Accounting Standards

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

IAS 16 - Property, Plant and Equipment

What is the recognition criteria for IAS 16?

What is the initial measurement of PPE and what costs should also be included?

What is the recognition criteria for IAS 16?

It is probable that economic benefits associated with the asset will flow into the entity; and

The cost can be reliably measured.

What is the initial measurement of PPE?

Initial measurement is at cost

Dr Non-Current Assets

Cr Bank

Any direct costs:

Costs involved in bringing the asset to its present condition and location (including delivery, site prep & installation etc).

The present value of the dismantling costs

Staff training IS NOT ALLOWED (this is revenue in nature).

Training costs cannot be capitalised as it is not possible to restrict the access of others to the economic benefit as staff could leave and take their skills elsewhere

IAS 16 PPE - Subsequent Measurement

How do we subsequently measure non-current assets held under the historic cost method?

When do we recongise depreciation and how is it calculated?

How do we subsequently measure non-current assets held under the historic cost method?

Original cost (including further allowable capitalised costs) less accumulated depreciation

Further capitalisation of costs can happen if:

The expenditure enhances the asset

A complex asset component is replaced

Works pre or post a major work inspection on the asset

To account for the above: DR NCA, CR Bank

When do we recongise depreciation and how is it calculated?

Depreciation is charged as soon as the asset becomes available for use.

Two methods: Straight line & reducing balance. Remember to excl. a residual value from depreciation where applicable.

Double entry DR Depreciation expense (CoS), Cr Accumulated Depn (PPE)

IAS 16 PPE - Depreciation

When can we change the depreciation policy and how does this affect the accounts?

When can we change the depreciation policy and how does this affect the accounts?

A change in policy should only happen if the new depreciation policy would give the users of the financial statements a more accurate and fairer presentation of the assets value at each reporting date.

A change to depreciation policy is a change in accounting estimate (this means they are applied prospectively in the current years statements).

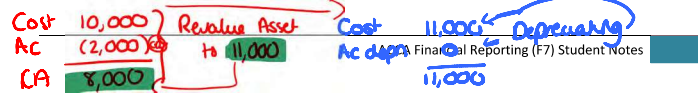

IAS 16 PPE - Subsequent Measurement (Revaluation Model)

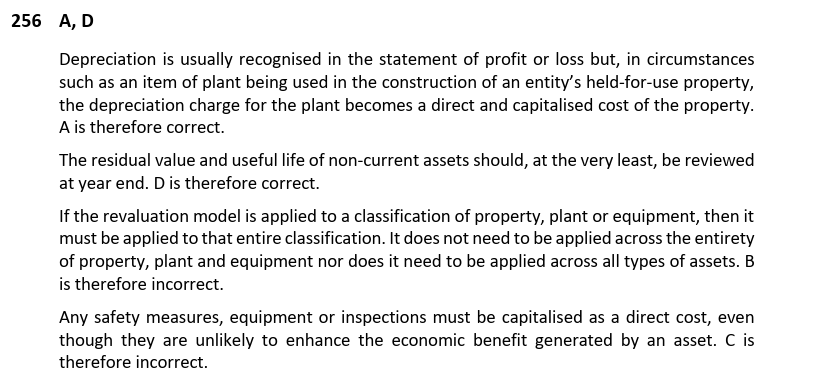

How do we account for PPE under the revaluation model?

Can we show a debit (loss) in the revaluation reserve?

How do we treat depreciation on revalued assets?

How do we account for PPE under the revaluation model?

Under IAS 16, companies have a choice whether to adopt the historic cost model or reval model for subsequent measurement.

Under the reval model, assets are revalued each year and the gain or loss goes through the reval reserve (OCI on SPLCOI & also SOCIE).

When the reval method is used, revals should be made with sufficient regularity to ensure that the carrying value remains close to the fair value. If one item in a class is revalued, all of the assets in that class must be revalued.

Gain

DR PPE

CR Revaluation Reserve (also shown in OCI)

Loss

DR P+L

CR PPE

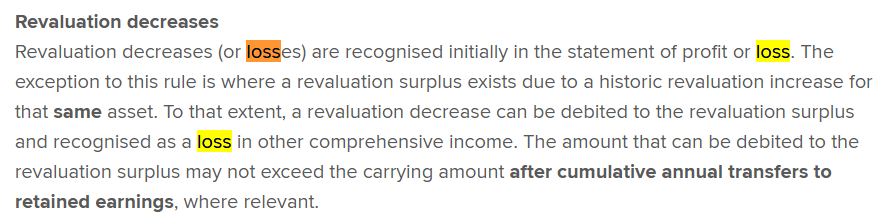

Can we show a debit (loss) in the revaluation reserve?

