Market Power 2.11-2.12

1/107

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

108 Terms

There are 4 different types of competiton

perfect competition

monopolistic competition

oligopoly

monopoly

the types of competition are classified by four different criteria

number of firms

freedom of entry to industry

nature of the product

nature of the demand curve

perfect competition has

very many firms

monopolistic competition has

many firms

oligopolies have

few firms

monopolies have

only one firm

perfect competitions freedom of entry is

completely unrestricted

monopolistic competitions freedom of entry is

unrestricted

oligopolies freedom of entry is

restricted

monopolies freedom of entry is

restricted of completely blocked

perfect competitions nature of product are

homogenous (undifferentiated)

monopolistic competitions nature of product are

differentiated

oligopolies nature of product are

undifferentiated or differentiated

monopolies nature of product are

unique

the short run is when the

Time period in which at least one factor of production is fixed and cannot be changed by firm (usually land or capital, not labor)

All production takes place in the short run

Length of short run determined by time it takes to increase the quantity of the fixed factor or production

E.g., If it takes a landscaping company one week to get a new lawnmower, the short run is one week; if it takes two years to build a factory, the short run is two years

the long run is when the

Time period in which all factors of production can be changed

All planning takes place in the long run

No fixed costs, as the whole scale of the operation can change

production output is measured through three values

Total product (TP) = total output a firm produces in a given time period

Can only be increased by adding more units of variable factors (machine operators) to fixed factors

Average product (AP) = output produced on average by each unit of the variable factor

Calculated by dividing TP by number of units of variable factors: AP = TP/V

Marginal product (MP) = extra output produced by using an extra unit of the variable factor

Calculated by dividing change in TP by change in V: MP = ΔTP/ΔV

Law of Diminishing Marginal Returns:

As more and units of a variable factor are added to a given quantity of a fixed factor, output will eventually diminish

the law of diminishing marginal returns can be reversed by

increasing the quantity of the fixed factor

this applies to both cost and output

the different types of total costs are

Total fixed cost (TFC) = total cost of the fixed assets that a firm uses in a given time period

Because number of assets is fixed, TFC is a constant amount

TFC is the same whether the firm produces or not

Example: rent for land/building, base utility bills, insurance, healthcare, etc.

Total variable cost (TVC) = total cost of variable assets a firm uses in a given period of time

TVC increases as the firm uses more of the variable factor

TVC is equal to the number of variable factors times the cost of the variable factor

Example: labor, raw materials for production, etc.

total cost (TC) = total cost of all fixed and variable factors used to produce a certain output

the different types of average/marginal costs are

Average fixed cost (AFC) = fixed cost per unit of output

Calculated by dividing TFC by amount of output (q): AFC = TFC/q

Because TFC is always constant, AFC always falls as output increases

Example: If TFC = $400, then producing 10 units results in an ATC of $40 ($400/10); if 25 units are produced, AFC = $16 ($400/25)

Average variable cost (AVC) = variable cost per unit of output

Calculated by dividing TVC by amount of output (q): AVC = TVC/q

AVC falls as output increases, then starts to rise again as output continues to increase

Average total cost (ATC) = total cost per unit of output

ATC = AFC + AVC or TC divided by amount of output: ATC = TC/q

Also tends to fall as output increases, and then starts to rise again as output continues to increase

Marginal cost (MC) = increase in the total cost of producing an extra unit of output

MC = ΔTC divided by change in amount of output (q): MC = ΔTC/Δq

Again, MC falls as output increases, then starts to rise again as output continues to increase

