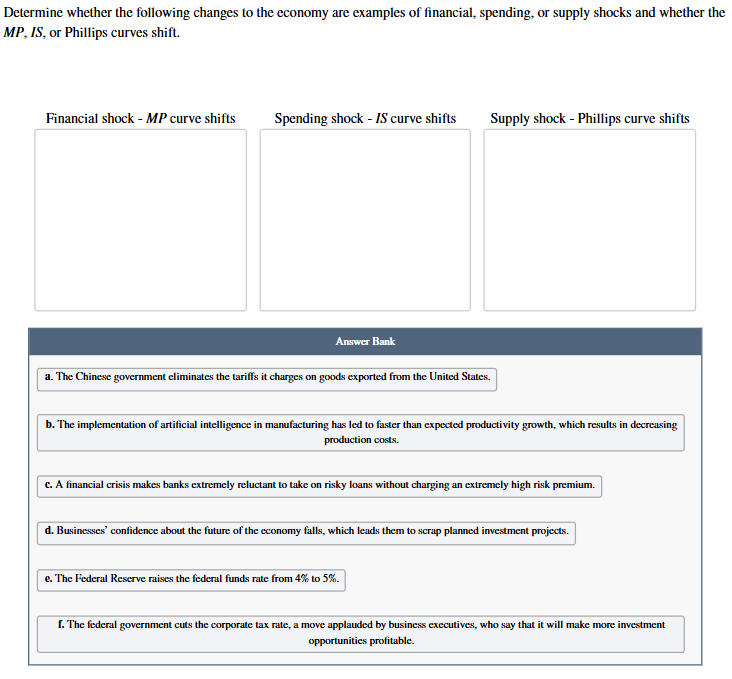

a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable.

Financial shock - MP curve shifts: c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., e. The Federal Reserve raises the federal funds rate from 4% to 5%. Spending shock - IS curve shifts: a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable. Supply shock - Phillips curve shifts: b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs.

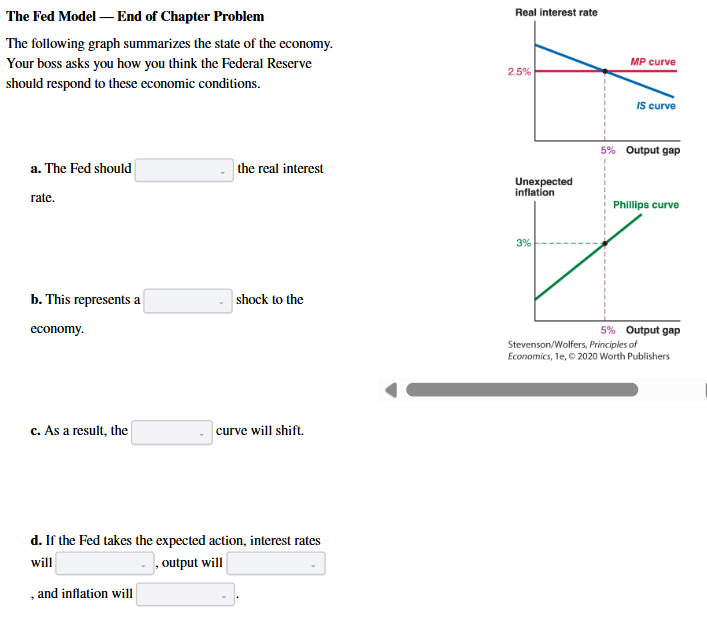

a. increase/decrease/not change, b. spending/supply/financial c. Phillips/IS/MP d. not change/fall/rise, not change/fall/rise, not change/fall/rise

