Chapter 7: Aggregate Expenditure (2)

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

55 Terms

What is the aggregate expenditure model

the relationship between total spending in the economy and real gdp, holding price level constant

the four components of Aggregate expenditure

Consumption (C)

Planned Investment (Ip)

Government purchases (G)

Next Exports (NX)

Consumption

spending by households on goods and services

Planned Investment

planned spending by firms on capital goods, research and development, and spending by households on new residential properties

Government Purchases

spending by federal, state, and local government on goods and services

Net Exports

Exports - Imports (X-M)

Aggregate Expenditure equation

AE = C + IP+G+NX

What is the difference between I and IP

I represents actual investment, while IP represents planned investment

What is investment (I)

firms spending on factories, tools, buildings, R&D, and inventories

What are inventories

goods produced in the current year but not sold, unused raw materials, and partially processed goods

What happens when there is no unplanned change in inventories

actual investment = planned investment

AE = real GDP

What happens when there is an unplanned increase in inventories

actual investment > then planned investment

Real GDP > AE

What happens when there is an unplanned decrease in inventories

planned investment < actual investment

AE < real GDP

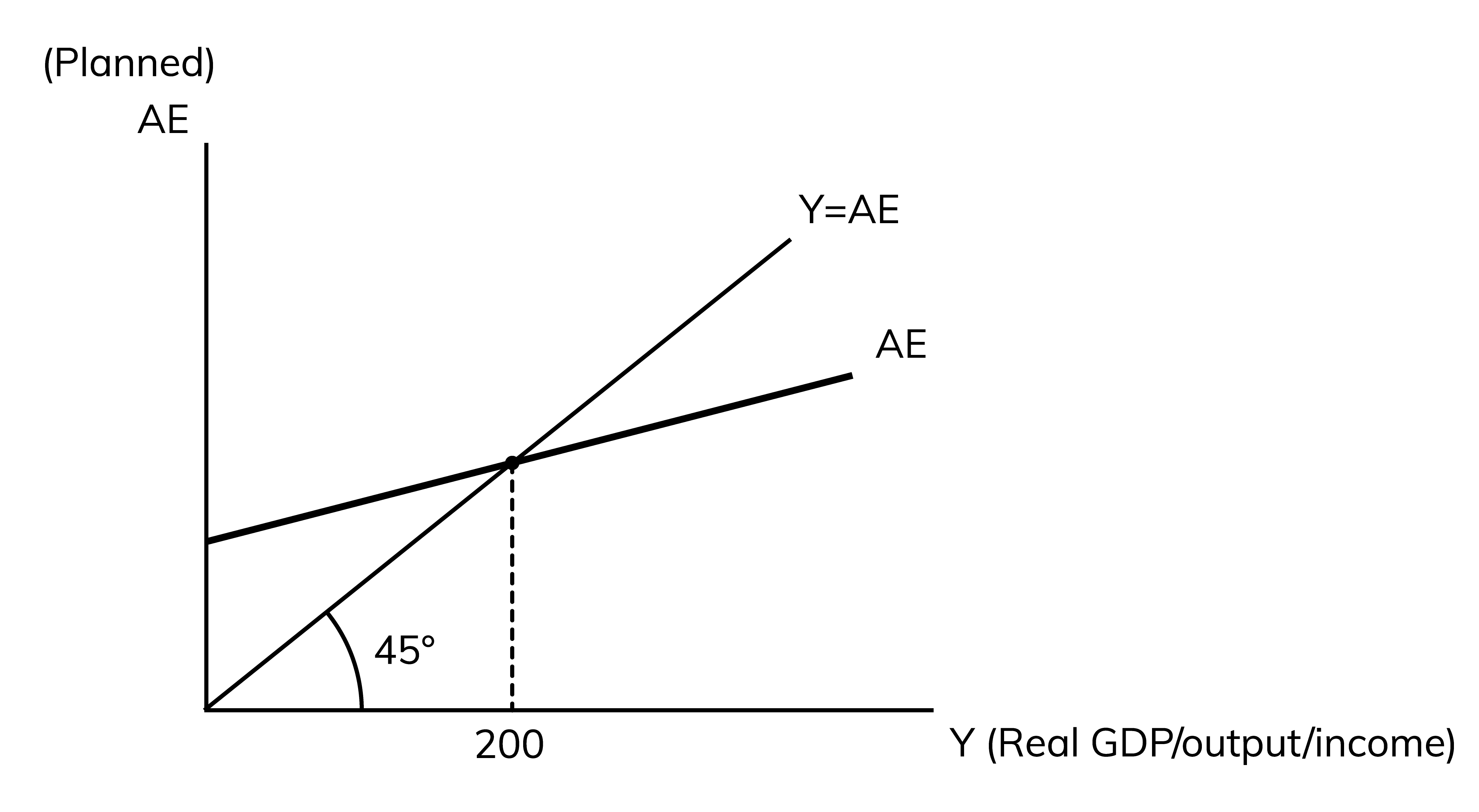

When does macroeconomic equilibrium occur

when AE = real GDP

What happens when AE exceeds real GDP

inventories decline

Production and employment increase

What happens when AE is less than real GDP

Inventories increase

Production and employment decrease

What happens when AE = Real GDP

there is no unplanned changes in inventories

There is no change in employment or production

what is the primary cause of fluctuations in real GDP from one year to the next

increases and decreases in AE

What is the largest component of AE

consumption

The five variables that influence the level of total consumption by households

Current disposable income

Household wealth

Expected future income

Price level

The interest rate

CHEPI!

Current disposable income

total household income (income + transfer payments) minus personal income taxes

(YD = Y - T)

Household wealth

household assets (real estate, stocks, bonds, etc) minus liabilities (debt)

Expected future income

income expected in the future

An ↑ in expected future income leads to an ↑ in consumption now

A ↓ in expected future income leads to a ↓ in consumption now

Price level

a measure of the average price of goods and services in an economy

the interest rate

additional money charged on loans

