IB Economics HL: Balance of payments

1/107

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

108 Terms

Balance of payments (BOP)

The balance of payments (BOP) is a financial record of a country's transactions with the rest of the world for a given time period, usually over one year.

This includes the country's trade in goods and services with other countries. The government and economists have a keen interest in the economy's international transactions as these can have a major impact on domestic consumption and investment, exchange rates, inflation, export competitiveness, employment and economic growth.

Inflows and outflows

Any money entering an economy can be referred to as an inflow or credit to the country's balance of payments, whereas an outflow or debit refers to any flow of money leaving the economy. Export sales are recorded as credit items on the balance of payments, whereas import expenditures are recorded as debit items.

Credit items

Credit items are payments received from consumers, firms and institutions or governments located outside of the economy.

Credit items on the balance of payments (BOP) include revenues earned from the export of goods and services, foreign direct investment and capital transfers. (For example, the expenditure of overseas tourists visiting Bangkok would be recorded as a credit item on Thailand's balance of payments.)

Debit items

Debit items are payments made to consumers, firms and institutions or governments located outside of the economy.

When money is withdrawn from the account, it is said to be debited, and the balance of the account decreases.

(Debit items on the BOP include the purchase of imports of foreign goods and services, income transfers overseas and the repatriation of profits from multinational companies in the economy. These transactions have a corresponding outflow of money from the domestic economy.)

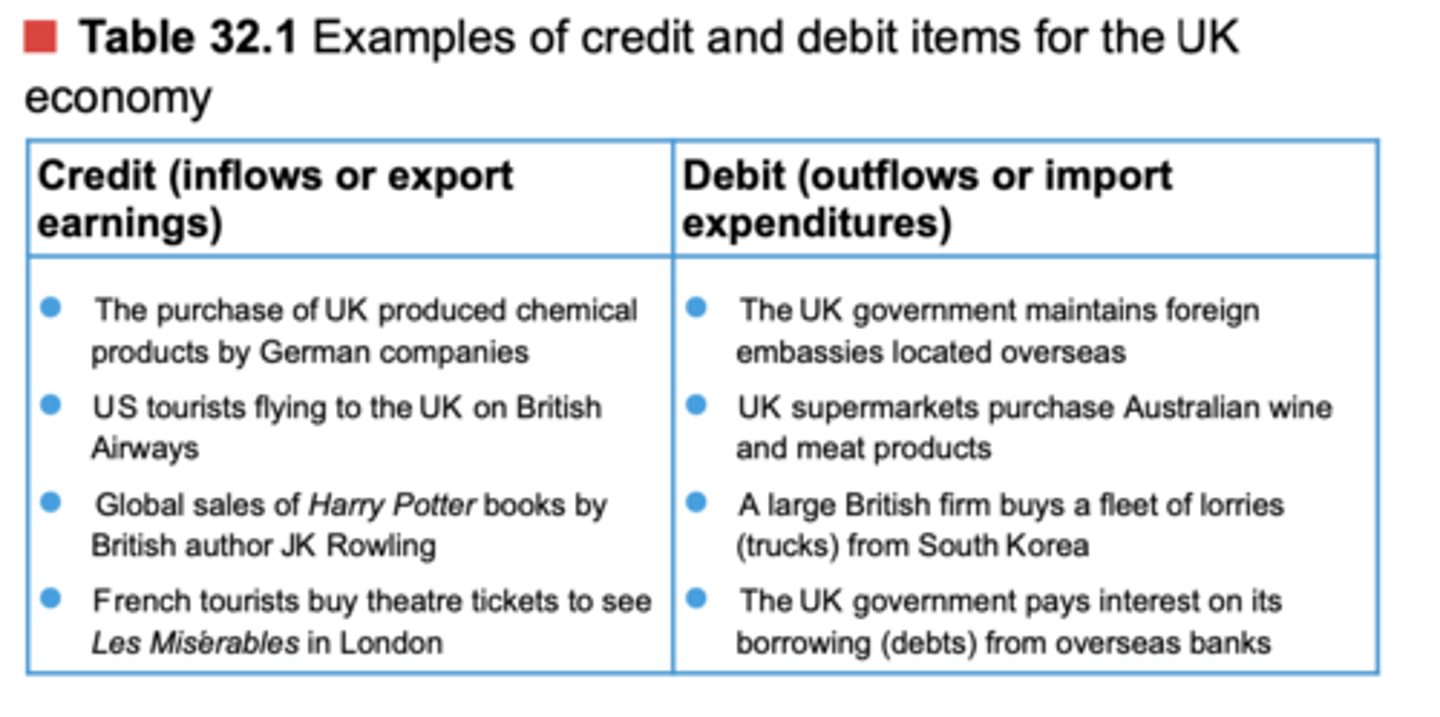

Examples of credit and debit items for the UK economy

Surplus on an account in the BoP

A surplus on an account on the balance of payments occurs when the total value of deposits (or credit items) over a period of time exceeds the total value of withdrawals (or debit items), the account is said to have a positive balance.

Deficit on an account in the BoP

A deficit on an account in the BoP occurs when the total value of withdrawals in an account exceeds the total amount of deposits, that account will have a negative balance. The account holder/country will therefore be in debt.

Surplus and deficit on the BoP (skip if you understand)

(-- Same logic applies to the BoP) If the sum of all credit items exceeds the total value of debit items on the balance of trade in goods and services then there is a surplus (that is, the value of exports exceeds the value of imports).

The balance of payments accounts

The balance of payments consists of three accounts: the current account, the capital account and the financial account.

