UBC ECON 102 - Finance, Saving, and Investment (Topic 6, Chapter 7 Slides)

1/30

Earn XP

Description and Tags

UBC Khan's ECON 102: Topic 6 (Finance, Saving, and Investment) Theory Study Cards -- Midterm 2

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

What is the study of finance?

How households and firms obtain and use financial resources (long-term deposit) and how they cope with the risks that arise in this activity.

In other words, the quantity and usage of financial resources.

An example of a financial resource is straw on a farm.

What is the study of money?

How households and firms use money, how much of it they hold, how banks create and manage it, and how its quantity influences the economy.

In other words, the quantity and usage of money.

What is physical capital?

The tools, instruments, machines, buildings, and other items that have been produced in the past and that are used today to produce goods and services.

Physical resources that were made in the past and ones that are used to make goods and services.

What is financial capital?

The funds that firms use to buy physical capital.

What is wealth? What can change (increase and decrease) wealth (think capital gains)?

The value of all things that someone owns. Everything has financial value, and these things and one’s income are part of one’s wealth.

Wealth is changed when the market value of assets changes (e.g. when the market value of assets rises, wealth increases); this is called capital gains.

What is saving? What does it increase?

The amount of income that is not paid in taxes or spent on consumptions goods and services.

Saving increases wealth.

What source of funds is used to finance investment?

Savings are used to fund investments.

These funds are supplied and demanded in three types of financial markets:

Loan markets

Bond markets (bond: contract between issuer/buyer)

Stock/share markets (sell and buy shares; when you hold stock, you get dividend)

What is a financial institution?

A firm that operates on both sides of the markets for financial capital. They are a borrower in one market and a lender in another.

What are the key financial institutions in Canada?

Banks

Trust and loan companies

Credit unions and caisses populaires

Pension funds

Insurance companies (sell insurance to get money)

What is a financial institution’s net worth?

The total market value of what it has lent minus the market value of what it has borrowed.

Financial institution’s net worth = what they’ve lent - what they’ve borrowed

OR net worth = asset value - liability value

If net worth is positive, the institution is ____ and _____.

The institution is solvent and can remain in business.

+ net worth = solvent = business

Asset value > Liability value

If net worth is negative, the institution is ____ and ____.

The institution is insolvent and goes out of business.

- net worth = insolvent = no business

Asset value < Liability value

What makes a firm/financial institution illiquid?

If it has made long-term loans with borrowed funds and is faced with a sudden demand to repay which is more than its available cash.

What is interest rate on a financial asset?

The interest rate is the interest received expressed as a percentage of the price of the asset.

For example, if the price of an asset is $25, and the interest is $5, then the interest rate is 20%.

What happens if an asset price changes?

If the asset price changes, the interest rate will change with it.

For example, if the asset price rises to $50 from $25, with other things remaining the same, the interest rate falls (10% now from the $5 interest in previous example).

