Lecture 6 Loan portfolio risk and liquidity risk

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

How do loan portfolio risk differ from individual loan risk

Loan portfolio risks refer to the risks of a portfolio of loans as opposed to the risks of a single loan

Simple model: Migration Analysis

Track credit ratings of firms in a particular sector or ratings class for unusual declines

Loan Migration Matrix

Reflects historic credit rating experience of a pool of loans and serves as a measure of the probability of the loan being upgraded, downgraded, or defaulting over some specified period.

What’s a disadvantage of migration analysis

Information may be received too late, making it obsolete.

Loan Concentration

Management sets external limit on maximum amount of loans to

be made to individual borrower, sector, or geographical area (that

is, concentration limits)

How to calculate CL

CL = (max loss as % of capital)*(1/loss rate)

Diversification and Modern Portfolio Theory (MPT)

Using MPT allows FIs to diversify sizeable amounts of credit risk exposure by taking advantage of their size.

Returns of assets within the portfolio must be imperfectly correlated with regards to their default risk adjusted returns

Minimum risk Portfolio

Combination of assets that reduces portfolio risk to lowest feasible level

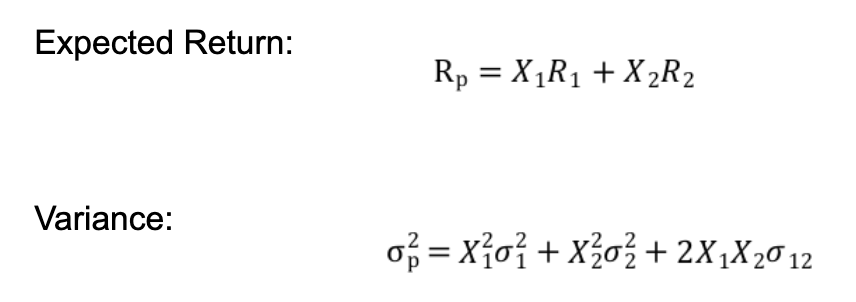

Expected Return formula

Rp = X1R1 + X2R2

Variance Formula

Variance = (X1² varaicne1²) + (X2² * variacne2² ) + (2X1X2Varaicne1&2)

What does low correlation of returns(P) mean

low correlation of returns(P) results in an overall reduction of risk when loans are put together in an FI’s portfolio

Why are small banks not able to diversify their assets

Small banks may not be able to diversify their assets, especially if the markets they serve have a limited number of industries.

The ability to diversify is even more acute if these loans cannot be traded easily.

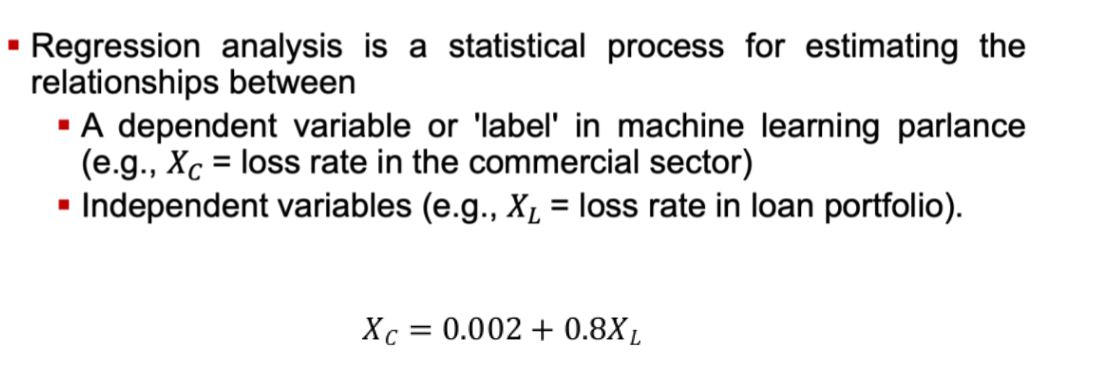

What is regression based models and what are they used for

Statistical process for estimating the relationship a dependent variable and independent variable

Regression analysis is widely used for prediction, where its use overlaps with Machine learning

What is liquidity risk

Risk that a sudden surge in liability withdrawals may leave an FI in a position of having to liquidate assets in a very short period of time and at low prices.

May generate runs.

Runs may turn a liquidity problem into a solvency problem

asset side liquidity risk

Occurs when borrowers make loan requests, exercise loan commitments, and access other credit lines

Liability side liquidity risk

Occurs when depositors or policyholders cash in claims

If low cash holdings, FI may be force to liquidate assets quickly, leading to fire sale prices

Responses to liquidity demands

Liquidity requirements can be met by FI:

Running down cash

Selling liquid assets

Additional borrowing

High exposure to liquidity risk

Depository institutions.

Loss of confidence in bank-to-bank lending during financial crisis resulted in more widespread liquidity risk

Liability-Side Liquidity Risk for DIs

Reliance on demand deposits.

Depository institutions need to be able to predict the probability distribution of net deposit drains.

Calculated as the difference between deposit withdrawals and deposit additions.