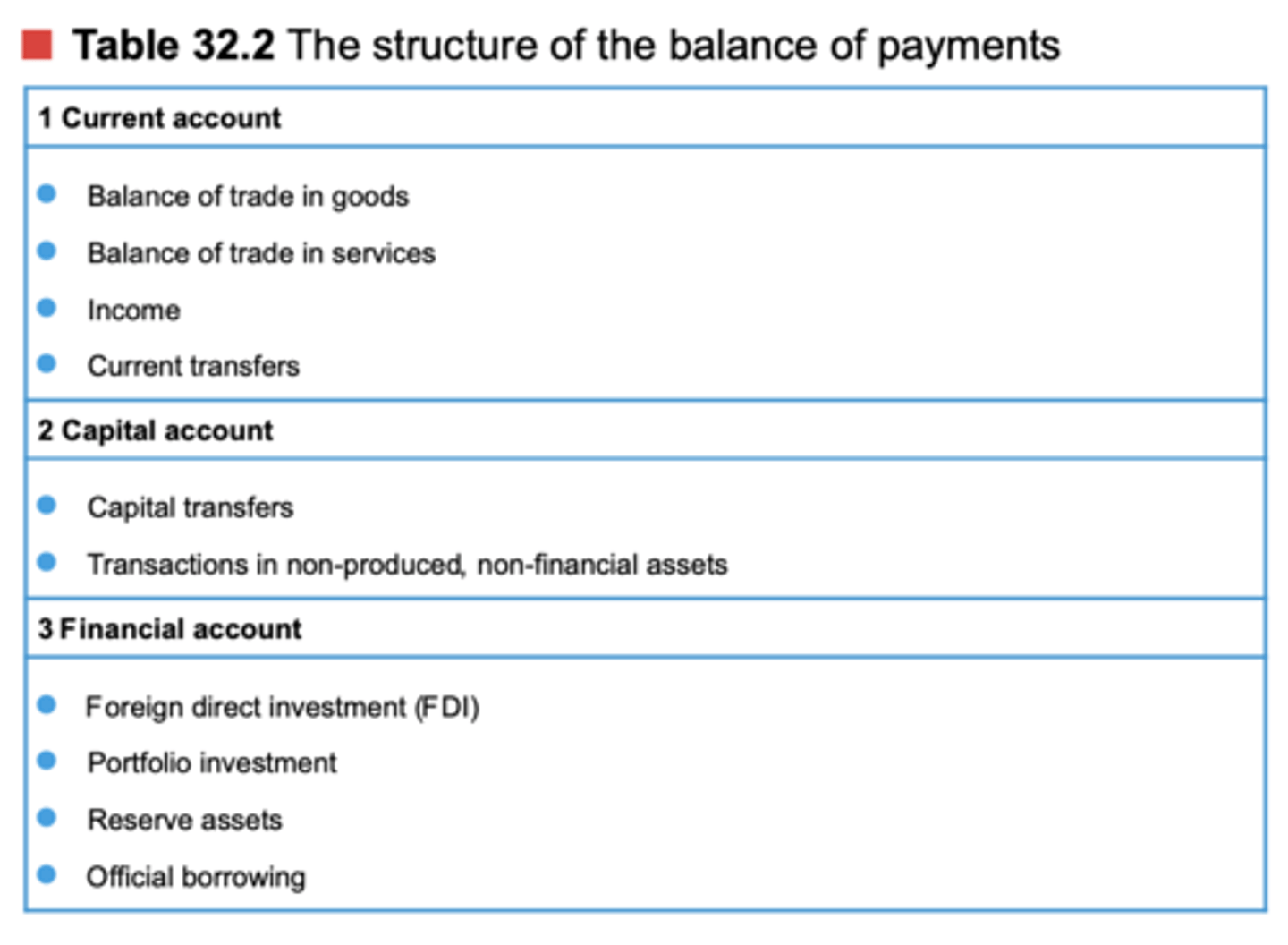

The structure of the balance of payments

Current account

The current account is a record of trade flows, income flows and income transfers across borders. It records all exports and imports of goods and services, plus net investment income from overseas assets, and the net balance of transfers made between countries by individuals, firms and governments.

Current account traits and components (optional/extra)

The current account is typically reported quarterly and yearly. It is the largest account in the balance of payments.

There are four components of the current account: balance of trade in goods, balance of trade in services, income and current transfers.

Current account: Balance of trade in goods

This records all exports and imports of physical goods (such as rice, coffee, oil, computers and motor vehicles) between a country and the rest of the world. These are sometimes referred to as visibles as they can be physically seen and checked at border crossings.

Current account: Balance of trade in services

This records all exports and imports of services (such as insurance, banking, management consultancy and tourism) between a country and the rest of the world. These are sometimes referred to as invisibles as they cannot be physically seen or checked at border crossings.

(If a foreign tourist makes a payment for a taxi fare in Paris or purchases a ticket to visit Disneyland Paris, then these expenditures cannot be seen or checked by the authorities at border control.)

Balance of trade

The balance of trade (or the trade balance) is then the difference between the value of exported goods and services and imported goods and services. The balance of trade is typically the largest component of the current account. The balance of trade is commonly referred to as net exports or abbreviated to (X - M).

Current account: income

This section of the current account records the income receipts (inflows or credit items) earned from foreign investments minus the income payments (outflows or debit items) of factor incomes paid to foreign investors. Income consists of the inflows and outflows of payments to the factors of production, that is, the sum of wages, interest, rent and profit (WIRP).

(Examples can be residents of an economy who receive incomes from abroad, either for employment purposes or returns on various investments of overseas assets. Hence, the value of net income from abroad is income earned from abroad minus income paid to those abroad.)

Current account: current transfers

Current transfers are the inflows and outflows of money that are not made in exchange for trade or any corresponding output. The value of net current transfers is current transfers from abroad minus current transfers sent abroad.

(An example is government grants. It also includes foreign workers' net remittances. Remittances are the movement of money when nationals working abroad (expatriate workers) send money back to their home country.)

Current account balance

The current account balance is the sum total of all items listed in the current account:

The sum of the current account = Net exports of goods and services + Net income + Net current transfers

Current account deficit

A current account deficit occurs when the sum of money flowing out of a country's current account exceeds the money flowing into the country's current account.

A current account deficit can occur due to exports being relatively more expensive to foreign buyers. This can be caused by higher labour costs in the domestic economy and a higher exchange rate making exports more expensive. Domestic buyers also tend to buy more imports if they are relatively cheaper and/or of better quality. This can also lead to a current account deficit.

Current account surplus

A current account surplus occurs when a country has a positive net balance on its current account.