No - it can’t be a debit balance. If the reserve is a credit due to a prior gains and a subsequent revaluation means a loss has occurred, we can net off the loss against the credit in the reval reserve until the reserve goes to nil.

Any excess loss will then be debited instead of P&L as an impairment loss.

DR Impairment Loss

Cr PPE

How do we treat depreciation on revalued assets?

At the date the asset is revalued, any accumulated depreciation b/fwd is wiped. Depreciation should subsequently be calculated on the new revalued amount.

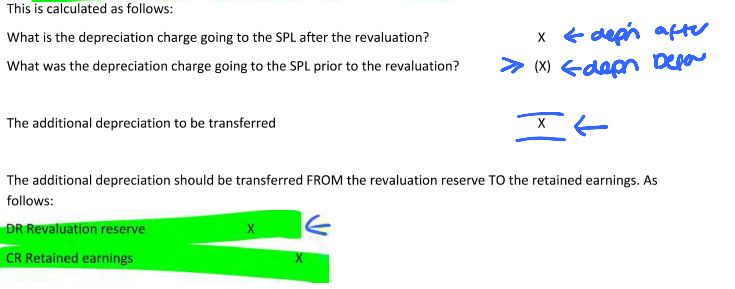

IAS 16 PPE - Transfer to retained earnings

Under IAS 16, some companies elect to transfer additional depreciation on revalued assets to retained earnings. Why is this done and what are the mechanisms behind the transfer?

When an asset is revalued upwards this usually results in a higher depreciation charge to the P+L, which ultimately reduces profits available to shareholders for dividends.

To avoid upsetting the shareholders, some companies transfer the additional depreciation on the revalued asset from reval reserve to retained earnings.

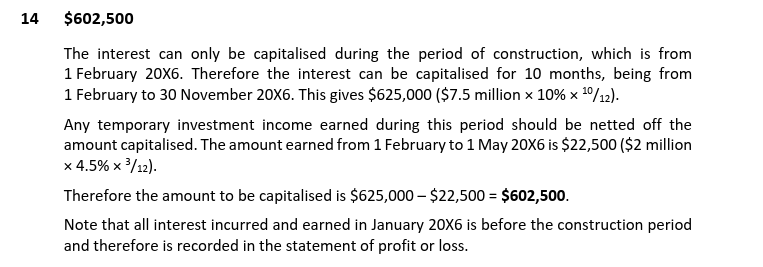

IAS 23 - Borrowing Costs

What is IAS 23 - borrowing costs?

Under this standard, what are the criteria that must be met in order to qualify?

What is IAS 23 - borrowing costs?

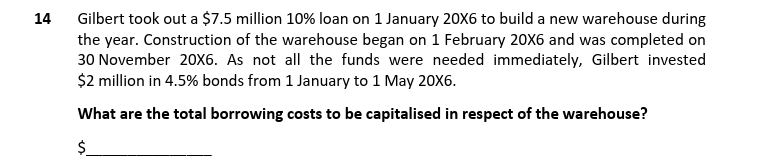

Companies may borrow money to allow them to pay for an asset to be constructed (qualifying asset - an asset that takes a substantial amount of time to get ready to use or sell).

If the costs meet the criteria then a company MUST CAPITALISE any finance costs (borrowing costs/interest) on that loan.

Under this standard, what are the criteria that must be met in order to qualify?

Borrowing costs on a qualifying asset must be capitalised once all of the following are met:

Expenditure for the asset has started to be incurred

Borrowing costs/finance costs has started to be incurred

Activity on the asset has commenced (construct begun).

Only those borrowing costs that would have been avoided if the asset had not been constructed are eligible for inclusion

IAS 23 - Borrowing Costs

What rate do we use to calculate the borrowing costs that will be capitalised?

When do we stop capitalising borrowing costs?

