Business Paper 1 - Revenue, Costs and Profit (108)

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

Revenue

money a business makes from its sales

formula: selling price x quantity sold

Profit

amount left over once a business subtracts its total costs from the total revenue they generate from selling goods/services to customers

formula: total revenue - total costs

Fixed Costs

do not vary with output - only change in long-term e.g rent, insurance

Variable Costs

costs that change in direct proportion to changes in output e.g raw materials, stock

Semi-Variable Costs

costs that include both fixed and variable cost-components e.g a business will pay its employees a monthly salary (fixed) but may pay them overtime if they have a lot of orders (variable)

Direct Costs

costs that can be identified directly with the production of a good or service e.g raw materials

Indirect Costs

costs that can’t be matched against each product as they need to be paid whether or not the production of a good/service takes place e.g rent on the premises

Total Costs

Total fixed costs + Total variable costs

Contribution

allows an organisation to analyse whether each of its products can cover their own variable costs

formula: selling price - variable cost per unit

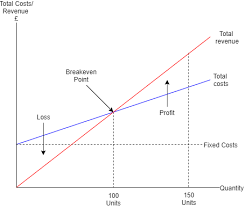

Break-even

a diagram that shows level of output in a business where they don’t make a profit nor a loss

formula: fixed costs/contribution

Margin of Safety

how much a product can reduce output before the business starts to make a loss

formula: output - break-even output

Break-even chart (describe)

Break-even (Advantages + Disadvantages)

Advantages:

used to secure finance (part of the business plan)

simple and easily understood representation of revenue, costs and potential profit

Disadvantages:

assumes all products are sold and are sold at one price - doesn’t account for damaged or wasted stock - some can be sold at a lower selling price

assumes only one product is sold - businesses normally have a range goods which all vary in variable costs depending on the size, complexity etc.

Usefulness to Stakeholders

Stakeholders:

owners - both advantages

employees - job security, enough payment (based on potential success shown in the diagram)