(For example, a lower exchange makes it cheaper for foreign buyers to purchase the country's exports of goods and services.)

The current account is said to be balanced when --

The current account is said to be balanced when the sum of inflows (credit items) matches the sum of outflows (debit items), that is, the value of exports is equal to the sum of imports (X = M). This means the value of net exports is zero.

Capital account

The capital account records the different forms of capital inflows and outflows of a country during a given time period. (The capital account is a relatively small section of the balance of payments)

(Examples include foreign currency flows, debt forgiveness or debt relief, and the buying and selling of non-produced, non-financial assets such as copyrights, trademarks and patents. - very small in comparison to the values of the current account (and the financial account))

Sections of the capital account

The capital account is made up of two sections: capital transfers and transactions in non-produced, non-financial assets.

Capital account - capital transfers

Capital transfers are the different forms of capital inflows and outflows of a country.

(Examples of transactions that could be seen in the capital transfers section of the capital account are payments associated with debt-forgiveness, project-aid for developmental purposes and sums of money/assets brought into an economy by immigrants (an inflow or credit item) or those leaving with immigrants (an outflow or debit item))

Capital account - transactions in non-produced, non-financial assets

Transactions in non-produced, non-financial assets are the legal property rights to natural resources (such as land rights, mineral rights and fishing rights) and intellectual property rights to intangible assets (such as trademarks, copyrights, brands and patents). These property rights are likely to produce an income stream for the country, so are included in its financial account.

(ex: purchasing the right to fish in their waters.)

Capital account balance (or net capital transfers) = --

Capital account balance (or net capital transfers) =

Capital transfers received from abroad - Capital transfers sent abroad

The financial account

The transactions that are recorded in the financial account relate to the change in ownership of assets, that is, cross-border transactions and investments. The financial account comprises four sections: foreign direct investment (FDI), portfolio investment, reserve assets and official borrowing.

The financial account - Foreign direct investment

Foreign direct investment (FDI) is spending by multinational corporations (MNCs) in economies that they are not headquartered in. Examples of such expenditure include MNCs setting up production and distribution facilities in overseas locations.

Net FDI = FDI inflows - FDI outflows

The financial account - Portfolio investment 1

Portfolio investment refers to the stock of investment assets, which can include equities (stocks and shares), government debt (bonds, treasury bills and securities) and debentures (corporate debts). It mainly consists of investors purchasing ownership of a company (stocks or shares) and the purchasing of government bonds (which is technically a purchase of debt).

The financial account - Portfolio investment 2: Portfolio investments are not -- investments

+ net portfolio investments = --

Portfolio investments are not direct investments as the investors do not generally have a lasting interest in the companies or governments but are speculating that such expenditure will generate positive returns in the future. Hence, these assets only represent lending and borrowing between households, firms and governments in international markets.

Net portfolio investments = sales of domestic portfolio assets - purchase of overseas portfolio assets

The financial account - Reserve assets

Reserve assets are stocks of foreign currencies and liquid assets such as gold reserves held by central banks used to balance international transactions and payments. A reserve asset must be readily available to the central or monetary authority, must be a physical asset and must be easily transferable or convertible. They are typically used to meet balance of payments financing needs or to influence the exchange rate.

The financial account - Official borrowing 1

Official borrowing refers to government borrowing rather than borrowing of private individuals, households and firms. Governments often borrow from creditors or institutions outside of their own economy. Examples of this can be borrowing from foreign banks and financial institutions or loans from the International Monetary Fund (IMF ) for development purposes. In the short run, these loans would represent a credit to the financial account (as there is an inflow of money).

The financial account - Official borrowing 2

However, as the repayments are made, along with interest charges, these would then represent a debit on the financial account. As the loan is likely to be on non-concessional terms, the final value of the loan will exceed what was originally borrowed. Governments of economically least developed economies often need to borrow from the IMF to finance their current account deficits.

Interdependence between the accounts - double-entry

The relationship between the three accounts in the balance of payments relates to an accountancy technique called ' double-entry'. This method of accounting means that for every transaction with an economy and its trading partners, a value will be credited, and a value will be debited. This means that an outflow of a value will be offset by an inflow of value.

Why does the balance of payments have to balance in the long term?

The overall balance of payments (BOP) must always balance because in the long-term a country can spend only what it earns, where the sum of all credit items equals the sum of all debit items. Therefore, it is possible to run a deficit in one component of the BOP as this will be 'balanced' by having a surplus on another account or component of the BOP.

Conditions for the balance of payments (to be balanced)

Three interrelated conditions must hold:

● zero balance in the overall balance of payments

● credit items are matched by debit items

● deficits are matched by surpluses.

RL Example: For example, owing to its geographical location, size and factor endowments, Hong Kong typically reports a deficit on its current account but funds this by having a surplus on its financial account owing to favourable conditions for F DI. In other words, Hong Kong must have a surplus in the financial account to provide the economy with the foreign exchange needed to pay for its excess of imports over exports.

By contrast, China, Norway, Germany and Saudi Arabia typically report a current account surplus. These countries can run a deficit on their capital account and/or financial account by directly investing the surplus from the current account in foreign countries and/or accumulate foreign currency reserves.

Interdependency of the accounts

he current account, capital account and the financial account are interdependent. A country with a current account deficit

consumes more than it produces so has to pay for this extra output somehow, that is, through a surplus on its financial account (and vice versa). We can therefore demonstrate this relationship as: Current account = Capital account + Financial account

In reality the balance of payments will not necessarily balance (have a zero balance) because there are just too many transactions to account for in such a precise way. -- How to resolve this?