a. increase b. financial c. MP d. rise, fall, fall

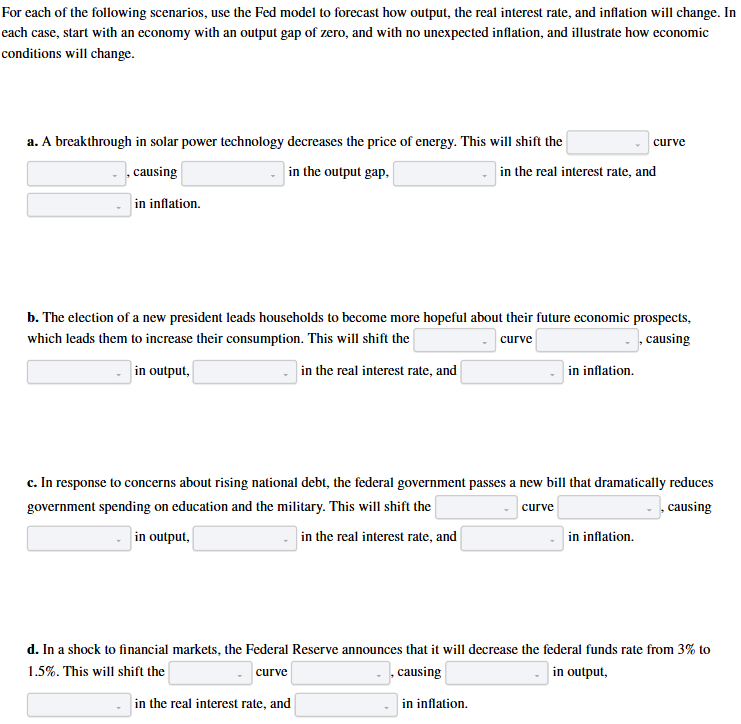

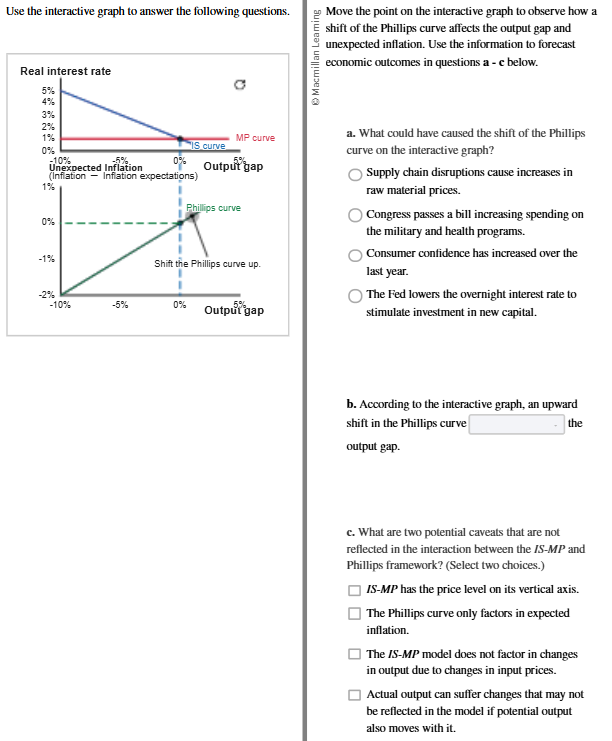

a. Phillips/MP/IS, upward/downward, a decrease/an increase/no change, a decrease/an increase/no change, a decrease/an increase/no change

b. Phillips/MP/IS, to the left/to the right, a decrease/an increase/no change, a decrease/an increase/no change, a decrease/an increase/no change

c. Phillips/MP/IS, to the left/to the right, a decrease/an increase/no change, a decrease/an increase/no change, a decrease/an increase/no change

d. Phillips/MP/IS, upward/downward, a decrease/an increase/no change, a decrease/an increase/no change, a decrease/an increase/no change

a. Phillips, downward, no change, no change, a decrease b. IS, to the right, an increase, no change, an increase c. IS, to the left, a decrease, no change, a decrease d. MP, downward, an increase, a decrease, an increase

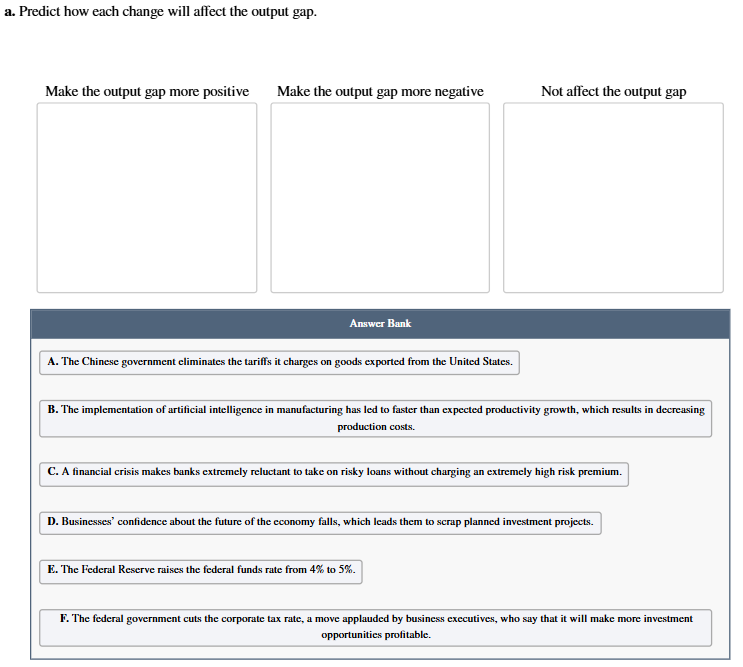

a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable.