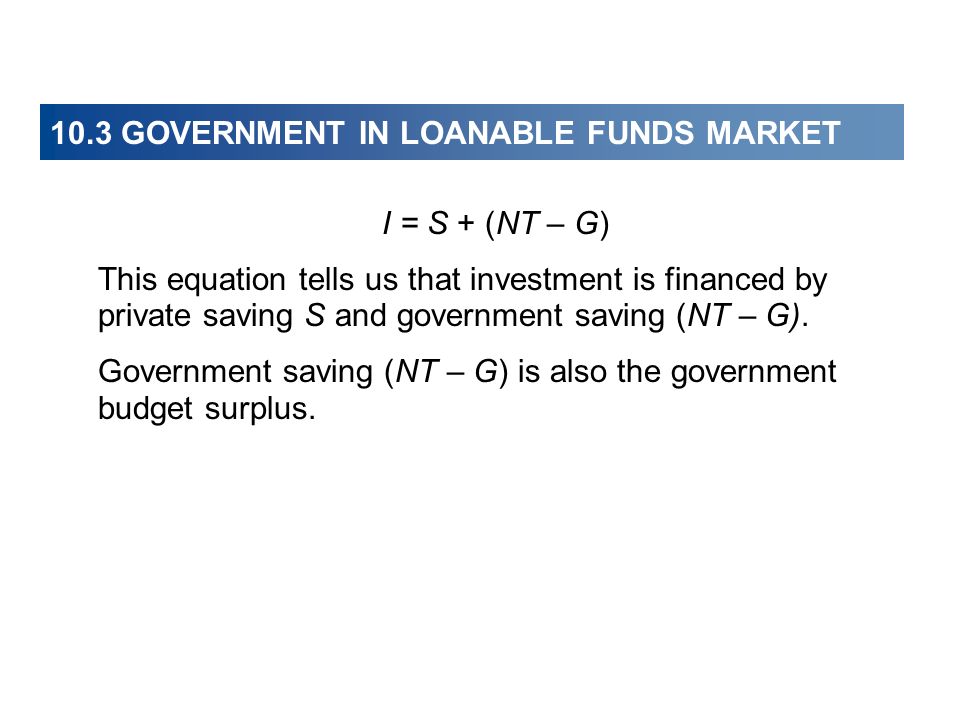

What are loanable funds?

Loanable funds are the funds that fund finance investments.

Funds come from three sources:

Household savings (S)

Government budget surplus (T-G)

Borrowing from the rest of the world (M-X)

National S = private S + government S (i.e. government budget surplus)

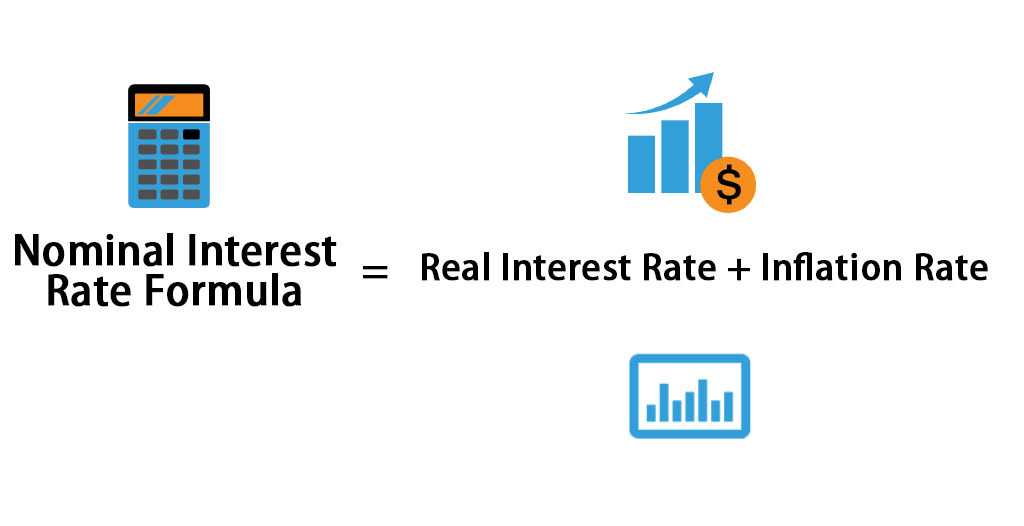

What is the nominal interest rate?

The number of dollars that a borrower pays and a lender receives in interest in a year expressed as a percentage of the number of dollars borrowed and lent.

For example, if the annual interest paid on a $500 loan is $25, the nominal interest rate is 5% per year.

What is the real interest rate?

The nominal interest rate adjusted to remove the effects of inflation on the buying power of money.

The real interest rate is ~= nominal interest rate - the inflation rate.

For example, if the nominal interest rate is 5% a year and the inflation rate is 2% a year, the real interest rate is 3% a year.

The real interest rate is the opportunity cost of borrowing.