To resolve this calculation problem, errors and omissions are used to represent statistical discrepancies when compiling the accounts. Therefore, the following condition must hold for the BO P to balance:

Current account = Capital account + Financial account + Errors and omissions

Another way of explaining why the balance of payments must balance (equal 0 ) is with a --

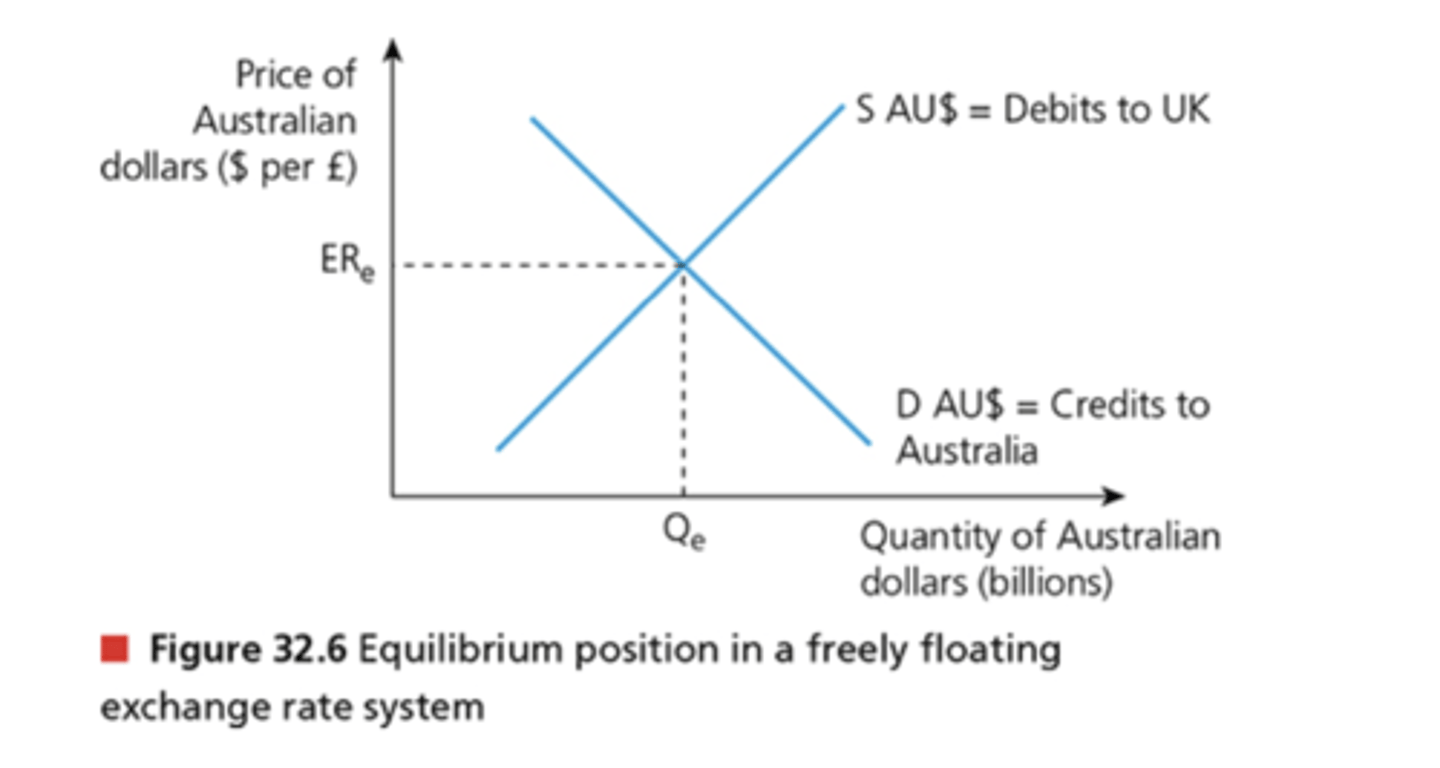

Another way of explaining why the balance of payments must balance (equal 0) is with a freely floating exchange rate diagram.

Graph: equilibrium position in a freely floating exchange rate system

Graph explanation: equilibrium position in a freely floating exchange rate system 1

In this diagram, Australia and the UK trade with each other, so whenever there is a supply of Australian dollars, this would be for the sole purpose of buying UK pounds (£). The supply of Australian dollars would therefore represent a debit to the Australian economy and a credit to the UK economy. When there is a demand for Australian dollars, this would have to be the result of an increase in the supply of UK pounds. This would mean that the demand for Australian dollars would represent credits to the Australian economy and a debit to the UK economy.

Graph explanation: equilibrium position in a freely floating exchange rate system 2

As a freely floating exchange rate market should always find equilibrium in the long run (at ERe and Q e), this means that debits and credits in both the British and Australian balance of payments will be equal. This means that the BOP should be equal to zero. Note that this is conditional on a freely floating exchange rate. Should a currency be overvalued, the quantity demanded will exceed the quantity supplied resulting in more debits than credits and a resulting balance of payments deficit. The opposite is true should the currency be undervalued.

Exchange rate relationship with the current account 1

When looking at the current account specifically, it can be seen that the value of an exchange rate will have a considerable impact on the demand for imports and exports. A current account deficit exists when the sum of the outflows from the current account exceeds the inflows into the account. This means the total import expenditure on goods and services is greater than total export earnings for the country. Hence, a current account deficit shows the country is spending more than it is earning, so it must require more foreign exchange while it faces relatively lower demand for its own currency as exports are in lower demand.

Exchange rate relationship with the current account 2 - restoring equilibrium in a freely floating exchange rate system

In theory, the deficit is automatically resolved under a freely floating exchange rate system because it makes exports relatively cheaper and imports relatively more expensive. Export earnings should therefore rise, and imports expenditure should fall, thereby restoring equilibrium.

Exchange rate relationship with the current account 3 - in a fixed exchange rate system

- This is more problematic in a fixed exchange rate system unless a devaluation of the currency is approved. If so, this should improve the current account in the same way as with a depreciation of the currency in a freely floating exchange rate system.

Exchange rate relationship with the current account 4 - in a managed exchange rate system

In a managed exchange rate system, a current account deficit is resolved by combining market forces and central bank intervention by buying and selling of foreign currencies to reduce the value of the domestic currency in overseas markets.

The balance of trade in the current account's relationship with the value of the domestic currency 1

Given that changes in the value of a currency are likely to change the value of export earnings and the value of import expenditures, it can be said that the balance of trade in the current account has an inverse relationship with the value of the domestic currency. This means that a lower exchange rate causes a rise in the price of imports and a fall in the price of exports. Assuming that this causes a greater than proportionate change in the quantity demanded for exports and imports, the value of exports will increase, and the value of imports will decrease.