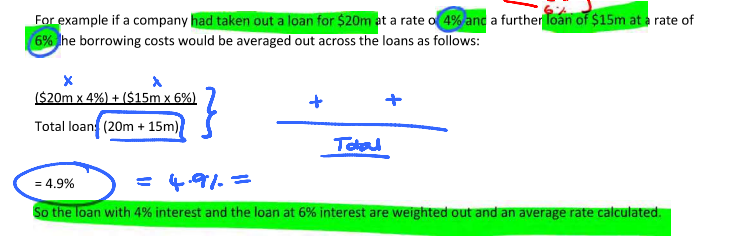

What rate do we use to calculate the borrowing costs that will be capitalised?

If it’s a specific loan relating directly to that particular asset - capitalise actual finance costs incurred

Variety of loans for various projects - weighted average

When do we stop capitalising borrowing costs?

Construction of the asset has suspended temporarily (once construction resumes the interest would again be capitalised)

Construction of the asset is completed and ready for its use or sale

IAS 20 - Accounting for government grants and disclosure of government assistance

A grant - money in from the government, provided certain criteria are met. If they are not met, the grant will have to be paid back.

What is the recognition criteria under IAS 20 for grants?

How do we account for capital grants?

How do we account for revenue grants?

What is the recognition criteria under IAS 20 for grants?

A grant should not be recongised until there is reasonable assurance that

The entity will comply with the conditions attaching to them; and

The grants will be received

How do we account for capital grants?

A capital grant, is where a grant has been given to purchase/replace a capital item.

There are two methods of presentation in SOFP

Set up grant as deferred income and recognise income on a systematic basis over EUL

Deduct the grant from cost of asset & recognise as part of depreciation charge

Both yield the same result.

How do we account for revenue grants?

A revenue grant is a grant given for revenue expenditure (wages/employing new staff etc). The income is recognised over the periods necessary to match them with the related costs on a systematic basis.

There are two methods of presentation in SOPL

Credit in the SOPL

Deduction from related expense

IAS 20 - Accounting for government grants and disclosure of government assistance

What happens if the conditions of the grant are not satisfied but the grant income has been received?

We would need to pay the value of the grant back. The approach would depend on which method was chosen:

Deferred Income

We’d have to clear the deferred income balance & put the remaining balance to the P+L as a loss

Cr Bank

Dr Deferred Income

Dr P+L

Off-set or netting off approach

Dr NCA (depreciation as normal - would result in a higher depreciation charge)

Cr Bank

IAS 40 - Investment Properties

Why are investment properties treated differently to other properties under IAS 16?

Why are investment properties treated differently to other properties under IAS 16?

They’re treated differently because the properties are not used within the business for admin purposes or to generate sales within the business (unlike NCA under IAS 16).

Investment properties are held to earn rental income or to sell in the future (capital appreciation).

If the building is being used by the entity then this is not an investment property as it is not being used for rental income or capital appreciation (waiting for value of property to increase & then selling it).

IAS 40 - Investment Properties

How do we initially and then subsequently measure investment properties?

How do we initially and then subsequently measure investment properties?

Initial measurement - at cost (same as IAS 16)

Subsequent measurement - can choose either at cost model or fair value model (again similar to IAS 16).

Historical Cost Method

This is identical to IAS 16 and depreciation is charged as normal.

Fair Value Model

Similar to revaluation model, with the exception of two key pieces of theory:

Any gains or losses go STRAIGHT to the P+L as a separate line (no reval reserve/OCI)

No depreciation

IAS 40 - Investment Properties

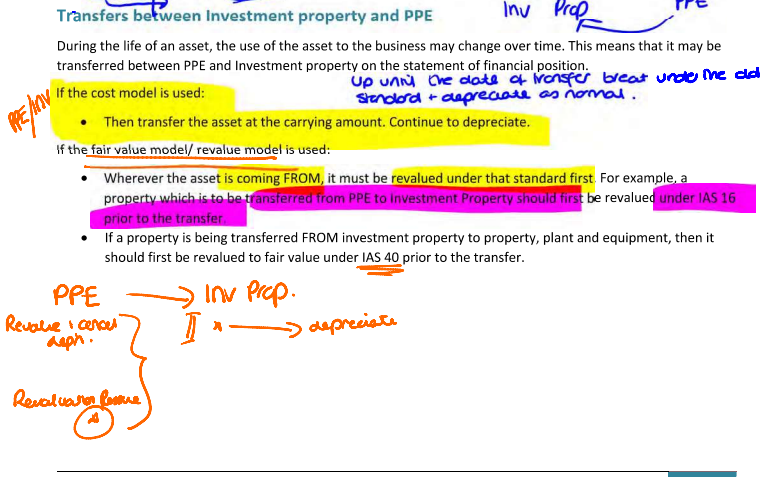

How do we account for a property held under IAS 16 to PPE that is not an investment property, and vice versa?