there are 4 short run cost curves

MC curve

ATC curve

AVC curve

AFC curve

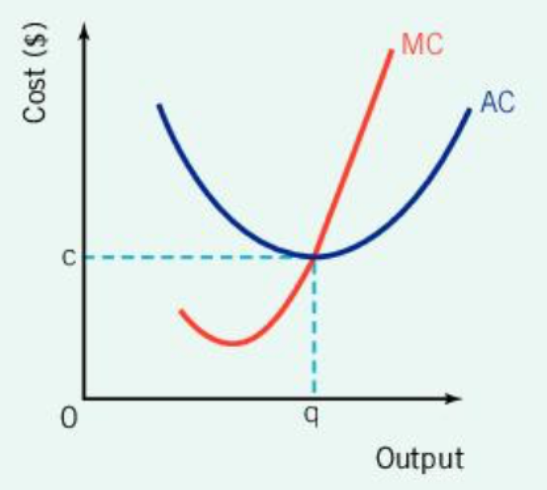

the MC curve will always cut the

AVC and ATC curves at their lowest point

once MC = AC, the increasing MC starts to increase

average costs

where the MC curve intersects the AC curve producers are

producing at the lowest possible cost

therefore productive efficiency is achieved where MC = AC

if firms want to producer more in the long run

they must lower their costs by altering the factors of production

the long run average cost curve (LRAC) is also known as an

“envelope curve” because it envelops an infinite number of short run average cost (SRAC) curves

LRAC curve represents the boundary between

attainable and unattainable unit cost levels of a firm

Scale =

a proportion or relative level of size or degree

the LRAC curve represents

increasing, constant, or decreasing returns of scale

increasing returns to scale means

increase in factors of production leads to greater increase in output and lower long run costs.

decreasing returns to scale means

increase in factors of production leads to smaller increase in output and higher long run costs.

economies of scale =

any decreases in LRAC that result from a firm altering all factors of production in order to increase its scale of output

resulting in increasing returns to scale for the firm

firms achieve economies of scale through 7 methods

specialization

division of labor

bulk buying

financial economies

transport economies

large machinery

promotional economies

specialization occurs when

specialization of labor leads to more efficiency and lower unit costs (e.g., specialized management roles vs. one manager taking on many different roles)

division of labor is when

Breaking down production processes into smaller parts to increase efficiency (e.g., assembly line production)

bulk buying provides

Discounts on larger supplies of raw materials (reduced production costs)

financial economies makes it

Easier for large firms to raise money (more investment for firm, less risk for lenders)

transport economies are when

Larger firms buying in bulk may pay less in transport costs, or may have their own transport fleet (e.g., Amazon)

large machinery means that

Some machinery is too big for small producers; larger firms need larger machinery (e.g., combine harvesters)

promotional economies occur

As a firm increases its output and revenue, expenditure on advertising/publicity remains constant (and therefore falls as the firm grows)

Diseconomies of scale =

any increases in LRAC that result from a firm altering all factors of production in order to increase its scale of output

Results in decreasing returns to scale for the firm

Essentially the long-run version of law of diminishing returns

there are 4 causes for diseconomies of scale

control/communication problems

alienation/loss of identity

slow decision making

excessive bureaucracy

Control/communication problems occur when

Larger firms are more difficult to control, and there is less communication, resulting in lost efficiency

Alienation/loss of identity:

Workers/managers lose sense of purpose/connection to firm, resulting in lost productivity

Revenue =

payments firms receive when they sell their products, goods, or services over a certain period of time

there are three types of revenue

Total revenue (TR) = total amount of money a firm receives by selling a product

TR = p x q

Average revenue (AR) = revenue a firm receives per unit of its sales (same as p)

AR = TR/q = (p x q)/q = p

Marginal revenue (MR) = extra revenue gained by a firm by selling one more unit of a product in a given time period

MR = ΔTR/Δ

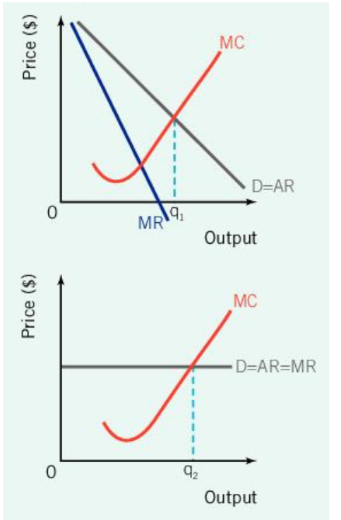

if firms do not have to lower prices to sell more of a product the demand curve is

perfectly elastic and total revenue (TR) increase at a constant rate

If demand is perfectly elastic, then price, average revenue, marginal revenue, and demand are all the same

Revenue when the price falls as output increases, the demand curve is

downward sloping

In order to sell more output because of increased demand

firms must lower the price

Because AR = P, it falls as

output increases; therefore, D = AR

MR also falls as

output increases, but at a higher rate; in order to sell more products, the firm must lower the price of all products sold, and thus loses revenue on the ones that could have been sold at a higher price in order to get revenue from the extra sales