The balance of trade in the current account's relationship with the value of the domestic currency 2

By contrast, a higher exchange rate causes a fall in the price of imports and an increase in the price of exports. Assuming that this causes a greater than proportionate change in the quantity demanded for exports and imports, the value of exports will decrease, and the value of imports will increase (see the Marshall-Lerner condition and the J -curve effect covered later in this chapter).

Financial account and the exchange rate relationship 1

The financial account handles mainly investments (FDI and portfolio investment), it also includes reserve assets and official borrowing. This means that a surplus in the financial account is likely to be due to credit items from investments being made in the domestic economy by those outside of the economy. To make these investments, investors will need to demand the domestic currency, thus causing an increase in the demand for that currency and therefore an increase in the value of a currency, ceteris paribus.

Financial account and the exchange rate relationship 2 - Financial account surplus case

In the case of a financial account surplus, this would likely be represented by domestic investors investing in portfolio investments abroad. This would mean that these investors would need to supply their own currency to purchase the currency of the foreign country that they are investing in. All things being equal, this would result in a fall in the value of the domestic currency.

Financial account and the exchange rate relationship 3 - portfolio investments yielding dividends for their investors

When portfolio investments, such as stocks and bonds, yield dividends for their investors, this would represent a debit in the current account as the money leaves the economy. This needs to be paid to investors in their foreign currencies, thus increasing the supply of the local currency, which would cause a currency depreciation, ceteris paribus. The opposite is true for domestic investors who receive dividend payments from holding foreign assets.

The implications of a persistent current account deficit - list summary

The implications of a persistent current account deficit can be examined in terms of:

- exchange rates

- interest rates

- foreign ownership of domestic assets

- debt

- credit ratings

- demand management

- economic growth.

The implications of a persistent current account deficit 1 - exchange rates

It is important to remember that whenever a good is imported, there has been a demand for a foreign currency to pay for the product by supplying the domestic currency. Therefore, persistent current account deficits will lead to a weaker domestic currency. F or countries reliant on key imports such as oil, a declining currency can fuel imported inflation, which increases the costs of production and erodes consumer surplus. There may subsequently be negative impacts on national output and employment.

The implications of a persistent current account deficit 2 - interest rates

As a persistent current account deficit puts downward pressure on the exchange rate, governments may be tempted to raise interest rates to attract foreign currency and capital inflows. Investors looking to save in foreign bank accounts will be attracted by the higher interest rates. However, higher interest rates can have a contractionary impact on aggregate demand in the local economy. If this is prolonged, it could even lead to a recession with detrimental impacts on the economy, including higher unemployment.

The implications of a persistent current account deficit 3 - foreign ownership of domestic assets 1

A current account deficit has to be financed by a surplus on the financial account, often in the form of foreign direct investment (FDI). However, this may mean that more domestic assets become owned by foreign multinational corporations. There are opposing implications of this as F DI can help to boost aggregate demand in the economy, thus increase economic growth.

The implications of a persistent current account deficit 3 - foreign ownership of domestic assets 2

However, FDI and foreign ownership of domestic assets can also cause leakages in the circular flow of income as MN Cs remit income and profits back to their home countries. There is also no guarantee that these foreign MN Cs will remain located in the domestic economy as they may choose to relocate for cost advantages in other countries. Hence, foreign ownership of domestic assets could leave the local economy in a vulnerable position.

The implications of a persistent current account deficit 4 - debt

If a country does not have sufficient financial reserves to fund its persistent current account deficit, it will have to borrow money to pay for this. One way of financing this current account deficit is by taking loans from the International Monetary Fund (IMF). This would represent a credit to the financial account, but the country therefore goes into debt with its related problems, such as mounting interest repayments, lower economic growth and job losses.

The implications of a persistent current account deficit 5 - credit ratings

Credit ratings refer to the creditworthiness of a borrower based on the likely ability to repay the debt. A persistent current account deficit tends to reduce a country's credit rating as it can signal underlying structural economic problems for the country. These economies may need to restructure their debt by agreeing new terms, such as longer repayment periods, or negotiate lower interest rates. However, these measures will make such countries much less attractive to foreign lenders in the future. This could mean that loans they receive in the future are at a much higher interest rate, if they manage to secure any further loans at all.

The implications of a persistent current account deficit 6 - demand management

An economy often experiences a current account deficit when the economy is growing rapidly, as those with higher incomes purchase more imports. Contractionary demand management policies might be used to reduce the demand for imports to correct this persistent current account deficit. These policies tend to focus on incentivizing households to purchase domestically produced goods or generic attempts at lowering expenditure on all goods and services (and therefore also targeting imported goods and services). However, this can negatively affect growth and employment in the economy.

The implications of a persistent current account deficit 7 - economic growth 1

A common theme of the previous implications of a persistent current account deficit has been the impact on economic growth. F or example, in order to close the current account deficit, a government may choose to use contractionary demand-side policies to lower aggregate demand, although this is likely to reduce economic growth.

The implications of a persistent current account deficit 7 - economic growth 2

Similarly, a poor credit rating due to high levels of indebtedness (to fund the deficit) will also impact on consumer and producer confidence levels. This will hinder both consumption and investment - key components of aggregate demand - so could lead to unemployment and lower economic growth.

List of the methods to correct a persistent current account deficit

Policies of the methods to correct a persistent current account deficit can be grouped into three categories:

- expenditure switching policies

- expenditure reducing policies

- supply- side policies

Expenditure switching policies

Expenditure switching policies are measures designed to cut a current account deficit by encouraging households and firms to buy domestically produced goods and services rather than imported alternatives by raising the relative price of imports or reducing the relative price of exports.

How can a government conduct expenditure switching policies: list

- export promotion

- trade protection

- currency devaluation

Expenditure switching policies: export promotion

Export promotion includes policies that stimulate the demand for exports. The government decides which industries could become export competitive. They then issue subsidies and direct spending towards these industries to help them develop. However, export promotion involves a large amount of public sector spending, for which there are opportunity costs.

