MODULE 2-B

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

43 Terms

An effective price ceiling is one that, when enforced, will cause the market to move

away from the equilibrium.

What is an effective price ceiling?

Either the market will (1) make no change and remain at the original equilibrium or (2) the price of the good will decrease but a shortage of the good will develop or (3) the price of the good will actually increase

3 possible outcomes of an impact of effective price ceiling

Price controls

_ refer to the government attempting to control the market price through legal intervention in the market. Two different types of price controls, price floors and price ceilings, are defined and analyzed separately.

price ceiling

rent controlled housing

A _ is a maximum legal price. The name is descriptive of the effect of a maximum legal price. Similar to a ceiling, the market price can be below the ceiling, but not above it. There are a number of examples of price ceilings. One example is _. A number of jurisdictions, usually urban areas, impose a price ceiling, often called rent controls, on housing in an attempt to reduce the prices consumers pay for housing

key money

one way to get around rent control laws for housing is to pay what is commonly known as “_.” That is a payment upfront to have the keys in an apartment changed when changing renters. However, if the key money is substantial, then this is clearly an attempt to avoid the price ceiling.

increase

decreasing

black market

2 outcomes if price ceiling cannot be enforced:

a. If the extra money simply goes to the firm producing the good, then they respond as do all firms when receiving a higher price. They (increase/decrease) their quantity supplied. Likewise, consumers respond to the higher price by (increasing/decreasing) their quantity demanded. As a result, the market simply moves back to the original equilibrium. (Note: the market might not go back all the way to the original equilibrium if the cost of avoiding the price ceiling is substantial. In that case, the equilibrium quantity will be lower.)

b. If the extra money does not go to the firm producing the good but, instead ends up going to some third party, then quite a different outcome results. Why might this even be a possibility? This commonly occurs because it is easier for the government to enforce the ceiling price upon the original producers but it cannot enforce the ceiling price on people who buy and then resell the product. This is the classic formation of a _.

1. When the ceiling price is enforced, the price does fall in the market to whatever price is set by the government. However, a shortage occurs in the market so that some consumers are unable to buy at this lower price. Hence, some consumers will be better off, those who can buy the good at the lower price. However, other consumers will be worse off, those who cannot buy the good at all but would have at the higher price.

2. When the ceiling price is not enforced and the illegal higher price is paid to the firms producing the good, the market does not change with the regulation. As a result, the price ceiling does not advantage consumers. In fact, consumers may be worse off if avoiding enforcement, as is likely, is costly to them. Furthermore, the government will be wasting some resources in passing and attempting to enforce the regulation. Hence, there exists no possibility of a consumer advantage and significant possibility of substantial costs.

3. When the ceiling price is not enforced and a black market forms, consumers actually end up paying a higher price and also buy a lower quantity. For both reasons, they are worse off as a result of the price ceiling.

Does the Price Ceiling Improve the Position of Consumers?

The normal justification for the imposition of price ceilings is to improve the welfare of consumers in a market where prices are considered too high by some subjective standard.

Consider the 3 outcomes

above price floor

where should the actual price be in price floor

(1) make no change and remain at the original equilibrium or (2) the price will increase but a surplus of the good will also result.

In the case of price floors, there are only two possible outcomes. Either the market will

1. Floor Price is Not Enforced

If the floor price is not enforced, then there exists only one possible outcome. At the floor price a surplus would exist so price competition by firms would force the price back to the equilibrium, at a price of PE and a quantity of QE. Similar to the same situation for price ceilings, there would potentially exist significant costs to the unenforceable floor price as firms attempt to avoid the regulation.

2. Floor Price is Enforced

The situation that results is quite different if the floor price is enforced. In that case, at a floor price of P2, then quantity demanded would only equal Q1 while quantity supplied would equal Q2. Hence, a surplus would occur with firms unable to sell all that they wish to at the higher price.

what happens if floor price unenforced or enforced?

Price floors

surplus

price supports

government subsidy

_ are usually intended to advantage firms or, in the case of minimum wage laws, individuals who supply labor. However, as we’ve seen above they do not necessarily work as planned. Either they have no impact on the market, even though imposing substantial enforcement costs, or they do increase the price while causing a _. In the latter case, only those firms who can sell their product will be better off. Other firms will be worse off and may even be forced out of business.

As a result, the government often enacts programs, known as _, in order to alleviate these problems. These programs tend to involve some type of _.

government subsidy

price supports

A _ is when the government either pays for part of the higher price for the good, or more commonly, buys up the extra surplus at the floor price. Such subsidies are often called _ because they are enacted in order to keep the price at the higher level. For example, price support programs are common in agricultural industries where products have price floors imposed.