TR rises at first, but will eventually start to fall as

output increases. This occurs when MR turns negative.

economic profit are measured in three ways

Normal Profit: total revenue is equal to total cost (zero economic profit)

Abnormal profit: total revenue is greater than total cost (economic profit)

Losses: total revenue is less than total cost (negative economic profit)

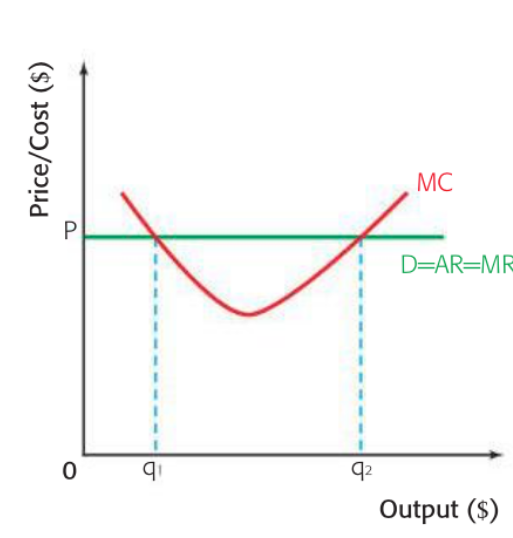

Firms seek to maximize profit. Therefore, if a firm finds that MR > MC,

it should increase production at MC = MR,q₁, profits are minimized

From q₁-q₂, the firm makes a profit on every additional unit produced

After MC = MR, q₂, the firm will make a loss for each additional unit. Therefore, profits are maximized at q₂.

As a rule, firms should produce at the level where

MC cuts MR from below in order to maximize profits

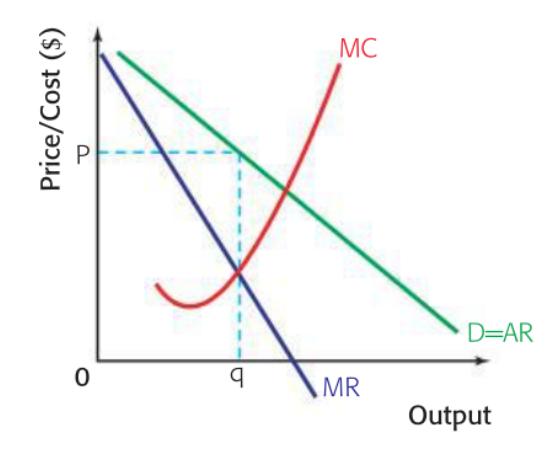

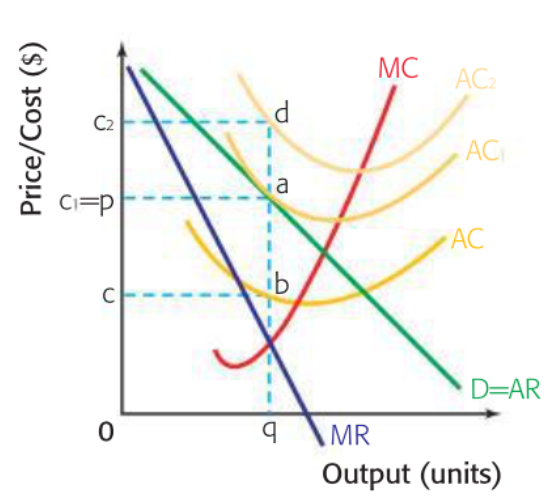

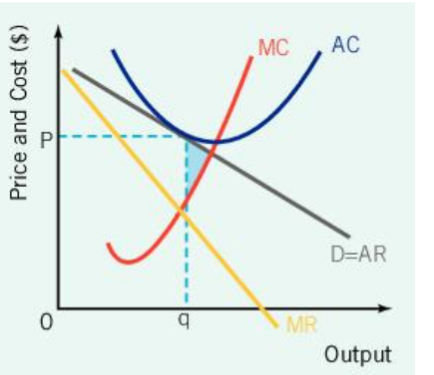

Profit is maximized where

MC = MR, with output at q

P (what consumers are willing to pay for this quantity) is identified where q meets D

