Theme 2 - Managing Business Activities

1/147

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

148 Terms

Source of finance

A source, either within or outside of a business, from which a business can get access to money

Internal source of finance

A source of finance that comes from within a business

Personal funds

An internal source of finance where the business owner's personal wealth is used in the business

Retained profit

An internal source of finance where the profits from the previous year are used in the business

Sale of assets

An internal source of finance where the business sells assets that they own (buildings, vehicles, equipment) to raise money

External source of finance

A source of finance that comes from outside of the business

Loan capital

An external source of finance where the business borrows money for an agreed length of time

Overdraft

An external source of finance (loan capital) where a business is able to go into an agreed negative balance on their current account. This is a short term measure

Bank loan

An external source of finance (loan capital) where a business borrows an agreed amount of money from a bank, but must pay back interest

Share capital

An external source of finance where a business sells a share in the business in exchange for money

Venture capitalist

An investor or business specialist who seeks to invest in businesses they feel can make them a profit

Leasing

Where a business rents the use of something (buildings, vehicles, equipment) for a monthly fee for a fixed period of time

Government grants

Where a business receives an amount of money from Government for a specific purpose. These are usually provided when Government benefits from the operation of the business.

Trade credit

Where a business is given a period of time to pay for something, effectively receiving a loan of the items with payment at a later date. This is often 30 days

Debentures

A long term source of finance where a business takes out a long-term loan from another company

Crowdfunding

An example of peer to peer funding where a business can raise money from a larger "crowd" of investors, who each take a small stake through contributing a small amount each

Working capital

The money invested into a business for use in day to day operations. Usually calculated by current assets - current liabilities.

Short term finance

Finance available for the next 12 months

Medium term finance

Finance available for between 1 and 5 years

Long term finance

Finance available for more than 5 years

Unlimited liability

Where the owner of a business is liable for all debts of the business. This is the case for unincorporated businesses

Limited liability

Where the business is only liable for debts up to the value of the assets and capital of the business. This is the case for incorporated businesses

Business plan

A document setting out the format of the business idea, including projected aims, objectives, information on the product/service and finance projections

Business model

The plan implemented by a company to generate revenue and make a profit from operations

Cash flow

The money that comes in to and out of a business

Cash inflow

Money coming into a business

Cash outflow

Money going out of a business

Cash flow forecast

A projection of cash inflows and outflows over a period of time (6 months or a year)

Net cash flow

Cash inflows - Cash Outflows. This shows how much cash you should have at the end of a period of time given how much money is coming in and going out.

Sales forecast

A projection of how many sales a business is expecting to receive over a period of time

Consumer trends

Patterns in consumer behaviour that show the popularity or growth/decline of a product/service

Economic variables

Something that has an impact on a forecast involving the economy. For example, an increase in inflation, in interest rates, in foreign exchange rates.

Competitor actions

Actions carried out by competing businesses that will impact on a business

Extrapolation

Using trends established by historical data to make predictions about future values, assuming that trend will continue going forwards

Correlation

A method of sales forecasting, looking at the strength of a relationship between two variables

Independent variable

A variable that causes another variable to change

Dependent variable

A variable that is influenced by another variable

Positive correlation

When the independent variable increases, so does the dependent variable

Negative correlation

When the independent variable increases, the dependent variable falls

No correlation

When there is no relationship between two variables

Line of best fit

This indicates the strength of a correlation. It is a line drawn through the middle of the data points. The closer the data points are to the line, the stronger the correlation.

Confidence intervals

The percentage probability that an estimated range of possible values includes the actual value being estimated.