What does the government do with the product that it buys up in the subsidy program? Often, they will use the good as part of a welfare program to support poor people, perhaps giving the good away to welfare recipients or other qualifying individuals.

the surplus persists and eventually some firms will go out of business. But the cycle will not stop there.

The higher price of the good and resultant higher profits for surviving firms will induce other firms to enter the industry, which will cause another surplus.

As a result, more firms will go out of business. This cycle could possibly continue indefinitely

What is the effect if the price floor is not subsidized?

the effect will be dependent upon which workers are considered. Higher skilled workers have higher wages and, hence, are not affected by the change because the price floor is not effective for them. It is only the lower skilled and wage workers who are affected directly.

As the wage increases for unskilled workers, they become less desirable to firms, who reduce their employment. For skilled workers, especially those who are close substitutes for the unskilled workers, employment increases as a result.

Suppose the minimum wage is increased,

1. Describe responsiveness to price changes in terms of the steepness (or slope) of the demand curve.

1. Elasticity - are “unit-free” measures.

Elasticity – a measure of how sensitive or responsive a dependent variable is with respect to a change in the independent variable

The responsiveness of quantity demanded can be measured in two ways:

200

quarts

slope of demand curve

For example: The demand curve for milk has a slope of –200 (two cases can show that slope may be confusing to use as a measure of how sensitive/responsive Qd is with respect to a price change, i.e., peso/dollar change

Interpretation:

a. If Qd is in quarts: When the price of milk rises by a dollar, _ fewer quarts of milk are sold.

b. If Qd is in gallons: When the price of milk rises by a dollar, 200 fewer _ of milk are sold.

elasticity

– a measure of how sensitive or responsive a dependent variable is with respect to a change in the independent variable

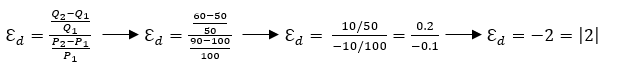

price elasticity of demand

– a measure of how sensitive or responsive a dependent variable is with respect to a change in the independent variable

For every 1% change (increase or decrease) in P, Qd changes (decrease, increase) by 2%

how would you interpret this as?

ELASTIC

UNITARY ELASTIC

INELASTIC

Ed > 1

Ed = 1

ED < 1

Perfectly elastic | |

Elastic | |

Unitary elastic |

|

Inelastic | |

Perfectly inelastic |

|

Determine type of demand curve

· Flatter demand curve · Slope is a low value (but constant) · Elasticity coefficients along the demand curve are greater than one |

· Demand curve lies in between elastic and inelastic demand curves · Neither flat nor steep · Elasticity coefficients along the demand curve are equal to one |

· Steep demand curve · Slope is a high value (but constant) · Elasticity coefficients along the demand curve are less than one |

· Demand curve is a horizontal line · Slope is ∞ (demand is expressed as Q-function) · At a certain price, consumers can buy any quantity

|

· Demand curve is a vertical line · Slope is zero (demand is expressed as Q-function) · Any P change leaves Qd unchanged |

Availability of Close Substitutes (or more substitutes

Definition of the Market

Time Horizon

The Proportion of Income Spent on a Good

Determinants of Price Elasticity of Demand

Narrowly

_ defined markets tend to have more elastic demand than broadly defined markets because it is easier to find close substitutes for _ defined goods. For example, food, a broad category, has a fairly inelastic demand because there are no good substitutes for food. Ice cream, a narrower category, has a more elastic demand because it is easy to substitute other desserts for ice cream. Vanilla ice cream, a very _ category, has a very elastic demand because other flavors of ice cream are almost perfect substitutes for vanilla

longer

Goods tend to have more elastic demand over (longer/shorter) time horizons. Because over time, consumers are able to adjust to their consumption patterns as more and more consumers find they have the time and inclination to search for substitutes. For example, when the price of gasoline rises, the quantity of gasoline demanded falls only slightly in the first few months. Over time, however, people buy more fuel-efficient cars, switch to public transportation, and move closer to where they work. Within several years, the quantity of gasoline demanded falls more substantially

greater

less

The (less/greater) the proportion of income spent on a good, the good is more elastic. On the other hand, the (less/greater) proportion of income spent on a good, the good is inelastic.

Electronics Cigarettes* Diapers* |

examples of unitary elastic goods

No effect on TR TR is maximum |

Elasticity | Change in Price | Effect on TR |

Elastic | Increase Decrease | Decrease Increase |

Unitary Elastic | Any change in P | ? |

Inelastic | Increase Decrease | Increase Decrease |

TR curve

_ is described as parabolic (parabola that opens downward, with maximum point). TR behavior is initially increasing, reaches a maximum, and eventually decrease (see Figure 4).