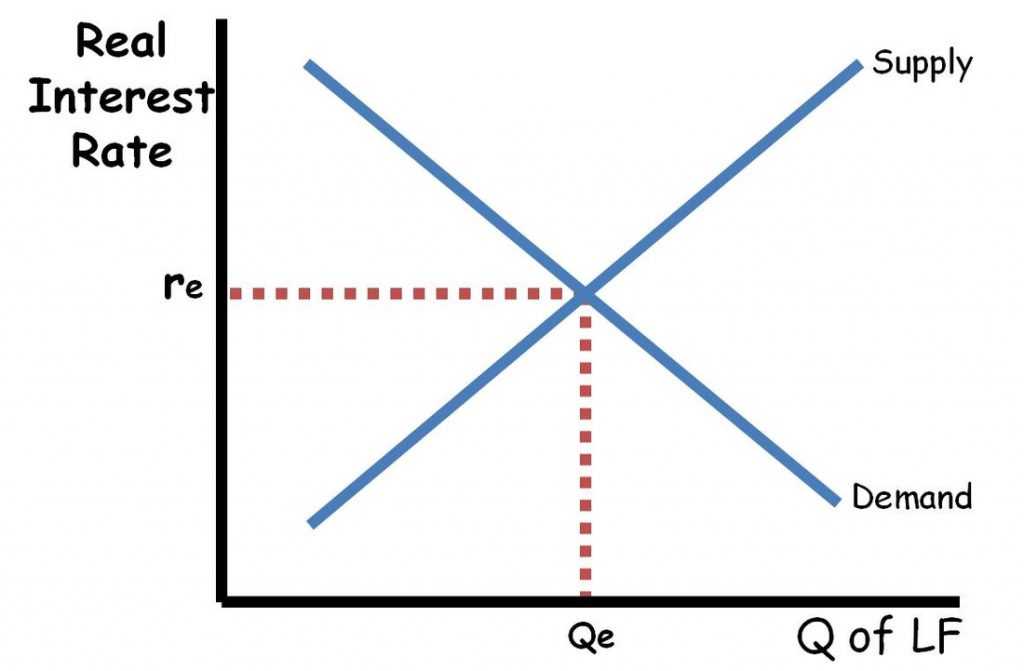

What is the market for loanable funds?

The market in which households, firms, governments, and financial institutions borrow and lend.

What does the quantity of loanable funds demanded depend on? What is the demand for loanable funds?

The quantity of loanable funds demanded depends on:

The real interest rate

Expected profit

The demand for loanable funds is the relationship between the quantity of loanable funds demanded and the real interest rate when all other influences on borrowing plans remain the same.

Business investment is the main item that makes up the demand for loanable funds.

How do changes in real interest rate affect the quantity of loanable funds demanded?

Look at slide 15 of chapter 7 for a demand for loanable funds curve.*

The relationship between real interest rate and quantity of loanable funds demanded is inverse.

A rise in the real interest rate decreases the quantity of loanable funds demanded, and vice versa.

What causes changes (shifts) in the demand for loanable funds?

When expected profit changes, the demand for loanable funds changes.

With other things remaining the same, the greater the expected profit from new capital, the greater is the amount of investment, and there the greater the demand for loanable funds.

What is the supply of loanable funds?

The supply of loanable funds is the relationship between the quantity of loanable funds supplied and the real interest rate when all other influences on lending plans remain the same.

Saving is the main item that makes up the supply of loanable funds.

How do changes in the real interest rate affect the quantity of loanable funds supplied?

Look at slide 18 of chapter 7 for a supply of loanable funds curve.*

The relationship between the real interest rate and the quantity of loanable funds supplied is direct.

A rise in the real interest rate increases the quantity of loanable funds supplied, and vice versa.

What causes changes (shifts) in the supply of loanable funds?

Disposable income

Expected future income

Wealth

Default risk

An increase in disposable income, a decrease in expected future income, a decrease in wealth, or a fall in default risk increases saving and therefore increases the supply of loanable funds.

When is the loanable funds market in equilibrium?

At the real interest rate at which the quantity of loanable funds demanded equals the quantity supplied.

Look at slide 22 of chapter 7 for example.*

Financial markets are ____ in the short run but remarkably ____ in the long run.

Financial markets are highly volatile in the short run but remarkably stable in the long run.

Volatility comes from the fluctuations in either the demand or supply of loanable funds. These fluctuations bring fluctuations in the real interest rate and in the equilibrium quantity of funds lent and borrowed, as well as in asset prices.

When does the government enter the financial loanable market?

When it has a budget surplus or deficit.

A government budget surplus increases the supply of funds.

A government budget deficit increases the demand for funds.

Is the loanable funds market global or national?

The loanable funds market is global!

Lenders want to earn the highest possible real interest rate and they will seek it by looking all over the world.

Borrowers want to pay the lowest possible real interest rate and they will seek it by looking all over the world.

Funds flow into the country in which the real interest rate is highest, and out of the country in which the real interest rate is lowest.

If a country’s net exports are _____, the rest of the world supplies funds to that country and the equilibrium quantity of loanable funds in that country is greater than national saving.

Negative

If a country’s net exports are ____, the country is a net supplier of funds to the rest of the world and the equilibrium quantity of loanable funds in that country is less than national saving.

Positive