Sales volume

The number of sales made in a time period

Sales revenue

Selling price x Quantity sold. The total amount received through selling a good/service

Demand

The quantity of a product consumers are willing and able to buy

Costs

Anything that costs a business money

Total costs

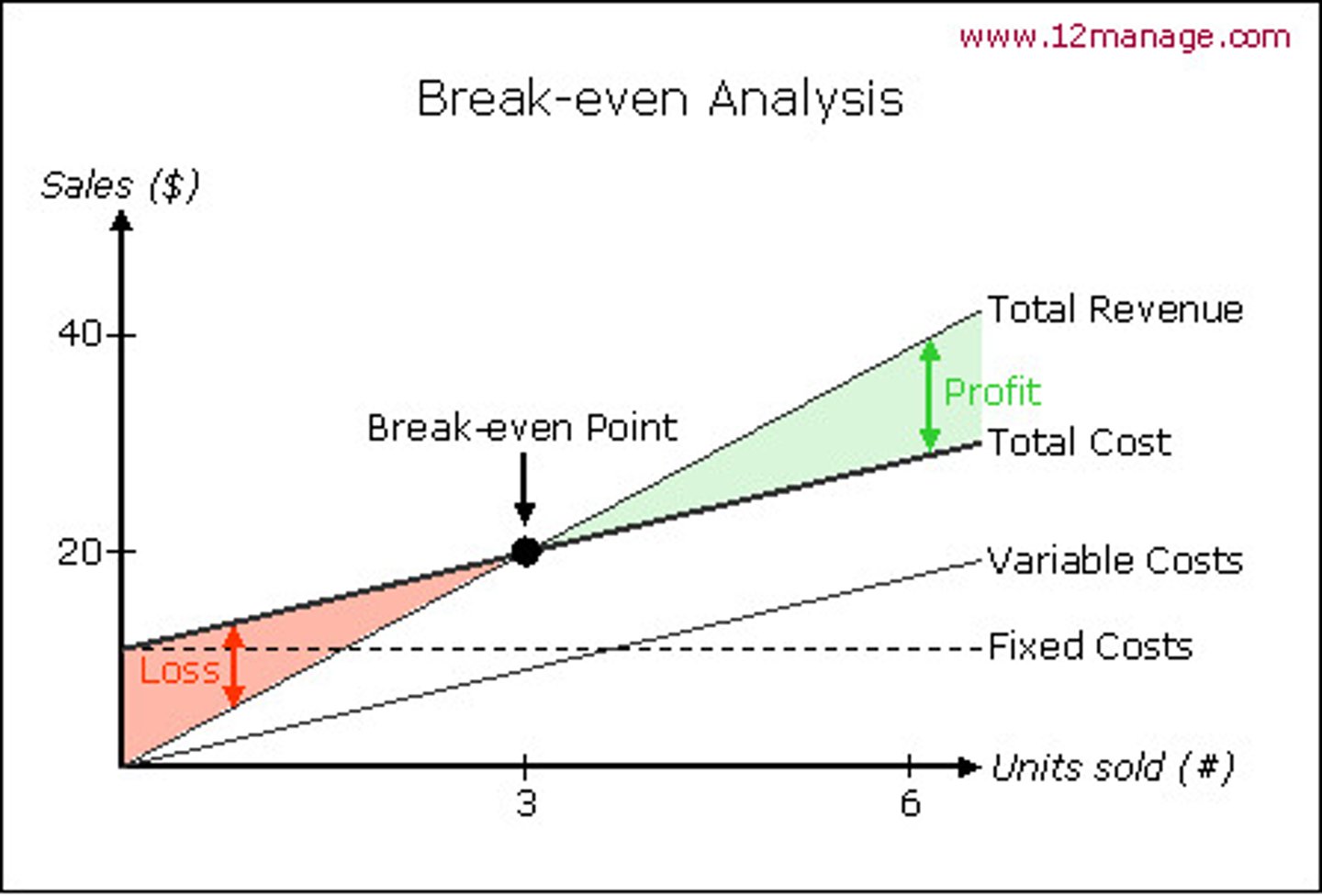

Fixed costs + Variable costs

Fixed costs

Costs that remain the same each money no matter how much output. Examples include rent, some utility bills, salaries

Variable costs

Costs that change depending on the level of output. Examples include raw materials used in production, some utility bills, wages.