How do we account for a property held under IAS 16 to PPE that is not an investment property, and vice versa?

Up until the date of transfer, treat under the old standard and then switch over to the new standard.

IAS 32 - Borrowing Costs

If any interest income is incurred on the loan received in the construction of an asset how is this treated?

IAS 40 - Investment Properties

How do we treat selling costs under the fair value model?

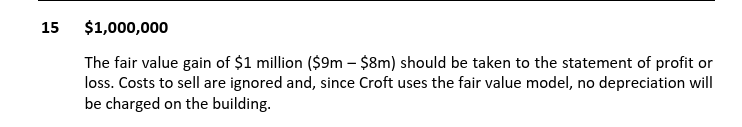

IAS 33 - Earnings Per Share

What is the aim of IAS 33?

What is the basic EPS calculation?

What is the aim of IAS 33?

Improve comparison of performance of different periods and between entities in the same period by setting out how EPS should be calculated and how it should be disclosed.

What is the basic EPS calculation?

Earnings / Share

Where Earnings is the amount attributable to ordinary equity holders of the parent: profit after tax - NCI - Irredeemable preference shares

Share - Weighted Average number of shares

Profit should be adjusted for the after-tax amounts of pref dividends, differences on settlement of pref shares & other effects of pref shares classed as equity

Presented as dollars or cents per share to 1 d.p

IAS 33 - Earnings Per Share

How do we calculate the P/E ratio?

P/E = Current share price / latest EPS

The P/E ratio represents the markets view of the future prospects of the company

We use the EPS to assess the financial performance of a company from year to year and to calculate the P/E ratio (major stock market indicator of performance).

IAS 33 - Earnings Per Share

What is the double entry for a bonus issue?

How do we calculate EPS for a bonus share?

Dr Share Premium

Cr Share Capital

How do we calculate EPS for a bonus share?

Assume that the bonus shares have always been in issue. We therefore need to restate prior year earnings per share (restate the comparative).

IAS 33 - Earnings Per Share

What is a rights issue & double entry?

How do we calculate EPS?

What is a rights issue & double entry?

A right to purchase shares at the discounted rate (discounted to the share price not the nominal value).

If an existing shareholder opts to not take up the share issue, you lose some of your shareholding.

Dr Bank

Cr Share capital (nominal)

Cr Share premium

How do we calculate EPS?

We pretend that some of the rights issue shares were issued at full market price and the remainder were bonus issues. For the bonus, we assume that they were always in issue and therefore we need to adjust the comparative.

IAS 33 - Earnings Per Share

What does cum rights and ex rights mean?

What does cum rights and ex rights mean?