Make the output gap more positive: a. The Chinese government eliminates the tariffs it charges on goods exported from the United States, f. The federal government cuts the corporate tax rate, a move applauded by business executives Make the output gap more negative: c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%. Not affect the output gap: b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs.

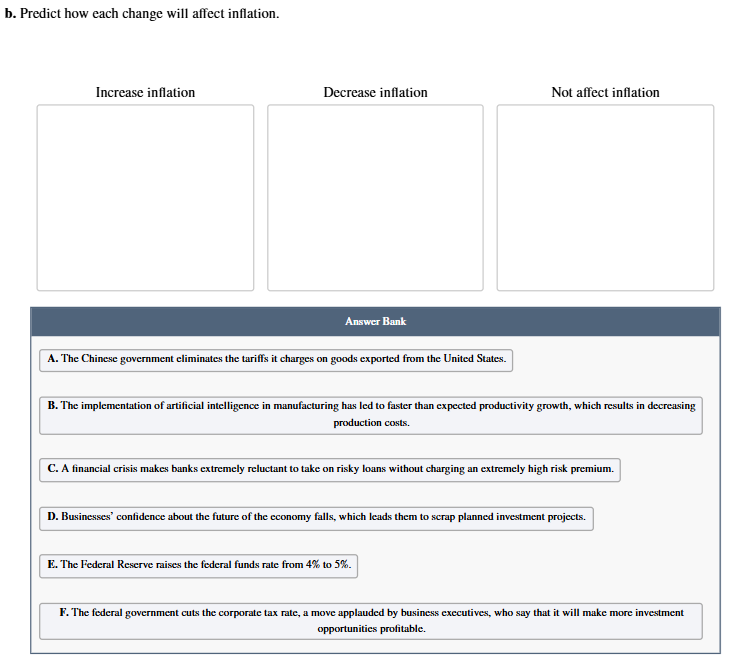

a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable.

Increase inflation: a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable. Decrease inflation: b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%.

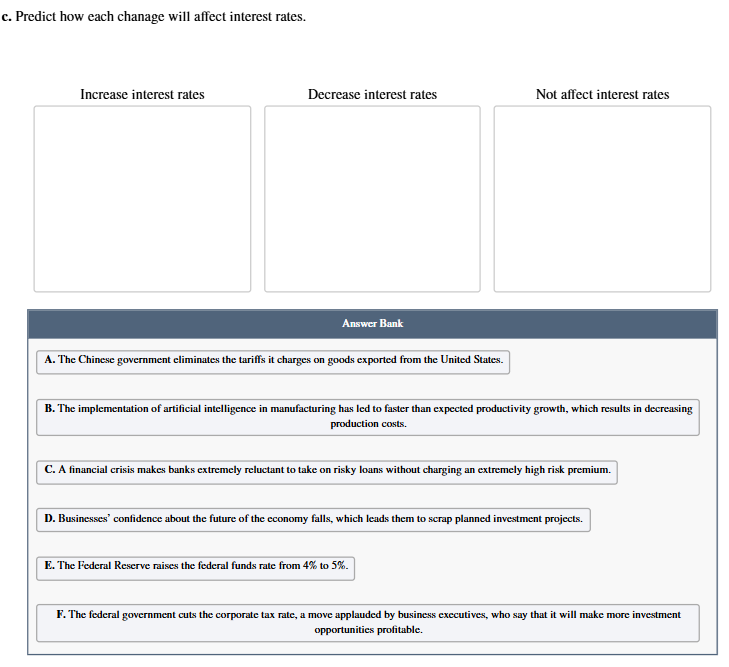

a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., e. The Federal Reserve raises the federal funds rate from 4% to 5%., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable.