Profit

Revenue - Total Costs

Contribution

The amount of each sale that is left after the cost of sales is taken off. This goes towards paying the fixed costs of a business

Contribution per unit

Selling price - Variable cost per unit

Total contribution

Contribution per unit x Quantity sold

OR

Total Revenue - Total Variable Costs

Break even output

Fixed costs / Contribution per unit. This shows the amount of units that must be sold in order to break even (meet all costs with revenue)

Break even chart

The chart that shows the costs and revenues on a graph, showing the point at which revenues meet with total costs.

Margin of safety

Actual output - Break even output. This shows how many sales the business was above the break even point.

Budget

A financial plan for the future concerning the revenues and costs of a business

Historical budgeting

Using last year's figures as the basis for the next year's budget

Zero budgeting

Setting budgets at £0 and people will have to put proposals forwards for sales and costs

Revenue / income budget

A budget showing expected revenues and sales

Cost / expenditure budget

A budget showing expected costs based on sales

Profit budget

A budget based on both the sales and cost budgets

Variance

Looking at the difference between a forecast budget and an actual budget

Favourable variance

Actual figure - Budgeted figure

WHEN spending is less than budgeted, or revenue is more than budget

Adverse variance

Actual figure - Budgeted figure

WHEN spending is more than budgeted, or revenue is less than budget

Gross profit

Revenue - Cost of sales

Operating profit

Gross profit - Fixed overheads

OR

Revenue - Cost of sales - Fixed Overheads

Net profit

Operating profit - Financing costs and tax

OR

Revenue - Cost of sales - Fixed overheads - Financing costs and tax

Profitability

The extent to which a business is able to make a profit

Liquidity

The extent to which a business is able to use cash to meet debts as they are due

Statement of comprehensive income

(Income statement) Measures the performance of a business over a given time period, comparing the income of the business against the cost of goods or services and expenses

Statement of financial position

(Balance sheet) A snapshot of a business' assets (what it owns) and liabilities (what it owes)

Current assets

What a business owns and will be able to turn into cash in the next 12 months (i.e. stock, money in the bank)

Assets

What a business owns

Fixed assets

What a business owns that will last for over a year (i.e. a building, machinery)

Liabilities

What a business owes

Long term liabilities

What a business owes over a longer term than the next 12 months (i.e. mortgages, long term loans)

Current liabilities

What a business owes within the next 12 months (i.e. suppliers debt, overdrafts, short term loans)

Credit control

The management of accounts owed on credit by the customers of a business

Debt factoring

Selling the rights to collect amounts owed by customers in order to release cash flow

Business failure

When a business fails and goes out of existence.

Management control

The systems and process enabling a business to be managed effectively, such as decision making, management authority and financial planning

External shock

A change in the external business environment that significantly impacts a business

Production

The amount of output produced in a period of time

Job production

A method of production where items are produced in small numbers or on a one off basis, usually to a customer specification (wedding cakes, building projects)

Batch production

A method of production where similar items are produced together, so each batch goes through one stage of the production process before moving to the next

Flow production

A method of production of associated with high volumes of the same product, where when one task is finished the next much be started immediately.

Cell production

A method of production where work is organised into teams who work together in a cell. Teams are given responsibility of doing a part of production as it moves through the process.

Lean production

A method of production that aims to maximise revenues while minimising costs. This involves ensuring minimal waste through quality control at each step of the process.

Productivity

The relationship between inputs into the production process and the resulting output

Unit cost

Total costs / number of units produced.

The amount it costs to produce each unit.

Non-productive (idle) resources

Any resources not being used by a business, so if an employee is left with spare time or a machine is not operating. A sign of inefficiency.

Efficiency

How effectively a business uses it's resources to achieve outputs with minimal wasted resources / time / effort / money

Economies of scale

Cost advantages that a business can exploit by expanding their scale of production, reducing the average unit costs of production

Internal economies of scale

Economies of scale arising from the growth of the business itself

External economies of scale

Economies of scale occurring from the growth of the industry as a whole

Labour-intensive business

A business with a high proportion of its costs related to the employment of people

Capital-intensive business

A business with relatively low labour costs, but high costs arising the extensive use of machinery

Production capacity

The measure of how much output it can achieve in a given time

Capacity utilisation

The proportion of a business' capacity that is being used within a specific time period. What percentage of the total capacity was produced?