cum rights - before share issue

ex rights - after share issue

IAS 33 - Earnings Per Share

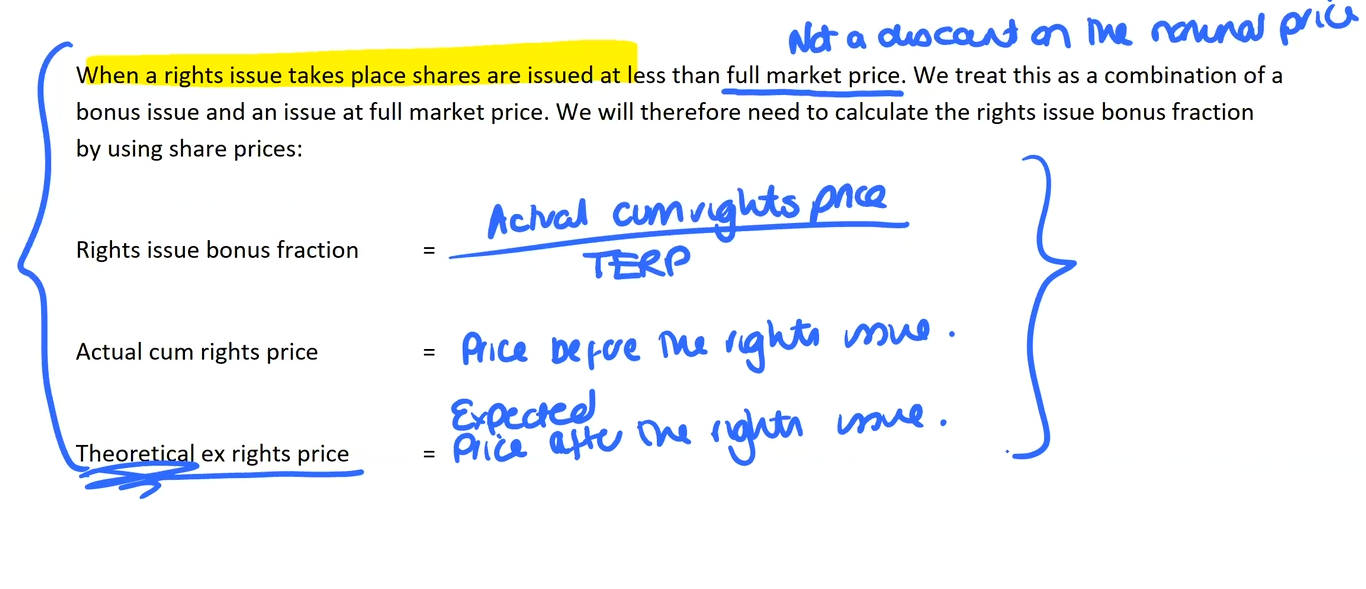

What is the rights issue bonus fraction?

IAS 33 - Earnings Per Share

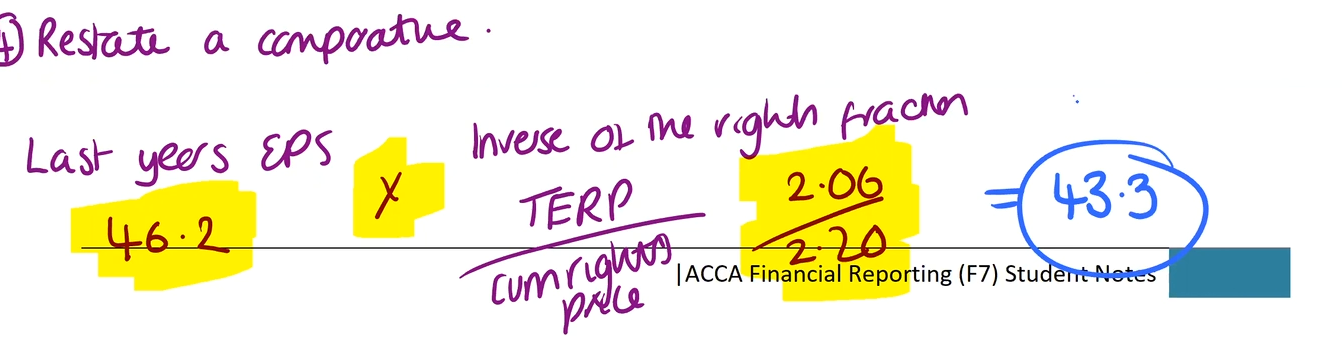

How do we restate the comparative?

Take last years EPS x Inverse of the rights fraction

Topic 5 14. AYK 10 (5 mins)

IAS 41 - Agriculture

How is milk, a harvested product, accounted for?

Milk is a harvested product as is therefore measured at fair value, under IAS 41.

It is then re-classified under IAS 2 inventories.

Something like cheese would measured under IAS 2 straight away because you can’t harvest cheese. You harvest the milk first and then produce the cheese.

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

What are the two reasons why an organisation changes their accounting policies?

A change has to be made if this is required by an IFRS Standard

If no requirement, an entity can choose to change their accounting policy if the believe a new policy would result in a more reliable and relevant presentation of events and transactions.

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

How do we determine if a change is a change in accounting policy and how do we account this?

Affects: Recognition, presentation or measurement.

Applied retrospectively

Restatement of opening balances and comparatives.

The retrospective adjustment is referred to as a prior period adjustment and is shown in the SOCIE (against RE).

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

What is a change in accounting estimate and how do we treat this?

Businesses have to make estimates and revisions to these estimates will need to be made.

Changes in accounting estimates include:

EUL of assets

Residual amount of an asset

Depreciation methods

Warranty provisions

Changes to the value of allowances for irrecoverable receivables

Applied prospectively in current years statement of P+L

IFRS 13 - Fair Value Measurement

How do we apply and measure assets/liabilities under this standard?

This standard provides a further method of valuing assets.

Fair value: Price that would be received to sell an asset or paid to transfer a liability in an orderly transaction (commercial transaction) between market participants at the measurement date.