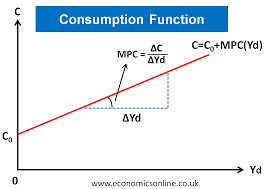

The consumption function

an algebraic relationship between consumption and income

What is the slope of the consumption function

Marginal Propensity to Consume (MPC) OR (ΔC/ΔY)

What is the MPC

the change in consumption spending when income changes by 1 dollar

The Consumption Function Units

Y = consumption spending, X = real GDP/income

National Income Equation

Y = Consumption (C) + Savings (S) + Taxes (T)

Marginal Propensity to Save (MPS)

tells us how much of an extra $1 that you earn you put into savings

MPS and MPC equation

1 = MPS + MPC (when taxes are constant)

The three variables that determine the level of investment in an economy

Expectations of future profitability

Interest rate

Taxes

TIE!

Expectations of future profitability

when firms expect higher future profits, they invest more

When firms expect lower future profits, they invest less

The interest rate

A higher interest rate decreases investment

A lower interest rate increases investment

Taxes

an increase in taxes decreases investment

a decrease in taxes increases investment

Three key determinants of net exports

The price level in the US, relative to price in other countries

The growth rate of real GDP in the US, relative to other countries

The exchange rate between the US dollar and other currencies

PEG!

How is macroeconomic equilibrium illustrated

a 45o angle line

Units for the AE graph

Y = AE (C) ; X = real gdp/income (Y)

When is real GDP greater than AE

Points below the 45 degree line

When is AE greater than real GDP

Points above the 45 degree line

Unplanned changes in inventories equation

Y - AE

autonomous expenditures

spending that is unaffected by changes in real gdp

what are the autonomous expenditures of AE

planned investment, government purchases, and net exports

What is Consumption split between

autonomous and non autonomous

The spending multiplier

the ratio of the increase in real GDP to the increase in autonomous spending

Spending multiplier equation

(1/1-MPC)

Change in Y equation

ΔY = multiplier x ΔAE

The Paradox of Thrift

When everyone tries to save more at the same time, spending, gdp, and total income in the economy falls

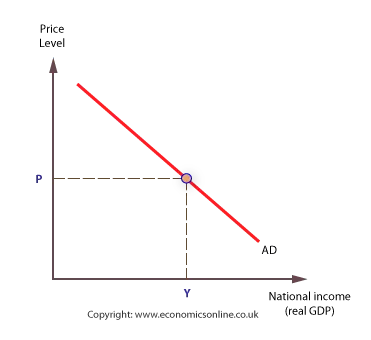

The Aggregate Demand curve

shows the relationship between the price level and the quantity of real gdp (output) demanded

what is the relationship between price level and AE

inverse relationship for (C + I + NX)

AD curve units

Y = Price level, X = Real GDP

Shift vs. movement for AD curve

movement: price level

Shift: anything else

Consumption function equation

A = C0 + (MPC x Y)

where MPC = slope of consumption function

C0 = fixed number/constant

equilibrium real GDP equation

Y = (1/1-MPC)(C + I + G + NX)