Expenditure switching policies: trade protection

These measures reduce the competiveness of imports thereby making domestically produced products more attractive. Examples of trade protectionist measures include tariffs (import taxes that raise the price of imports) and quotas (quantitative limits on the amount of available imports). However, trade protection could cause trading partners to retaliate by imposing their own restrictions and cause economic inefficiency as governments protect uncompetitive domestic industries.

Expenditure switching policies: currency devaluation

The central bank or monetary authority of a country can devalue its exchange rate in order to reduce the price of exports and make imports relatively more expensive. This will lead to an increase in net exports (exports exceeding imports), ceteris paribus. Whether this policy will help to correct the balance of payments deficit depends on the value of the price elasticity of demand for both imports and exports (see the Marshall-Lerner condition)

Expenditure reducing policies

Expenditure reducing policies are measures designed to cut a current account deficit by lowering disposable income in order to limit aggregate demand and import expenditure in particular. This is usually achieved through the use of contractionary monetary and fiscal policies.

Expenditure reducing policies: Contractionary monetary policy

Higher interest rates make new and existing loans more expensive for borrowers, while greater incentives to save will withdraw more money from the circular flow of income. Hence, both households and firms will tend to reduce their demand for imports.

Expenditure reducing policies: Contractionary fiscal policy

These measures use a combination of higher taxes and reduced government spending in order to reduce consumption, investment and the amount of money available to spend on imports. The effect of this policy will be more significant for economies that have a high marginal propensity to import

Supply-side policies

Supply-side policies are long-term measures that strive to raise the productive capacity of the economy and to increase the country's international competitiveness.

Supply-side policies examples: Investments in education and healthcare

These measures help to improve the economy's human capital (investments to improve the skills and productivity of the workforce), thereby raising the quality of exports and improving the country's long-term international competitiveness. This should then increase the demand for exports, ceteris paribus. There could also be a resulting reduction in the demand for imported goods because domestic firms become more productive owing to their healthier and more skilled workers.

Supply-side policies examples: Investment in infrastructure

This policy measure would help to support businesses and industries, especially those engaged in export-orientated markets, owing to improved transportation and communications networks. This will improve the productivity of domestic firms and make them more competitive against foreign firms. This should then lead to a reduction in the demand for imports in favour of greater demand for exports (for overseas customers) and domestically produced products (for local customers).

Supply-side policies examples: Measures to encourage export-driven business start-ups and industries

These policies include the use of government subsidies and tax incentives for targeted businesses. The measures focus on the long-term but will potentially or eventually develop home-grown industries that will rival those found in foreign economies.

Limitation of using supply-side policies to correct a persistent deficit on the BOP

The biggest limitation of using supply-side policies to correct a persistent deficit on the BOP is the time involved. While these policies can be extremely expensive to fund, they take a significant amount of time to have any meaningful impact on the economy and, hence, the BOP. There is no guarantee that the above examples will correct the disequilibrium in the current account.

Expenditure switching policies' effectiveness to correct a persistent current account deficit

Expenditure switching policies do not always work because price is not always the deciding factor in determining the level of demand for goods and services. Customers will consider non-price factors that determine the demand for products, such as quality, functionality and brand loyalty. This can apply to any good or service that is being exported or imported, but is particularly applicable in the case of luxury products. The effectiveness of any policies to correct a persistent current account deficit will therefore also depend on the price elasticity of demand (PED) for both exports and imports. This point is discussed further under the theory of the J -curve effect.

Trade protection's effectiveness to correct a persistent current account deficit

Trade protection can also cause problems, as other countries are likely to retaliate by creating their own trade barriers. Such political and economic disharmony in the global economy will reduce the benefits of free international trade and lower economic efficiency. Domestic consumer surplus will be reduced, due to higher prices and reduced choice, which can lead to a reduction in the standard of living, especially in ELDCs.

Currency devaluation effectiveness to correct a persistent current account deficit

Attempts by governments to devalue their currency will work only under a system of fixed exchange rates, yet the falling value of the currency can cause imported inflation (higher priced imports of essential products such as crude oil, raw materials and foodstuff). This can result in inflation and a reduction in the standard of living in that economy as wages often will not rise with inflation, therefore reducing the purchasing power of households and firms.

Expenditure reducing policies effectiveness to correct a persistent current account deficit

Expenditure reducing policies, such as higher direct taxes, can cause huge disincentive effects in the economy, thereby negatively affecting economic growth and development in the long-term.

Contractionary demand-side policies effectiveness to correct a persistent current account deficit

Contractionary demand-side policies can also cause mass-scale unemployment in the economy. The impact of these policies will depend on the macroeconomic position of the economy at the time that they are implemented. Should the economy be experiencing demand-pull inflation, then the impact of contractionary policies will be less damaging

Supply-side policies effectiveness to correct a persistent current account deficit

While supply-side policies, such as investments in education and healthcare, aim to make domestically produced goods and services more competitive, they tend to take a very long time to materialize and require significant government expenditure. Hence, the implementation of supply- side policies to rectify a persistent current account deficit tends to be very costly to the economy.

The Marshall-Lerner condition and the J-curve effect - Under a fixed exchange rate system, a government can devaluate its exchange rate to --

Under a fixed exchange rate system, a government can devaluate its exchange rate to resolve a current account deficit. In theory, this will make exports relatively more attractive to overseas buyers and make imports more expensive for domestic citizens, thus improving or correcting the current account deficit.

A country with a current account deficit and operating under a floating exchange rate system should experience an improvement if there --

A country with a current account deficit and operating under a floating exchange rate system should experience an improvement if there is downward pressure (currency depreciation) on its exchange rate. Assuming customers are responsive to the relative change in prices of exports and imports, the fall in the exchange rate should help to correct the current account deficit.