MR or marginal revenue

The slope of the TR function can also be derived. The slope of TR function is called _, i.e., it is the additional revenue received for selling additional output. _ describes the shape or behavior of the TR curve.

MR

Used when deriving the slope from point to point on a TR curve

increase

decrease

Zero

Elasticity & P Change | TR | MR |

Elastic: Price decrease | TR _ | Positive |

Unitary Elastic | TR maximum | _ |

Inelastic: Price decrease | TR _ | Negative |

income elasticity of demand

other demand elasticities

income elasticity of demand

It is a measure of how much the quantity demanded of a good responds to a change in consumers’ income, computed as the percentage change in quantity demanded divided by the percentage change in income.

Cross-Price Elasticity of Demand

It is a measure of how much the quantity demanded of a good responds to a change in the price of a related good, computed as the percentage change in quantity demanded divided by the percentage change in the price of a related good.

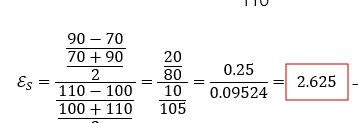

law of supply

The _ states that, ceteris paribus, as price rises quantity supplied rises (& vice versa).

For every 1% increase in price, quantity supplied increases by 2.625%

how do u read this

Capacity Addition.

Related Infrastructure Growth

Perishable vs. Non-Perishable.

Length of Production Period.

Time: Long Run vs. Short Run.

Determinants of Price Elasticity of Supply

1. most manufactured goods today are mass produced in massive factories and most of these factories are working to their optimum levels. Hence, if supply has to be increased new capacity needs to be added i.e. new factories need to be built. his obviously means that supply will remain stagnant for a while when capacity is stagnant and may then increase by leaps and bounds when additional capacity is introduced. This is an important determinant of elasticity of supply. Products where capacity can be easily added and reduced have an elastic supply whereas products where it is difficult to increase or decrease capacity have inelastic demand.

2. Industry is usually an interconnected supply chain. If one part of the supply chain grows, whereas the rest of the supply chain remains stagnant, the growth will be lopsided. This affects the elasticity of supply as well. Consider the case of agriculture. Let’s assume that farmers have got hold of a revolutionary technique with which they can increase productivity two fold. However, more production would mean more warehouses, more cold storages and even more transport vehicles. If this related infrastructure does not grow, producers may have to willfully cut down their production to avoid wastage. So, if the related infrastructure is easily scalable, then the supply of such a product will be highly elastic or else it will be inelastic.

3. Storage capacity is not the only issue. The supplier also needs to consider whether or not the goods that they hold are perishable or not. Perishable goods have a limited shelf life and the buyers know it. The buyers can wait for some time and producers will have to lower the prices or take the losses that arise from wastage. The supply of perishable goods is therefore highly elastic since whatever has been produced has to be disposed off at the earliest. However, when it comes to non-perishable goods it has been observed that the supply is usually inelastic since producers can hold on for as long as they have to. They are under no immediate compulsion to sell and hence the supply is inelastic.

The law of supply assumes that changes in price will produce an immediate effect in the quantity supplied. This may be theoretically correct. However, this is not possible in reality for many products. Production is a time and resource consuming process. Hence, it cannot be scaled up or down with that much ease. In many cases, the time required for production stretches to many months or even years. Hence, there is a lagging effect on supply. This is another important determinant of the elasticity of supply. Products whose production times take longer have relatively inelastic supply compared to those products where the production time is less.

5. In the short run, the supply of all products is more or less inelastic. This is because there are many factors which producers cannot vary in the short run. However, in the long run, all the factors are variable and hence the supply of all products is completely elastic. Hence companies must be careful while making capital decisions.

less

A tax burden falls more heavily on the side of the market that is (less/more) elastic. Why is this true? In essence, the elasticity measures the willingness of buyers or sellers to leave the market when conditions become unfavorable. A small elasticity of demand means that buyers do not have good alternatives to consuming this particular good. A small elasticity of supply means that sellers do not have good alternatives to producing this particular good. When the good is taxed, the side of the market with fewer good alternatives is less willing to leave the market and must, therefore, bear more of the burden of the tax.

consumer surplus

The benefit surplus received by a consumer or consumers in a market is called _. It is defined as the difference between the maximum price a consumer is (or consumers are) willing to pay for a product and the actual price

inversely (negatively)

Consumer surplus and price are () related. Given the demand curve, higher prices reduce consumer surplus; lower prices increase it.

producer surplus

This _ is the difference be- tween the actual price a producer receives (or producers receive) and the minimum acceptable price

direct (positive)

There is a (?) relationship between equilibrium price and the amount of producer surplus. Given the supply curve, lower prices reduce producer surplus; higher prices increase it.