Measurement

Measure at FV using assumption that market participants would use when pricing asset/liability assuming that they act in their economic best interest.

Considerations on measurement: condition and location of asset & where there are restrictions on asset in relation to use or if buyer went on to sell.

IFRS 13 - Fair Value Measurement

What is the hierarchy established under this standard?

Level 1 inputs: Observable market prices. Active market = asset values are readily available. Most reliable.

Level 2 inputs: Observable. No active market for this particular asset but market for similar assets. Adjustments will have to be made to valuation to ensure it’s more accurate.

Level 3 inputs: Unobservable. Use the best information available. Regarded as least reliable.

IAS 2 - Inventories

How do we measure inventories?

Lower of cost & NRV

Cost - purchase, conversion & other costs incurred in bringing inventories to present location & condition.

IAS 2 - Inventories

What does the cost of purchase comprise of?

Purchase price

Import duties

Irrecoverable taxes (recoverable taxes are excluded)

Transport

Handling & other costs attributable to acquisition of finished goods, materials and services

Trade discounts and expected settlement discounts are deducted

IAS 2 - Inventories

What does the cost of conversion comprise of?

Direct costs related to the units of production, such as direct labour

We can’t include

Abnormal costs

Storage costs

Admin & selling costs

IAS 2 - Inventories

How do we measure NRV?

Estimate selling cost in ordinary cost of business - estimated costs of completing & cost necessary to make sale.

IAS 41 - Agriculture

What is agricultural activity, biological assets, harvest & agricultural produce?

Agricultural activity

Biological transformation of biological assets for sale into agricultural produce or into additional biological assets.

Biological assets

Living animal or plant (e.g. sugar cane, trees, wheat, cows or sheep).

Harvest

Detachment of produce from a biological asset or the cessation of the asset’s life process.

Agricultural Produce

Harvested produce of biological assets. IAS 41 applies initially. Once the product is processed after harvesting, IAS 41 ceases to apply and it falls under IAS 2 instead.

IAS 41 - Agriculture

What is a bearer plant and how do we account for it?

Living plant used in production or supply of agricultural produce and is expected to produce for more than 1 period.

Impractical to calculate the FV of these plants each reporting period so accounted for under IAS 16.

IAS 41 - Agriculture

When do we recognise biological assets or agricultural produce?

Only recognise when, and only when:

The company controls the asset as a result of past events

Probably that future economic benefits will flow to the entity; and

The fair value or cost can be reliably measured,

IAS 41 - Agriculture

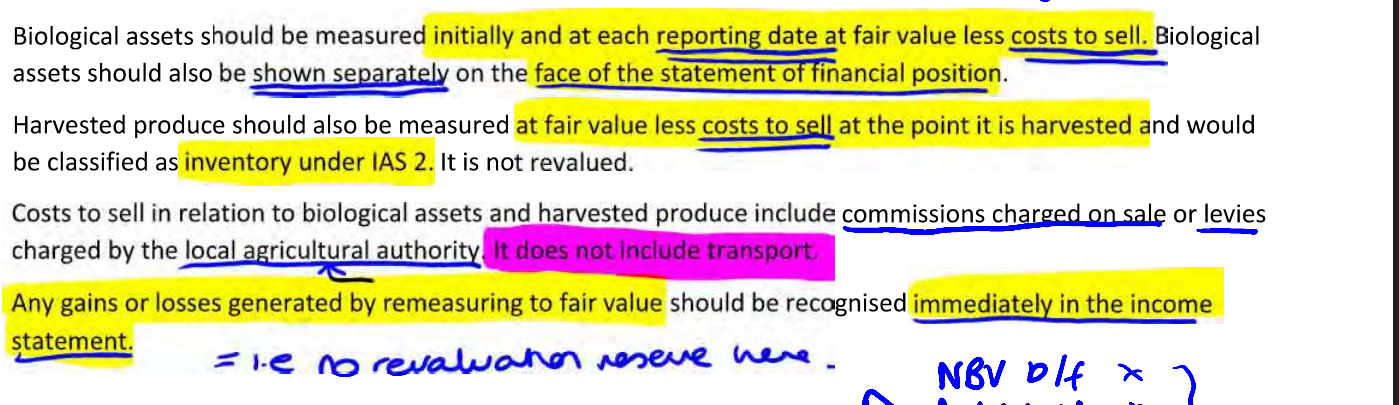

How do we measure biological assets or agricultural produce?