A devaluation or depreciation of the currency will work in rectifying a balance of trade deficit only if the --

A devaluation or depreciation of the currency will work in rectifying a balance of trade deficit only if the sum of the price elasticity of demand for exports (X ) and imports (M) is greater than 1 , that is, price elastic. This rule is called the Marshall-Lerner condition:

The Marshall-Lerner condition

The Marshall-Lerner condition states that a devaluation or depreciation of the currency will work in rectifying a balance of trade deficit only if the sum of the price elasticity of demand for exports and imports is greater than 1 (that is, price elastic).

The Marshall-Lerner condition formula

PEDx+ PEDm> 1

The Marshall-Lerner condition formula explanation

Hence, if PEDx + PEDm = 1 , then a currency devaluation or depreciation has no impact on the current account deficit. Likewise, if the PEDx +PEDm < 1 , then the fall in the exchange rate will actually worsen the deficit further. This is because the currency is worth less, yet exporters and importers are not relatively responsive to the fall in the exchange rate.

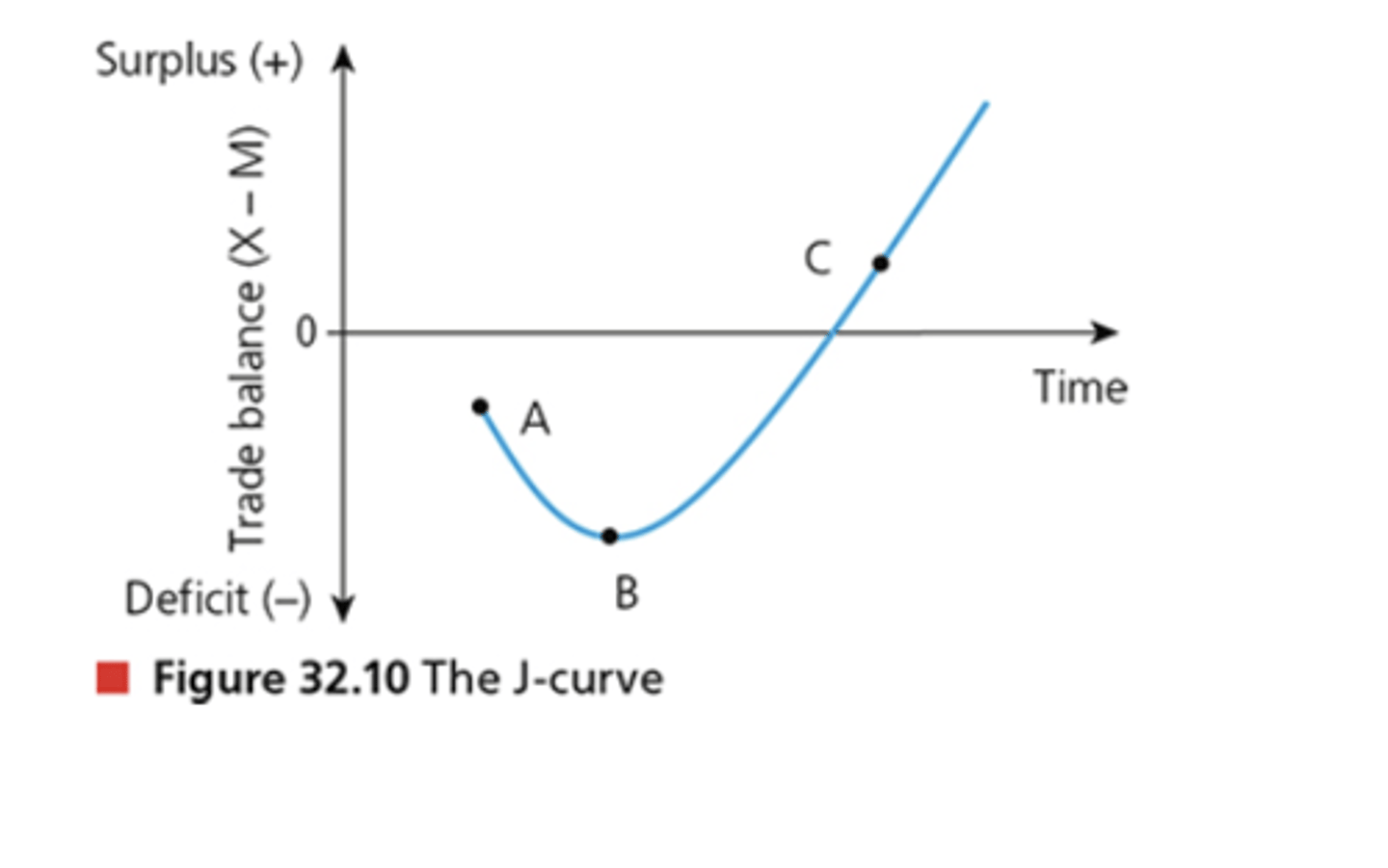

The impact or significance of the Marshall-Lerner condition can be illustrated by using a --

The impact or significance of the Marshall-Lerner condition can be illustrated by using a J -curve diagram (or J-curve effect). The J-curve effect is an economic model that shows the impact on a country's balance of trade following a currency depreciation. Initially, the balance of trade worsens before it gets better

The J -curve effect is caused by time lags, such as: 1 --

- Limited access to information - individuals, households and firms are not fully aware of the currency devaluation or its relevance to them.

The J -curve effect is caused by time lags, such as: 2 --

- Ongoing contracts - being bound by existing contracts means that some firms cannot take advantage of the currency devaluation immediately.

The J -curve effect is caused by time lags, such as: 3 --

- Existing habits and tastes - in the short run, buyers might not be responsive to the currency devaluation so continue to buy

imports at a higher price (and export at a lower price). This is particularly the case for customers who have a high degree of customer loyalty for foreign brands.

-- individuals, households and firms in both domestic and foreign markets need --

Owing to the time lags, individuals, households and firms in both domestic and foreign markets need time to adjust to the change in the relative prices of exports and imports.

The J -curve will materialize (that is, a fall in the value of the exchange rate rectifying a balance of trade deficit) only if the --

The J -curve will materialize (that is, a fall in the value of the exchange rate rectifying a balance of trade deficit) only if the Marshall-Lerner condition holds.