Remember, the MC curve always cuts

the AC curve at its lowest point

The profit of producing q units is the difference between AR and AC

The AC curve is important because its position can show

different profit and loss situations. Here:

AC represents abnormal profit (pabc)

AC₁ represents normal profit (AC = AR)

AC₂ represents losses (pc₂da)

Remember, in a perfectly competitive market:

Because each firm is small compared to the size of the industry,

they cannot affect prices -- they are price takers

Producers and consumers have

perfect knowledge of the market (prices, costs, quality, availability, etc.)

perfect competition cannot have

long run abnormal profits or losses

Perfect competition is theoretical, but some industries are close to being perfectly competitive, such as

those for agricultural goods (e.g., a wet market)

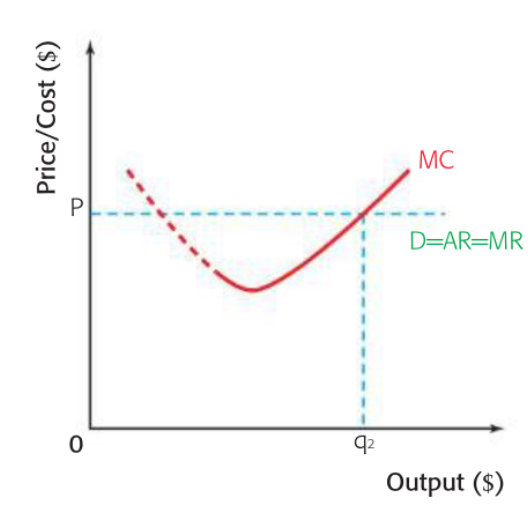

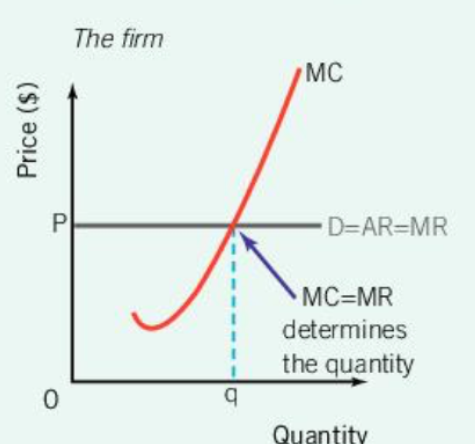

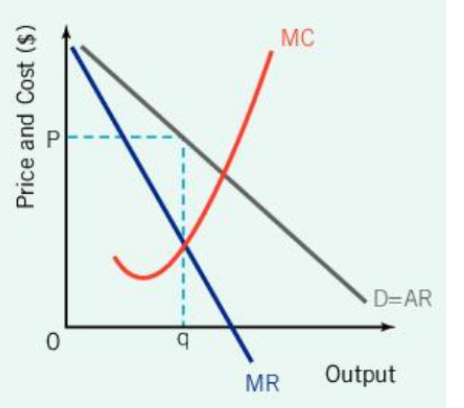

for perfect competition when graphing a firm

the demand curve will be perfectly elastic (because they are price takers).

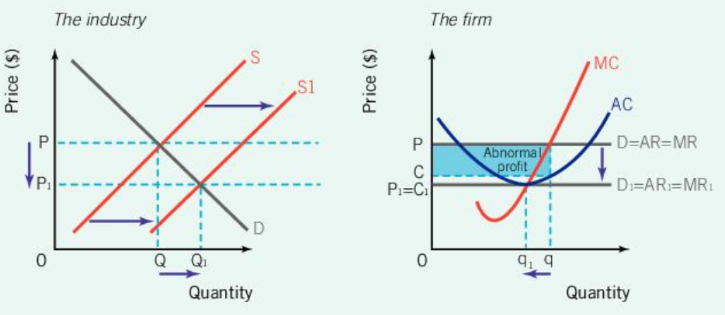

Perfect Competition: Profits and Losses (Short Run)

firms maximize profits when they produce at the level of output where

MC = MR; this will always identify the quantity (q)