What kind of disclosures are required?

Disclosures: Significant disclosures required including reconciliations of the changes in biological assets during the reporting period.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

When do we recongise a provision?

An entity has a present obligation, legal or constructive, as a result of a past event

It is probable that an outflow of resources will be required to settle the obligation;

A reliable estimate can be made of the amount of the obligation

If all 3 of these are not met, no provision shall be recognised.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

What is a legal and constructive obligation?

Legal Obligation

Derives from a contract or legislation

Constructive Obligation

Obligation that derives from an entity’s actions where:

By an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and

as a result, the entity has created a valid expectation that it will discharge those responsibilities.

BASICALLY, WE’VE ALWAYS DONE IT SO NOT WE’RE LIABLE TO DO IT.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

What is a contingent liability and how do we recognise it?

A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

A present obligation that arises from past events but is not recognised because:

Not probable that an outflow of resources will be required to settle the obligation

The amount can’t be reliably measured

We do not recognise it. Instead a disclosure is made.

The nature of the contingency

The uncertainties expected to affect the ultimate outcome

An estimate of the potential financial effect

Probable = Provision

Possible = Contingent Liability

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

What is a contingent asset and how do we recognise it?

A possible asset arising from past events whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

It MUST not be recognised as an asset unless virtually certain.

If probable we disclose

This includes:

The nature of the contingency

The uncertainties expected to affect the ultimate outcome

An estimate of the potential financial effect

If possible or remote we ignore (no disclosure is made).

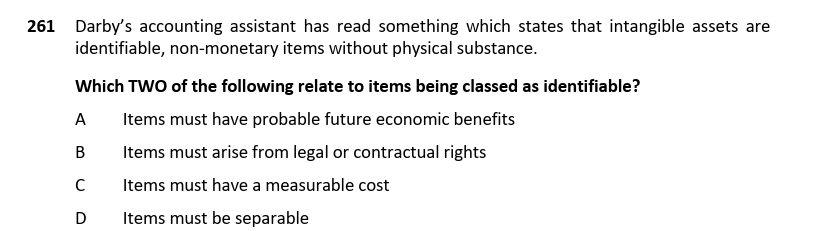

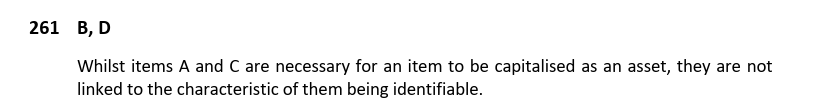

IAS 38 - Intangible Assets

What kind of things are specifically excluded by IAS 38?

Internally generated customer lists are specifically excluded by IAS 38 from being recognised as intangible assets (along with other items such as internally generated brands). This is because any expenditure incurred on such items cannot be distinguished from the cost of developing the business as a whole.

Under IAS 16 - How often must PPE be revalued (including reviews of useful life & Residual Value)?

Under IAS 36 - How often should impairment reviews be done on both tangible and intangible assets with indefinite useful lives?

Under IAS 16 - How often must PPE be revalued (including reviews of useful life & Residual Value)?

Annually

Under IAS 36 - How often should impairment reviews be done on both tangible and intangible assets with indefinite useful lives?

Annually (at end of each reporting period)

IAS 16 - PPE how do we account for revaluation losses?

Under IAS 16 - can we capitalise necessary safety measures, equipment or inspections?

Yes Any safety measures, equipment or inspections must be capitalised as a direct cost, even though they are unlikely to enhance the economic benefit generated by an asset.

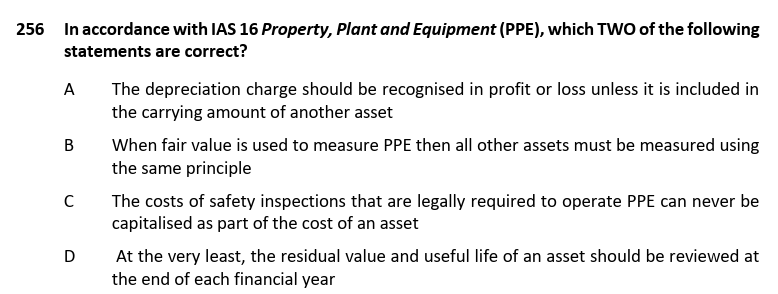

Which two of the following statements are correct?