Graph: The J-curve

Graph explanation: The J-curve: Lower exchange rate effect on the current account

A lower exchange rate causes a relative rise in the price of imports and a relative fall in the price of exports. This worsens the deficit, as shown by the movement from point A to point B in the diagram, as the PEDx and PEDm remain relatively price inelastic in the short run. In the long run, the PEDx and PEDm will increase as households and firms adjust to the relative price changes of exports and imports, resulting in the lower exchange rate boosting exports and reducing imports over time. This enables the trade balance to move from point B to point C, thereby eliminating the deficit on the balance of trade.

Implications of a persistent current account

surplus list

A persistent current account surplus is not necessarily or always desirable. There are implications of this on the:

- level of domestic consumption and investment

- exchange rates

- inflation

- employment

- export competitiveness.

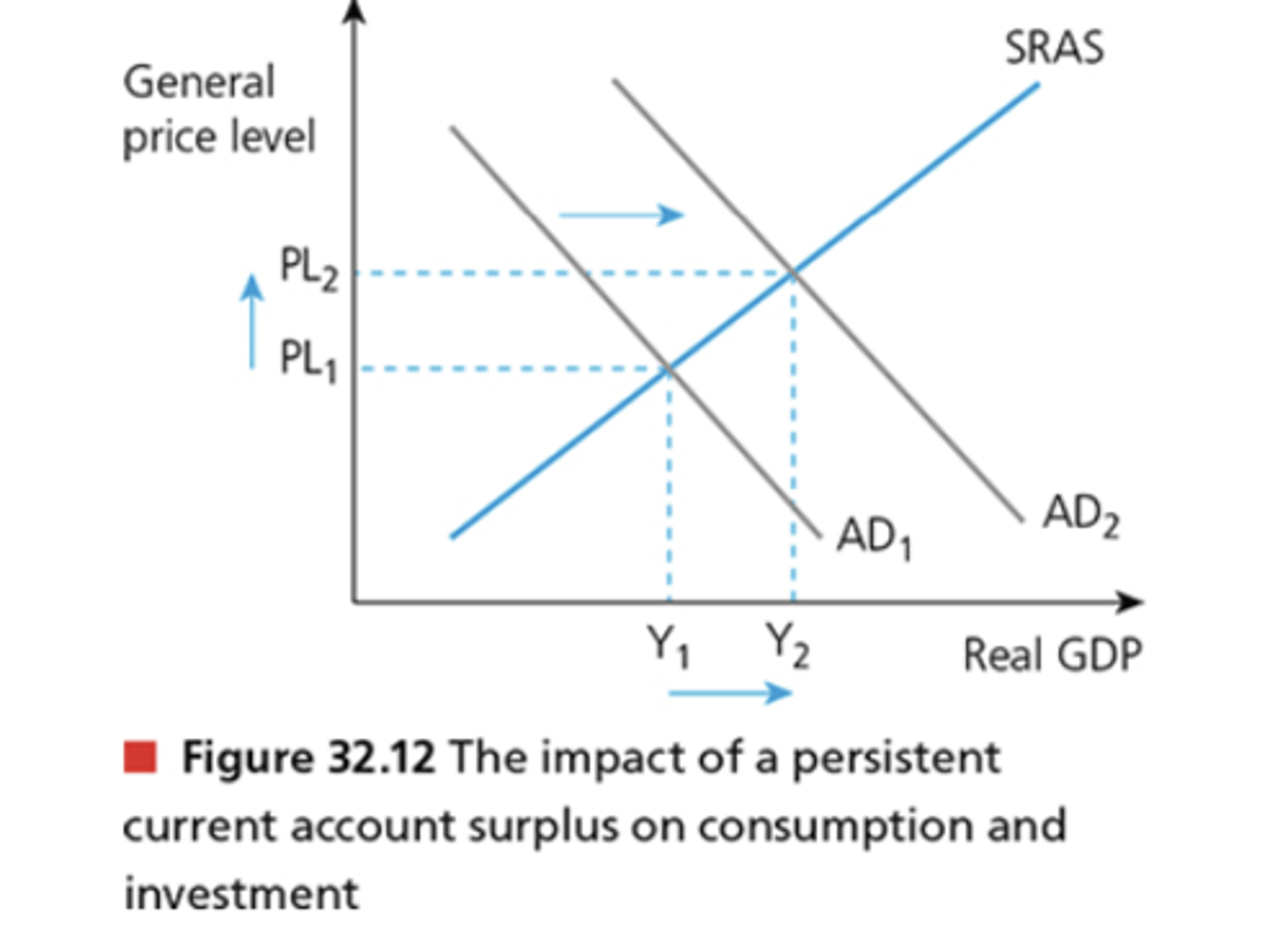

Implications of a persistent current account

surplus 1 - level of domestic consumption and investment (graph)

Implications of a persistent current account

surplus 1 - level of domestic consumption and investment - explanation 1

In the short run, a current account surplus means the (X - M) component of aggregate demand is positive, so this helps to boost AD from AD1 to AD2 , as shown in the graph. This causes the economy to grow, with real GDP rising from Y1 to Y2 . As a result, employment will also increase. However, there is likely to be some inflationary pressure on the economy owing to the higher level of AD, causing the general price level to rise from PL1 to PL2 . Hence, a persistent current account surplus can create inflationary pressures on the economy so can deter future investments in the country.

Implications of a persistent current account

surplus 1 - level of domestic consumption and investment - explanation 2

Alternatively, a persistent current account surplus can be caused by lower domestic expenditure on imports, but this is not necessarily good for households and firms if it is due to a lower level of income. As the current account is in surplus, it could mean that the additional money coming into the country is not being spent on imported goods and services, which could represent less choice for domestic consumers and therefore a lower standard of living.

Implications of a persistent current account surplus 2 - exchange rates 1

Demand for exports represents demand for the currency of the exporting nation. A current account surplus implies there is greater demand for the domestic currency as export sales exceed import expenditure. This can then cause the domestic currency to appreciate in value. Subsequently, exporters will find it increasingly difficult to sell to foreign buyers who have to pay higher prices for these products.