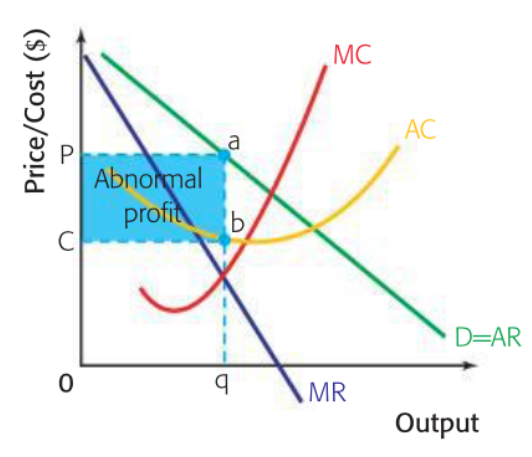

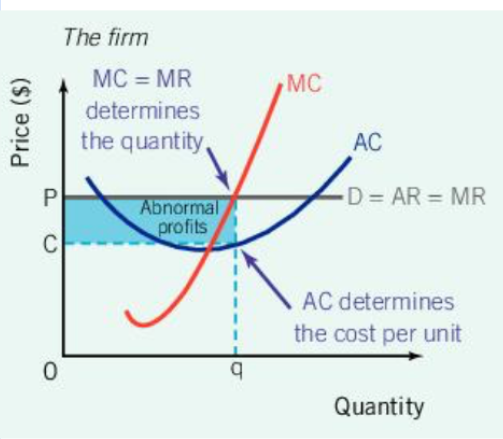

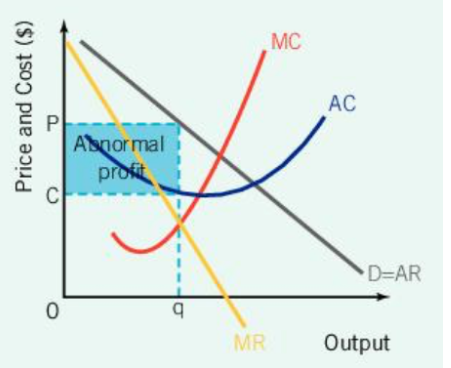

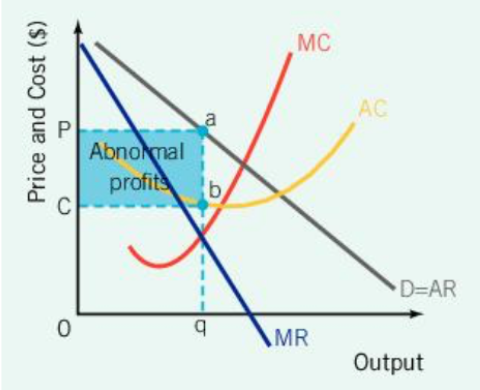

Perfect Competition: Profits and Losses (Short Run) (Abnormal Profit)