Increase interest rates: c. A financial crisis makes banks extremely reluctant to take on risky loans without charging an extremely high risk premium., e. The Federal Reserve raises the federal funds rate from 4% to 5%. Not affect interest rates: a. The Chinese government eliminates the tariffs it charges on goods exported from the United States., b. The implementation of artificial intelligence in manufacturing has led to faster than expected productivity growth, which results in decreasing production costs., d. Businesses’ confidence about the future of the economy falls, which leads them to scrap planned investment projects., f. The federal government cuts the corporate tax rate, a move applauded by business executives, who say that it will make more investment opportunities profitable.

a. financial/spending/supply b. financial/spending/supply c. financial/spending/supply

a. financial b. supply c. spending

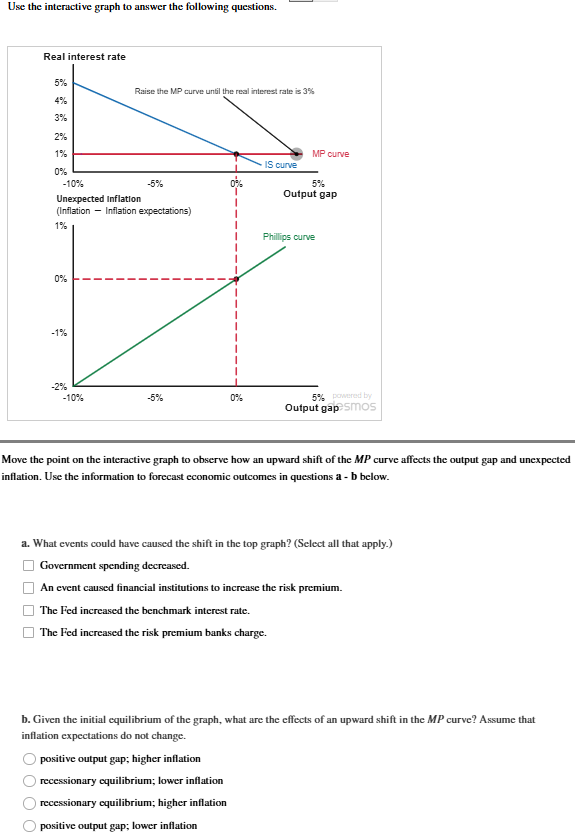

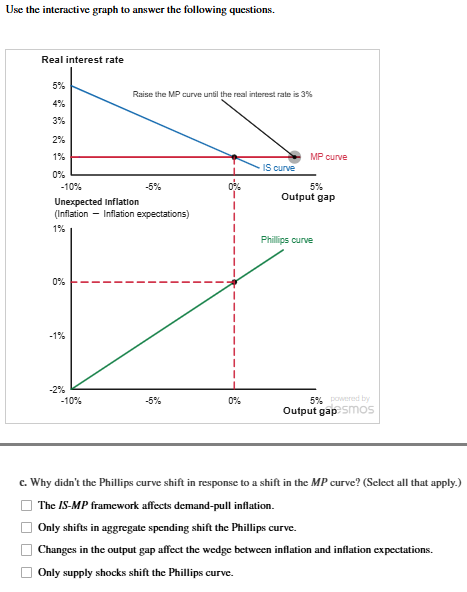

a. b, c b. b

c. a, b, c

b. more than/equal to/less than

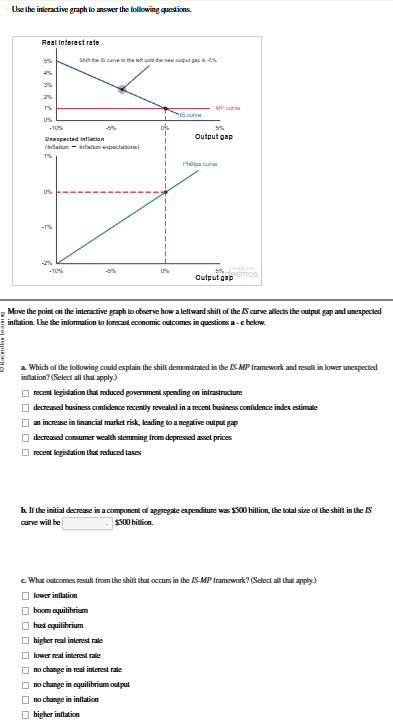

a. a, b, d b. more than c. a, c, f

b. increased/did not affect/decreased

a. a b. did not affect c. c, d