Seasonality effects in net withdrawal patterns (for example, end of year and summer due to holidays and vacations).

Managing drain on deposits:

Purchased liquidity management.

Stored liquidity management.

Purchase liquidity management

Sources of purchased liquidity:

Interbank markets for short-term loans

Federal funds market

Repurchase agreement markets

Issuing additional certificates of deposit, more expensive options

Market level interest rates are expensive relative to low interest rates on deposits

Stored liquidity Management

Liquidate Assets to meet withdrawals

In addition to reserve requirements set by the Federal Reserve,

DIs tend to hold excess reserves.

Downsides of holding excess reserves:

Contraction of asset size.

Requires holding excess low-rate assets.

High opportunity cost of holding cash and other liquid assets

Asset side liquidity risk for DIs

Liquidity risk from loan commitments and other credit lines.

Met either by borrowing funds and/or by using cash assets.

Levels of loan commitments are high.

Commercial banks have been increasing commitments over the past few years, presumably believing commitments will stay unused.

Unused loan commitments to cash grew from 529.4% in 1994 to 1K% in 2008 before dropping to 608.6% during the financial crisis

Investment portfolio and asset side liquidity risk

Interest rate risk and market risk of the investment portfolio can

cause values to fluctuate significantly.

Suppose interest rates up, portfolio value declines, many want to sell, liquidity dries up, only can get fire sale prices

Arguments that technological improvements have led to improve liquidity of financial markets.

But herd behavior makes things worse.

What are the 3 ways to measure liqudity risk

Financing gap

Peer group ratio comparisons

Liquidity index

Financing Gap formula

FG = Avg loans - Avg deposits (If positive then can use cash and liquid assets or borrowing)

or

FG = -Liquid assets + borrowed funds

FG + Liquid assets = financing requirement (Borrowed funds)

Larger FG means larger financing requirements, meaning more exposure to liquidity risk and can warn of future liquidity problems

Peer group ratio comparisons

Compare:

Loans to deposits.

Loans to assets.

Unused commitments to assets ratios.

A high ratio of loans to deposits may indicate a heavy reliance of the short-term money market, resulting in future liquidity problems.

Liquidity index

Weighted sum of fire sale price, P, to fair market price, P*

Portfolio weights are the percent of the portfolio value formed by individual assets

Measure of potential losses an FI could suffer as the result of a fire sale disposal of assets (Between 0 and 1)

Measuring liquidity risk: BIS Changes

Post financial crisis, Bank for International Settlements (BIS)

develops new metrics to measure DI liquidity risk

Liquidity Coverage Ratio

Net Stable Funding Ratio

Liquidity coverage ratio

(Stock of high-quality liquid assets)/(Total net cash outflows over

the next 30 calendar days) ≥ 100%.

Ensure DI has enough high-quality liquid assets

Reported to DI supervisors monthly

Net stable funding ratio (NSFR)

(Available amount of stable funding)/(Required amount of stable

funding) > 100%.

Longer term look at liquidity position over next year

Liquidity Planning

Planning is a key component of measuring and coping with liquidity risk and associated costs.

Make funding decisions before liquidity problems arise.

Lower the cost of funds by identifying an optimal funding mix.

Minimize the need for excess reserve holdings.

Delineate managerial responsibilities.

Identify who responds to regulatory agencies, who discloses information to the public, etc.

Detailed list of funds providers, important to anticipate the expected pattern of withdrawals in a crisis.

Identify size of potential deposit and fund withdrawals over various future time horizons.

Set internal limits on subsidiaries and branches borrowings and boundaries on risk premiums

Plan the sequence of asset disposal to meet liqudity needs

How do bank runs arise

Can arise due to concern about:

Bank solvency.

Failure of a related FI.

Sudden changes in investor preferences.

Bank runs

Demand deposits are first come first serve

Can cause bank panic: Systemic or contagious bank run on deposits of banking industry

How to alleviate bank runs

Measures to reduce likelihood of bank runs:

Deposit insurance and discount window.

FDIC.

Direct actions, such as TARP (2008 to 2009).

Not without economic costs.

Protection may encourage DIs to increase liquidity risk

Liquidity risk: Life insurance companies

Life insurance companies hold reserves as a buffer to offset policy cancellations (surrenders) and other working capital needs.

Pattern is normally predictable.

Solvency concerns can still generate runs on life insurance companies.

State guaranty schemes deter runs on life insurance companies.

Liquidity risk: Property - Casualty Insurers

Assets tend to be shorter term and more liquid than life insurers.

Claims are virtually impossible to predict.

Hurricane Andrew and Hurricane Katrina precipitated severe liquidity crises for many PC insurers.

Liquidity risk: Property - Investment Funds

Investment funds can sell shares as liabilities and invest proceeds in assets such as bonds and equities.

Closed-end funds issue a fixed number of shares as liabilities.

Open-end funds sell an elastic number of shares to investors

Mutual funds and hedge funds

Risk of runs is less than that faced by banks

Asset losses will be shared on a pro rata basis

But money market mutual funds (MMMFs) face significant liquidity risk at beginning of the crisis