Now we add the average cost (AC) curve

In this case, the cost per unit, or average cost, (C) is

less than the industry price (P) and average revenue

Therefore, the firm makes an abnormal profit of P-C, or, the area shaded in blue

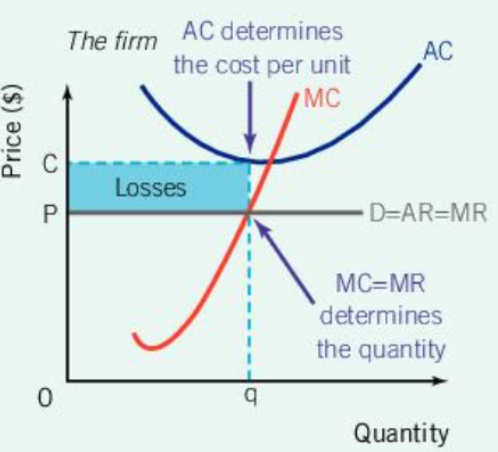

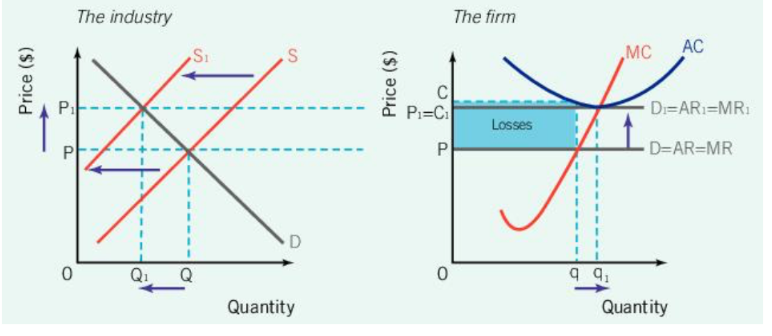

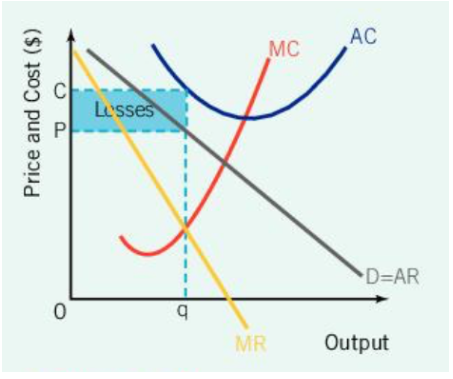

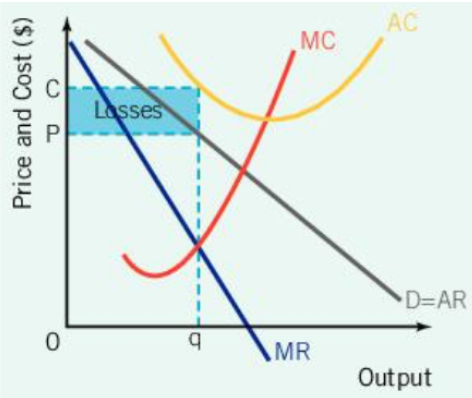

Perfect Competition: Profits and Losses (Short Run) (losses)

Here, cost per unit (C) is

greater than the industry price (P) and average revenue, resulting in losses for the firm

Because producing at any other level of output would result in further losses, the firm is still producing at the profit maximizing level of output--they are loss minimizing

Perfect Competition: Profits and Losses (Long Run) (short run abnormal profits to long run normal profits)

More firms enter the industry because

of abnormal profits (perfect knowledge and no barriers)

Over time, the supply curve shifts to the right, increasing total industry quantity (Q) and lowering prices (P)

Firms start to make normal profits, and no more firms enter the industry. The industry is bigger and produces more in total (Q1), with more, smaller firms producing less per firm (q1)

Perfect Competition: Profits and Losses (Long Run) (Short-run losses to long-run normal profits)

Firms exit the market because of

losses

The supply curve shifts to the left, decreasing total industry quantity (Q) and increasing prices (P)

Losses are reduced and firms start to make normal profits. The industry is smaller and produces less in total (Q1), with fewer, larger firms producing more per firm (q1)

Perfect Competition: Efficiency

Productive efficiency:

producing goods and services with the optimal combination of inputs to produce maximum output for the minimum cost

Perfect Competition: Efficiency

Allocative efficiency:

optimal distribution of goods and services, taking into account consumer preferences

Occurs where Price equals the Marginal Cost (MC) of production

This is because the price that consumers are willing to pay is equivalent to the marginal utility that they get, thus the optimal distribution is achieved when the marginal utility of the good equals the marginal cost.

Therefore, allocative efficiency is where MC = AR

Monopolistic Competition cannot have

long run abnormal profits or losses

in monopolistic competition product differentiation allows

consumer preference and therefore, brand loyalty

Because of brand loyalty, firms can be price makers to some extent

This ability to make prices gives them some market power, but it is small because the firm is small relative to the size of the industry (e.g., Nike in the shoe industry)

Monopolistic Competition

Because firms are price makers to some extent, this will result in

a downward sloping and relatively elastic demand curve

Remember, the firm maximizes profits by producing at q, where MC = MR

At this level of output, price is at level P

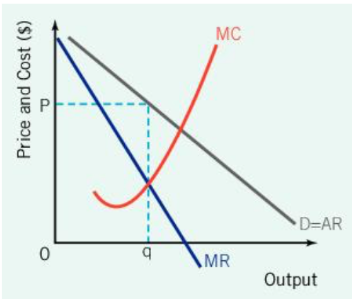

Monopolistic Competition: Profits and Losses

Short run abnormal profit

The per unit cost (C) is

below the selling price (P)

This results in abnormal profits and firms will begin to enter the industry

How efficient is this situation in terms of

Productive efficiency (lowest cost per unit, or, MC = AC)?

Allocative efficiency (socially optimal level of output, or, MC = AR)?

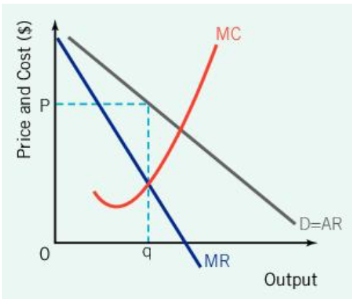

Monopolistic Competition: Profits and Losses

Short run losses

The per unit cost (C) is

higher than the selling price (P)

This results in losses; firms will begin to exit the industry

How efficient is this situation in terms of

Productive efficiency (lowest cost per unit, or, MC = AC)?

Allocative efficiency (socially optimal level of output, or, MC = AR)?

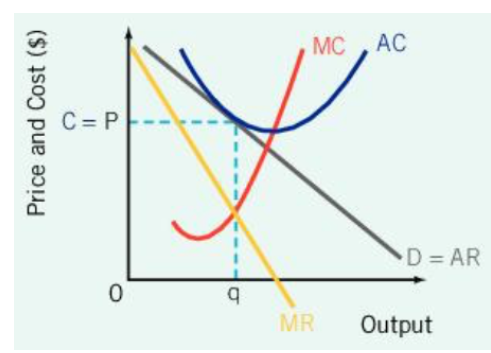

Monopolistic Competition: Profits and Losses

long run normal profit

Profit is maximized (MC = MR)

Cost per unit (C) equals

price per unit P (or, AC = AR); each firm is covering its costs

No firms will enter or exit the industry, because neither losses nor abnormal profits are being made

What about efficiency?

This scenario is not productively efficient (MC ≠ AC at q)

It is also not allocatively efficient (MC ≠ AR at q)

Monopolistic Competition: Market Failure?

Lack of allocative efficiency =

market failure

The lack of efficiency is offset by the presence of greater product variety (i.e., consumers give up efficiency, but they get greater product choice)

monopolistic competition is good because of

Strong competition makes “price exploitation” lower than monopoly/oligopoly

Differentiated goods means plenty of substitutes available

Differentiation makes it difficult to exploit economies of scale (and therefore obtain significant market power)

is government intervention necessary for monopolistic competition

Only to fix the negative effects of imperfect information: trade standards, licensing, nutrition facts, health inspections, etc.

because of barriers to entry for a monopoly

the monopoly can make abnormal profits in the long run

The best way to define a monopoly is

how much market power it has: to what extent can the firm set its own prices without worrying about competitors and keep others out of the industry?

How can a monopoly maintain its position (ie., What are the barriers to entry)

monopolies have

economies of scale

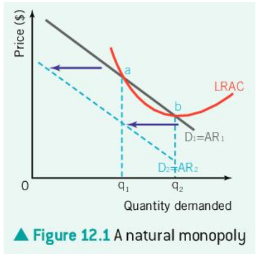

Natural monopoly

The most efficient number of firms is one; the fixed costs are so high that it is impractical to have more than one firm producing

Example: Tap water. Because setting up the system of pipes and sewers is so expensive, it wouldn’t make sense to have two water companies.

this is the scenario where another firm joins a natural monopoly, if this happens

the natural monopoly would make abnormal profit between q1 and q2; if the new firm entered the industry, then demand would be taken from the monopoly, shifting the curve to the left and therefore making it impossible to make a profit

How can a monopoly maintain its position (ie., What are the barriers to entry)?

Legal barriers

Firms may be given the legal right to exclusive production

Examples include patents, copyrights, trademarks, or a nationalized industry

E.g., a pharmaceutical company gets a patent for a drug it develops, meaning only they can produce it

How can a monopoly maintain its position (ie., What are the barriers to entry)?

Brand loyalty

If a product gains enough brand loyalty, other firms may be discouraged from entering the industry because they feel they may not be able to compete

E.g., Hoover vacuum cleaners--now in some places “hoover” means a vacuum cleaner

How can a monopoly maintain its position (ie., What are the barriers to entry)?

Anti-competitive behavior

Legal or illegal actions to block competition, such as starting a “price war”

Example: In 2018, Google was fined $5 billion by the European Commission for violating the EU’s competition rules

Google required phone manufacturers to preinstall its search function in order to access its app store (Google Play)

Monopoly, the Industry, & Market Power

The monopolist IS

the industry

Because the demand curve is downward sloping the monopolist can control price or level of output, but not both

This means that monopolies cannot charge what they want and still sell their product--they have to lower their price to sell more

Monopoly, the Industry, & Market Power

The monopoly completely controls

industry output

This means they can restrict quantity to increase price

Level of market power is high

Monopoly: Profits and Losses

Abnormal Profits

If, in the short run, a monopoly is making abnormal profits, and they have effective barriers to entry that keep other firms out, then they can make

abnormal profits in the long run

This situation will continue as long as new firms cannot enter the industry

Monopoly: Profits and Losses

Losses

If the monopoly produces something for which there is little demand, they will face

losses

Firms then have two choices:

Make changes in order to achieve normal profit in the long run

Close the firm. Because the firm is the industry, the industry will cease to exist.

In this diagram, the firm cannot cover its costs in the long run: AC > AR

If nothing can be done to fix this situation, no firm will be willing to produce, so there will be no industry

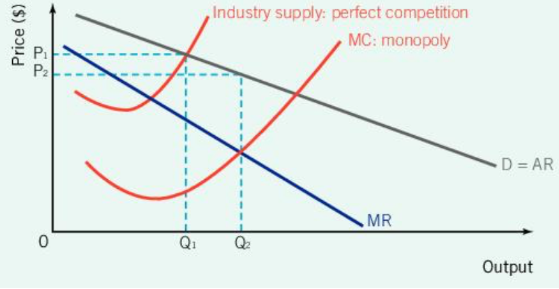

Monopoly vs. Perfect Competition

Advantages of Monopoly

Monopolies have

economies of scale, which allows higher product output and lower costs (and prices)

In the diagram, assume perfect competition the market equilibrium is where demand = supply (P1 & Q1)

If the firm is a monopoly and has economies of scale, the MC curve will be much lower. The monopoly maximizes profits at MC = MR, thus leading to lower costs and prices and greater output than the industry supply (perfect competition, P2 & Q 2).

I.e., monopolies produce lower prices and greater output than PC because of economies of scale

Monopoly vs. Perfect Competition

Advantages of Monopoly

dynamic efficiency

investment of profits into research & development or innovation

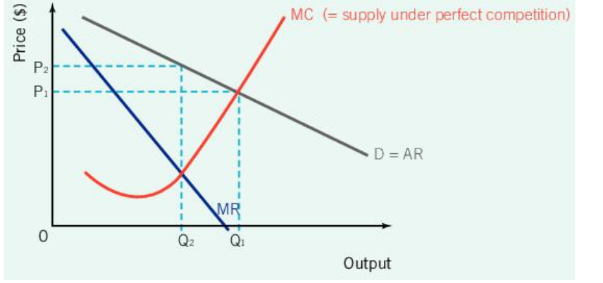

Monopoly vs. Perfect Competition

Disadvantages of Monopoly

Monopolies are neither

productively nor allocatively efficient

They can exercise anti-competitive behavior to keep their monopoly power

If not significant economies of scale, they can charge a higher price for a lower level of output

In the diagram, assume there are no differences in cost for a monopoly and the perfectly competitive market

Because the monopoly maximizes profits and therefore produces at MC = MR, costs are higher and output is lower (P2 & Q 2) than would be in perfect competition (P1 & Q 1).

Oligopoly =

few firms dominate an industry

Oligopolies are measured by

concentration ratios (CRx), which show the percentage of market share held by x firms

Example: In the US malt beverage industry, there are 160 firms and the CR4 is 90%, meaning the four largest firms produce 90% of the industry’s output--a high concentration of market power. In the frozen seafood industry, which has 600 firms, the CR4 is 19%--a low concentration of market power.

Therefore, the malt beverage industry is an oligopoly, while the frozen seafood industry is in monopolistic competition

oligopolies can produce

nearly identical products (petrol), highly differentiated products (motor cars), or slightly differentiated products (shampoo)

Oligopolies have

Distinct barriers to entry, such as large-scale production or distinct branding

Oligopolies have a level of

interdependence: Actions of one firm can have major effects on the others

Oligopolies also have

Price rigidity